Discover the Top Business Intelligence Software for Hedge Funds

Introduction

The financial landscape is increasingly driven by data, rendering business intelligence (BI) tools essential for hedge funds seeking to excel in a competitive market. These advanced applications not only facilitate data analysis but also enable fund managers to make informed decisions that enhance profitability and mitigate risks. Given the multitude of options available, hedge funds face the challenge of identifying which BI software best aligns with their specific requirements. This article explores the leading business intelligence software designed for hedge funds, assessing key features, benefits, and implementation strategies to assist firms in navigating the complexities of data-driven decision-making.

Define Business Intelligence Tools and Their Importance for Hedge Funds

The top business intelligence software consists of essential applications designed to gather, analyze, and present business information, facilitating informed decision-making. In the context of hedge portfolios, these applications are crucial as they empower managers to process vast amounts of data, identify patterns, and make strategic investment decisions.

The importance of top business intelligence software in hedge investments lies in its ability to enhance operational efficiency, improve risk management, and ensure compliance with regulatory standards. By leveraging BI tools, hedge organizations can gain valuable insights into market trends, optimize portfolio performance, and ultimately increase profitability.

Identify Key Selection Criteria for Hedge Fund BI Tools

When selecting BI tools for hedge funds, several key criteria must be prioritized:

-

Information Integration: Smooth incorporation with current information sources is crucial for precise analysis and decision-making. Top business intelligence software applications, such as Tableau and Power BI, should eliminate information silos, permitting a comprehensive view of operations and performance metrics.

-

User-Friendliness: An intuitive interface is essential, allowing team members to navigate the system effectively without extensive training. This accessibility can significantly reduce onboarding time and enhance overall productivity.

-

Scalability: As hedge investments grow, their business intelligence resources must adapt to handle increasing information volumes and complexity. This flexibility ensures that the resources remain effective as the organization expands and evolves.

-

Real-Time Analytics: The ability to analyze information in real-time is critical for hedge funds, enabling prompt decisions based on the latest market insights. Proactive alerts and dynamic reporting features can enhance responsiveness to market changes.

-

Given the stringent regulatory environment, it is imperative that top business intelligence software supports compliance with financial regulations and reporting standards. Robust governance features help maintain data integrity and mitigate risks associated with non-compliance.

-

Cost Considerations: The total cost of ownership, encompassing licensing, implementation, and ongoing support, should be assessed to ensure that the chosen BI solution fits within budget constraints while fulfilling the required feature set.

-

Participant Engagement: Engaging a diverse range of stakeholders during the trial phase is crucial for identifying potential challenges and ensuring that the tool addresses the varied requirements of the organization.

Compare Leading Business Intelligence Tools: Features, Pros, and Cons

-

Tableau:

- Features: Tableau is recognized for its advanced data visualization capabilities, featuring a user-friendly interface and strong community support, which makes it a preferred choice among analysts.

- Pros: Its primary strength lies in visual analytics, allowing users to create engaging dashboards and reports that integrate seamlessly with various data sources.

- Cons: However, the pricing model of Tableau can pose a financial challenge for larger teams, particularly due to its creator-centric licensing structure, which escalates costs as more users require access.

-

Microsoft Power BI:

- Features: Power BI offers robust reporting capabilities, real-time data access, and seamless integration with Microsoft products, making it an appealing option for organizations already utilizing the Microsoft ecosystem.

- Pros: It is both cost-effective and user-friendly, particularly for those familiar with Excel, facilitating rapid adoption across teams. Notably, Power BI has recently surpassed Tableau in traffic data, reflecting a shift in popularity among users.

- Cons: Conversely, Power BI has limited customization options compared to its competitors, which may restrict advanced users seeking tailored solutions. Additionally, users often depend on analysts for deeper exploration, potentially slowing down decision-making processes.

-

Qlik Sense:

- Features: Qlik Sense employs an associative data model that enhances self-service analytics while ensuring robust data governance.

- Pros: It excels in complex analysis and is particularly suited for collaborative environments, allowing multiple users to explore data simultaneously.

- Cons: The platform does present a steeper learning curve for new users, which may impede swift adoption in fast-paced settings.

-

Looker:

- Features: Looker includes a powerful data modeling layer and real-time analytics capabilities, along with strong integration options with various data sources.

- Pros: It is particularly effective for data exploration and collaboration, enabling teams to quickly derive insights.

- Cons: However, Looker requires a higher level of technical skill for installation and maintenance, which can pose a challenge for organizations lacking dedicated analytics teams.

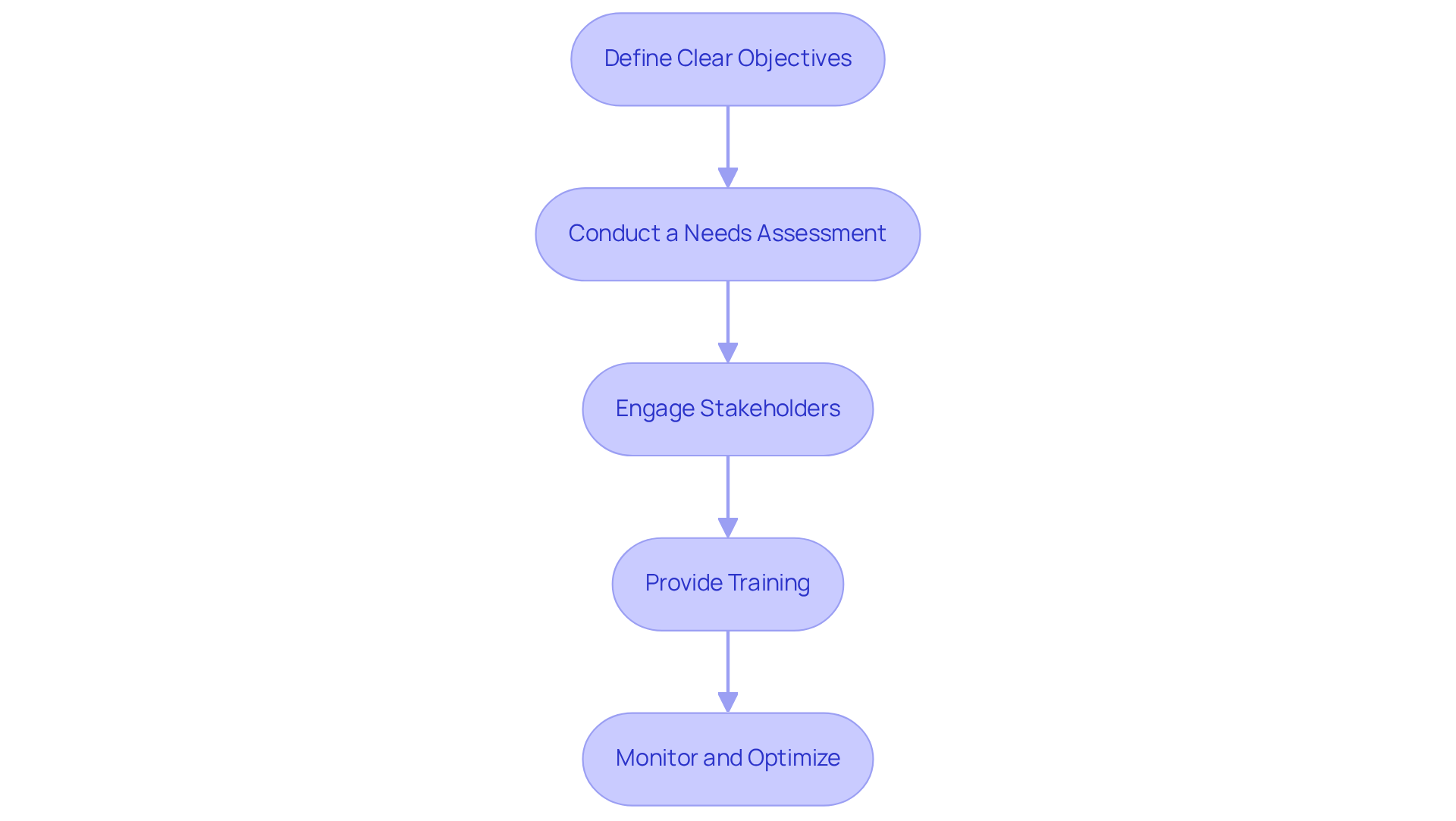

Examine Implementation Strategies for Effective BI Tool Integration

To effectively integrate BI tools into hedge fund operations, it is essential to adopt several key strategies.

-

Define Clear Objectives: Establish specific goals for the BI resource, such as improving reporting accuracy or enhancing information visualization. This clarity helps align the instrument’s capabilities with the fund’s strategic needs.

-

Conduct a Needs Assessment: Assess current information sources and workflows to identify integration points and potential challenges. This evaluation ensures that the BI application enhances existing systems and addresses any shortcomings in information management.

-

Engage Stakeholders: Involve key team members in the selection and implementation process to secure buy-in and address concerns. Engaging stakeholders fosters a sense of ownership and encourages adherence to new practices, which is crucial for successful integration.

-

Provide Training: Offer comprehensive training sessions to ensure that all individuals are comfortable with the new resource and understand its capabilities. Ongoing training enhances data literacy and empowers team members to leverage BI effectively, ultimately improving decision-making processes.

-

Monitor and Optimize: After implementation, continuously observe the system’s performance and gather user feedback to make necessary adjustments and enhancements. Regular evaluations assist in keeping alignment with changing business goals and ensure the BI resource remains a valuable asset in navigating market complexities.

Integrating these strategies is crucial, especially as the top business intelligence software market is projected to expand from $37.22 billion in 2024 to $73.36 billion by 2033. This growth underscores the increasing significance of top business intelligence software in the finance sector. Real-world examples, such as Enovate Medical’s integration of BI into their healthcare operations, which resulted in a 25% increase in clinician efficiency, further illustrate the effectiveness of these tools. Additionally, defining data ownership and implementing quality checks are critical best practices that ensure the reliability and accuracy of the data utilized in BI systems.

Conclusion

The exploration of business intelligence software underscores its essential role in enabling hedge funds to excel in a data-driven landscape. By effectively leveraging these tools, hedge funds can convert extensive datasets into actionable insights, thereby refining decision-making processes and enhancing overall performance. The appropriate BI software not only optimizes operations but also bolsters compliance and risk management, ultimately fostering profitability and strategic growth.

Key criteria for selecting BI tools in hedge funds encompass:

- Information integration

- User-friendliness

- Scalability

- Real-time analytics

- Compliance support

- Cost considerations

- Participant engagement

Each of these elements is crucial in ensuring that the selected software aligns with the organization’s unique requirements while facilitating a smooth transition to data-driven decision-making. Moreover, comparing leading tools such as Tableau, Microsoft Power BI, Qlik Sense, and Looker reveals the varied features, advantages, and limitations that can significantly impact a hedge fund’s selection process.

In conclusion, as the market for business intelligence software continues to grow, hedge funds must prioritize the adoption of effective BI tools to maintain competitiveness. By implementing strategic integration practices and continuously optimizing their usage, firms can harness the full potential of data analytics. Embracing these technologies not only improves operational efficiency but also positions hedge funds to adeptly navigate the complexities of the financial landscape with confidence and agility.

Frequently Asked Questions

What are business intelligence tools?

Business intelligence tools are essential applications designed to gather, analyze, and present business information, facilitating informed decision-making.

Why are business intelligence tools important for hedge funds?

They are important for hedge funds because they enable managers to process vast amounts of data, identify patterns, and make strategic investment decisions.

How do business intelligence tools enhance operational efficiency in hedge funds?

By leveraging business intelligence tools, hedge funds can streamline processes, improve risk management, and ensure compliance with regulatory standards.

What insights can hedge funds gain from using business intelligence tools?

Hedge funds can gain valuable insights into market trends, optimize portfolio performance, and ultimately increase profitability by using business intelligence tools.