Master Software Implementation Planning for Hedge Funds: Key Practices

Introduction

Navigating the complex landscape of software implementation in hedge funds requires more than just technical expertise; it necessitates a strategic approach that emphasizes regulatory compliance, stakeholder engagement, and iterative testing. This article explores essential best practices that can enable investment firms to streamline their software deployment processes while ensuring adherence to evolving regulations. As firms work to align their technological solutions with organizational needs, a critical question arises: how can they effectively balance compliance, efficiency, and stakeholder involvement to achieve successful outcomes?

Understand Regulatory Compliance Requirements

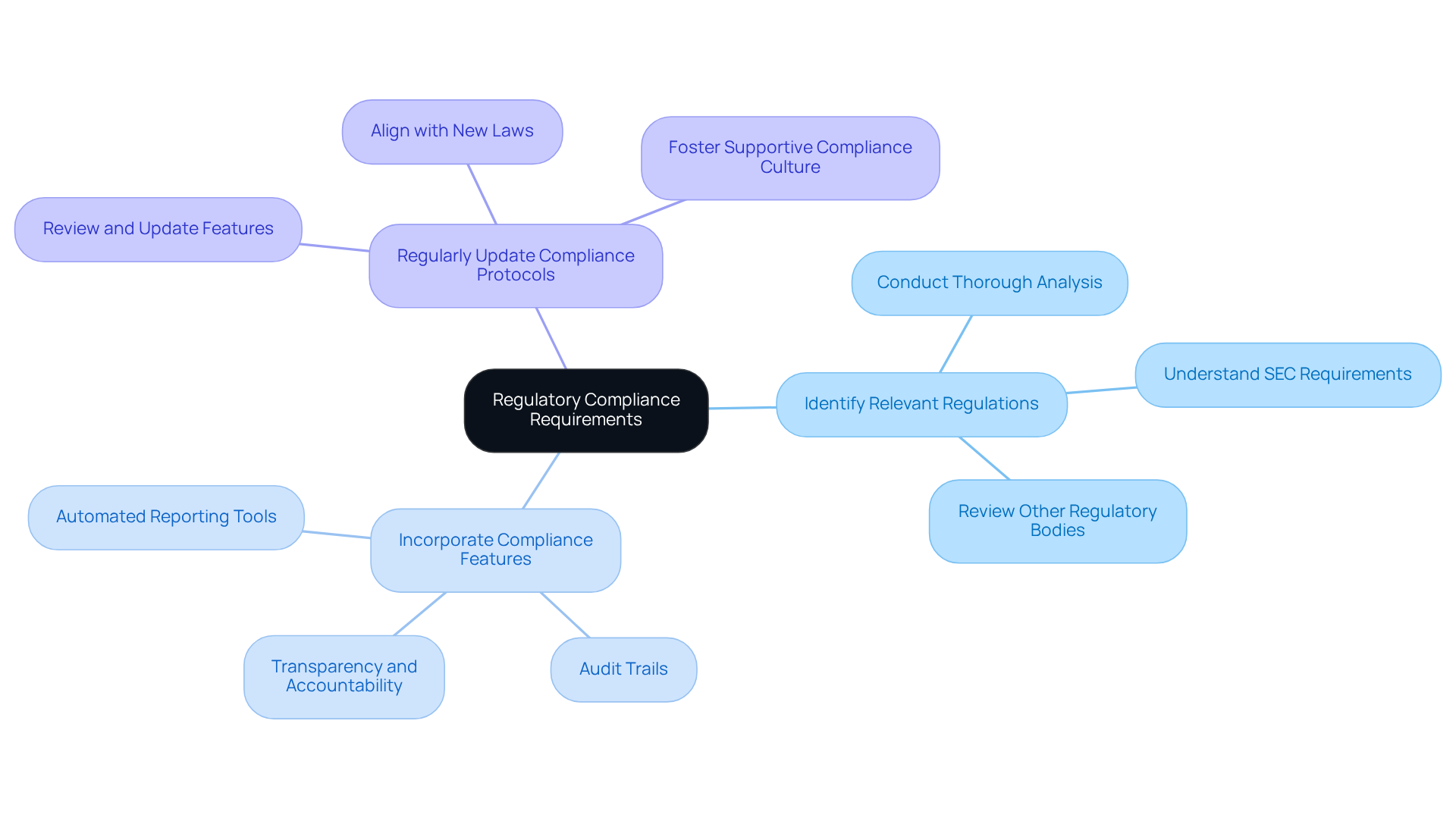

Hedge entities must navigate a complex landscape of regulatory compliance, which includes adhering to laws such as the Investment Advisers Act, the Securities Act, and various anti-money laundering (AML) regulations. To ensure compliance during software implementation planning, it is essential to identify relevant regulations, incorporate compliance features, and regularly update compliance protocols.

-

Identify Relevant Regulations: Conduct a thorough analysis of the regulations that apply to your specific hedge fund operations. This includes understanding the requirements set forth by the SEC and other regulatory bodies.

-

Incorporate Compliance Features: Ensure that the system includes features that facilitate compliance, such as automated reporting tools and audit trails. This can help in maintaining transparency and accountability.

-

Regularly Update Compliance Protocols: As regulations evolve, so should your software. Implement a process for software implementation planning that focuses on regularly reviewing and updating compliance features to align with new laws and guidelines.

In 2026, major regulatory changes are anticipated to affect banks and asset managers, highlighting the necessity for investment firms to remain proactive in addressing compliance challenges. As Chairman Atkins stated, examinations should not be a ‘gotcha exercise,’ underscoring the importance of fostering a supportive compliance culture. By prioritizing adherence from the outset, investment firms can reduce risks and improve their operational integrity. For instance, investment vehicles that have successfully followed the Investment Advisers Act demonstrate the effectiveness of incorporating compliance features into their technology solutions, ensuring they meet regulatory standards while maintaining operational efficiency.

Assess Organizational Needs and Software Alignment

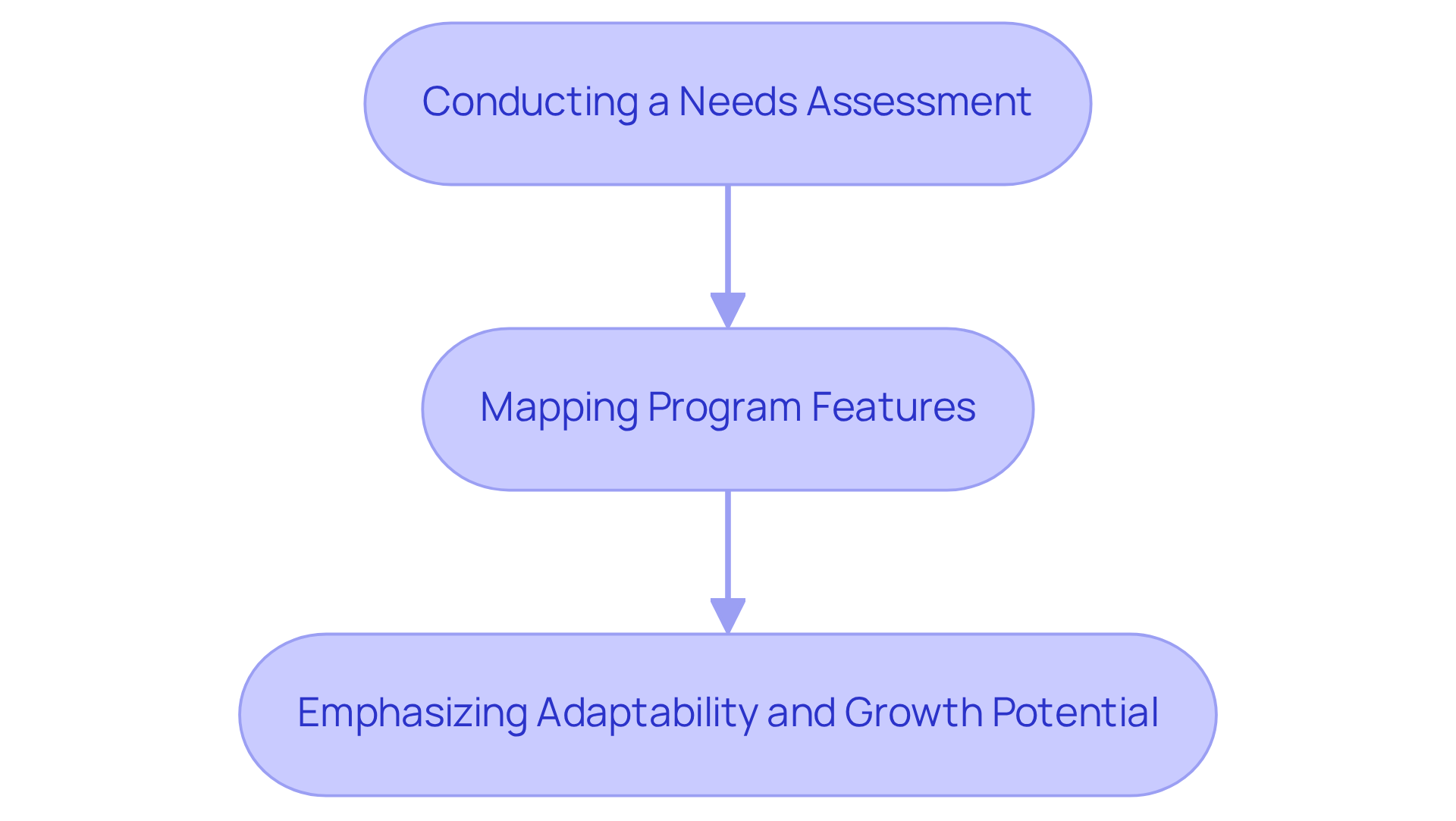

To effectively engage in software implementation planning for technological solutions, hedge funds must first assess their organizational requirements. This process involves several key steps:

-

Conducting a Needs Assessment: It is essential to engage with various departments to gain a comprehensive understanding of their specific requirements and challenges. This may encompass areas such as portfolio management, risk assessment, and compliance reporting. At Neutech, we facilitate this process by collaboratively identifying your needs and providing access to a range of potential designers and developers who can be integrated into your team.

-

Mapping Program Features: After identifying the requirements, the next step is to align these specifications with the capabilities of potential program solutions. It is crucial to seek features that directly address the identified needs, such as real-time data analytics or seamless integration with existing systems.

-

Emphasizing Adaptability and Growth Potential: When selecting applications, it is important to choose those that can adapt to changing business requirements and scale as the investment firm evolves. This approach ensures long-term sustainability and reduces the necessity for frequent updates.

By aligning technological capabilities with organizational requirements and leveraging Neutech’s tailored engineering expertise, investment firms can enhance operational efficiency through software implementation planning, ensuring that their technology investments yield optimal returns.

Engage Stakeholders Throughout the Implementation Process

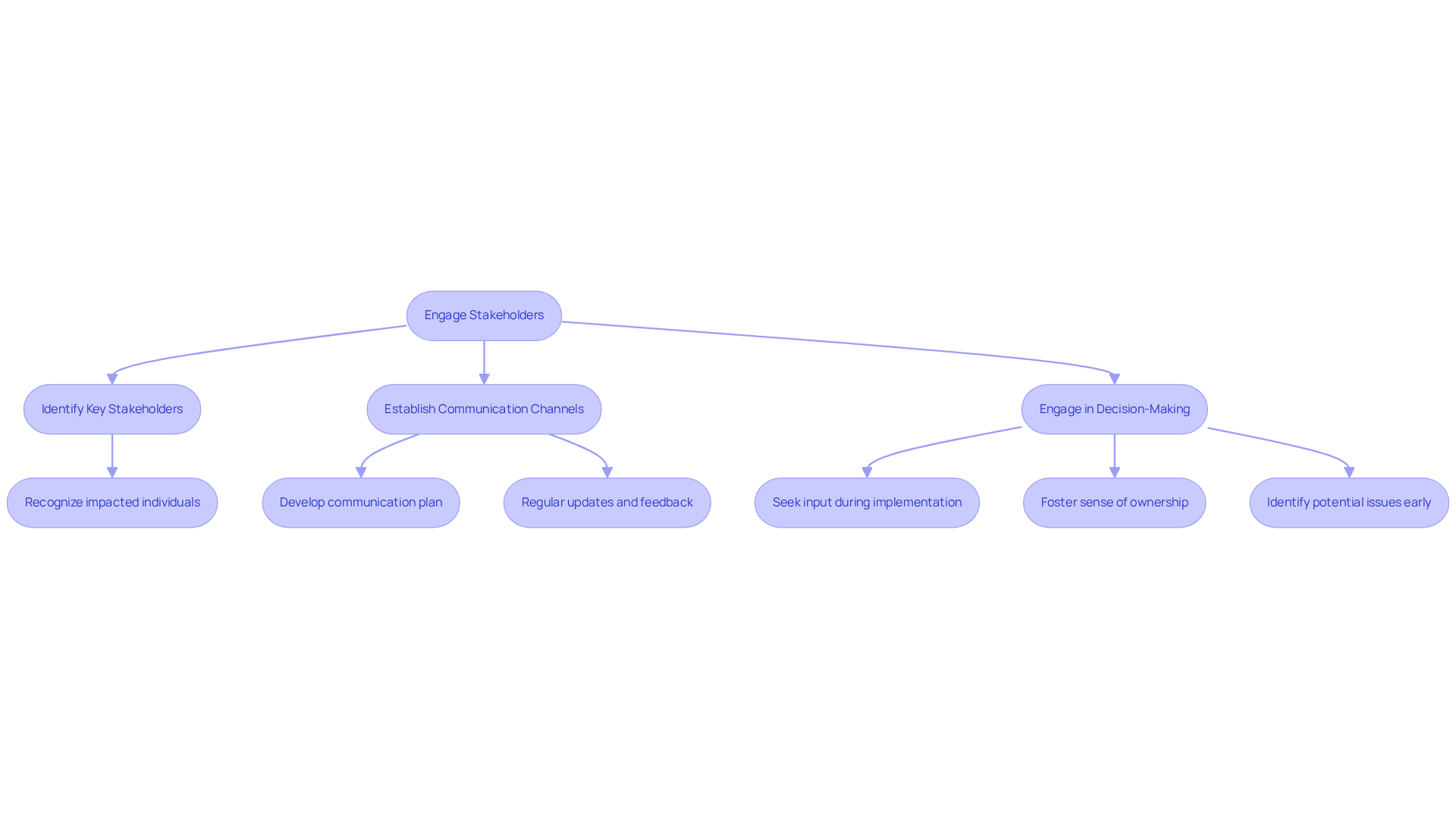

Stakeholder engagement is crucial for the successful implementation of systems in hedge funds. To effectively engage stakeholders, consider the following practices:

-

Identify Key Stakeholders: Recognize all individuals impacted by the software implementation, including team members, management, and external partners. Understanding their roles and concerns is vital for effectively addressing their needs.

-

Establish clear communication channels by developing a comprehensive communication plan that specifies how information will be disseminated throughout the software implementation planning process. Regular updates and feedback sessions are essential for keeping stakeholders informed and engaged. As Justin Lagac notes, “By engaging stakeholders, companies can foster greater workforce engagement, which ultimately contributes to superior financial results.”

-

Engage Stakeholders in Decision-Making: Actively seek input from stakeholders during critical stages of the implementation, such as system selection and testing. This approach not only fosters a sense of ownership but also aids in identifying potential issues early on. Research indicates that projects lacking focus on stakeholder engagement succeed only 32% of the time, underscoring the risks associated with neglecting this aspect.

By prioritizing stakeholder engagement, investment groups can enhance collaboration, reduce opposition to change, and facilitate smoother software implementation planning. Companies that engage with stakeholders are 50% more likely to achieve their significant goals, highlighting the substantial impact of effective engagement.

Implement Iterative Testing and Feedback Mechanisms

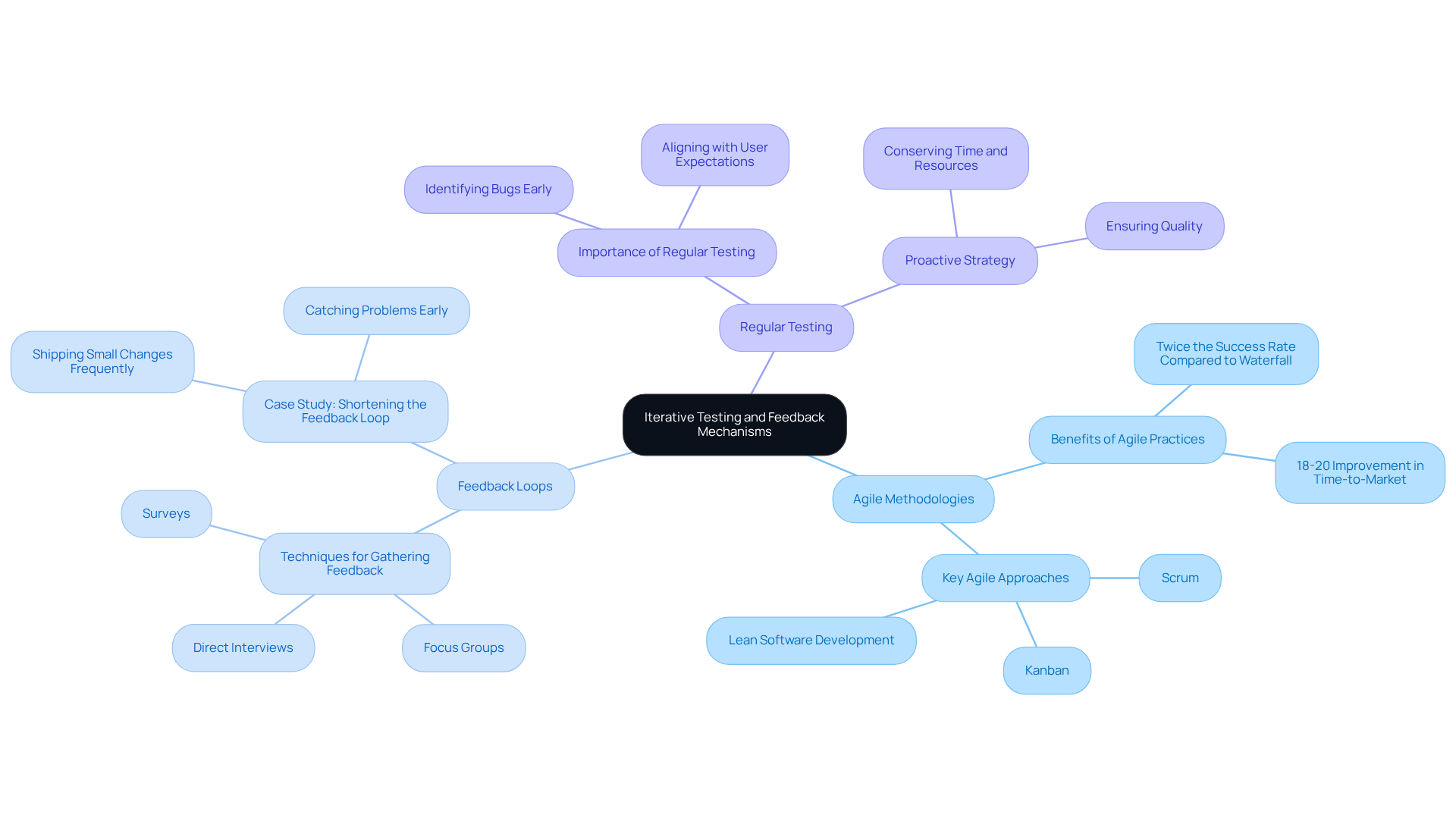

To ensure that technological solutions effectively address user requirements, investment groups must adopt iterative testing and feedback systems. This approach can be realized through several key practices.

-

Adopting Agile Methodologies: Investment groups should embrace Agile development practices that prioritize iterative cycles of development, testing, and feedback. Agile projects demonstrate a success rate that is twice that of Waterfall projects, achieving an 18-20% improvement in time-to-market. This facilitates rapid adjustments based on user input and evolving requirements, thereby enhancing responsiveness to market changes.

-

Establishing Feedback Loops: It is essential to develop structured processes for gathering user feedback at various stages of implementation. Techniques such as surveys, focus groups, and direct interviews yield valuable insights into user experiences, helping to identify areas for improvement. The case study “Shortening the Feedback Loop” illustrates how shipping small changes frequently enables teams to catch problems early and make necessary adjustments before they escalate.

-

Conducting Regular Testing: Regular testing of the application should be scheduled to identify bugs and performance issues early in the development process. This proactive strategy not only conserves time and resources but also ensures that the final product aligns closely with user expectations and business objectives.

By focusing on these iterative testing and feedback mechanisms, hedge funds can significantly enhance the quality of their software solutions through effective software implementation planning, ensuring they remain relevant and effective in a competitive landscape.

Conclusion

Effective software implementation planning is essential for hedge funds seeking to navigate the complexities of regulatory compliance, enhance operational efficiency, and foster stakeholder engagement. By prioritizing these elements, investment firms can ensure that their technology solutions not only meet current regulations but also adapt to future challenges.

Understanding regulatory compliance requirements is paramount. Hedge funds must assess their organizational needs and engage stakeholders throughout the implementation process. Adopting iterative testing and feedback mechanisms further strengthens this approach. Each of these practices contributes to a cohesive and effective software implementation strategy, ultimately leading to improved operational integrity and reduced risks. By aligning software capabilities with organizational goals and actively involving stakeholders, hedge funds can enhance collaboration and drive successful outcomes.

In a rapidly evolving financial landscape, the significance of these best practices cannot be overstated. Hedge funds must adopt a proactive approach to software implementation, ensuring they are not merely compliant but also positioned for long-term success. Embracing these strategies will streamline operations and cultivate a culture of continuous improvement, setting the stage for sustained growth and innovation in the industry.

Frequently Asked Questions

What are the main regulatory compliance requirements for hedge entities?

Hedge entities must adhere to laws such as the Investment Advisers Act, the Securities Act, and various anti-money laundering (AML) regulations.

How can hedge entities identify relevant regulations?

Hedge entities should conduct a thorough analysis of the regulations that apply to their specific operations, including understanding the requirements set forth by the SEC and other regulatory bodies.

What compliance features should be incorporated into software systems?

Software systems should include features that facilitate compliance, such as automated reporting tools and audit trails, which help maintain transparency and accountability.

Why is it important to regularly update compliance protocols?

As regulations evolve, software and compliance features must also be updated to align with new laws and guidelines, ensuring ongoing compliance.

What significant changes are anticipated in 2026 regarding regulatory compliance?

Major regulatory changes are expected to affect banks and asset managers, making it crucial for investment firms to proactively address compliance challenges.

What is the significance of fostering a supportive compliance culture?

Fostering a supportive compliance culture helps reduce risks and improve operational integrity, as emphasized by Chairman Atkins, who noted that examinations should not be a ‘gotcha exercise.’

How can investment firms demonstrate effective compliance?

Investment vehicles that successfully follow the Investment Advisers Act show the effectiveness of integrating compliance features into their technology solutions, ensuring they meet regulatory standards while maintaining operational efficiency.