Introduction

In an industry where financial integrity and regulatory adherence are crucial, hedge fund managers encounter the significant challenge of navigating the intricate landscape of software compliance. Understanding and implementing the necessary compliance standards not only protects against substantial penalties but also bolsters an organization’s reputation and operational efficiency. As regulations continue to evolve and the stakes increase, hedge funds must consider how to maintain compliance and competitiveness in this dynamic environment.

This article explores essential strategies and best practices for mastering software compliance, equipping hedge fund managers with the insights required to excel amidst regulatory challenges.

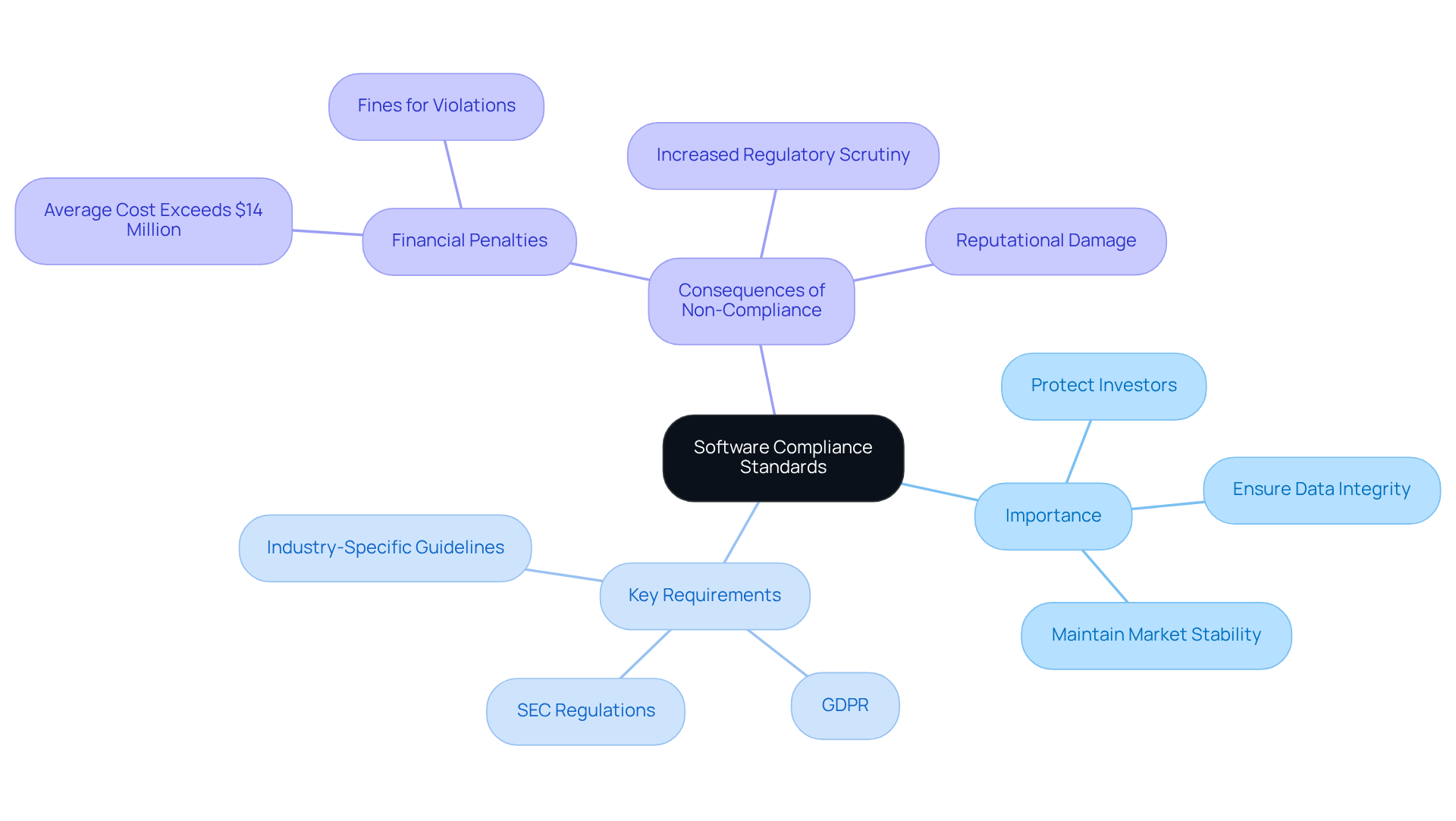

Define Software Compliance Standards and Their Importance

Software compliance involves the criteria that encompass the regulations and guidelines which software applications must adhere to in order to operate legally and ethically within the financial services sector. These guidelines are designed to protect investors, ensure data integrity, and maintain market stability. For hedge fund managers, understanding these guidelines related to software compliance is crucial, as non-compliance can lead to severe penalties, including fines and damage to reputation. Key requirements include:

- SEC regulations

- GDPR for data protection

- Various industry-specific guidelines that dictate the management and reporting of financial data

Recent statistics indicate that the average cost of non-compliance now surpasses $14 million, primarily due to breaches of regulations such as SOX, AML, and GDPR, highlighting the financial risks tied to regulatory failures. Furthermore, the need to strengthen cybersecurity measures following high-profile breaches underscores the importance of adhering to regulatory standards. By adhering to software compliance requirements, hedge funds can mitigate risks while enhancing their credibility and trustworthiness in the eyes of both investors and regulators. Additionally, as regulatory landscapes evolve, outsourcing software compliance assistance can provide investment groups with access to specialized expertise, ensuring they remain compliant and competitive.

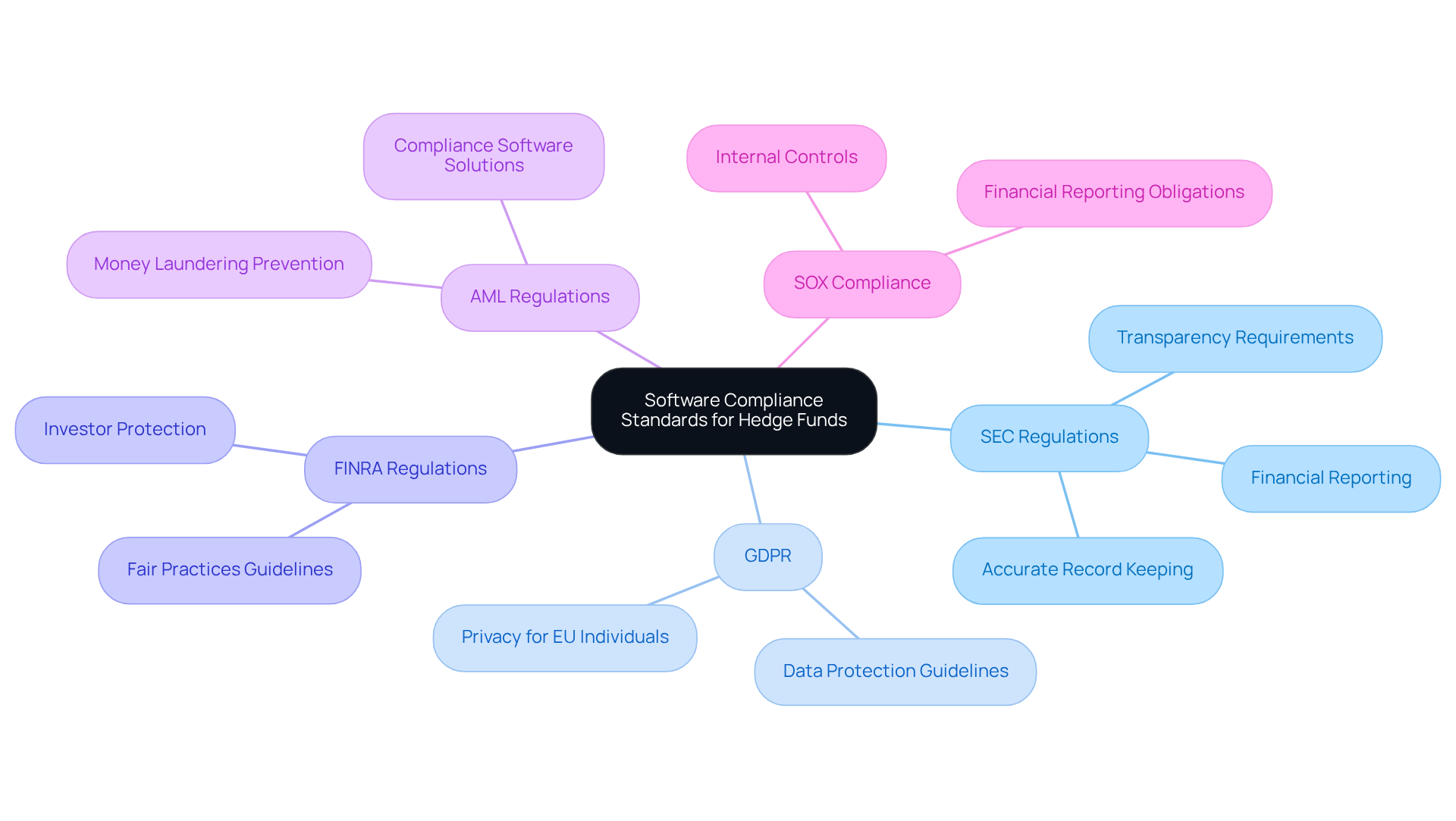

Explore Key Software Compliance Standards for Regulated Industries

In the realm of hedge funds, adherence to several key software compliance standards is essential:

- SEC Regulations: These rules govern the securities sector, requiring investment pools to maintain accurate records, report financial information, and ensure transparency in their operations.

- GDPR: The General Data Protection Regulation imposes stringent guidelines on data protection and privacy for individuals within the European Union, significantly influencing how investment firms manage personal data.

- FINRA Regulations: The Financial Industry Regulatory Authority sets forth guidelines that investment pools must follow to ensure fair practices and protect investors.

- AML Regulations: Anti-Money Laundering laws require investment pools to implement strategies to identify and prevent money laundering activities, necessitating robust compliance software solutions.

- SOX Compliance: The Sarbanes-Oxley Act mandates obligations regarding financial reporting and internal controls, ensuring that investment pools maintain accurate financial records.

By understanding these criteria, investment managers can navigate the complex regulatory landscape more effectively and implement successful strategies for software compliance.

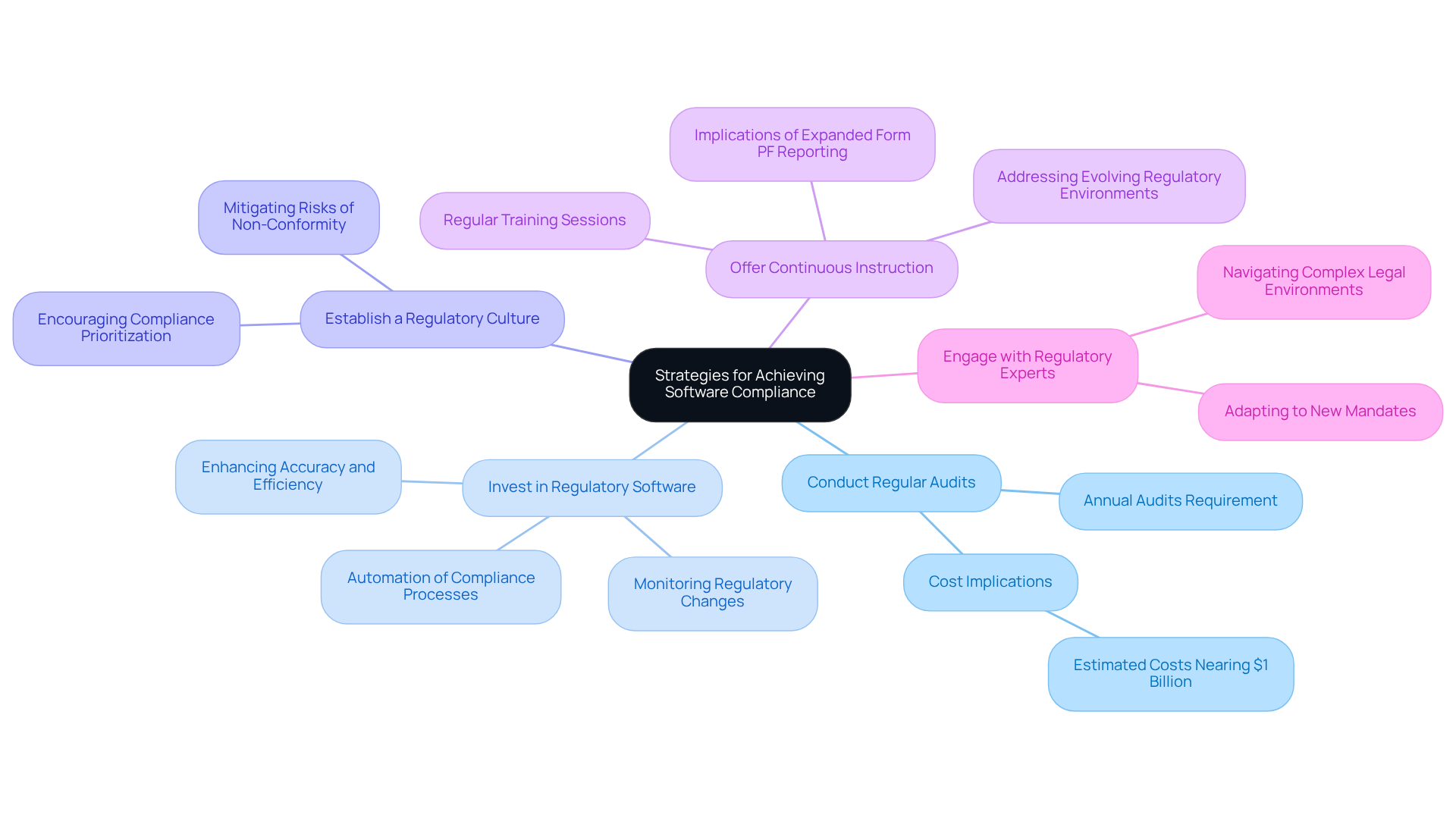

Implement Strategies for Achieving Software Compliance

To achieve software compliance, hedge fund managers can implement several key strategies:

-

Conduct Regular Audits: Frequent evaluations are essential for identifying adherence gaps and ensuring that software systems comply with the latest regulations. Starting in 2024, hedge fund managers are required to conduct annual audits by independent public accountants registered with the PCAOB, reinforcing the necessity for thorough oversight. The SEC estimates that yearly audits and quarterly reports will incur costs nearing $1 billion, highlighting the financial implications of regulatory compliance.

-

Investing in regulatory software compliance ensures that specialized regulatory software facilitates the monitoring of regulatory changes and automates adherence processes. This investment not only alleviates the burden on staff but also enhances the accuracy and efficiency of compliance efforts, which is critical in a landscape where the SEC imposed over $5 billion in penalties in 2024 alone.

-

Establish a Regulatory Culture: Cultivating a culture of adherence within the organization encourages all employees to prioritize compliance with regulations and ethical standards. This cultural shift is vital as compliance professionals face increasing scrutiny and the demand for transparency in operations. Experts indicate that a robust adherence culture can significantly mitigate risks associated with regulatory non-conformity.

-

Offer Continuous Instruction: Regular training sessions on regulatory requirements and best practices ensure that staff remain informed of their responsibilities. With 50% of North American respondents identifying regulatory proposals as a primary concern for 2024, ongoing education is crucial for navigating evolving regulatory environments. Training should also encompass the implications of expanded Form PF reporting and the prohibition of preferential treatment of clients.

-

Engage with Regulatory Experts: Collaborating with regulatory specialists provides valuable insights into navigating complex legal environments. Their expertise can assist investment pools in adapting to new mandates, such as the expanded Form PF reporting and the ban on preferential treatment of clients, ensuring that all regulatory measures are effectively implemented.

By applying these strategies, investment managers can establish a robust regulatory framework that not only meets legal obligations but also enhances operational integrity.

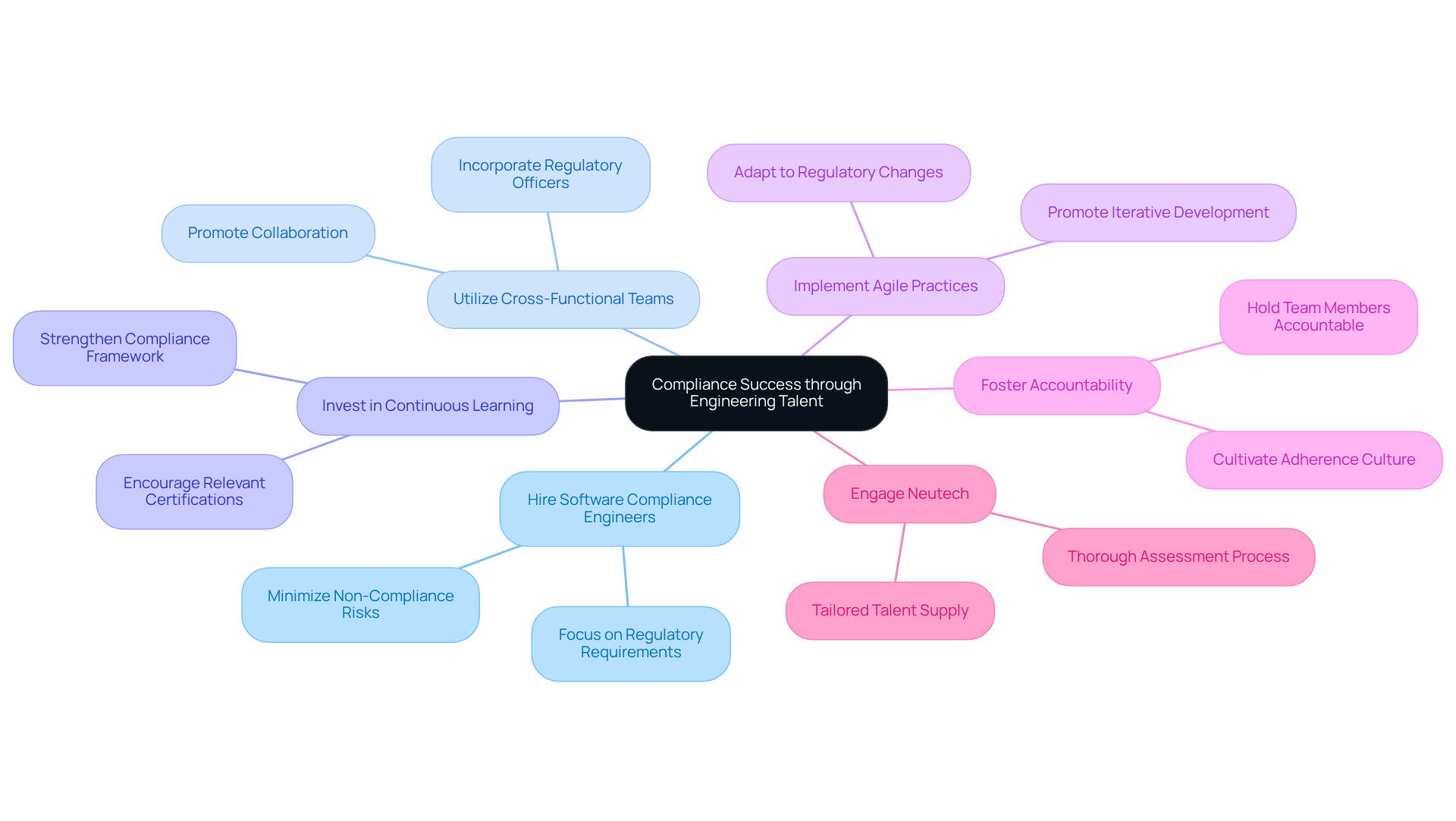

Leverage Specialized Engineering Talent for Compliance Success

To achieve compliance success, hedge fund managers should strategically leverage specialized engineering talent in the following ways:

-

Hire engineers with a strong background in software compliance to ensure effective compliance-related software development. Their expertise ensures that systems are designed with a focus on software compliance and regulatory requirements, minimizing risks associated with non-compliance.

-

Utilize cross-functional teams: Establish cross-functional teams that incorporate regulatory officers, software engineers, and data analysts. This collaborative approach promotes a culture where software compliance is integrated into every stage of software development, thereby enhancing overall effectiveness.

-

Invest in continuous learning: Encourage engineers to pursue relevant certifications and training in regulatory standards specific to the financial services industry. This investment not only improves their skills but also strengthens the organization’s software compliance framework.

-

Implement agile development practices: Adopt agile methodologies that promote iterative development and continuous feedback. This flexibility enables teams to quickly adjust to changing regulatory requirements, ensuring that software compliance remains aligned with legislative shifts.

-

Foster a culture of accountability: Cultivate an environment where engineers recognize the essential role of adherence in their work. By holding team members accountable for their contributions to regulatory guidelines, investment groups can reinforce the importance of software compliance throughout the organization.

-

Engage Neutech for tailored talent: Once you mutually determine your needs, Neutech can supply you with a selection of candidate designers and developers to integrate into your team. Neutech evaluates client requirements through a thorough assessment process, ensuring that the candidates provided possess the specific qualifications and expertise necessary to enhance your regulatory capabilities.

By effectively leveraging specialized engineering talent, including the tailored support from Neutech, hedge fund managers can significantly enhance their software compliance capabilities, ensuring that their software solutions consistently meet the highest standards of regulatory adherence.

Conclusion

Mastering software compliance is crucial for hedge fund managers aiming to navigate the complex regulatory landscape while protecting their operations and reputation. By understanding and adhering to key software compliance standards, investment firms can avoid costly penalties and enhance their credibility with investors and regulatory bodies. Compliance is not merely a legal obligation; it serves as a strategic advantage that fosters greater operational integrity and trust.

This article outlines several critical strategies for achieving software compliance, including:

- Conducting regular audits

- Investing in specialized compliance software

- Fostering a culture of adherence

- Leveraging specialized engineering talent

Each strategy is vital for ensuring hedge funds remain compliant with regulations such as SEC, GDPR, and AML. Additionally, integrating cross-functional teams and promoting continuous learning initiatives significantly bolster a robust compliance framework, enabling firms to adapt swiftly to evolving regulatory demands.

Ultimately, the importance of software compliance in the hedge fund industry cannot be overstated. As regulations continue to evolve, it is imperative for hedge fund managers to prioritize compliance not just as a requirement, but as a cornerstone of their operational strategy. By implementing best practices and leveraging specialized talent, firms can navigate the complexities of compliance with confidence, positioning themselves for sustainable success in a competitive financial landscape.

Frequently Asked Questions

What is software compliance in the context of financial services?

Software compliance refers to the criteria that software applications must meet to operate legally and ethically within the financial services sector, ensuring adherence to regulations and guidelines designed to protect investors and maintain market stability.

Why is understanding software compliance important for hedge fund managers?

Understanding software compliance is crucial for hedge fund managers because non-compliance can result in severe penalties, including significant fines and damage to their reputation.

What are some key requirements for software compliance?

Key requirements for software compliance include adherence to SEC regulations, GDPR for data protection, and various industry-specific guidelines related to the management and reporting of financial data.

What are the financial consequences of non-compliance?

The average cost of non-compliance exceeds $14 million, primarily due to breaches of regulations such as SOX, AML, and GDPR, highlighting the financial risks associated with regulatory failures.

How do high-profile cybersecurity breaches relate to software compliance?

High-profile cybersecurity breaches emphasize the need to strengthen cybersecurity measures, reinforcing the importance of adhering to regulatory standards to mitigate risks.

How can hedge funds benefit from adhering to software compliance requirements?

By adhering to software compliance requirements, hedge funds can mitigate risks and enhance their credibility and trustworthiness in the eyes of both investors and regulators.

What role does outsourcing play in software compliance for investment groups?

Outsourcing software compliance assistance allows investment groups to access specialized expertise, helping them remain compliant and competitive as regulatory landscapes evolve.