Introduction

The landscape of software delivery models is evolving rapidly, particularly within the highly regulated financial sector where hedge fund managers operate. These professionals face the dual challenge of adhering to stringent compliance standards while maintaining agility in a competitive market. Therefore, understanding the various software delivery methodologies is crucial.

This article examines ten essential software delivery models, emphasizing their unique advantages and challenges. It also explores how these models can empower hedge fund managers to optimize their technology solutions.

How can investment firms effectively navigate this complex terrain to ensure both compliance and innovation?

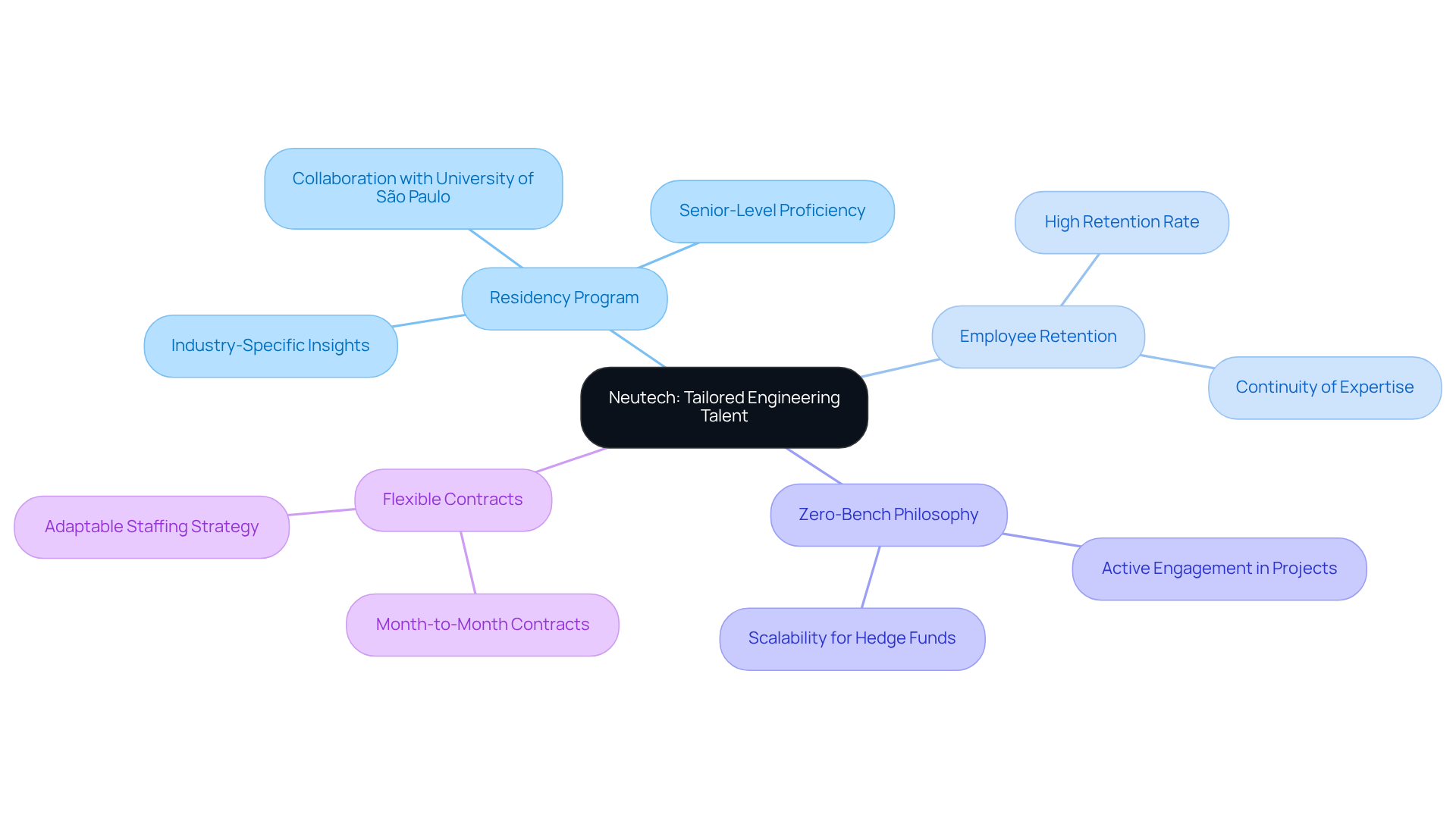

Neutech: Tailored Engineering Talent for Regulated Industries

Neutech specializes in providing hyper-specialized engineering talent tailored for regulated industries, particularly in financial services. Their rigorous residency program, developed in collaboration with the University of São Paulo, cultivates engineers who achieve senior-level proficiency and acquire critical industry-specific insights. This commitment to quality and compliance is vital for investment managers, who depend on robust software delivery models to meet stringent regulatory standards.

Neutech’s impressive employee retention rate underscores its reliability, assuring investment groups of the continuity and expertise of their resources. Furthermore, Neutech’s zero-bench philosophy guarantees that all engineers are actively engaged in projects, allowing hedge funds to scale their resources effectively as needed.

This strategic focus on specialized expertise and operational readiness, combined with a flexible month-to-month contract framework, positions Neutech as an essential partner in navigating the complexities of technology development within the financial sector, especially in light of the anticipated shortage of engineering talent.

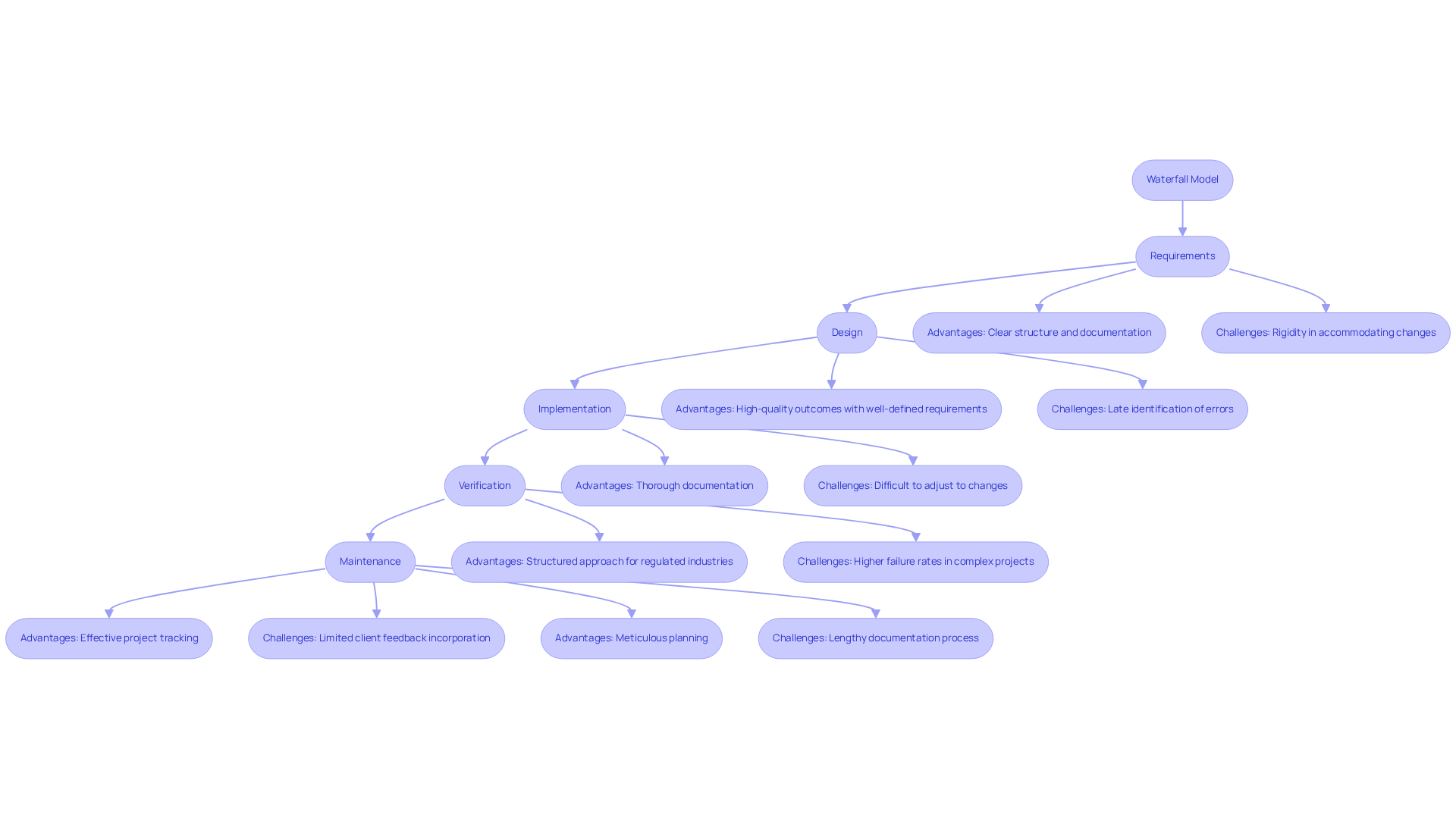

Waterfall Model: A Structured Approach to Software Development

The Waterfall Model exemplifies a linear and sequential approach to application development, where each stage must be completed before progressing to the next. This methodology proves particularly advantageous for investment managers operating under clear and stable requirements, as it promotes thorough documentation and meticulous planning-essential components in regulated industries. Neutech’s extensive engineering services, including expertise in React Development, Python Development, and more, are tailored to support such structured methodologies, ensuring that projects effectively meet compliance and regulatory standards.

Advantages of the Waterfall Model:

- A clear structure and comprehensive documentation facilitate effective project tracking.

- High-quality outcomes are achievable when requirements are well-defined.

Challenges of the Waterfall Model:

- The inherent rigidity of the model complicates the accommodation of changes once a phase is completed.

- Research indicates that the failure rate for projects utilizing the Waterfall Model can reach as high as 87% in the U.K. and 85% for projects with budgets exceeding $3 million to $5 million.

Thus, the Waterfall Model is optimally suited for projects characterized by stable requirements, where the clarity of the process can be fully leveraged. As the financial services sector continues to evolve, it is crucial to understand the balance between the structured approach of software delivery models like the Waterfall Model and the flexibility offered by Agile methodologies for successful project delivery. Notably, only 14% of Waterfall projects are completed on time and within budget, in contrast to 42% for Agile projects. This disparity underscores the significance of stakeholder feedback and adaptability in project management. By partnering with Neutech, investment managers can ensure that their technology creation processes are not only organized but also aligned with industry best practices.

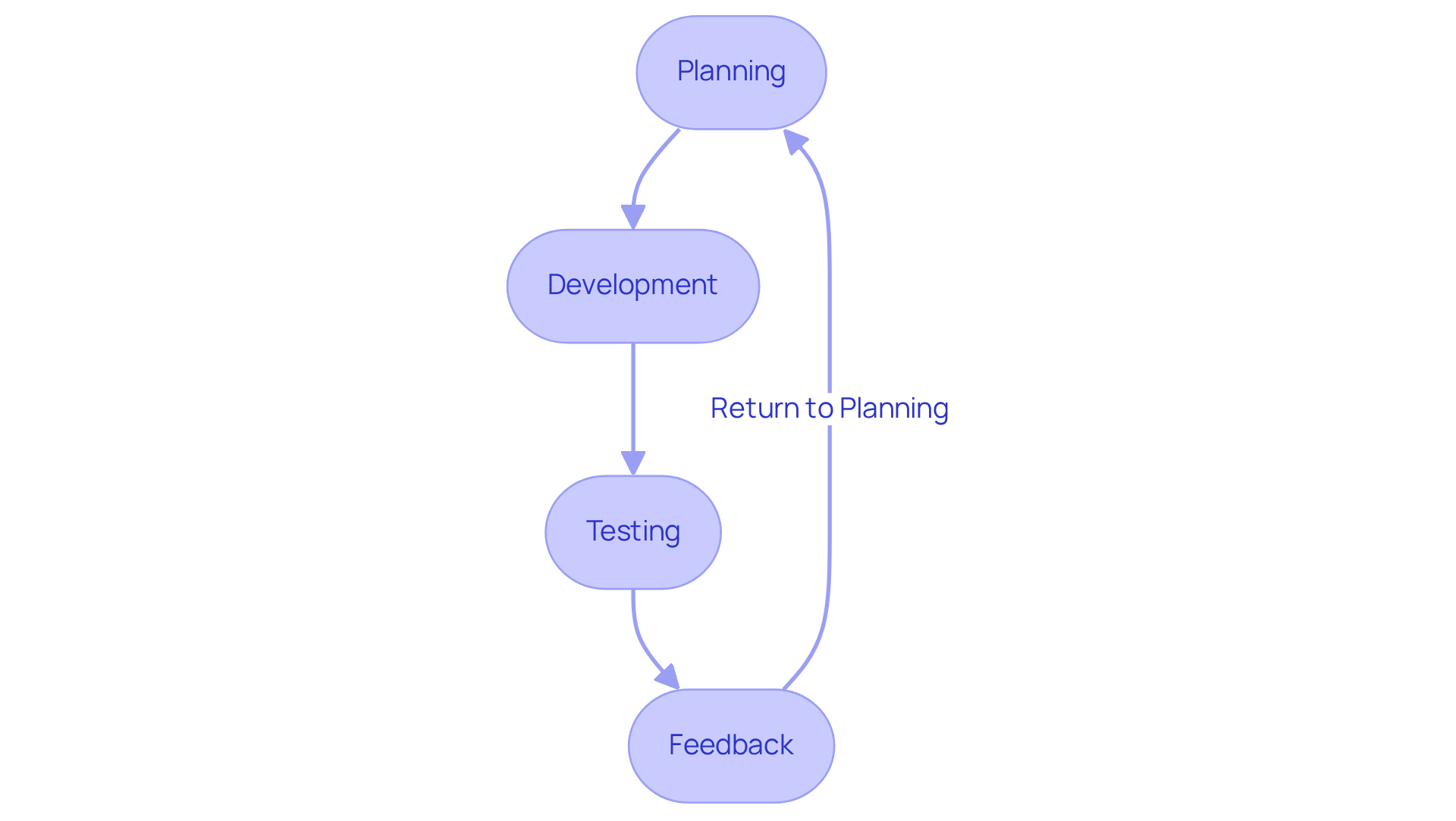

Agile Model: Flexibility and Iteration for Rapid Development

The Agile Model emphasizes iterative development and flexibility, allowing teams to adapt swiftly to changing requirements. For investment managers, this means the ability to develop software in short cycles, facilitating rapid modifications in response to real-time market dynamics.

Neutech offers comprehensive engineering services, with expertise in technologies such as React, Python, .NET, GoLang, Node.js, and AWS DevOps, specifically designed to support agile methodologies. By leveraging these specialized skills, Neutech fosters collaboration and continuous improvement, making them well-suited for projects where requirements are likely to evolve.

This adaptability can significantly enhance investment groups’ responsiveness to market fluctuations. To explore how Neutech can help your investment portfolio thrive in a fast-paced environment, schedule a complimentary consultation today!

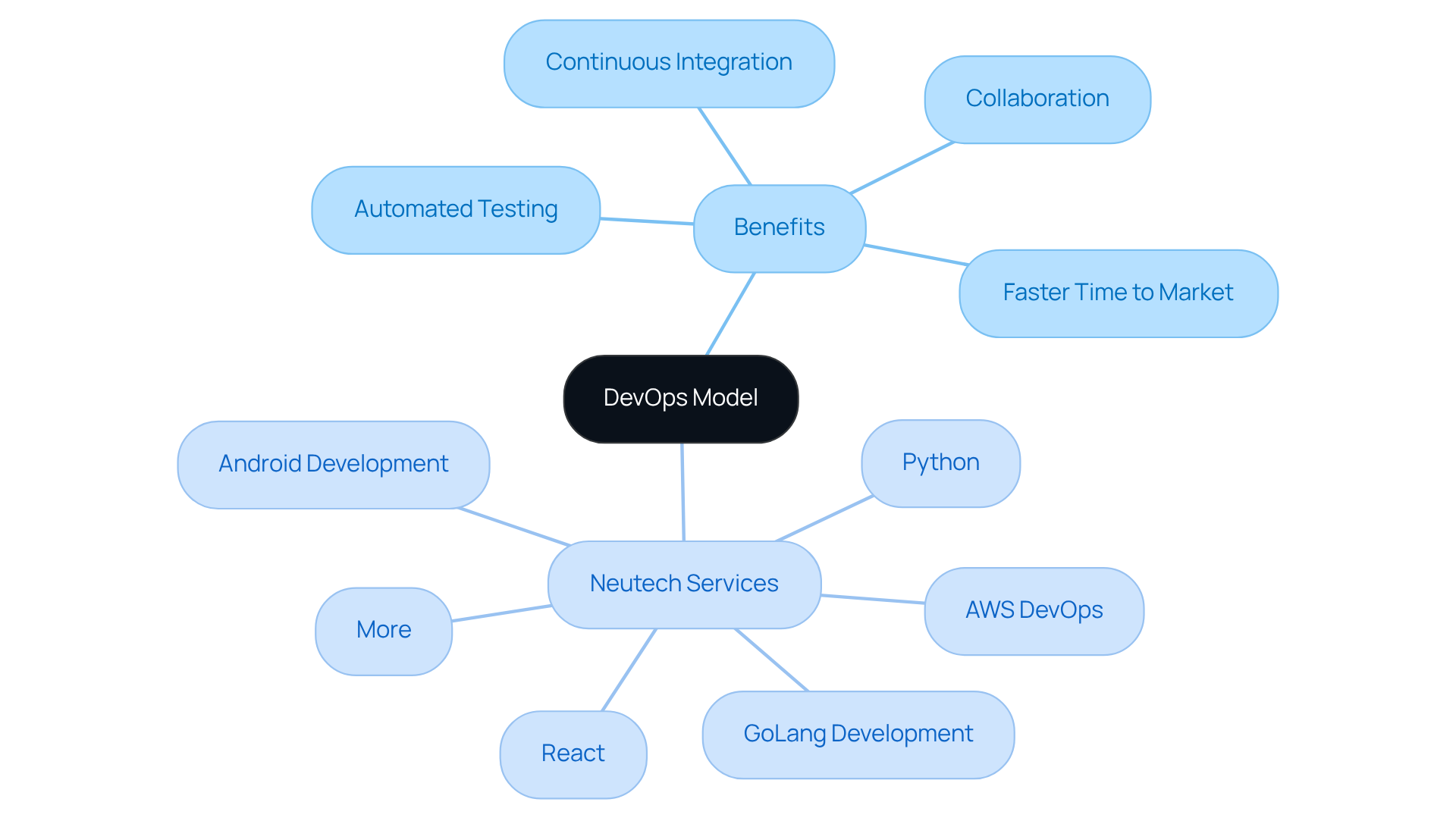

DevOps Model: Enhancing Collaboration for Continuous Delivery

The DevOps model plays a vital role in fostering collaboration between development and operations teams, leading to significant improvements in the delivery process. For investment managers, this model is indispensable as it enables continuous integration and delivery of updates. By automating testing and deployment, DevOps accelerates time to market while enhancing the reliability of releases. This methodology promotes a culture of collaboration and accountability, which is crucial in the ever-evolving landscape of financial services.

Neutech offers comprehensive engineering services, including expertise in:

- React

- Python

- AWS DevOps

- Android Development

- GoLang Development

- More

These services ensure that hedge fund managers receive tailored solutions that meet the rigorous demands of regulated industries. We invite you to discuss how Neutech can support your application development needs.

Incremental Model: Managing Risk Through Gradual Delivery

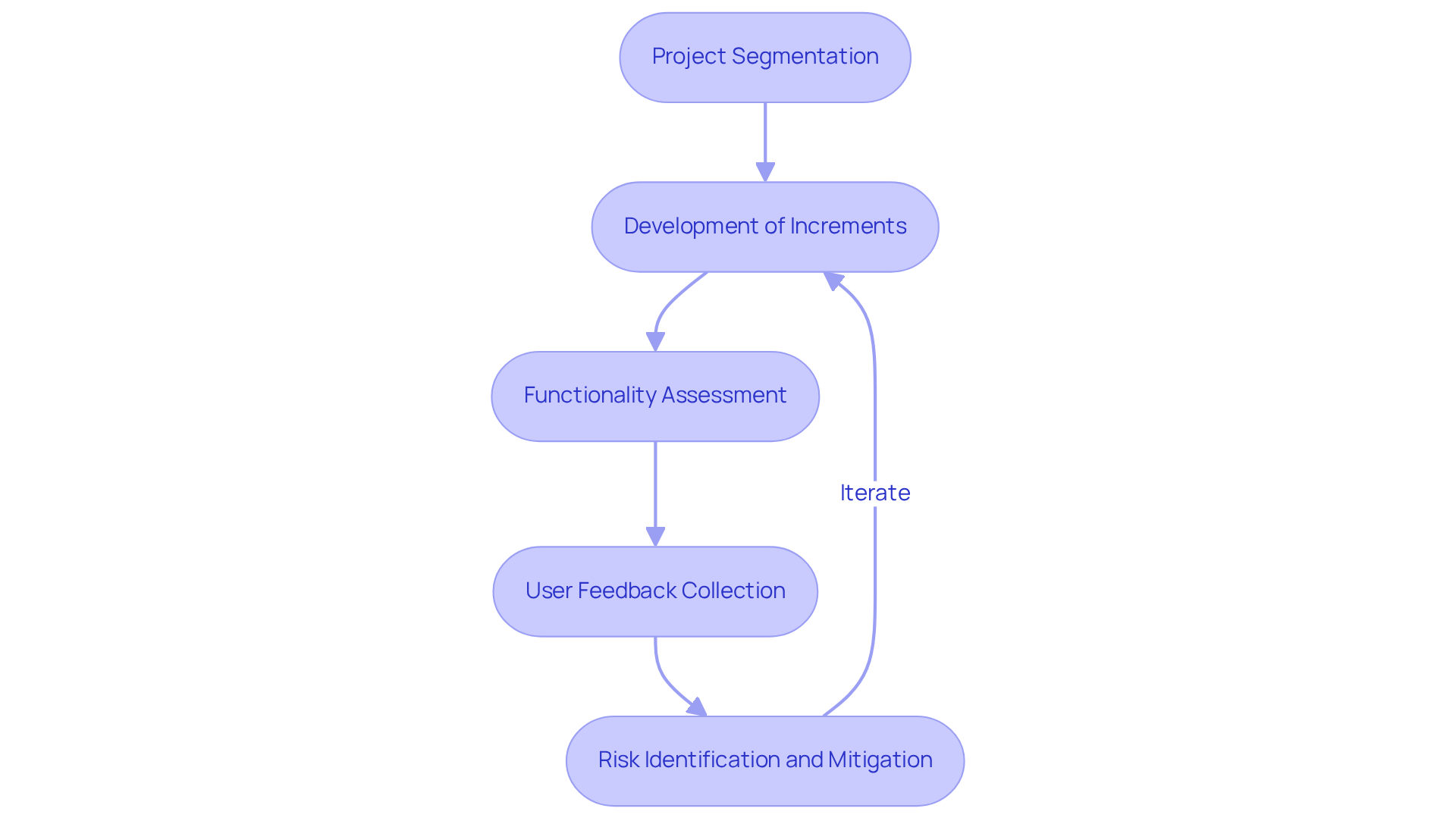

The Incremental Model is one of the software delivery models that involves the development of software in small, manageable segments, facilitating gradual delivery and integration. This method proves particularly beneficial for hedge fund managers, as it allows for the assessment of functionality and the collection of user feedback at each stage. By segmenting the project into increments, potential risks can be identified and addressed early, thereby reducing the likelihood of significant issues arising later in the process.

Neutech’s comprehensive engineering capabilities, which include expertise in React, Python, and .NET development, support a more flexible and adaptive approach to technology creation, tailored specifically for regulated sectors and startups. This software delivery model not only promotes effective risk management but also aligns with Neutech’s commitment to delivering high-quality solutions that meet the distinct needs of investment managers.

Spiral Model: Balancing Development and Risk Management

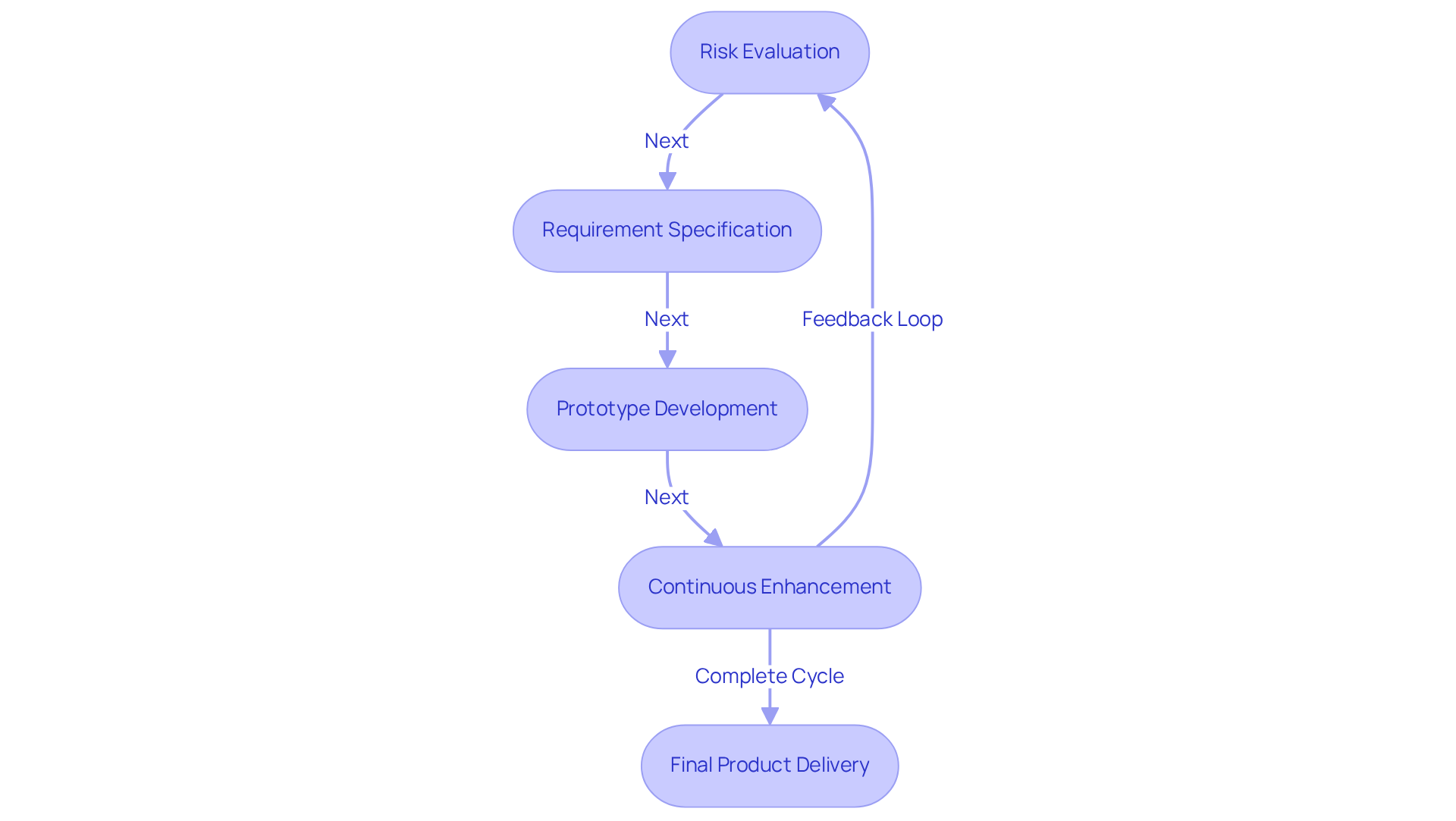

The Spiral Model represents a risk-oriented approach that effectively merges iterative development with comprehensive risk assessment, making it particularly advantageous for investment managers dealing with complex technology projects. Each iteration within the Spiral Model prioritizes risk evaluation, requirement specification, and prototype development, facilitating the continuous enhancement of the application. This iterative methodology not only enables the early detection of potential challenges but also improves adaptability to changes, thereby ensuring adherence to stringent regulatory standards.

Neutech’s extensive engineering capabilities, which include expertise in React Programming, Python Programming, and other areas, provide the customized software development necessary to support investment firms throughout this process. The iterative aspect of this model is vital in the financial sector, where the capacity to respond promptly to shifting market conditions can greatly influence success. By focusing on risk management during the development phase, investment groups can implement robust strategies that mitigate potential obstacles and capitalize on emerging opportunities.

However, it is essential to recognize that the Spiral Model also entails certain challenges, such as increased costs and complex management demands, which may not be suitable for smaller projects. Introduced by Barry Boehm in 1986, the Spiral Model’s final loop culminates in the delivery of the final product, thereby completing the cycle and underscoring its significance for hedge fund managers. As Michael Porter emphasizes, understanding risk is fundamental to formulating effective business strategies, highlighting the importance of iterative progress in the financial domain.

RAD Model: Speed and Adaptability in Software Development

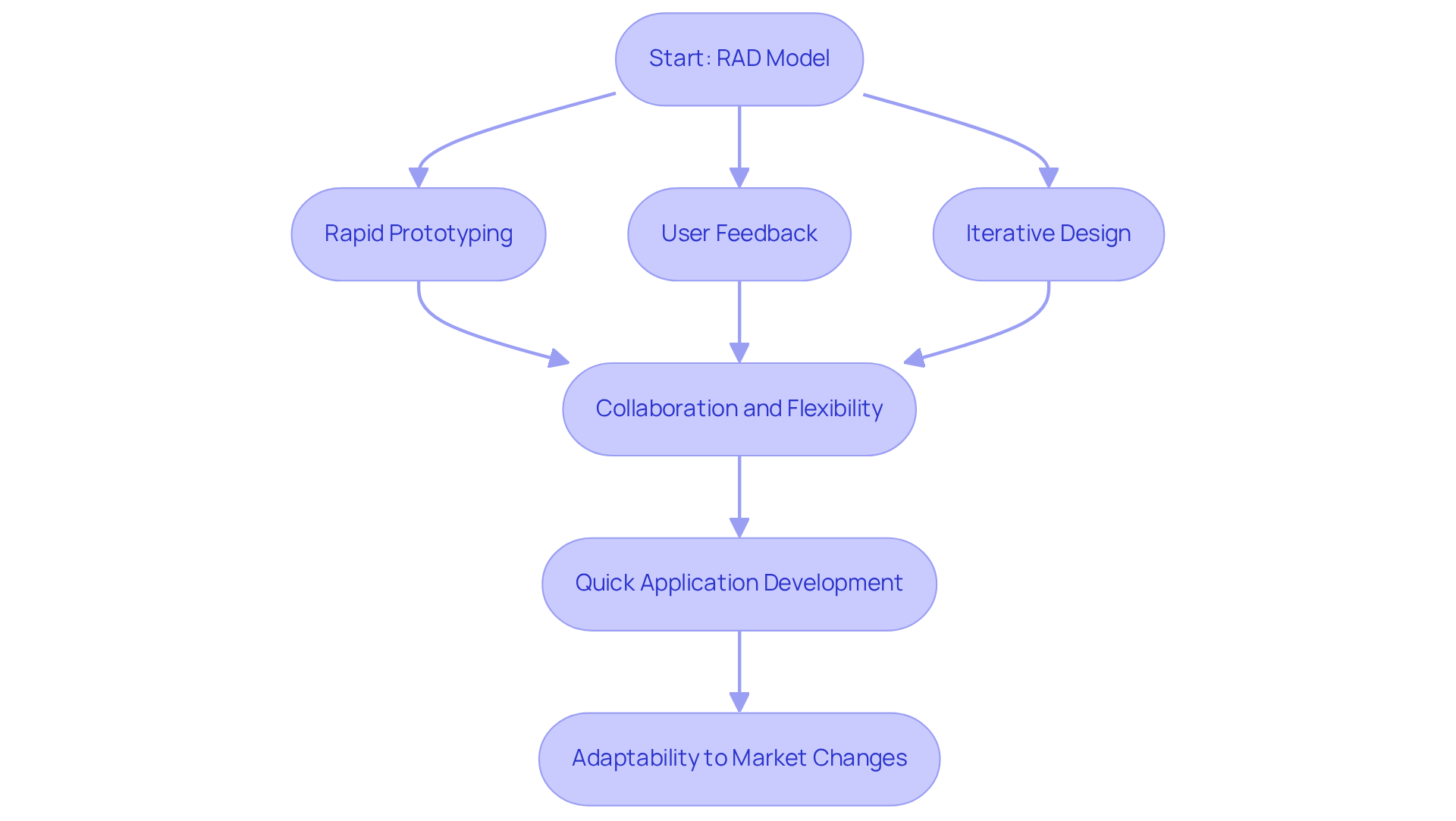

The Rapid Application Development (RAD) Model facilitates swift development and frequent iterations, allowing for rapid prototyping and immediate user feedback. For investment managers, this translates to the ability to create and enhance applications quickly, aligning with the ever-evolving market demands. The RAD approach emphasizes collaboration and flexibility, making it particularly advantageous for projects where time-to-market is critical.

By prioritizing user feedback and iterative design, investment firms can develop technology solutions that are not only efficient but also highly adaptable to changing market conditions. This model significantly accelerates delivery speed, enabling investment groups to maintain competitiveness and agility in a fast-paced environment.

Neutech further optimizes this process by assessing client needs and providing specialized developers and designers, equipped with expertise in React, Python, and other relevant technologies tailored to those specific requirements.

V-Model: Ensuring Quality Through Verification and Validation

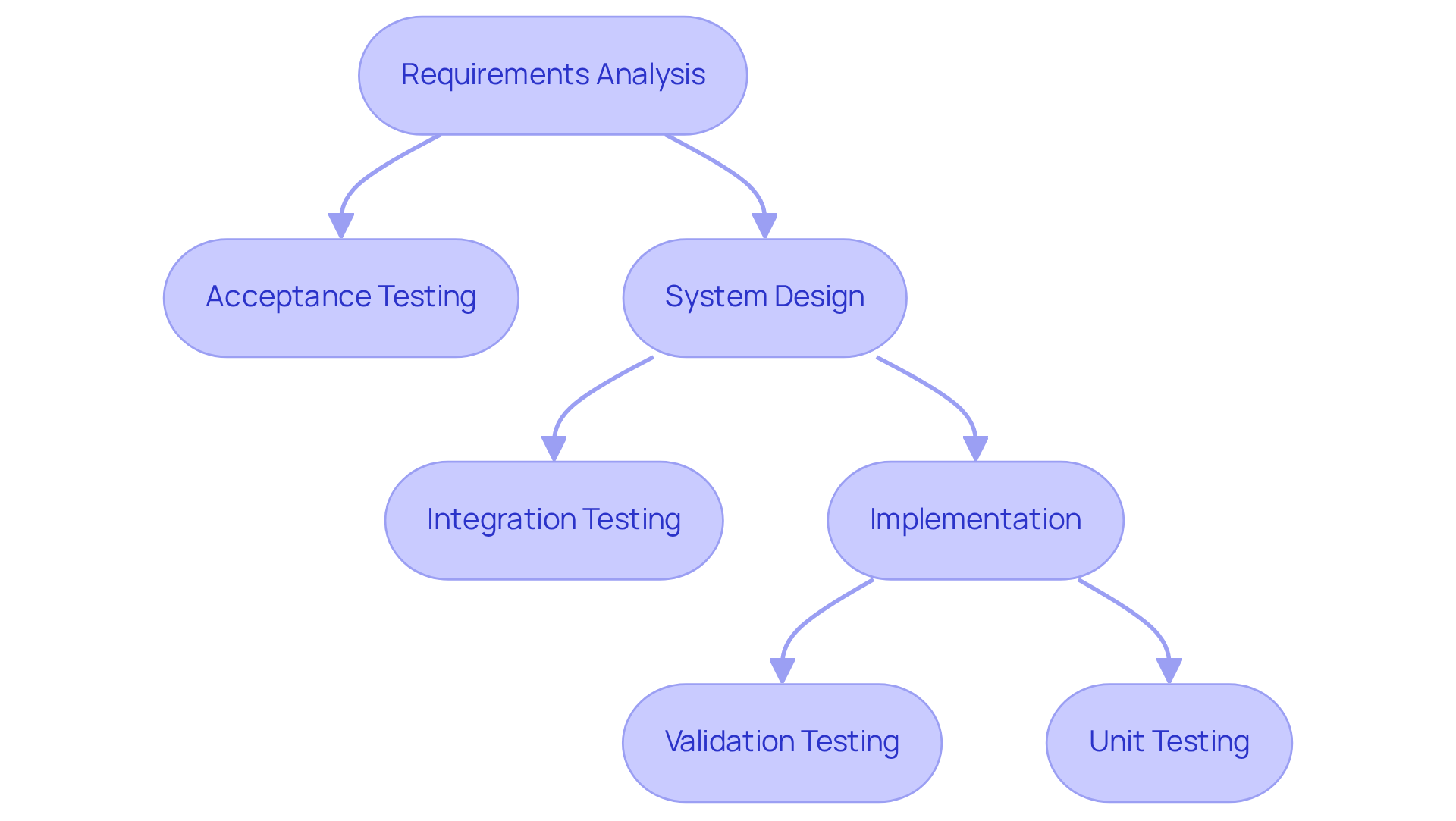

The V-Model, or Verification and Validation Model, plays a vital role in the application development lifecycle, particularly for hedge fund managers who demand high-quality, compliant solutions. This methodology emphasizes the importance of testing at every stage, ensuring that each development phase is paired with corresponding testing activities. By enabling early defect detection, the V-Model not only improves application reliability but also ensures adherence to stringent regulatory standards.

As the financial sector faces increasing scrutiny in 2026, the structured approach of the V-Model becomes essential for delivering software that satisfies both user requirements and compliance mandates. Effective verification and validation strategies, including comprehensive traceability and rigorous testing protocols, are critical for hedge funds seeking to mitigate risks and enhance operational efficiency.

Neutech’s extensive engineering services, which include expertise in React, Python, .NET, Android, and AWS DevOps, support the implementation of these strategies. Industry specialists emphasize that incorporating verification and validation into the development process is not merely a best practice; it is a fundamental requirement for maintaining trust and integrity in financial solutions.

Moreover, achieving a minimum of 80% code coverage during unit testing is crucial for ensuring application quality, as recent industry statistics indicate. The V-Model’s focus on traceability guarantees that every requirement is linked from specification to validation, reinforcing its organized approach to system development.

Iterative Model: Continuous Improvement Through Repetition

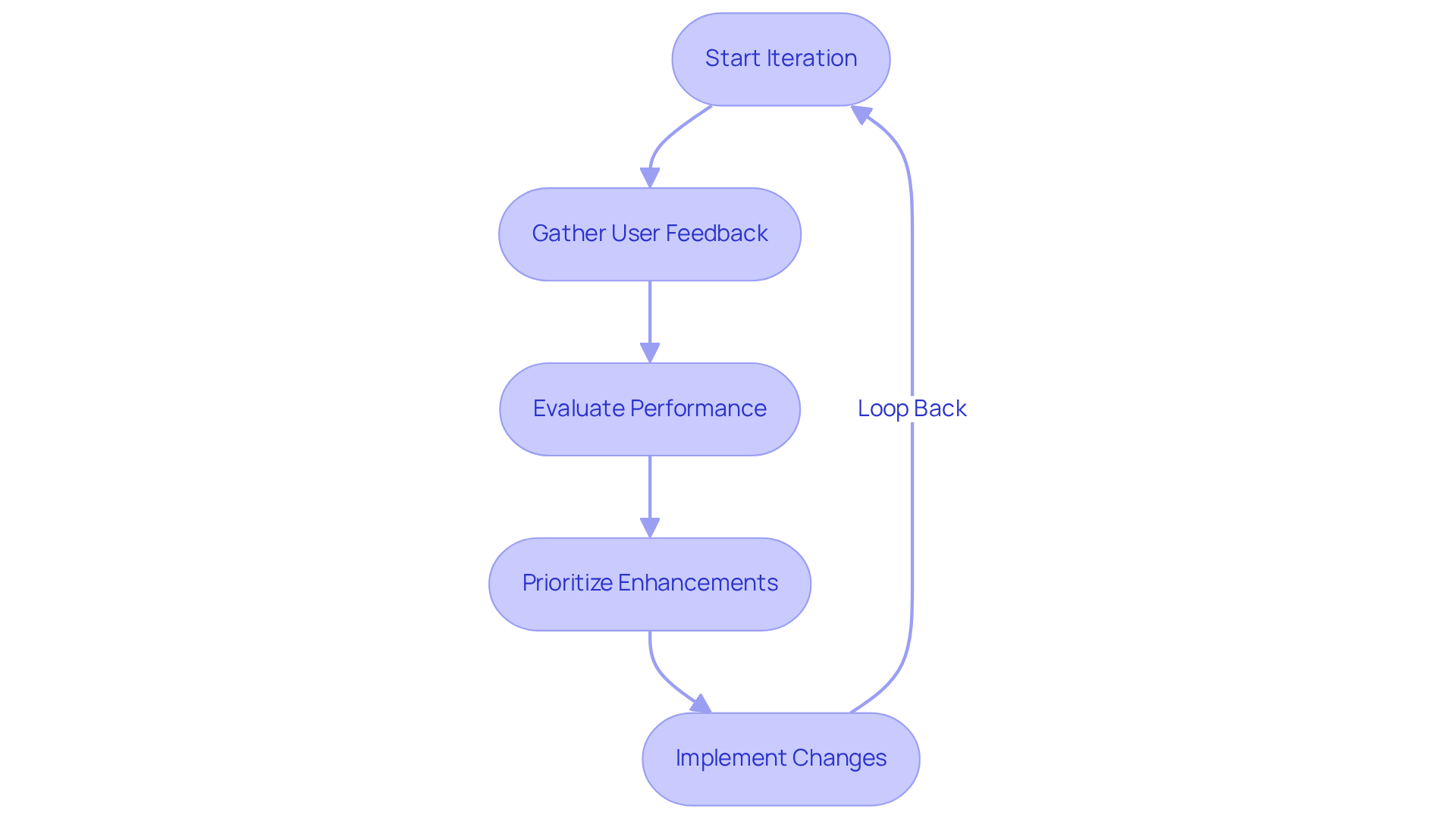

The Iterative Model represents a dynamic approach to application development, characterized by repeated cycles of refinement. This method allows investment managers to adapt their solutions in response to user feedback and shifting market conditions. Each iteration acts as a critical checkpoint for evaluating performance, identifying areas for improvement, and implementing necessary changes. Such an approach cultivates a culture of continuous enhancement, ensuring that investment management applications remain relevant and efficient in an ever-evolving financial landscape.

As investment groups face increasing demands for transparency and operational resilience, the ability to swiftly adapt technological solutions becomes essential. Neutech’s comprehensive engineering services, which include expertise in React, Python, and AWS DevOps, are tailored to meet this need by providing specialized developers and designers aligned with client requirements. Experts in program development assert that iterative cycles not only enhance functionality but also align closely with the strategic objectives of financial services, ultimately yielding better outcomes for investors and stakeholders.

To fully leverage the benefits of the Iterative Model, investment managers should consider the following actionable strategies:

- Regularly gather user feedback to guide each iteration

- Prioritize enhancements based on performance evaluations

- Ensure that technological processes align with strategic business objectives

Nick Nolan, an authority in alternative management, underscores that a robust operational infrastructure is vital for sustaining growth and maintaining allocator trust, further reinforcing the importance of the Iterative Model in today’s competitive environment.

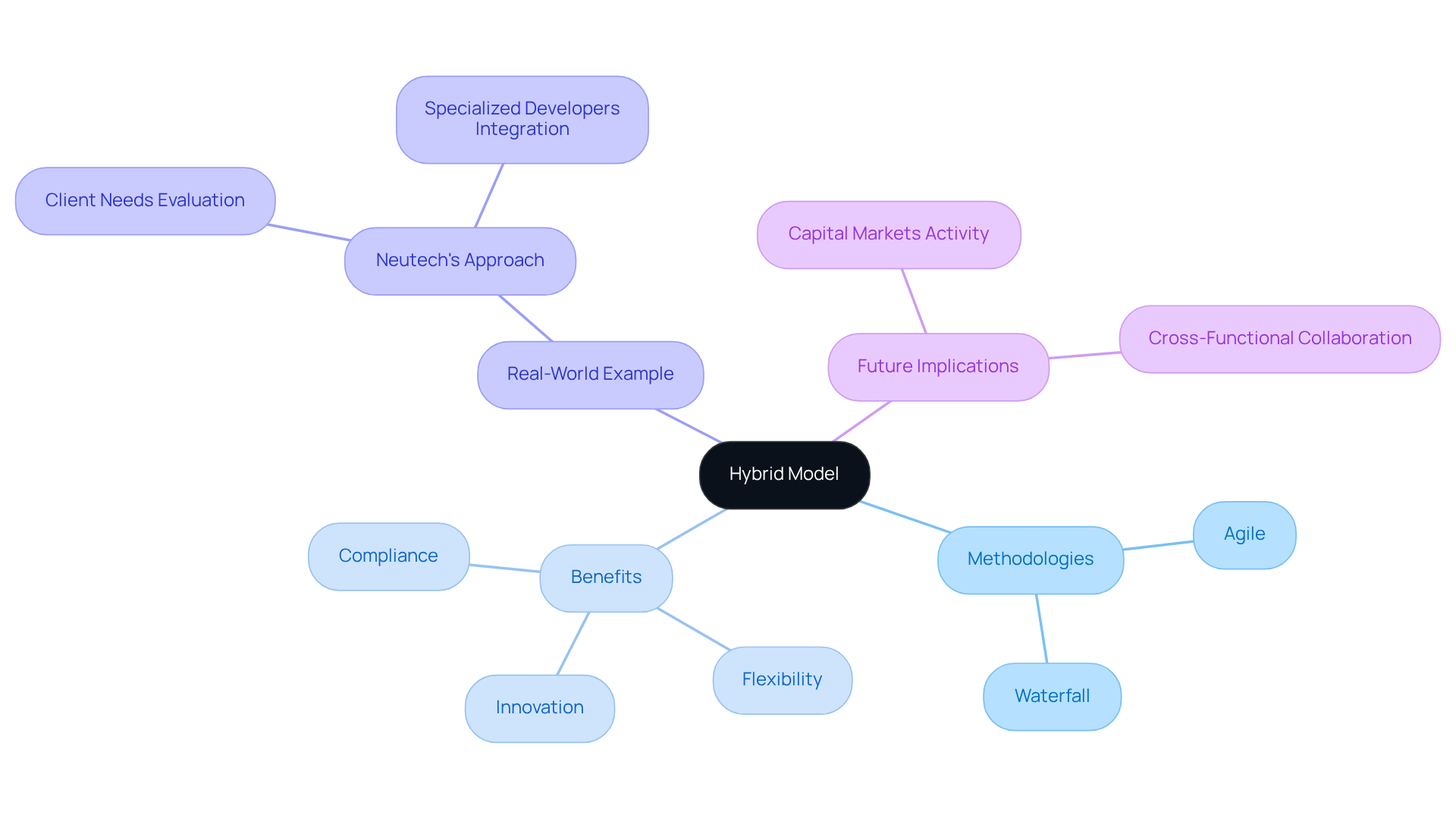

Hybrid Model: Customizing Approaches for Diverse Needs

The Hybrid Model effectively integrates elements from various development methodologies, allowing investment managers to tailor their strategies to specific project needs. This flexibility is essential in the financial sector, where projects often involve diverse complexities and strict regulatory requirements. By harnessing the strengths of methodologies such as Agile and Waterfall, the Hybrid Model enables hedge funds to optimize their processes for superior outcomes. This approach not only fosters innovation but also ensures compliance with standards and upholds high-quality software delivery models.

Neutech exemplifies this model by evaluating client needs and providing specialized developers and designers who seamlessly integrate into existing teams, thereby enhancing project execution. As James Cullum articulates, ‘Hybrid transformation is not a destination, it is a journey, one that demands humility, curiosity, and a willingness to learn.’ This viewpoint highlights the critical role of adaptability within the Hybrid Model.

Moreover, with the expected rise in capital markets activity and the potential for creative disruption in 2026, the integration of multiple methodologies becomes increasingly crucial. Cross-functional collaboration, as emphasized in industry discussions, is vital for effectively addressing these challenges and ensuring project success.

Conclusion

In hedge fund management, grasping and implementing the appropriate software delivery model is essential for navigating the complexities of the financial landscape. This article outlines ten critical software delivery models, each presenting distinct advantages tailored to the specific needs of investment managers. By utilizing these models, hedge funds can improve operational efficiency, ensure compliance with regulatory standards, and ultimately achieve superior investment outcomes.

Key insights from this discussion include:

- The structured approach of the Waterfall Model, which excels in environments with stable requirements.

- The Agile Model’s flexibility, allowing for rapid iteration and adaptation to market changes.

- Models such as DevOps and the Hybrid Model emphasize collaboration and customization, ensuring that projects align with both business objectives and regulatory demands.

Each model carries its own set of challenges and benefits, highlighting the necessity of selecting the right approach based on project-specific needs.

As the financial services sector continues to evolve, investment managers are urged to explore these software delivery models and consider their integration into technology strategies. Adopting a tailored approach can significantly enhance responsiveness to market dynamics and foster innovation, ultimately positioning hedge funds for success in a competitive environment. By collaborating with specialized engineering firms like Neutech, hedge funds can access the expertise required to implement these models effectively, ensuring their technology solutions are both robust and compliant.

Frequently Asked Questions

What is Neutech’s primary focus in terms of engineering talent?

Neutech specializes in providing hyper-specialized engineering talent tailored for regulated industries, particularly in financial services.

How does Neutech ensure the quality of its engineering talent?

Neutech has developed a rigorous residency program in collaboration with the University of São Paulo, which cultivates engineers to achieve senior-level proficiency and acquire critical industry-specific insights.

What is Neutech’s employee retention rate, and why is it significant?

Neutech has an impressive employee retention rate, which underscores its reliability and assures investment groups of the continuity and expertise of their resources.

What is the zero-bench philosophy at Neutech?

Neutech’s zero-bench philosophy guarantees that all engineers are actively engaged in projects, allowing hedge funds to scale their resources effectively as needed.

How does Neutech’s contract framework operate?

Neutech offers a flexible month-to-month contract framework, positioning itself as an essential partner in navigating technology development complexities within the financial sector.

What is the Waterfall Model in software development?

The Waterfall Model is a linear and sequential approach to application development where each stage must be completed before progressing to the next.

What are the advantages of using the Waterfall Model?

Advantages include a clear structure, comprehensive documentation that facilitates effective project tracking, and the potential for high-quality outcomes when requirements are well-defined.

What are the challenges associated with the Waterfall Model?

The model’s rigidity complicates accommodating changes once a phase is completed, and research indicates a high failure rate for projects using this model.

For what type of projects is the Waterfall Model best suited?

The Waterfall Model is optimally suited for projects characterized by stable requirements, where the clarity of the process can be fully leveraged.

How does the Agile Model differ from the Waterfall Model?

The Agile Model emphasizes iterative development and flexibility, allowing teams to adapt quickly to changing requirements, while the Waterfall Model follows a strict linear sequence.

What technologies does Neutech support for Agile methodologies?

Neutech offers expertise in technologies such as React, Python, .NET, GoLang, Node.js, and AWS DevOps, specifically designed to support Agile methodologies.

How can Neutech help investment managers with software development?

By leveraging specialized skills and fostering collaboration and continuous improvement, Neutech enhances investment groups’ responsiveness to market fluctuations.