Introduction

Outsourcing software development has emerged as a strategic approach for hedge funds, enabling them to leverage specialized expertise while significantly reducing operational costs. By partnering with external vendors, investment firms can streamline their processes and concentrate on core investment strategies, thereby enhancing their competitive advantage.

As this trend continues to gain traction, it prompts essential inquiries:

- What best practices should firms adopt to ensure successful outsourcing engagements?

- How can they effectively navigate the inherent challenges associated with delegation?

Examining these dynamics not only uncovers the potential benefits of outsourcing but also outlines the strategies necessary for mitigating risks and achieving optimal outcomes in the rapidly evolving financial landscape.

Define Outsourcing Software Development for Hedge Funds

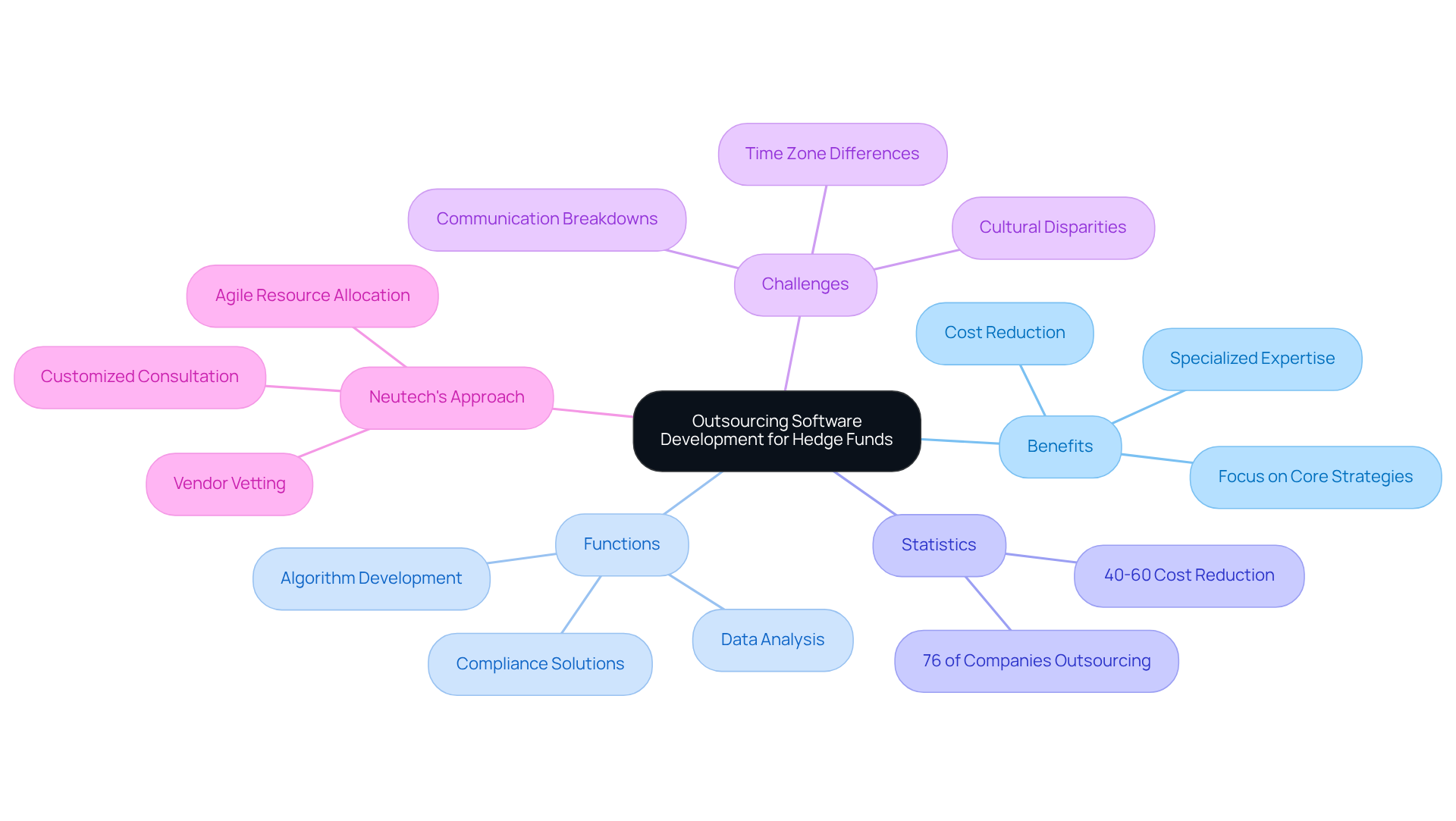

Outsourcing development software for investment firms involves collaborating with external vendors to manage software projects that are typically handled in-house. This strategic approach enables investment firms to tap into specialized expertise, significantly reduce operational costs, and focus on core investment strategies. In this context, delegation can cover various functions, including:

- Algorithm development

- Data analysis

- Compliance-related software solutions

By leveraging external resources, hedge funds gain access to a diverse talent pool, ensuring they have the necessary skills to meet the stringent demands of the financial industry.

Statistics indicate that outsourcing can lead to cost reductions of 40-60% compared to internal hiring, making it an attractive option for firms looking to optimize their budgets. Additionally, 76% of companies in the financial sector are now outsourcing IT functions, highlighting the trend of utilizing external expertise to improve operational efficiency. Industry leaders have noted that externalizing tasks not only accelerates project timelines but also allows companies to concentrate on their primary investment activities, ultimately enhancing performance in a competitive market. By 2026, the advantages of outsourcing development software in financial services are projected to continue expanding, as firms increasingly acknowledge the value of specialized skills and the agility that outsourcing offers.

Neutech exemplifies this approach with a strong commitment to reliability, reflected in a high employee retention rate that ensures continuity and stability for clients. Their flexible engineering talent framework facilitates month-to-month agreements and agile resource allocation, improving project management and adapting to the evolving needs of investment firms. Neutech’s client engagement process begins with a customized consultation to evaluate specific requirements, followed by the selection of specialized designers and developers who integrate seamlessly into the client’s team. This ensures that hedge funds not only acquire the technical expertise needed but also benefit from a collaborative approach that promotes innovation and efficiency.

However, it is crucial to recognize the common challenges associated with delegation, such as:

- Communication breakdowns

- Time zone differences

- Cultural disparities

These challenges can hinder collaboration. To address these risks, Neutech implements rigorous vendor vetting and maintains robust communication, ensuring successful outsourcing engagements.

Leverage Benefits of Outsourcing: Cost Savings and Access to Talent

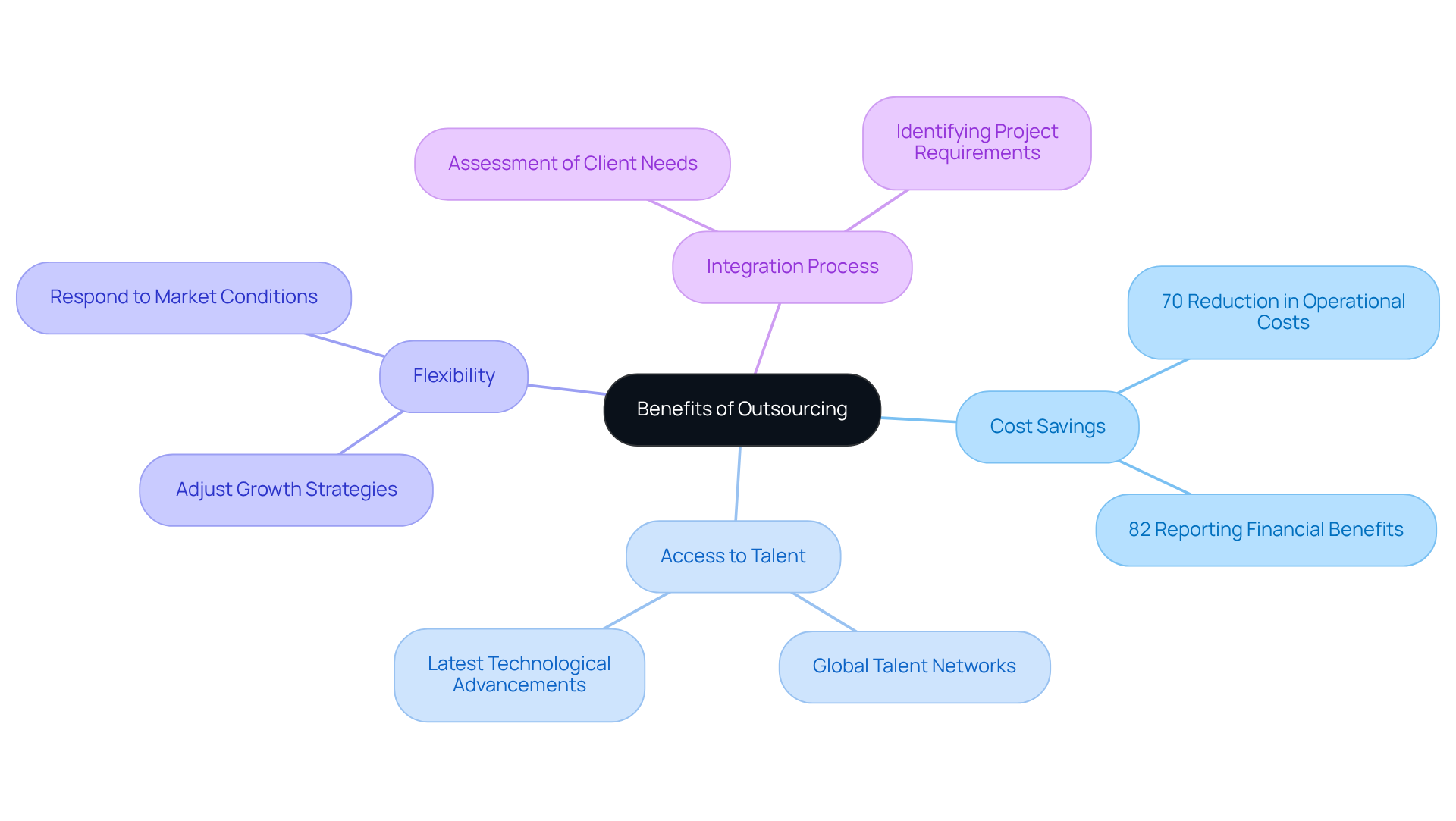

Outsourcing development software offers investment firms significant cost savings by reducing the need for internal resources and infrastructure. By partnering with specialized suppliers such as Neutech, investment groups can tap into top-tier talent without incurring the overhead costs associated with full-time employees. This approach can reduce operational costs by as much as 70%, with 82% of companies reporting financial benefits from IT services in 2023.

Neutech’s process for providing tailored engineering talent begins with a thorough assessment of client needs. This step involves identifying specific project requirements and the necessary skill sets for success, ensuring that the right designers and developers are integrated seamlessly into the team.

Moreover, outsourcing development software offers flexibility, enabling investment groups to adjust their growth strategies in response to market conditions and project demands. This adaptability is particularly advantageous in the fast-paced financial sector, where the ability to respond swiftly can confer a competitive edge.

Additionally, outsourcing development software enables investment firms to access global talent networks, ensuring they leverage the latest technological advancements and expertise in financial software development.

Identify and Mitigate Risks in Outsourcing Development

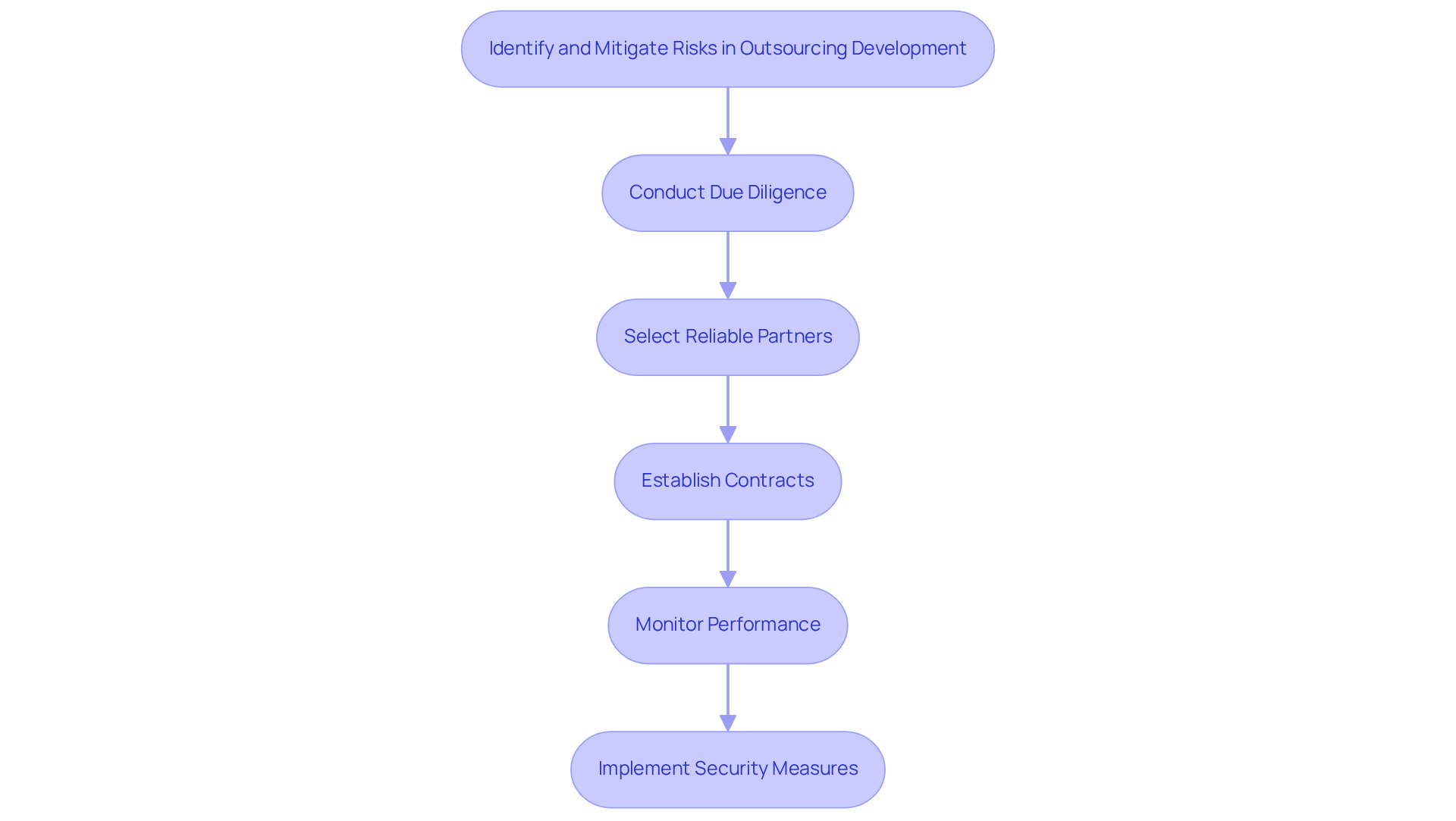

Outsourcing development in the investment sector carries notable risks, particularly concerning compliance and data security. To mitigate these risks effectively, investment groups must engage in thorough due diligence when selecting external partners, prioritizing those with a proven track record in the financial sector. Neutech is instrumental in this process, assessing client needs and providing specialized developers and designers tailored to those requirements. As Gita Gopinath suggests, businesses should concentrate on their core strengths and seek assistance in other areas, making it vital to collaborate with dependable firms like Neutech.

Establishing comprehensive contractual agreements that clearly outline expectations, deliverables, and compliance obligations is crucial. Regular communication and performance monitoring of the outsourced team facilitate the early identification of potential issues, allowing for timely intervention. Furthermore, implementing stringent security measures and data protection protocols is essential to safeguard sensitive information and ensure adherence to regulatory standards.

Significantly, a recent statistic indicates that 78% of companies have increased their cybersecurity budgets over the past year, underscoring the growing importance of robust security in external partnerships. By proactively addressing these risks, investment groups can harness the benefits of external support while minimizing potential disruptions and maintaining operational integrity. Moreover, with 90% of Fortune 500 firms engaging in outsourcing development software for at least part of their projects, this trend highlights the necessity for investment groups to adopt effective external strategies.

Choose the Right Outsourcing Partner for Quality Assurance

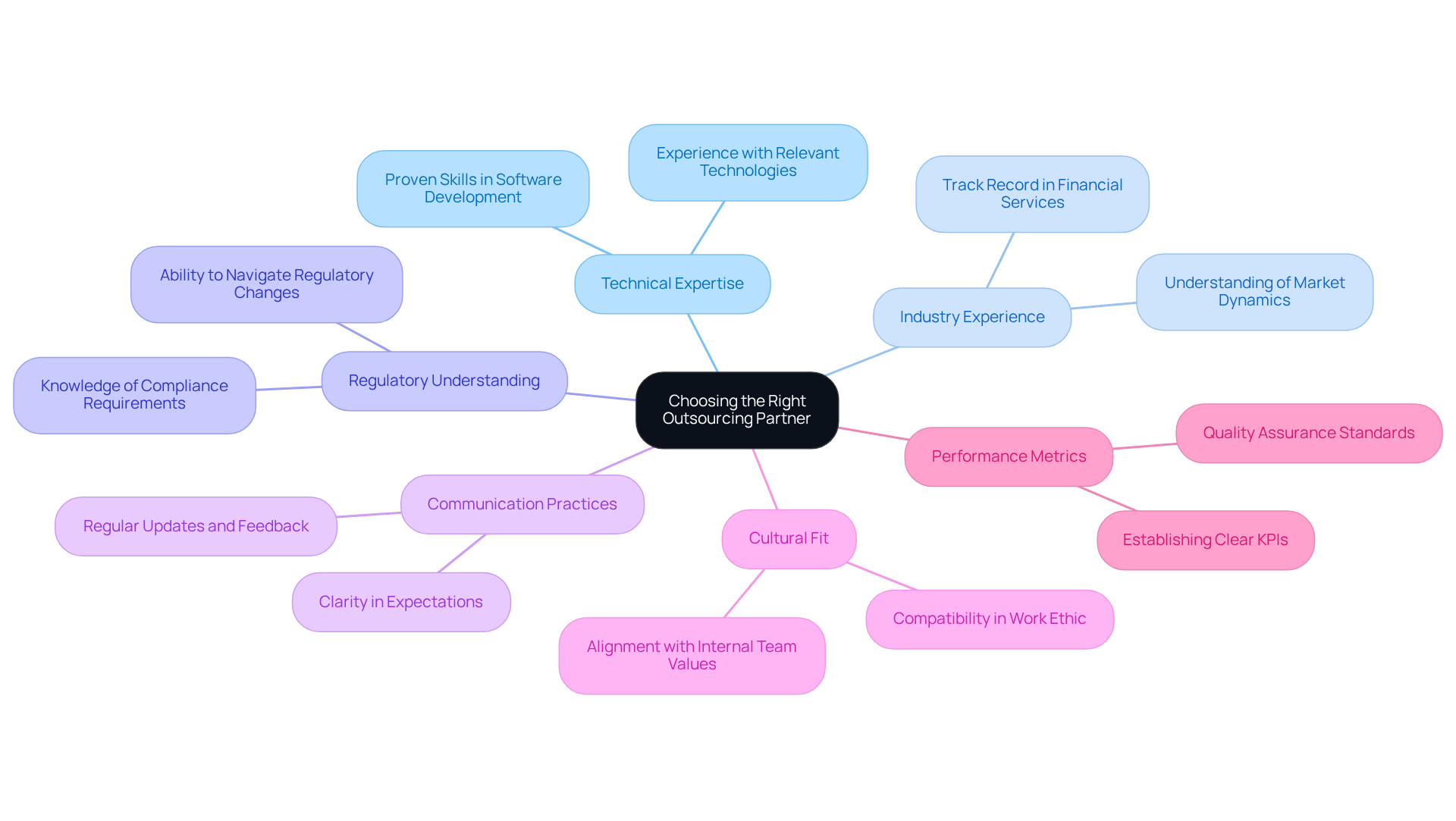

Selecting the right outsourcing partner is essential for investment groups aiming to maintain the quality and reliability of their software development projects. Hedge investments should focus on partners with a solid reputation in the financial services sector and a proven track record of delivering high-quality solutions. Key factors to evaluate include:

- The partner’s technical expertise

- Industry experience

- Understanding of regulatory requirements

Additionally, examining the partner’s communication practices and cultural fit with the investment group’s internal team can significantly enhance collaboration and project outcomes. Establishing clear performance metrics and quality assurance standards is vital to ensure that the outsourcing development software aligns with the investment firm’s expectations and operational benchmarks.

As Paul Singer notes, successful investment groups embody an entrepreneurial spirit, underscoring the need for strategic partnerships that foster innovation and efficiency.

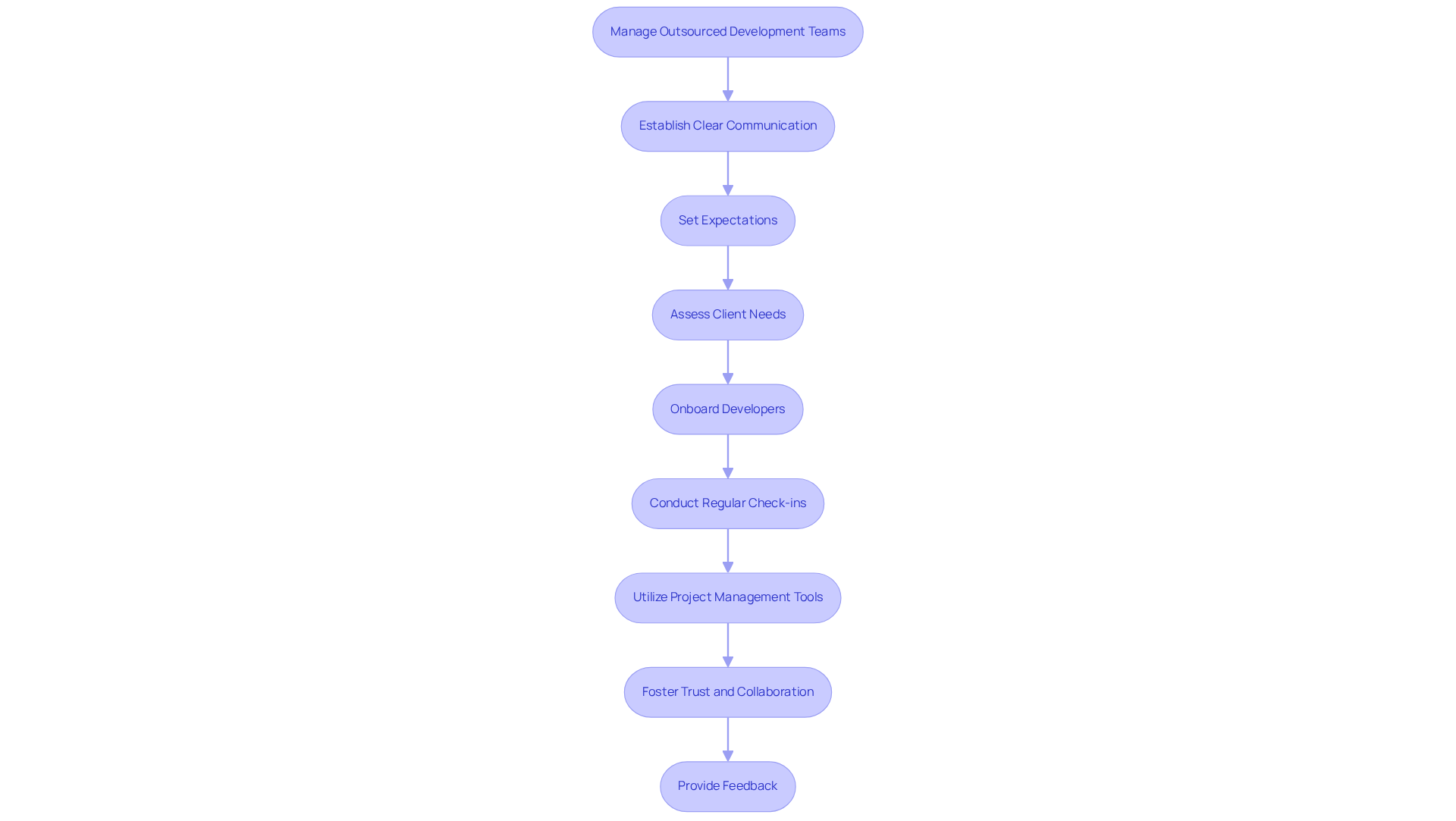

Implement Best Practices for Managing Outsourced Development Teams

To effectively manage outsourcing development software teams, investment groups must establish clear communication channels and set expectations from the outset. Neutech facilitates this process by assessing client needs and supplying specialized developers and designers tailored to those requirements. Their streamlined ongoing pipeline for identifying and training talented software engineers ensures that developers are onboarded with the necessary skills to meet project demands.

Regular check-ins and progress updates are vital for maintaining alignment and swiftly addressing any emerging issues. Utilizing project management tools can enhance collaboration and transparency, enabling both the investment firm and the outsourced team to monitor progress and deliverables. A recent Deloitte survey indicates that 76% of companies are increasingly relying on third-party vendors for critical functions, underscoring the importance of effective management strategies in outsourcing development software.

Neutech’s monthly agreements allow investment groups to flexibly scale their resource capabilities, ensuring they can adjust to evolving project requirements. Additionally, fostering a culture of trust and collaboration is essential for building strong relationships with outsourced teams. Providing constructive feedback and recognizing achievements can serve as powerful motivators, ultimately enhancing overall performance.

By adopting these best practices, investment groups can ensure their outsourcing development software initiatives are not only successful but also closely aligned with their strategic objectives. Furthermore, as the global outsourcing market is projected to grow significantly, hedge funds must remain agile and proactive in their management approaches to leverage the full potential of their outsourced teams.

Conclusion

Outsourcing software development offers hedge funds a strategic avenue to boost operational efficiency while concentrating on core investment activities. By partnering with specialized external vendors, investment firms can tap into expert skills, lower costs, and foster innovation. This strategy not only helps firms maintain competitiveness but also equips them to swiftly adapt to the changing demands of the financial sector.

Key insights throughout the article highlight the diverse advantages of outsourcing, including substantial cost savings – up to 70% – and access to a global talent pool. The selection of the right outsourcing partner is crucial, as is the implementation of effective communication strategies and risk mitigation practices. By proactively addressing potential challenges such as cultural differences and compliance issues, hedge funds can secure successful collaborations that align with their strategic goals.

Ultimately, the rising trend of outsourcing within the financial industry emphasizes the necessity for hedge funds to adopt best practices in managing external development teams. As the landscape evolves, investment firms are urged to embrace these strategies, cultivating partnerships that not only improve project outcomes but also drive long-term success in an increasingly competitive environment. Taking decisive steps now will enable hedge funds to fully leverage the benefits of outsourcing, ensuring they remain leaders in innovation and efficiency in the years ahead.

Frequently Asked Questions

What is outsourcing software development for hedge funds?

Outsourcing software development for hedge funds involves collaborating with external vendors to manage software projects that are typically handled in-house, allowing investment firms to access specialized expertise, reduce operational costs, and focus on core investment strategies.

What functions can be outsourced in software development for investment firms?

Functions that can be outsourced include algorithm development, data analysis, and compliance-related software solutions.

What are the cost benefits of outsourcing for hedge funds?

Outsourcing can lead to cost reductions of 40-60% compared to internal hiring, making it an attractive option for firms looking to optimize their budgets.

How prevalent is outsourcing in the financial sector?

Statistics show that 76% of companies in the financial sector are now outsourcing IT functions, indicating a trend towards utilizing external expertise to improve operational efficiency.

What advantages does outsourcing provide to hedge funds?

Outsourcing accelerates project timelines, allows firms to concentrate on primary investment activities, and enhances performance in a competitive market.

How does Neutech approach outsourcing for investment firms?

Neutech provides a customized consultation to evaluate specific requirements, followed by the selection of specialized designers and developers who integrate seamlessly into the client’s team, ensuring technical expertise and a collaborative approach.

What challenges are associated with outsourcing software development?

Common challenges include communication breakdowns, time zone differences, and cultural disparities, which can hinder collaboration.

How does Neutech address the challenges of outsourcing?

Neutech implements rigorous vendor vetting and maintains robust communication to ensure successful outsourcing engagements.

What are the financial benefits of partnering with specialized suppliers like Neutech?

Partnering with specialized suppliers can reduce operational costs by as much as 70%, with 82% of companies reporting financial benefits from IT services in 2023.

How does outsourcing provide flexibility for investment firms?

Outsourcing allows investment groups to adjust their growth strategies in response to market conditions and project demands, which is particularly advantageous in the fast-paced financial sector.

What access does outsourcing provide to investment firms?

Outsourcing enables investment firms to access global talent networks, ensuring they leverage the latest technological advancements and expertise in financial software development.