Master On-Premise Data Integration: Best Practices for Hedge Funds

Introduction

On-premise data integration is a crucial strategy for hedge funds aiming to leverage their data while ensuring compliance and security. By consolidating information from various sources within their local infrastructure, these funds can sustain a competitive advantage and reduce risks linked to fragmented data.

Nevertheless, the path to effective integration presents numerous challenges, including:

- Data silos

- Outdated systems

- Stringent regulatory requirements

How can hedge funds effectively navigate this intricate landscape to achieve seamless data integration while maintaining the highest standards of quality and compliance?

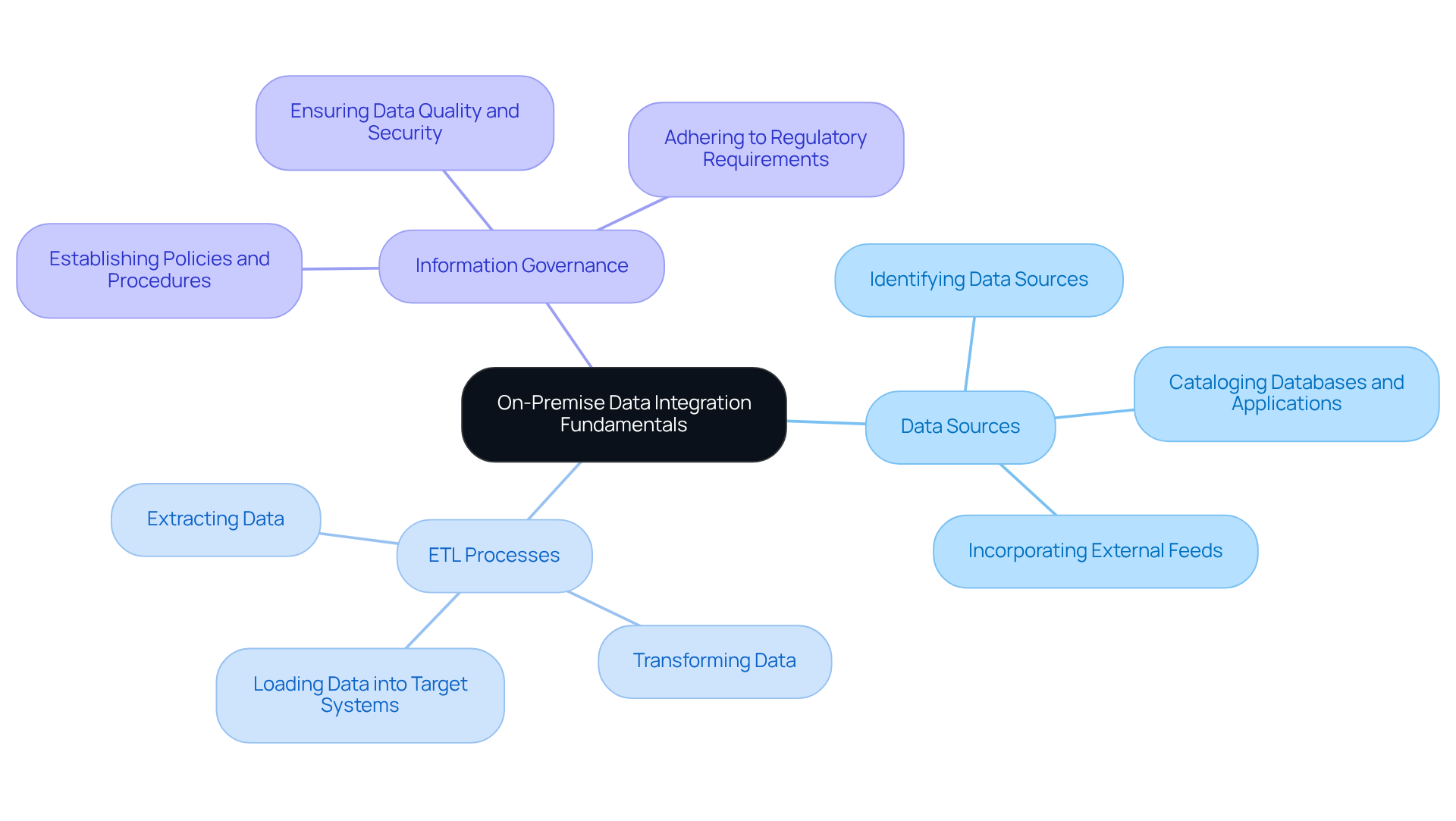

Understand On-Premise Data Integration Fundamentals

On-premise data integration involves the process of merging details from various sources within an organization’s local infrastructure. This approach allows hedge funds to maintain control over their information, ensuring compliance with regulatory requirements and enhancing security.

Key components of on-premise data integration include:

- Data Sources: This involves identifying and cataloging all data sources, which encompass databases, applications, and external feeds.

- ETL Processes: Implementing Extract, Transform, Load (ETL) processes is essential for accurately collecting information, transforming it into a usable format, and loading it into target systems.

- Information Governance: Establishing policies and procedures for information management is crucial to ensure quality, security, and adherence to industry regulations.

Understanding these fundamentals is vital for hedge funds aiming to develop a robust information unification strategy that meets their operational and compliance needs.

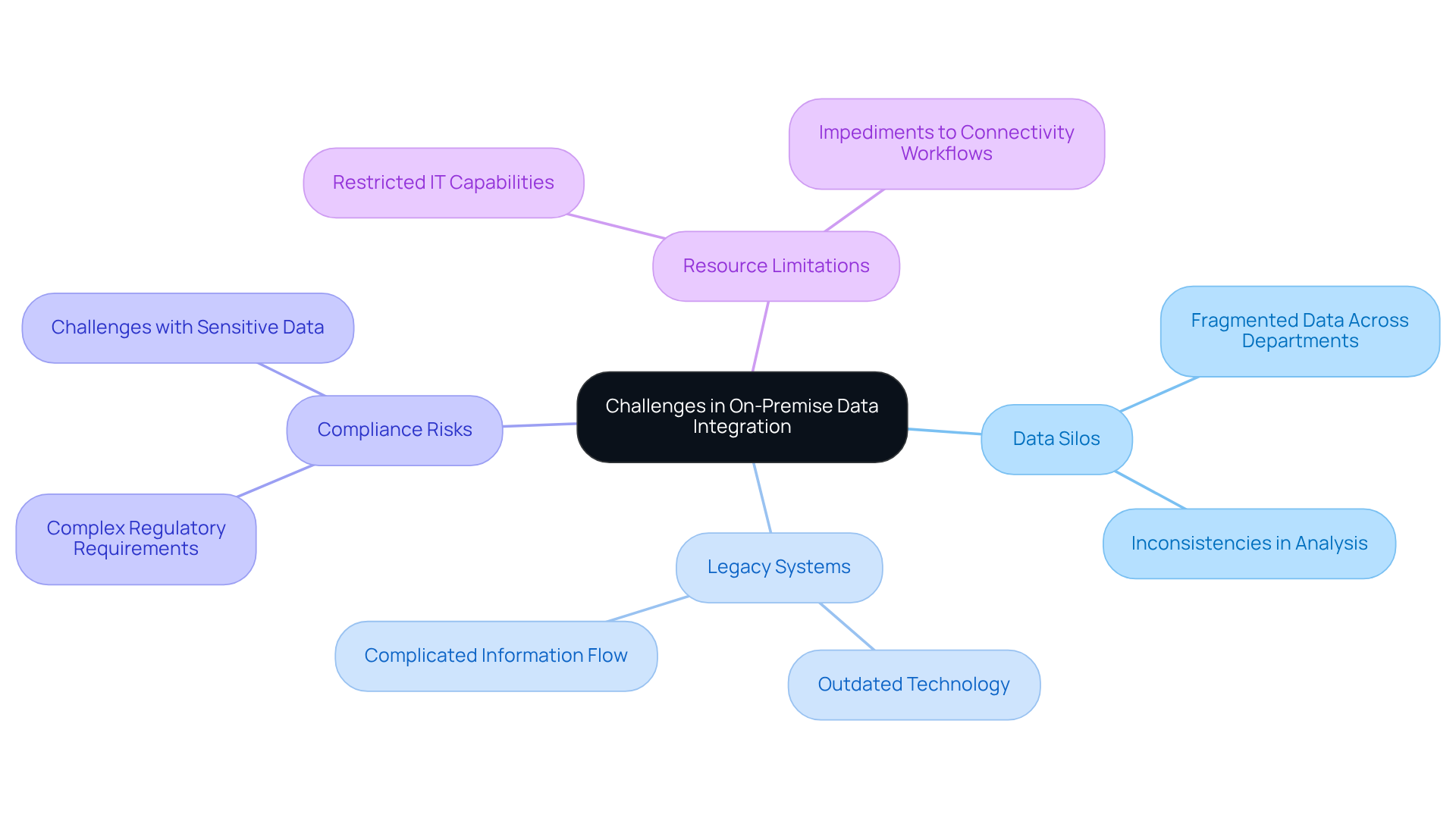

Identify Challenges in On-Premise Data Integration for Regulated Industries

Hedge funds encounter various significant challenges when it comes to on-premise data integration implementation.

- Data Silos represent a critical issue, as fragmented data across various departments can lead to inconsistencies, ultimately hindering comprehensive analysis.

- Legacy Systems pose another challenge; many hedge funds rely on outdated technology that may not support modern connection methods, complicating the flow of information.

- Compliance Risks are also prevalent, as navigating complex regulatory requirements can be daunting, particularly when integrating sensitive financial data.

- Finally, Resource Limitations can restrict IT capabilities, impeding the ability to sustain and enhance connectivity workflows.

Addressing these challenges requires a strategic approach that includes on-premise data integration, investing in modern technology, fostering cross-departmental collaboration, and ensuring compliance through robust governance frameworks.

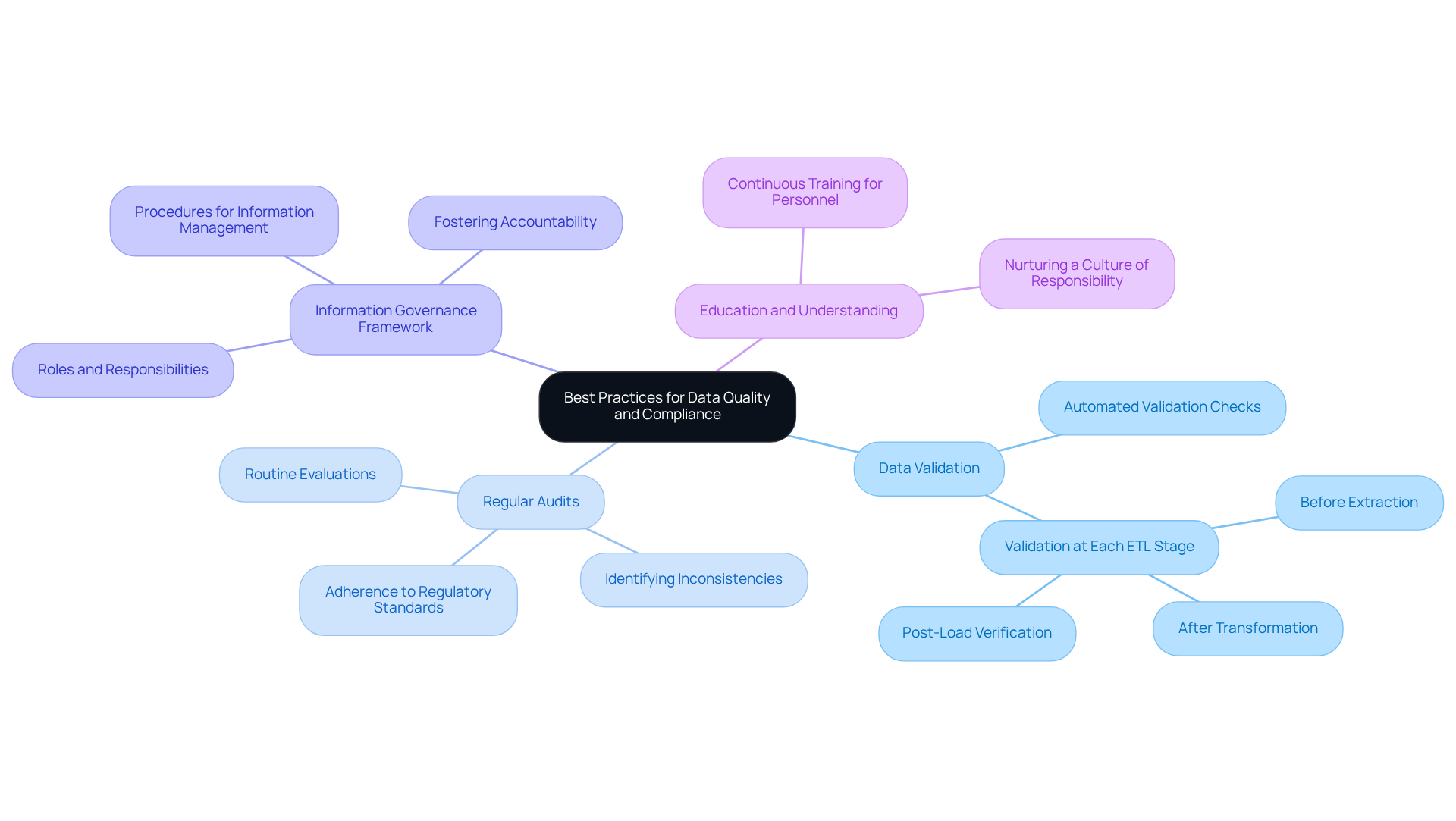

Implement Best Practices for Data Quality and Compliance

To ensure high data quality and compliance in on-premise data integration, hedge funds should adopt several key practices:

-

Data Validation: Automated validation checks are essential for ensuring data accuracy and completeness throughout the ETL process. This step is critical in maintaining the integrity of the data being integrated.

-

Regular Audits: Routine evaluations of information integration procedures are necessary to identify and rectify inconsistencies. These audits help ensure adherence to regulatory standards, thereby mitigating potential risks.

-

Information Governance Framework: Establishing a comprehensive information governance framework is vital. This framework should clearly outline roles, responsibilities, and procedures for effective information management, fostering accountability within the organization.

-

Education and Understanding: Continuous training for personnel on information quality and compliance best practices is crucial. This education nurtures a culture of responsibility, empowering staff to uphold high standards in data management.

By incorporating these practices into their on-premise data integration strategy, hedge funds can enhance reliability and significantly reduce regulatory risks.

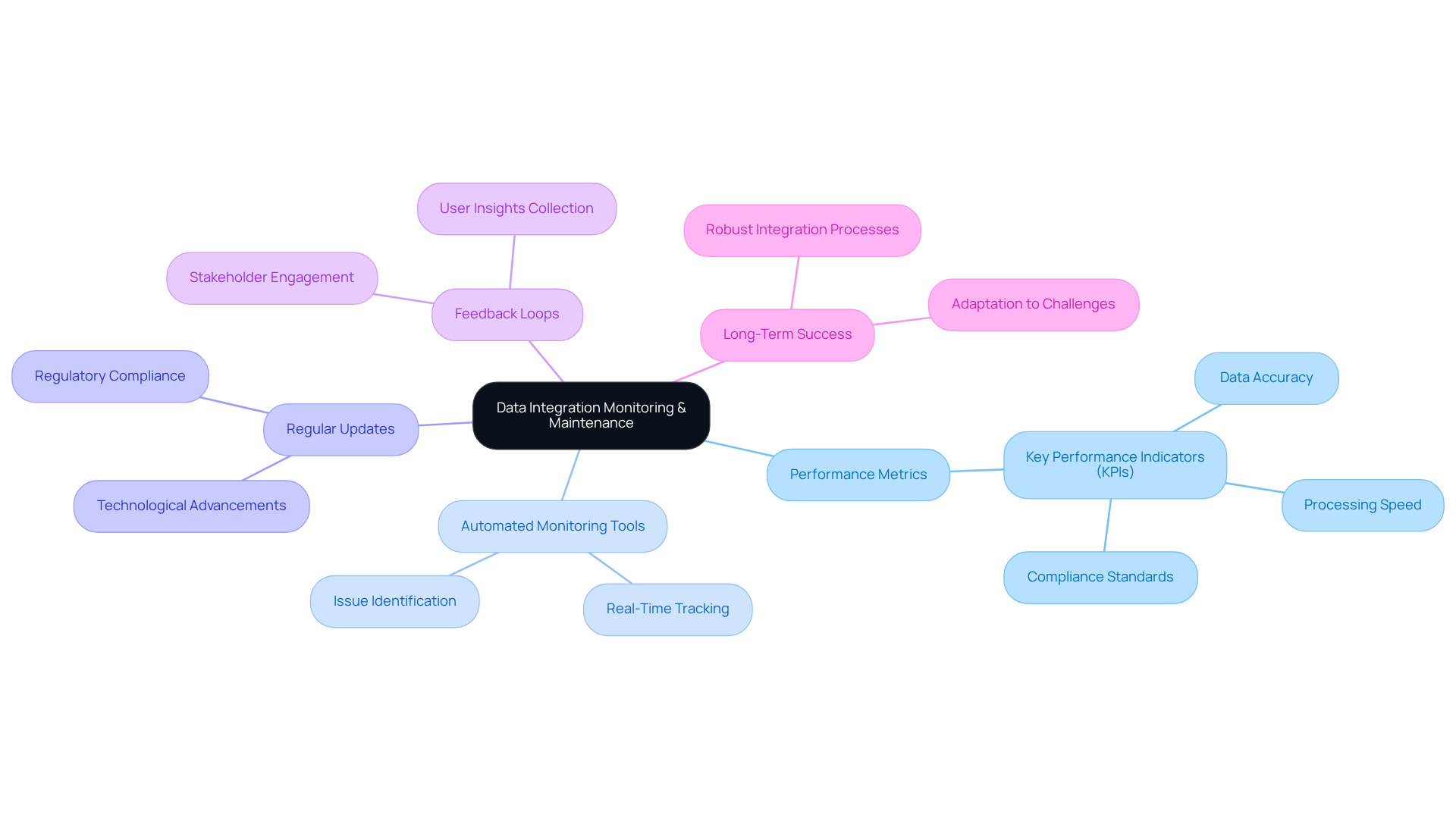

Monitor and Maintain Data Integration Processes for Long-Term Success

To ensure the long-term success of on-premise data integration, effective monitoring and maintenance strategies must be implemented by hedge funds.

Performance Metrics: It is essential to establish key performance indicators (KPIs) that measure the effectiveness of data integration processes. These metrics should include data accuracy, processing speed, and adherence to compliance standards.

Automated Monitoring Tools: The utilization of automated monitoring tools is crucial for tracking information flows and identifying issues in real-time. This capability allows for prompt resolution of any problems that may arise.

Regular Updates: Keeping systems and methodologies updated is necessary to accommodate changes in regulatory requirements and technological advancements. Regular updates ensure that the integration processes remain relevant and effective.

Feedback Loops: Establishing feedback systems to collect insights from users and stakeholders is vital. This practice facilitates the ongoing enhancement of information unification practices, ensuring that they meet the evolving needs of the organization.

By prioritizing these monitoring and maintenance strategies, hedge funds can effectively adapt to evolving challenges, ensuring that their on-premise data integration processes remain robust and compliant.

Conclusion

On-premise data integration is essential for hedge funds, allowing them to consolidate information from diverse sources while ensuring control, security, and compliance with regulatory standards. By grasping the fundamentals of this integration approach, organizations can establish a robust foundation for their data management strategies, effectively meeting both operational and legal requirements.

This article has discussed key components such as:

- Identifying data sources

- Implementing ETL processes

- Establishing strong information governance frameworks

Furthermore, the challenges faced by hedge funds – including data silos, legacy systems, compliance risks, and resource limitations – underscore the complexities involved in achieving seamless data integration. Best practices such as:

- Data validation

- Regular audits

- Continuous education

are emphasized as crucial steps to enhance data quality and compliance.

The importance of effective monitoring and maintenance strategies is paramount. By prioritizing performance metrics, utilizing automated tools, and fostering feedback loops, hedge funds can ensure that their on-premise data integration processes remain resilient and adaptable to the evolving regulatory landscape. Adopting these best practices not only improves data reliability but also positions hedge funds for sustained success in a competitive financial environment.

Frequently Asked Questions

What is on-premise data integration?

On-premise data integration is the process of merging details from various sources within an organization’s local infrastructure, allowing organizations to maintain control over their information.

Why is on-premise data integration important for hedge funds?

It helps hedge funds ensure compliance with regulatory requirements and enhances security over their information.

What are the key components of on-premise data integration?

The key components include data sources, ETL processes, and information governance.

What are data sources in the context of on-premise data integration?

Data sources involve identifying and cataloging all sources of data, which can include databases, applications, and external feeds.

What does ETL stand for, and why is it important?

ETL stands for Extract, Transform, Load. It is important for accurately collecting information, transforming it into a usable format, and loading it into target systems.

What is the role of information governance in on-premise data integration?

Information governance involves establishing policies and procedures for information management to ensure quality, security, and adherence to industry regulations.

How can understanding on-premise data integration fundamentals benefit hedge funds?

It is vital for developing a robust information unification strategy that meets operational and compliance needs.