Introduction

Financial automation software is reshaping the operational landscape for hedge fund managers, fundamentally altering their approach in a competitive market. By streamlining repetitive tasks and improving data accuracy, these tools not only enhance operational efficiency but also lead to substantial cost savings and better decision-making capabilities.

However, as firms adopt this technology, they encounter the critical challenge of ensuring robust cybersecurity and adhering to regulatory compliance.

What key benefits can financial automation deliver for hedge fund managers, and how can they effectively navigate the complexities of implementation to fully realize its potential?

Enhance Operational Efficiency with Financial Automation Software

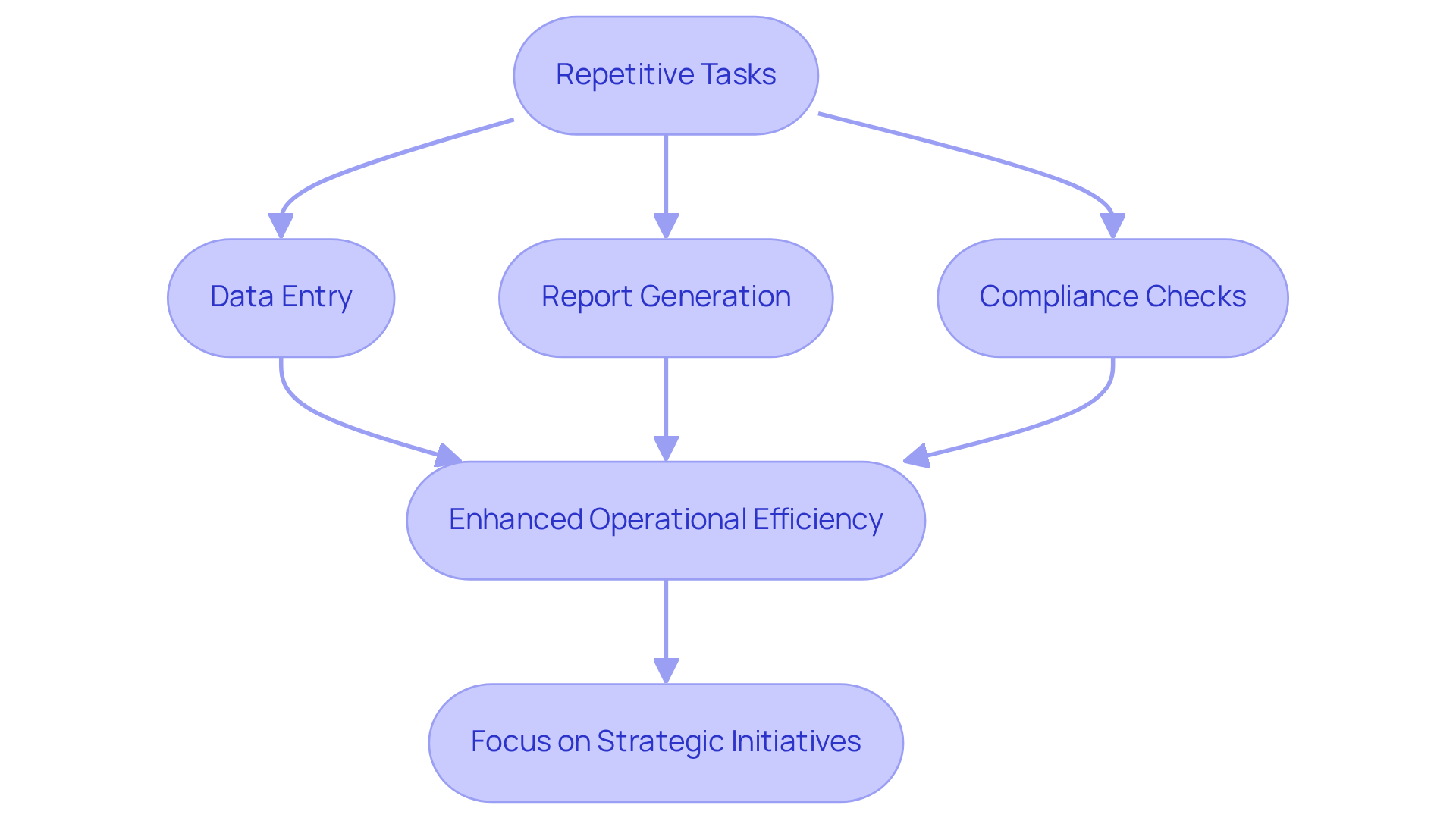

Financial automation software enables hedge fund managers to streamline repetitive tasks such as data entry, report generation, and compliance checks. By minimizing the time dedicated to these manual processes, firms can significantly enhance their operational efficiency using financial automation software. This improvement allows teams to redirect their focus toward strategic initiatives.

For example, financial automation software can substantially reduce the time needed for month-end closes by automating budget reporting. This efficiency enables managers to concentrate on analyzing performance metrics rather than merely compiling data.

Achieve Greater Accuracy in Financial Reporting

Automated monetary reporting tools, such as financial automation software, are essential for minimizing human error by standardizing data entry and calculations. These advanced systems utilize financial automation software to integrate data from multiple sources, ensuring that reports reflect the most accurate and up-to-date information.

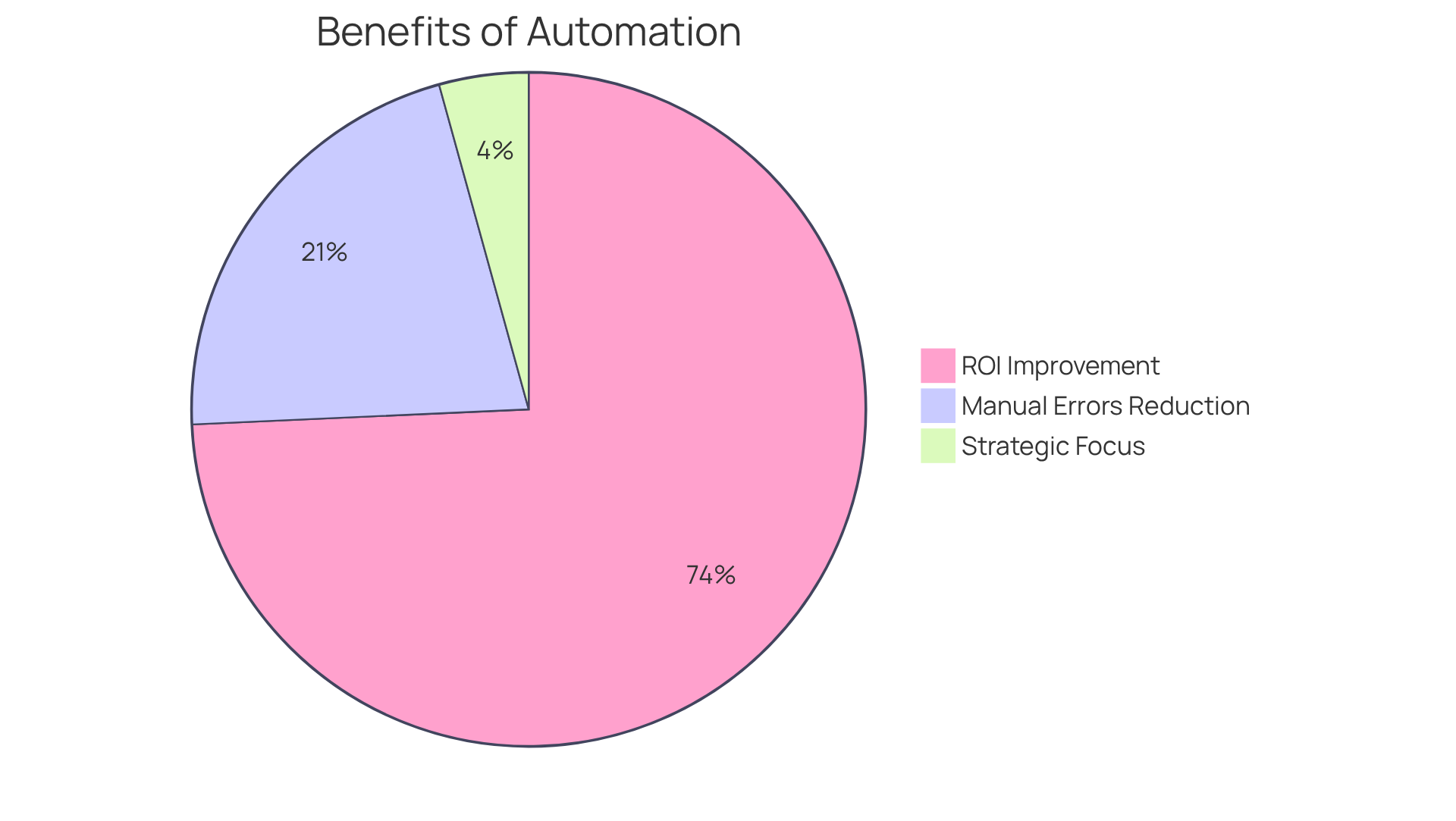

For example, automated reconciliation processes can quickly detect discrepancies, allowing managers to address issues proactively before they escalate. Hedge funds that have implemented these technologies report significant improvements in accuracy, with some achieving up to a 90% reduction in manual data entry errors.

Furthermore, companies utilizing financial automation software observe an average ROI of 312% within 18 months, highlighting the financial benefits of these systems. This transition not only enhances the reliability of financial reports but also enables finance teams to concentrate on strategic analysis rather than routine tasks.

Analysts emphasize that incorporating mechanization in investment reporting is vital for maintaining a competitive edge and ensuring compliance in an increasingly complex regulatory environment.

Gain Real-Time Insights for Informed Decision-Making

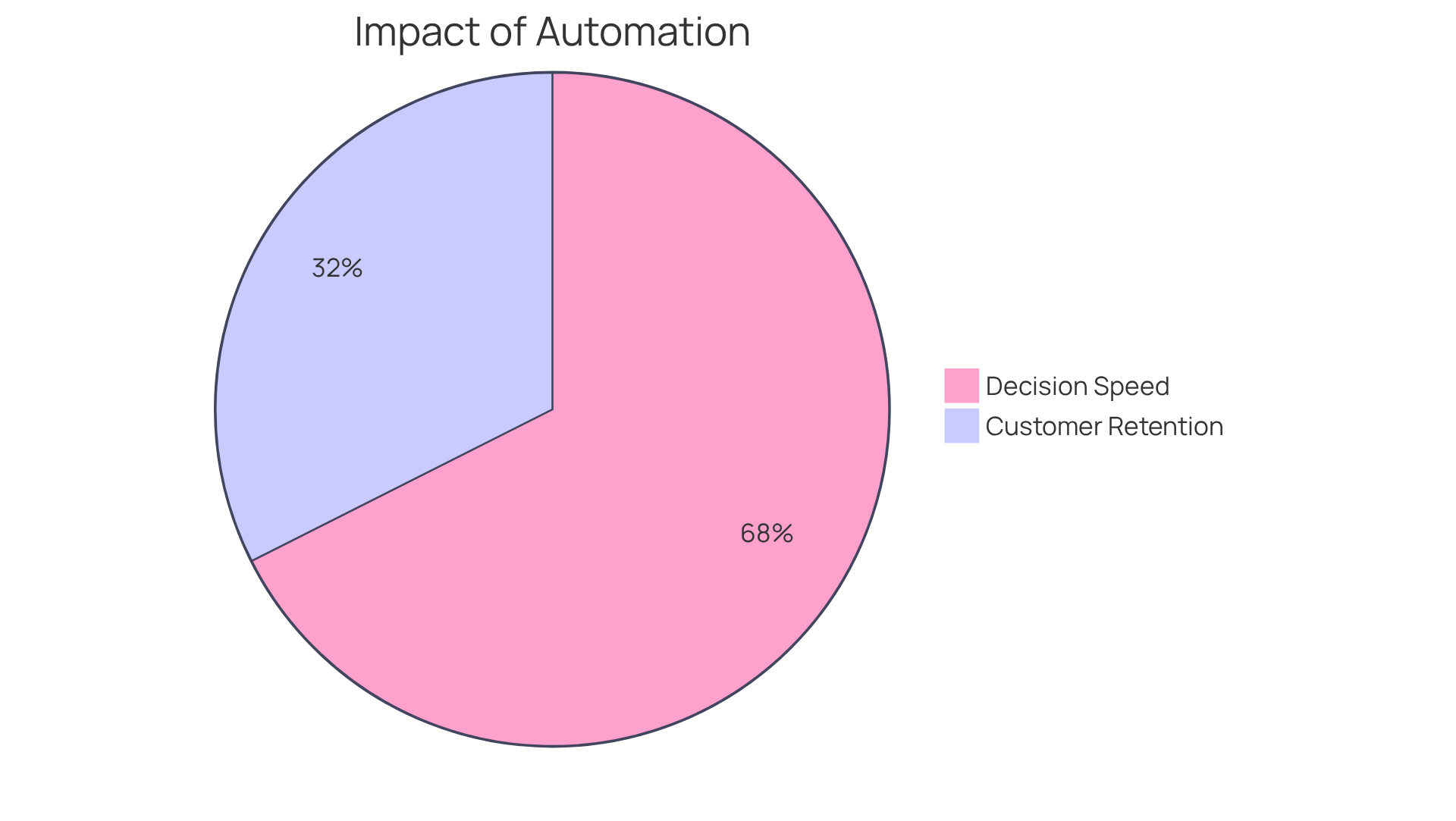

Financial automation software empowers investment managers by delivering real-time data analysis, which is a crucial factor for making timely investment decisions. With automated dashboards, managers can effectively monitor key performance indicators (KPIs) and market trends, allowing for prompt adjustments to their investment strategies based on prevailing market conditions. This capability not only accelerates decision-making but also enhances performance outcomes. For example, firms that utilize AI-driven dashboards have reported a 25% increase in decision-making speed and a 12% improvement in customer retention, highlighting the concrete advantages of real-time insights.

Leaders in hedge organizations assert that these tools are vital for navigating the complexities of the financial landscape. One manager remarked, ‘Real-time analytics provide instant visibility into market shifts, allowing us to act swiftly and confidently.’ Furthermore, 90% of investors believe that generative AI will enhance investment performance over the next three years, underscoring the growing importance of AI in investment strategies. Tom Kehoe notes, ‘Gen AI is reshaping the operating model of alternative investment firms.’

As investment groups increasingly adopt financial automation software, the integration of these dashboards is becoming standard practice, significantly influencing investment strategies and overall performance. To maintain a competitive edge, investment managers should consider implementing financial automation software to leverage real-time data for informed decision-making.

Ensure Regulatory Compliance and Reduce Risks

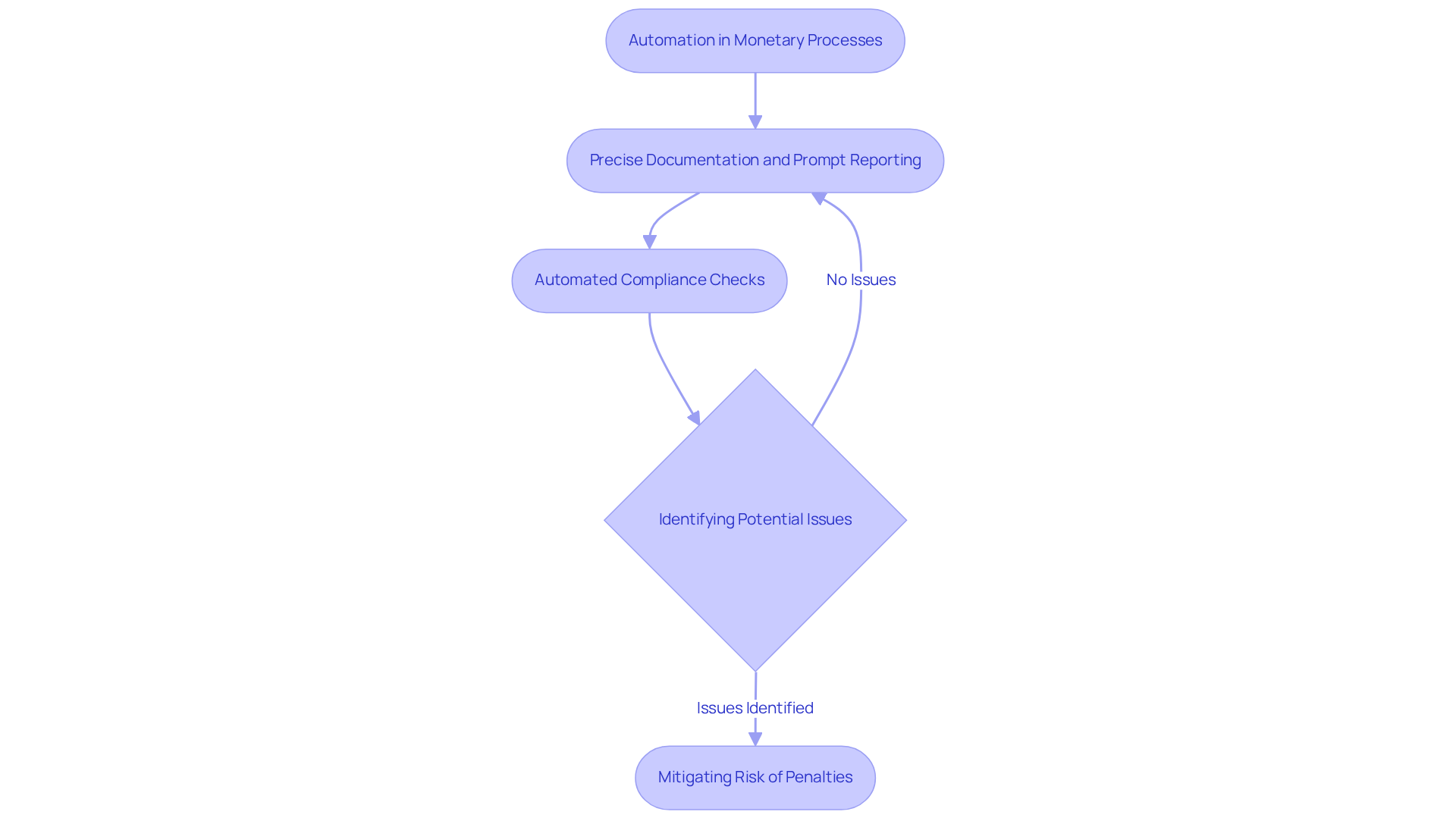

Automation in monetary processes plays a crucial role in helping investment managers maintain compliance with regulatory standards. By ensuring precise documentation and prompt reporting, automated systems enhance the overall compliance framework. Furthermore, automated compliance checks are capable of identifying potential issues before they escalate into significant problems, thereby mitigating the risk of penalties. For example, these systems can monitor changes in regulations and adjust compliance protocols accordingly, allowing firms to remain compliant without the need for manual intervention.

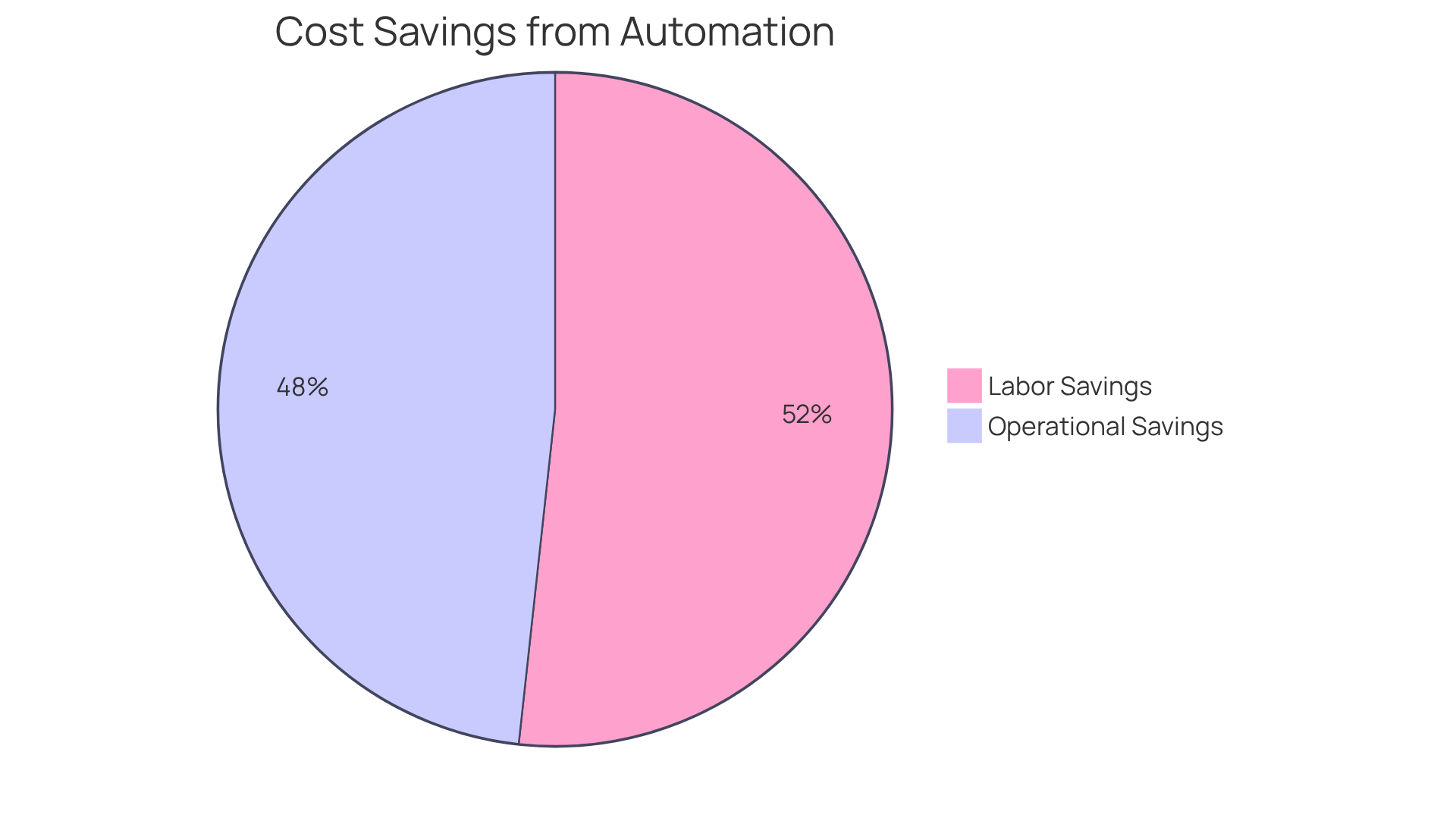

Reduce Operational Costs with Automation

Implementing financial automation software can lead to substantial cost reductions by significantly minimizing manual labor and decreasing errors that often result in expensive corrections. For instance, financial automation software can be used to automate accounts payable processes, which can decrease processing times and mitigate costs associated with late payments. A notable example is Balyasny’s creation of an AI bot, which has improved productivity and efficiency within the investment context.

Furthermore, firms can reallocate resources previously dedicated to manual tasks towards more strategic initiatives, thereby enhancing overall profitability. Financial automation software not only streamlines workflows but also ensures timely and accurate regulatory filings, thereby reducing the risk of penalties that can reach up to €20 million for non-compliance.

Financial advisors highlight that organizations generally save 25-50% on labor expenses and decrease operational costs by 30-40% through efficient technology strategies, as supported by Gartner’s research. This shift allows hedge funds to focus on growth and innovation while maintaining a competitive edge in a rapidly evolving market.

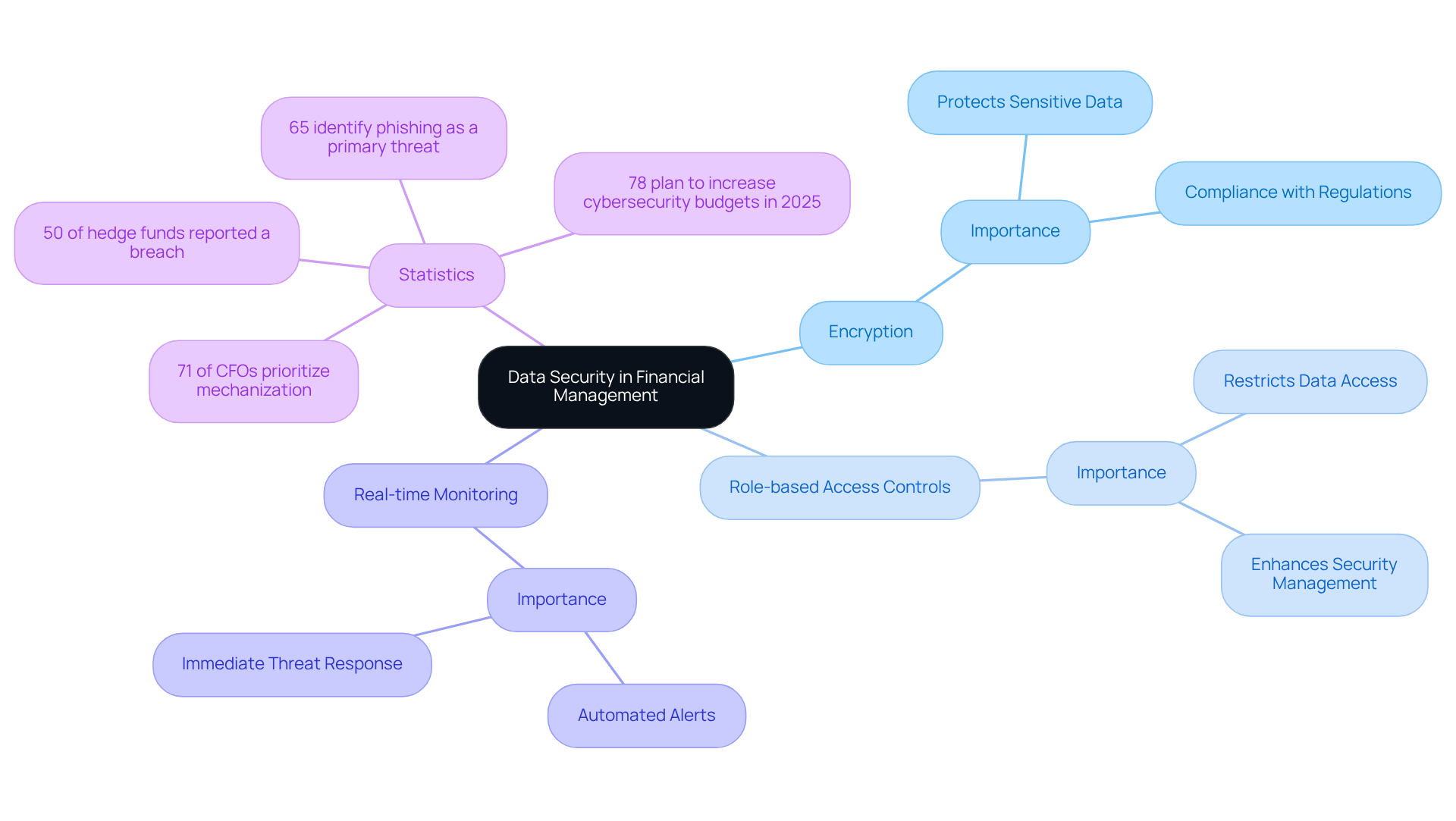

Enhance Data Security and Protect Sensitive Information

Financial management software incorporates advanced security features aimed at safeguarding sensitive data from unauthorized access. These systems employ:

- Encryption

- Role-based access controls

- Real-time monitoring

to uphold the integrity of financial information. For instance, automated alerts can swiftly inform managers of any suspicious activities, allowing for immediate action against potential threats. This proactive approach to data security is essential for maintaining client trust and ensuring compliance with regulatory standards.

As investment groups increasingly focus on digital transformation, a significant 71% of CFOs are prioritizing mechanization to enhance customer experience and security. Moreover, with 78% of investment groups planning to increase their cybersecurity budgets in 2025, the integration of technology into data protection strategies is becoming standard practice. However, it is noteworthy that 50% of investment funds reported experiencing a breach despite heightened spending, underscoring persistent challenges in cybersecurity.

Additionally, 65% of investment groups identify phishing as the primary threat, emphasizing the necessity for comprehensive automation solutions. By leveraging financial automation software and other advanced tools, investment firms can substantially reduce the risk of data breaches and bolster their overall cybersecurity posture.

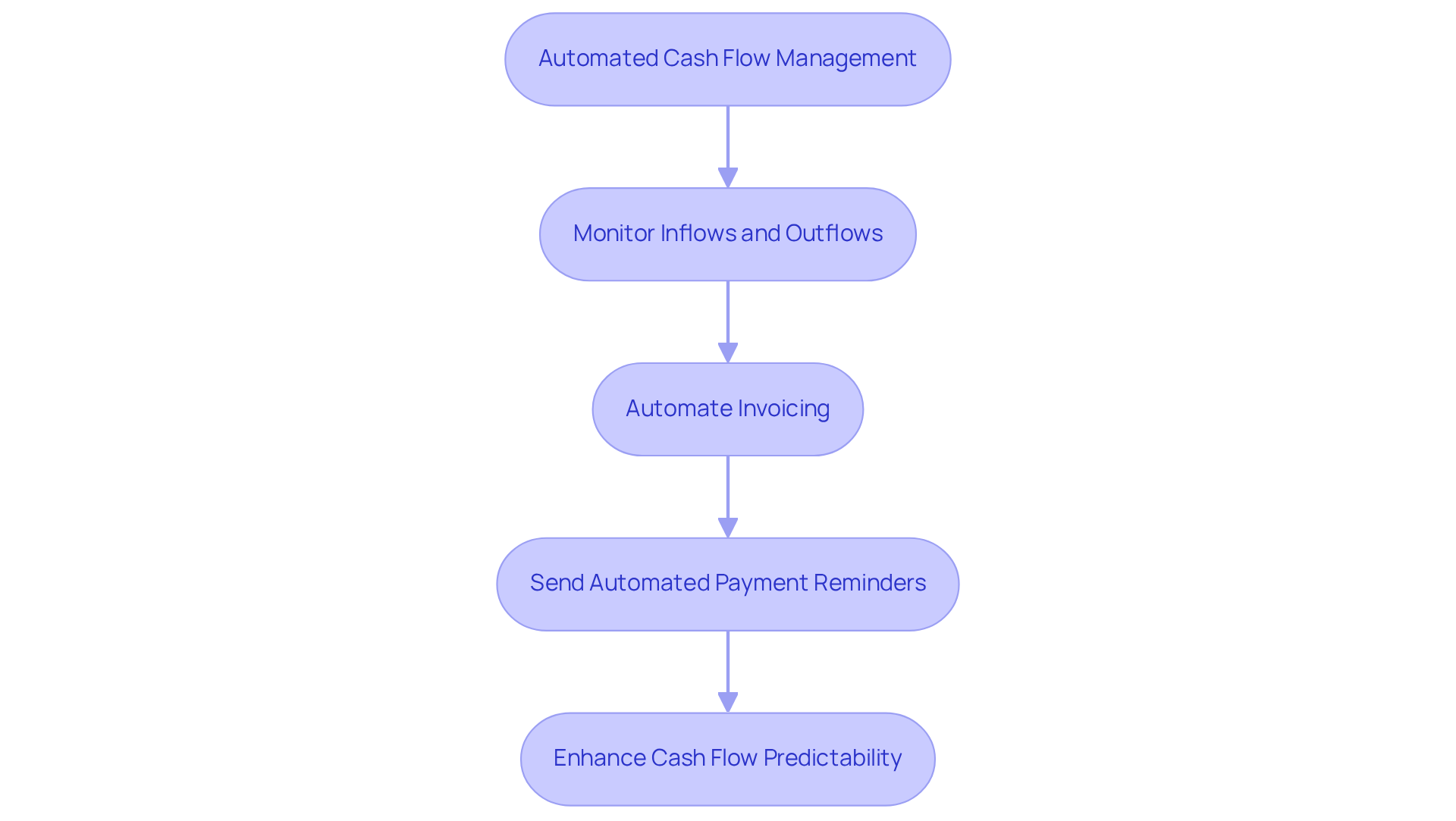

Improve Cash Flow Management with Automation

Automated cash flow management tools empower investment managers to monitor inflows and outflows in real-time, providing a clearer view of liquidity. By using financial automation software to automate invoicing and payment processes, firms can effectively reduce delays and enhance cash flow predictability. For example, automated reminders for unpaid invoices ensure prompt payments, thereby improving cash flow stability. This stability enables managers to make informed monetary decisions by utilizing financial automation software.

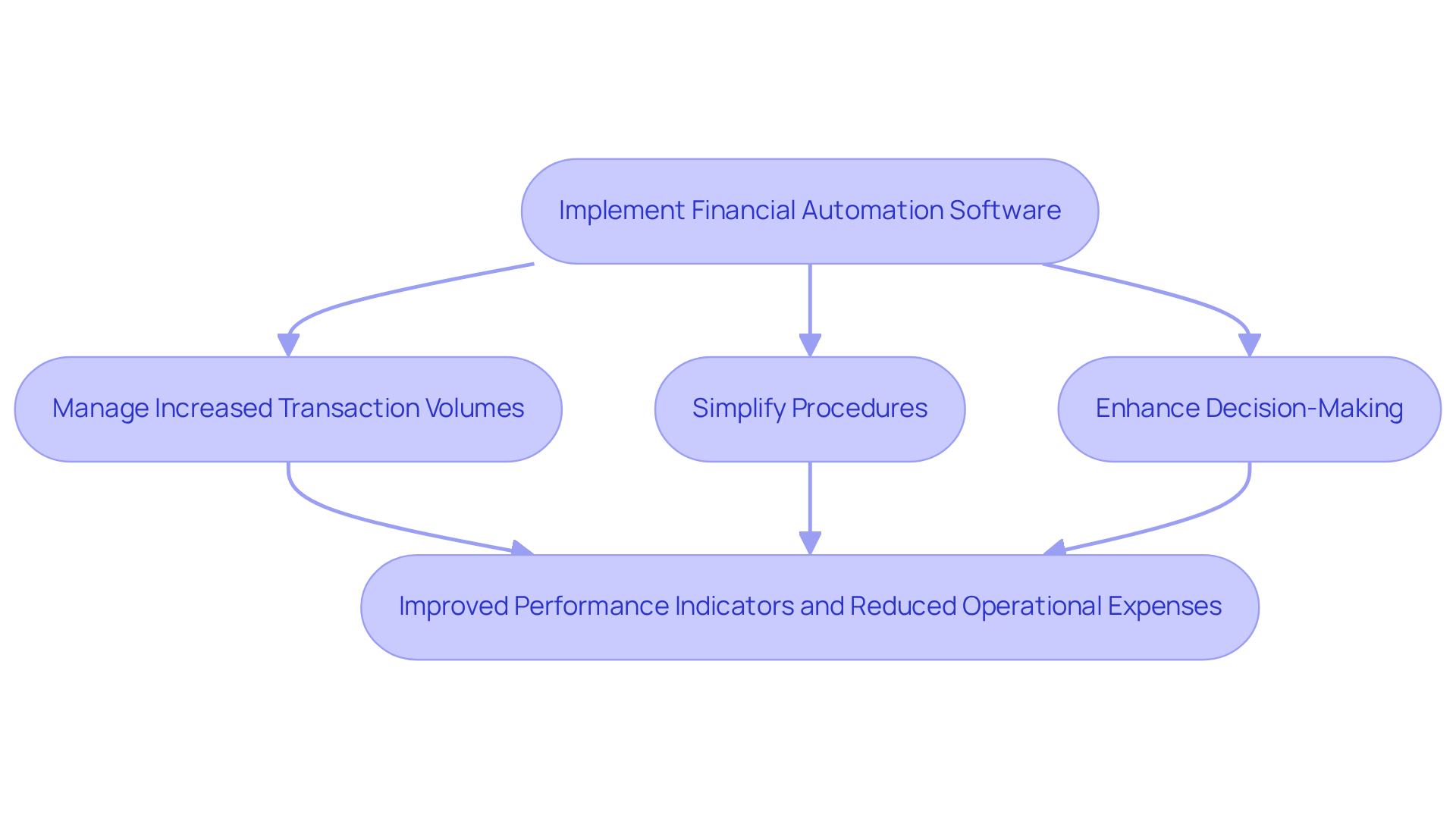

Achieve Scalability in Financial Operations

Financial software equips investment firms with the essential adaptability needed to expand operations effectively. By automating routine tasks with financial automation software, these firms can manage increased transaction volumes adeptly, without necessitating additional personnel. For example, as an investment pool grows, financial automation software seamlessly adjusts to handle larger datasets and more complex transactions. This capability is vital for sustaining operational efficiency during periods of rapid growth with the use of financial automation software.

Hedge investment leaders emphasize that mechanization not only simplifies procedures but also enhances decision-making. This enables firms to focus on strategic initiatives rather than being encumbered by manual tasks. As a result, numerous investment groups report improved performance indicators and reduced operational expenses, underscoring the significant potential of financial automation software within the sector.

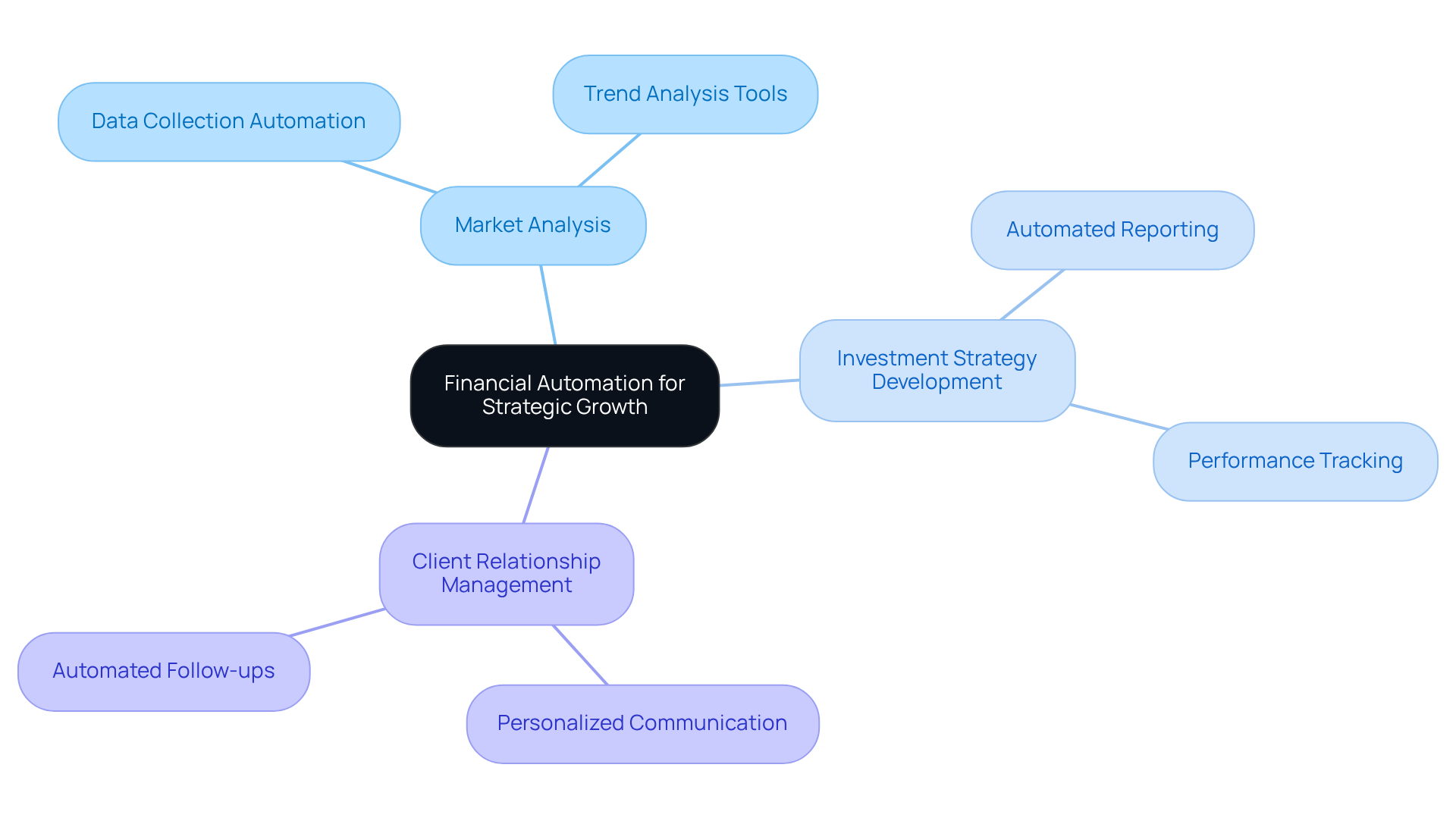

Free Up Time for Strategic Growth Initiatives

Automating regular monetary tasks with financial automation software enables investment managers to free up valuable time for strategic growth initiatives. By reducing the burden of manual processes, financial automation software enables teams to focus on critical activities such as:

- Market analysis

- Investment strategy development

- Client relationship management

For instance, automating reporting can save hours each month, allowing managers to dedicate that time to exploring new investment opportunities. Furthermore, implementing financial automation software to automate administrative tasks could potentially save companies up to $5 trillion annually, underscoring the financial advantages of such technologies.

As noted by George Soros, investment pools are an effective method for managing capital, yet they carry inherent risks. This highlights the necessity of leveraging technology to enhance operational efficiency. Additionally, with 75% of business leaders eager to adopt automation and AI to uncover new prospects, investment firms have the opportunity to capitalize on these tools to bolster their strategic initiatives and drive growth.

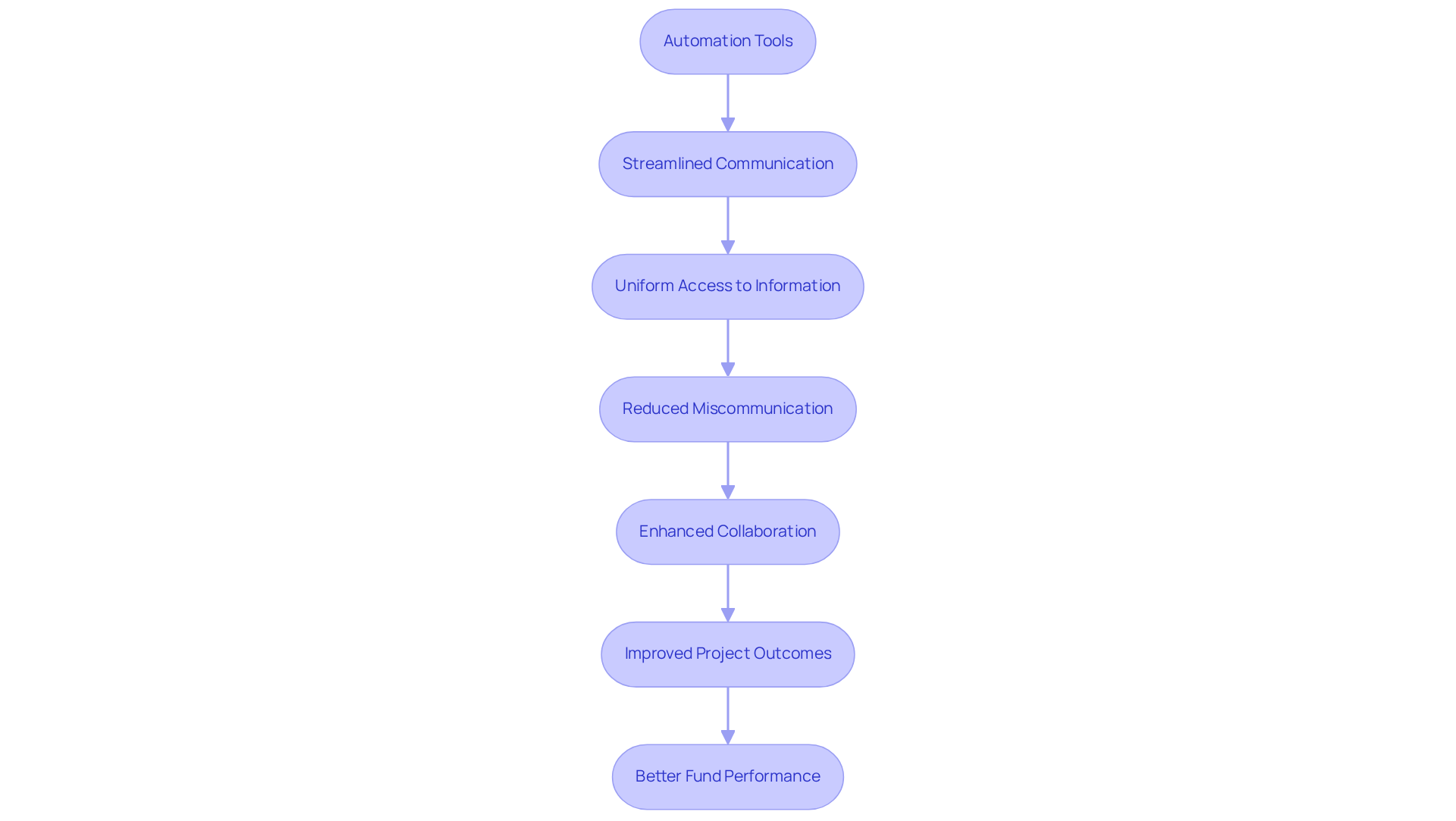

Enhance Team Collaboration and Communication

Automation tools significantly enhance collaboration among hedge teams by streamlining communication and ensuring uniform access to information. Automated project management systems, for example, keep team members informed about task progress and deadlines. This reduces the likelihood of miscommunication, which can hinder project success. As a result, enhanced collaboration fosters more efficient workflows and leads to improved project outcomes, ultimately benefiting the fund’s performance.

Conclusion

Implementing financial automation software serves as a crucial tool for hedge fund managers, enhancing operational efficiency and elevating overall firm performance. By automating repetitive tasks, investment managers can concentrate on strategic initiatives, which ultimately leads to improved decision-making and increased profitability.

This article has highlighted several key benefits of financial automation, including:

- Enhanced accuracy in financial reporting

- Real-time insights that facilitate informed decision-making

- Improved regulatory compliance

Furthermore, the reduction in operational costs and the enhancement of data security underscore the necessity of adopting this technology. The capability to scale operations seamlessly and allocate time for strategic growth initiatives positions hedge funds to thrive in a competitive landscape.

As the financial sector continues to evolve, embracing financial automation software is not merely an option; it is a critical step toward achieving sustainable success. Hedge fund managers are encouraged to leverage these advancements to:

- Streamline operations

- Mitigate risks

- Foster collaboration within their teams

By doing so, they can ensure their firms remain agile and responsive to market demands, ultimately driving growth and innovation in an ever-changing environment.

Frequently Asked Questions

What is financial automation software and how does it benefit hedge fund managers?

Financial automation software helps hedge fund managers streamline repetitive tasks such as data entry, report generation, and compliance checks, enhancing operational efficiency by allowing teams to focus on strategic initiatives.

How does financial automation software improve the month-end closing process?

It automates budget reporting, significantly reducing the time required for month-end closes, thus enabling managers to focus on analyzing performance metrics instead of compiling data.

What role does financial automation software play in improving accuracy in financial reporting?

It minimizes human error by standardizing data entry and calculations, integrating data from multiple sources to ensure reports are accurate and up-to-date, and enabling automated reconciliation processes to quickly detect discrepancies.

What improvements in accuracy have hedge funds seen after implementing financial automation software?

Hedge funds report significant improvements in accuracy, with some achieving up to a 90% reduction in manual data entry errors.

What is the average ROI for companies using financial automation software?

Companies utilizing financial automation software observe an average ROI of 312% within 18 months.

How does financial automation software aid in real-time decision-making for investment managers?

It delivers real-time data analysis through automated dashboards, allowing managers to monitor key performance indicators (KPIs) and market trends, which facilitates timely adjustments to investment strategies.

What specific benefits have firms experienced from using AI-driven dashboards?

Firms using AI-driven dashboards have reported a 25% increase in decision-making speed and a 12% improvement in customer retention.

Why do investment managers consider financial automation software essential in today’s financial landscape?

It provides instant visibility into market shifts and enhances decision-making capabilities, which are vital for navigating the complexities of the financial environment and maintaining a competitive edge.