4 Best Practices for Effective P2P Lending Software Implementation

Introduction

The rise of peer-to-peer (P2P) lending has transformed how individuals and businesses secure financing, establishing a vibrant marketplace that connects borrowers directly with investors. With projections indicating that the P2P lending market will reach USD 21.42 billion by 2026, it is crucial to understand best practices for implementing effective P2P lending software to achieve success.

However, the complexities surrounding regulatory compliance, technology selection, and security measures present significant challenges for developers and financial institutions. Stakeholders must consider how to effectively navigate these demands while maximizing user trust and operational efficiency.

Define Peer-to-Peer Lending and Its Mechanisms

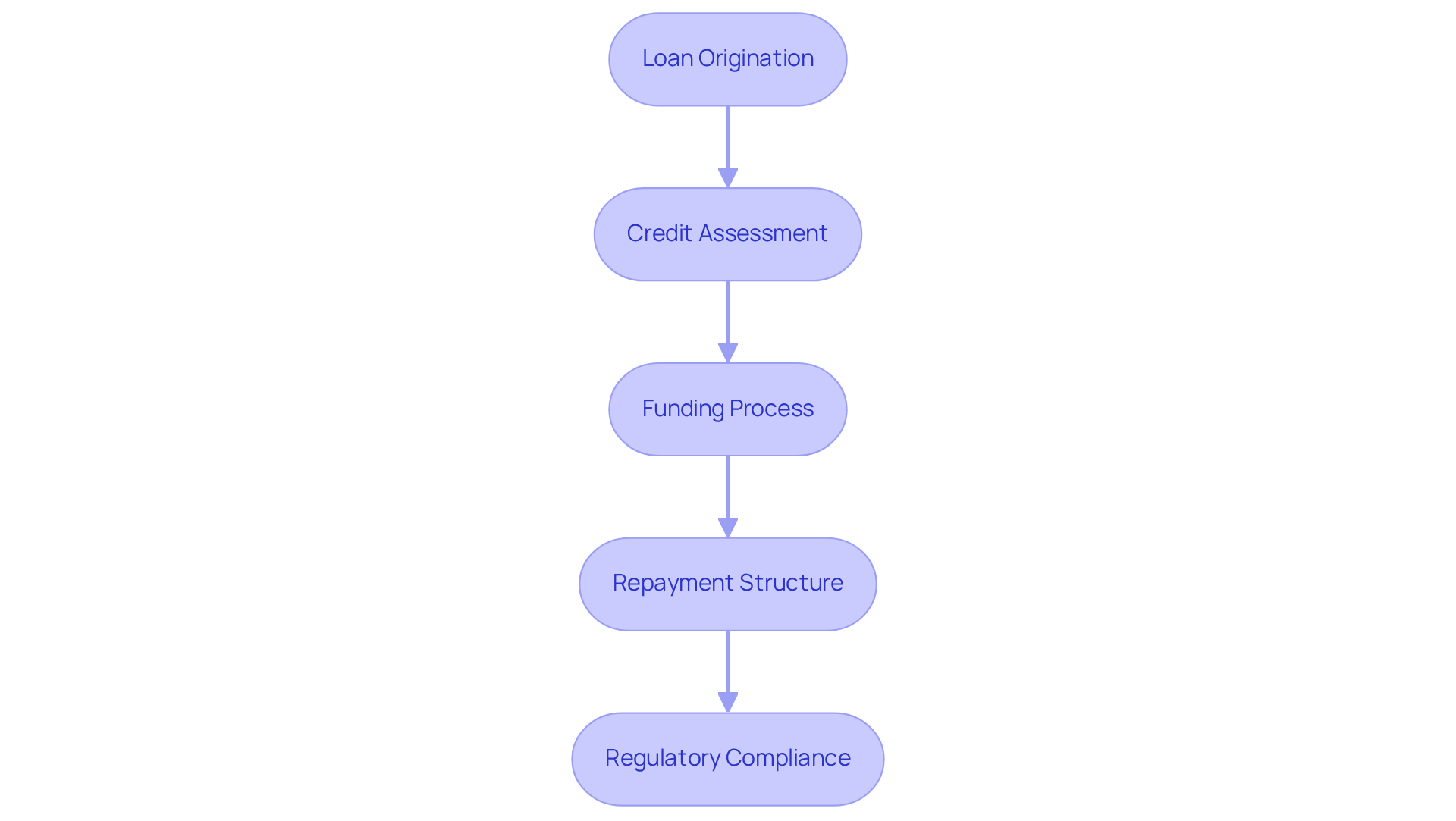

Peer-to-peer (P2P) financing facilitates direct borrowing and lending between individuals or businesses through online platforms, effectively bypassing traditional financial institutions. This innovative model connects borrowers seeking funds with investors willing to finance those loans, often at competitive interest rates. The operational framework of P2P lending consists of several essential components:

-

Loan Origination: The process begins when borrowers submit loan requests on a P2P platform, outlining their financial situations and the intended use of the funds. Investors can review these requests and select loans to finance based on their risk tolerance.

-

Credit Assessment: To determine borrower creditworthiness, platforms employ advanced algorithms and credit scoring systems. This critical evaluation helps mitigate default risks and ensures that investors are paired with borrowers who meet their investment criteria.

-

Funding Process: Once a loan is approved, funding typically comes from multiple investors contributing varying amounts. This diversification strategy reduces risk for individual investors, enhancing the overall stability of the borrowing process.

-

Repayment Structure: Borrowers repay their loans in installments that include both principal and interest. The P2P platform manages these transactions, ensuring timely returns for investors while minimizing operational costs by reducing the need for physical branches and staff.

-

Regulatory Compliance: P2P lending platforms must comply with various regulations that vary by jurisdiction, aimed at safeguarding consumer interests and ensuring financial stability.

As of 2026, the global peer-to-peer lending market is projected to reach USD 21.42 billion, reflecting a compound annual growth rate of 20.2% from 2023 to 2030. The market was valued at USD 5.91 billion in 2023, indicating substantial growth potential. Furthermore, the small business loans segment is anticipated to grow at a CAGR of 29%, underscoring the increasing acceptance of P2P funding as a viable alternative to traditional financing methods. Understanding these mechanisms is crucial for developing effective P2P lending software that meets user needs and adheres to regulatory standards.

Address Regulatory Compliance and Industry Standards

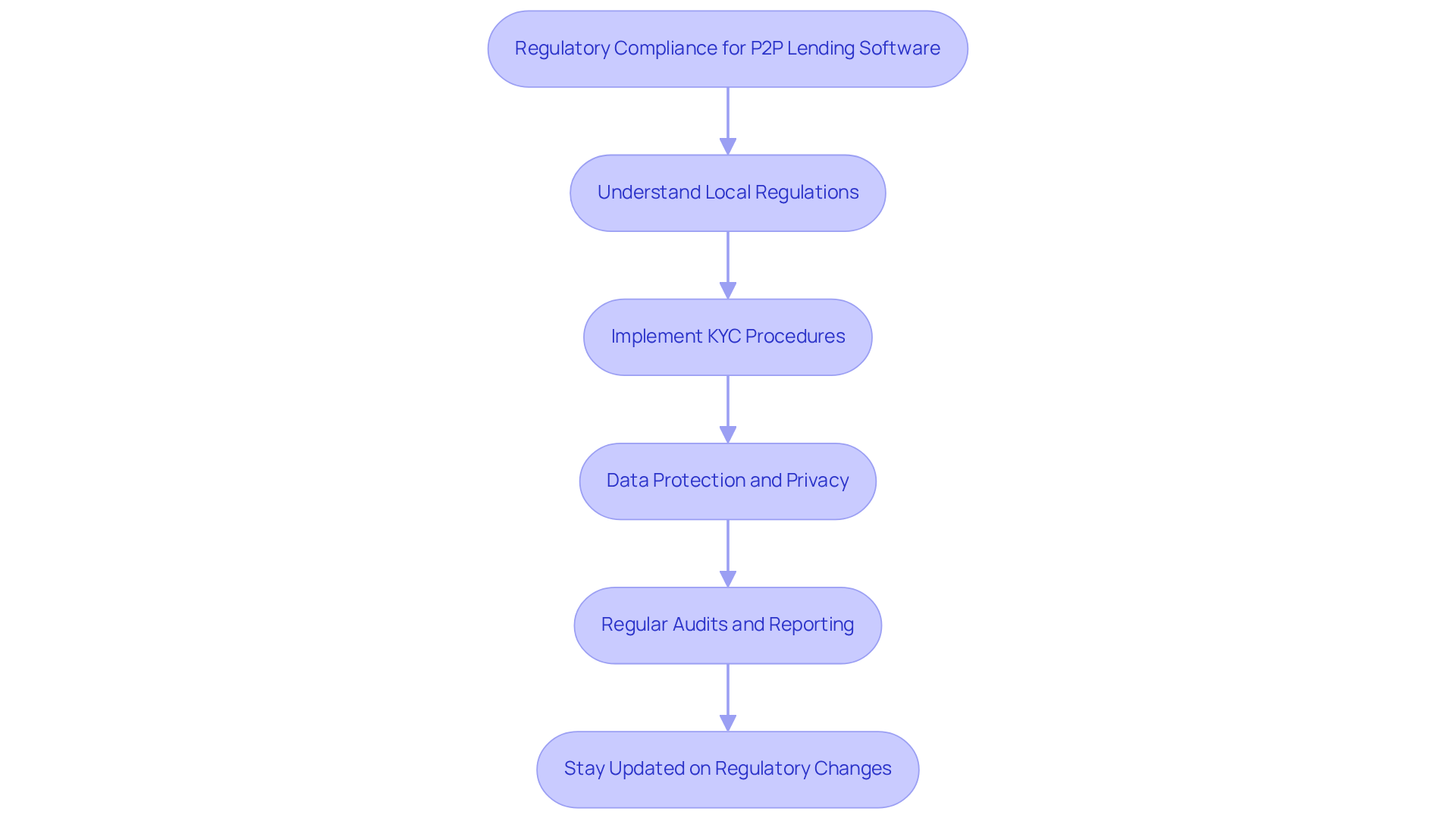

Regulatory compliance stands as a cornerstone for the successful implementation of p2p lending software. The following key considerations are essential:

-

Understand Local Regulations: Each jurisdiction imposes specific laws governing P2P lending, which include registration requirements, consumer protection laws, and anti-money laundering (AML) regulations. It is imperative to familiarize yourself with these regulations to ensure compliance.

-

Implement KYC Procedures: Know Your Customer (KYC) protocols are vital for verifying the identities of borrowers and investors. This process not only helps prevent fraud but also ensures adherence to AML regulations.

-

Data Protection and Privacy: Compliance with data protection laws, such as GDPR or CCPA, is crucial. It is essential to ensure that user data is collected, stored, and processed securely, with clear consent mechanisms established.

-

Regular Audits and Reporting: Establishing a framework for regular compliance audits and reporting to regulatory bodies is necessary. This practice not only ensures adherence to laws but also fosters trust with users.

-

Stay Updated on Regulatory Changes: The financial landscape is in constant flux, making it vital to stay informed about changes in regulations. Establish a system for tracking regulatory updates and adjusting your framework accordingly.

By prioritizing regulatory compliance, p2p lending software can enhance its credibility, attract more users, and mitigate legal risks.

Choose the Right Technology and Development Expertise

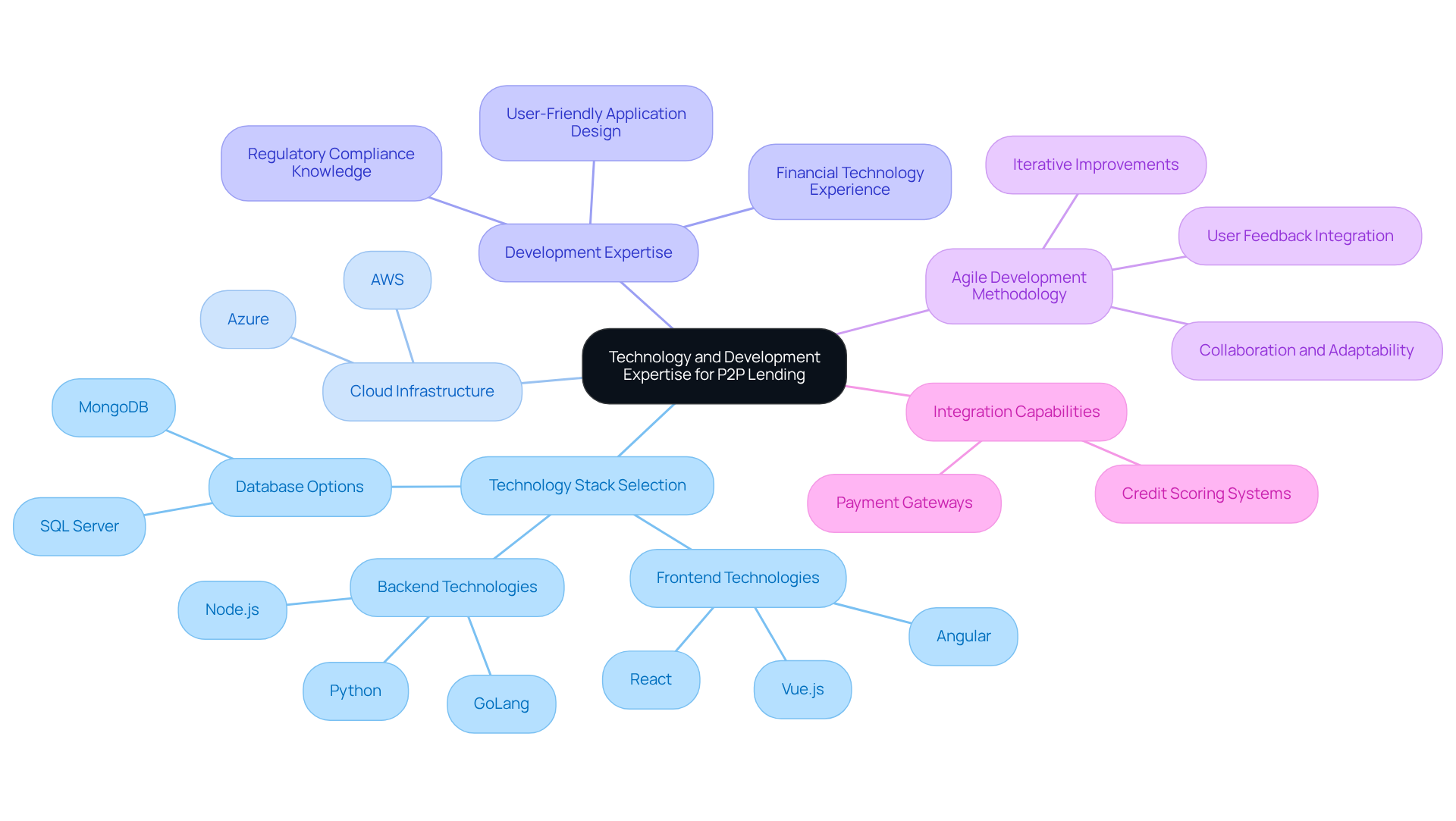

Choosing the appropriate technology stack and development skills is crucial for creating a successful p2p lending software service. Key considerations include:

-

Technology Stack Selection: Select a technology stack that prioritizes scalability, security, and performance. Recommended choices are:

- Frontend: React, Angular, or Vue.js for dynamic user interfaces.

- Backend: Node.js, Python, or GoLang for robust server-side processing.

- Database: SQL Server or NoSQL databases like MongoDB for flexible data management.

-

Cloud Infrastructure: Utilize cloud services such as AWS or Azure for hosting your system. These services offer essential scalability, reliability, and security features, which are crucial for managing varying loads and ensuring consistent uptime. By 2026, cloud service adoption in financial technology is projected to reach significant levels, with many firms prioritizing cloud solutions for their operational needs.

-

Development expertise: Collaborate with a development team experienced in financial technology and p2p lending software. Partnering with teams that understand regulatory compliance and have a proven track record of delivering secure, user-friendly applications is vital. Neutech can assist by evaluating your specific requirements and providing specialized designers and developers to ensure that your system meets regulatory compliance while delivering secure, user-friendly applications.

-

Agile Development Methodology: Implement an agile development approach to facilitate iterative improvements and rapid responses to user feedback. This methodology promotes collaboration and adaptability, which are critical in the fast-paced fintech landscape.

-

Integration Capabilities: Ensure your system can seamlessly connect with third-party services, such as payment gateways and credit scoring systems. This capability enhances functionality and provides a smoother user experience.

By strategically selecting the appropriate technology and development skills, P2P services can establish a strong foundation for growth and success.

Implement Robust Security and Risk Management Protocols

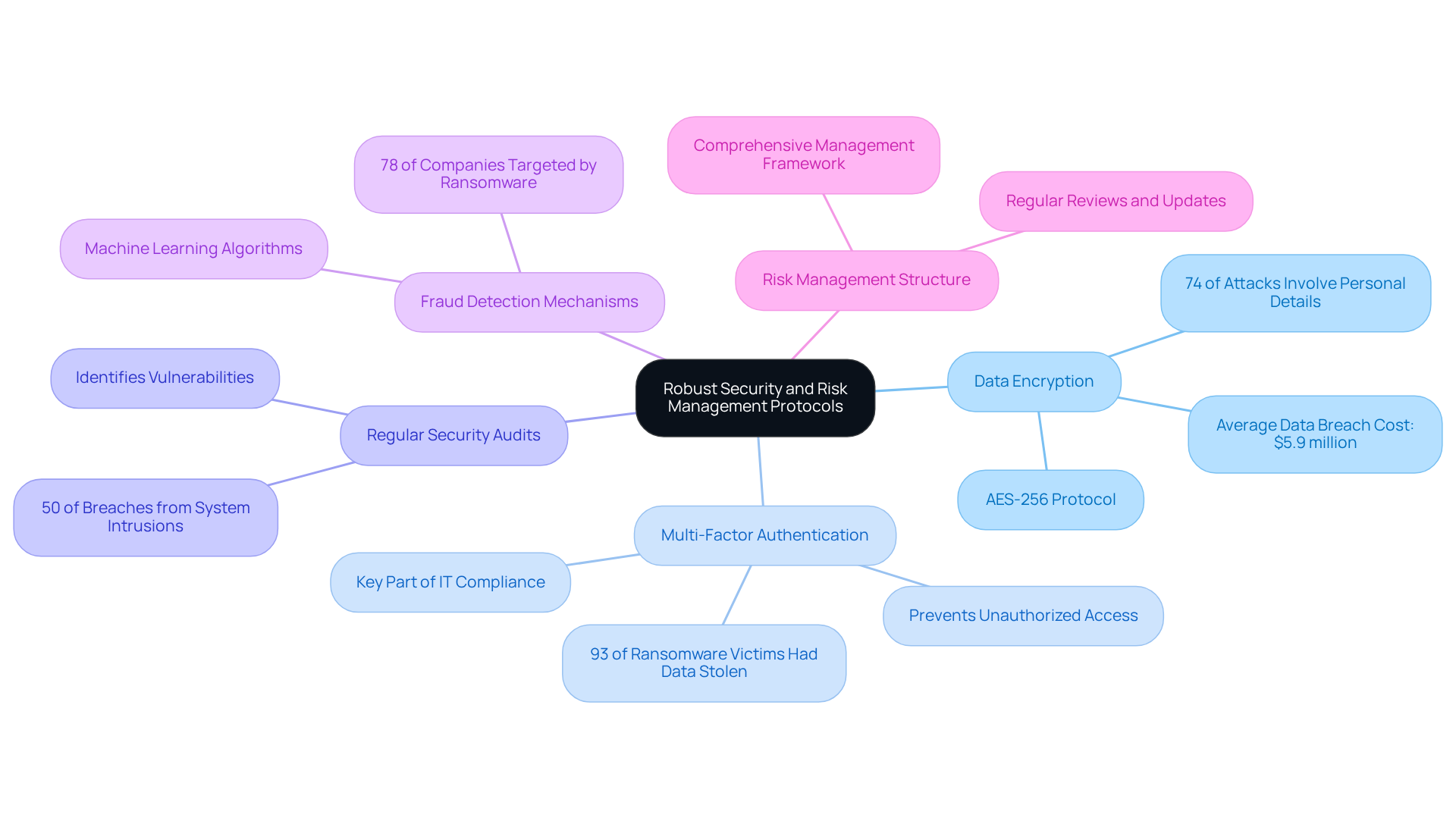

Security and hazard management are critical components for any p2p lending software service. Implementing the following essential practices can significantly enhance security:

-

Data Encryption: Employ robust encryption protocols, such as AES-256, to safeguard sensitive user data both in transit and at rest. This measure is vital for protecting personal and financial information from unauthorized access. The financial services sector faces an average data breach cost of $5.9 million, with 74% of attacks involving customer personal details, underscoring the importance of strong encryption.

-

Multi-Factor Authentication (MFA): Implement MFA for user accounts to bolster security. This additional layer of protection helps prevent unauthorized access, particularly in cases where passwords may be compromised. By 2026, the significance of MFA will be highlighted by the fact that 93% of ransomware victims who pay extortion fees have had their data stolen in double extortion attacks, emphasizing the need for stronger authentication measures.

-

Regular Security Audits: Conduct frequent security audits and vulnerability assessments to identify and rectify potential weaknesses in your platform. This proactive strategy is essential for mitigating vulnerabilities before they can be exploited, especially considering that system intrusion attacks accounted for 50% of all breaches in 2025.

-

Fraud Detection Mechanisms: Integrate advanced fraud detection systems that utilize machine learning algorithms to identify suspicious activities and transactions. These systems are crucial in preventing losses due to fraud, as 78% of companies reported being targeted by ransomware attacks in the past year.

-

Risk Management Structure: Establish a comprehensive management structure that encompasses credit assessment, operational management, and compliance monitoring. This framework should be regularly reviewed and updated to adapt to evolving market conditions, ensuring that organizations remain resilient against emerging threats.

By implementing these robust security and risk management protocols, p2p lending software can effectively protect their users and maintain trust in their services.

Conclusion

Implementing effective peer-to-peer (P2P) lending software necessitates a nuanced understanding of its mechanisms, regulatory requirements, and technological needs. By leveraging best practices in these domains, organizations can establish a robust platform that not only meets user expectations but also adheres to industry standards. The central message underscores that successful P2P lending relies on a comprehensive approach that integrates technology, compliance, and security.

Key insights from the article emphasize the significance of grasping the P2P lending process, which encompasses:

- Loan origination

- Credit assessment

- Repayment structures

Moreover, prioritizing regulatory compliance through KYC procedures and regular audits is vital for fostering trust and credibility. Additionally, selecting the appropriate technology stack and development expertise ensures that the platform remains scalable and secure, while robust security measures and risk management protocols safeguard user data and uphold operational integrity.

In conclusion, as the P2P lending market continues to expand, stakeholders must remain vigilant in adopting these best practices. By concentrating on compliance, technology, and security, organizations can effectively navigate the challenges of P2P lending while seizing growth opportunities in this dynamic sector. Embracing these strategies will be crucial for those aiming to succeed in the evolving landscape of peer-to-peer lending.

Frequently Asked Questions

What is peer-to-peer (P2P) lending?

Peer-to-peer (P2P) lending is a method of direct borrowing and lending between individuals or businesses through online platforms, bypassing traditional financial institutions.

How does the loan origination process work in P2P lending?

The loan origination process begins when borrowers submit loan requests on a P2P platform, detailing their financial situations and intended use of the funds. Investors can then review these requests and choose loans to finance based on their risk tolerance.

What is involved in the credit assessment for P2P lending?

P2P lending platforms use advanced algorithms and credit scoring systems to evaluate borrower creditworthiness. This assessment helps reduce default risks and ensures that investors are matched with suitable borrowers.

How is funding structured in P2P lending?

After a loan is approved, funding typically comes from multiple investors who contribute varying amounts. This diversification reduces risk for individual investors and enhances the overall stability of the borrowing process.

What does the repayment structure look like in P2P lending?

Borrowers repay their loans in installments that include both principal and interest. The P2P platform manages these transactions to ensure timely returns for investors while minimizing operational costs.

What regulatory compliance is required for P2P lending platforms?

P2P lending platforms must adhere to various regulations that vary by jurisdiction, which are designed to protect consumer interests and ensure financial stability.

What is the projected growth of the global P2P lending market?

The global peer-to-peer lending market is projected to reach USD 21.42 billion by 2026, reflecting a compound annual growth rate of 20.2% from 2023 to 2030, up from a valuation of USD 5.91 billion in 2023.

Which segment of P2P lending is expected to grow the fastest?

The small business loans segment of P2P lending is anticipated to grow at a compound annual growth rate of 29%, indicating a growing acceptance of P2P funding as an alternative to traditional financing.