Introduction

The financial landscape is evolving rapidly, placing hedge funds at a critical juncture where effective data management is essential. As these investment groups confront challenges such as information fragmentation and regulatory compliance, adopting a Software as a Service (SaaS) data warehouse presents a compelling solution. This article examines how utilizing a SaaS data warehouse not only streamlines operations but also enhances decision-making capabilities. Ultimately, this positions hedge funds for sustained success in a competitive market. Could embracing this cloud-based technology be the key to overcoming the obstacles that impede growth and efficiency in hedge fund management?

Define SaaS Data Warehouse and Its Role in Hedge Funds

A saas data warehouse is a cloud-based solution designed to store, manage, and analyze extensive information from diverse sources. This technology acts as a centralized repository for investment groups, seamlessly integrating both internal and external data, which facilitates real-time analytics and reporting. By leveraging a saas data warehouse, hedge funds can streamline their data management processes, ensuring that critical information is readily available for informed decision-making.

The benefits of this model are substantial, including significant reductions in infrastructure costs, enhanced scalability, and improved collaboration among teams. Industry forecasts indicate that the U.S. software-as-a-service market is projected to exceed $225 billion by 2025, highlighting the growth potential of these solutions. As Frank Caccio III notes, “Regulatory reporting, investor communication, and compliance features in software solutions have always been highly customizable according to jurisdictional requirements.”

These advantages contribute to more effective investment strategies and increased operational efficiency. As the financial landscape evolves, the importance of saas data warehouse becomes increasingly critical, enabling hedge organizations to swiftly adapt to market fluctuations and enhance their overall performance.

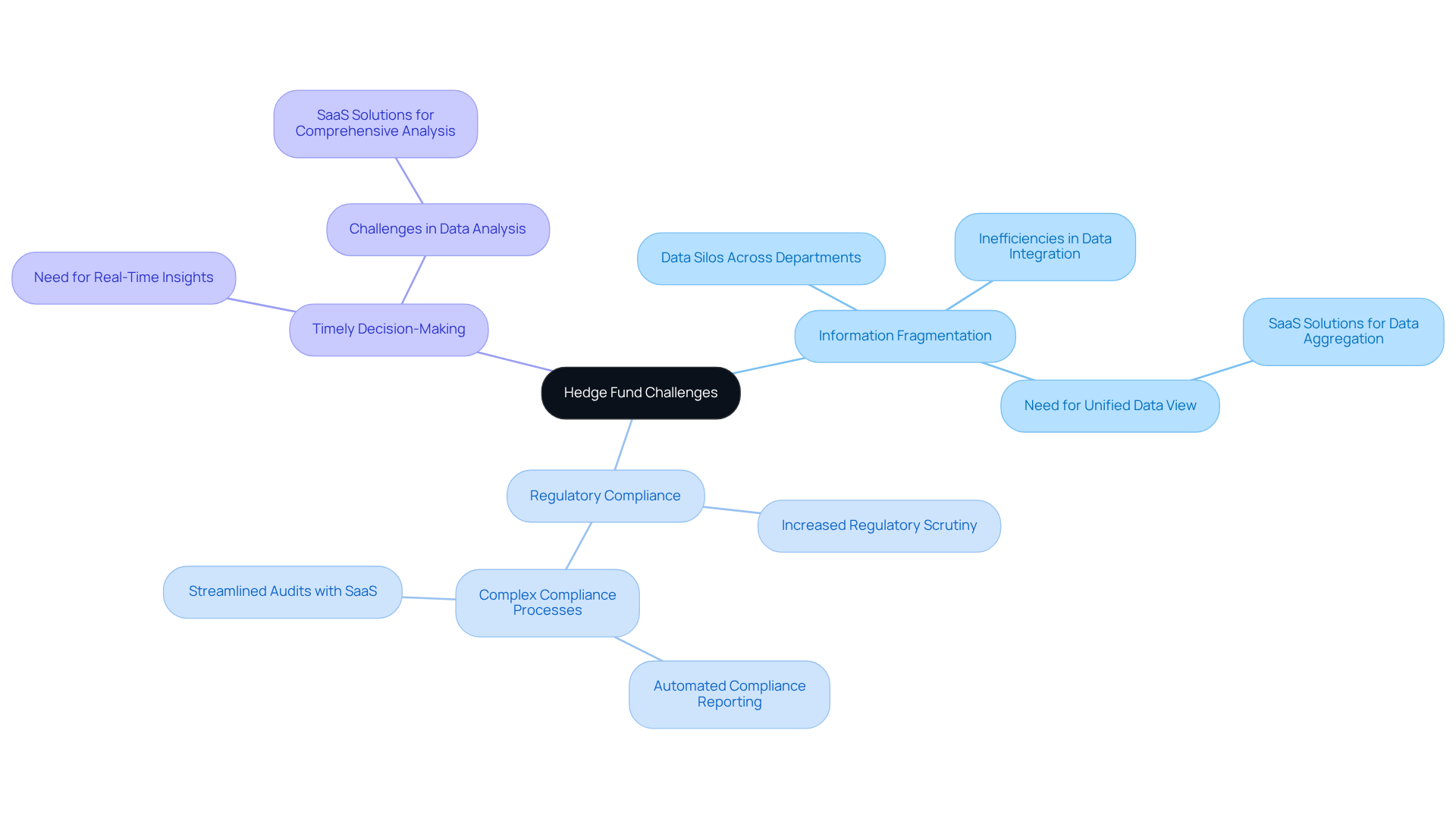

Address Hedge Fund Challenges with SaaS Data Warehousing Solutions

Hedge funds encounter significant challenges, including information fragmentation, regulatory compliance, and the need for timely decision-making. Traditional information management systems often struggle to integrate diverse sources, resulting in inefficiencies and heightened operational risks. As Douglas Moffat notes, “Due to the nature of a Hedge Fund’s internal structure, this information often exists in multiple silos across departments, making it more challenging to extract, unify, and analyze efficiently.”

SaaS Data Warehouse solutions effectively address these issues by offering a unified platform that aggregates information from various sources. This capability enables investment firms to conduct comprehensive analyses and derive actionable insights. Statistics indicate that by 2024, 67% of investment managers in alternative investments, private equity, and venture capital are expected to utilize alternative information, underscoring the urgency of addressing information silos.

By ensuring secure information storage and facilitating straightforward audits, these solutions enhance compliance, thereby reducing risks associated with regulatory scrutiny. Moffat further emphasizes, “In recent years, Hedge Funds have come under closer scrutiny from regulators as increasingly stringent regulatory requirements have been introduced.”

Adopting a SaaS data warehouse not only streamlines processes but also reduces costs and improves overall performance, positioning investment groups for success in a competitive landscape.

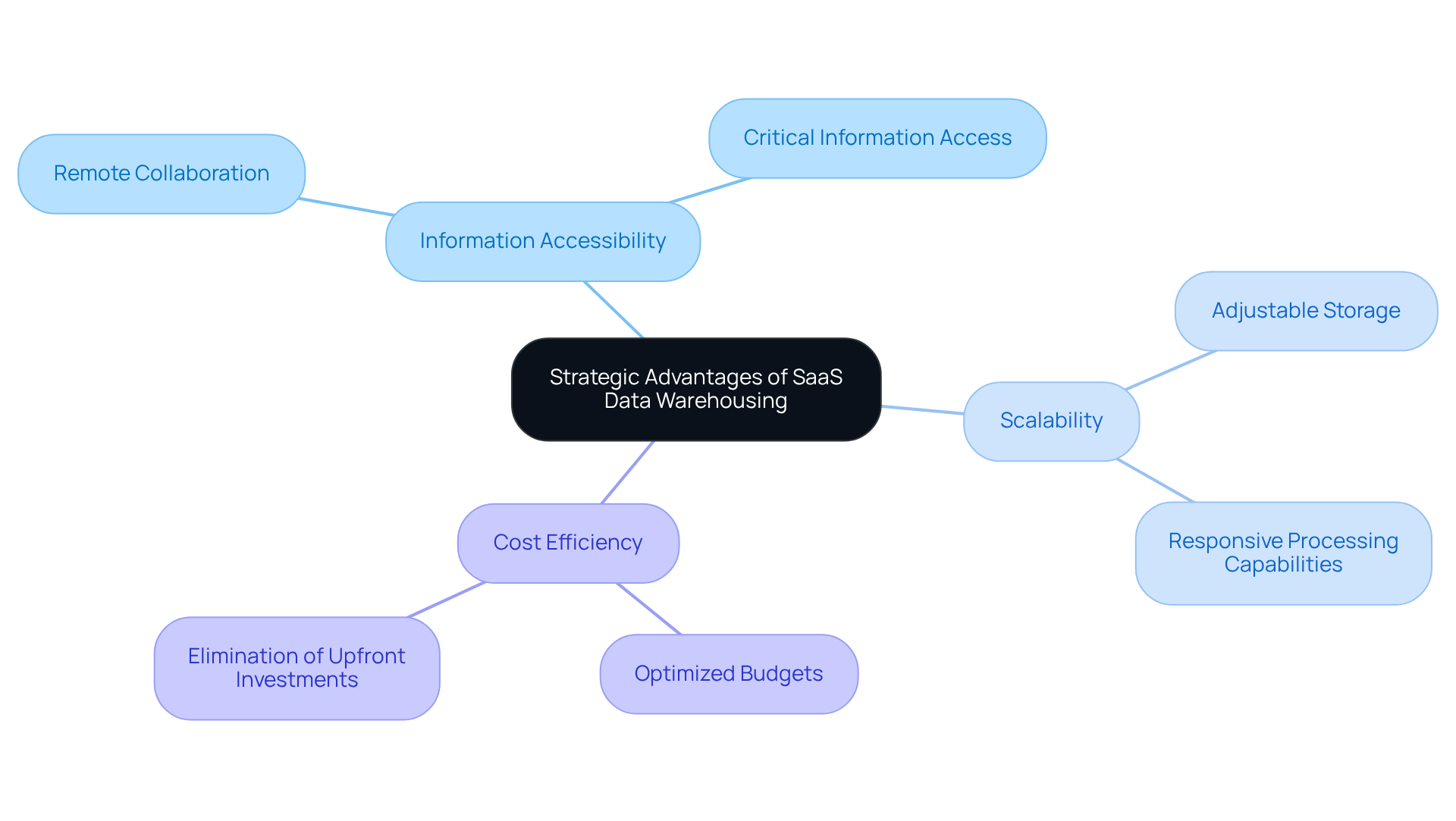

Leverage Strategic Advantages of SaaS Data Warehousing for Success

Cloud-based data warehousing offers significant strategic advantages for investment groups, including enhanced information accessibility, scalability, and cost efficiency. By leveraging cloud-based solutions, these groups can access critical information from any location, facilitating remote collaboration and informed decision-making.

The scalability inherent in SaaS data warehouse platforms allows organizations to adjust their data storage and processing capabilities in response to changing market conditions and operational needs. This flexibility is crucial for maintaining competitiveness in a dynamic environment.

Furthermore, the cost efficiency of a SaaS data warehouse eliminates the necessity for substantial upfront investments in infrastructure. This enables investment groups to allocate resources more effectively, optimizing their operational budgets.

Collectively, these advantages empower investment firms to respond swiftly to market fluctuations, refine their investment strategies, and ultimately achieve superior performance.

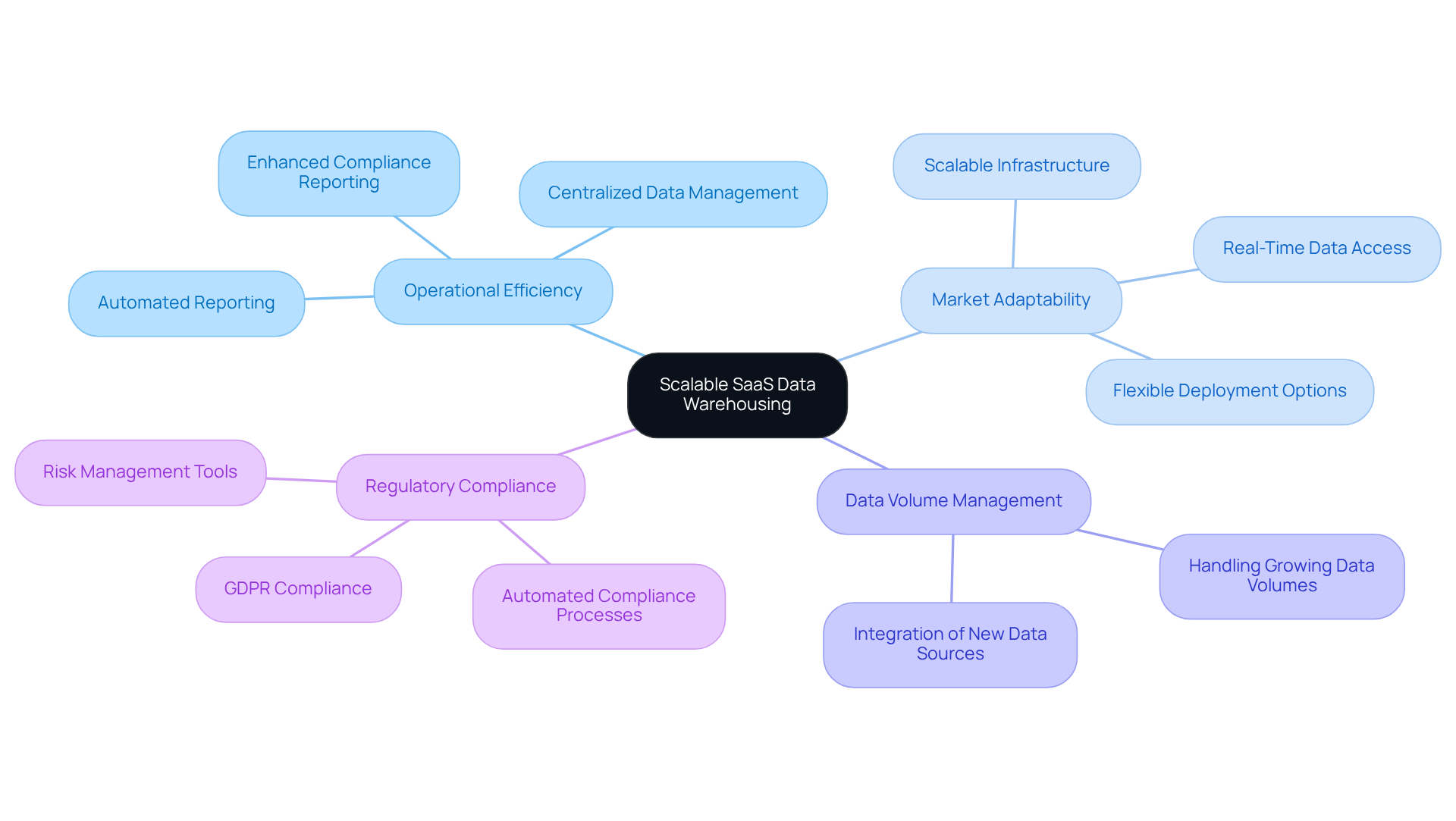

Ensure Long-Term Success with Scalable SaaS Data Warehousing

Scalability is a crucial factor for investment groups seeking success in an increasingly competitive landscape. Cloud-based Data Warehousing solutions, such as Geneva® by SS&C Advent, are designed to evolve alongside organizational needs, allowing investment groups to seamlessly enhance their SaaS data warehouse capabilities as their operations expand. This adaptability is particularly vital in the financial sector, where market conditions can shift rapidly, making the ability to adjust essential.

By investing in scalable SaaS data warehouse solutions, investment firms can ensure they are prepared to manage growing data volumes, integrate new data sources, and comply with changing regulations. As noted by SS&C Advent, ‘The key to effective and lucrative expansion is scalability,’ highlighting the necessity for investment firms to establish robust systems.

This strategic approach not only enhances operational efficiency but also positions investment firms for sustained success in a data-driven market. Additionally, statistics show that hedge fund management SaaS software facilitates real-time tracking of market activities, which is critical for making informed decisions and maintaining investor confidence.

Conclusion

Adopting a SaaS data warehouse is crucial for hedge funds seeking to excel in a competitive financial landscape. This cloud-based solution centralizes data management and enhances operational efficiency, enabling investment firms to make informed decisions swiftly. As the financial environment evolves, the capacity to integrate diverse data sources and respond to market fluctuations becomes increasingly vital for sustained success.

The article outlines several key benefits of SaaS data warehousing, such as:

- Reduced infrastructure costs

- Improved scalability

- Enhanced collaboration among teams

By addressing common challenges like information fragmentation and regulatory compliance, these solutions empower hedge funds to streamline their processes and mitigate risks. With predictions indicating a significant shift towards cloud-based systems in the investment sector, the urgency for hedge funds to adopt these technologies is paramount.

Ultimately, leveraging SaaS data warehousing positions hedge funds for immediate operational improvements and ensures long-term adaptability and success. Investment groups must embrace this strategic advantage to remain competitive, optimize resources, and maintain investor confidence in an ever-changing market. The future of hedge fund management hinges on the effective use of technology, making the implementation of scalable SaaS solutions a critical step toward achieving excellence in finance.

Frequently Asked Questions

What is a SaaS data warehouse?

A SaaS data warehouse is a cloud-based solution designed to store, manage, and analyze extensive information from diverse sources, acting as a centralized repository for investment groups.

How does a SaaS data warehouse benefit hedge funds?

It streamlines data management processes, ensures critical information is readily available for decision-making, reduces infrastructure costs, enhances scalability, and improves collaboration among teams.

What are some key features of SaaS data warehouses for hedge funds?

Key features include real-time analytics and reporting, customizable regulatory reporting, investor communication, and compliance features tailored to jurisdictional requirements.

What is the projected growth of the SaaS market?

The U.S. software-as-a-service market is projected to exceed $225 billion by 2025, indicating significant growth potential for these solutions.

Why is a SaaS data warehouse increasingly critical for hedge funds?

As the financial landscape evolves, a SaaS data warehouse enables hedge organizations to swiftly adapt to market fluctuations and enhances their overall performance.