Why Corporate Software Development is Essential for Hedge Funds

Introduction

Corporate software development is crucial in the dynamic environment of hedge funds, where precision and speed are essential for investment success. By leveraging tailored technology solutions, investment firms can efficiently manage extensive data sets, facilitating real-time analysis and informed decision-making. As the financial landscape continues to evolve, marked by increasing regulatory requirements and market fluctuations, hedge funds must ensure that their software solutions not only comply with regulations but also provide a competitive edge.

Understand the Essential Role of Software Development in Hedge Funds

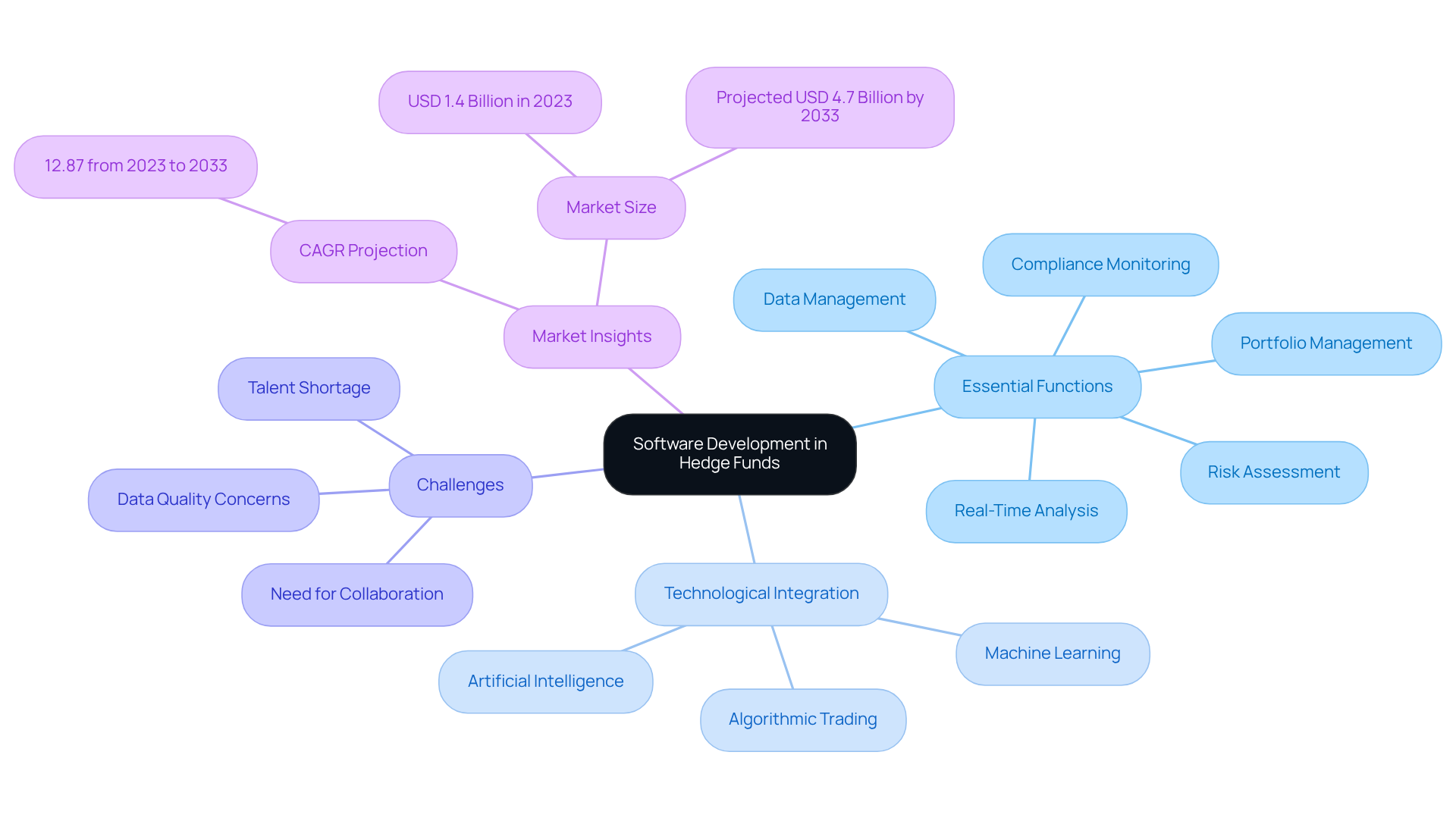

Corporate software development is integral to the operations of investment firms, acting as the backbone for various essential functions. Hedge pools function in a fast-paced environment where timely and precise data is vital for making informed investment decisions. Corporate software development enables investment groups to manage large volumes of data effectively through bespoke technology solutions, facilitating real-time analysis and reporting. This capability is essential for portfolio management, risk assessment, and compliance monitoring. Furthermore, as investment groups increasingly adopt algorithmic trading strategies, the demand for reliable systems that can execute trades at high speeds becomes critical.

At Neutech, we understand the unique challenges faced by investment groups and offer a tailored engineering talent supply process. We initiate this process by scheduling a complimentary consultation to assess your company’s setup and specific needs. Once we collaboratively identify your requirements, Neutech provides a selection of specialized developers and designers who seamlessly integrate into your team. This ensures that you have the right expertise to enhance your technological capabilities.

The integration of advanced technologies such as machine learning and artificial intelligence significantly enhances investment groups’ ability to identify trends and optimize strategies, which makes corporate software development a vital investment for maintaining a competitive edge. However, the implementation of AI also introduces challenges, including data quality concerns and the need for collaboration with professionals for effective software configuration and user training. According to industry insights, the market size for AI in investment portfolios is projected to grow substantially, with an anticipated compound annual growth rate (CAGR) of 12.87% from 2023 to 2033. As noted by a Forrester contributor, “AI will move beyond generating code snippets to delivering engineering-grade outputs from high-level intent,” underscoring the transformative potential of AI in this sector.

Address Key Challenges: Regulatory Compliance and Market Volatility

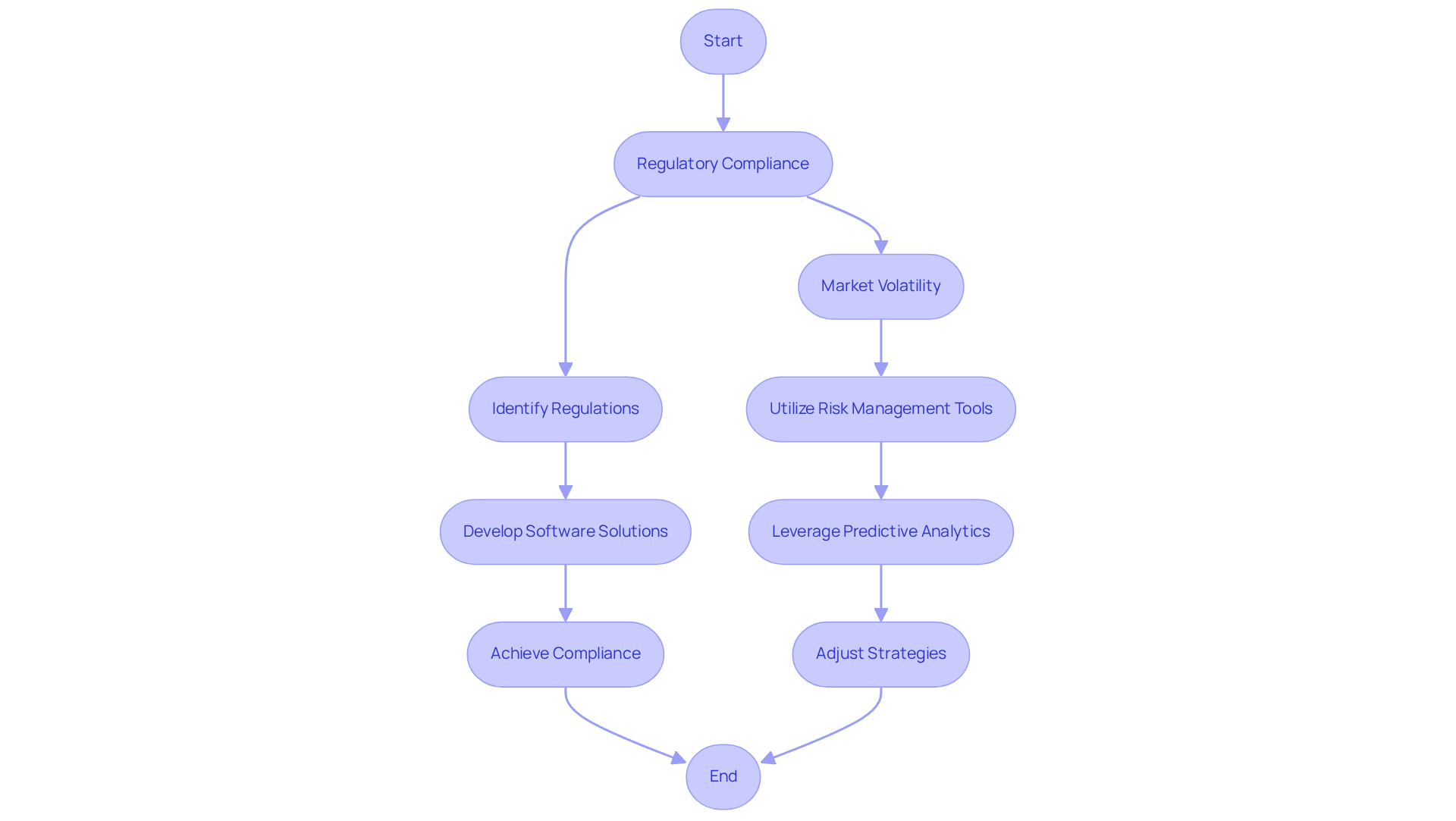

Hedge pools operate within stringent regulatory frameworks that necessitate meticulous reporting and compliance. The complexity of these regulations can be daunting, particularly as they continue to evolve. To address these challenges, bespoke software solutions are developed to streamline compliance procedures, ensuring that investment groups can meet regulatory obligations without sacrificing efficiency. Notably, larger firms managing over $1.5 billion in assets achieved compliance with Amended Reg S-P on December 3, 2025, underscoring the urgency of these compliance demands.

Moreover, fluctuations in the financial environment pose significant threats to investment performance. Through corporate software development, investment groups are empowered to utilize advanced risk management tools that assess conditions and adjust strategies accordingly. By leveraging predictive analytics and real-time data, investment firms can better anticipate changes in the financial landscape and make informed decisions that protect their assets. This proactive approach not only enhances compliance but also positions investment vehicles to capitalize on market opportunities.

As new regulations in 2026 will focus on AI governance, cybersecurity, data privacy, climate-risk disclosure, transaction monitoring, and cryptocurrencies, it is crucial for investment groups to adapt their technological solutions to meet these evolving requirements. The SEC’s imposition of over $5 billion in penalties in 2024 highlights the financial risks associated with non-compliance, making investment in compliance technology more critical than ever.

Leverage Software Development for Strategic Advantages in Investment Management

In the competitive landscape of investment vehicles, leveraging technological advancements for strategic advantages is essential. Bespoke technology solutions empower investment groups to implement sophisticated financial modeling techniques that significantly enhance investment strategies. By employing algorithms that analyze historical data and market trends, these groups can efficiently identify profitable opportunities and optimize their portfolios.

Furthermore, the integration of automation in trading processes allows for faster trade execution, minimizing the risk of slippage and maximizing returns. Hedge funds that invest in tailored technology solutions also improve their client reporting capabilities, offering investors timely and clear insights into investment performance. This level of sophistication not only builds trust with investors but also positions hedge funds as innovators within the financial services sector.

With 81% of executives acknowledging that investment assessment and due diligence are labor-intensive, adopting advanced technology becomes a strategic imperative for maintaining a competitive edge. Additionally, the Global Hedge Fund Technology Market is anticipated to grow to USD 5.75 billion by 2032, with a CAGR of 14.71%, underscoring the increasing importance of technology solutions in the industry.

Neutech’s customized engineering talent supply process ensures that investment groups can accurately assess their specific needs. By providing specialized developers and designers, Neutech enhances application capabilities tailored to the unique challenges faced by investment groups. Moreover, AI-driven analytics are becoming increasingly vital for hypothesis testing and strategy refinement, further highlighting the necessity of investing in advanced technology to improve operational efficiency.

Embrace Continuous Improvement: The Long-Term Value of Software Development

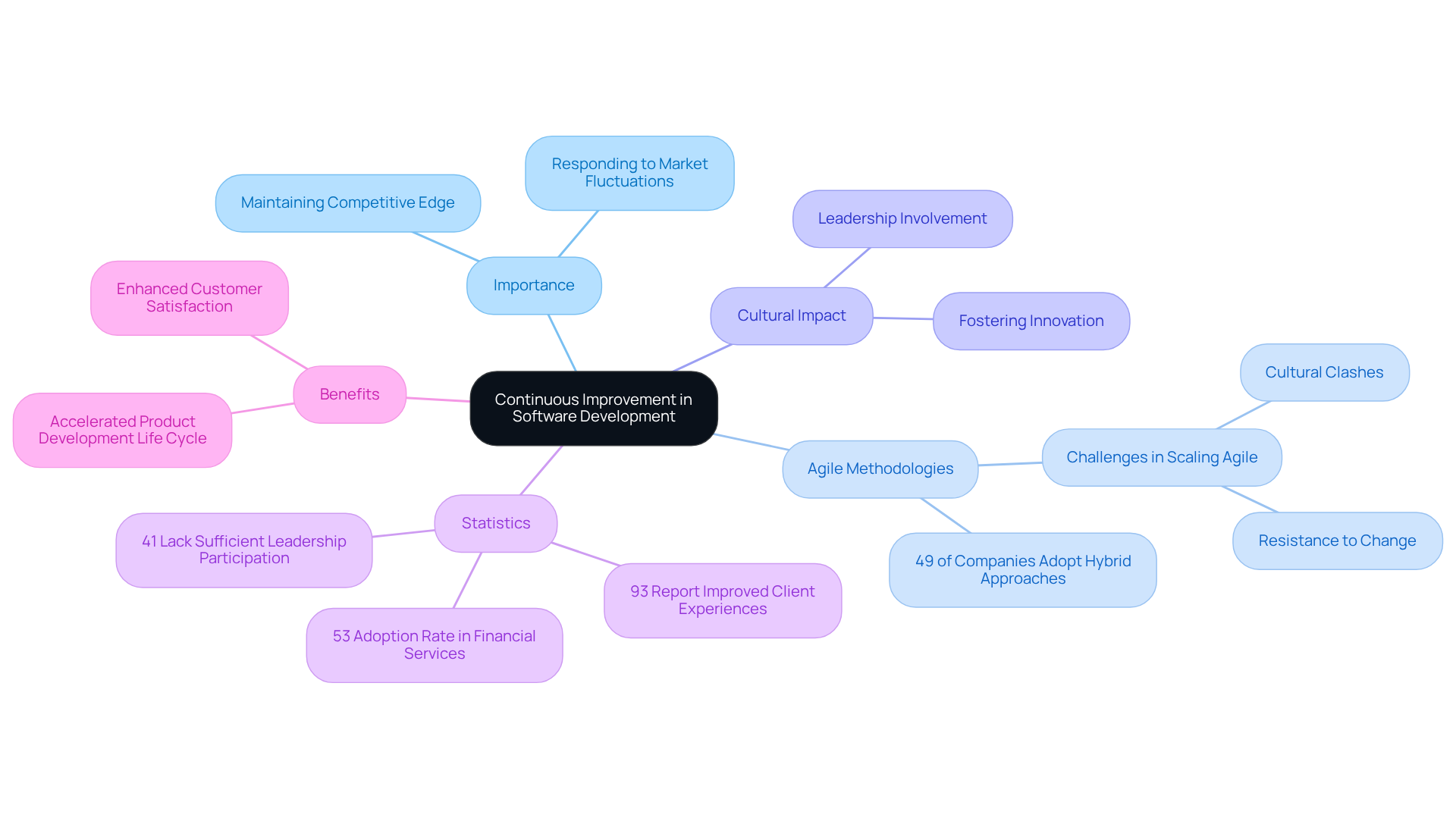

Ongoing enhancement in corporate software development is essential for investment firms striving to maintain a competitive edge in a rapidly evolving financial landscape. As new technologies and industry dynamics emerge, adopting agile development methodologies allows investment groups to develop solutions that are both effective and adaptable. This iterative approach facilitates improvements based on user feedback and market demands, leading to more efficient processes and enhanced investment outcomes.

Investing in corporate software development cultivates a culture of innovation within investment firms, motivating teams to explore new technologies and methodologies that can elevate performance. For example, 49% of large companies have adopted hybrid approaches, indicating a trend towards customized Agile methodologies tailored to specific organizational needs. Nevertheless, 47% of Agile practitioners report resistance to organizational change as a significant obstacle, highlighting the challenges investment firms may face in fully implementing Agile practices.

As hedge funds emphasize continuous improvement, they position themselves to respond swiftly to market fluctuations, thereby strengthening their resilience and ensuring long-term success. This dedication to agile practices not only accelerates the product development life cycle but also enhances customer satisfaction, with 93% of Agile companies noting improved client experiences. Furthermore, the financial repercussions of project failures underscore the necessity of effective methodologies in corporate software development to prevent costly errors, making continuous improvement not merely advantageous but imperative.

Conclusion

Corporate software development stands as a pivotal component for hedge funds, fundamentally supporting their capacity to navigate a complex financial landscape. By utilizing tailored technology solutions, investment firms can significantly enhance their data management, compliance, and trading capabilities. This, in turn, leads to more informed decision-making and improved performance.

The article presents several key arguments that underscore the multifaceted benefits of software development within the hedge fund sector. From managing regulatory compliance to optimizing trading strategies through advanced analytics, the integration of bespoke software solutions markedly enhances operational efficiency. Furthermore, the adoption of agile methodologies cultivates a culture of continuous improvement, enabling firms to adapt swiftly to market fluctuations and technological advancements.

As the financial industry continues to evolve, the necessity for hedge funds to invest in corporate software development is paramount. Embracing these technological advancements not only positions firms for immediate success but also secures long-term resilience and competitiveness in an ever-changing market. Investment groups are urged to acknowledge the transformative potential of software development and prioritize it as a strategic asset within their operational framework.

Frequently Asked Questions

What is the role of software development in hedge funds?

Software development is essential for hedge funds as it supports various functions, enabling effective management of large data volumes, real-time analysis, and reporting, which are critical for portfolio management, risk assessment, and compliance monitoring.

Why is timely and precise data important for investment firms?

Timely and precise data is vital for making informed investment decisions in the fast-paced environment of hedge funds, where quick access to accurate information can significantly impact investment outcomes.

How does Neutech assist investment groups with software development?

Neutech offers a tailored engineering talent supply process, starting with a complimentary consultation to assess a company’s needs, followed by providing specialized developers and designers who integrate into the client’s team.

What advanced technologies are mentioned as beneficial for investment groups?

Advanced technologies such as machine learning and artificial intelligence enhance investment groups’ ability to identify trends and optimize strategies, making corporate software development a crucial investment.

What challenges does the implementation of AI present for investment groups?

The implementation of AI introduces challenges such as data quality concerns and the need for collaboration with professionals for effective software configuration and user training.

What is the projected market growth for AI in investment portfolios?

The market size for AI in investment portfolios is projected to grow at a compound annual growth rate (CAGR) of 12.87% from 2023 to 2033.

How is AI expected to evolve in software development according to industry insights?

AI is anticipated to evolve from generating code snippets to delivering engineering-grade outputs from high-level intent, indicating its transformative potential in the software development sector for investment firms.