Introduction

In the dynamic realm of hedge fund management, effectively harnessing data is crucial; it can distinguish between thriving and merely surviving. By implementing essential best practices in business intelligence (BI), hedge fund managers can gain significant advantages, including enhanced decision-making, improved compliance, and better performance metrics. However, as the landscape evolves and regulatory pressures increase, how can these managers ensure their strategies remain relevant and impactful? This article explores seven critical BI best practices that empower hedge fund managers to navigate the complexities of data governance, optimization, and stakeholder engagement, ultimately driving superior investment outcomes.

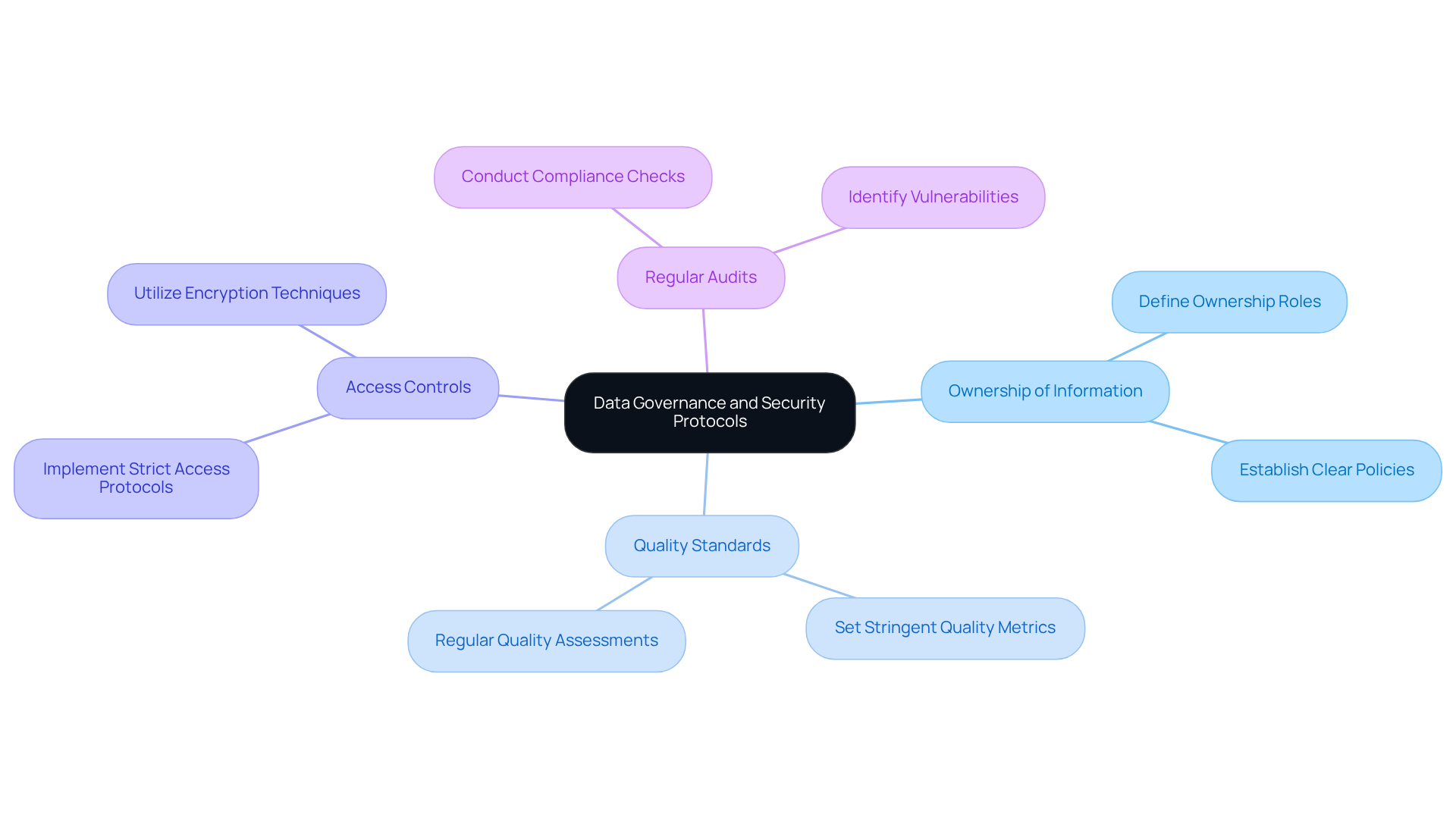

Implement Robust Data Governance and Security Protocols

To protect sensitive information and ensure compliance, hedge fund managers must establish a comprehensive governance framework. This framework should:

- Clearly define ownership of information

- Establish stringent quality standards

- Ensure strict access controls are in place

Regular audits and compliance checks are essential to identify vulnerabilities and ensure adherence to regulations such as SEC Form PF and AML requirements, particularly as regulatory scrutiny intensifies in 2026.

Furthermore, utilizing encryption and secure information storage solutions is crucial to safeguard against unauthorized access and breaches. For instance, a hedge investment that implemented a robust information governance strategy experienced a 30% decrease in compliance-related incidents over the course of a year. Given that the SEC imposed more than US$5 billion in fines in 2024, the financial risks associated with non-compliance underscore the necessity of prioritizing information security protocols.

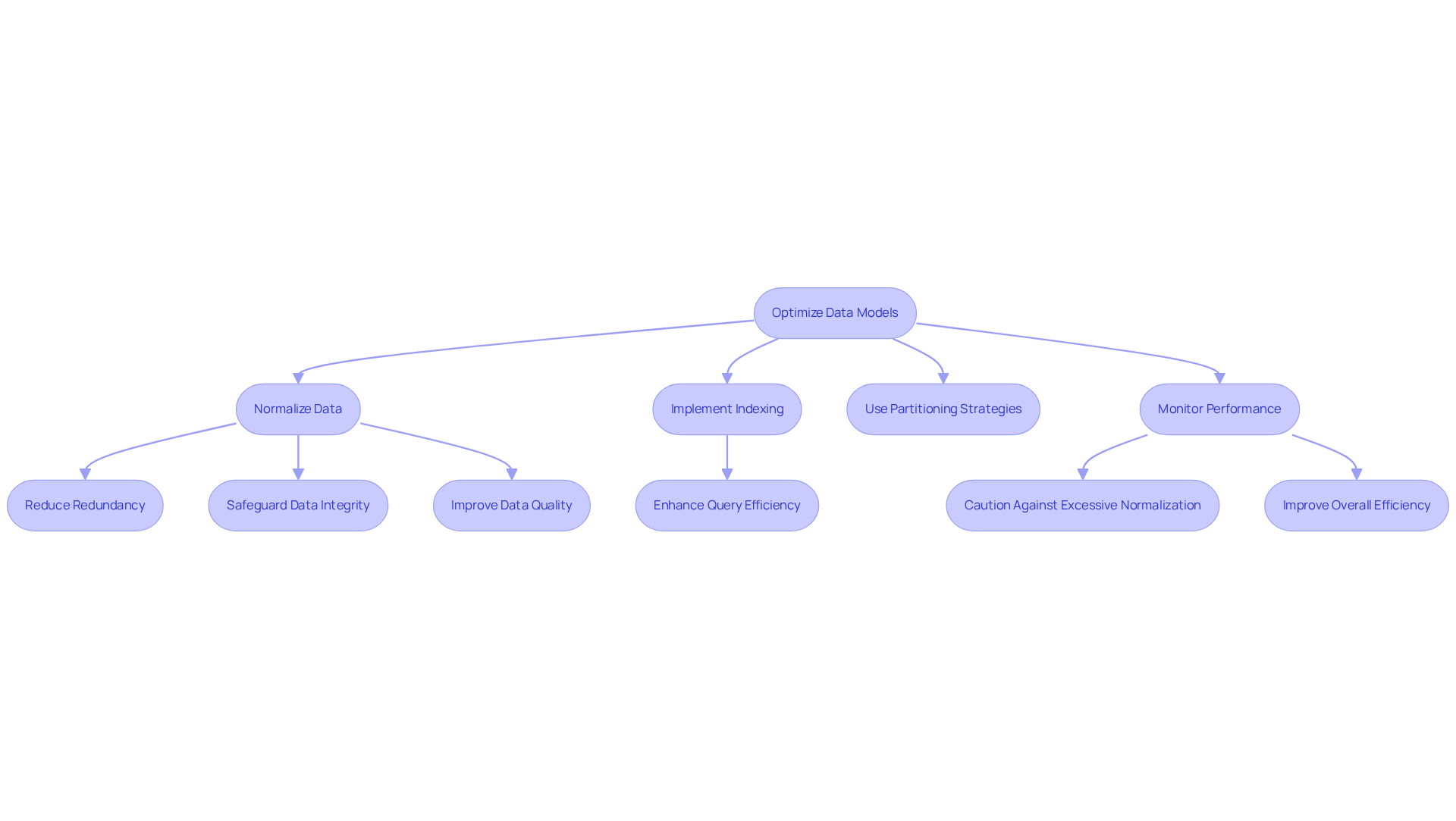

Optimize Data Models and Query Performance

Hedge fund managers must prioritize enhancing their models to facilitate efficient information retrieval. Normalizing data is essential for reducing redundancy, safeguarding data integrity, and improving overall data quality. Furthermore, indexing significantly enhances query efficiency by allowing faster access to information. Implementing partitioning strategies can further improve efficiency, enabling the database to manage large datasets more effectively.

For instance, a hedge fund that reorganized its information model experienced a remarkable 50% improvement in query response times. This enhancement allowed analysts to access essential information swiftly, enabling them to make informed decisions without delay. However, caution is warranted regarding excessive normalization, as it can lead to performance issues due to complex joins.

As Eric Schmidt observes, the growing dependence on skilled analytics professionals is vital for converting large volumes of information into significant insights. This underscores the importance of optimization methods and best practices within the financial sector.

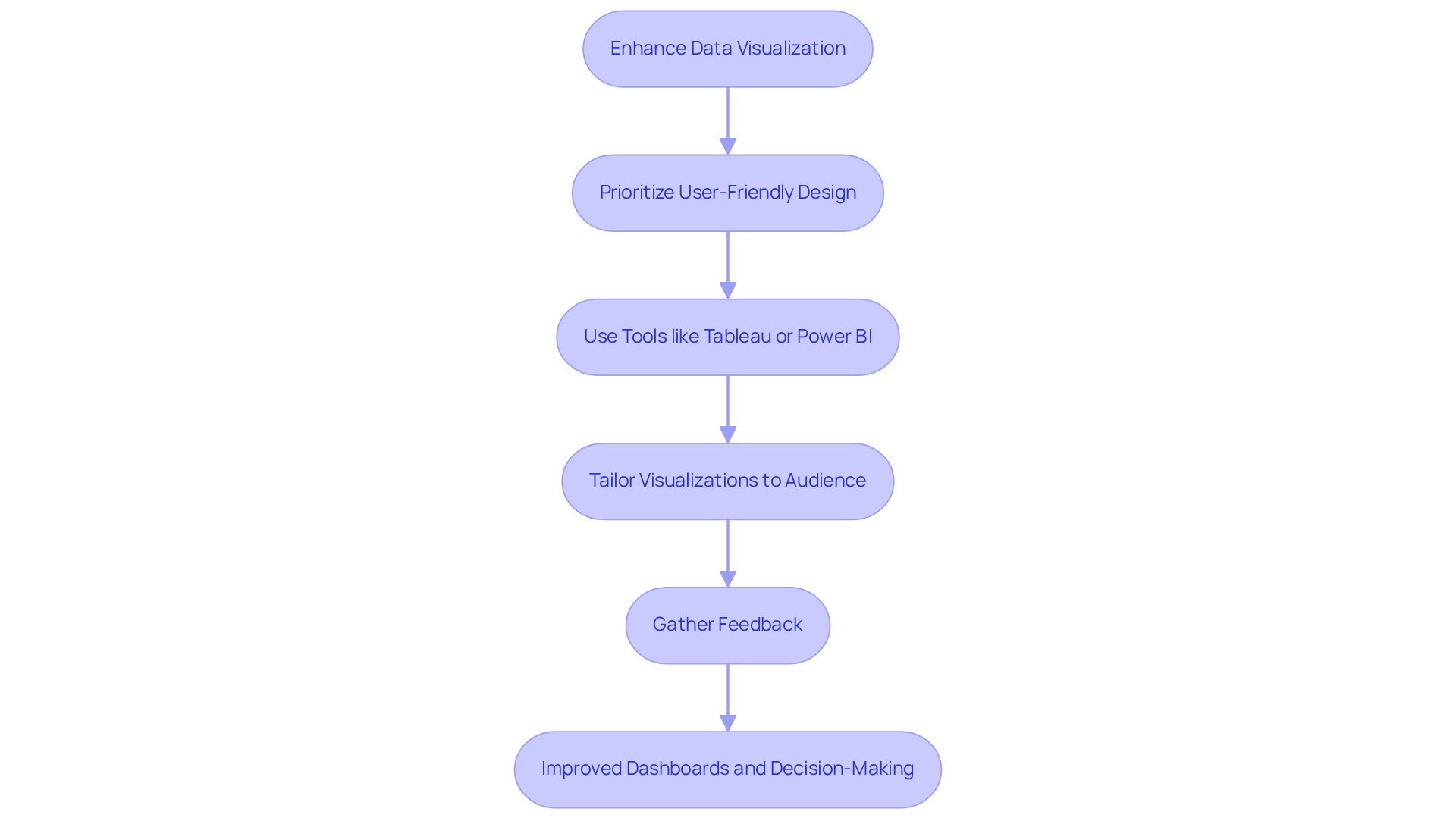

Enhance Data Visualization and User Experience

To enhance information visualization, hedge fund managers must prioritize user-friendly dashboard designs that clearly and succinctly display key metrics. Tools such as Tableau or Power BI can facilitate the creation of interactive visualizations, allowing users to delve into the data for deeper insights.

It is crucial to tailor these visualizations to the audience, ensuring that complex data is presented in a digestible format. For example, a hedge investment group that revamped its reporting dashboard received positive feedback from stakeholders, which resulted in increased engagement and expedited decision-making processes.

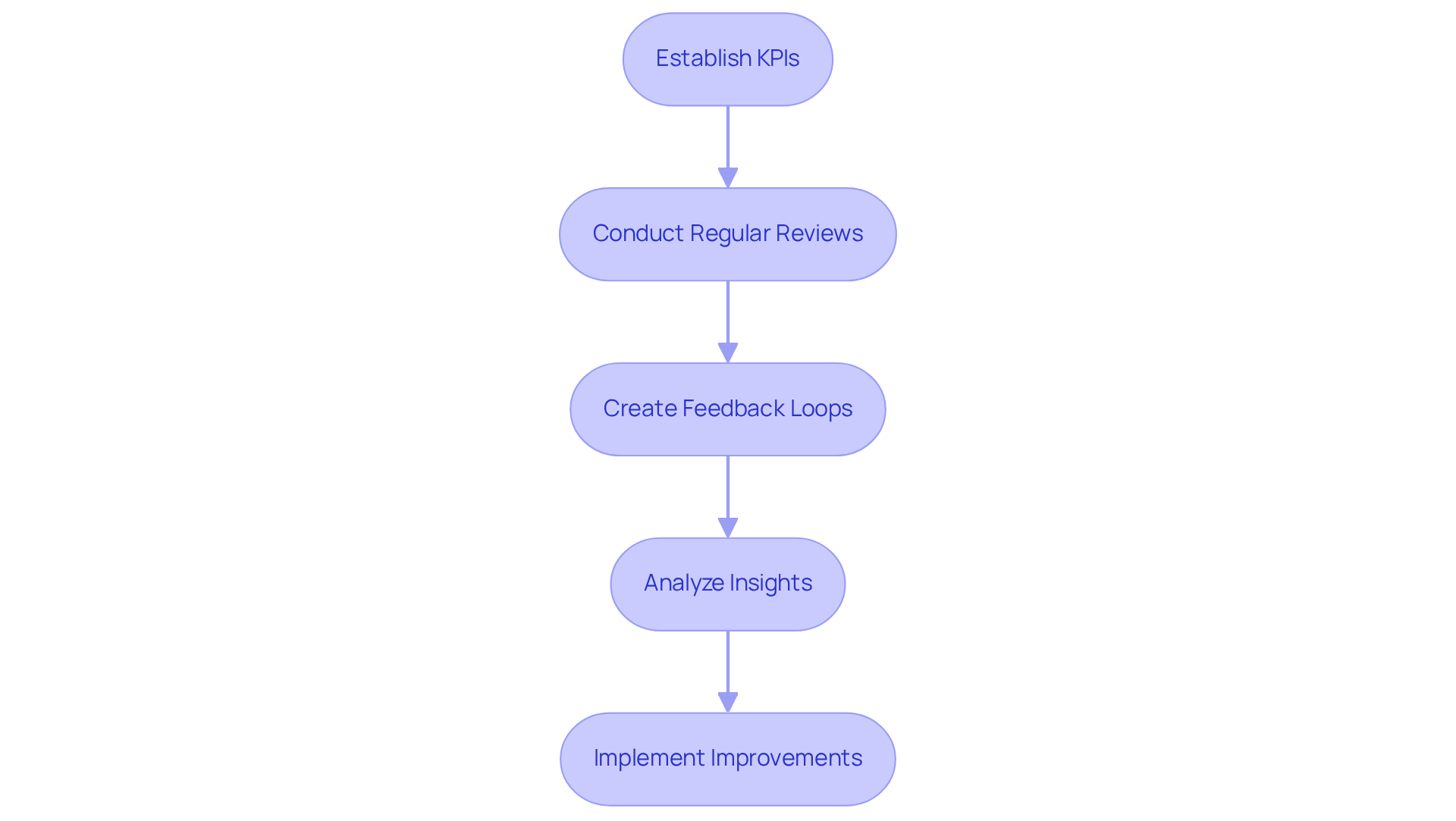

Monitor and Evaluate BI Performance Continuously

Hedge investment managers must establish key success indicators (KPIs) to effectively monitor their business intelligence (BI) best practices. Regular reviews of these metrics are essential for identifying areas of improvement and ensuring alignment with business objectives. By creating feedback loops, users can provide insights on the usefulness of BI data, which further enhances system efficiency.

For instance, an investment group that instituted quarterly assessments of its BI metrics realized a 20% improvement in forecasting accuracy, demonstrating the tangible benefits of continuous evaluation. Industry specialists emphasize that understanding investment vehicle metrics is vital for effective performance assessment, especially in a context where senior loan writedowns by private credit entities have tripled since 2022.

Incorporating insights from leaders in the field can further highlight the significance of KPIs in enhancing BI best practices within financial services.

Train and Empower Staff for Effective BI Utilization

To maximize the benefits of Business Intelligence (BI) tools, investment managers must implement comprehensive training programs that follow BI best practices, prioritizing information literacy and tool proficiency. Fostering a culture of continuous learning empowers employees to effectively leverage BI best practices. By providing access to resources such as online courses and workshops, organizations can significantly enhance their staff’s capabilities. For instance, a hedge fund that invested in training its analysts on BI tools experienced a 40% increase in the speed of analysis and reporting.

Integrate Advanced Analytics and Machine Learning

Hedge managers should consider integrating machine learning algorithms to enhance their analytical capabilities. By utilizing predictive analytics, they can identify trends and forecast market movements with greater accuracy. The implementation of tools that support machine learning can automate data analysis processes, leading to quicker insights.

For example, an investment group that adopted machine learning for its trading strategies experienced a 25% increase in return on investment by leveraging predictive models.

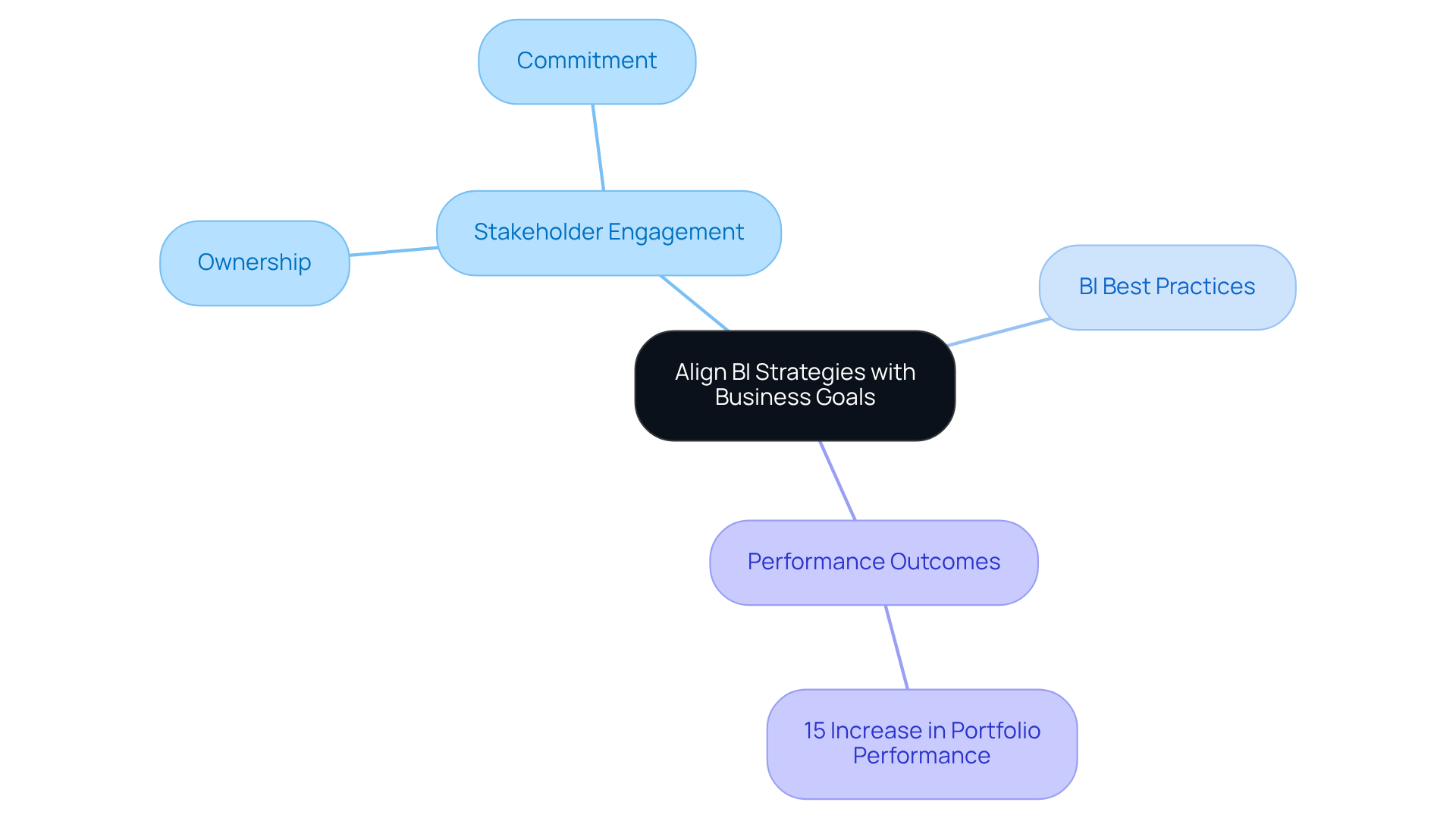

Align BI Strategies with Business Goals and Market Dynamics

Hedge investors must consistently assess and modify their strategies in business intelligence (BI) to align with evolving business objectives and market dynamics, following BI best practices. Engaging stakeholders throughout the strategy development process cultivates a sense of ownership and enhances commitment to BI best practices. Stakeholder expectations should be regarded as essential business intelligence and BI best practices rather than mere external pressure, reinforcing the critical role of stakeholder involvement in refining BI strategies.

For instance, an investment vehicle that aligns its BI strategy with its investment objectives is currently experiencing a notable 15% increase in overall portfolio performance. This demonstrates the ongoing effectiveness of stakeholder engagement. Such an approach ensures that hedge funds remain agile and responsive to market changes, ultimately driving better investment outcomes in the evolving landscape of 2026.

Conclusion

Implementing best practices in business intelligence (BI) is essential for hedge fund managers who seek to enhance operational efficiency and improve decision-making processes. By prioritizing robust data governance, optimizing data models, and leveraging advanced analytics, hedge funds can safeguard sensitive information while also boosting their overall performance in a competitive market.

The article delineates several key strategies that hedge fund managers should adopt. These include:

- Establishing comprehensive data governance frameworks

- Enhancing query performance through effective data modeling

- Fostering a culture of continuous learning among staff

Furthermore, integrating advanced analytics and aligning BI strategies with business objectives are critical for adapting to market dynamics and maximizing investment outcomes. Collectively, these practices contribute to a more agile and responsive investment approach.

In a rapidly evolving financial landscape, the significance of effective BI practices cannot be overstated. Hedge fund managers are urged to prioritize these strategies not only to comply with regulatory standards but also to facilitate better investment decisions. By embracing these best practices, firms can position themselves for success, ensuring they remain at the forefront of innovation and responsiveness within the industry.

Frequently Asked Questions

What are the key components of a robust data governance framework for hedge fund managers?

A comprehensive governance framework should clearly define ownership of information, establish stringent quality standards, and ensure strict access controls are in place.

Why are regular audits and compliance checks important for hedge fund managers?

Regular audits and compliance checks help identify vulnerabilities and ensure adherence to regulations such as SEC Form PF and AML requirements, especially as regulatory scrutiny is expected to intensify in 2026.

How can hedge fund managers protect sensitive information?

Hedge fund managers can protect sensitive information by utilizing encryption and secure information storage solutions to safeguard against unauthorized access and breaches.

What impact can a robust information governance strategy have on compliance-related incidents?

Implementing a robust information governance strategy can lead to a significant decrease in compliance-related incidents; for example, one hedge investment experienced a 30% reduction over the course of a year.

What financial risks do hedge funds face regarding non-compliance?

The financial risks associated with non-compliance can be substantial, as evidenced by the SEC imposing more than US$5 billion in fines in 2024.

What strategies should hedge fund managers use to optimize data models and query performance?

Hedge fund managers should prioritize normalizing data to reduce redundancy, safeguard data integrity, and improve overall data quality. Additionally, indexing and implementing partitioning strategies can enhance query efficiency.

What is the effect of reorganizing an information model on query response times?

Reorganizing an information model can lead to significant improvements in query response times; for instance, one hedge fund experienced a 50% improvement, allowing analysts to access essential information more swiftly.

What caution should hedge fund managers take when normalizing data?

Hedge fund managers should be cautious of excessive normalization, as it can lead to performance issues due to complex joins.

Why is the role of skilled analytics professionals important in the financial sector?

Skilled analytics professionals are vital for converting large volumes of information into significant insights, highlighting the importance of optimization methods and best practices.