Master the Software Outsourcing Business Model for Hedge Funds

Introduction

The landscape of hedge funds is undergoing significant transformation, with software outsourcing emerging as a crucial strategy for firms aiming to enhance operational efficiency and ensure compliance. By entrusting software development and IT tasks to specialized external providers, investment groups can access a wealth of expertise. This delegation allows them to concentrate on their core investment strategies while establishing robust and scalable technology infrastructures.

However, the choice to outsource introduces critical considerations regarding control, security, and the potential for unforeseen challenges. Hedge funds must navigate these complexities effectively to leverage outsourcing and secure a competitive advantage in an increasingly demanding market.

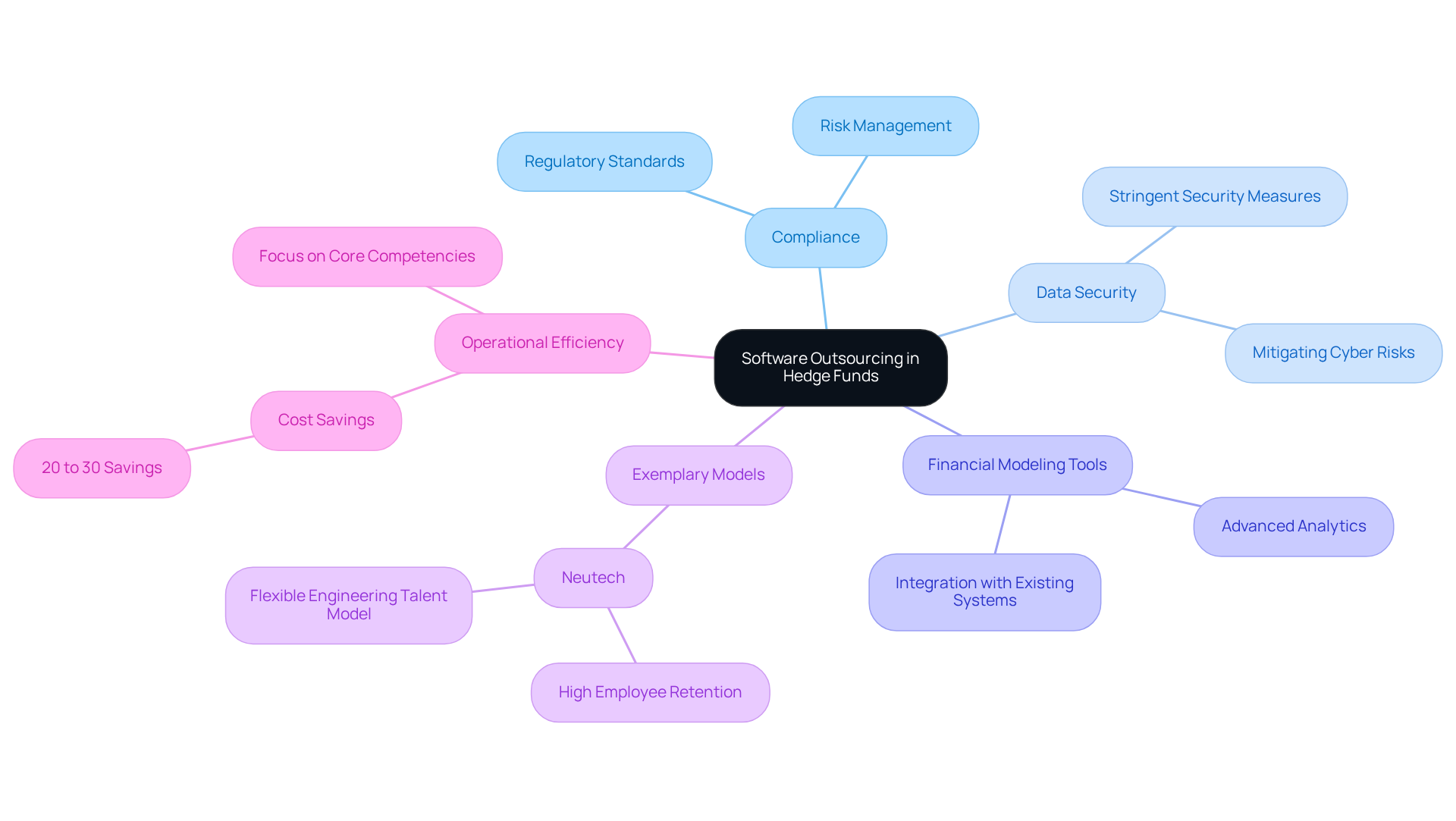

Define Software Outsourcing in the Context of Hedge Funds

Software delegation for investment firms entails assigning software development and IT tasks to specialized external service providers within the financial services sector. This approach enables investment groups to leverage external expertise, resulting in the creation of robust, scalable, and secure applications tailored to their specific operational requirements. Key considerations in this process include:

- Compliance with regulatory standards

- Implementation of stringent data security measures

- Integration of advanced financial modeling tools

By utilizing a software outsourcing business model, investment firms can concentrate on their core investment strategies while ensuring that their technology infrastructure meets the rigorous demands of the financial industry. This strategic decision not only enhances operational efficiency but also allows firms to respond swiftly to evolving market conditions, ultimately positioning them for sustained growth and a competitive edge.

An exemplary model of this practice is demonstrated by a company that evaluates client needs and provides specialized developers and designers, ensuring seamless integration with existing teams. Their commitment to reliability is evident in their high employee retention rate, which mitigates the risks associated with turnover. Furthermore, Neutech’s flexible engineering talent model, characterized by month-to-month agreements, empowers hedge groups to improve project management and resource allocation.

Industry experts emphasize that focusing on core competencies while delegating ancillary functions can enhance decision-making and resource distribution, highlighting the importance of the software outsourcing business model in today’s complex financial landscape. Companies can achieve savings of 20% to 30% in operational expenses by contracting services, and 68% of asset managers view this approach as essential for minimizing risks and optimizing processes. However, it is imperative for investment groups to thoroughly evaluate external service options to avoid potential drawbacks, such as loss of control over operations. As Gyan Nagpal aptly states, ‘Focus on what makes your company great. Partner with others to handle the rest.

Identify Key Benefits of Software Outsourcing for Hedge Funds

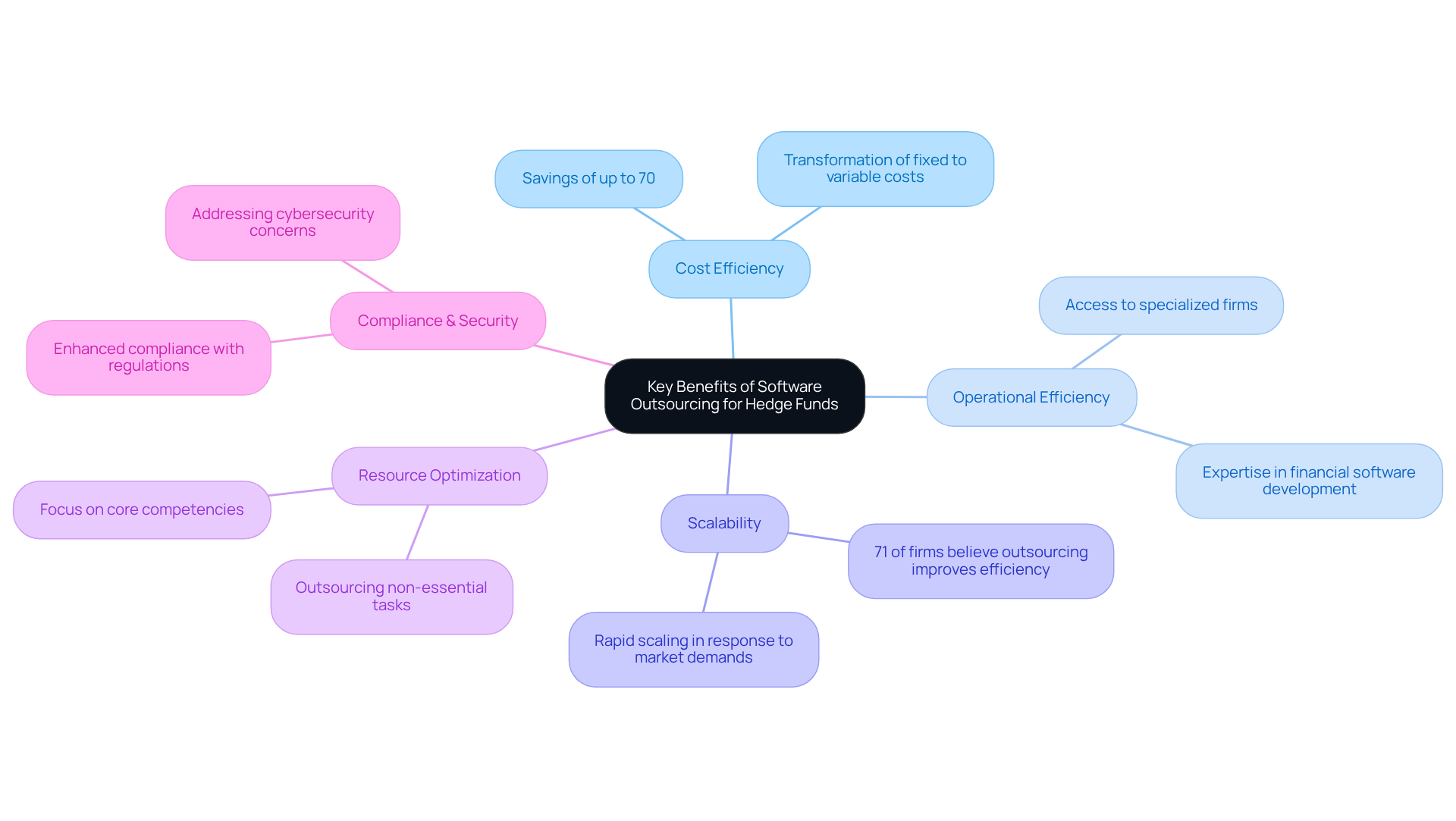

The key benefits of software outsourcing for hedge funds are as follows:

-

Cost efficiency is realized through the software outsourcing business model, which transforms fixed expenses into variable ones, enabling investment groups to adjust costs based on operational needs. This flexibility is vital, particularly as firms navigate changing market conditions. Notably, companies can achieve savings of up to 70% on software development costs by leveraging offshore talent through a software outsourcing business model, which includes expertise in technologies such as React and Python.

-

The software outsourcing business model can significantly improve operational efficiency. The software outsourcing business model enables investment groups to partner with specialized firms, granting them access to a vast pool of skilled professionals proficient in financial software development, compliance, and risk management. This expertise is crucial for effectively navigating the complex regulatory landscape and enhancing operational efficiency, especially through Neutech’s tailored engineering talent provision process.

-

The software outsourcing business model allows investment firms to rapidly scale operations in response to market demands. This agility is essential for maintaining competitiveness, particularly in an environment where 71% of investment firms believe that delegating tasks can lead to improved cost efficiency.

-

The software outsourcing business model is essential for optimizing resources. By utilizing a software outsourcing business model, investment firms can focus on their core competencies by outsourcing non-essential tasks and concentrating on their primary strategies and client relationships. This strategic focus not only boosts overall performance but also empowers firms to innovate and adapt to market changes more effectively.

-

The software outsourcing business model has gained popularity among companies looking to reduce costs. The software outsourcing business model allows specialized external partners, such as Neutech, to be better equipped to handle the intricate regulatory requirements of the financial industry, enhancing compliance and security. This capability ensures that investment pools remain compliant and secure, addressing the growing concerns surrounding cybersecurity, particularly in light of recent global events that have heightened risks in the sector.

Implement Best Practices for Successful Software Outsourcing

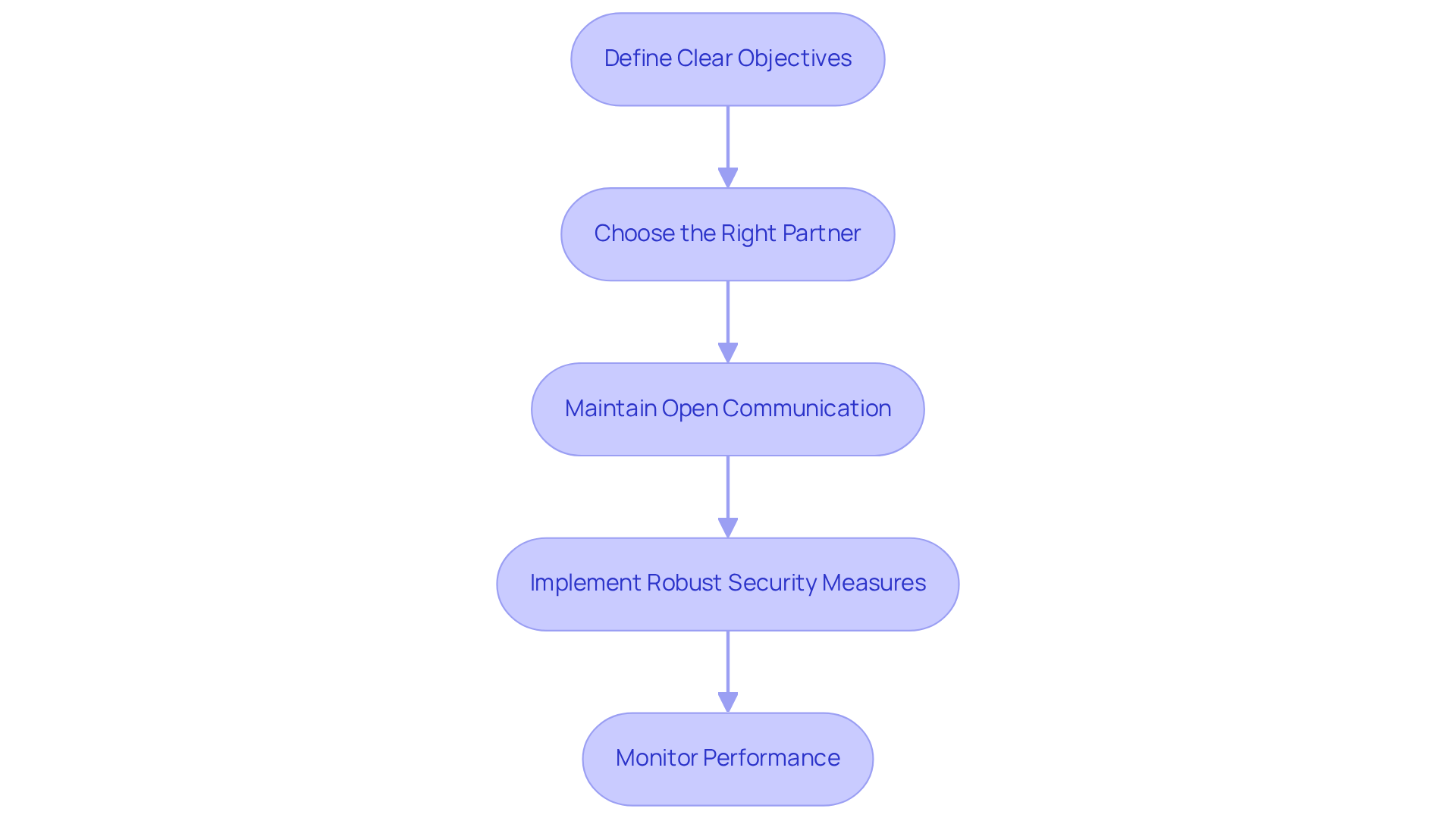

To achieve successful software outsourcing, hedge funds should adopt several best practices:

-

Define Clear Objectives: Establish specific goals for the external partnership, including expected outcomes, timelines, and performance metrics. Clarity in these objectives is essential; firms that effectively define their goals report a 30-50% reduction in product development time. At Neutech, we initiate this process by collaboratively determining your needs to ensure alignment with your objectives.

-

Choose the Right Partner: Select an outsourcing partner with a proven track record in the financial services sector. This choice ensures that the partner understands the unique challenges and requirements of hedge funds, which is crucial for maintaining compliance and operational efficiency in the software outsourcing business model. Our company can provide you with several potential designers and developers tailored to your specific requirements, thereby enhancing your team’s capabilities.

-

Maintain Open Communication: Foster a collaborative environment characterized by regular updates and feedback loops. Neutech emphasizes the importance of communication throughout this process, ensuring that any issues are promptly addressed and that project alignment is consistently maintained. This approach is supported by data indicating that 89% of companies collaborating with Agile teams report enhanced productivity, underscoring the significance of communication in partnerships.

-

Implement Robust Security Measures: Ensure that the external partner adheres to stringent data security protocols to protect sensitive financial information. Given the increasing cybersecurity concerns, particularly with 74% of firms expressing worries about cyber-attack threats, this step is vital for safeguarding assets.

-

Monitor Performance: Regularly evaluate the effectiveness of the external partner against established metrics. Neutech offers tools and assistance to help investment firms efficiently monitor their associates, ensuring they meet operational standards and can adapt to evolving market conditions.

Mitigate Risks and Challenges in Software Outsourcing

Hedge funds can effectively mitigate risks and challenges in software outsourcing by adopting several key strategies:

-

Conducting Comprehensive Due Diligence: It is essential to evaluate potential outsourcing partners based on their financial stability, industry reputation, and specific experience within the investment management sector. This step is crucial, as approximately 80 percent of investment firms rely on a software outsourcing business model for their back office, making partner reliability a fundamental consideration.

-

Establishing Clear Contracts: Comprehensive contracts should be created to clearly define responsibilities, deliverables, timelines, and penalties for non-compliance. This approach safeguards both parties and ensures accountability, which is vital in an industry where over a third of investment pools utilize the software outsourcing business model to outsource significant portions of their front office activities.

-

Establishing Robust Governance: A governance structure must be established to manage the external partnership, ensuring alignment with the investment firm’s strategic goals. Strong governance is critical for monitoring the software outsourcing business model, especially as hedge funds increasingly rely on external providers.

-

Regular Risk Assessments: Continuous evaluation of risks associated with the external relationship is necessary, including compliance, data security, and operational risks. Strategies should be adjusted as needed to address emerging challenges in the software outsourcing business model, especially in light of rising cybersecurity concerns intensified by recent global events.

-

Building Contingency Plans: Formulating contingency plans is essential to address potential disruptions, thereby ensuring business continuity in the face of external sourcing challenges. This proactive approach in the software outsourcing business model enables hedge funds to navigate unexpected issues, such as staff turnover or operational hiccups, thus maintaining stability and performance.

-

Leveraging Reliable Partners: It is advisable to choose outsourcing partners recognized for their high employee retention and commitment to seamless client integration. Neutech, for instance, ensures that developers remain dedicated to your projects, minimizing disruptions and maintaining continuity. Their proactive approach includes having replacement developers ready to step in if needed, ensuring effective knowledge transfer. This reliability fosters a strong alliance, allowing investment groups to focus on their core operations while trusting that their software needs are managed effectively through a software outsourcing business model.

Choose the Right Outsourcing Partner for Hedge Fund Needs

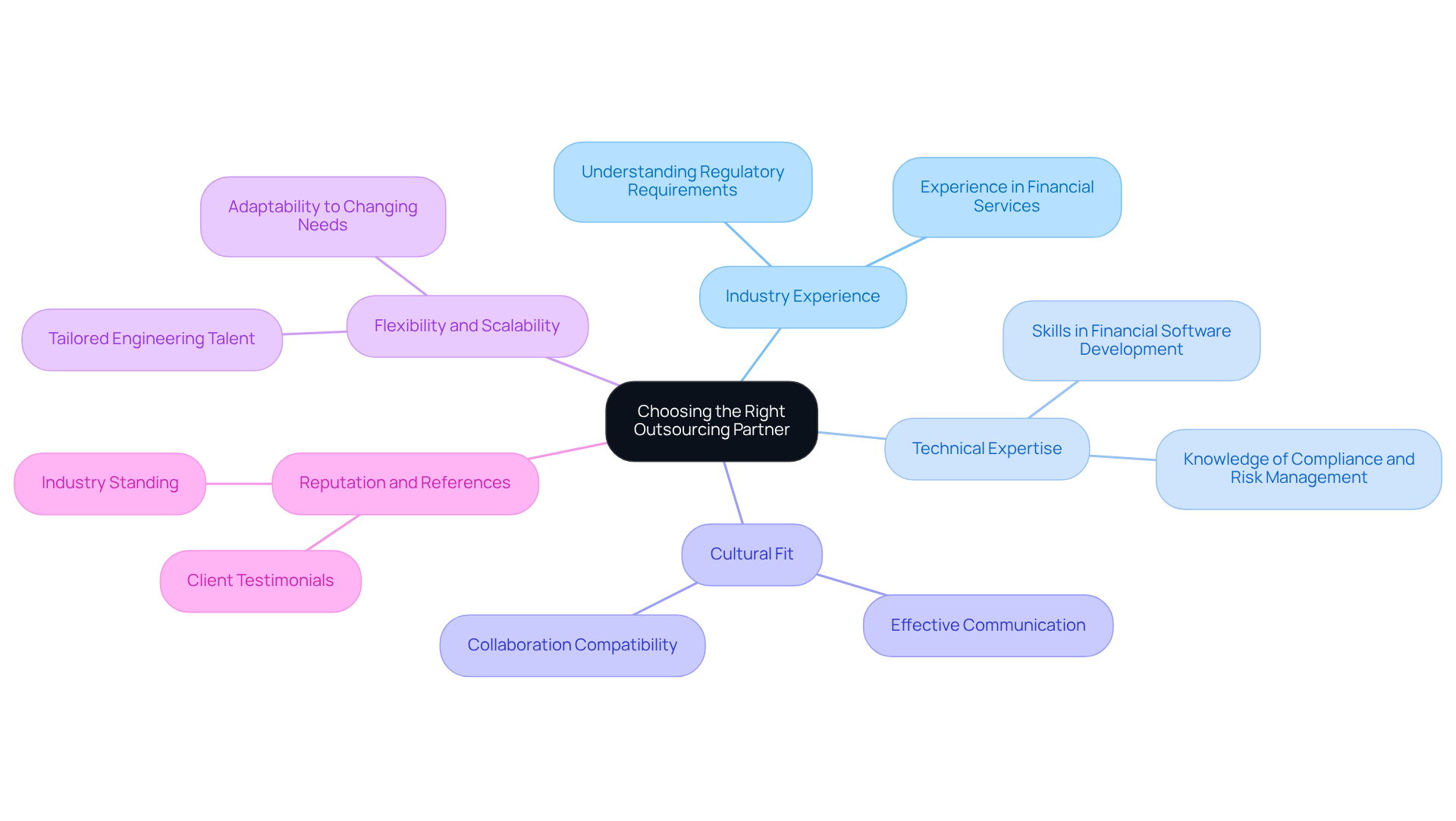

Choosing the right outsourcing partner is crucial for investment firms aiming to enhance operational efficiency and maintain compliance in the software outsourcing business model. Key criteria to consider include:

-

Industry Experience: It is vital to prioritize partners with substantial experience in financial services, particularly those who have successfully collaborated with investment firms. A partner’s robust experience in this sector ensures an understanding of the unique challenges and regulatory requirements that investment groups face.

-

Technical Expertise: Confirm that the partner possesses the requisite technical skills in financial software development, compliance, and risk management. Such expertise is essential for navigating the complexities of investment operations and delivering effective solutions.

-

Cultural Fit: Assess the cultural alignment between your hedge fund and the outsourcing partner. A compatible culture promotes effective communication and collaboration, which are critical for successful project execution. The company emphasizes this alignment to facilitate seamless integration with your team.

-

Flexibility and Scalability: Select a partner that demonstrates the capacity to adapt to changing needs and scale operations accordingly. The company exemplifies this by evaluating client requirements and providing tailored engineering talent, including specialized developers and designers, to integrate smoothly into your team, particularly in response to demand fluctuations.

-

Reputation and References: Investigate the partner’s standing within the industry and seek testimonials from other investment firms. Gaining insights into their reliability and performance through testimonials can be invaluable. The company’s proven track record in enhancing operational efficiency and compliance is supported by positive client feedback.

By concentrating on these criteria and evaluating how Neutech aligns with each, hedge funds can establish partnerships under the software outsourcing business model that not only bolster their operational capabilities but also align with their strategic objectives, ultimately leading to enhanced performance and compliance.

Conclusion

The software outsourcing business model offers a significant opportunity for hedge funds to enhance operational efficiency while concentrating on core investment strategies. By collaborating with specialized external service providers, investment firms can tap into expert knowledge and advanced technology, which ultimately leads to improved compliance, security, and scalability in their operations.

This article highlights several key benefits of software outsourcing, including:

- Substantial cost savings

- Access to specialized talent

- The agility to adapt swiftly to changing market conditions

To ensure successful outsourcing, it is essential to adhere to best practices such as:

- Defining clear objectives

- Maintaining open lines of communication

- Conducting thorough due diligence

These practices are crucial for mitigating risks and fostering a productive partnership. The selection of the right outsourcing partner is vital, as it significantly impacts the effectiveness of the implemented software solutions.

In a rapidly evolving financial landscape, the strategic adoption of software outsourcing is not merely an option; it is a necessity for hedge funds seeking to thrive. By embracing this model, firms can optimize their resources while also fostering innovation and resilience in the face of challenges. As the industry continues to evolve, investment groups are encouraged to prioritize thoughtful partnerships and proactive management strategies that will secure their competitive edge in the market.

Frequently Asked Questions

What is software outsourcing in the context of hedge funds?

Software outsourcing for hedge funds involves delegating software development and IT tasks to specialized external service providers, enabling investment firms to leverage external expertise to create robust, scalable, and secure applications tailored to their operational needs.

What are the key considerations when outsourcing software for hedge funds?

Key considerations include compliance with regulatory standards, implementation of stringent data security measures, and integration of advanced financial modeling tools.

How does software outsourcing benefit investment firms?

It allows firms to focus on their core investment strategies while ensuring their technology infrastructure meets industry demands, enhancing operational efficiency and enabling quick responses to market changes.

What savings can investment firms expect from software outsourcing?

Investment firms can achieve savings of 20% to 30% in operational expenses and up to 70% on software development costs by utilizing offshore talent through a software outsourcing business model.

How does software outsourcing improve operational efficiency for hedge funds?

By partnering with specialized firms, investment groups gain access to skilled professionals proficient in financial software development, compliance, and risk management, which enhances operational efficiency and helps navigate complex regulatory landscapes.

What role does agility play in software outsourcing for hedge funds?

The software outsourcing model allows investment firms to rapidly scale operations in response to market demands, which is crucial for maintaining competitiveness.

How does software outsourcing optimize resources for investment firms?

It enables firms to focus on their core competencies by outsourcing non-essential tasks, which boosts overall performance and empowers innovation and adaptation to market changes.

Why is compliance and security important in software outsourcing for hedge funds?

Specialized external partners are better equipped to handle the regulatory requirements of the financial industry, ensuring that investment pools remain compliant and secure, especially amid heightened cybersecurity concerns.