Cloud Computing Elasticity vs Scalability: Key Insights for Hedge Funds

Introduction

Cloud computing has fundamentally transformed how hedge funds manage their resources. The distinction between elasticity and scalability is crucial for determining operational success. A clear understanding of these concepts not only enhances cost efficiency but also enables firms to respond swiftly to market fluctuations. This adaptability is essential for maintaining competitiveness in a constantly evolving financial landscape.

As hedge funds increasingly depend on cloud capabilities, a significant question emerges: how can they effectively balance the advantages of immediate resource adjustments with the potential challenges of unpredictability and complexity?

Define Elasticity and Scalability in Cloud Computing

In internet-based computing, elasticity refers to a system’s ability to autonomously adjust its resources in response to fluctuating demand. This means that during peak periods, additional resources can be provisioned, while during times of low demand, resources can be scaled back. Industry insights indicate that global public spending on online services is expected to reach $723.4 billion by 2025, underscoring the growing dependence on digital solutions for managing demand fluctuations.

Conversely, scalability denotes a system’s capability to accommodate increased loads by adding resources, which can be achieved through:

- Scaling up (enhancing the power of existing machines)

- Scaling out (adding more machines)

While the concept of cloud computing elasticity vs scalability emphasizes real-time adjustments, scalability is primarily concerned with long-term growth strategies. As Cody Slingerland, a FinOps certified practitioner, observes, ‘Cloud computing is a modern data protection strategy,’ highlighting the significance of these concepts in ensuring secure and efficient operations. Hedge investments, in particular, can leverage scalable technology to effectively manage increased workloads, thereby positioning themselves to meet future demands.

Explore Benefits of Elasticity in Cloud Computing

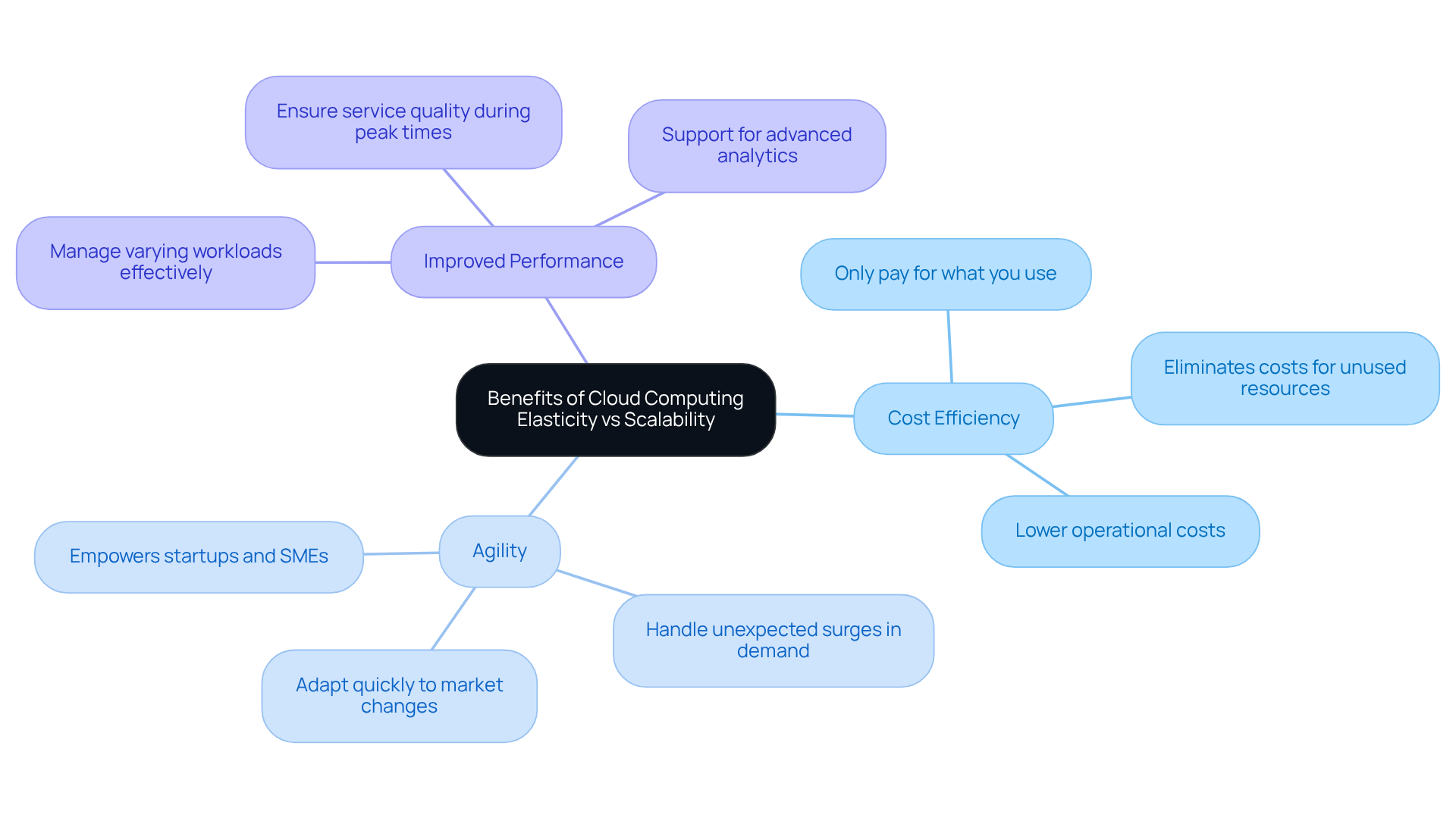

The advantages for investment firms are significantly enhanced by understanding cloud computing elasticity vs scalability. Primarily, it fosters cost efficiency, as firms incur expenses only for the assets they actively utilize, thereby eliminating costs associated with unused resources. Furthermore, the concept of cloud computing elasticity vs scalability enhances agility, enabling investment groups to rapidly adapt to market fluctuations and unexpected surges in demand. Such adaptability is essential for sustaining a competitive edge in the dynamic financial landscape. Additionally, the concept of cloud computing elasticity vs scalability contributes to improved performance, ensuring that applications can manage varying workloads without compromising service quality.

Examine Benefits of Scalability in Cloud Computing

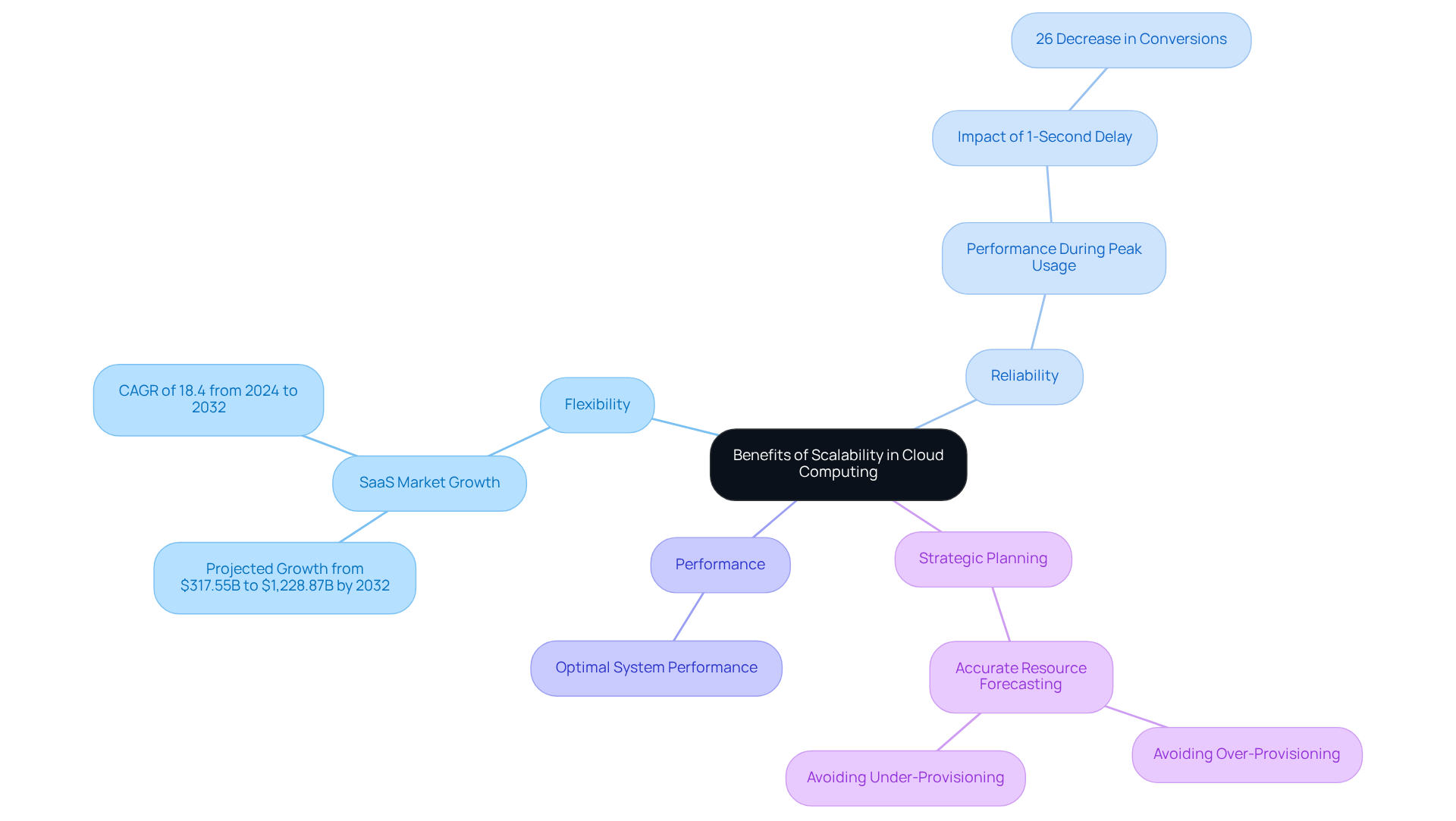

Investment firms can benefit from cloud computing elasticity vs scalability, as it enables them to manage expansion through the flexible incorporation of resources. This flexibility allows investment groups to effectively handle increasing transaction volumes and data processing demands without sacrificing performance. For example, the global SaaS market is projected to grow from $317.55 billion in 2024 to $1,228.87 billion by 2032, reflecting a compound annual growth rate (CAGR) of 18.4% during this period. Hedge groups that utilize cloud computing elasticity vs scalability can enhance their positioning to capitalize on this growth.

Furthermore, scalability improves reliability, ensuring that systems maintain optimal performance even during peak usage periods. This reliability is essential in the fast-paced financial environment, where transaction spikes can occur unexpectedly. Notably, a one-second delay in page load time during mobile session traffic can lead to a 26% decrease in conversions. Additionally, scalability supports strategic planning, enabling hedge funds to accurately forecast their resource needs based on anticipated growth. This foresight helps avoid the common pitfalls of over-provisioning or under-provisioning resources, ultimately leading to more efficient operations and better cost management. As hedge funds increasingly adopt cloud-based solutions, the distinction between cloud computing elasticity vs scalability becomes a crucial differentiator in sustaining a competitive advantage.

Assess Drawbacks of Elasticity in Cloud Computing

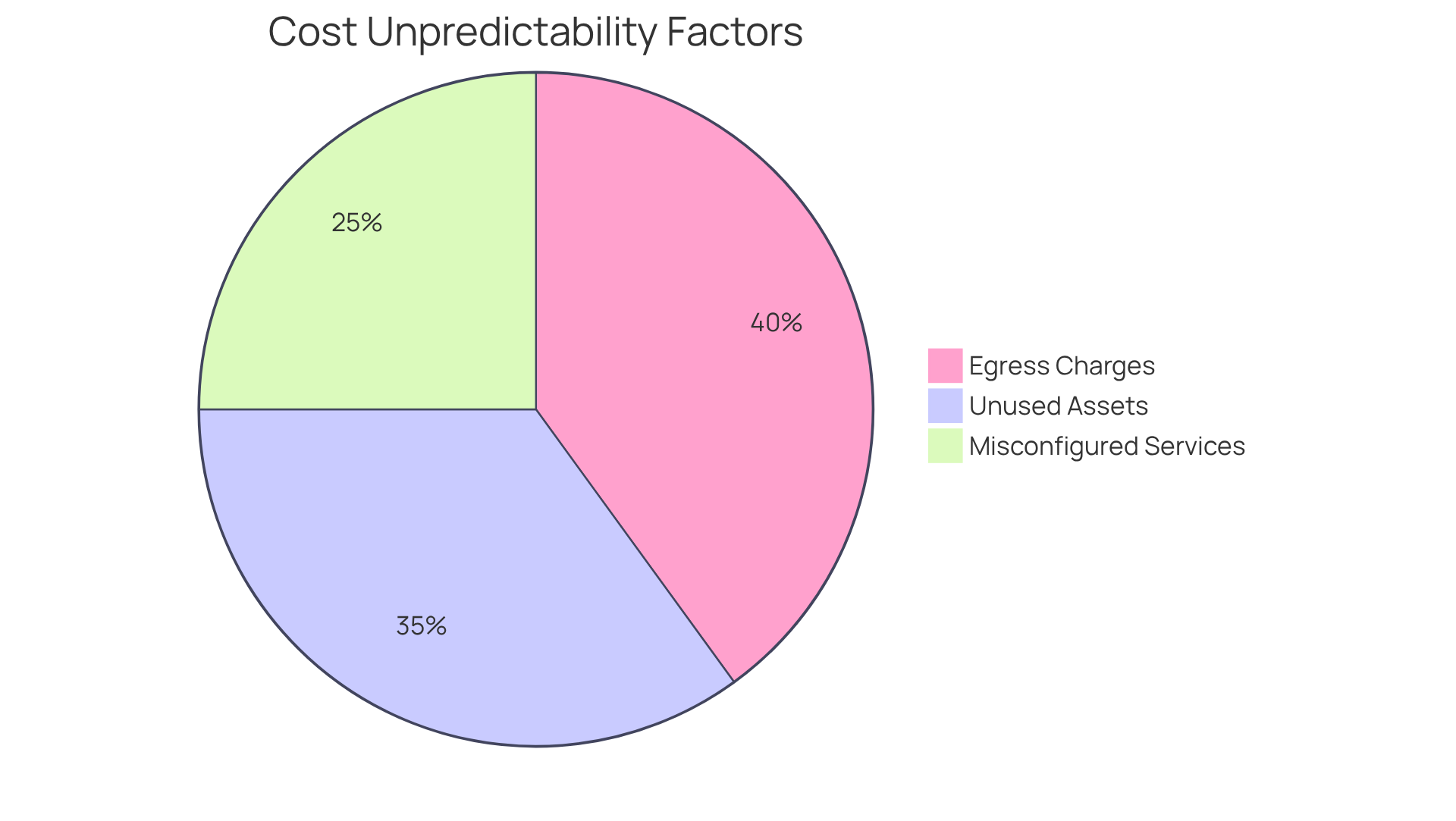

While cloud computing elasticity vs scalability offers significant advantages, it also presents notable drawbacks. A primary concern is cost unpredictability; although firms pay only for what they use, sudden spikes in demand can lead to unexpectedly high expenses. As Shashikant Kalsha, CEO of Qodequay Technologies, observes, “The unpredictability of expenses in the digital storage environment means your bill varies in ways you cannot quickly clarify, predict, or manage.” Organizations frequently encounter concealed spending risks from factors such as:

- egress charges

- unused assets

- misconfigured services

These factors can swiftly escalate costs. In fact, a staggering 94% of enterprises reported facing challenges related to cloud cost management in 2022.

Furthermore, the complexity of management increases as companies must establish robust monitoring and governance systems to ensure efficient allocation of assets. This complexity is particularly pronounced in hedge funds, where the dynamic nature of financial markets necessitates agile responses to fluctuating demands. Without effective oversight, companies may struggle to optimize their online resources, leading to inefficiencies and potential service disruptions. Kalsha emphasizes that “you move to the cloud for speed, flexibility, and innovation. Then one day, you open the billing dashboard and feel like you’re looking at a thriller plot twist.”

Additionally, reliance on elasticity can result in performance issues if configurations are not meticulously managed. Rapid scaling, while beneficial for meeting immediate needs, can sometimes lead to service interruptions, impacting overall operational efficiency. Therefore, while the advantages of cloud computing elasticity vs scalability are clear, companies must navigate these challenges carefully to harness its full potential.

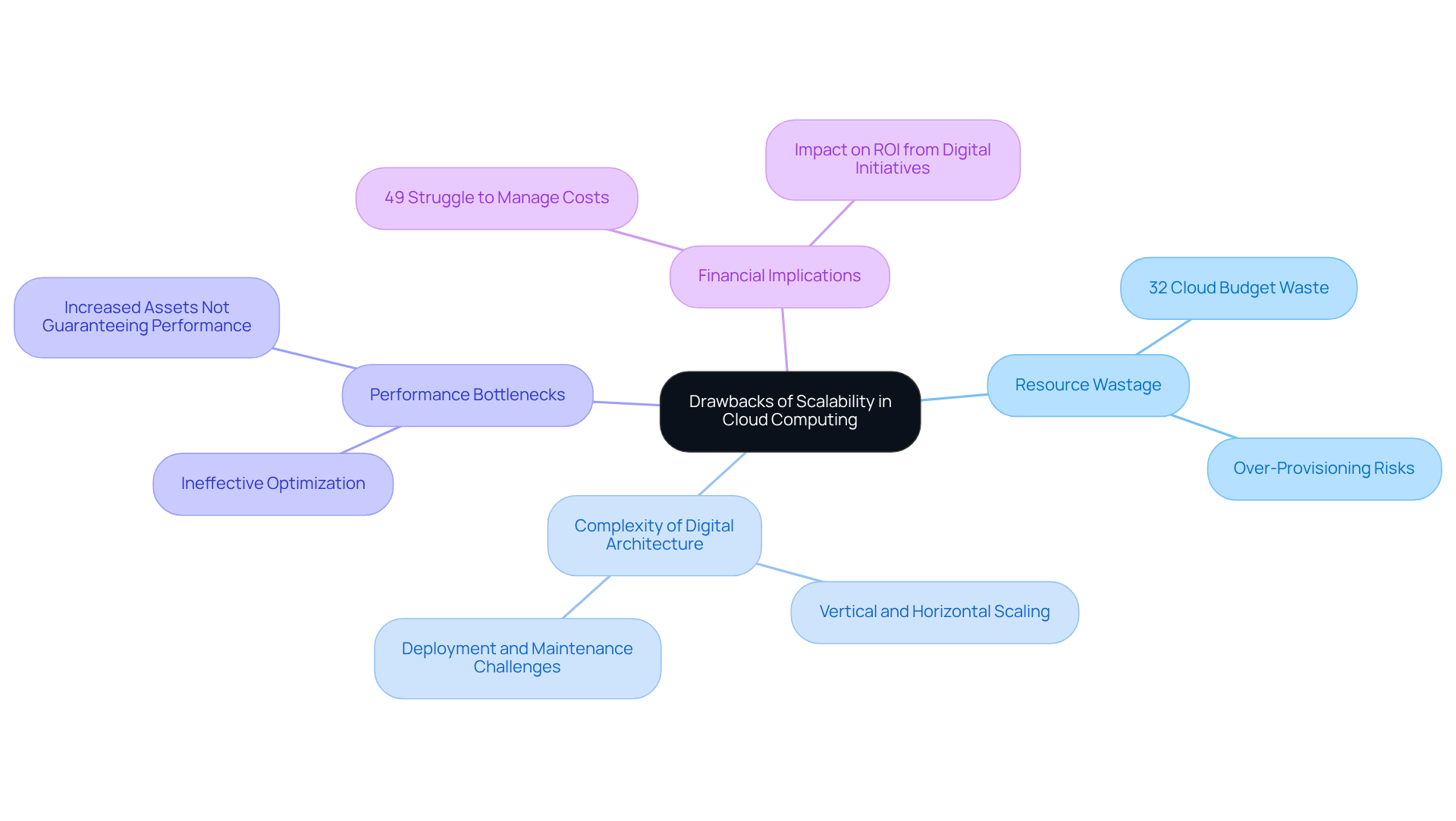

Evaluate Drawbacks of Scalability in Cloud Computing

Investment firms must navigate various challenges related to cloud computing elasticity vs scalability, despite the benefits it offers. A primary concern is the potential for resource wastage; research indicates that understanding cloud computing elasticity vs scalability is crucial, as cloud waste averaged 32% of companies’ cloud budgets in 2022, underscoring the financial implications of over-provisioning. If a hedge fund does not understand the implications of cloud computing elasticity vs scalability while scaling up, it risks incurring costs associated with excess capacity.

Furthermore, the complexity of digital architecture can increase, as systems must accommodate both vertical and horizontal scaling. This added complexity complicates deployment and maintenance, making it essential for firms to implement robust strategies. Additionally, scalability can lead to performance bottlenecks if not managed effectively. Simply increasing assets does not guarantee improved performance; without adequate optimization, the anticipated benefits of scalability may not materialize, resulting in inefficiencies that hinder operational effectiveness.

As the percentage of cloud-based application software expenditures is projected to rise from 57.7% in 2022 to 65.9% in 2025, hedge funds must remain vigilant in managing their cloud resources. A report indicates that 49% of internet-based businesses struggle to manage costs, highlighting the financial implications of scalability issues. Moreover, 42% of CIOs and CTOs identified excessive allocation and inadequate cloud computing elasticity vs scalability as significant obstacles in 2025, emphasizing the ongoing challenges hedge funds face in efficiently managing their digital assets. Addressing these challenges is crucial, as more than half of businesses are experiencing difficulties in realizing a return on investment from their digital initiatives.

Summarize Key Differences Between Elasticity and Scalability

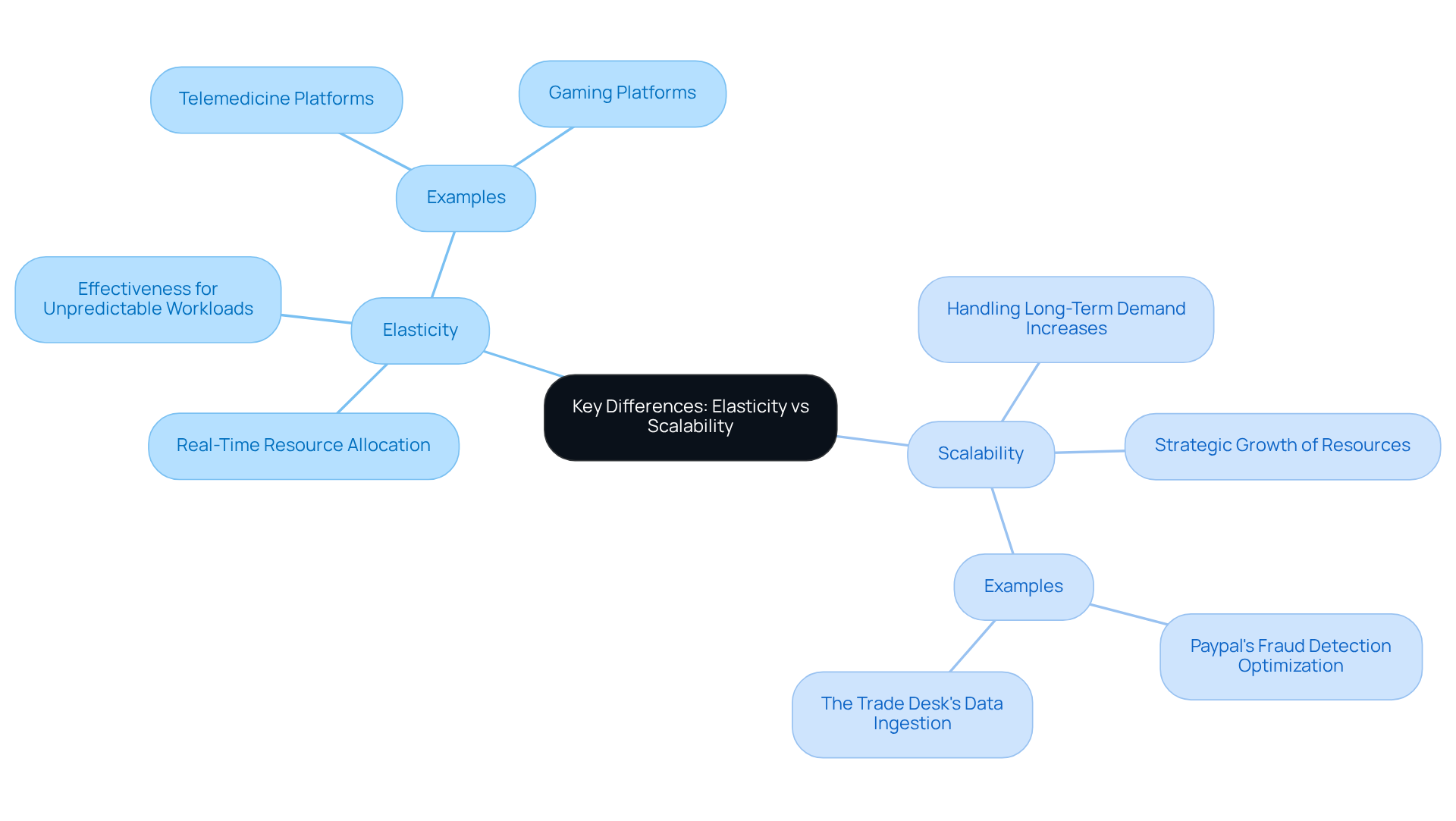

In summary, the primary distinctions in cloud computing elasticity vs scalability are as follows:

- Elasticity focuses on the real-time, dynamic allocation of resources to address immediate demand fluctuations, making it particularly effective for managing unpredictable workloads.

- Conversely, scalability pertains to the strategic growth of resources to accommodate long-term increases in demand, ensuring that systems can effectively handle larger loads over time.

- While both concepts are crucial for hedge funds, the decision between them hinges on the specific operational requirements and market conditions they encounter.

Conclusion

Understanding the distinctions between cloud computing elasticity and scalability is crucial for hedge funds seeking to optimize their operations. Elasticity offers the flexibility to dynamically adjust resources in response to immediate demand fluctuations, whereas scalability emphasizes the strategic enhancement of capacity to support long-term growth. Both concepts are essential for navigating the complexities of the financial landscape, enabling firms to remain competitive and responsive to market changes.

The article outlines the specific benefits and challenges associated with each approach. Elasticity fosters cost efficiency and performance adaptability, allowing hedge funds to manage resources more effectively during unpredictable market conditions. Conversely, scalability facilitates strategic planning and reliability, empowering firms to handle increasing workloads without compromising service quality. However, both concepts present drawbacks, such as potential cost unpredictability with elasticity and resource wastage with scalability, highlighting the necessity for meticulous management.

As the financial sector increasingly adopts cloud-based solutions, distinguishing between elasticity and scalability becomes imperative. Hedge funds must prioritize the development of robust strategies that leverage these concepts to enhance operational efficiency and drive growth. By doing so, they can optimize their cloud resources and position themselves to thrive in an ever-evolving digital landscape.

Frequently Asked Questions

What is elasticity in cloud computing?

Elasticity in cloud computing refers to a system’s ability to autonomously adjust its resources in response to fluctuating demand, provisioning additional resources during peak periods and scaling back during low demand.

What does scalability mean in the context of cloud computing?

Scalability denotes a system’s capability to accommodate increased loads by adding resources, which can be achieved through scaling up (enhancing the power of existing machines) or scaling out (adding more machines).

How do elasticity and scalability differ?

Elasticity emphasizes real-time adjustments to resources based on immediate demand fluctuations, while scalability focuses on long-term growth strategies to handle increased workloads over time.

What are the benefits of elasticity in cloud computing for investment firms?

The benefits include cost efficiency by incurring expenses only for actively utilized assets, enhanced agility to adapt to market fluctuations, and improved performance to manage varying workloads without compromising service quality.

Why is understanding elasticity and scalability important for investment firms?

Understanding these concepts is crucial for investment firms as they enable rapid adaptation to market changes and unexpected surges in demand, helping to sustain a competitive edge in the dynamic financial landscape.