Introduction

Hedge funds operate within a highly competitive environment, where the demands of regulatory compliance and the necessity for innovative investment strategies present considerable operational challenges.

As these investment pools encounter heightened scrutiny and complex data management issues, the importance of specialized expertise becomes critical.

To effectively navigate these complexities and sustain a competitive advantage, hedge funds must consider forming strategic partnerships with embedded product development companies.

Such collaborations can offer essential technological and regulatory insights, thereby enhancing performance and securing long-term success.

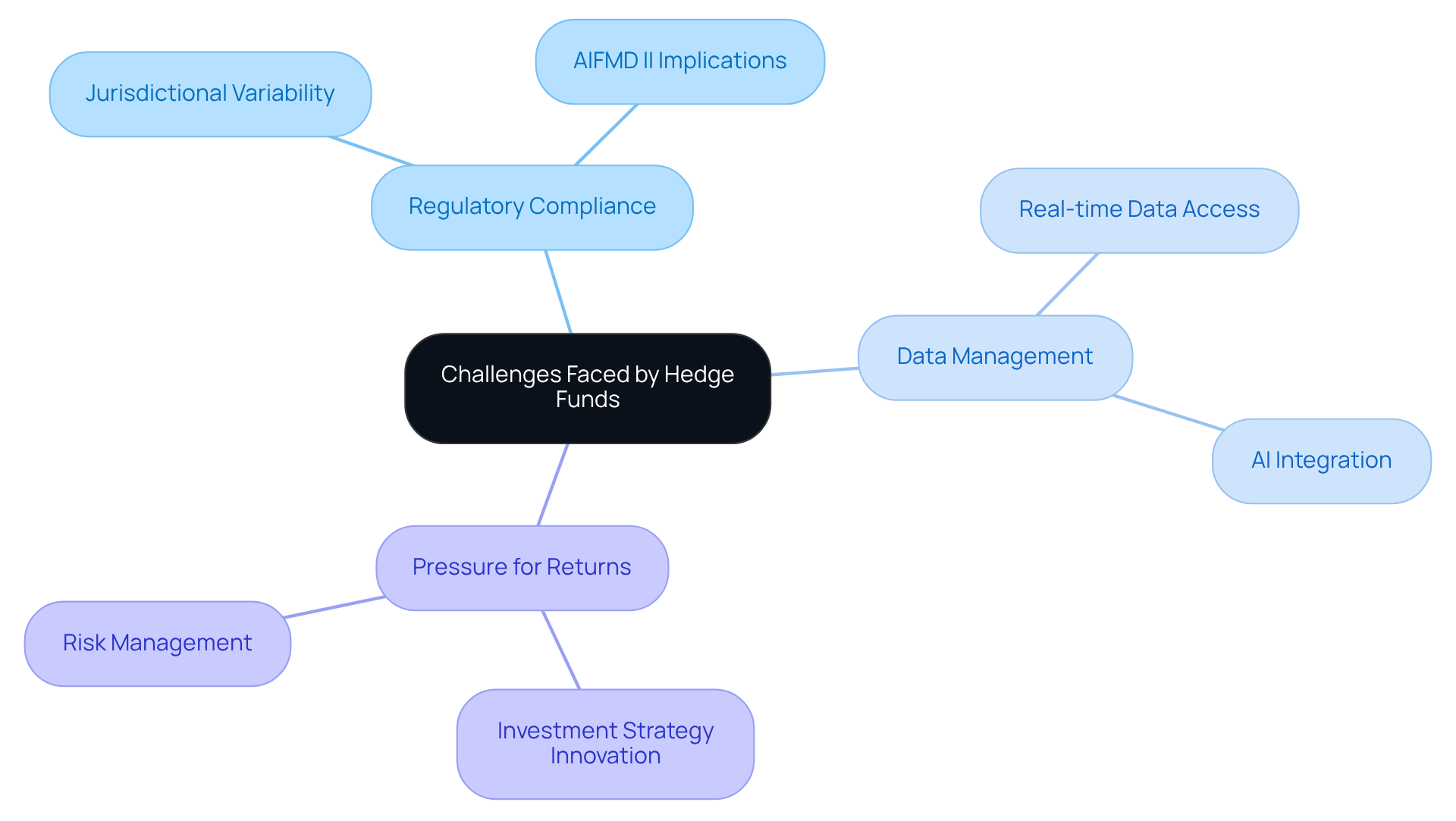

Understanding the Unique Challenges Faced by Hedge Funds

Hedge pools operate within a highly competitive and regulated environment, encountering distinct challenges that can impede their operational efficiency and growth. A primary challenge is the necessity for compliance with stringent regulatory requirements, which can differ significantly across jurisdictions. This situation demands a robust understanding of legal frameworks and the capacity to adapt swiftly to regulatory changes. By 2026, investment pools are expected to face increased scrutiny as regulators push for ongoing supervision and enhanced data clarity, particularly with the implications of AIFMD II in Europe, which mandates detailed reporting on delegated tasks and investor interactions.

Furthermore, investment pools often grapple with complex data management challenges, requiring real-time access to substantial volumes of financial information for analysis and decision-making. The integration of advanced technologies, such as machine learning and artificial intelligence, is crucial for effectively processing this data. Notably, 90% of investment firms are employing AI to manage investments and optimize portfolios, highlighting its essential role in contemporary operations. However, many hedge managers lack the in-house expertise necessary to implement these solutions, which can restrict their ability to utilize data as a competitive asset.

Additionally, the pressure to deliver consistent returns to investors introduces another layer of complexity. Hedge pools must continuously innovate their investment strategies while managing risks associated with market fluctuations. This environment necessitates not only technical proficiency but also agility and adaptability, which can be difficult to achieve without specialized support. As David Csiki observes, AI can serve as a valuable tool for enhancing efficiency and detecting fraud, further underscoring its significance in compliance and risk management.

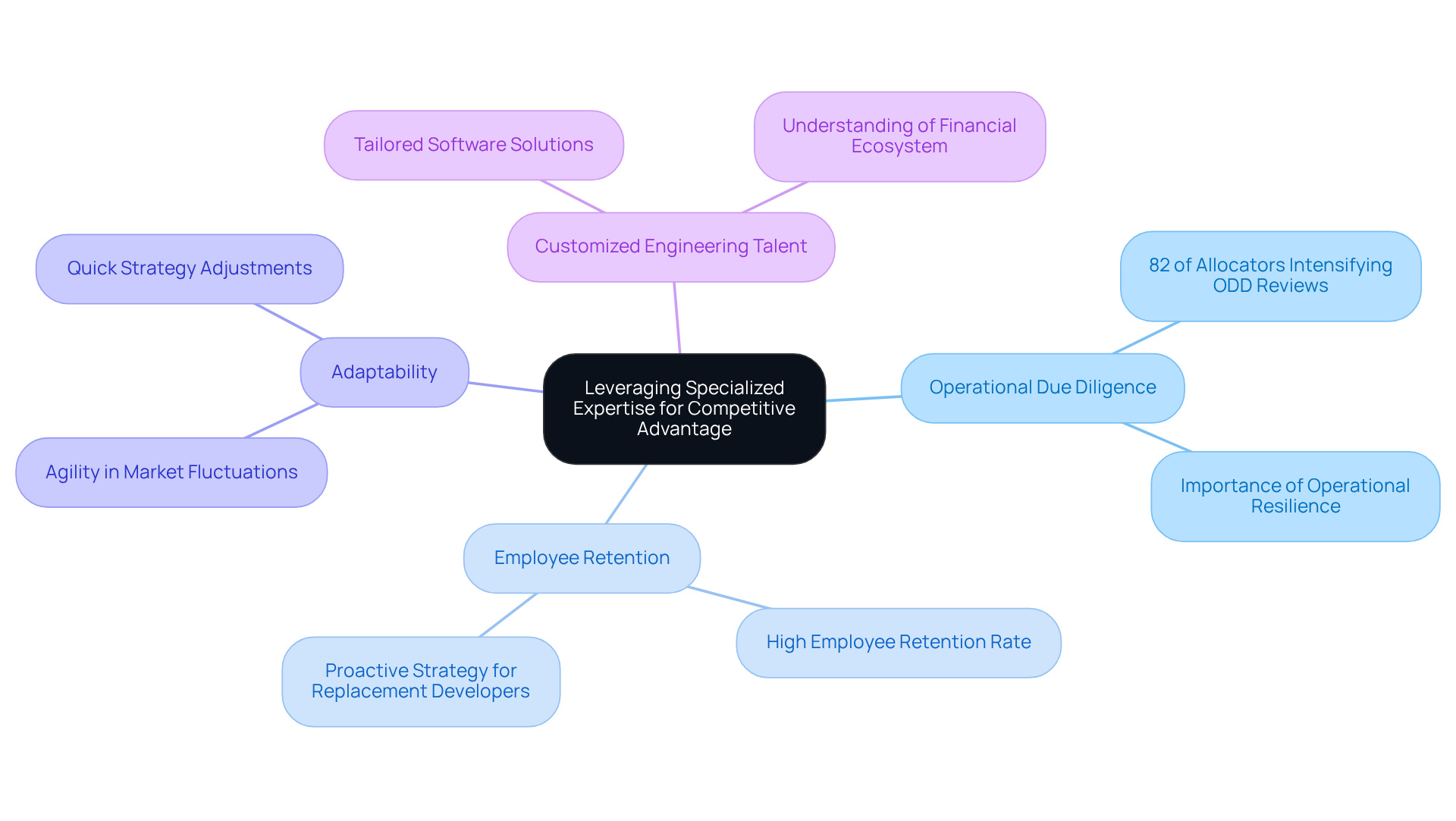

Leveraging Specialized Expertise for Competitive Advantage

In the dynamic landscape of investment vehicles, leveraging specialized knowledge is essential for gaining a competitive edge. Companies like Neutech, an embedded product development company, provide access to a team of highly skilled engineers and developers who possess extensive expertise in financial technologies and regulatory compliance. This specialized knowledge is crucial for investment pools seeking to innovate and streamline their operations, especially considering that 82 percent of North American allocators have intensified the rigor of their operational due diligence (ODD) reviews in the past two to three years.

Neutech exemplifies a commitment to reliability, ensuring that clients remain secure despite staffing changes. With a high employee retention rate and a proactive strategy for preparing replacement developers, Neutech guarantees seamless integration of engineering talent into client teams. By collaborating with Neutech, an embedded product development company, investment groups can swiftly develop and implement tailored software solutions that meet their specific requirements. This approach not only accelerates the development timeline but also ensures that the solutions are crafted with a thorough understanding of the financial ecosystem. Insights from industry leaders, such as Nick Nolan, underscore the importance of robust operational infrastructure for sustaining growth and maintaining allocator trust into 2026.

Moreover, Neutech’s adaptable engineering talent model empowers investment firms to maintain agility in the face of market fluctuations. This model enables investment groups to quickly adjust their strategies, adopt new technologies, and enhance their data analysis capabilities. By utilizing specialized teams, investment firms can make informed decisions and improve overall performance.

As the investment sector evolves, the integration of sophisticated management frameworks and expert personnel will be vital. Neutech’s customized engineering talent delivery process ensures that investment firms acquire the necessary expertise to enhance their infrastructure, positioning them for success in an increasingly competitive environment. This is further illustrated by a case study on managed services, which highlights how investment groups are enhancing their operational capabilities without overextending their personnel.

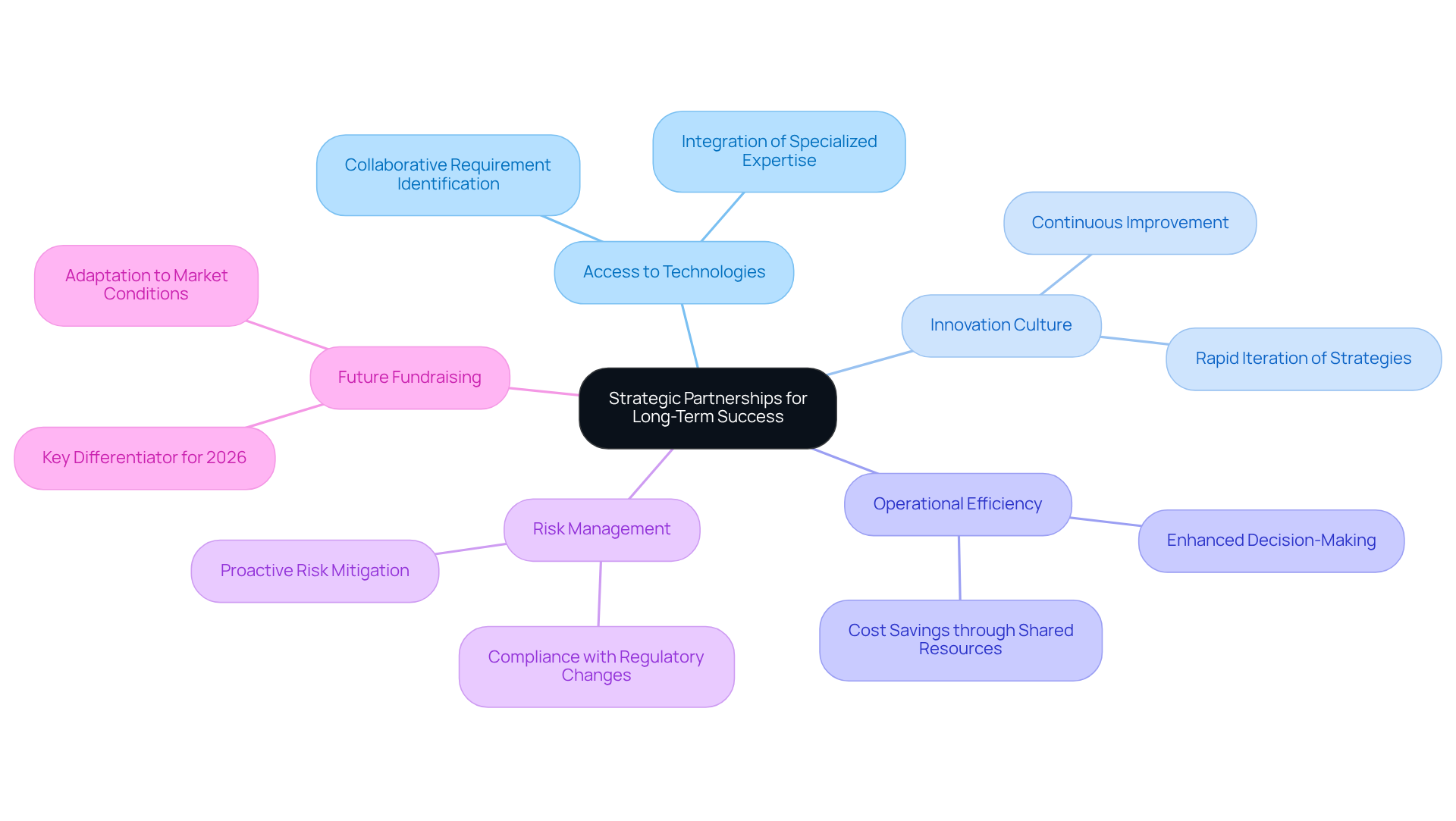

Ensuring Long-Term Success Through Strategic Partnerships

Strategic alliances with an embedded product development company are essential for the long-term success of investment firms. These collaborations provide access to advanced technologies and specialized expertise that are often difficult to develop internally.

At Neutech, we begin by collaboratively identifying your requirements. This approach allows us to present several potential designers and developers who can seamlessly integrate into your team. By integrating an embedded product development company directly into their operations, investment firms can cultivate a culture of innovation and continuous improvement. This strategy not only enhances operational efficiency but also enables the rapid iteration of investment strategies and technological solutions, which is vital in a fast-paced market.

Furthermore, these partnerships improve risk management practices. Specialized teams focused on compliance and regulatory changes empower investment firms to navigate the complexities of the financial landscape effectively. This ensures adherence to regulations while pursuing investment goals. Such a proactive approach to risk management is crucial for building investor trust and maintaining a competitive advantage in an increasingly demanding market.

As investment groups gear up for a strong fundraising year in 2026, partnering with an embedded product development company will serve as a key differentiator, enabling them to innovate efficiently and adapt to evolving market conditions.

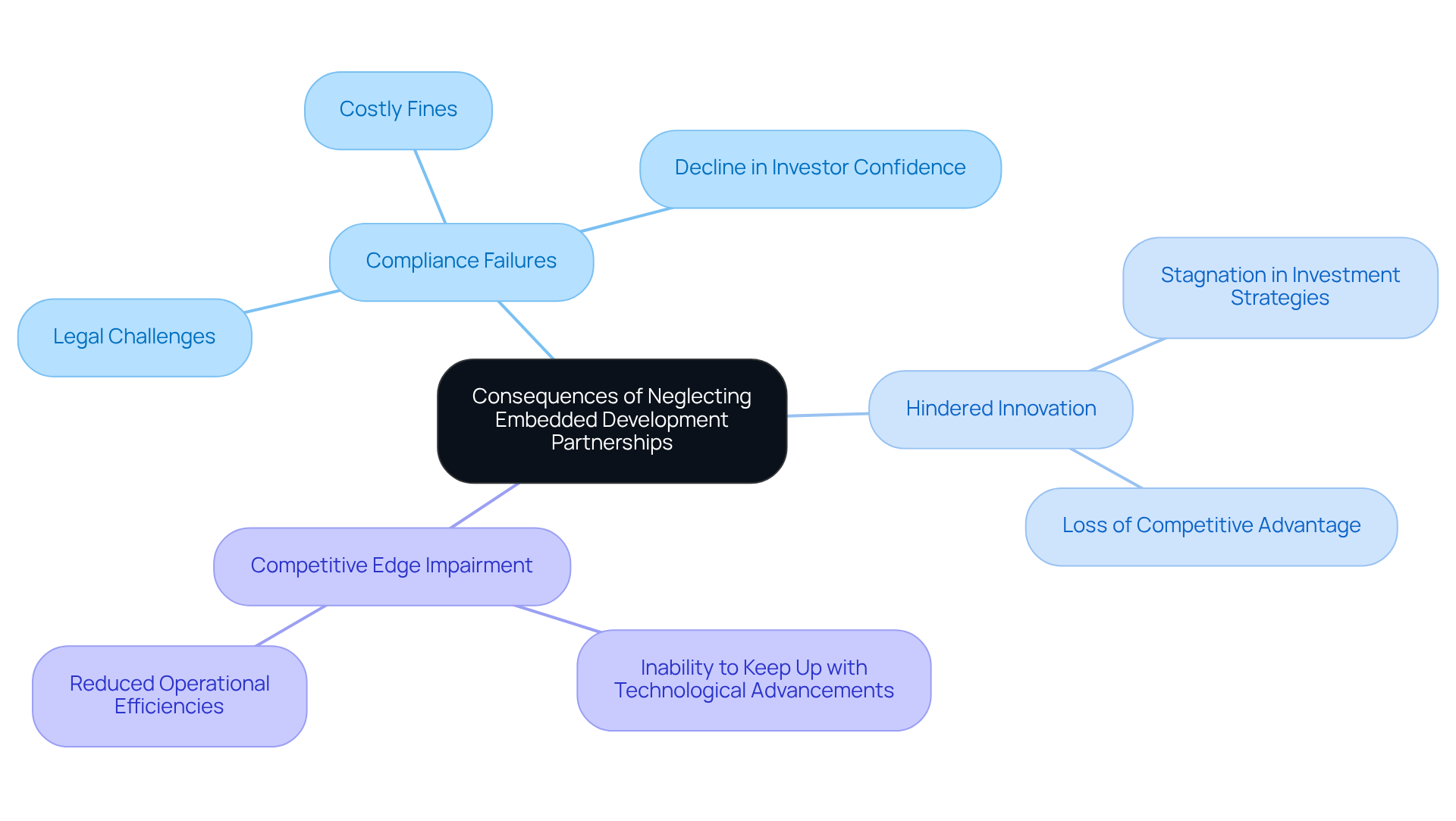

Consequences of Neglecting Embedded Development Partnerships

Ignoring collaborations with an embedded product development company can lead to significant adverse effects for investment firms. Without access to specialized expertise, these groups may find it challenging to keep up with technological advancements and regulatory changes, ultimately impairing their competitive edge.

A major risk is the potential for compliance failures. As regulations become increasingly complex, hedge organizations that lack specialized teams focused on compliance may face legal challenges and reputational damage. Such issues can result in costly fines and a decline in investor confidence.

Moreover, the absence of specialized development resources in an embedded product development company can hinder innovation. Hedge entities that do not embrace new technologies may forfeit opportunities to improve their investment strategies and operational efficiencies. This stagnation can result in underperformance compared to competitors who are utilizing advanced technologies and data analytics.

At Neutech, we recognize these challenges and emphasize a tailored engineering talent provision process. Once we collaboratively identify your needs, we provide a selection of candidate designers and developers to integrate seamlessly into your team. This approach ensures that investment groups have access to the specialized skills required to navigate the complexities of the financial landscape.

In conclusion, the repercussions of neglecting an embedded product development company in partnerships can be severe, affecting not only the operational capabilities of hedge funds but also their long-term viability in a competitive market.

Conclusion

Hedge funds navigate a complex landscape characterized by stringent regulatory requirements and a pressing need for innovation. Integrating an embedded product development company, such as Neutech, is a crucial strategy for these investment firms to effectively address their unique challenges. By harnessing specialized expertise and advanced technologies, hedge funds can improve operational efficiency, ensure compliance, and sustain a competitive advantage in a rapidly changing market.

Key insights throughout this article underscore the significance of specialized knowledge in overcoming challenges such as compliance complexities and data management issues. Collaborating with an embedded development company not only streamlines the creation of customized solutions but also cultivates a culture of agility and innovation. Firms that overlook these partnerships risk lagging in technological advancements and regulatory compliance, which could jeopardize their long-term viability.

As the investment landscape continues to evolve, the importance of strategic partnerships cannot be overstated. Embracing collaborations with embedded product development companies is essential for hedge funds seeking to excel in a competitive environment. These alliances equip firms with the necessary tools and expertise to innovate, adapt, and ultimately secure investor trust, paving the way for sustained success in the years ahead.

Frequently Asked Questions

What are the primary challenges faced by hedge funds?

Hedge funds face challenges such as compliance with stringent regulatory requirements, complex data management, and the pressure to deliver consistent returns to investors.

How do regulatory requirements impact hedge funds?

Hedge funds must navigate varying regulatory requirements across jurisdictions, which necessitates a strong understanding of legal frameworks and the ability to adapt to regulatory changes. By 2026, increased scrutiny and enhanced data clarity will be expected, particularly due to AIFMD II in Europe.

What role does data management play in hedge fund operations?

Hedge funds require real-time access to large volumes of financial data for analysis and decision-making, making effective data management crucial for their operations.

How are advanced technologies like AI used in hedge funds?

Many hedge funds are employing AI and machine learning to manage investments and optimize portfolios, with 90% of investment firms utilizing these technologies to process data effectively.

What challenges do hedge fund managers face regarding technology implementation?

Many hedge fund managers lack the in-house expertise necessary to implement advanced technologies, which can limit their ability to leverage data as a competitive asset.

Why is delivering consistent returns a challenge for hedge funds?

Hedge funds must continuously innovate their investment strategies while managing risks associated with market fluctuations, which adds complexity to their operations.

How can AI enhance hedge fund efficiency and compliance?

AI can improve efficiency, detect fraud, and play a significant role in compliance and risk management, thereby supporting hedge funds in navigating their operational challenges.