How to Choose a Fintech Software Development Agency Effectively

Introduction

The fintech landscape is undergoing significant transformation, with projections indicating a rise from approximately USD 340 billion to over USD 1 trillion by 2032. This remarkable growth highlights the essential role of fintech software development agencies in crafting innovative solutions that cater to the unique demands of the financial sector.

However, the process of selecting the right agency presents numerous challenges, including:

- The need for regulatory compliance

- The alignment of expectations

Businesses must navigate this intricate landscape to identify a partner that not only fulfills their technical requirements but also cultivates a successful collaborative relationship.

Understand Fintech Software Development Agencies

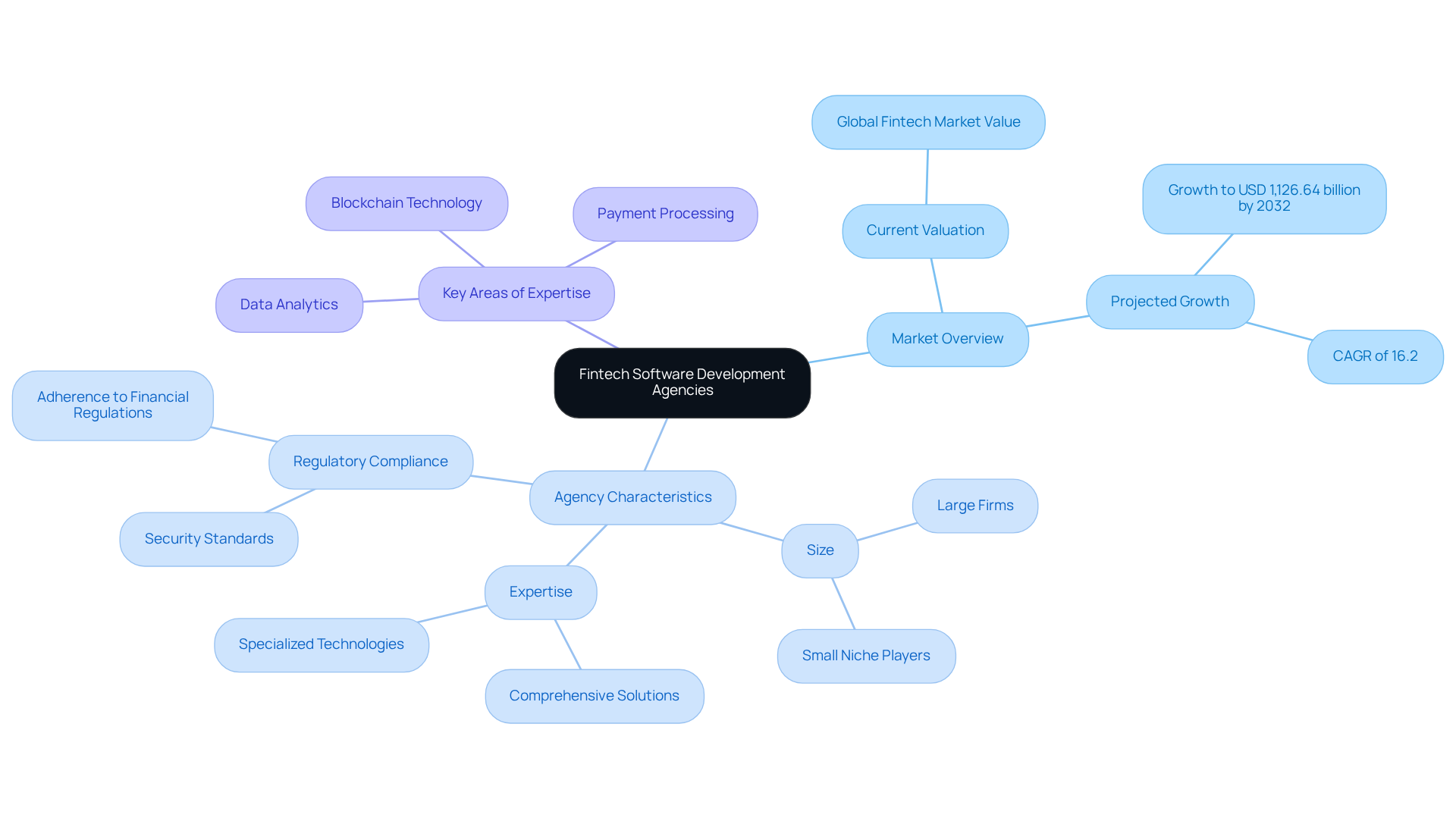

Fintech software development agencies play a crucial role in developing technology solutions tailored specifically for the financial services sector. The global fintech market was valued at approximately USD 340.10 billion in 2024 and is projected to experience substantial growth, reaching USD 1,126.64 billion by 2032. This anticipated growth highlights the increasing demand for specialized software development that meets the unique needs of financial institutions.

These agencies, including a fintech software development agency, exhibit a wide range of sizes and expertise, from large firms providing comprehensive end-to-end solutions to smaller, niche players focusing on specific technologies or regulatory compliance. Adherence to financial regulations and security standards is essential, as it ensures that applications not only fulfill legal requirements but also safeguard sensitive user data. For instance, advanced financial technology applications frequently incorporate multi-layered biometric authentication and encryption to bolster security.

Key participants in this sector typically possess experience in critical areas such as:

- Blockchain technology

- Payment processing

- Data analytics

These areas are vital for a fintech software development agency to create robust and scalable financial technology applications. Successful initiatives often showcase the ability to integrate seamlessly with existing financial systems, thereby enhancing operational efficiency and user experience. Familiarizing yourself with these elements will enable you to identify the appropriate organization that aligns with your project requirements, ensuring a successful collaboration in the evolving financial technology landscape.

Identify Key Selection Criteria

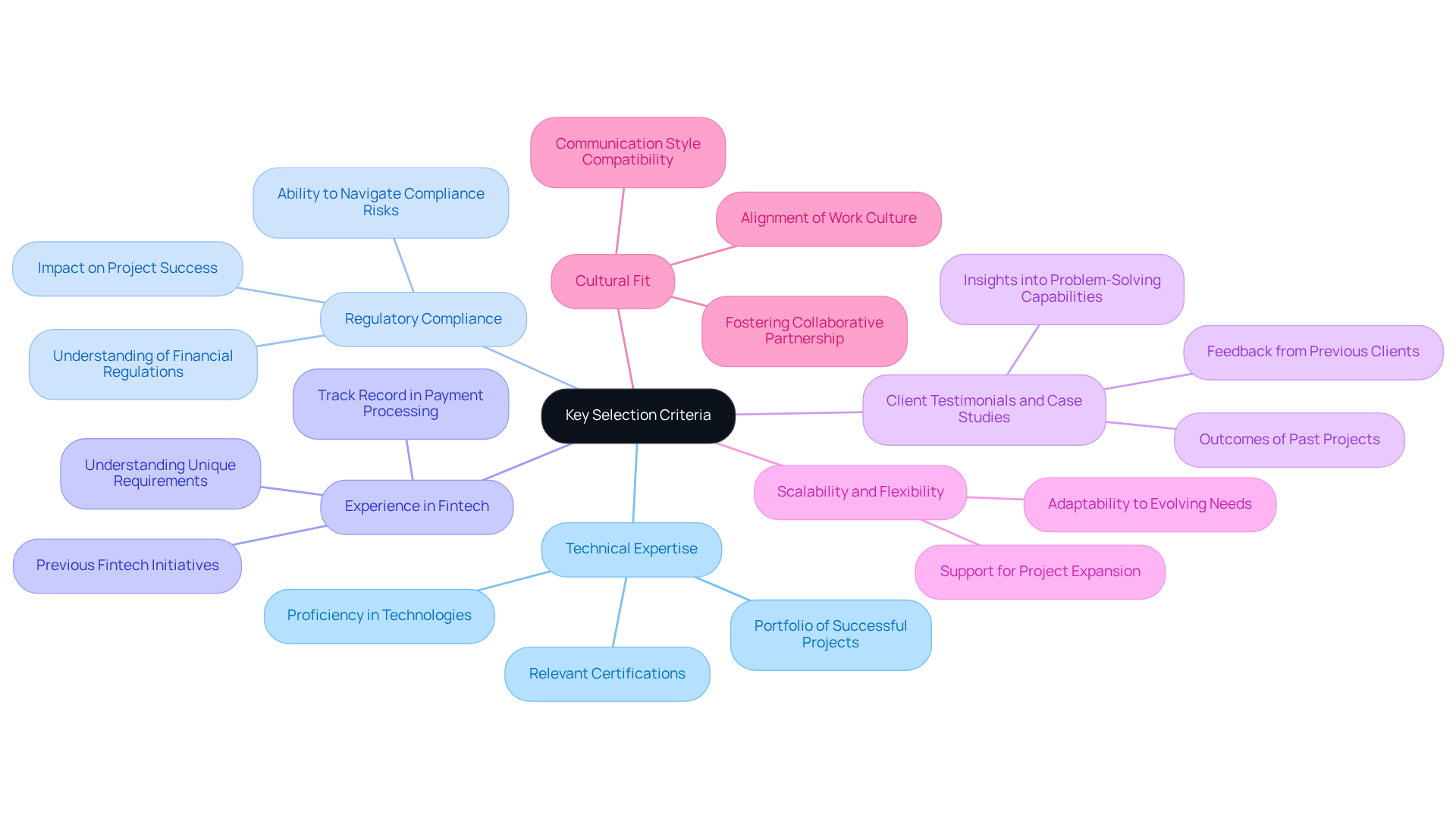

When selecting a fintech software development agency, it is essential to consider several key criteria:

-

Technical Expertise: Evaluate the agency’s proficiency in critical technologies such as blockchain, artificial intelligence, and data analytics. Look for relevant certifications and a portfolio that showcases successful projects, highlighting their capabilities.

-

Regulatory Compliance: A strong understanding of financial regulations, including GDPR, PCI DSS, and AML, is vital. The agency’s ability to navigate these regulations effectively can significantly influence the success of your project and mitigate potential risks.

-

Experience in Fintech: Review the firm’s portfolio for previous fintech initiatives. A fintech software development agency with a proven track record in specific areas, such as payment processing or lending platforms, is more likely to understand your unique requirements and challenges.

-

Client Testimonials and Case Studies: Analyze feedback from previous clients to assess satisfaction levels and the agency’s reliability in delivering results. Case studies can offer valuable insights into their problem-solving capabilities and the outcomes of their projects.

-

Scalability and Flexibility: Consider whether the agency can adapt its services to meet your evolving needs, particularly if your project expands or shifts direction.

-

Cultural Fit: Ensure that the agency’s work culture and communication style align with your team’s values and expectations, fostering a collaborative and productive partnership.

Follow the Engagement Process

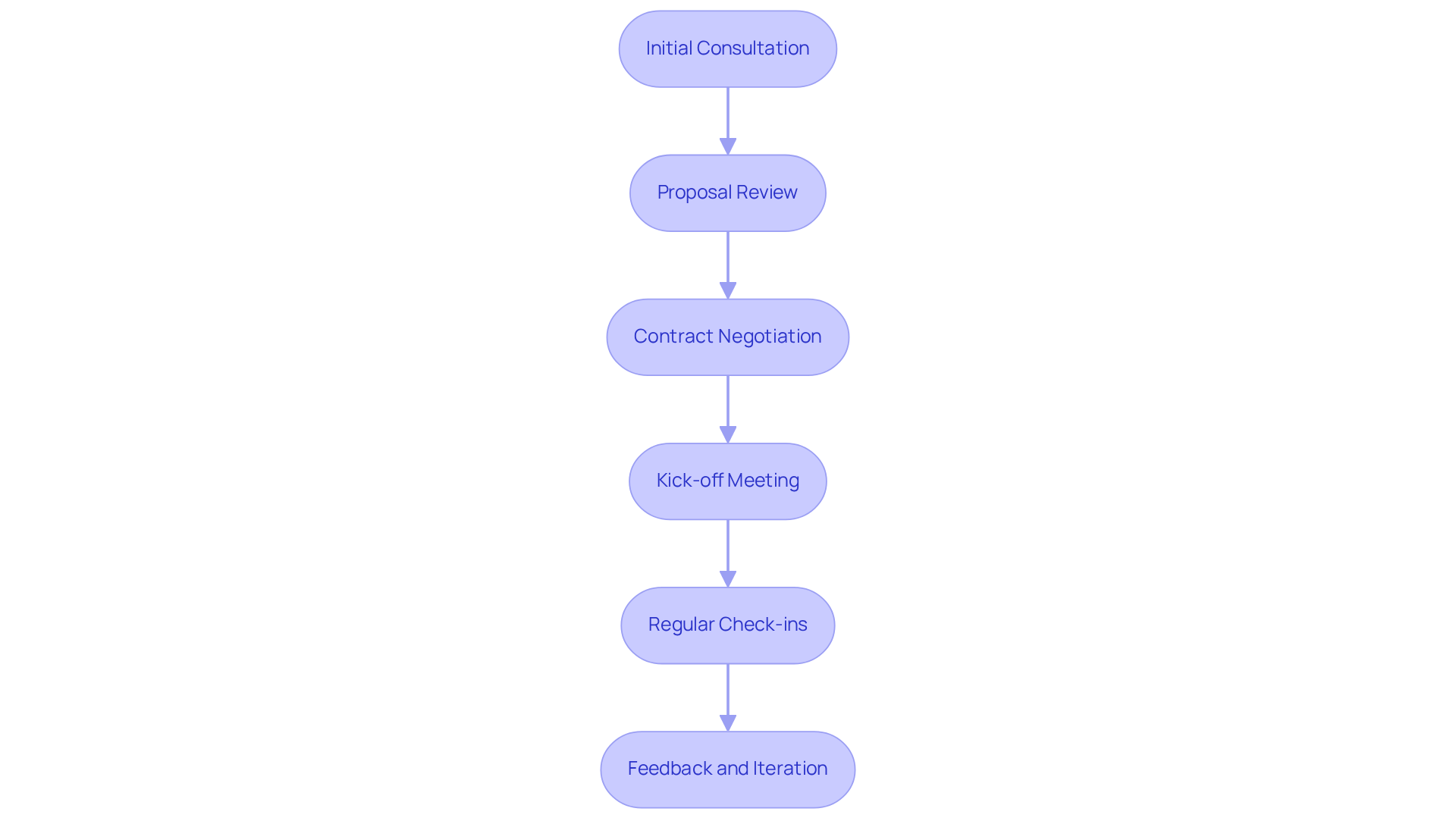

Engaging with a fintech software development agency like Neutech involves several key steps that are crucial for project success:

-

Initial Consultation: Schedule a meeting with Neutech to discuss your objectives, timelines, and budget. This meeting serves as a critical opportunity to assess Neutech’s understanding of your specific needs and their proposed approach. During this consultation, Neutech collaborates with you to determine how they can best enhance your initiative. A successful initial consultation sets the foundation for a productive partnership, allowing both parties to align on expectations and objectives. Vinod Sivagnanam highlights that introducing a financial technology product poses distinct challenges, necessitating a careful balance among innovation, compliance, and customer trust.

-

Proposal Review: Following the initial consultation, Neutech presents a proposal detailing their approach, timelines, and costs. It is crucial to examine this document thoroughly, ensuring it aligns with your expectations and task requirements. Development costs for a simple MVP start around $50K-$100K, underscoring the financial implications of the proposal review process. Average proposal review times in fintech can vary, but prompt feedback is vital to maintain momentum.

-

Contract Negotiation: Once the proposal meets your approval, negotiate the contract terms, including deliverables, payment schedules, and confidentiality agreements. Clearly defining all aspects of the endeavor helps prevent future disputes and ensures that both parties are aligned.

-

Kick-off Meeting: Organize a kick-off meeting with your team and Neutech to establish communication protocols, project management tools, and timelines. This meeting sets the tone for cooperation and ensures that everyone is aligned on the goals and processes.

-

Regular Check-ins: Schedule regular management calls with Neutech to monitor progress, address any issues, and adjust project scopes as necessary. Maintaining open lines of communication is vital for a successful partnership, allowing for timely adjustments and fostering a collaborative environment.

-

Feedback and Iteration: Provide constructive feedback throughout the development process. Encourage Neutech to iterate on their work based on your input, ensuring that the final product aligns with your expectations and meets the evolving needs of your users. Successful initial consultations with a fintech software development agency often lead to a more refined and effective final product, as they establish a framework for ongoing collaboration and improvement. Furthermore, it is essential to consider compliance and regulatory elements during the proposal evaluation process, as these factors greatly influence the timeline and overall success of the initiative.

Navigate Challenges in Selection and Engagement

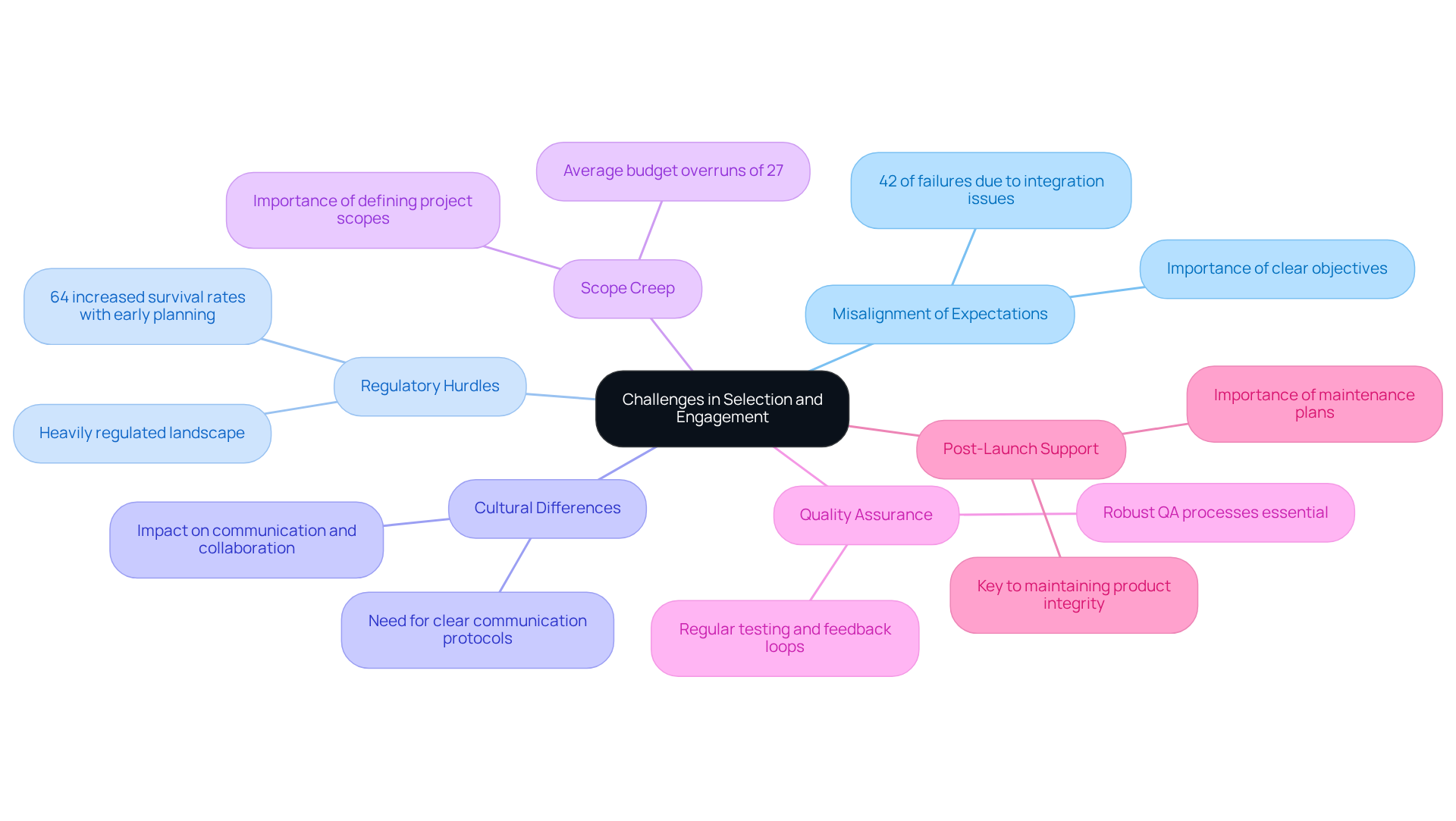

Selecting and engaging with a fintech software development agency presents several challenges that necessitate careful consideration:

-

Misalignment of Expectations: A clear understanding of objectives and deliverables is essential. Miscommunication can lead to dissatisfaction and project delays. Studies indicate that 42% of failures in technically viable products arise from integration issues, often exacerbated by misaligned expectations.

-

Regulatory Hurdles: The fintech landscape is heavily regulated, making it crucial to navigate these complexities to avoid compliance issues. Agencies, such as a fintech software development agency with a proven track record in regulatory navigation, can offer a competitive advantage, as early regulatory planning has been shown to increase survival rates by 64% for startups.

-

Cultural Differences: Collaborating with international agencies introduces cultural differences that can affect communication and collaboration. Establishing clear communication protocols is vital to bridge these gaps and foster a productive working relationship.

-

Scope Creep: Clearly defining project scopes and adhering to them is critical. Regularly reviewing progress and making adjustments only when necessary can help prevent extended timelines and budget overruns, which are common in large-scale projects that often exceed budgets by an average of 27%.

-

Quality Assurance: Implementing a robust quality assurance process is essential to ensure that the final product meets established standards. Regular testing and feedback loops are critical for identifying and addressing issues early in the development cycle, thereby enhancing overall project success.

-

Post-Launch Support: Discussing post-launch support and maintenance with the agency upfront is crucial. It is important to ensure they have a comprehensive plan for addressing any issues that may arise after deployment, as ongoing support is key to maintaining product integrity and user satisfaction.

Conclusion

Choosing the right fintech software development agency is crucial for navigating the complexities of the financial technology landscape. This decision relies on a thorough understanding of the agency’s expertise, regulatory knowledge, and its capacity to align with your project’s unique requirements. A strategic approach to selection and engagement can significantly improve the chances of a successful partnership and project outcome.

This article explored key factors for selecting a fintech agency, highlighting the importance of:

- Technical expertise

- Regulatory compliance

- A proven track record in fintech projects

The engagement process was outlined, emphasizing the necessity of:

- Clear communication

- Regular check-ins

- A commitment to quality assurance

Furthermore, potential challenges, such as misalignment of expectations and cultural differences, were discussed, underscoring the need for proactive management and collaboration.

In conclusion, as the fintech sector continues to expand, the importance of partnering with a capable software development agency cannot be overstated. By carefully considering the selection criteria and fostering a transparent engagement process, organizations can lay the groundwork for innovation and success in their fintech initiatives. Prioritizing these elements not only mitigates risks but also enhances the potential for creating impactful financial solutions that meet the evolving demands of the market.

Frequently Asked Questions

What is the role of fintech software development agencies?

Fintech software development agencies develop technology solutions specifically tailored for the financial services sector.

What was the global fintech market value in 2024, and what is it projected to reach by 2032?

The global fintech market was valued at approximately USD 340.10 billion in 2024 and is projected to reach USD 1,126.64 billion by 2032.

Why is there a growing demand for fintech software development?

The anticipated growth of the fintech market highlights the increasing demand for specialized software development that meets the unique needs of financial institutions.

What types of fintech software development agencies exist?

There are large firms providing comprehensive end-to-end solutions and smaller, niche players focusing on specific technologies or regulatory compliance.

What is essential for fintech software development agencies to ensure?

Adherence to financial regulations and security standards is essential to ensure applications meet legal requirements and safeguard sensitive user data.

What security measures are commonly incorporated in fintech applications?

Advanced financial technology applications often incorporate multi-layered biometric authentication and encryption to enhance security.

What critical areas of expertise should fintech software development agencies possess?

Key areas of expertise include blockchain technology, payment processing, and data analytics.

Why is it important for fintech applications to integrate with existing financial systems?

Successful initiatives should integrate seamlessly with existing financial systems to enhance operational efficiency and improve user experience.

How can one identify the appropriate fintech software development agency for a project?

Familiarizing yourself with the key elements of fintech software development will help you identify the agency that aligns with your project requirements for successful collaboration.