Master Cloud Computing Scalability for Hedge Fund Success

Introduction

Cloud computing scalability has emerged as a pivotal factor for investment firms navigating the unpredictable tides of financial markets. It enables firms to dynamically adjust their IT resources, optimizing operational costs and enhancing efficiency during periods of market volatility. However, as the demand for flexible and robust cloud solutions increases, hedge funds face the complexities of implementing effective scalability strategies. They must ensure compliance and manage associated risks.

What best practices can empower these firms to fully harness the potential of cloud scalability for sustained success?

Define Cloud Scalability in Financial Services

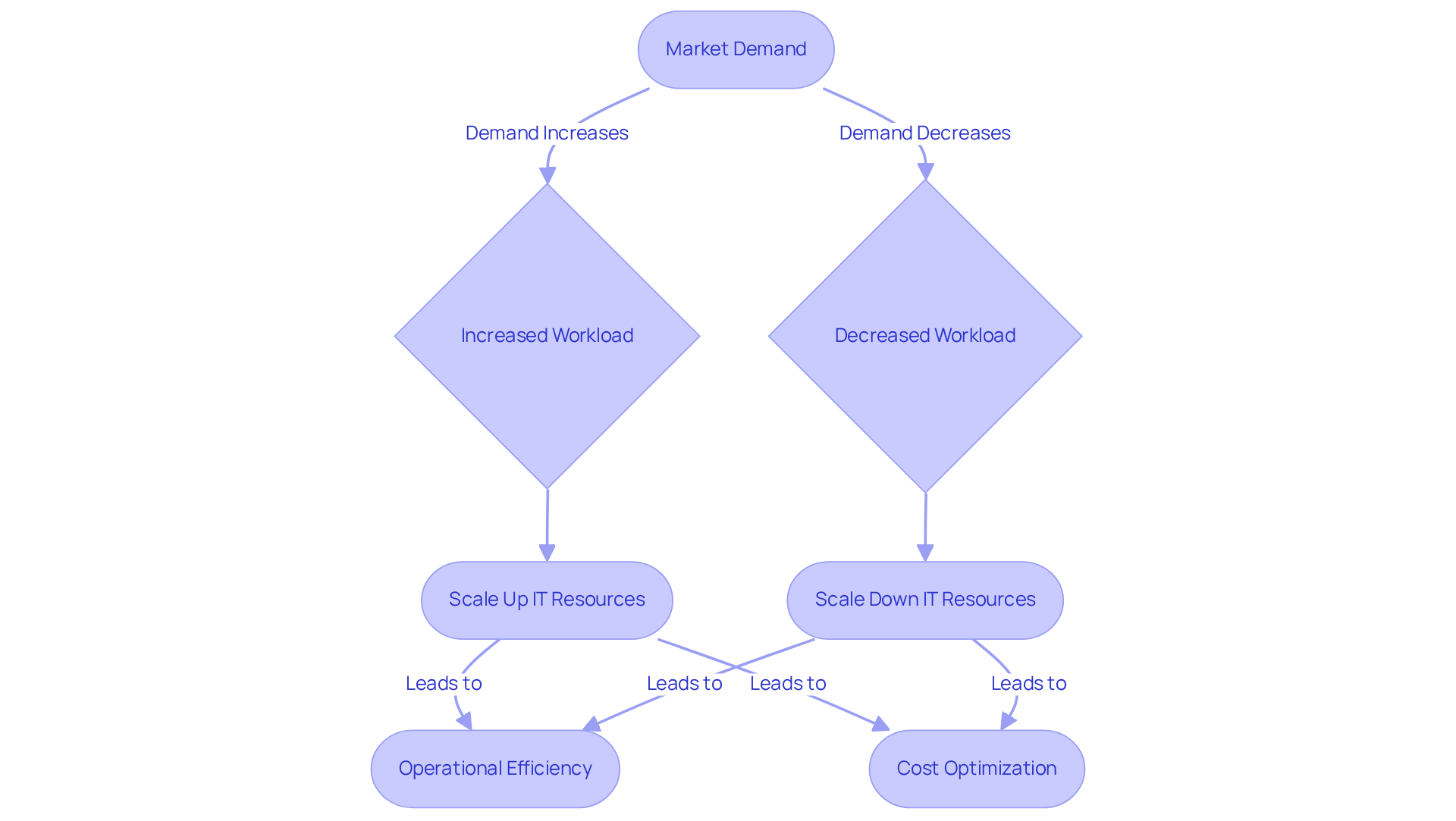

Cloud computing scalability refers to the capacity of cloud computing assets to dynamically adjust to varying workloads, which is a vital characteristic for investment firms operating in the fast-paced financial services sector. This capability enables firms to scale their IT resources up or down in response to market demands, ensuring they incur costs only for what they actually utilize. Such flexibility is essential for investment firms, which often face fluctuating workloads driven by market volatility.

For example, during periods of heightened trading activity, an investment group can rapidly increase its computing capacity to manage the surge in transactions, subsequently reducing it during quieter times. This strategy not only optimizes operational costs but also significantly boosts efficiency, allowing firms to react promptly to market changes.

As investment firms look ahead to 2026, the significance of cloud computing scalability is expected to increase. Nearly 100% of financial institutions have indicated plans to maintain or increase their AI budgets, underscoring the necessity for flexible solutions that can accommodate complex trading strategies and operational demands.

Implement Strategies for Effective Cloud Scalability

To effectively implement cloud scalability, hedge funds should consider several key strategies:

-

Auto-Scaling: Hedge funds can leverage auto-scaling features that dynamically adjust resources based on real-time demand. This capability ensures efficient management of peak loads, highlighting the importance of cloud computing scalability, while avoiding unnecessary costs during quieter periods, thereby enhancing operational efficiency. Notably, 82 percent of North American allocators have increased the rigor of their operational due diligence (ODD) reviews over the past two to three years, underscoring the importance of operational resilience in today’s market.

-

Load Balancing: Deploying load balancers is essential for evenly distributing workloads across servers. This approach not only boosts performance but also enhances reliability by preventing any single server from becoming a bottleneck, which is crucial for maintaining service continuity during high-demand scenarios. The case study ‘Market Volatility Puts Emphasis on Hedge Groups’ Operational Infrastructure’ illustrates the challenges faced by hedge groups in 2025, highlighting the need for robust operational infrastructure.

-

Containerization: Embracing containerization technologies such as Docker or Kubernetes is vital. These tools facilitate the deployment of applications in isolated environments, which allows for cloud computing scalability based on demand. This is particularly beneficial in a multi-asset investment landscape. As Dakota McMahon notes, “A cloud-native OMS that supports both fund and SMA trading models within the same framework allows firms to replicate strategies across structures without duplicating operational processes.”

-

Monitoring and Analytics: Investing in comprehensive monitoring tools is crucial for gaining insights into asset usage and performance metrics. This data is essential for making informed scaling choices and recognizing trends that may necessitate modifications in asset distribution, thereby ensuring operational resilience is upheld.

-

Hybrid Solutions: Exploring a hybrid strategy that combines both public and private resources can enhance security and adaptability. This model allows hedge investments to protect sensitive information in a secure environment while leveraging the scalability of public infrastructures for less sensitive operations.

Ensure Compliance and Risk Management in Scalability Practices

Hedge funds must prioritize compliance and risk management when implementing solutions that leverage cloud computing scalability. Key practices to consider include the following:

-

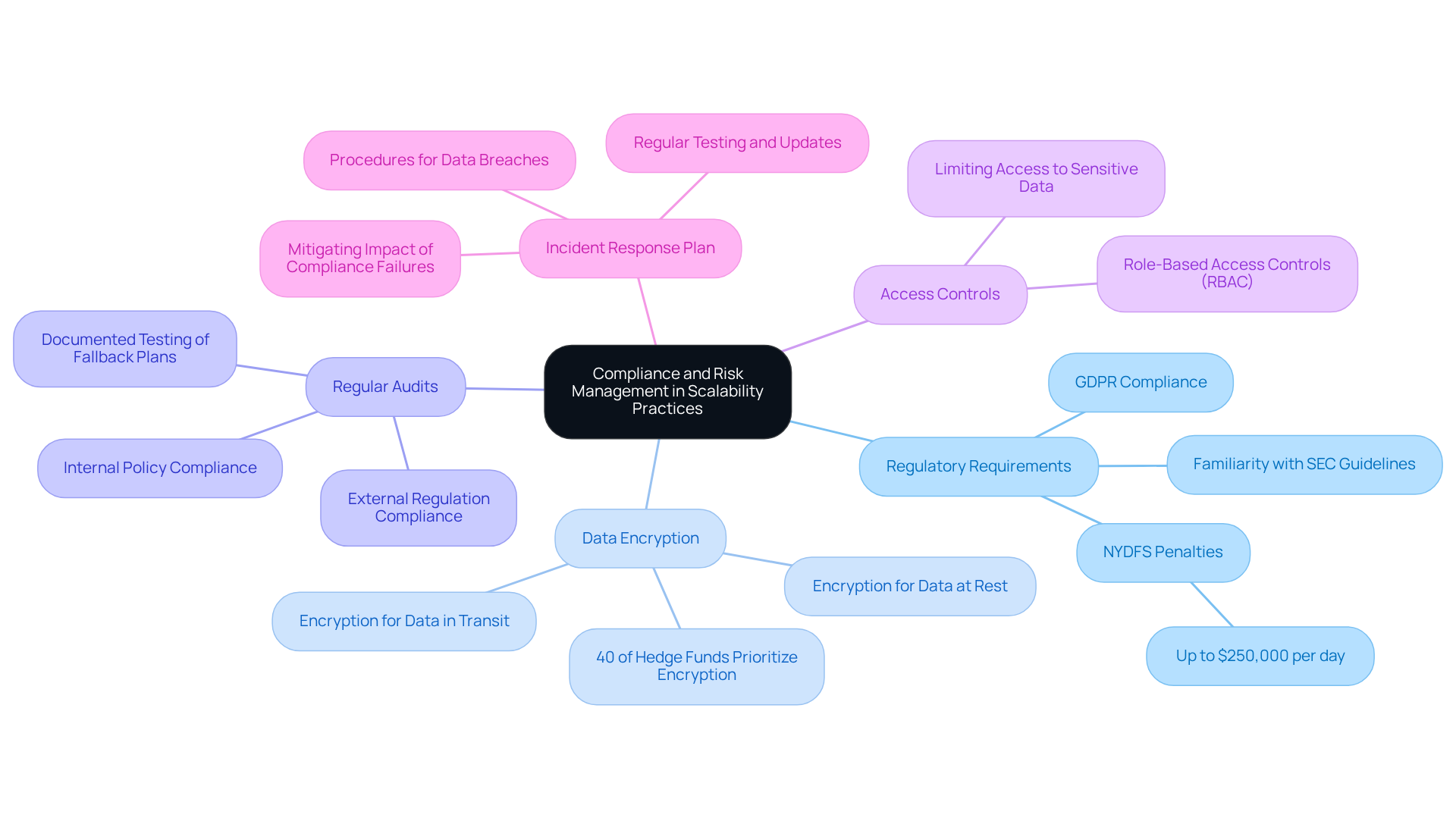

Understand Regulatory Requirements: It is essential to familiarize yourself with regulations such as the SEC guidelines, GDPR, and others that may impact the usage of online services. Ensure that your online service provider complies with these regulations to avoid penalties, which can amount to $250,000 per day for ongoing violations under NYDFS.

-

Data Encryption: Strong encryption protocols should be implemented for data at rest and in transit. Recent statistics indicate that over 40% of hedge funds are prioritizing data encryption as a critical compliance measure. This practice protects sensitive financial data from unauthorized access, which is crucial for maintaining compliance and safeguarding client trust.

-

Regular Audits: Conducting regular audits of your online infrastructure is vital to ensure compliance with internal policies and external regulations. This process helps identify potential vulnerabilities and areas for improvement. Regulatory experts note that firms with documented testing of fallback plans face less scrutiny than those without.

-

Access Controls: Establishing strict access controls is necessary to limit who can access sensitive data and systems. Implement role-based access controls (RBAC) to ensure that only authorized personnel can make modifications to online assets, thereby reducing the risk of data breaches.

-

Incident Response Plan: Developing and maintaining an incident response plan is crucial. This plan should outline procedures for addressing data breaches or compliance failures and must be regularly tested and updated to reflect changes in regulations or business operations. Firms with robust incident response plans are better positioned to mitigate the impact of compliance failures, as anecdotal evidence suggests.

Leverage Technology and Tools for Cloud Scalability

To enhance cloud scalability, hedge funds should leverage several key technologies and tools:

-

Infrastructure as Code (IaC): Hedge funds can utilize IaC tools such as Terraform or AWS CloudFormation to automate the provisioning and management of online assets. This approach facilitates consistent and repeatable deployments, thereby improving cloud computing scalability and making scaling more efficient.

-

Serverless Computing: It is advisable to consider serverless architectures, such as AWS Lambda or Azure Functions, which automatically scale based on demand. This eliminates the necessity of managing servers, allowing developers to concentrate on writing code.

-

Cloud Management Platforms: Implementing cloud management platforms is crucial for providing visibility and control over cloud assets. These platforms assist in optimizing utilization and expenses while ensuring compliance with regulatory standards.

-

APIs and Microservices: Adopting an API-first approach alongside a microservices architecture enables the independent scaling of application components. This strategy allows hedge funds to leverage cloud computing scalability to scale specific parts of their applications based on demand without impacting the entire system.

-

Performance Monitoring Tools: Utilizing performance monitoring tools, such as New Relic or Datadog, provides valuable insights into application performance and resource utilization. This data is instrumental in informing scaling decisions and identifying areas for optimization.

Conclusion

Cloud computing scalability stands as a vital asset for hedge funds striving to excel in a dynamic financial landscape. It enables firms to adjust their IT resources in response to market fluctuations, optimizing operational costs and enhancing efficiency. As investment firms gear up for future challenges, the capacity to scale effectively will be crucial for maintaining a competitive edge.

This article outlines several key strategies for implementing cloud scalability, including:

- Auto-scaling

- Load balancing

- Containerization

- Utilization of monitoring tools

Each strategy is essential in ensuring that hedge funds can swiftly respond to market demands while adhering to compliance and risk management protocols. Furthermore, adopting advanced technologies such as Infrastructure as Code and serverless computing can streamline operations and strengthen scalability initiatives.

In conclusion, the importance of cloud scalability within the financial sector cannot be overstated. As hedge funds navigate an increasingly complex market, embracing best practices and innovative technologies will be essential for achieving operational resilience and regulatory compliance. By adopting these strategies, firms not only prepare for immediate challenges but also position themselves for sustained success in an evolving financial landscape.

Frequently Asked Questions

What is cloud scalability in financial services?

Cloud scalability in financial services refers to the ability of cloud computing resources to dynamically adjust to varying workloads, allowing investment firms to scale their IT resources up or down based on market demands.

Why is cloud scalability important for investment firms?

It is important because it enables firms to incur costs only for the resources they actually use, which is essential for managing fluctuating workloads driven by market volatility.

How does cloud scalability benefit investment firms during trading activity?

During periods of heightened trading activity, investment firms can rapidly increase their computing capacity to handle the surge in transactions and then reduce it during quieter times, optimizing operational costs and boosting efficiency.

What trend is expected regarding cloud computing scalability by 2026?

By 2026, the significance of cloud computing scalability is expected to increase, as nearly 100% of financial institutions plan to maintain or increase their AI budgets, highlighting the need for flexible solutions to accommodate complex trading strategies and operational demands.