Crafting a Winning Software Project Proposal for Hedge Funds

Introduction

Crafting a software project proposal for hedge funds presents a complex challenge that demands a thorough understanding of the financial industry’s regulatory landscape. As investment firms encounter heightened scrutiny and an increasing need for advanced technological solutions, addressing compliance and risk management becomes essential. The critical question arises: what are the key components that not only satisfy these rigorous requirements but also resonate with decision-makers? This article explores best practices for developing compelling software project proposals specifically designed for hedge funds, providing developers with the insights necessary to successfully navigate this intricate environment.

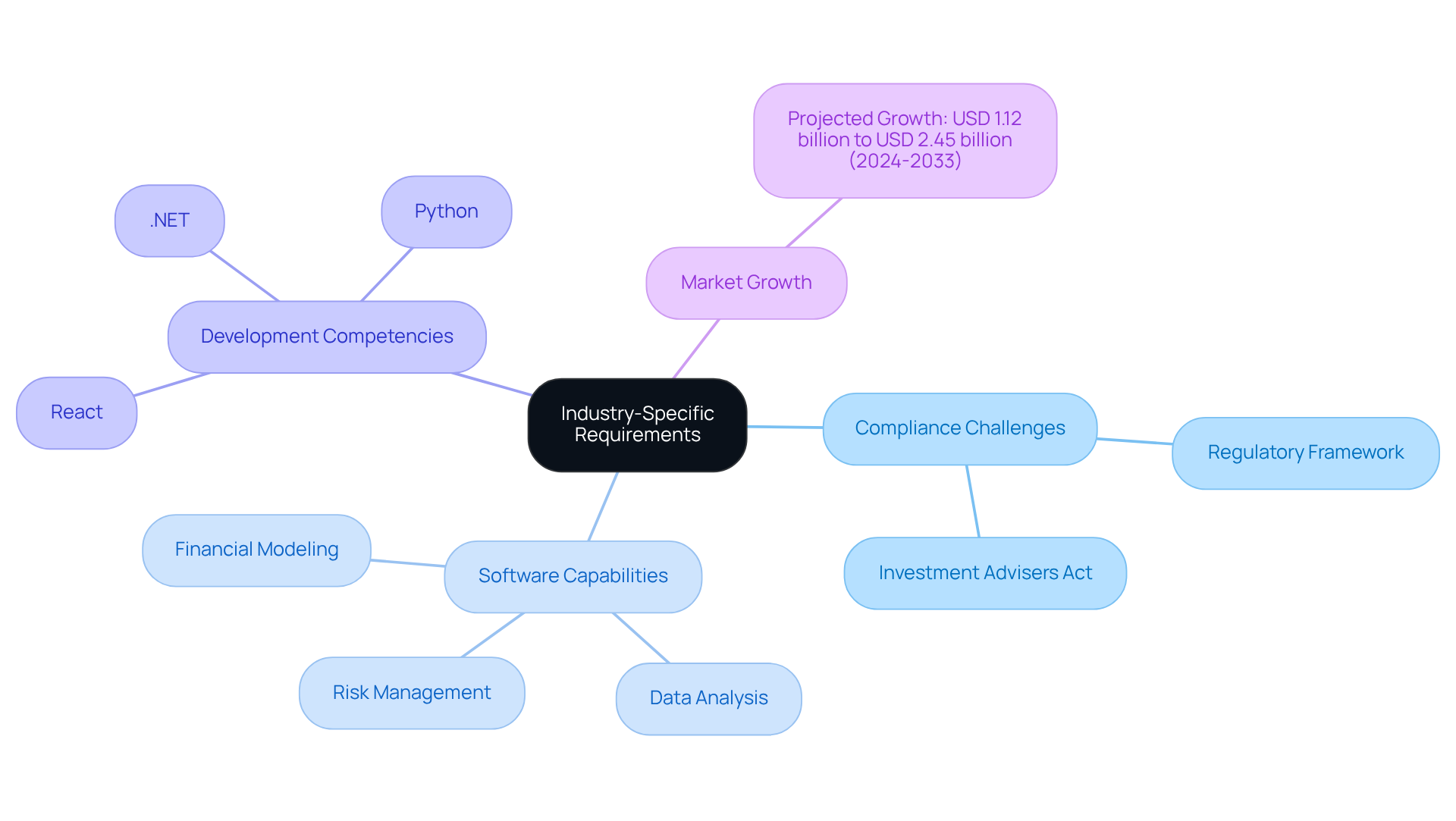

Understand Industry-Specific Requirements

Creating an engaging software project proposal for investment firms necessitates a deep understanding of the unique compliance challenges within the financial services sector. Hedge vehicles operate under a strict regulatory framework, adhering to laws such as the Investment Advisers Act and SEC guidelines. Therefore, the software project proposal must explicitly address these compliance requirements, demonstrating a comprehensive understanding of the regulatory landscape.

Moreover, hedge funds necessitate software solutions that can handle complex financial modeling, risk management, and data analysis. Highlighting your capability to deliver robust, scalable, and secure applications tailored to these specific needs will significantly enhance the appeal of your software project proposal.

Neutech excels in various software development competencies, including React, Python, and .NET, which are crucial for crafting effective solutions in this sector. Incorporating case studies or examples of successful software project proposals in similarly regulated environments not only strengthens your position but also demonstrates your ability to navigate the complexities of compliance effectively.

With the North American investment management software market projected to grow from USD 1.12 billion in 2024 to USD 2.45 billion by 2033, the demand for advanced software solutions that meet regulatory standards is more critical than ever. At Neutech, we prioritize collaboration; once integrated into your team, we schedule regular management calls to reinforce your roadmap and synchronize our ongoing performance.

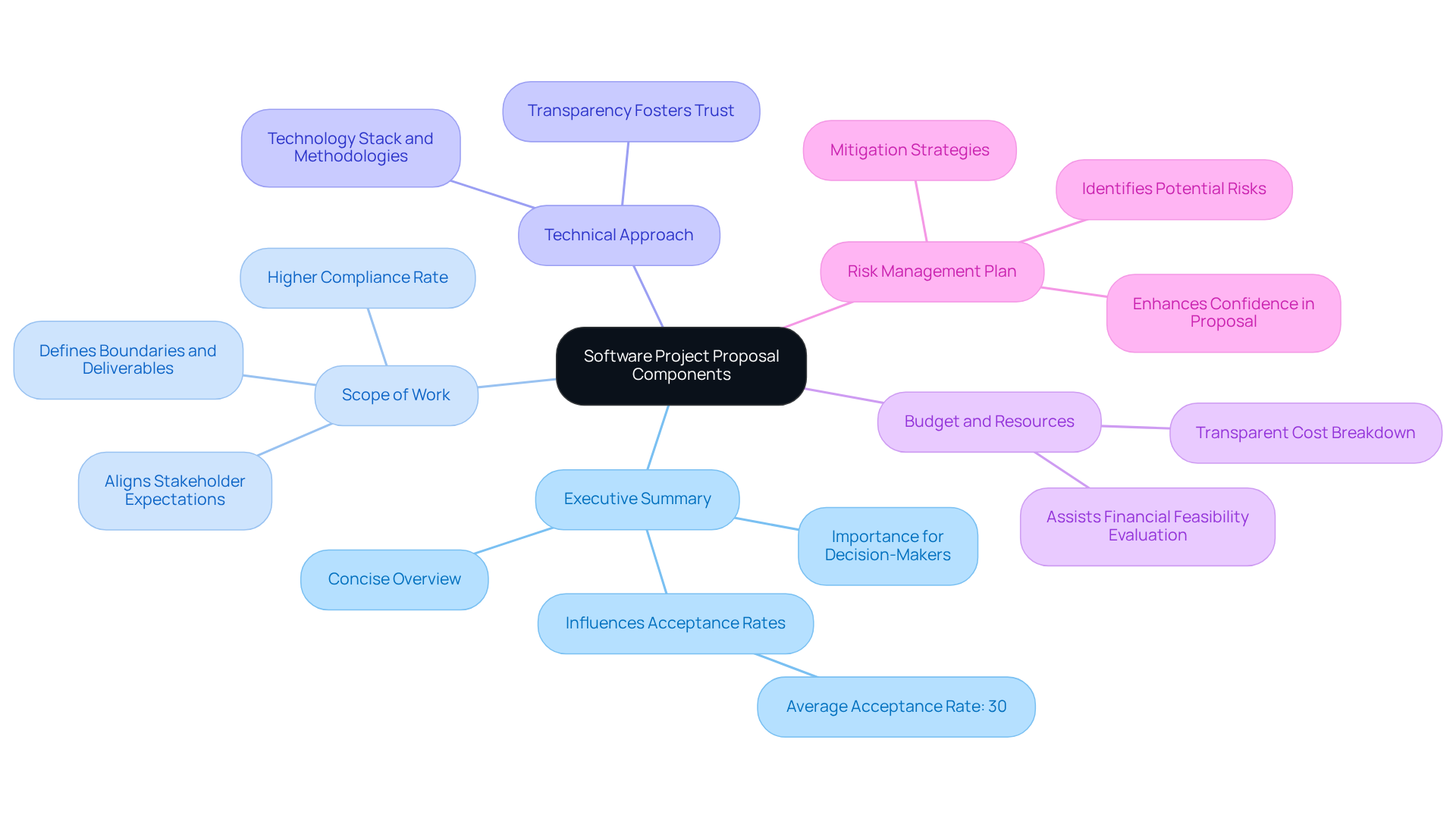

Include Key Proposal Components

A well-structured software project proposal for hedge funds must encompass several essential components:

-

Executive Summary: This section provides a concise overview of the initiative, outlining its objectives and the value it delivers to the hedge fund. A strong executive summary significantly influences acceptance rates, which in financial services average around 30%. Industry leaders emphasize that a compelling executive summary is crucial for capturing the attention of decision-makers.

-

Scope of Work: Clearly defining the boundaries, deliverables, and timelines of the endeavor is vital. Effective scope definition is foundational to success, ensuring all stakeholders have aligned expectations. Research indicates that submissions that clearly outline their scope enjoy a higher compliance rate, thereby reducing the risk of rejection.

-

Technical Approach: Detail the technology stack, methodologies, and processes employed in software development. This transparency fosters trust and showcases the technical viability of the initiative.

-

Budget and Resources: Provide a transparent breakdown of costs, including development, maintenance, and any additional resources required. This clarity assists investment managers in evaluating the financial feasibility of the plan.

-

Risk Management Plan: Outline potential risks associated with the project and strategies for mitigation. A proactive risk management strategy can enhance confidence in the plan, as investment groups often prioritize reducing exposure to uncertainties.

By integrating these elements, the software project proposal becomes comprehensive, addressing all essential factors that investment managers consider when evaluating software options. This structured approach not only improves the likelihood of acceptance but also aligns with best practices in the financial services sector.

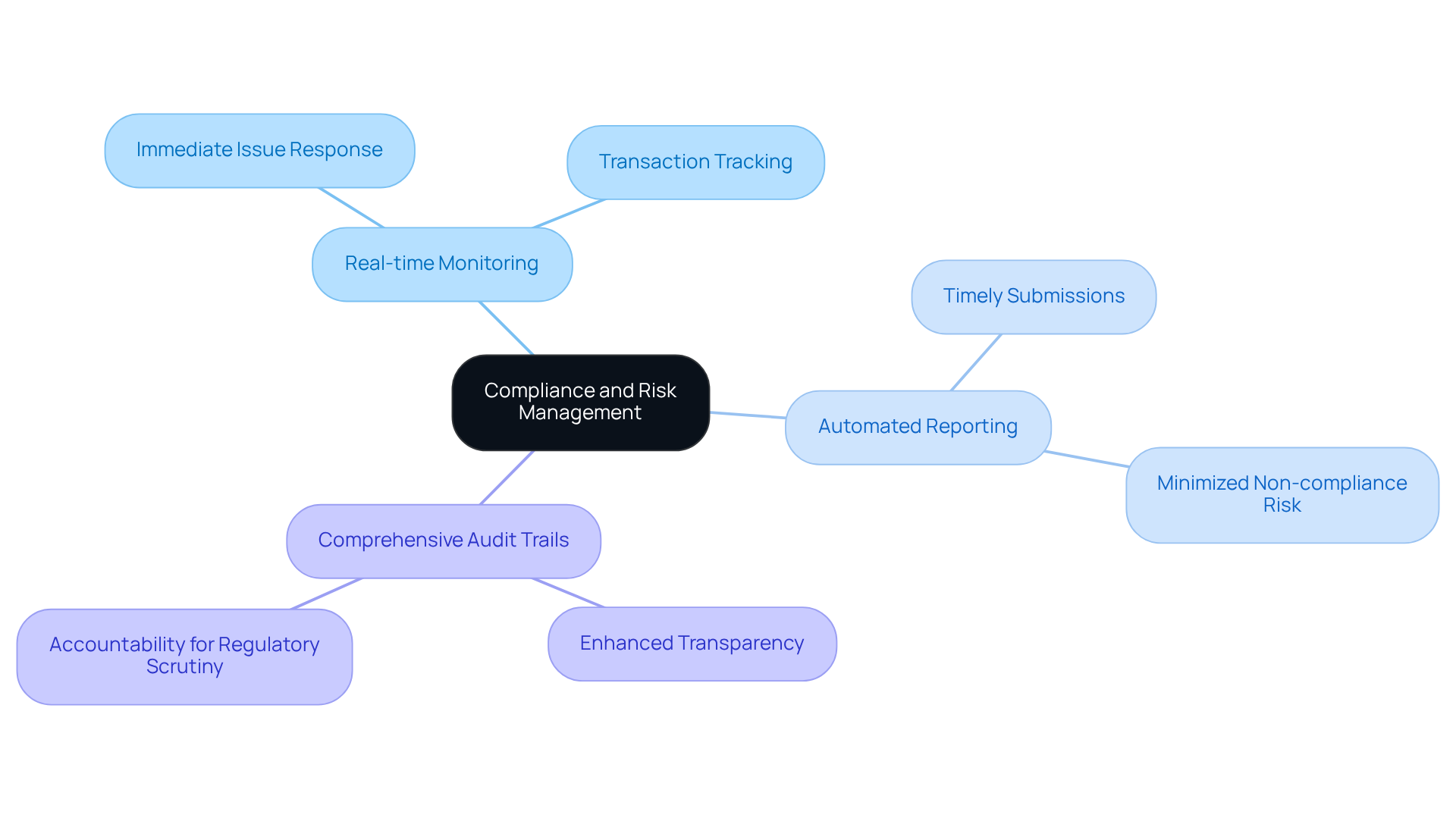

Emphasize Compliance and Risk Management

In the realm of investment vehicles, compliance and risk management extend beyond mere regulatory requirements; they are essential for maintaining the operational integrity of the organization. Proposals must explicitly outline how the proposed software will adhere to relevant regulations, particularly concerning data protection laws and financial reporting standards. Key risk management features should be emphasized, including:

- Real-time Monitoring: This feature enables hedge funds to track transactions and activities as they happen, allowing for immediate responses to potential issues.

- Automated Reporting: Streamlining the reporting process guarantees timely and accurate submissions to regulatory bodies, thereby minimizing the risk of non-compliance.

- Comprehensive Audit Trails: Keeping detailed logs of all transactions and changes enhances transparency and accountability, which are vital for regulatory scrutiny.

These features not only improve operational efficiency but also strengthen security against potential breaches. For example, nearly 70% of organizations in the Middle East are planning to migrate most operations to the cloud, highlighting the necessity for robust data protection measures in software solutions. By demonstrating a commitment to developing secure and compliant systems, you can instill confidence in hedge fund managers regarding the safety of their investments. Additionally, presenting case studies of past projects that successfully navigated compliance challenges will significantly bolster your credibility and showcase your expertise in this critical area.

As Rafael DeLeon states, “Investing in compliance isn’t optional – it’s the necessary cost of doing business.” Incorporating insights from regulatory experts can further enhance your plan and underscore the importance of adhering to evolving compliance standards.

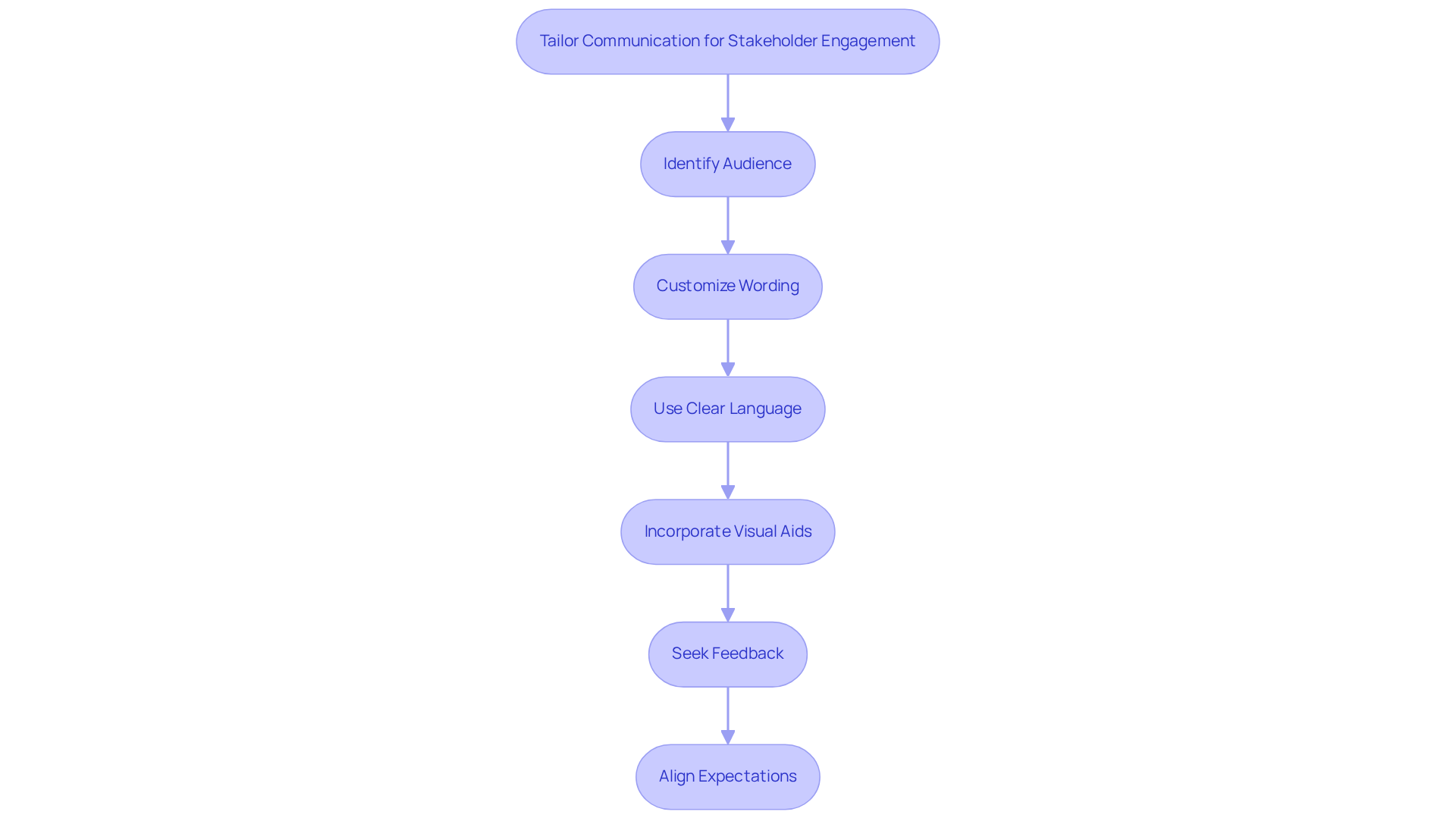

Tailor Communication for Stakeholder Engagement

Effective communication is crucial for engaging stakeholders in the investment sector. It is important to customize your document’s wording and presentation approach to resonate with specific audiences, such as investment managers, compliance officers, and stakeholders. Employing clear, jargon-free language helps to demystify complex concepts. Additionally, incorporating visual aids like charts and graphs can significantly enhance understanding by illustrating key points.

Actively seeking feedback from stakeholders throughout the development process is vital. This collaborative approach not only improves the quality of the software project proposal but also builds trust and fosters buy-in, greatly increasing the likelihood of approval. For example, successful hedge fund software project proposals typically involve regular check-ins with stakeholders to align expectations and address concerns, ensuring that the final proposal effectively meets their needs.

Conclusion

Crafting a successful software project proposal for hedge funds necessitates a nuanced understanding of the industry’s unique compliance and operational needs. Addressing these specifics – such as regulatory requirements and the necessity for robust risk management – can significantly enhance the proposal’s appeal to decision-makers in the investment sector.

Key components, including a compelling executive summary, a clearly defined scope of work, and a detailed technical approach, are essential for creating a persuasive proposal. By emphasizing compliance and integrating risk management strategies, the proposal not only demonstrates expertise but also instills confidence in potential clients. Furthermore, tailoring communication to effectively engage stakeholders fosters trust and improves the likelihood of proposal acceptance.

Ultimately, the significance of a well-crafted software project proposal cannot be overstated. As the hedge fund industry continues to evolve, staying ahead of regulatory requirements and delivering innovative, compliant solutions will be crucial for success. Adopting best practices in proposal development and prioritizing stakeholder engagement will enhance the quality of submissions and position firms to thrive in a competitive landscape.

Frequently Asked Questions

What are the key compliance challenges in creating software project proposals for investment firms?

The key compliance challenges include adhering to strict regulatory frameworks such as the Investment Advisers Act and SEC guidelines, which must be explicitly addressed in the software project proposal.

What specific software solutions do hedge funds require?

Hedge funds require software solutions that can handle complex financial modeling, risk management, and data analysis.

How can a software project proposal enhance its appeal to hedge funds?

By demonstrating a comprehensive understanding of compliance requirements and highlighting the capability to deliver robust, scalable, and secure applications tailored to the specific needs of hedge funds.

What software development competencies does Neutech excel in?

Neutech excels in software development competencies including React, Python, and .NET, which are crucial for crafting effective solutions in the financial services sector.

Why is it beneficial to include case studies in a software project proposal?

Including case studies or examples of successful software project proposals in similarly regulated environments strengthens the proposal and demonstrates the ability to navigate compliance complexities effectively.

What is the projected growth of the North American investment management software market?

The North American investment management software market is projected to grow from USD 1.12 billion in 2024 to USD 2.45 billion by 2033.

How does Neutech prioritize collaboration with clients?

Neutech prioritizes collaboration by integrating into the client’s team and scheduling regular management calls to reinforce the roadmap and synchronize ongoing performance.