4 Best Practices for P2P Lending Software Development Success

Introduction

In the rapidly evolving finance sector, peer-to-peer (P2P) lending has emerged as a revolutionary model that connects borrowers directly with lenders, effectively bypassing traditional banking systems. As this innovative approach gains traction, it becomes essential for developers to understand the intricacies of P2P lending software development in order to create effective and user-friendly platforms.

However, navigating the complexities of regulatory compliance, security standards, and user experience presents significant challenges. What best practices can ensure success in this competitive landscape?

Understand P2P Lending Software Principles and Mechanics

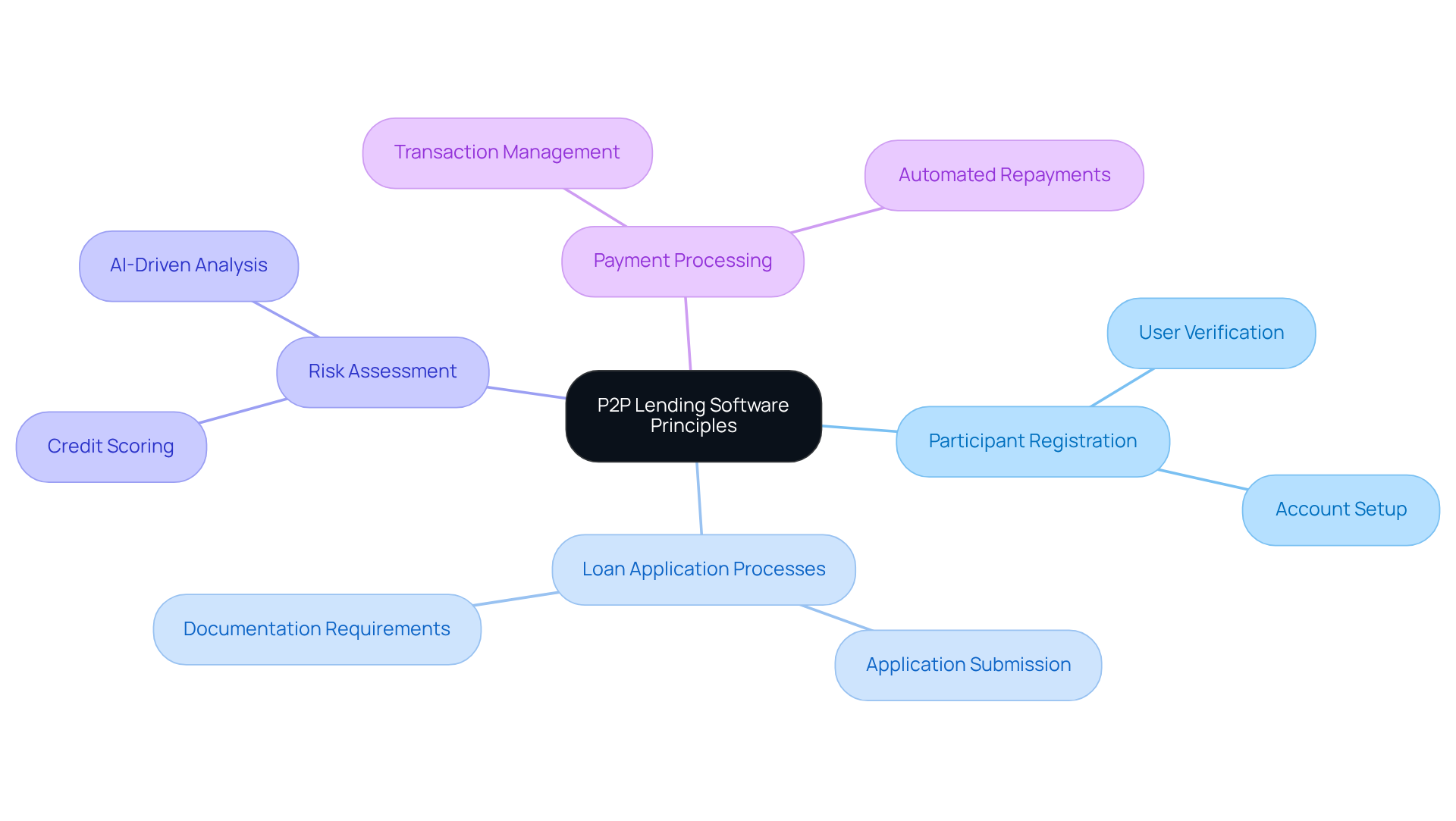

To successfully engage in p2p lending software development, it is crucial to understand the fundamental principles and mechanics that govern these platforms. P2P lending functions as a decentralized model, directly connecting borrowers with lenders and thereby circumventing traditional financial institutions. Key components of this model include:

- Participant registration

- Loan application processes

- Risk assessment

- Payment processing

By comprehending these mechanics, developers can ensure that p2p lending software development creates a seamless experience for users and operates effectively. For instance, implementing a robust matching algorithm can enhance the speed and accuracy of loan approvals, which directly influences user satisfaction and the overall reliability of the system.

Ensure Regulatory Compliance and Security Standards

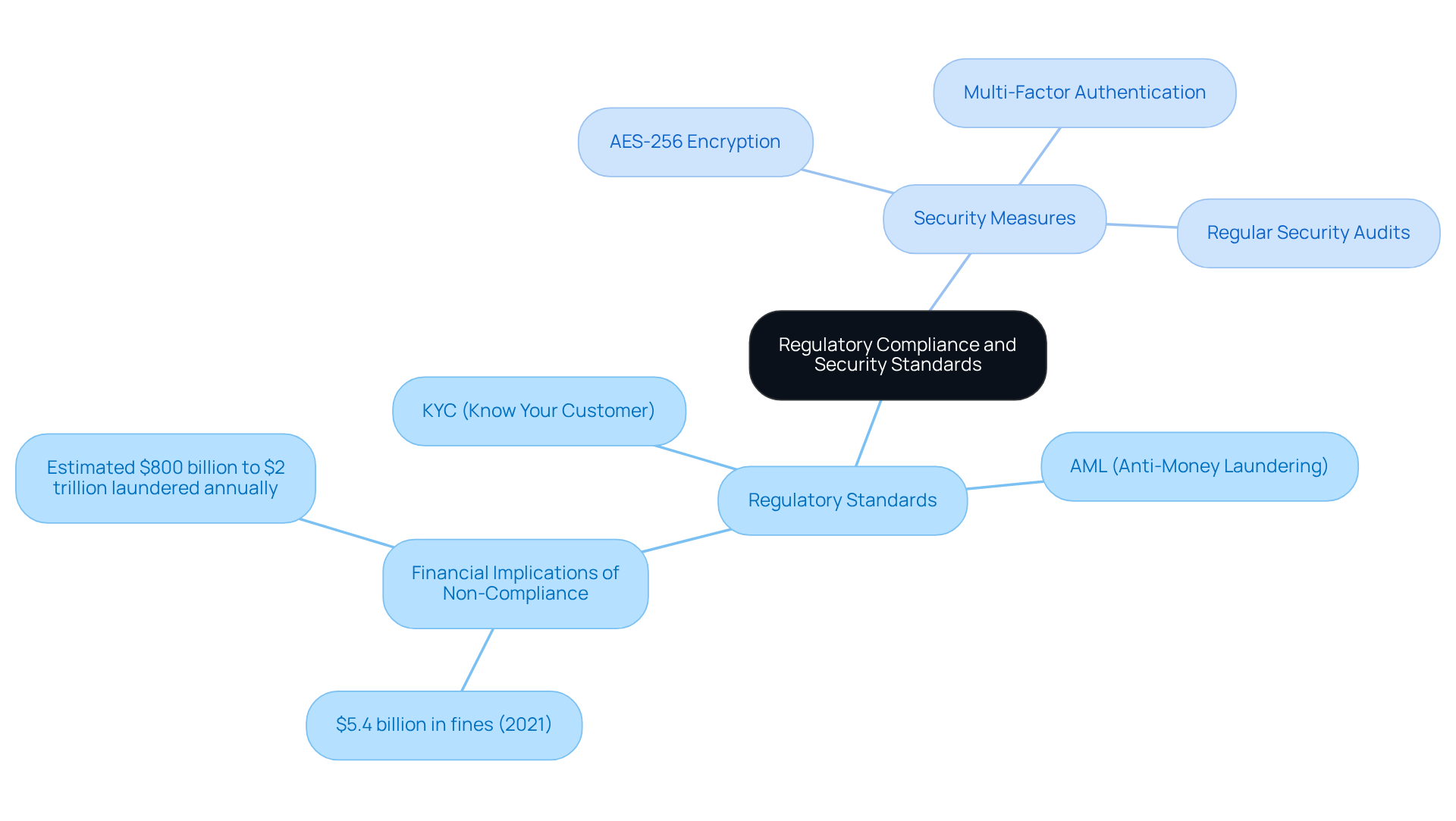

In the P2P lending landscape, adherence to regulatory standards is imperative. Developers must ensure their platforms comply with both local and international regulations, particularly KYC (Know Your Customer) and AML (Anti-Money Laundering) laws. Implementing stringent security measures – such as AES-256 encryption, multi-factor authentication, and regular security audits – is crucial for protecting personal information and reducing fraud risks.

Notably, violations in AML and KYC compliance totaled $5.4 billion in fines in 2021, underscoring the financial repercussions of non-compliance. Moreover, a worldwide estimate indicates that 2-5% of GDP, amounting to $800 billion to $2 trillion, is laundered each year. This statistic emphasizes the essential requirement for compliance in P2P financing.

For instance, LendingClub has effectively navigated the regulatory environment by emphasizing compliance and security. This approach has fostered trust among users and investors. Such a commitment to regulatory adherence not only enhances platform integrity but also positions P2P lending software development as a reliable alternative to traditional banking, where compliance failures can lead to significant penalties and reputational damage.

Select Key Features for User Experience and Efficiency

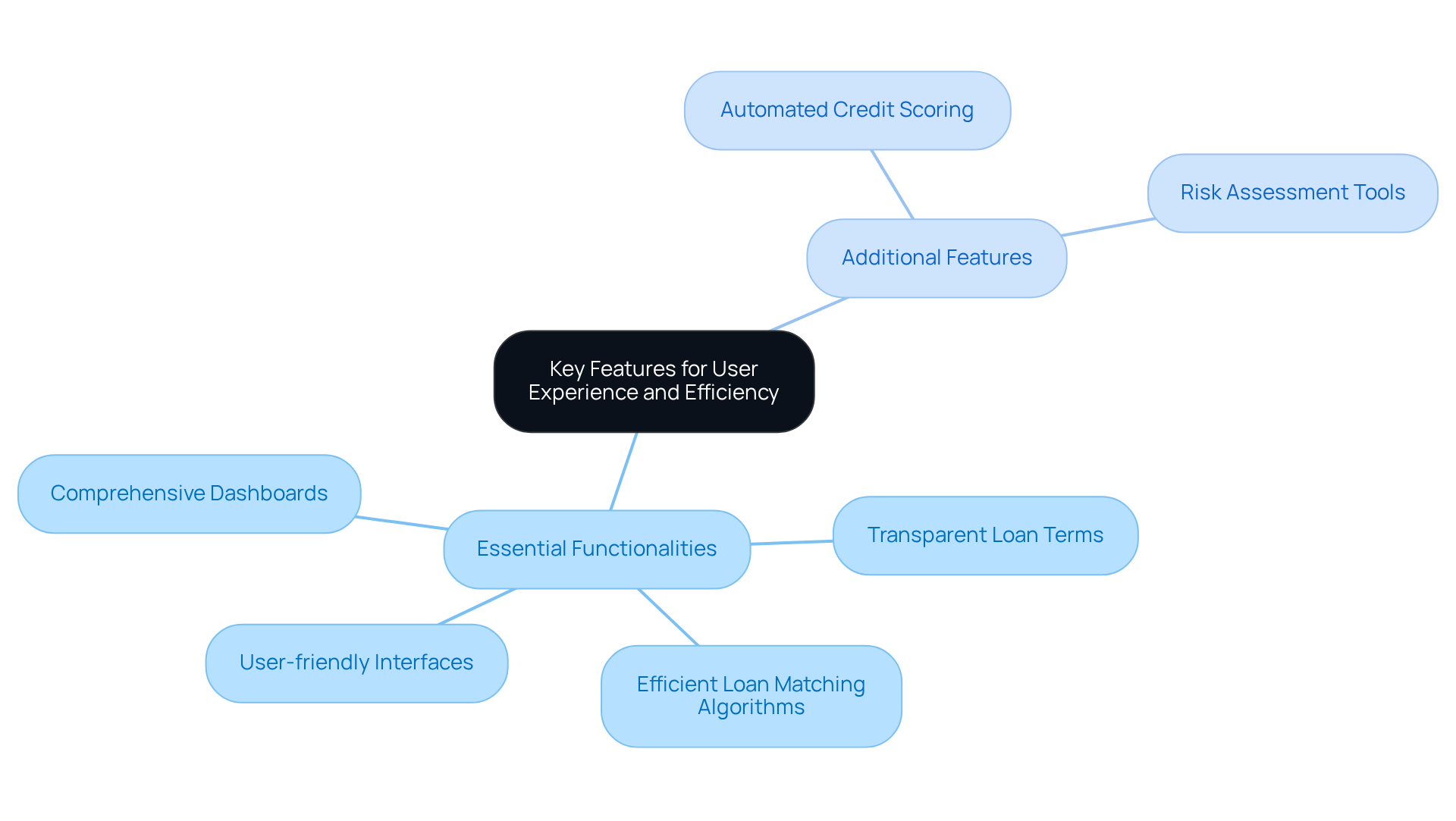

Selecting the right features is paramount in the process of p2p lending software development. Essential functionalities encompass:

- User-friendly interfaces

- Efficient loan matching algorithms

- Transparent loan terms

- Comprehensive dashboards for both borrowers and lenders

Additionally, features such as automated credit scoring and risk assessment tools can streamline the lending process, enhancing speed and reliability.

For instance, platforms that incorporate AI-driven analytics to assess borrower risk have demonstrated improved loan performance and reduced default rates. By prioritizing these features, developers not only enhance customer experience but also drive operational efficiency in p2p lending software development.

Develop a Minimum Viable Product for Risk Mitigation

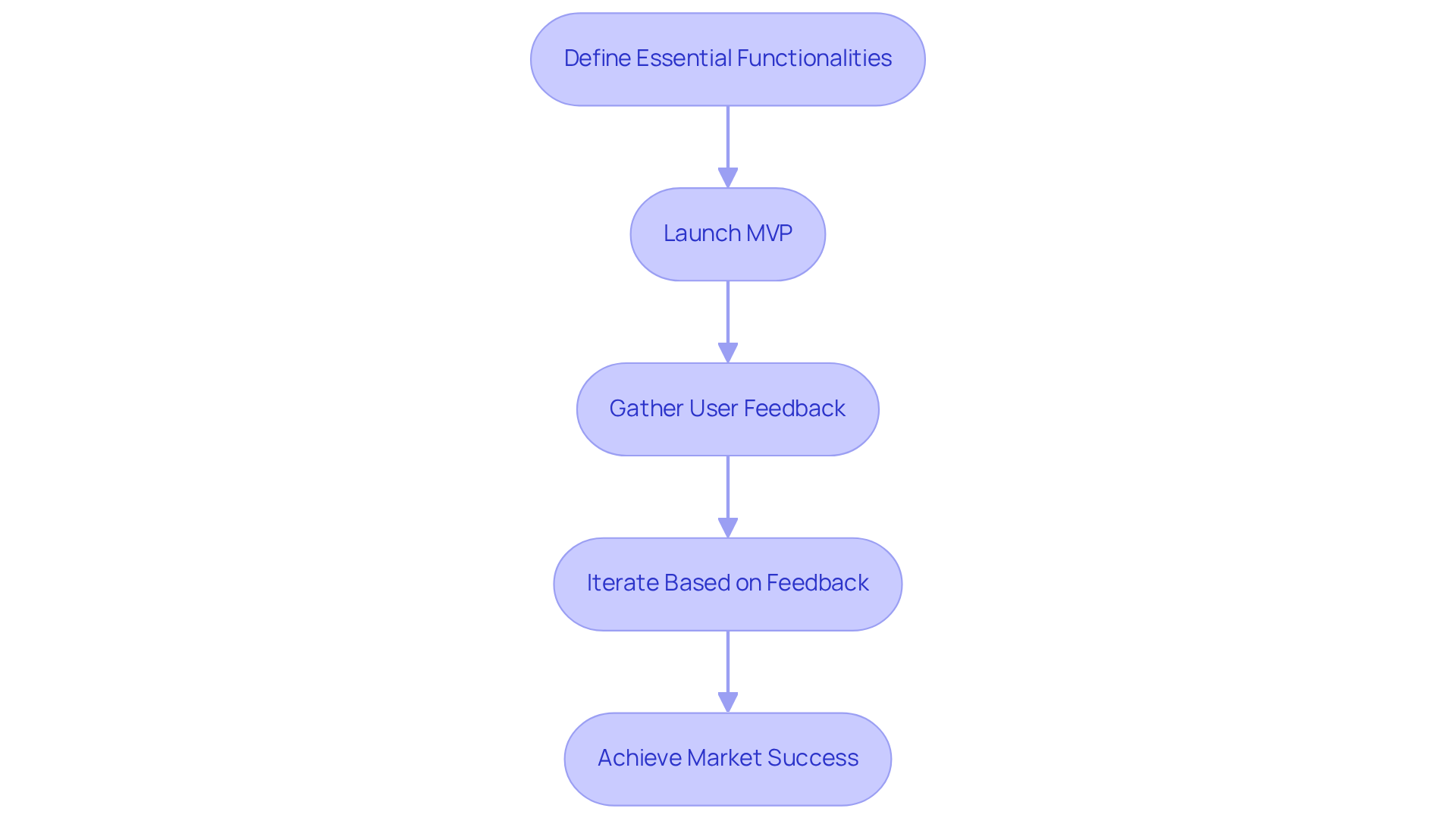

Creating a Minimum Viable Product (MVP) serves as a strategic approach to mitigate risks in p2p lending software development. An MVP should focus on essential functionalities that address the primary requirements of users, such as loan application processing and basic verification. By launching an MVP, developers can gather valuable feedback from early adopters, facilitating iterative improvements based on actual user experiences.

For example, services like Upstart have effectively utilized MVPs to assess their algorithms and refine their offerings prior to large-scale launches. This method not only conserves resources but also aligns product development with consumer expectations. Statistics reveal that startups employing MVP strategies achieve a 40% higher success rate in securing subsequent funding rounds compared to traditional development paths, highlighting the effectiveness of this approach within the competitive fintech landscape.

Moreover, successful P2P lending systems underscore the importance of maintaining a narrow focus during the MVP phase, ensuring that the value proposition is clear and directly addresses customer pain points. By concentrating on essential features and gathering insights from users, these platforms can adapt and evolve, ultimately leading to greater market success.

As Ivan Aleksandrov points out, a common mistake is attempting to address every piece of feedback received after launching an MVP, which can dilute the focus and effectiveness of the product. Additionally, employing strategies such as the ‘Wizard of Oz’ MVP can yield practical insights into user needs while minimizing development risks.

Conclusion

Understanding the complexities of P2P lending software development is crucial for success in this growing field. By concentrating on fundamental principles such as participant registration, risk assessment, and payment processing, developers can create platforms that not only fulfill user needs but also promote trust and efficiency within the lending ecosystem.

This article outlines several best practices essential for effective P2P lending software development. Key insights include:

- The significance of regulatory compliance and security measures to safeguard user data.

- The careful selection of features that enhance user experience and operational efficiency.

- The strategic implementation of Minimum Viable Products to mitigate risks and refine offerings based on user feedback.

Each of these components is vital in constructing a reliable and user-friendly lending platform.

Ultimately, the success of P2P lending software relies on a dedication to understanding user needs, adhering to regulatory standards, and continuously enhancing the platform through feedback and innovation. As the P2P lending landscape progresses, adopting these best practices will not only contribute to the success of individual platforms but also bolster the overall integrity and reliability of the financial technology sector. Taking proactive steps now to implement these strategies can pave the way for a more robust and trustworthy lending environment for all stakeholders involved.

Frequently Asked Questions

What is P2P lending?

P2P lending, or peer-to-peer lending, is a decentralized model that connects borrowers directly with lenders, bypassing traditional financial institutions.

What are the key components of P2P lending software?

The key components include participant registration, loan application processes, risk assessment, and payment processing.

Why is it important to understand the principles of P2P lending software?

Understanding these principles is crucial for developers to create a seamless user experience and ensure the software operates effectively.

How can a matching algorithm benefit P2P lending software?

A robust matching algorithm can enhance the speed and accuracy of loan approvals, which improves user satisfaction and the overall reliability of the system.