Why Neutech is the Top Software Development Firm for Hedge Funds

Introduction

Neutech distinguishes itself in the competitive realm of software development for hedge funds, primarily due to its unique emphasis on specialized engineering talent that meets the complex demands of financial services. This focus is underpinned by a rigorous training program and a steadfast commitment to client integration, which not only boosts operational efficiency but also ensures compliance within a swiftly changing regulatory landscape. As the stakes in the financial sector continue to escalate, one must ask: can even the most sophisticated software solutions effectively navigate the relentless challenges posed by market fluctuations and regulatory scrutiny?

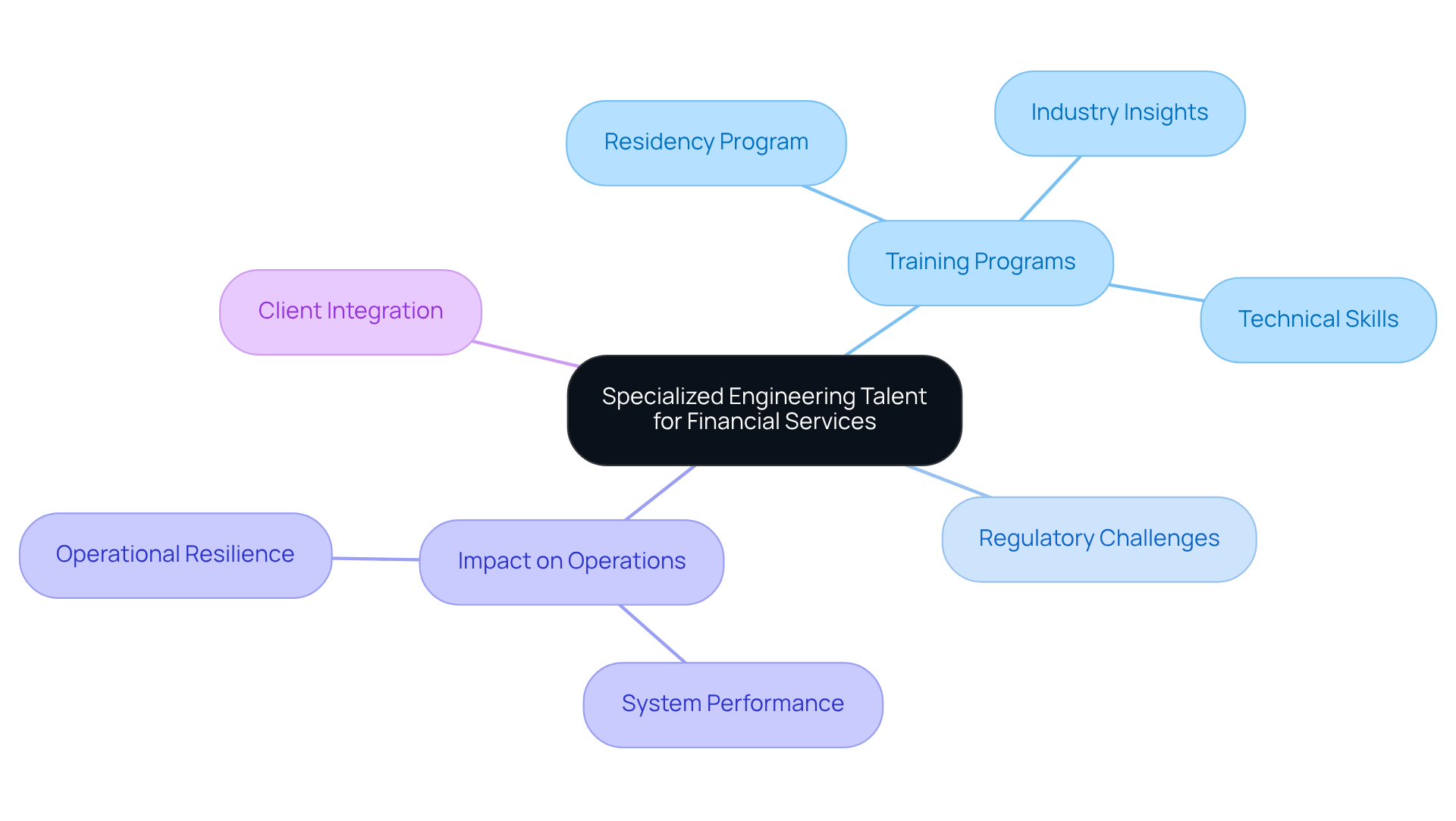

Specialized Engineering Talent for Financial Services

Neutech distinguishes itself as a top software development firm by offering hyper-specialized engineering talent, meticulously trained to meet the complex demands of the financial services industry. This specialization is not just a marketing strategy; it stems from a profound understanding of the regulatory challenges and intricacies that investment pools encounter.

Engineers at Neutech engage in a rigorous residency program in partnership with the University of São Paulo, ensuring they gain both technical skills and industry-specific insights. This dual focus is crucial for investment firms that need robust, scalable, and secure applications to support their investment strategies. Investment pools often manage extensive datasets and require software solutions that can efficiently process and analyze this information while complying with stringent regulations.

The engineers at Neutech excel in delivering such solutions, establishing themselves as a top software development firm and vital partners for investment groups looking to enhance their operations and technological frameworks. The impact of specialized training is evident in successful case studies, where a tailored approach has led to improved system performance and operational resilience, highlighting the critical role of well-trained software engineers in the investment landscape.

Moreover, Neutech’s commitment to reliability is reflected in its emphasis on intangibles such as work ethic, communication, and leadership, which are essential for cultivating a collaborative environment. With total compensation for mid to senior engineers at leading hedge funds ranging from USD 450,000 to 700,000, the necessity for specialized training is underscored, as firms strive to attract top talent capable of driving innovation in algorithmic trading, AI, machine learning, and data analytics.

Neutech’s tailored consultation process ensures that client needs are thoroughly assessed, facilitating the seamless integration of specialized developers and designers from a top software development firm into existing teams. This includes a structured onboarding process that promotes effective collaboration and ongoing management to align with client objectives.

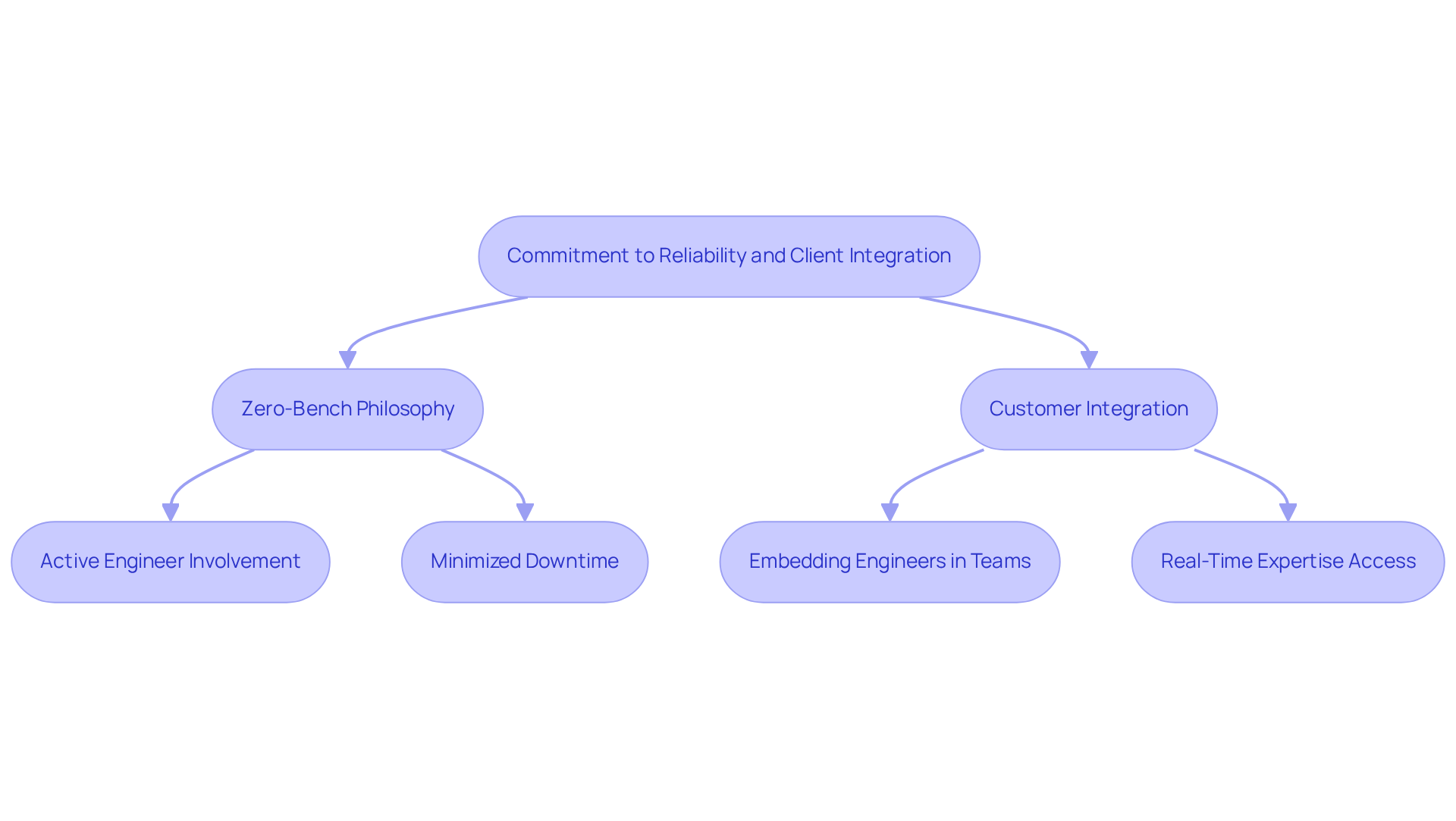

Commitment to Reliability and Client Integration

In the high-stakes realm of hedge funds, reliability is paramount. The company’s zero-bench philosophy ensures that every engineer is actively involved in projects, significantly minimizing downtime and enhancing productivity. This unwavering commitment to reliability is further reinforced by a strong focus on customer integration. By embedding engineers within customer teams, the company fosters a collaborative atmosphere that enhances communication and aligns project goals.

This approach not only streamlines the development process but also allows investment firms to access expertise in real-time, facilitating swift adjustments to evolving market conditions and client needs. For instance, when an investment group encounters an unforeseen regulatory change, having the company’s engineers integrated into their team enables rapid modifications to software solutions, ensuring compliance and maintaining operational continuity.

Moreover, the adaptable staffing strategy allows investment firms to quickly adjust their development resources in response to urgent requirements, thereby improving responsiveness and efficiency. This proactive method exemplifies how effective stakeholder integration can enhance outcomes for investment groups in a top software development firm.

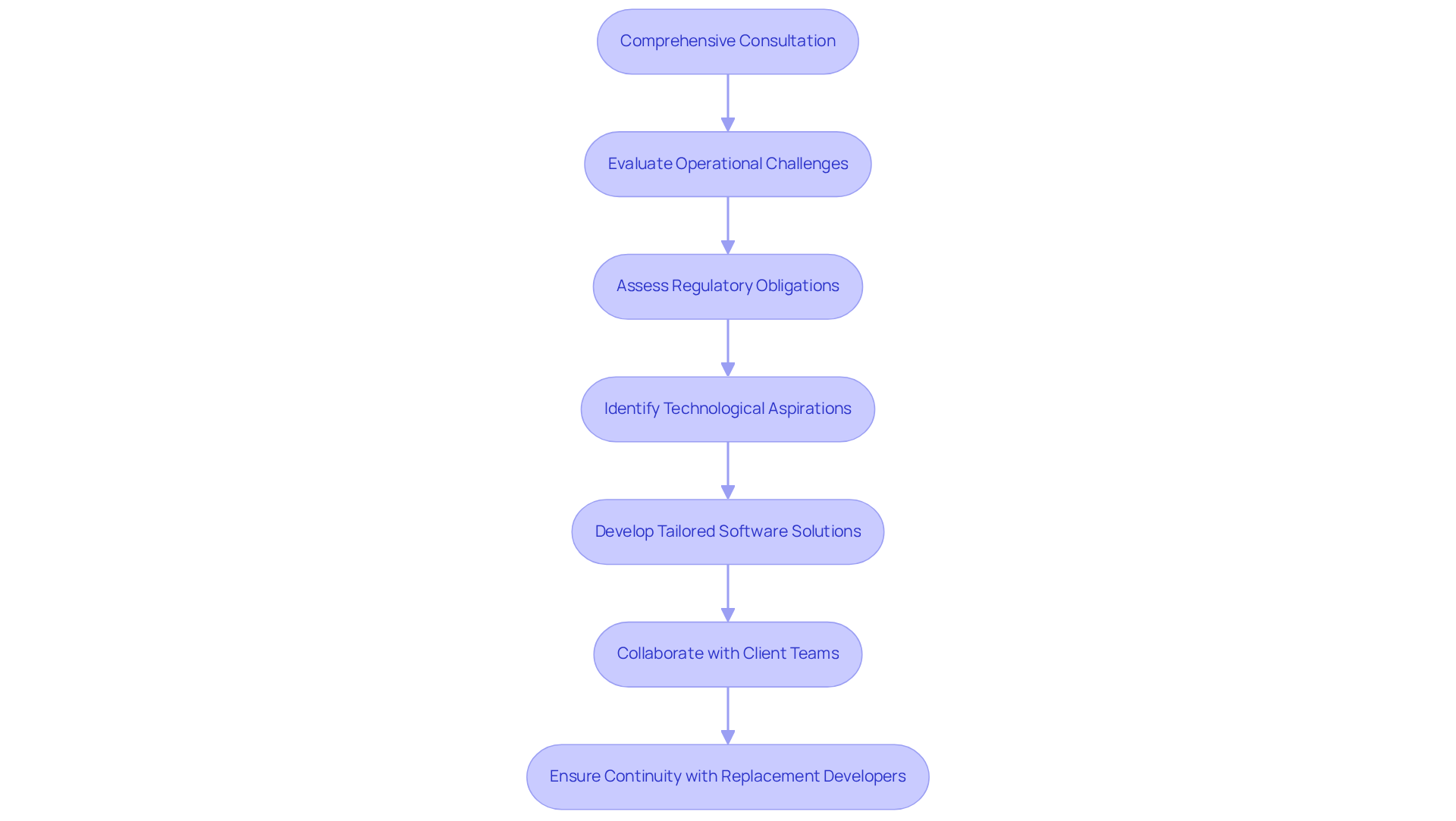

Tailored Client Engagement and Consultation Process

The firm’s engagement strategy is grounded in a profound understanding of the unique requirements of each hedge fund. This process initiates with a comprehensive consultation that evaluates the organization’s operational challenges, regulatory obligations, and technological aspirations. By employing a consultative approach, the company ensures that the solutions crafted are not only technically sound but also strategically aligned with the client’s business objectives.

The company takes pride in its high employee retention rate, which guarantees that clients benefit from a stable and reliable team. For example, when collaborating with an investment group seeking to enhance its risk management capabilities, the company’s engineers work closely with the client’s internal teams to develop software that integrates seamlessly with existing systems. This software is designed to provide advanced analytics and reporting features tailored to the specific needs of the financial services sector. Such customization is crucial, as standard solutions frequently fall short of meeting the intricate regulatory and operational demands of investment firms.

Moreover, Neutech proactively prepares replacement developers to ensure continuity in service, further bolstering reliability. The investment management software market is projected to reach USD 2.51 billion by 2026, growing at a CAGR of 12.87%, underscoring the increasing demand for specialized solutions. As Lucia, the founder of a software development company, observes, “The increasing complexity of financial markets drives the demand for comprehensive software solutions that can manage a wide range of asset classes and trading methods.

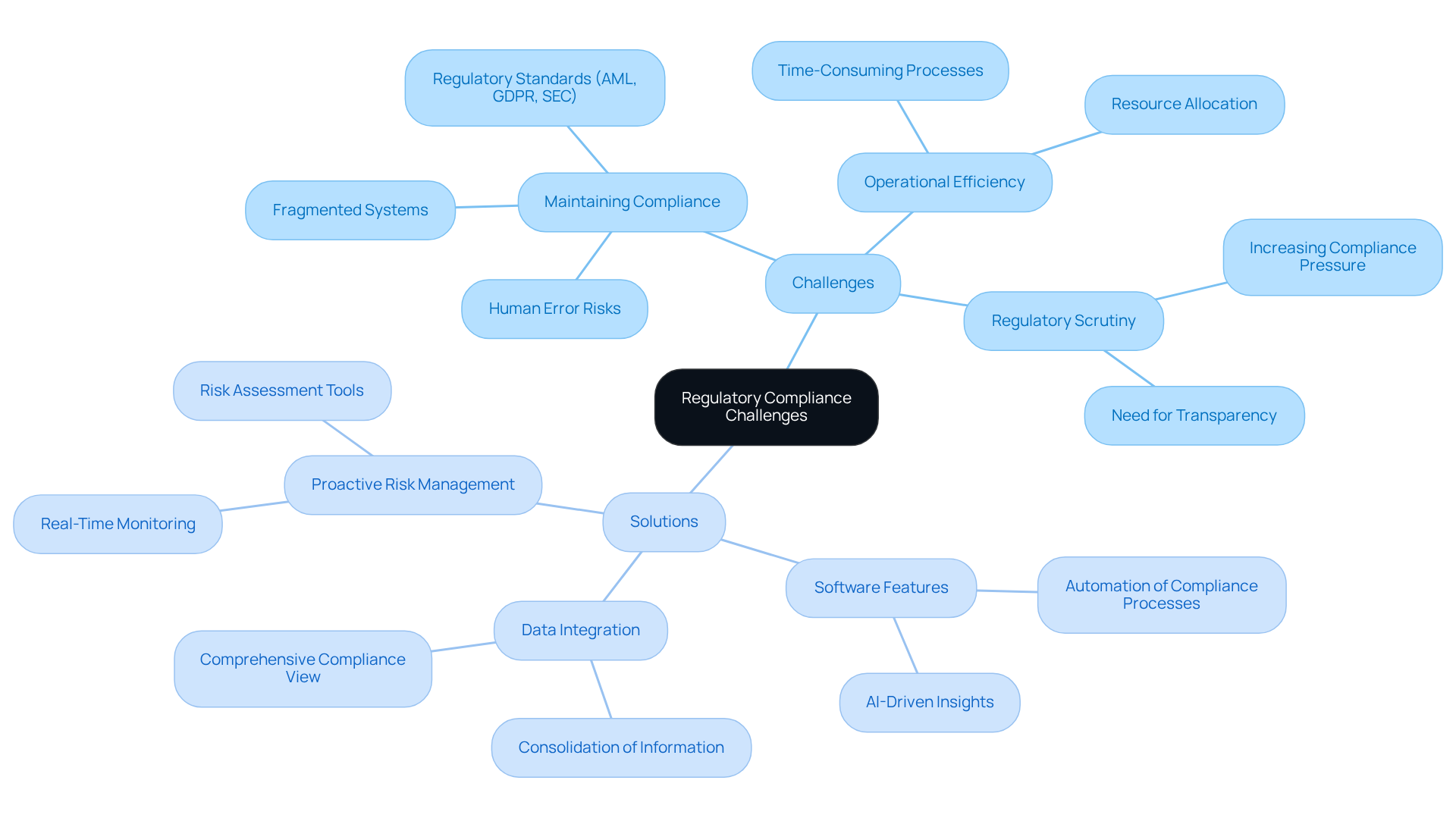

Impact on Regulatory Compliance and Market Challenges

In the dynamic landscape of financial regulations, investment firms face significant challenges in maintaining compliance while striving for operational efficiency. The company’s software solutions are designed specifically to address these challenges, incorporating features that ensure adherence to regulatory standards such as AML, GDPR, and SEC regulations. By leveraging advanced technologies, the company enables investment groups to automate compliance processes, thereby reducing the risk of human error and ensuring timely reporting.

For example, Neutech’s data integration solutions allow investment firms to consolidate information from various sources, providing a comprehensive view of their compliance status and facilitating proactive risk management. This capability is particularly crucial in a market characterized by increasing regulatory scrutiny, as it empowers hedge funds to respond swiftly to regulatory changes and uphold investor confidence.

Conclusion

Neutech distinguishes itself as a leading software development firm for hedge funds, primarily due to its dedication to specialized engineering talent and a profound understanding of the financial services landscape. By equipping its engineers with both technical expertise and industry-specific knowledge, Neutech adeptly addresses the intricate needs of investment firms. This strategic focus not only enhances operational efficiency but also ensures compliance with stringent regulatory requirements.

Several key factors contribute to Neutech’s success:

- The firm implements rigorous training programs in collaboration with esteemed institutions.

- Neutech adheres to a zero-bench philosophy that maximizes productivity.

- This approach prioritizes reliability and seamless integration within client teams.

- Neutech’s tailored consultation process guarantees that solutions are not only effective but also aligned with the unique objectives of each hedge fund, thereby fostering long-term partnerships and stability.

In conclusion, Neutech’s methodology in software development within the hedge fund sector exemplifies the essential role of specialized talent, client integration, and proactive compliance strategies. As the financial landscape continues to evolve, the demand for innovative and reliable software solutions will only increase. Investment firms are encouraged to explore partnerships that not only enhance their technological capabilities but also adeptly navigate the complexities of regulatory compliance, ultimately driving success in an increasingly competitive market.

Frequently Asked Questions

What makes Neutech a top software development firm in the financial services sector?

Neutech distinguishes itself by offering hyper-specialized engineering talent that is meticulously trained to meet the complex demands of the financial services industry, particularly in addressing regulatory challenges and intricacies faced by investment pools.

How do engineers at Neutech gain their expertise?

Engineers at Neutech participate in a rigorous residency program in partnership with the University of São Paulo, which equips them with both technical skills and industry-specific insights necessary for developing robust software solutions.

What types of software solutions do investment firms require?

Investment firms require software solutions that can efficiently process and analyze extensive datasets while ensuring compliance with stringent regulations, supporting their investment strategies.

How does specialized training impact Neutech’s software engineers?

Specialized training enables Neutech’s engineers to deliver tailored software solutions that improve system performance and operational resilience, demonstrating the critical role of well-trained software engineers in the investment landscape.

What intangibles does Neutech emphasize in its engineering talent?

Neutech emphasizes work ethic, communication, and leadership, which are essential for fostering a collaborative environment among teams.

What is the compensation range for mid to senior engineers at leading hedge funds?

Total compensation for mid to senior engineers at leading hedge funds ranges from USD 450,000 to 700,000, highlighting the necessity for specialized training to attract top talent.

How does Neutech ensure effective integration of its developers into client teams?

Neutech has a tailored consultation process that thoroughly assesses client needs, facilitating seamless integration of specialized developers and designers into existing teams, along with a structured onboarding process for effective collaboration.

What areas of technology does Neutech’s talent focus on?

Neutech’s talent focuses on driving innovation in areas such as algorithmic trading, AI, machine learning, and data analytics within the financial services industry.