4 Best Practices for Agile Software Consulting in Hedge Fund Management

Introduction

In the dynamic realm of hedge fund management, the capacity to adapt and innovate is crucial. Agile methodologies present a structured approach that enhances collaboration and streamlines processes, addressing the ever-evolving demands of the financial sector. However, the path to successful Agile implementation is not without its challenges.

How can hedge funds effectively navigate these complexities to fully leverage Agile practices? This article examines best practices that empower investment managers to adopt Agile values, choose appropriate frameworks, and utilize expert consulting, ultimately leading to enhanced operational efficiency and improved client satisfaction.

Understand Agile Values and Principles

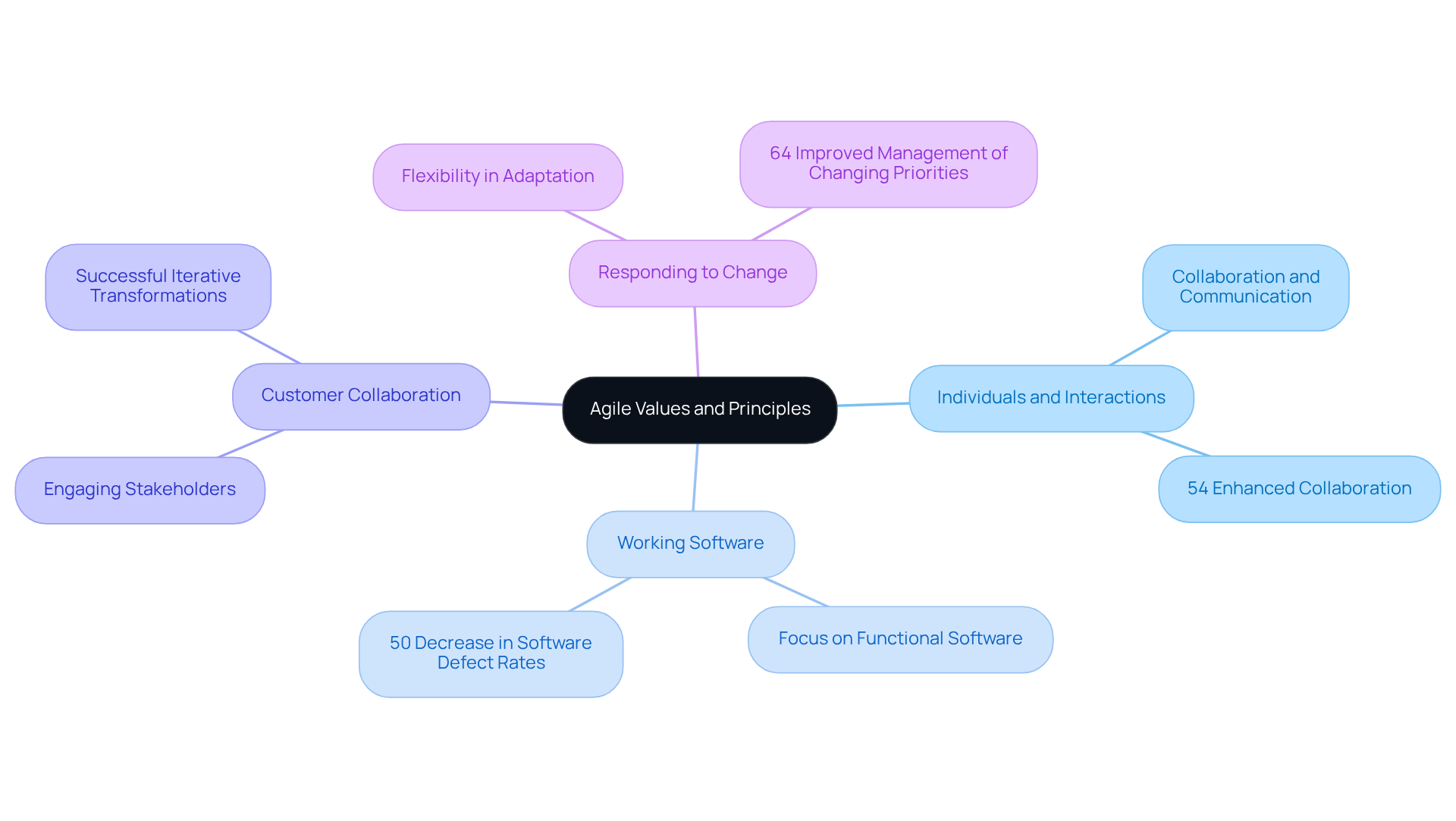

Agile methodologies are anchored in four fundamental values articulated in the Agile Manifesto, which are particularly relevant for hedge fund managers navigating the complexities of financial services:

-

Individuals and Interactions Over Processes and Tools: Emphasizing collaboration and communication among groups fosters innovation and responsiveness, which are crucial for adapting to market fluctuations. Statistics indicate that 54% of companies enhanced collaboration among teams after implementing flexible practices, underscoring the significance of this value.

-

Working Software Over Comprehensive Documentation: The focus shifts to delivering functional software that meets user needs, avoiding the pitfalls of excessive documentation that can hinder progress. Flexible methodologies have been associated with a 50% decrease in software defect rates, thereby enhancing overall software quality.

-

Customer Collaboration Over Contract Negotiation: Engaging stakeholders throughout the development process ensures that the final product aligns with their expectations, enhancing satisfaction and reducing the risk of misalignment. Successful iterative transformations in financial services, as observed at leading banks like BBVA and ING, demonstrate the effectiveness of this approach.

-

Responding to Change Over Following a Plan: Flexibility is key; embracing change allows teams to adapt swiftly to evolving market conditions and client requirements, a necessity in the fast-paced financial landscape. Reports indicate that 64% of organizations adopting Agile have improved their ability to manage changing priorities, underscoring the value of this principle.

By internalizing these values, investment managers can foster a culture that encourages rapid iteration and ongoing enhancement. This approach not only enhances team performance but also positions organizations to respond effectively to the dynamic challenges of the financial sector. Moreover, being aware of typical traps linked to flexible methodology implementation, such as the absence of a shared vision and outdated technology, can assist asset managers in preventing errors during execution. Overall, embracing flexible methodologies can lead to significant enhancements in operational efficiency and customer satisfaction.

Implement Effective Agile Frameworks

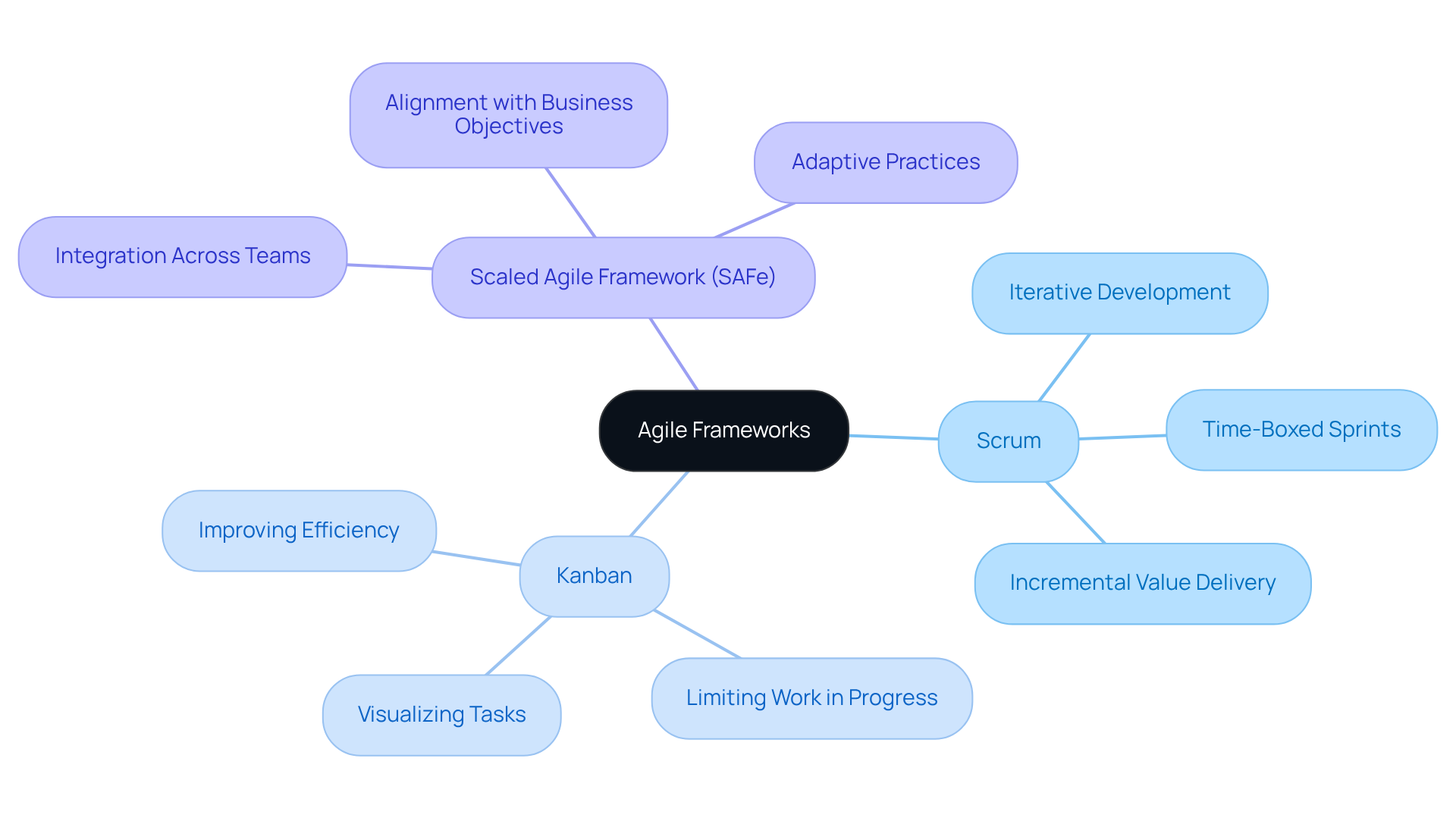

To effectively implement Agile methodologies, hedge funds can adopt several frameworks:

-

Scrum: This framework promotes iterative development through time-boxed sprints, enabling teams to deliver incremental value.

-

Kanban: Focused on visualizing tasks and limiting work in progress, Kanban helps teams manage flow and improve efficiency.

-

Scaled Agile Framework (SAFe): Particularly suited for larger organizations, SAFe integrates adaptive practices across multiple teams, ensuring alignment with business objectives.

By selecting the appropriate framework for agile software consulting, investment groups can enhance collaboration, accelerate time-to-market, and ensure compliance with regulatory standards.

Choose Tailored Agile Methodologies

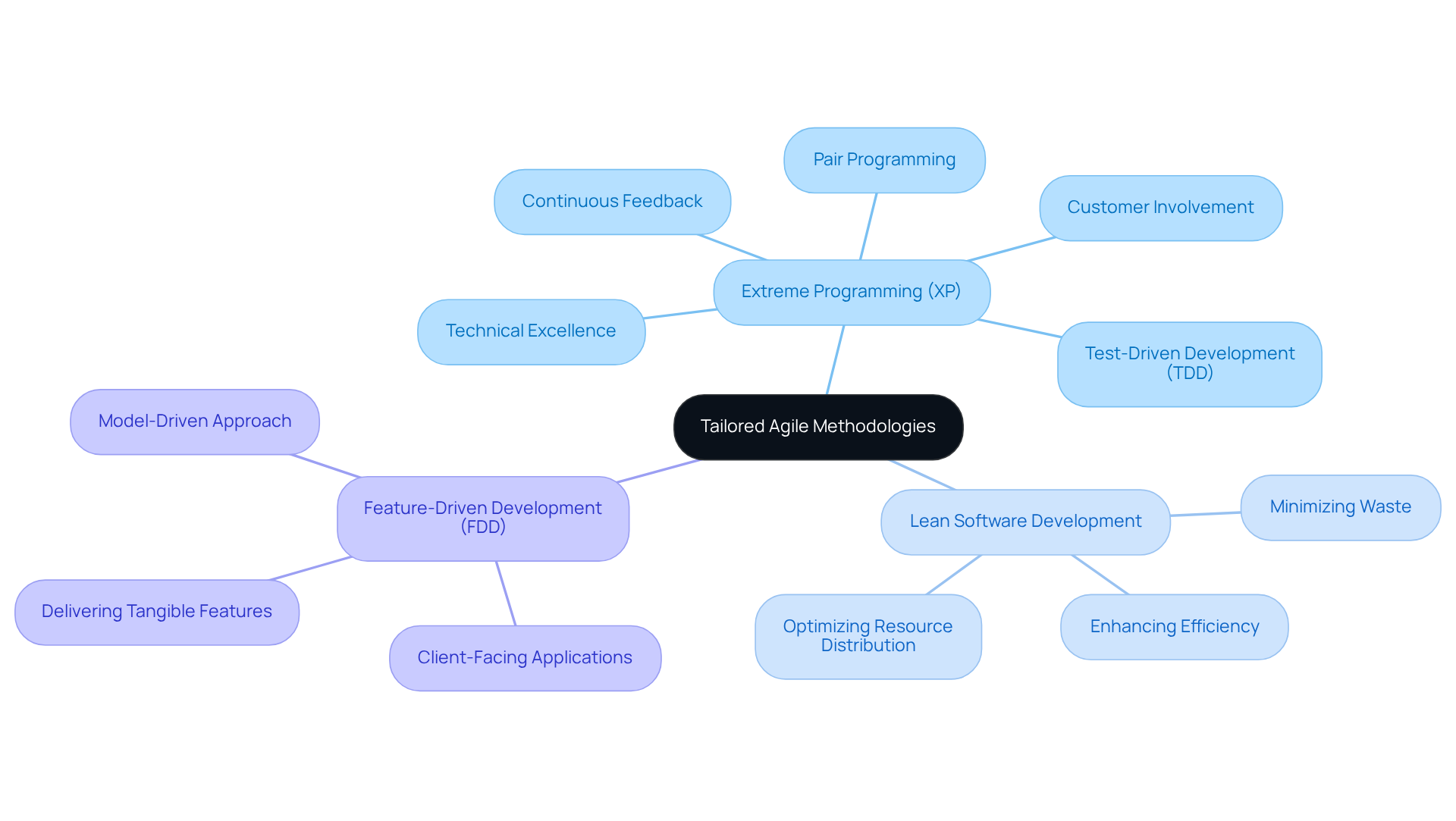

Hedge funds should consider agile software consulting to tailor methodologies that enhance their operations.

-

Extreme Programming (XP) emphasizes technical excellence and continuous feedback, making it particularly suitable for projects that require high-quality software.

-

Lean Software Development focuses on minimizing waste and enhancing efficiency, which is ideal for optimizing resource distribution in investment projects.

-

Feature-Driven Development (FDD) adopts a model-driven approach that prioritizes delivering tangible, working software features, proving beneficial for client-facing applications.

By selecting methodologies that align with their specific environment, investment groups can foster cooperation, accelerate delivery, and ultimately increase overall project success.

Leverage Expertise of Agile Consultants

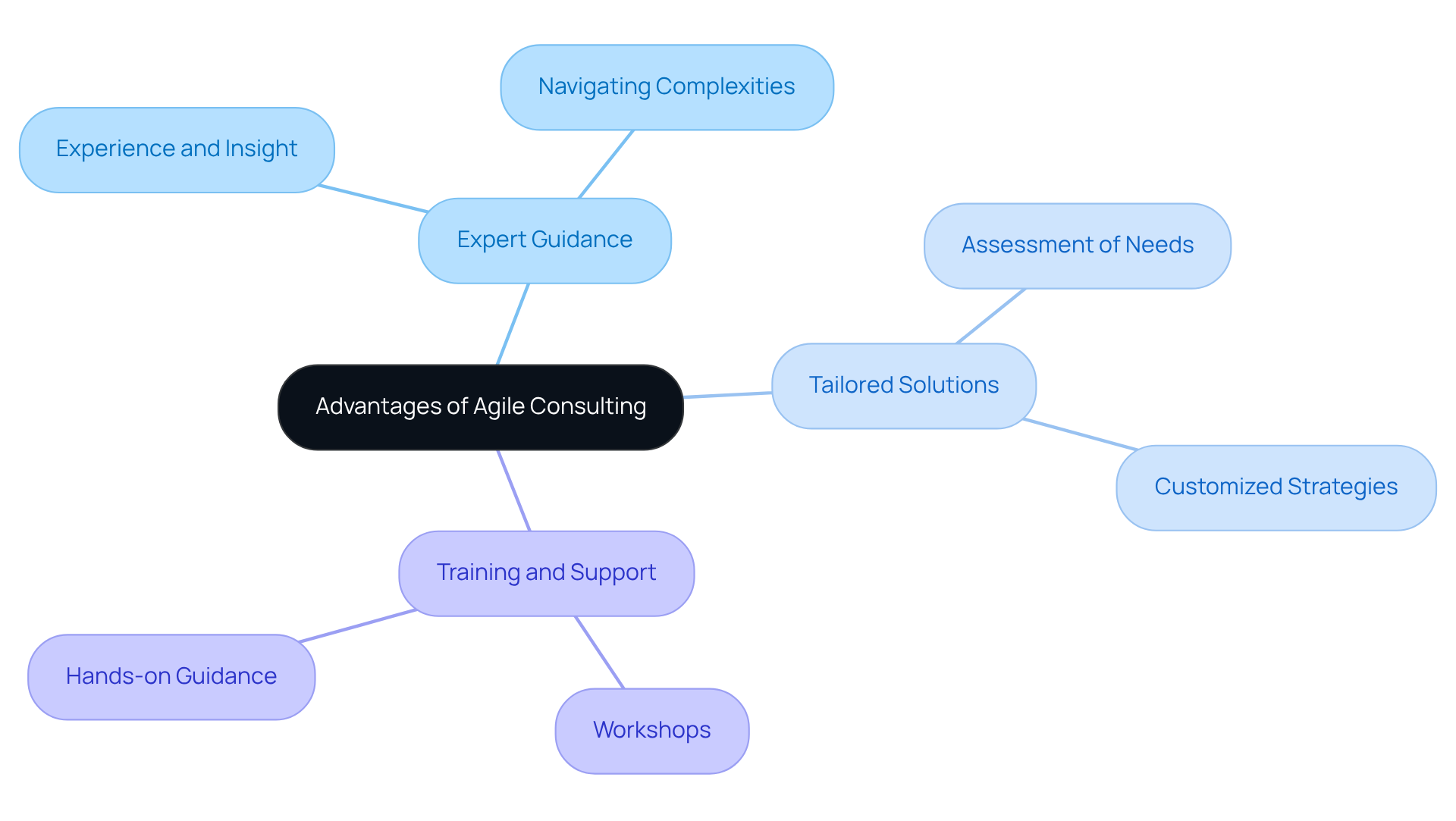

Engaging in agile software consulting offers hedge funds several distinct advantages.

-

Expert Guidance: These advisors bring a wealth of experience and insight, aiding organizations in navigating the complexities of Agile implementation. Their expertise ensures that teams can effectively manage the challenges that arise during this transition.

-

Tailored Solutions: Agile consultants assess the unique needs of each organization, recommending customized strategies that align with specific business objectives. This tailored approach enhances the likelihood of successful outcomes by addressing the particular context of the hedge fund.

-

Training and Support: Consultants also provide essential training and support, leading workshops and sessions that empower teams to adopt iterative methodologies efficiently. This hands-on guidance fosters a deeper understanding of Agile principles, facilitating smoother transitions.

By leveraging the expertise of agile software consulting, hedge funds can accelerate their Agile transformation, improve team dynamics, and enhance overall project success.

Conclusion

Embracing Agile methodologies in hedge fund management is not merely a trend; it is a strategic necessity for navigating the complexities of the financial landscape. By prioritizing values such as collaboration, customer engagement, and adaptability, hedge funds can cultivate a responsive environment that meets the ever-changing demands of the market. This shift towards Agile practices empowers investment managers to enhance operational efficiency and customer satisfaction while mitigating risks associated with rigid processes.

The article highlights several key practices that facilitate successful Agile implementation in hedge funds:

- Understanding Agile values and principles lays the foundation for effective collaboration and innovation.

- Implementing frameworks like Scrum, Kanban, and SAFe enables teams to streamline their processes and deliver value incrementally.

- Tailoring methodologies such as Extreme Programming or Lean Software Development ensures that the unique needs of each hedge fund are addressed, fostering a culture of continuous improvement.

- Engaging with Agile consultants further amplifies these benefits, providing expert guidance and tailored solutions that enhance the likelihood of successful outcomes.

Ultimately, the integration of Agile methodologies in hedge fund management is crucial for maintaining a competitive edge in a fast-paced industry. By adopting these best practices, hedge funds can improve their internal processes and enhance their ability to respond effectively to market shifts and client needs. The call to action is clear: investing in Agile practices and expertise is essential for any hedge fund aiming for sustainable success in the evolving financial landscape.

Frequently Asked Questions

What are the four fundamental values of Agile methodologies?

The four fundamental values of Agile methodologies are: 1. Individuals and Interactions Over Processes and Tools 2. Working Software Over Comprehensive Documentation 3. Customer Collaboration Over Contract Negotiation 4. Responding to Change Over Following a Plan.

Why is collaboration emphasized in Agile methodologies?

Collaboration is emphasized because it fosters innovation and responsiveness, which are crucial for adapting to market fluctuations. Statistics show that 54% of companies enhanced collaboration among teams after implementing flexible practices.

How does Agile prioritize software development?

Agile prioritizes delivering functional software that meets user needs over excessive documentation, which can hinder progress. This focus has been associated with a 50% decrease in software defect rates, thereby improving overall software quality.

What is the importance of customer collaboration in Agile?

Customer collaboration is important because it ensures that stakeholders are engaged throughout the development process, aligning the final product with their expectations. This approach has proven effective in iterative transformations within financial services at leading banks.

How does Agile address change in project management?

Agile emphasizes responding to change over strictly following a plan, allowing teams to adapt swiftly to evolving market conditions and client requirements. Reports indicate that 64% of organizations adopting Agile have improved their ability to manage changing priorities.

What benefits can investment managers gain from Agile methodologies?

Investment managers can foster a culture of rapid iteration and ongoing enhancement, which enhances team performance and positions organizations to respond effectively to dynamic challenges in the financial sector.

What are some common traps in implementing Agile methodologies?

Common traps include the absence of a shared vision and reliance on outdated technology, which can lead to errors during execution of flexible methodologies.

What overall improvements can Agile methodologies bring to organizations?

Embracing Agile methodologies can lead to significant enhancements in operational efficiency and customer satisfaction.