Introduction

Asset condition monitoring software is transforming the operations of hedge funds by providing unparalleled insights into resource performance and operational efficiency. By utilizing real-time data and predictive maintenance strategies, investment firms can significantly reduce unexpected downtimes, enhance compliance, and prolong the lifespan of their assets. However, as these advancements unfold, hedge funds face the challenge of integrating such technologies while ensuring optimal performance and effective risk management. This article explores ten key benefits of asset condition monitoring software, highlighting its essential role in shaping the future of hedge fund operations.

Enhance Operational Efficiency with Asset Condition Monitoring Software

Asset condition monitoring software offers hedge funds real-time insights into resource performance, facilitating the swift identification of inefficiencies and the enhancement of workflows. By automating data collection and analysis, firms can significantly minimize manual errors, thereby accelerating decision-making processes. This automation not only leads to quicker response times but also cultivates a more agile operational framework, ultimately enhancing overall efficiency.

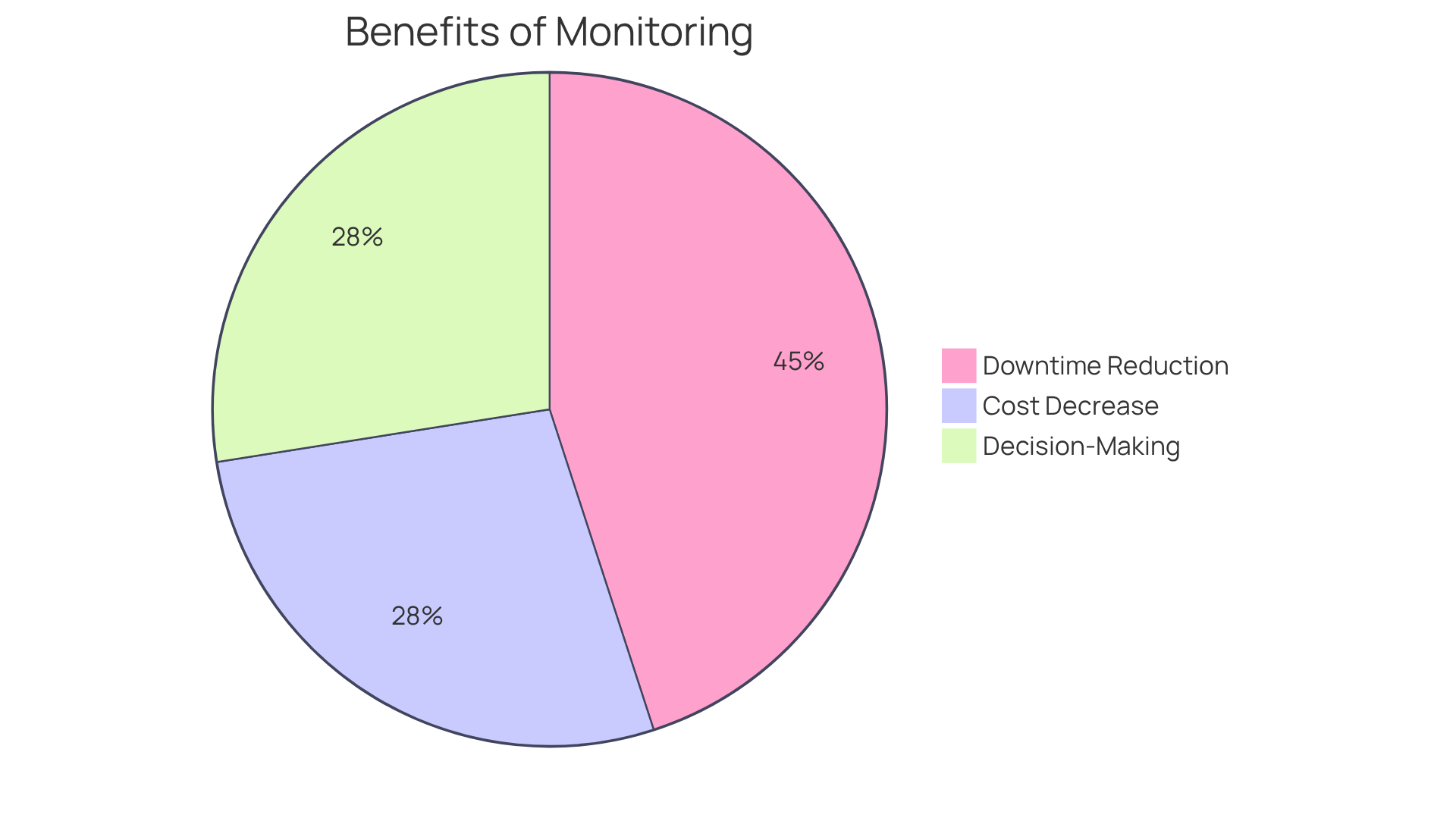

For example, organizations that implement asset condition monitoring software have reported a 40-50% reduction in unplanned downtime and a 25-30% decrease in maintenance costs, highlighting the substantial impact of this software on operational performance. Industry leaders further assert that timely interventions and optimized maintenance routines, supported by asset condition monitoring software, extend asset lifespan and maximize return on investment, reinforcing the strategic advantage of integrating such technologies into financial operations.

Moreover, real-time monitoring can detect delays in market price feeds, averting potential cascading failures in trading workflows. The advanced analytics and visualization capabilities of asset condition monitoring software streamline operations and optimize resource allocation, establishing it as an indispensable tool for investment firms.

Minimize Unexpected Downtime through Predictive Maintenance

Asset condition monitoring software enables hedge firms to continuously monitor resource conditions and receive timely alerts regarding potential failures through predictive maintenance. This proactive approach facilitates swift interventions, significantly mitigating the risk of unexpected downtime.

For instance, when a critical trading system shows signs of wear, maintenance can be scheduled in advance, protecting trading activities and ensuring smooth operations. Hedge vehicles that implement such oversight solutions often report average downtime reductions of 35-50 percent, as highlighted by various industry studies, leading to improved operational continuity and enhanced financial performance.

Moreover, the annual cost of equipment failures for companies reaches $1.4 trillion, illustrating the financial repercussions of neglecting predictive maintenance. By prioritizing the oversight of resource conditions through asset condition monitoring software, companies can not only protect their trading capabilities but also optimize their overall maintenance costs, which can decrease by 20-40 percent, as evidenced by case studies like Fiberon achieving a 2.5× ROI during an eight-month pilot with Augury.

This strategy not only preserves profit margins but also bolsters the confidence of clients and stakeholders in the operational resilience of the investment vehicle.

Ensure Regulatory Compliance with Advanced Monitoring Solutions

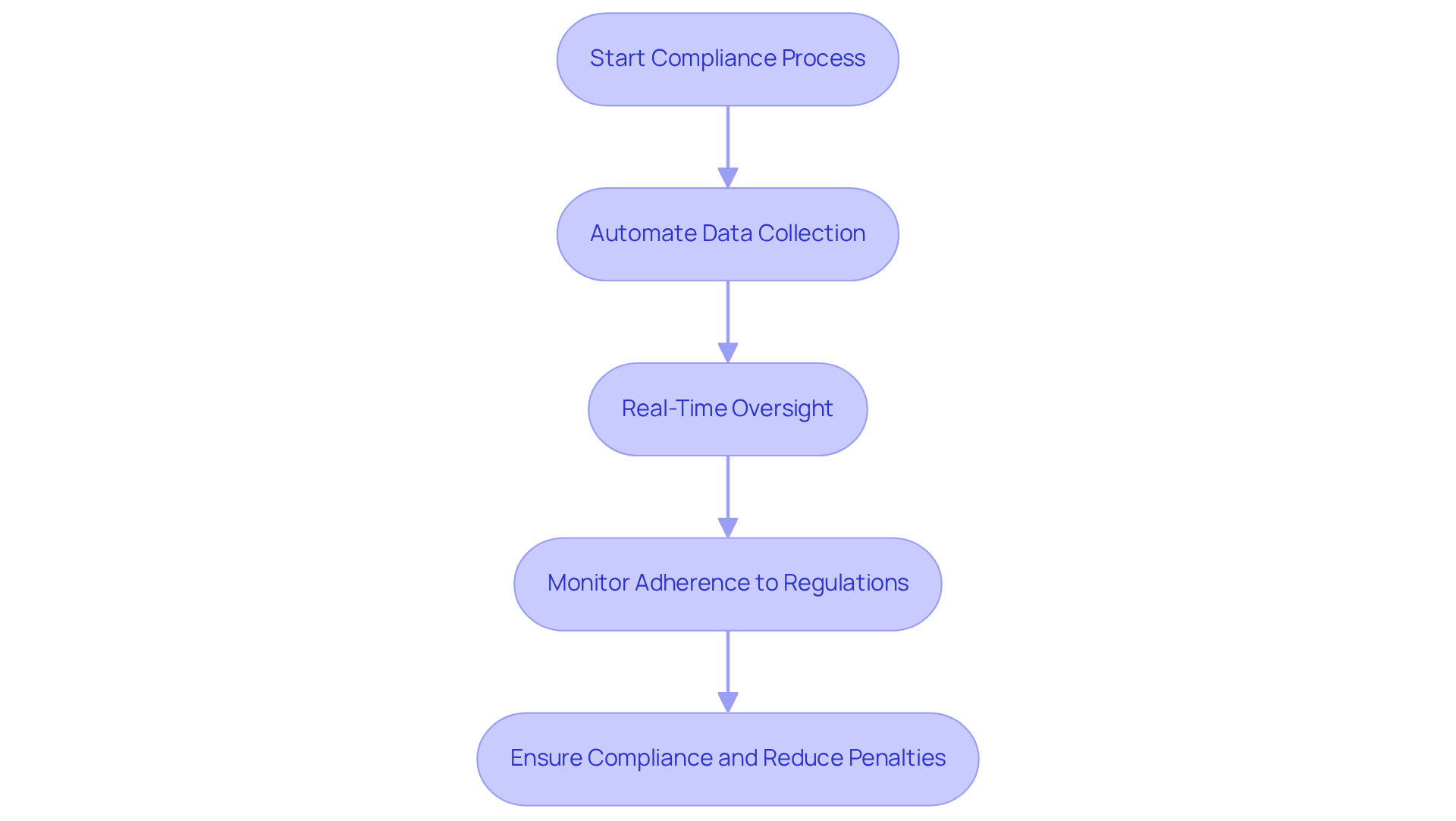

Sophisticated resource condition assessment solutions equip investment groups with essential tools to ensure compliance with regulatory standards. By automating data collection and reporting, these systems guarantee that operational practices align with industry benchmarks. For example, real-time oversight facilitates the monitoring of adherence to financial regulations, thereby reducing the risk of penalties associated with non-compliance.

Extend Asset Lifespan with Continuous Monitoring

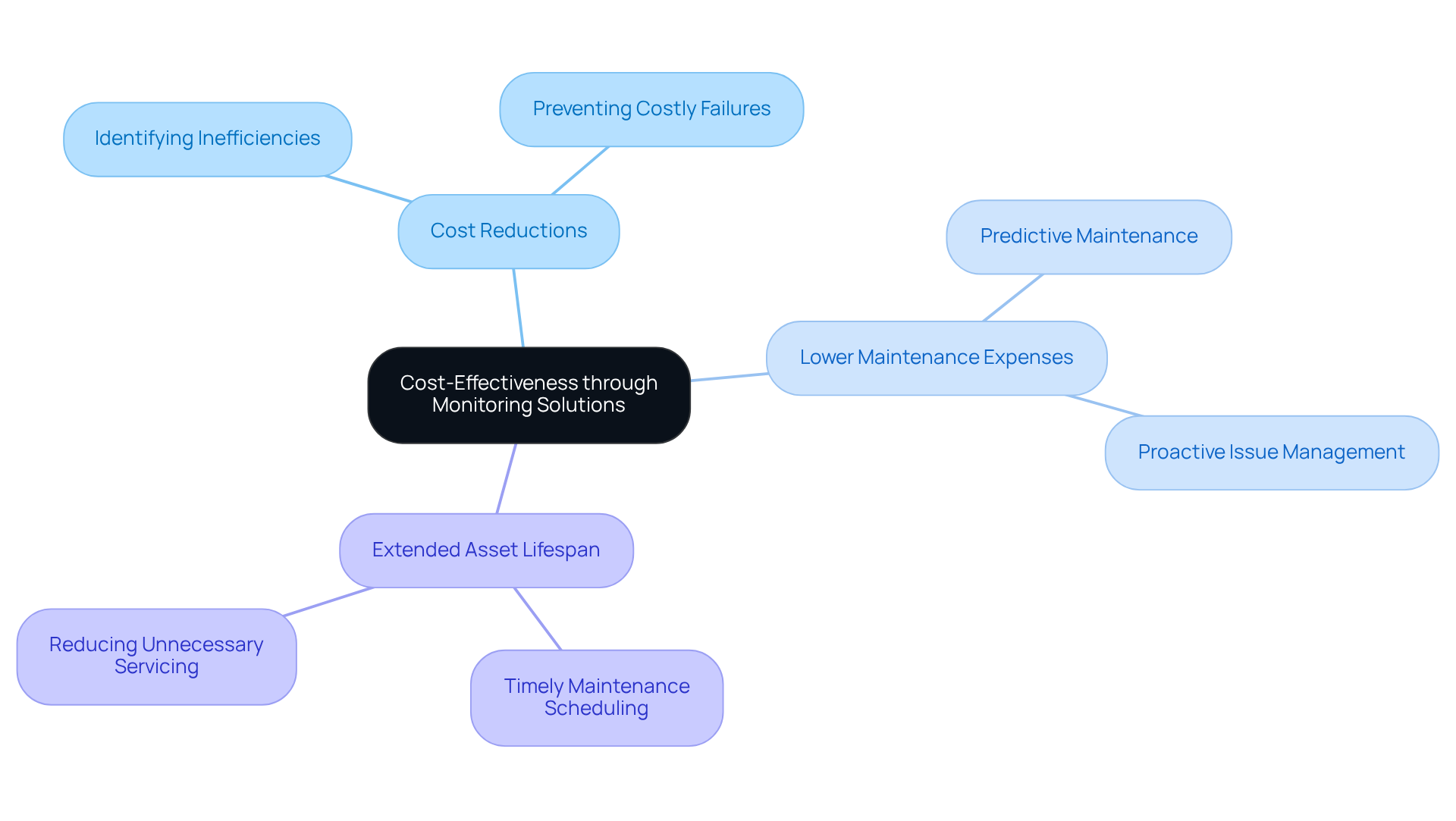

Ongoing oversight of resource conditions allows investment groups to detect and address issues proactively, preventing them from escalating into major failures. By implementing a proactive maintenance strategy, firms can significantly extend the lifespan of critical resources, such as trading platforms and data servers. This approach minimizes replacement costs and enhances the overall reliability of operations. For example, organizations that adopt predictive maintenance can realize up to a 40% reduction in maintenance costs, illustrating the financial advantages of such strategies.

Furthermore, continuous supervision enhances compliance by providing real-time records and automated reporting, ensuring that investment groups adhere to regulatory standards. Consequently, firms can maintain operational integrity while improving their resource management processes. Notably, 67% of manufacturers are actively implementing preventive maintenance to reduce downtime, underscoring the increasing significance of these strategies within the industry. Additionally, 32% of maintenance leaders regard maintenance as a profit center, further highlighting the financial benefits associated with proactive maintenance.

Leverage Real-Time Data Analytics for Informed Decisions

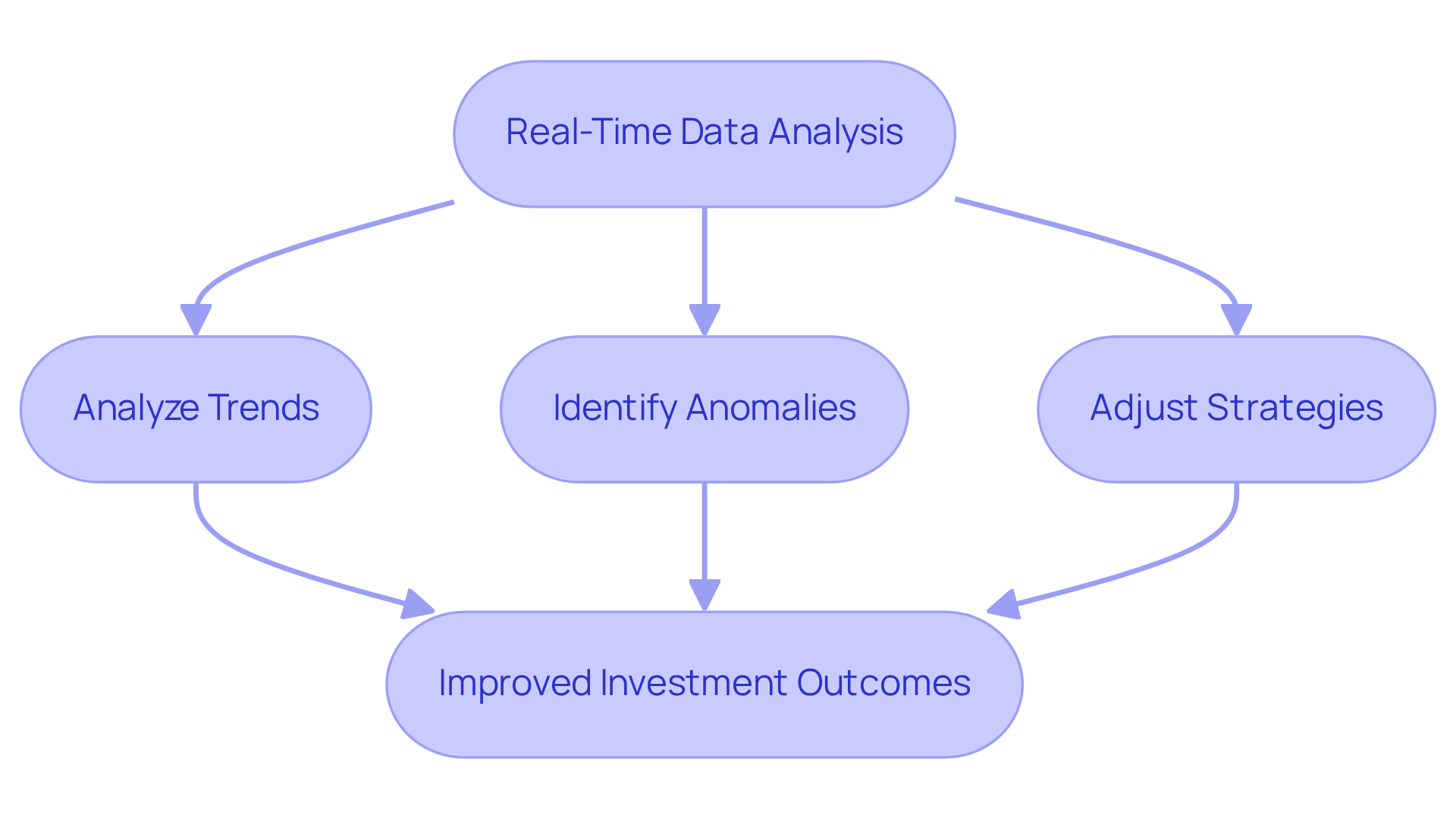

Asset condition monitoring software equips investment groups with real-time data analysis, enabling informed decision-making based on the latest performance metrics. By analyzing trends and identifying anomalies, firms can quickly adapt their strategies, optimizing their investment approaches. For example, when data reveals a decline in asset performance, investment groups can adjust their strategies to mitigate potential losses. This agility enhances risk management and allows resources to capitalize on emerging opportunities, ultimately leading to improved investment outcomes.

As Sarah McCullough, a Portfolio Manager, stated, “The real-time alerts are our safety net… allowing us to adjust our position proactively.”

Furthermore, research from McKinsey in 2023 shows that investment pools leveraging operational metrics have increased earnings prediction accuracy by 18%, underscoring the effectiveness of data-driven strategies in enhancing investment performance.

Achieve Cost-Effectiveness through Efficient Monitoring Solutions

Condition assessment software can lead to significant cost reductions for hedge funds. By utilizing asset condition monitoring software to identify inefficiencies and prevent costly failures, organizations can lower maintenance expenses and extend the lifespan of their assets. For instance, predictive maintenance can reduce repair costs by addressing potential issues before they escalate, ultimately fostering a more cost-effective operational model.

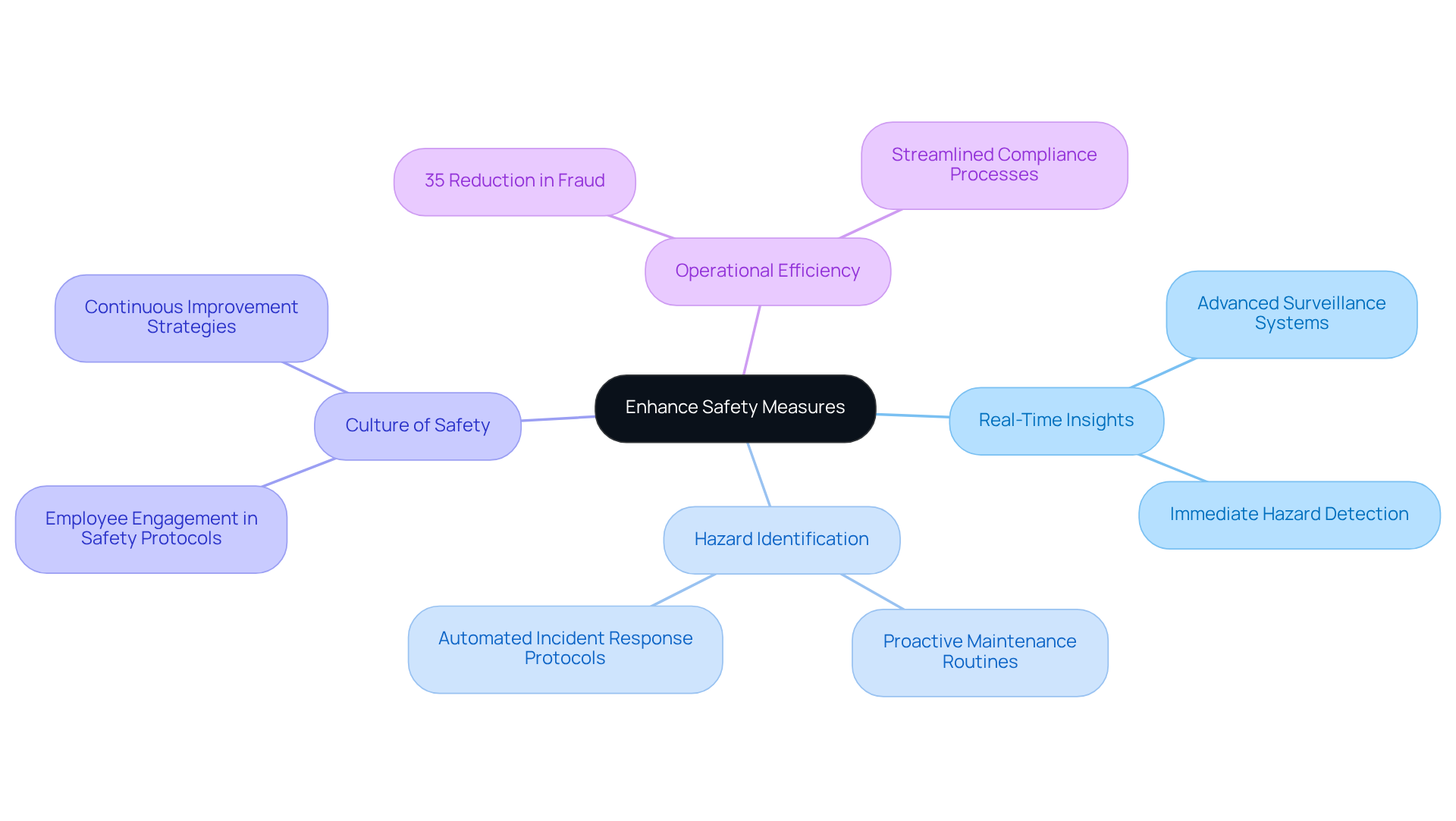

Enhance Safety Measures with Comprehensive Monitoring

Comprehensive asset condition monitoring software significantly enhances safety measures by providing real-time insights into asset health and performance. This proactive approach enables hedge funds to implement asset condition monitoring software to identify potential hazards before they escalate into accidents, thereby fostering a safer working environment.

For example, advanced surveillance systems can promptly alert teams to equipment failures that may pose safety risks, enabling swift corrective actions. As Miceál O’Kane states, “Our goal is to leverage such sensor capabilities to safeguard personnel and equipment on-site,” which underscores the proactive nature of these systems.

This strategy not only mitigates risks but also promotes a culture of safety within financial services, ensuring operational integrity while protecting personnel. Furthermore, studies indicate that real-time oversight can lead to a 35% reduction in fraud occurrences, emphasizing its broader impact on operational efficiency and compliance.

Optimize Resource Allocation with Effective Monitoring Tools

Efficient evaluation instruments empower hedge funds to optimize resource distribution by delivering critical insights into resource utilization and performance. By leveraging data from these oversight systems, firms can pinpoint underutilized resources and strategically reallocate their assets. This data-driven methodology not only enhances operational efficiency but also maximizes the return on investment for each asset.

Financial strategist Warren Buffett aptly states, “The best investment you can make is in yourself. The more you learn, the more you earn,” underscoring the importance of utilizing effective evaluation tools to refine decision-making processes.

Furthermore, Modern Portfolio Theory (MPT) highlights the necessity of diversification and optimal resource allocation to improve returns while mitigating risk. Hedge fund managers should commit to regular financial evaluations and utilize advanced tracking tools to ensure informed decisions that align with their investment strategies.

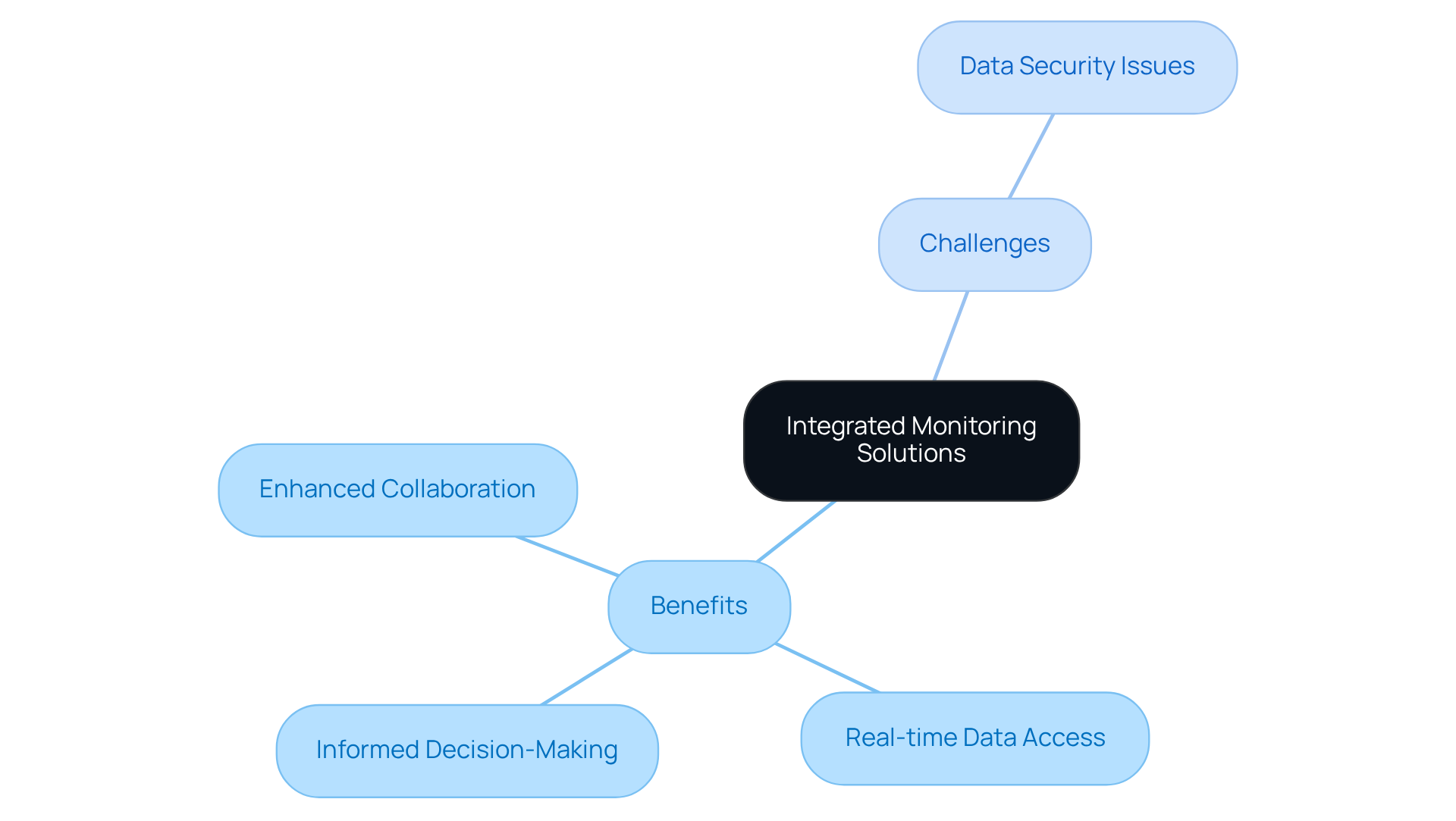

Improve Team Collaboration through Integrated Monitoring Solutions

Integrated monitoring solutions significantly enhance team collaboration by providing a centralized platform for data sharing and communication. This approach ensures that all team members have access to real-time performance data of resources, which enhances coordination and simplifies decision-making processes. For example, hedge funds have increased their AI usage by up to 400% year-over-year, illustrating a shift towards more data-driven operations. When teams are uniformly informed about resource conditions, they can collectively address issues more effectively and optimize operations.

As Tom Kehoe, Global Head of Research and Communications at AIMA, noted, “The very mention of the term AI sparks excitement and anxiety in equal measure, heralding the most significant disruption most of us are likely to witness in our lifetime.” This centralized approach not only fosters a collaborative environment but also empowers finance teams to make informed decisions swiftly, ultimately leading to improved asset management and operational efficiency with the use of asset condition monitoring software.

However, it is crucial to consider potential challenges, such as data security issues, which can obstruct the integration of cloud-based AI systems in investment firms. Addressing these challenges is essential for maximizing the advantages of integrated oversight solutions.

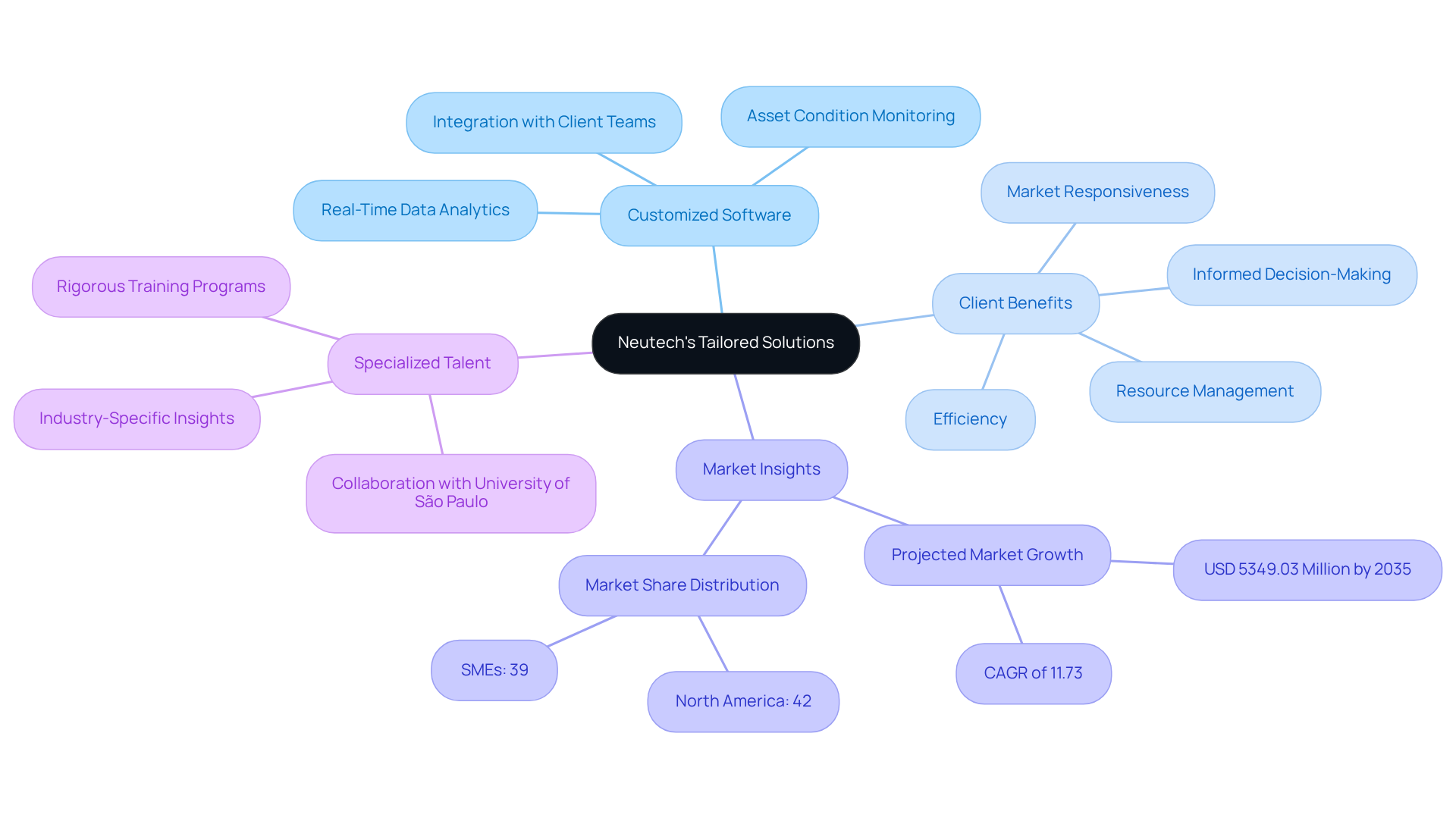

Utilize Neutech’s Tailored Solutions for Enhanced Monitoring Benefits

Neutech specializes in delivering customized asset condition monitoring software solutions tailored specifically for investment groups. Leveraging deep expertise in software development alongside a comprehensive understanding of the financial services landscape, Neutech crafts oversight systems that align with the unique requirements of each client. This level of personalization significantly enhances the efficiency of oversight solutions, empowering investment firms to optimize operational productivity, ensure compliance, and effectively manage risks using asset condition monitoring software.

Clients have noted that Neutech’s bespoke oversight systems improve their resource management processes and provide critical insights that facilitate informed decision-making. The incorporation of real-time data analytics enables hedge funds to swiftly respond to market fluctuations, thereby enhancing their overall performance and resilience in a competitive landscape.

Once we collaboratively identify your needs, Neutech will present a selection of candidate designers and developers to integrate into your team, ensuring that the solutions are not only customized but also backed by specialized talent. This direct connection between engineering expertise and oversight effectiveness is vital for maximizing the advantages of asset management.

Moreover, the Hedge Fund Software Market is anticipated to reach USD 5349.03 million by 2035, underscoring the increasing significance of asset condition monitoring software as an effective monitoring solution. Neutech’s engineers, trained through a rigorous residency program in collaboration with the University of São Paulo, possess the industry-specific insights essential for developing robust software solutions that address the complex demands of the financial services sector.

Conclusion

The integration of asset condition monitoring software signifies a pivotal advancement for hedge funds, allowing them to improve operational efficiency, reduce unexpected downtime, and ensure compliance with regulatory standards. By utilizing real-time data and predictive maintenance strategies, investment firms can optimize their resources and extend the lifespan of critical assets, ultimately enhancing financial performance and resilience in a competitive environment.

This article highlights key benefits, including:

- Improved decision-making through data analytics

- Substantial cost reductions

- Enhanced safety measures

- Optimized resource allocation

These insights emphasize the necessity of adopting advanced monitoring solutions to protect investments and cultivate a collaborative atmosphere within teams, thereby streamlining operations and boosting overall effectiveness.

As the financial industry evolves, the imperative is clear: hedge funds must adopt asset condition monitoring software as a fundamental tool for success. By prioritizing these technologies, firms can position themselves for future growth, ensuring agility and responsiveness to market changes while maximizing returns and safeguarding operational integrity.

Frequently Asked Questions

What is asset condition monitoring software and how does it benefit hedge funds?

Asset condition monitoring software provides hedge funds with real-time insights into resource performance, allowing for quick identification of inefficiencies and enhancement of workflows. It automates data collection and analysis, reducing manual errors and accelerating decision-making processes, ultimately improving operational efficiency.

What impact does asset condition monitoring software have on unplanned downtime and maintenance costs?

Organizations using asset condition monitoring software have reported a 40-50% reduction in unplanned downtime and a 25-30% decrease in maintenance costs, demonstrating its significant effect on operational performance.

How does asset condition monitoring software enhance asset lifespan and ROI?

Timely interventions and optimized maintenance routines supported by asset condition monitoring software can extend the lifespan of assets and maximize return on investment, providing a strategic advantage for firms that integrate this technology.

In what way does real-time monitoring contribute to trading workflows?

Real-time monitoring can detect delays in market price feeds, helping to prevent potential cascading failures in trading workflows, which is crucial for maintaining operational continuity.

What role does predictive maintenance play in minimizing unexpected downtime?

Predictive maintenance, enabled by asset condition monitoring software, allows hedge firms to continuously monitor resource conditions and receive alerts about potential failures. This proactive approach helps schedule maintenance in advance, significantly reducing the risk of unexpected downtime.

What are the reported benefits of implementing predictive maintenance in hedge funds?

Hedge funds that adopt predictive maintenance strategies often experience average downtime reductions of 35-50%, leading to improved operational continuity and better financial performance.

What are the financial implications of neglecting predictive maintenance?

The annual cost of equipment failures for companies can reach $1.4 trillion, highlighting the significant financial repercussions that can arise from not prioritizing predictive maintenance.

How does asset condition monitoring software help with regulatory compliance?

Advanced monitoring solutions automate data collection and reporting, ensuring that operational practices align with regulatory standards. This real-time oversight reduces the risk of penalties associated with non-compliance.