Introduction

In the competitive landscape of hedge funds, the selection of a software development pricing model plays a crucial role in determining financial outcomes. Projections indicate significant capital inflows in the coming years, making this choice even more critical. This article explores essential practices for identifying the most effective pricing strategies, providing insights into various models, including:

- Fixed price

- Time and materials

- Mixed approaches

Given the multitude of options available, hedge funds must navigate these choices carefully to optimize costs and ensure project success while steering clear of common pitfalls.

Explore Software Development Pricing Models

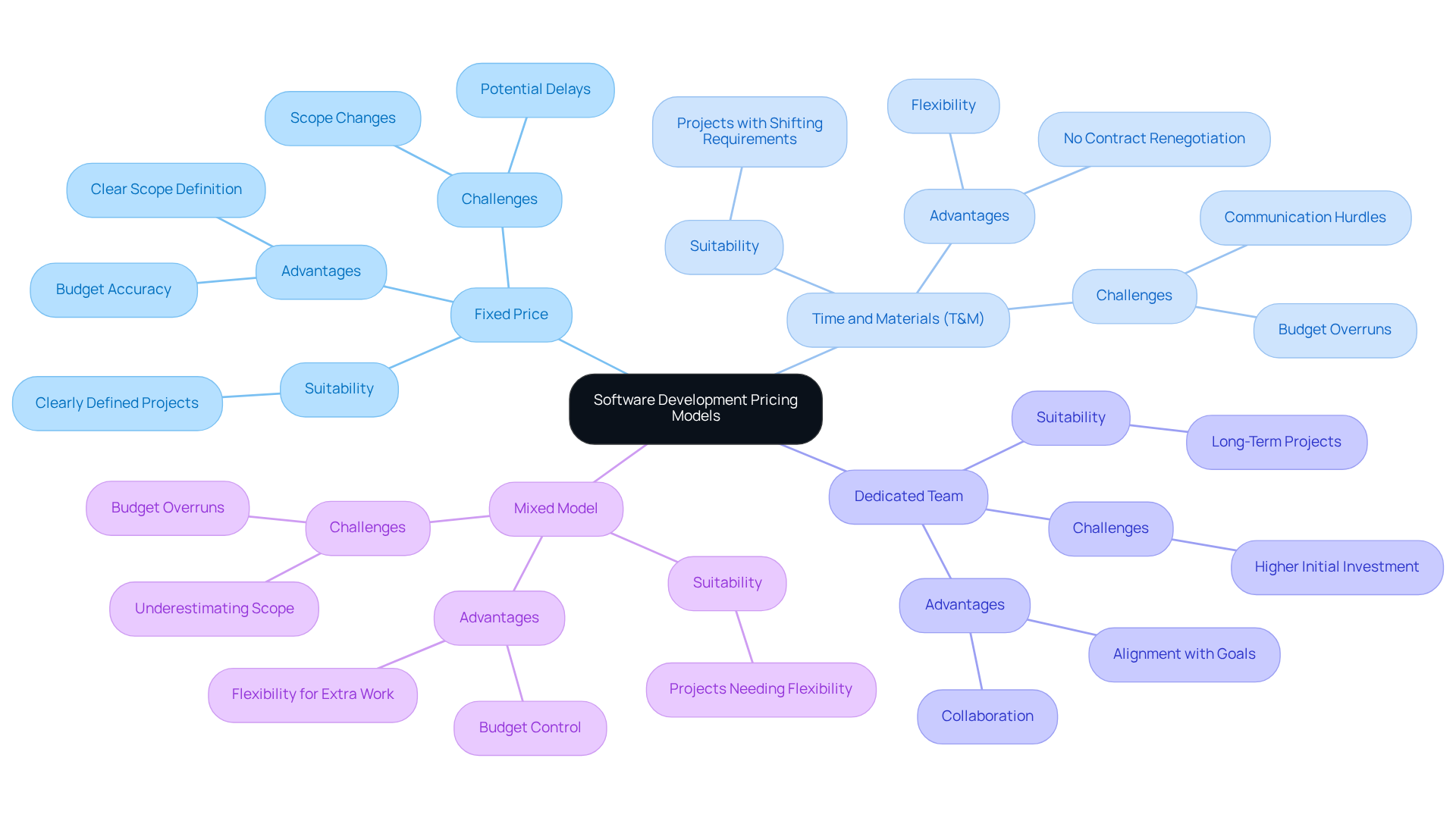

In the realm of hedge investments, it is essential to select the right software development pricing model, particularly considering the anticipated capital inflows in 2026 that emphasize the importance of strategic budgeting. The most common models include:

-

Fixed Price: This model is best suited for projects with clearly defined requirements. It allows hedge funds to budget accurately, as the total cost is established upfront. However, challenges may arise if the project’s scope changes, potentially leading to additional costs or delays.

-

Time and Materials (T&M): This adaptable model charges based on the actual time spent and materials utilized. It is appropriate for projects where requirements may shift, enabling adjustments without the need for contract renegotiation. This flexibility is crucial in the fast-paced hedge environment, where communication hurdles can occur, particularly when teams are distributed across different time zones.

-

Dedicated Team: In this approach, a team is assigned to the hedge investment for a predetermined period. This fosters collaboration and ensures that the team is fully aligned with the project’s goals, although it may require a higher initial investment. In the competitive landscape of hedge investment software, having a dedicated team can offer a strategic edge.

-

Mixed Model: This model merges elements of fixed price and T&M, allowing for a base fee with additional charges for extra work. This can be beneficial for hedge portfolios aiming to maintain budget control while allowing for flexibility. However, it is crucial to be mindful of potential pitfalls, such as underestimating the scope of additional work, which can result in budget overruns.

Understanding these models enables hedge organizations to navigate their software development pricing strategically, ensuring they choose the most appropriate method for their specific needs. With the hedge fund software market projected to reach USD 4.7 billion by 2033, making informed decisions about pricing models is more critical than ever.

Identify Key Factors Affecting Development Costs

Several key factors significantly influence software development costs for hedge funds:

-

Complexity of the Project: The complexity of an endeavor directly correlates with its costs. Hedge funds must clearly define their requirements to prevent scope creep, which can lead to unexpected expenses. A well-defined project scope not only aids in budgeting but also ensures that all necessary functionalities are included from the outset. Moreover, concealed expenses linked to scope creep can greatly affect budgets, making it vital to handle changes efficiently.

-

Technology Stack: The selection of technology has a significant impact on expenses. Utilizing advanced technologies may necessitate specialized skills, which can increase costs. Choosing widely supported and cost-effective technologies can help reduce licensing fees and improve efficiency.

-

Team Size and Location: The number of project team members and their geographical position can significantly influence labor expenses. While offshore teams may offer lower rates, potential challenges such as communication barriers and time zone differences must be considered. Balancing expenses with effective collaboration is essential for project success.

-

Development Methodology: Embracing agile approaches can result in increased initial expenses due to the iterative nature of the process. However, this approach frequently leads to improved alignment with business needs and can lower long-term costs by permitting regular feedback and modifications throughout the creation process. Prioritizing core functions within this framework is essential for cost-effective development.

-

Testing and Maintenance: Ongoing testing and maintenance are vital for ensuring software longevity and compliance. Hedge funds should include these expenses in their budgets to sustain functionality and comply with regulatory standards over time. Moreover, overlooking technical debt arising from shortcuts taken during development can lead to higher upkeep expenses in the future.

-

Setting Realistic Schedules: Establishing a realistic timeline for project completion is crucial. A carefully organized timetable aids in managing project timelines efficiently and can avert hasty choices that might result in higher expenses.

By comprehending these elements, hedge funds can efficiently oversee their software creation budgets and make knowledgeable choices that align with their financial goals.

Implement Cost Optimization Strategies

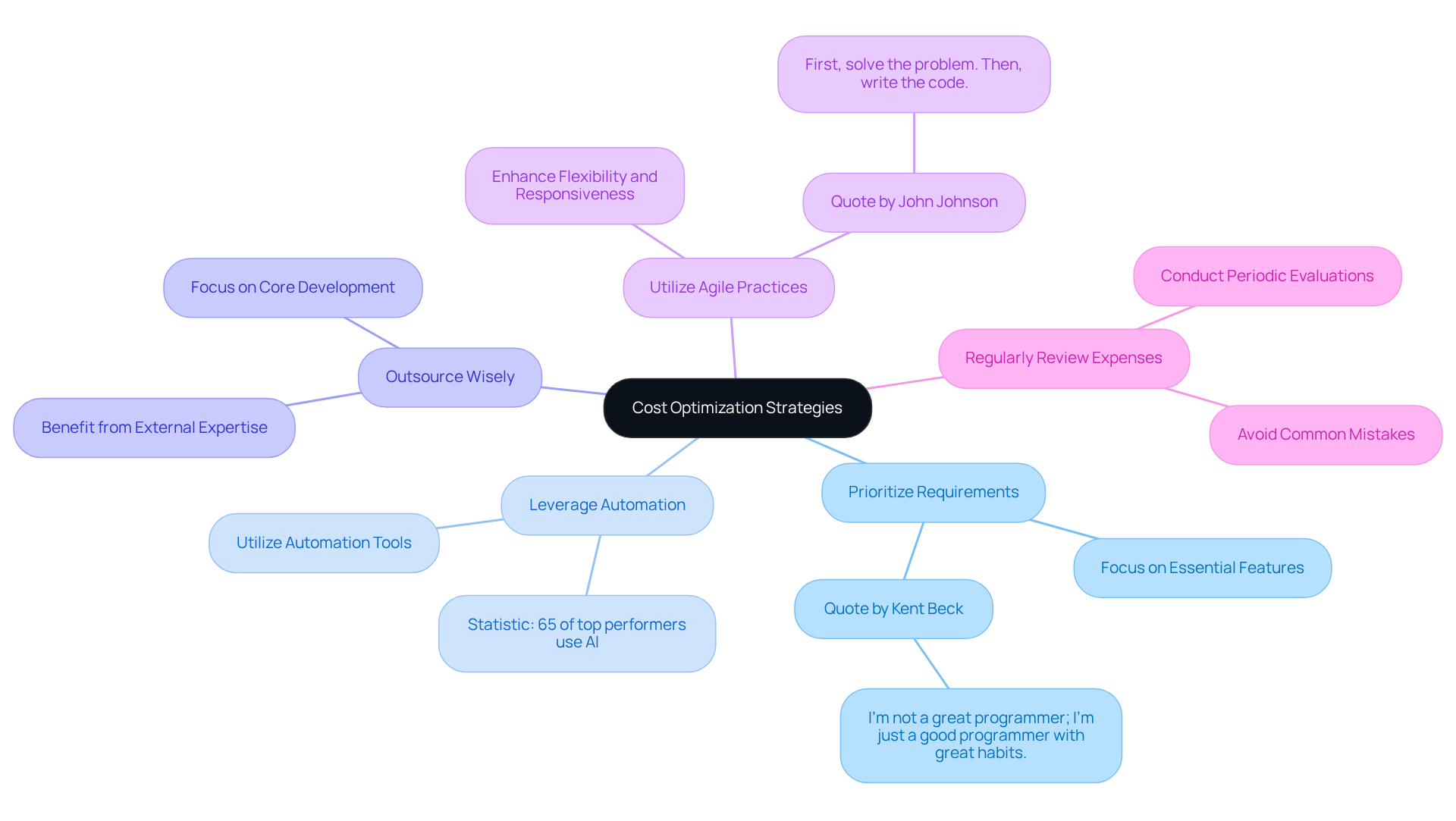

To optimize software development costs, hedge funds can implement several strategies:

-

Prioritize Requirements: Clearly defining and prioritizing project requirements enables teams to focus on essential features first. As Kent Beck, one of the original signatories of the Agile Manifesto, states, “I’m not a great programmer; I’m just a good programmer with great habits.” This targeted approach minimizes unnecessary expenses associated with less critical functionalities, ensuring efficient allocation of resources.

-

Leverage Automation: Utilizing automation tools for testing and deployment significantly reduces manual effort and accelerates the production process. Statistics indicate that sixty-five percent of top performers have integrated AI into IT, resulting in savings and improved overall productivity. This integration allows teams to deliver high-quality software more rapidly.

-

Outsource Wisely: Outsourcing non-core development tasks to specialized firms or freelancers can be a cost-effective strategy. This approach enables internal teams to concentrate on strategic initiatives while benefiting from the expertise of external partners, ultimately lowering operational expenses.

-

Utilize Agile Practices: Adopting Agile methodologies enhances flexibility and responsiveness to changes in project scope or requirements. This iterative method promotes effective resource utilization and can lead to lower expenses by allowing teams to adjust swiftly to evolving requirements. As noted in the case study “Problem-Solving Before Coding,” understanding the problem at hand before coding results in more effective solutions.

-

Regularly Review Expenses: Conducting periodic evaluations of project expenses and processes is crucial for identifying areas for enhancement. This proactive strategy assists hedge funds in remaining within budget and making essential adjustments in real-time, ensuring financial efficiency. Regular reviews can help avoid pitfalls and common mistakes in implementing these strategies.

By applying these strategies, hedge funds can achieve significant cost reductions while maintaining high standards in software development pricing.

Choose the Right Development Partner

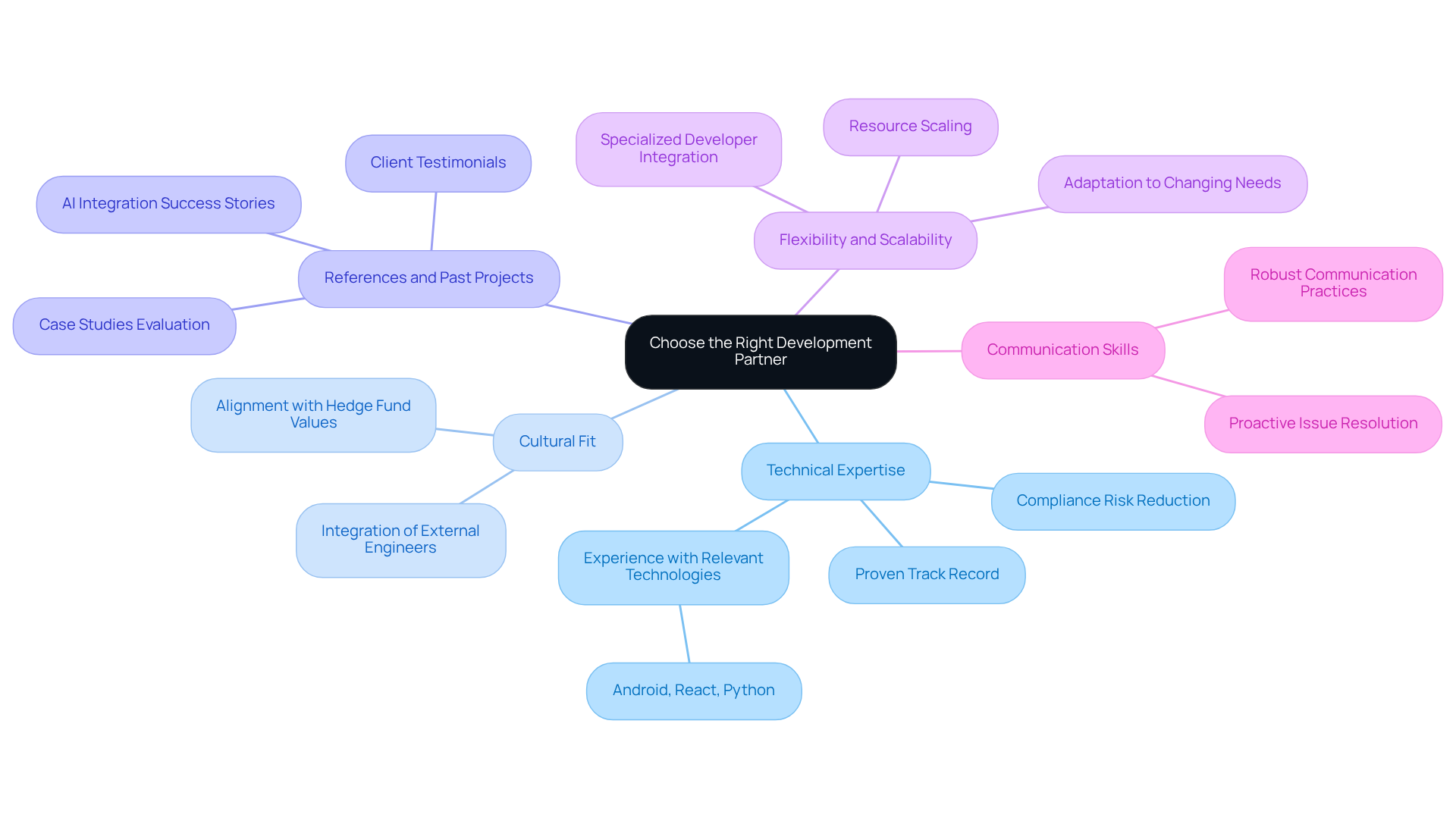

Selecting the right software creation partner is essential for hedge funds. Key considerations can significantly enhance the likelihood of a successful collaboration:

-

Technical Expertise: It is crucial to prioritize partners with a proven track record in financial software development. Look for experience with initiatives similar to yours and knowledge of the technologies that align with your specific requirements. For example, partnerships with firms specializing in Android, React, and Python have been shown to reduce non-compliance risks and enhance operational capabilities.

-

Cultural Fit: Assess whether the partner’s values and work culture resonate with your hedge fund’s ethos. A strong cultural alignment fosters improved collaboration and communication, both of which are essential for success. Companies that integrate external engineers as core team members often experience better outcomes and heightened commitment.

-

References and Past Projects: Request case studies or references from previous clients to evaluate the partner’s reliability and quality of work. Insights from past endeavors can illuminate their ability to deliver on time and within budget, which is vital in the fast-paced financial sector. For instance, firms that have successfully incorporated AI into their processes have demonstrated improved results and client retention.

-

Flexibility and Scalability: Opt for a partner capable of adapting to changing needs and scaling resources as required. This flexibility is particularly important in the dynamic environment of hedge funds, where market conditions can shift rapidly. Neutech, for instance, assesses client needs and provides specialized developers and designers, ensuring that the right talent is integrated into your team to enhance operational efficiency.

-

Communication Skills: Effective communication is paramount for success in this endeavor. Ensure that the partner has robust communication practices in place to facilitate collaboration and promptly address any issues. A partner that maintains clear and consistent communication can help mitigate misunderstandings and keep tasks on track.

By thoroughly evaluating potential development partners against these criteria, hedge funds can significantly improve their chances of executing successful software development pricing.

Conclusion

Navigating the complexities of software development pricing in hedge funds is crucial for achieving financial success and strategic growth. By comprehending the various pricing models available – such as fixed price, time and materials, dedicated teams, and mixed models – hedge funds can make informed decisions that align with their specific project requirements and budget constraints.

Key factors that influence software development costs include:

- Project complexity

- Technology stack

- Team size

- Development methodology

These elements play a significant role in shaping overall expenses. Furthermore, implementing cost optimization strategies – such as prioritizing requirements, leveraging automation, and conducting regular expense reviews – can greatly enhance financial efficiency. Selecting the appropriate development partner based on technical expertise, cultural fit, and communication skills further ensures that hedge funds can successfully execute their projects while adhering to budgetary guidelines.

Ultimately, the capacity to strategically manage software development pricing and costs empowers hedge funds to seize opportunities in the rapidly evolving financial landscape. By adopting these best practices, organizations can achieve substantial cost reductions and position themselves for long-term success in a competitive market. Embracing informed decision-making in software development is not merely a necessity; it represents a strategic advantage that can foster sustained growth and innovation.

Frequently Asked Questions

What is the importance of selecting the right software development pricing model in hedge investments?

Selecting the right software development pricing model is essential for strategic budgeting, especially considering anticipated capital inflows in 2026.

What are the most common software development pricing models?

The most common pricing models include Fixed Price, Time and Materials (T&M), Dedicated Team, and Mixed Model.

What is the Fixed Price model, and when is it best suited?

The Fixed Price model is best suited for projects with clearly defined requirements, allowing hedge funds to budget accurately since the total cost is established upfront. However, changes in project scope can lead to additional costs or delays.

How does the Time and Materials (T&M) model work?

The T&M model charges based on the actual time spent and materials used, making it adaptable for projects where requirements may shift. This flexibility is crucial in the fast-paced hedge environment.

What is the Dedicated Team model, and what are its benefits?

The Dedicated Team model assigns a team to the hedge investment for a predetermined period, fostering collaboration and alignment with project goals. It may require a higher initial investment but can provide a strategic edge in competitive landscapes.

What does the Mixed Model entail?

The Mixed Model combines elements of Fixed Price and T&M, featuring a base fee with additional charges for extra work. This model helps maintain budget control while allowing for flexibility, though it carries the risk of underestimating additional work, leading to budget overruns.

Why is understanding these pricing models important for hedge organizations?

Understanding these models helps hedge organizations navigate software development pricing strategically, ensuring they choose the most appropriate method for their specific needs, especially as the hedge fund software market is projected to grow significantly.