Introduction

Operational efficiency is a cornerstone of success in the competitive hedge fund landscape, where firms compete for a share of a $4 trillion market. By optimizing processes and minimizing costs, investment groups can enhance profitability while also improving risk management and regulatory compliance. However, operational inefficiencies can lead to significant financial losses and reputational damage. Thus, the pressing question remains: how can hedge funds effectively navigate the complexities of operational efficiency to secure their position in an ever-evolving market?

Define Operational Efficiency and Its Importance

Operational effectiveness refers to an organization’s ability to deliver products or services in the most cost-effective manner without compromising quality. In the context of hedge funds, this means optimizing processes to minimize costs while maximizing investment returns. Understanding why operational efficiency is important is paramount; it directly influences profitability, enhances risk management, and ensures compliance with regulatory standards.

In a highly competitive landscape, where no single firm exceeds a 5% market share, it is essential to understand why operational efficiency is important as it becomes a crucial differentiator between success and failure. By streamlining operations, investment groups can effectively lower transaction costs, accelerate decision-making, and improve overall service delivery to clients.

As the hedge fund sector, which manages approximately $4 trillion in assets as of 2023, evolves – particularly looking ahead to 2026 – understanding why operational efficiency is important will be vital. Firms are increasingly integrating advanced technologies and methodologies to refine their operational frameworks. Nick Nolan emphasizes that a robust functional infrastructure is essential for sustaining growth and maintaining allocator trust in this dynamic environment.

This focus not only aids in navigating market volatility but also positions investment groups to seize emerging opportunities, ultimately fostering sustainable growth.

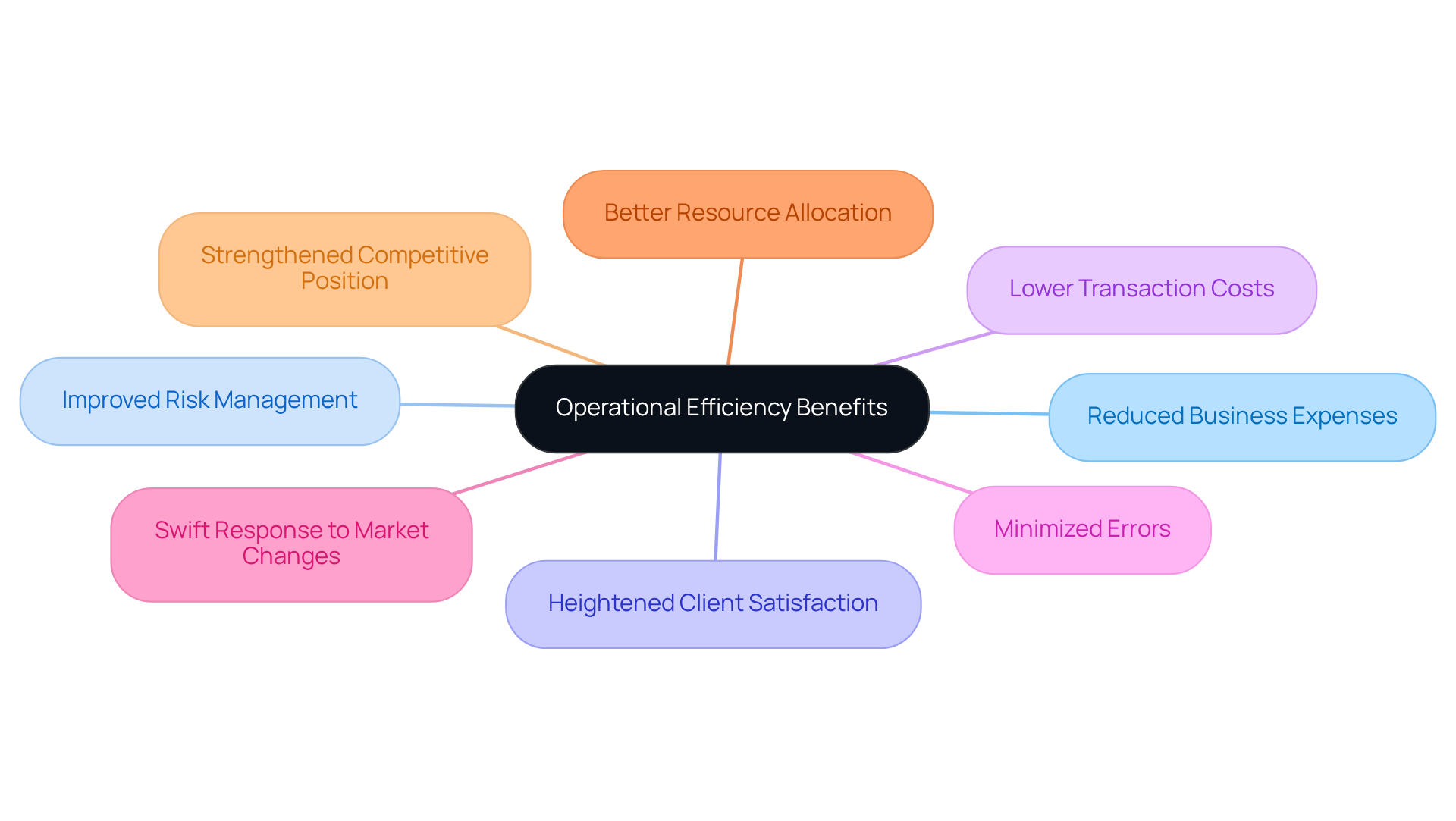

Explore the Benefits of Achieving Operational Efficiency

Understanding why operational efficiency is important provides significant advantages for investment firms, including reduced business expenses, improved risk management, and heightened client satisfaction. By optimizing workflows and leveraging technology, these firms can lower transaction costs and minimize errors, highlighting why operational efficiency is important for maintaining compliance with regulatory requirements.

Furthermore, functional effectiveness empowers investment groups to respond swiftly to market changes, enabling them to capitalize on investment opportunities more effectively. The discussion on why operational efficiency is important highlights how enhanced efficiency leads to better resource allocation, enabling financial teams to focus on strategic initiatives instead of being bogged down by logistical issues.

Ultimately, these advantages strengthen the firm’s competitive position in the market, attracting more investors and increasing assets under management.

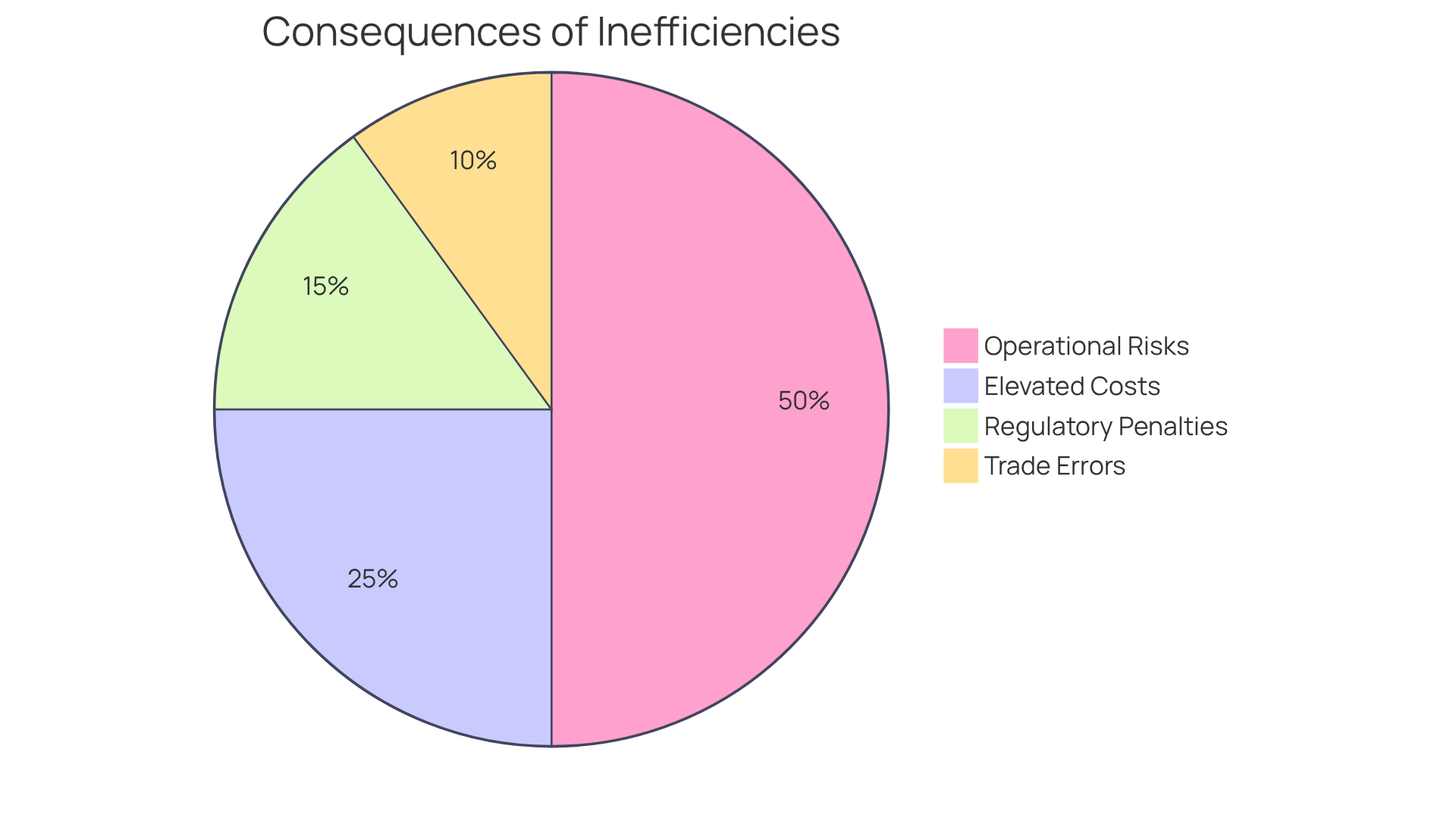

Analyze the Consequences of Inefficiency in Operations

Operational inefficiencies can lead to significant consequences for investment pools, manifesting as increased operational risks, elevated costs, and potential regulatory penalties. Research indicates that 50% of hedge investment failures are attributable to these inefficiencies, underscoring the urgency of addressing this critical issue. Inefficient processes often result in errors in trade execution, delays in reporting, and compliance failures, which can undermine investor confidence and tarnish a portfolio’s reputation.

Moreover, these inefficiencies squander valuable resources, redirecting time and capital toward rectifying errors rather than seizing profitable opportunities. In an environment where profit margins are already tight, the financial impact of inefficiency can be the determining factor between success and failure. For instance, the collapse of the Lipper convertible arbitrage portfolios exemplifies how inadequate oversight can lead to substantial losses, highlighting the necessity for rigorous due diligence.

As investment groups continue to evolve, understanding why operational efficiency is important will only grow, making it imperative for managers to prioritize effective processes and compliance measures. Additionally, with total investment vehicle assets under management projected to reach US $4.5 trillion by the end of 2024, the ramifications of operational inefficiencies are more pronounced than ever. Notably, 85% of functional failures involved misrepresentation, misappropriation of resources, and unauthorized trading, further emphasizing the need for stringent management controls.

As the sector braces for forecasts of 800 investment vehicles shutting down this year, the urgency for managers to address these inefficiencies cannot be overstated.

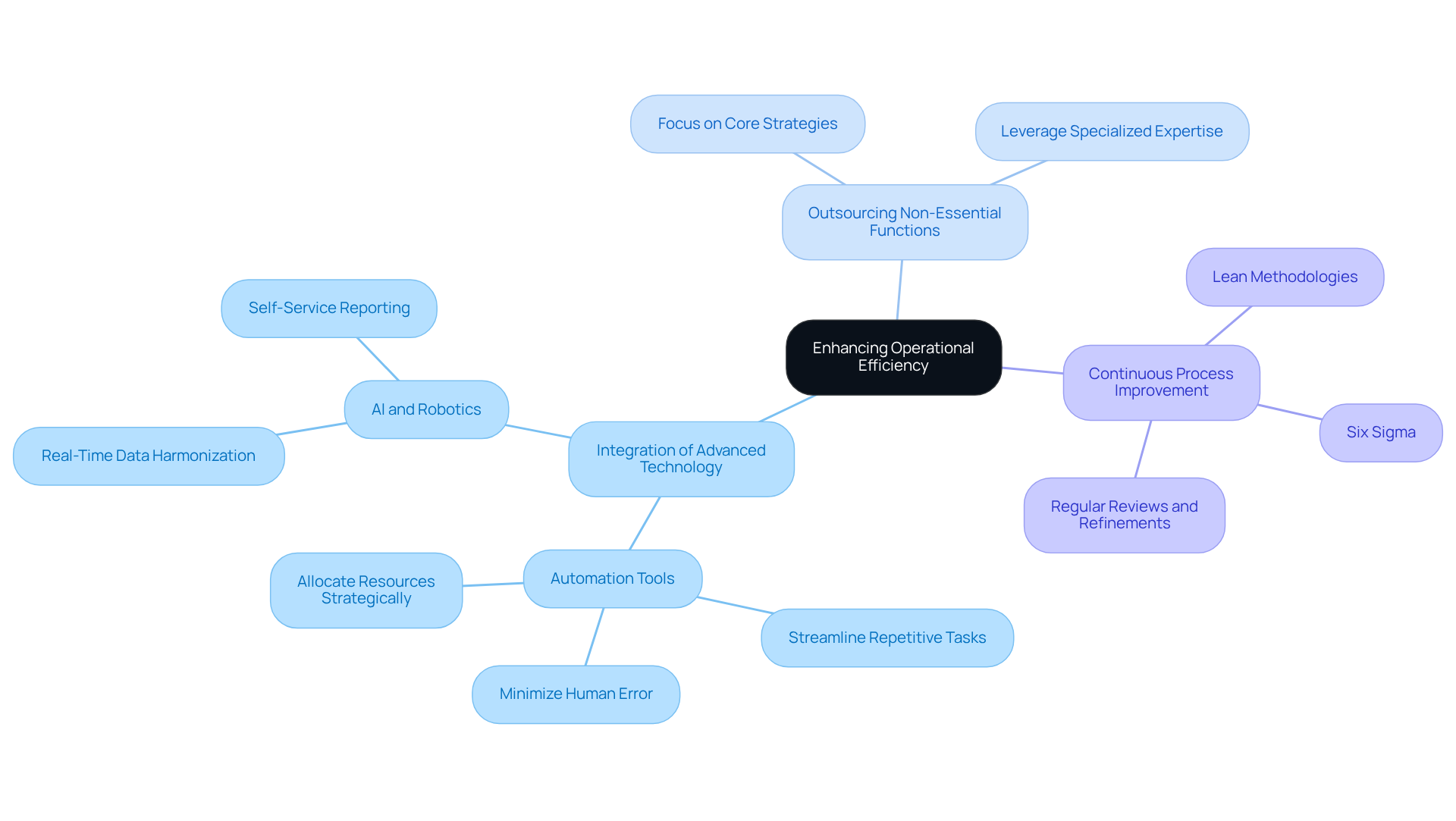

Identify Strategies to Enhance Operational Efficiency

To enhance business effectiveness, investment groups can adopt several strategies, including:

- The integration of advanced technology

- Outsourcing non-essential functions

- Continuous process improvement

The implementation of automation tools can streamline repetitive tasks, minimize human error, and allocate valuable resources to more strategic initiatives. Additionally, outsourcing back-office functions allows investment firms to focus on their core strategies while leveraging specialized expertise for administrative tasks. Regular reviews and refinements of processes through methodologies such as Lean or Six Sigma can identify inefficiencies and promote ongoing improvement. By cultivating a culture of operational excellence, hedge funds can demonstrate why operational efficiency is important, as it not only boosts their efficiency but also strengthens their overall performance and resilience in a competitive market.

Conclusion

Operational efficiency is a cornerstone for the success of hedge funds, acting as a vital mechanism that drives profitability and enhances competitive advantage. By optimizing processes and streamlining operations, investment firms can reduce costs while improving service quality and risk management, positioning themselves favorably in an increasingly crowded marketplace.

The article outlines several key benefits of achieving operational efficiency:

- Cost reduction

- Improved risk management

- Enhanced client satisfaction

By leveraging advanced technologies and refining workflows, hedge funds can respond swiftly to market changes, allocate resources more effectively, and ultimately attract more investors. In contrast, operational inefficiencies lead to increased risks, elevated costs, and potential regulatory penalties, undermining investor confidence and tarnishing reputations.

Emphasizing the importance of operational efficiency is crucial for hedge funds aiming to thrive in a competitive landscape. As the industry evolves, embracing strategies such as automation, outsourcing, and continuous improvement will mitigate risks and foster sustainable growth. Investment managers must prioritize operational excellence, as it is not merely a competitive advantage but a necessity for long-term success in the hedge fund arena.

Frequently Asked Questions

What is operational efficiency?

Operational efficiency refers to an organization’s ability to deliver products or services in the most cost-effective manner without compromising quality.

Why is operational efficiency important for hedge funds?

Operational efficiency is crucial for hedge funds as it directly influences profitability, enhances risk management, and ensures compliance with regulatory standards.

How does operational efficiency impact profitability in hedge funds?

By optimizing processes to minimize costs while maximizing investment returns, operational efficiency helps hedge funds increase their overall profitability.

What role does operational efficiency play in a competitive landscape?

In a highly competitive environment, operational efficiency becomes a crucial differentiator between success and failure, allowing firms to lower transaction costs, accelerate decision-making, and improve service delivery.

What is the significance of operational efficiency in the context of the hedge fund sector’s size?

The hedge fund sector, managing approximately $4 trillion in assets as of 2023, must focus on operational efficiency to adapt and thrive, especially as it evolves towards 2026.

How are hedge funds improving their operational efficiency?

Hedge funds are increasingly integrating advanced technologies and methodologies to refine their operational frameworks and sustain growth.

What does Nick Nolan emphasize regarding operational infrastructure?

Nick Nolan emphasizes that a robust functional infrastructure is essential for sustaining growth and maintaining allocator trust in the dynamic hedge fund environment.

How does operational efficiency aid in navigating market volatility?

By streamlining operations, investment groups can better manage market volatility and position themselves to seize emerging opportunities, fostering sustainable growth.