Introduction

As the financial landscape increasingly shifts towards digital platforms, hedge funds encounter a pressing need to safeguard sensitive data against rising cyber threats. Mobile application security testing services stand out as a crucial line of defense, providing a variety of methodologies designed to identify and mitigate vulnerabilities that could undermine client trust and regulatory compliance. Yet, with a multitude of providers asserting they offer the best solutions, how can hedge funds determine which services genuinely align with their specific requirements? This article presents a comparative analysis of leading mobile application security testing services, equipping investment firms with the insights necessary to make informed decisions in this critical aspect of their operations.

Understanding Mobile Application Security Testing

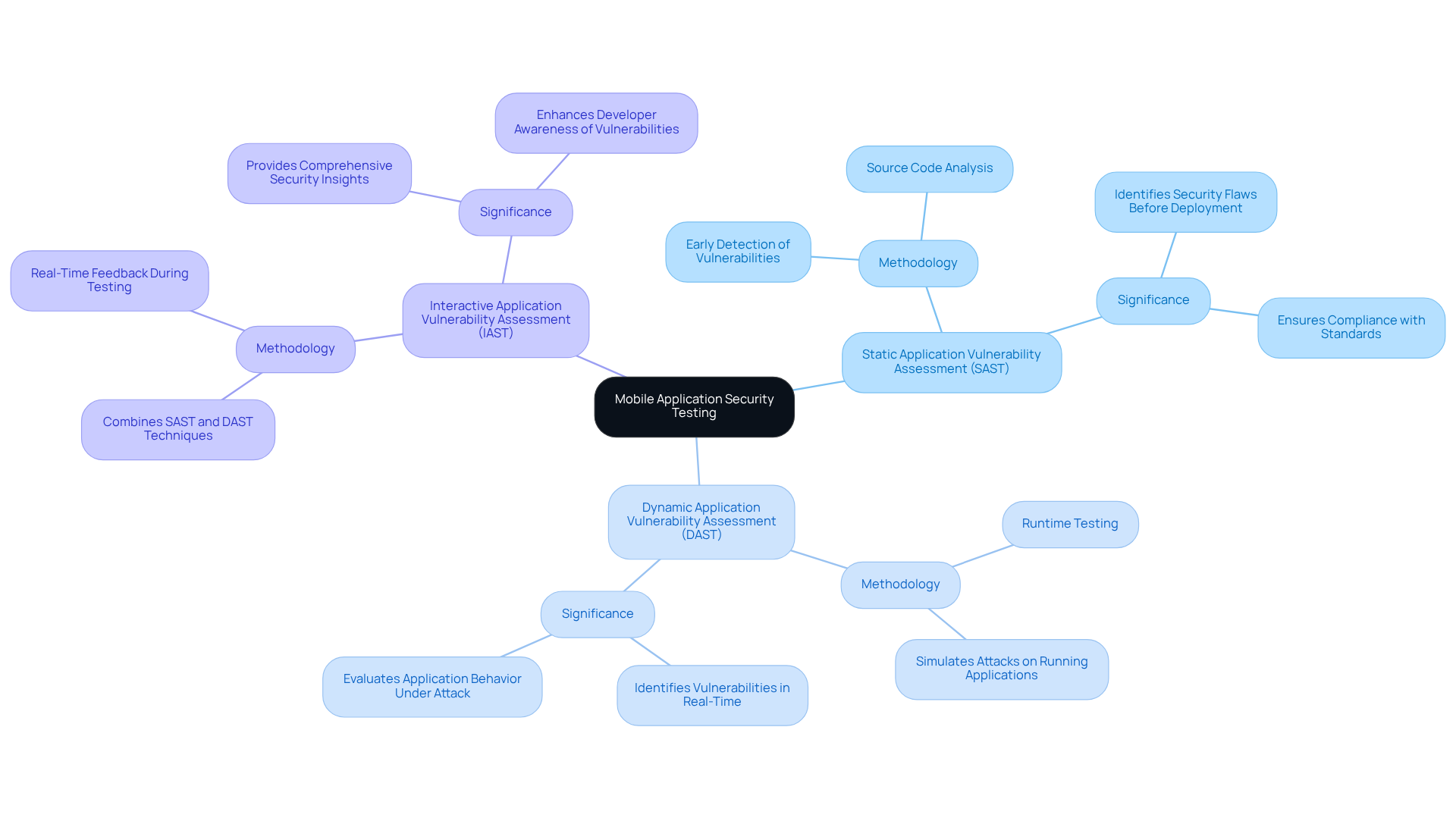

Mobile application security testing services are essential for identifying vulnerabilities in mobile applications that could be exploited by malicious actors. This comprehensive evaluation employs various methodologies, including:

- Static application vulnerability assessment (SAST)

- Dynamic application vulnerability assessment (DAST)

- Interactive application vulnerability assessment (IAST)

For investment groups, where the stakes are particularly high due to the sensitive nature of financial data, understanding these evaluation methods is critical.

Effective vulnerability assessment not only uncovers potential weaknesses but also ensures compliance with regulatory standards, thereby safeguarding the integrity of financial transactions and maintaining client trust. By 2026, a significant number of investment groups are expected to prioritize mobile application security testing services, recognizing their role in mitigating risks associated with vulnerabilities.

Real-world instances underscore the importance of these evaluations; for example, vulnerabilities discovered in mobile applications have led to substantial financial losses and regulatory fines. As the threat landscape evolves, investment firms must adopt mobile application security testing services as robust strategies to protect their assets and uphold their reputations.

Key Features of Leading Mobile Application Security Testing Providers

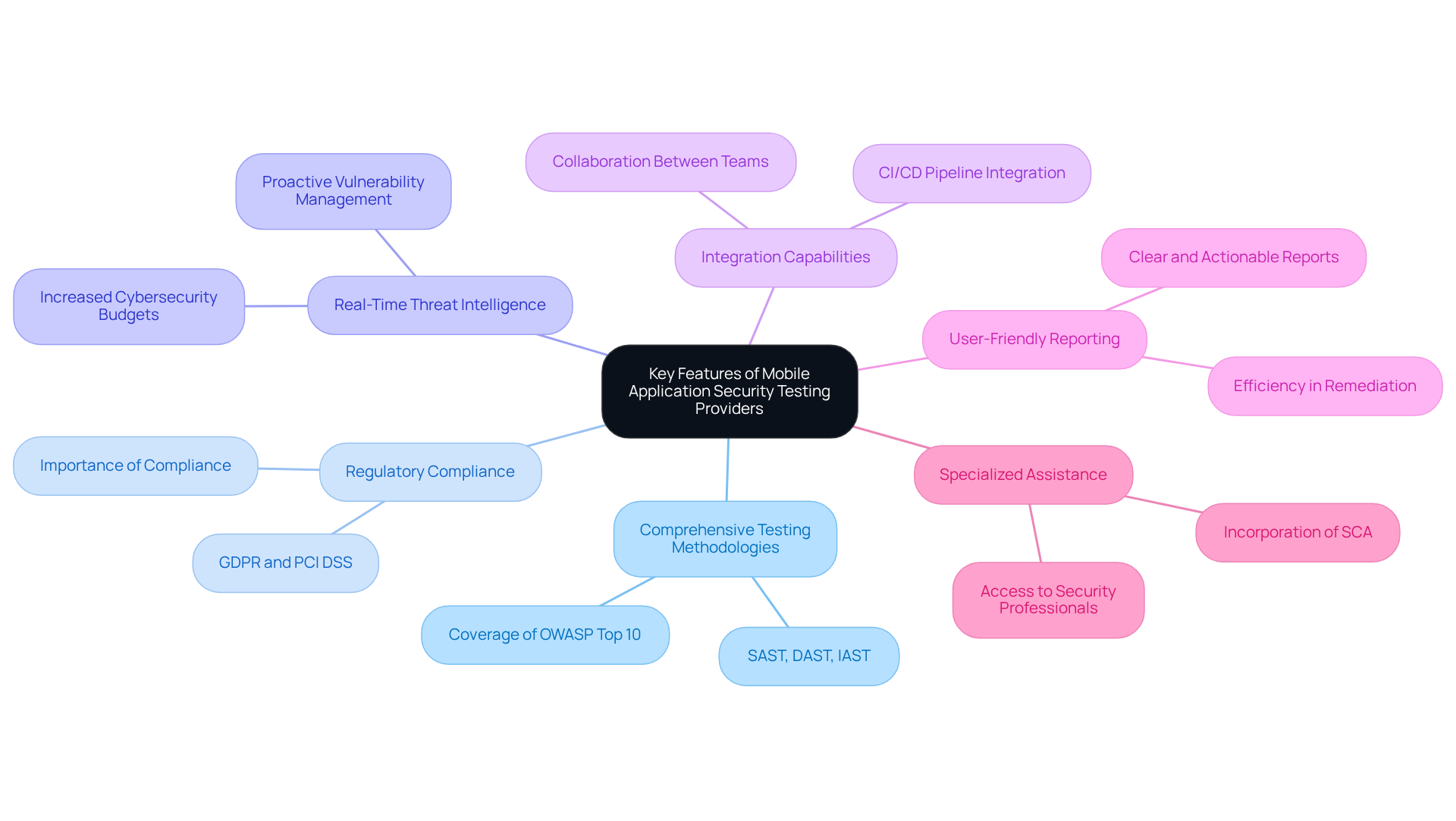

When evaluating mobile application security testing providers, hedge funds should prioritize several essential features:

-

Comprehensive Testing Methodologies: Leading providers employ a combination of Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), and Interactive Application Security Testing (IAST) to identify a wide range of vulnerabilities. This multi-faceted approach ensures thorough coverage of potential threats, including critical vulnerabilities highlighted in the OWASP Top 10, such as misconfigurations and cryptographic failures.

-

Regulatory Compliance: Ensuring compliance with stringent financial regulations, such as GDPR and PCI DSS, is paramount. Providers must demonstrate their ability to assist investment companies in managing these intricate requirements, as increasing regulatory demands underscore the necessity for robust protective measures. A significant portion of investment pools emphasizes regulatory adherence in their testing efforts.

-

Real-Time Threat Intelligence: Providers that deliver real-time updates on emerging threats empower hedge funds to proactively address vulnerabilities. This capability is increasingly vital, given that 78% of firms have reported an increase in their cybersecurity budgets, reflecting a heightened focus on threat detection and incident response.

-

Integration Capabilities: Seamless integration with existing development and CI/CD pipelines is crucial for maintaining workflow efficiency. Providers should facilitate smooth collaboration between development and safety teams, minimizing friction and enhancing overall productivity. Notably, 90% of teams employ three or more tools to identify and prioritize application vulnerabilities, highlighting the complexity of managing protection across various platforms.

-

User-Friendly Reporting: Clear and actionable reporting is essential for enabling teams to quickly understand vulnerabilities and prioritize remediation efforts. Efficient reporting tools can significantly decrease the time required to address safety concerns, as 81% of organizations indicate that conventional reviews often exceed one business day.

-

Specialized Assistance: Access to safety professionals for consultation and guidance can greatly enhance the efficiency of the evaluation process. This support is particularly important in high-risk sectors like finance, where specialized knowledge can make a substantial difference in mitigating vulnerabilities. Additionally, incorporating Software Composition Analysis (SCA) alongside SAST and DAST is recommended for identifying coding weaknesses early in the development process.

By concentrating on these essential features, hedge funds can ensure they select a provider of mobile application security testing services that not only meets their safety requirements but also adheres to regulatory compliance standards.

Comparative Analysis of Top Mobile Application Security Testing Services

This comparative analysis examines three leading mobile application security testing services: Appknox, Veracode, and NowSecure.

Appknox is recognized for its AI-driven evaluation solutions, offering thorough vulnerability assessments that integrate seamlessly with CI/CD pipelines. Its advantages include real-time threat intelligence and user-friendly reporting. However, some users have noted a steep learning curve associated with its use.

Veracode, a well-established player in the market, provides a robust suite of assessment tools, including Static Application Security Testing (SAST) and Dynamic Application Security Testing (DAST). Its strengths are particularly evident in regulatory compliance and extensive reporting capabilities. Nonetheless, it may be perceived as more expensive compared to other options.

NowSecure focuses specifically on mobile application security testing services, providing both automated evaluations and manual assessments. Its strengths lie in addressing mobile-specific vulnerabilities and providing excellent customer support. However, it may lack some advanced features that are available in competing services.

Each of these suppliers presents distinct advantages that investment groups must consider in relation to their specific asset requirements and budget.

Considerations for Hedge Funds in Choosing Security Testing Services

When selecting mobile application security testing services, hedge funds should prioritize several key factors:

-

Regulatory Compliance: Ensuring that the provider can meet industry-specific regulations and standards is essential, particularly in the highly regulated financial sector. The evolving regulatory landscape, including the SEC’s 2026 priorities, underscores the importance of compliance in maintaining investor trust and avoiding penalties.

-

Scalability: The ability to modify services according to project requirements is crucial for investment firms, which frequently encounter varying workloads. Scalable solutions enable companies to effectively manage resources, ensuring that protective measures can grow or shrink as needed without compromising quality. As industry specialists highlight, “Scalability in safeguarding is not merely an advantage but an essential requirement for hedge funds seeking to uphold strong protections against advancing cyber threats.”

-

Cost-Effectiveness: Evaluating the pricing structure is vital to align with budget constraints while ensuring comprehensive coverage. The worldwide mobile application testing (MAST) market is projected to expand from approximately USD 0.9 billion in 2023 to USD 3.2 billion by 2028, indicating a compound annual growth rate (CAGR) of 28.3%. This growth illustrates the increasing demand for affordable protection solutions.

-

Reputation and Experience: Providers with a proven track record in the financial services sector are preferable, as their experience can significantly enhance the effectiveness of protective measures.

-

Customization: Tailoring assessment services to specific applications and business requirements improves safety outcomes, enabling investment groups to address distinct vulnerabilities efficiently.

-

Post-Assessment Support: It is vital to consider the extent of assistance provided after evaluation, including remediation help and continuous monitoring to ensure ongoing safety.

By focusing on these factors, hedge funds can navigate the complexities of mobile application security testing services more effectively and safeguard their sensitive data.

Conclusion

Investment firms must acknowledge the critical role of mobile application security testing services in protecting sensitive financial data. As the threat landscape evolves, these services offer essential methodologies for identifying vulnerabilities, ensuring compliance, and safeguarding client trust. By prioritizing robust security measures, hedge funds can effectively mitigate risks associated with potential breaches and uphold their reputations in a competitive market.

The article underscores the necessity of comprehensive testing methodologies, regulatory compliance, and real-time threat intelligence. A comparative analysis of leading providers such as Appknox, Veracode, and NowSecure highlights their unique strengths and weaknesses, emphasizing the importance for hedge funds to choose a provider that aligns with their specific needs and budget constraints. Furthermore, considerations such as scalability, cost-effectiveness, and post-assessment support are identified as vital factors in the decision-making process.

Ultimately, the selection of a mobile application security testing service can significantly influence the overall cybersecurity posture of investment firms. By adopting a proactive approach and investing in the right testing solutions, hedge funds can not only protect their assets but also cultivate a culture of security that reassures clients and stakeholders alike. Taking decisive action now to evaluate and implement these services will ensure a resilient future in the face of increasingly sophisticated cyber threats.

Frequently Asked Questions

What is mobile application security testing?

Mobile application security testing is a comprehensive evaluation aimed at identifying vulnerabilities in mobile applications that could be exploited by malicious actors.

What methodologies are used in mobile application security testing?

The methodologies employed include Static Application Vulnerability Assessment (SAST), Dynamic Application Vulnerability Assessment (DAST), and Interactive Application Vulnerability Assessment (IAST).

Why is mobile application security testing important for investment groups?

It is crucial for investment groups due to the sensitive nature of financial data, helping to uncover potential weaknesses, ensure compliance with regulatory standards, and maintain client trust.

What are the expected trends in mobile application security testing by 2026?

By 2026, a significant number of investment groups are expected to prioritize mobile application security testing services to mitigate risks associated with vulnerabilities.

What are the consequences of not conducting mobile application security testing?

Failing to conduct these evaluations can lead to substantial financial losses and regulatory fines, as vulnerabilities in mobile applications can be exploited.

How do mobile application security testing services help investment firms?

These services provide robust strategies to protect assets, uphold reputations, and adapt to the evolving threat landscape.