Why Cloud Computing Software is Essential for Hedge Fund Success

Introduction

Cloud computing has fundamentally transformed the financial landscape, serving as a crucial driver of success for hedge funds. By utilizing on-demand resources and cutting-edge technologies, investment firms can significantly enhance their operational efficiency, lower costs, and react promptly to market changes.

However, as the dependence on cloud solutions increases, so do the challenges related to:

- Data security

- Regulatory compliance

- Technological integration

Therefore, it is essential for hedge funds to navigate this evolving landscape effectively, not only to survive but also to thrive in an increasingly competitive environment.

Define Cloud Computing and Its Core Principles

Cloud computing software represents the on-demand provision of resources via the internet, enabling users to access and store data and applications without reliance on physical infrastructure. The core principles of cloud computing that are particularly pertinent for hedge funds include:

- On-Demand Self-Service: Users can automatically provision processing capabilities as needed, eliminating the need for human intervention from service providers. This feature is crucial for investment groups that require swift adjustments to their resources in response to market conditions.

- Broad Network Access: Services are accessible over the network through standard mechanisms, facilitating use across various platforms such as mobile devices, tablets, and laptops. This flexibility allows investment managers to oversee and manage assets from any location.

- Resource Pooling: Providers consolidate their computing resources to serve multiple consumers through a multi-tenant model. This dynamic allocation of physical and virtual resources based on demand is essential for investment groups that need to scale operations efficiently.

- Rapid Elasticity: Capabilities can be elastically provisioned and released, enabling investment groups to scale resources quickly in response to fluctuating market demands. This agility is vital for maintaining a competitive edge in fast-paced financial environments, especially when leveraging cloud computing software.

- Measured Service: Cloud systems automatically manage and enhance resource utilization through metering features, ensuring that investment groups only pay for what they consume. This cost efficiency is increasingly important, as 67% of CIOs have identified cost optimization in the digital environment as a top priority for 2025.

As of 2026, approximately 91% of investment funds are utilizing online storage solutions, underscoring its critical role in enhancing operational effectiveness and regulatory compliance. Industry leaders emphasize that remote servers not only drive innovation but also significantly improve time to market, with users of these services reporting a 37% increase in this area. Furthermore, 60% of organizations have achieved higher revenue from cloud computing software usage, illustrating how investment firms can leverage cloud computing software to enhance their operations and maintain a competitive advantage.

Examine the Benefits of Cloud Computing for Developers

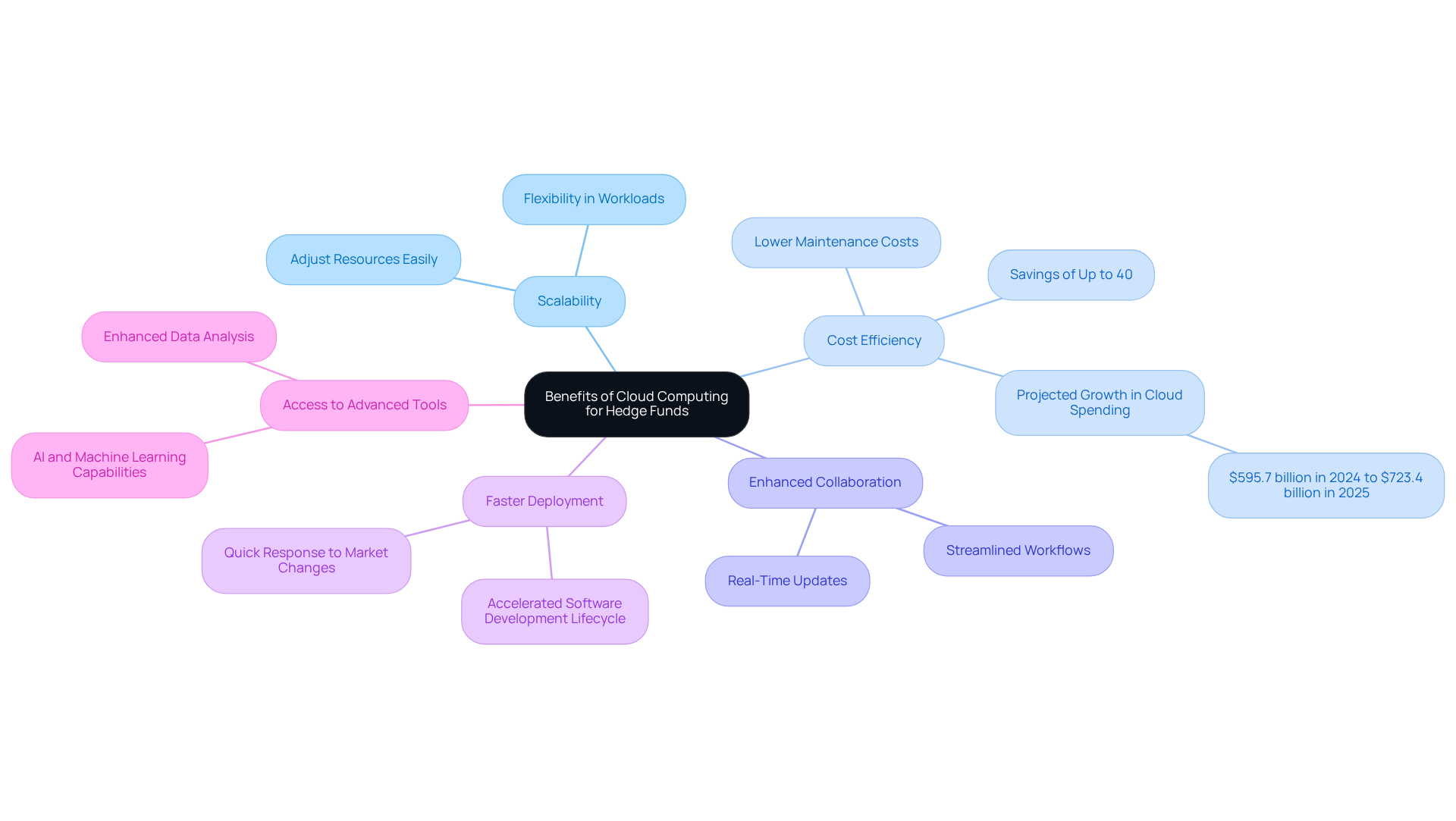

Cloud computing software offers numerous advantages for hedge funds, particularly in enhancing operational efficiency and financial performance.

-

Scalability: Hedge funds can easily adjust their resources in response to changing workloads, ensuring they meet demand without overcommitting. This flexibility is vital in a market characterized by rapid fluctuations.

-

Cost Efficiency: Transitioning to cloud services allows hedge funds to significantly lower the costs associated with maintaining physical servers and infrastructure. This shift leads to more adaptable IT budgets, with many firms reporting savings of up to 40% in total cost of ownership through cloud computing software solutions. Furthermore, public spending on cloud services is expected to increase from $595.7 billion in 2024 to $723.4 billion in 2025, highlighting a strong trend toward adoption.

-

Enhanced collaboration is achieved when using cloud computing software, as it facilitates improved teamwork among development teams, allowing for real-time updates and shared access to resources. This capability is crucial for projects requiring input from various stakeholders, streamlining workflows and boosting productivity.

-

Faster Deployment: The cloud accelerates the software development lifecycle, enabling investment firms to launch applications swiftly. This agility is essential for responding promptly to market changes, a critical factor in maintaining a competitive advantage.

-

Access to Advanced Tools: Developers can leverage a wide range of cloud-based tools and services, including AI and machine learning capabilities. These technologies enhance data analysis and decision-making processes, allowing investment firms to gain deeper insights from their data.

Together, these advantages empower investment funds to continuously innovate and sustain a competitive edge in an ever-evolving financial landscape by leveraging cloud computing software. As the adoption of cloud services grows, firms that capitalize on these capabilities are likely to experience significant improvements in operational efficiency and overall performance.

Analyze the Transformative Impact of Cloud Computing on Development Practices

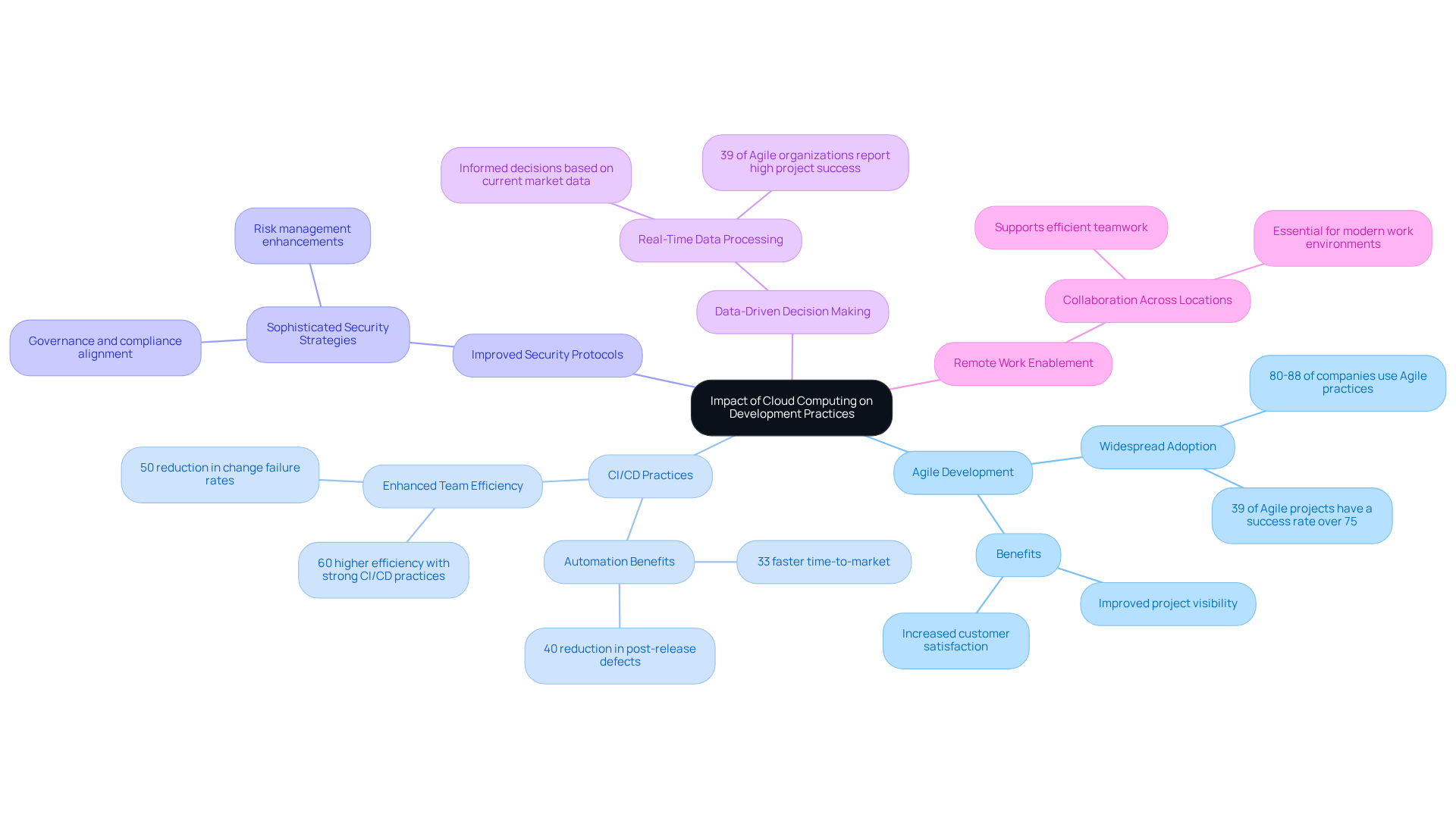

The adoption of cloud computing software has significantly transformed development practices within hedge funds.

-

Agile Development: Cloud environments support agile methodologies, enabling teams to iterate quickly and respond to feedback. This adaptability is crucial in the fast-paced financial sector. Notably, over 80-88% of companies currently employ Agile practices, underscoring its widespread acceptance in the industry.

-

Cloud computing software facilitates Continuous Integration and Deployment (CI/CD) practices, allowing developers to automate testing and deployment processes. This automation reduces the time to market for new features and updates by an average of 33% compared to traditional development methods, thereby enhancing the competitive advantage of investment firms.

-

Improved Security Protocols: Given the increasing importance of data protection in finance, service providers offer sophisticated security strategies that investment groups can leverage to safeguard sensitive information. As highlighted by TransUnion, strengthening governance and security across software delivery pipelines is essential for compliance with regulatory and risk management requirements.

-

Data-Driven Decision Making: The ability to process and analyze extensive datasets in real-time through online technology empowers investment firms to make informed decisions based on current market information. In fact, 39% of organizations utilizing Agile report a project success rate exceeding 75%, illustrating the effectiveness of data-driven approaches in Agile environments.

-

Remote Work Enablement: The online platform supports remote work features, allowing investment teams to collaborate efficiently regardless of their physical location, a necessity in today’s work environment.

These transformative effects illustrate that cloud computing software is not merely a technological enhancement; it represents a fundamental shift in how investment groups approach software development and operational efficiency.

Explore Future Trends and Challenges in Cloud Computing Development

As cloud computing evolves, hedge funds must recognize emerging trends and challenges:

- Increased Regulation: With the growth of cloud adoption, regulatory scrutiny will intensify. Hedge funds must ensure compliance with evolving regulations concerning data privacy and security.

- Multi-Cloud Strategies: Many organizations are adopting multi-cloud approaches to avoid vendor lock-in and enhance resilience. Investment groups should consider these strategies for improved adaptability and risk management.

- AI and Machine Learning Integration: The integration of AI and machine learning into online services provides investment firms with advanced analytical capabilities. However, it also requires a skilled workforce to effectively leverage these technologies.

- Cybersecurity Threats: As reliance on online services increases, so does the risk of cyberattacks. Hedge funds must invest in robust security measures to safeguard their data and maintain client trust.

- Sustainability Issues: The environmental impact of online services is becoming a pressing concern. Hedge funds may need to incorporate sustainable practices into their online strategies to align with broader corporate responsibility objectives.

By understanding these trends and challenges, hedge funds can navigate the complexities of cloud computing more effectively and position themselves for future success.

Conclusion

Cloud computing software has become a crucial component for the success of hedge funds, fundamentally altering their operational dynamics. By leveraging cloud technology, hedge funds can streamline processes, enhance collaboration, and sustain a competitive advantage in a rapidly evolving financial landscape. This transition to cloud solutions is not merely a trend; it is a strategic imperative for firms seeking to excel in the current market.

The article examined essential principles of cloud computing, such as:

- On-demand self-service

- Rapid elasticity

- Resource pooling

These principles collectively empower hedge funds to respond swiftly to market fluctuations. The advantages of cloud computing for developers-including scalability, cost efficiency, and access to advanced tools-further demonstrate how these technologies facilitate innovation and improve operational efficiency. Moreover, the significant impact of cloud adoption on development practices, including agile methodologies and enhanced security protocols, highlights the necessity of integrating cloud solutions into investment strategies.

As hedge funds prepare for the future, embracing cloud computing will be vital in addressing emerging trends and challenges, including:

- Heightened regulation

- Cybersecurity threats

- The integration of artificial intelligence

By proactively tackling these issues and capitalizing on the benefits of cloud technology, hedge funds can position themselves for sustained success and innovation. The journey toward cloud computing adoption transcends mere technology; it involves redefining success within the financial sector and ensuring that investment firms remain resilient and responsive to the ever-changing market demands.

Frequently Asked Questions

What is cloud computing?

Cloud computing refers to the on-demand provision of resources via the internet, allowing users to access and store data and applications without relying on physical infrastructure.

What are the core principles of cloud computing relevant to hedge funds?

The core principles include On-Demand Self-Service, Broad Network Access, Resource Pooling, Rapid Elasticity, and Measured Service.

What is On-Demand Self-Service in cloud computing?

On-Demand Self-Service allows users to automatically provision processing capabilities as needed, without requiring human intervention from service providers. This is crucial for investment groups that need to quickly adjust their resources based on market conditions.

How does Broad Network Access benefit investment managers?

Broad Network Access ensures that services are accessible over the network through standard mechanisms, allowing investment managers to oversee and manage assets from various platforms, including mobile devices, tablets, and laptops, from any location.

What is Resource Pooling in cloud computing?

Resource Pooling is when providers consolidate their computing resources to serve multiple consumers through a multi-tenant model, dynamically allocating physical and virtual resources based on demand, which is essential for efficiently scaling operations in investment groups.

What does Rapid Elasticity mean in the context of cloud computing?

Rapid Elasticity refers to the ability to elastically provision and release capabilities, enabling investment groups to quickly scale resources in response to fluctuating market demands, which is vital for maintaining a competitive edge.

How does Measured Service contribute to cost efficiency?

Measured Service automatically manages and enhances resource utilization through metering features, ensuring that investment groups only pay for what they consume, which is increasingly important for cost optimization.

What percentage of investment funds are using online storage solutions as of 2026?

Approximately 91% of investment funds are utilizing online storage solutions, highlighting its critical role in enhancing operational effectiveness and regulatory compliance.

How does cloud computing drive innovation and improve time to market?

Industry leaders indicate that remote servers drive innovation and significantly improve time to market, with users reporting a 37% increase in this area.

What financial benefits do organizations experience from using cloud computing?

About 60% of organizations have achieved higher revenue from the usage of cloud computing software, demonstrating how investment firms can leverage these solutions to enhance operations and maintain a competitive advantage.