Why Hedge Funds Choose an Outsourced Software Product Development Company

Introduction

Hedge funds operate within a complex landscape marked by stringent regulations, evolving technologies, and an ongoing demand for innovation. In their pursuit of enhanced operational efficiency and a competitive edge, these investment firms increasingly consider outsourcing software development as a strategic solution. However, this decision presents challenges: how can hedge funds effectively balance the advantages of external expertise with the risks associated with dependency and cultural integration? By examining the rationale for outsourcing and the unique benefits provided by specialized companies like Neutech, hedge funds can identify pathways to thrive in a rapidly evolving financial environment.

Identify Challenges in Hedge Fund Software Development

Hedge pools operate within a highly regulated and competitive landscape, presenting distinct challenges in application development. Key issues include:

-

Regulatory Compliance: Hedge pools face stringent regulations governing financial transactions and data management. Developing applications that adhere to these compliance standards necessitates specialized knowledge and continuous updates to adapt to evolving laws. The SEC underscores the necessity of detailed incident response plans and robust cybersecurity measures, which are vital for maintaining compliance and fostering investor trust.

-

Data Protection: With sensitive financial information at stake, investment groups confront significant cybersecurity threats. Implementing robust security measures during application development is essential, albeit resource-intensive and complex. Firms must ensure secure storage of client data, employing multi-factor authentication and adhering to least-privilege access principles to mitigate risks.

-

Integration with Legacy Systems: Many investment firms depend on outdated technology, complicating the integration of new digital solutions. This reliance can result in inefficiencies and increased operational risks, as legacy systems may not accommodate modern compliance and security requirements.

-

Scalability: As investment groups expand, their system requirements evolve. Developing scalable solutions capable of managing increased data loads and user demands poses a critical challenge. Cloud-based applications are gaining traction due to their flexibility and scalability, allowing investment firms to adapt to changing business needs without incurring substantial infrastructure costs.

-

Talent Shortage: A notable scarcity of skilled engineers with expertise in financial services exists. This shortage can impede an investment group’s ability to develop and maintain high-quality applications internally, making an outsourced software product development company an attractive option to access specialized skills and knowledge. Neutech addresses this challenge by assessing client needs and providing tailored engineering expertise, including specialized developers and designers, to ensure investment groups can effectively navigate the complexities of application development. As noted by Spherical Insights, robust and reliable applications are crucial for managing high-frequency trading, risk management, and regulatory compliance.

These challenges underscore a compelling case for an outsourced software product development company, as investment groups seek to leverage external expertise to manage these complexities efficiently.

Explore Benefits of Outsourcing Software Development

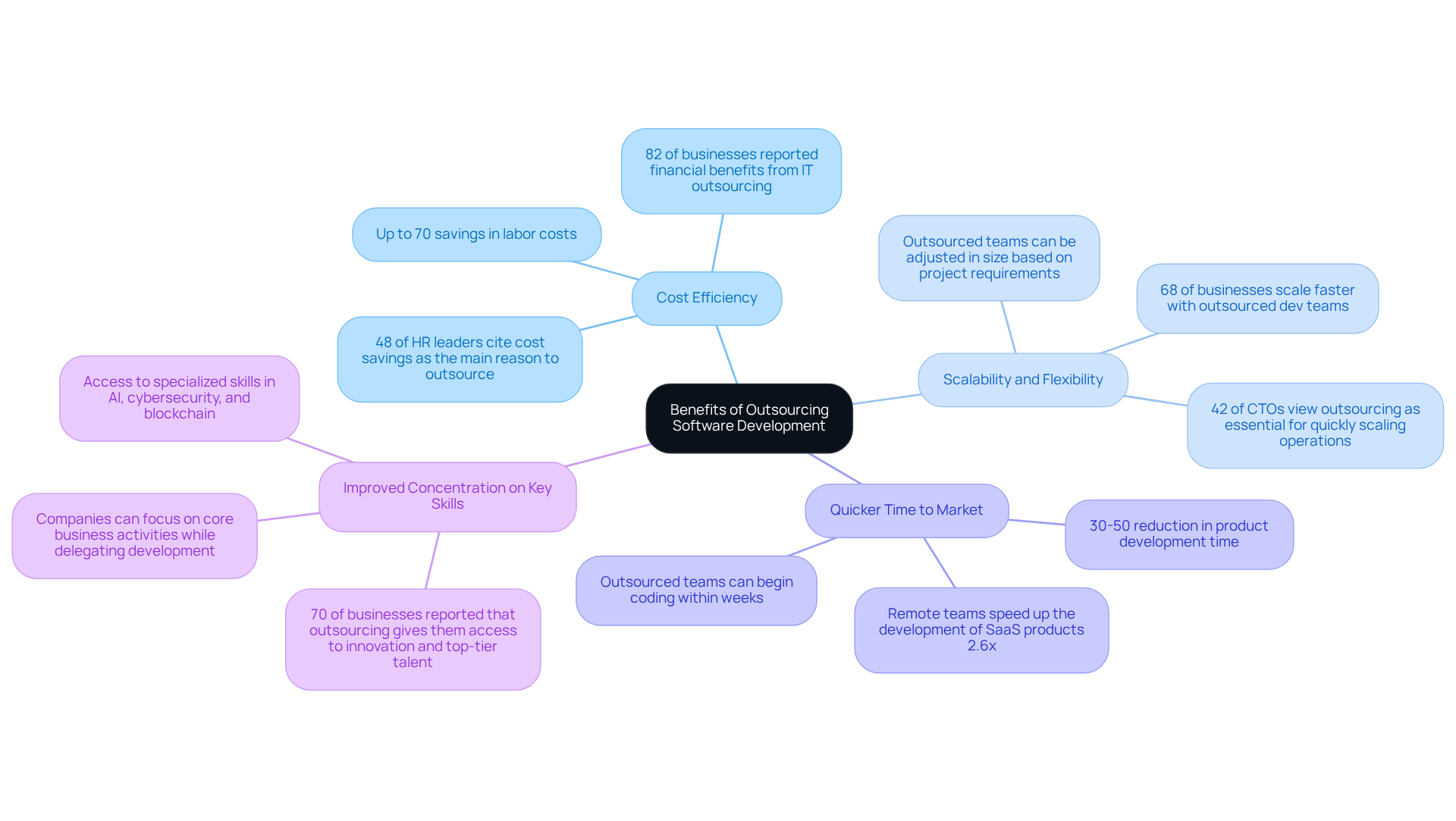

An outsourced software product development company provides hedge funds with several strategic advantages that can significantly enhance their operations.

By outsourcing to an outsourced software product development company, investment groups can access a global talent pool of software developers with specialized skills in financial technology, compliance, and data security. This expertise is often difficult to source internally, especially in a rapidly evolving regulatory environment. Neutech plays a crucial role in this process by assessing client needs and providing tailored candidates, ensuring that investment firms have access to the right talent for their specific requirements.

-

Cost Efficiency: Outsourcing can lead to substantial reductions in operational costs associated with hiring, training, and maintaining an in-house development team. Hedge funds can engage services on an as-needed basis, facilitating improved budget management and allowing for a more agile financial strategy. In fact, companies can save up to 70% in labor costs by opting for dedicated offshore developers instead of maintaining in-house teams.

-

Scalability and Flexibility: Outsourced teams can be adjusted in size based on project requirements, offering investment firms the flexibility to respond to market changes without the long-term commitment of employing full-time personnel. This adaptability is essential in the fast-paced financial sector, where project scopes can change rapidly.

-

Quicker Time to Market: With dedicated teams focusing solely on application development, investment groups can significantly accelerate project timelines. This enables faster deployment of new features and updates, which is vital for maintaining a competitive edge in the financial landscape.

-

Improved Concentration on Key Skills: By outsourcing non-essential functions, investment firms can concentrate on their core business activities, such as investment strategies and client relations, while delegating application development to specialized companies. This strategic delegation to an outsourced software product development company enhances operational efficiency and fosters innovation. As Janet Yellen noted, outsourcing is a beneficial form of trade that can enhance overall productivity.

These advantages underscore why numerous investment firms are increasingly choosing to work with an outsourced software product development company to address their development needs, enabling them to remain competitive in a rapidly changing financial environment.

Highlight Neutech’s Unique Value Proposition for Hedge Funds

Neutech offers a compelling value proposition for hedge funds in need of outsourced software development solutions:

-

Hyper-Specialized Engineering Talent: Neutech grants access to engineers who complete a rigorous residency program, ensuring they possess the senior-level proficiency and industry-specific expertise crucial for regulated sectors such as financial services.

-

Zero-Bench Philosophy: This innovative approach guarantees that every engineer is actively engaged in projects, significantly reducing downtime and ensuring that investment groups benefit from consistent quality and resource availability.

-

Customized Consultation and Candidate Selection: The process begins with a complimentary consultation to understand the specific requirements of investment groups. Once these needs are clearly defined, Neutech provides a selection of candidate designers and developers tailored to integrate seamlessly into the client’s team, ensuring optimal project outcomes.

-

Flexible Contract Models: The adaptable contract structure allows hedge funds to modify their development resources on a monthly basis, accommodating varying project demands without the constraints of long-term commitments.

-

Focus on Intangibles: Neutech prioritizes work ethic, communication skills, and leadership alongside technical proficiency, ensuring that developers integrate smoothly with internal teams and contribute positively to the company culture.

-

Regular Management Calls: After onboarding, Neutech schedules regular management calls to reinforce the project roadmap and synchronize on ongoing performance, ensuring continuous support and alignment with client objectives.

-

Global Presence: With operations in six countries, Neutech provides investment vehicles with diverse insights and solutions, enhancing innovation and flexibility in application development.

These attributes position Neutech as an outsourced software product development company and a strategic partner for investment groups that aim to bolster their technological capabilities while effectively navigating the complexities of the financial services sector.

Assess Long-Term Implications of Outsourcing Decisions

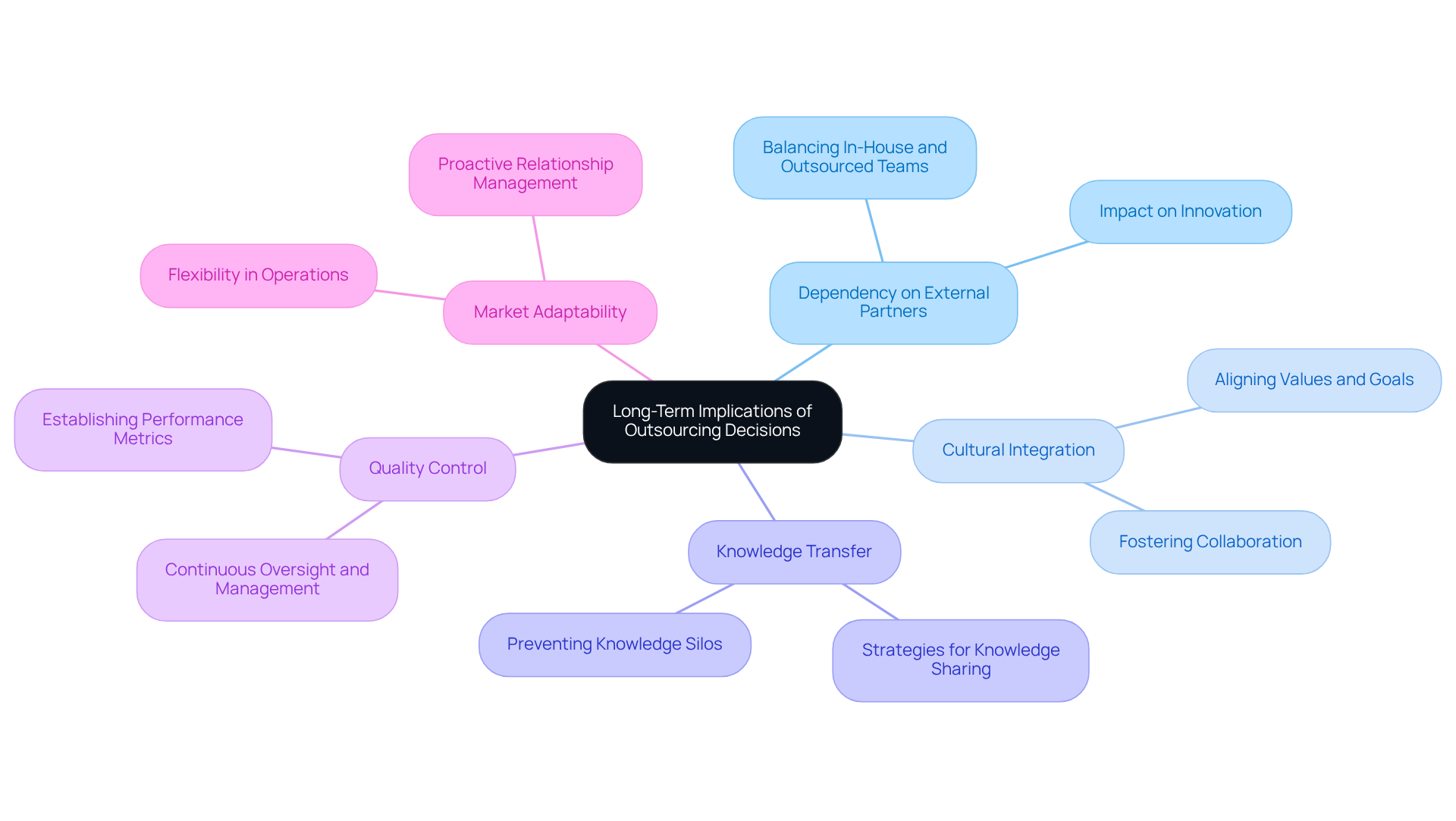

While an outsourced software product development company offers immediate advantages, hedge funds must carefully evaluate the long-term implications of this strategy.

-

Dependency on External Partners: A heavy reliance on outsourced teams can hinder a hedge organization’s capacity for independent innovation. It is crucial to strike a balance between in-house capabilities and external support to maintain agility and creativity.

-

Cultural Integration: Successfully integrating outsourced teams into the existing company culture presents significant challenges. Our company emphasizes a family-oriented culture that fosters collaboration and camaraderie among teams. Hedge funds must prioritize initiatives that align external teams with their core values and goals to cultivate a cohesive working environment.

-

Knowledge Transfer: Without proper management, outsourcing can lead to knowledge silos, jeopardizing operational continuity. Neutech addresses this issue by ensuring seamless knowledge transfer, supported by high employee retention rates that prevent service disruptions. Hedge investment groups should implement robust strategies to facilitate knowledge sharing between internal and external teams, ensuring that critical insights and expertise are preserved.

-

Quality Control: Maintaining high standards in outsourced projects requires continuous oversight and management. Hedge funds must establish clear performance metrics and effective communication channels to monitor quality and ensure that deliverables meet rigorous standards. Our commitment to reliability means we never divert a developer from a project, ensuring consistent quality and performance.

-

Market Adaptability: The financial environment is in constant flux, necessitating that investment groups remain flexible. While partnering with an outsourced software product development company can provide the needed flexibility to respond to market changes, it also requires a proactive approach to managing relationships with external partners to ensure alignment with evolving business needs. Neutech’s customized approach to supplying engineering talent enables investment firms to scale efficiently and effectively, adapting to their specific requirements.

By thoroughly assessing these long-term implications, hedge funds can make informed decisions regarding their outsourcing strategies, ensuring alignment with overall business objectives and maintaining a competitive edge in the market.

Conclusion

Outsourcing software development has become a strategic necessity for hedge funds as they navigate the complexities of a highly regulated and competitive financial landscape. By leveraging external expertise, investment groups can effectively address significant challenges, including regulatory compliance, data protection, and the integration of legacy systems. This approach ultimately enhances their operational efficiency and adaptability.

The article outlines several compelling reasons for hedge funds to partner with outsourced software product development companies. Key benefits include:

- Access to specialized talent

- Cost efficiency

- Scalability

- A quicker time to market

Neutech exemplifies this value proposition by providing tailored engineering solutions and a commitment to quality, allowing hedge funds to concentrate on their core competencies while ensuring robust and compliant software applications.

In light of these insights, it is essential for hedge funds to carefully consider their outsourcing strategies, balancing immediate advantages with potential long-term implications. By fostering a collaborative culture with external partners and ensuring effective knowledge transfer, investment groups can sustain innovation and agility in a rapidly evolving market. Embracing outsourcing not only enhances operational capabilities but also positions hedge funds to thrive amidst the complexities of the financial services sector.

Frequently Asked Questions

What are the main challenges in hedge fund software development?

The main challenges include regulatory compliance, data protection, integration with legacy systems, scalability, and a talent shortage in skilled engineers.

Why is regulatory compliance important for hedge funds?

Regulatory compliance is crucial because hedge funds must adhere to stringent regulations governing financial transactions and data management. This requires specialized knowledge and continuous updates to meet evolving laws, ensuring investor trust.

What cybersecurity measures should be implemented during application development for hedge funds?

Robust security measures should include secure storage of client data, multi-factor authentication, and adherence to least-privilege access principles to mitigate risks associated with sensitive financial information.

How does reliance on legacy systems affect hedge fund software development?

Reliance on outdated technology complicates the integration of new digital solutions, leading to inefficiencies and increased operational risks as legacy systems may not meet modern compliance and security requirements.

What is the significance of scalability in hedge fund software solutions?

Scalability is critical as investment groups expand and their system requirements evolve. Developing scalable solutions helps manage increased data loads and user demands, with cloud-based applications providing flexibility and cost-effectiveness.

What is the impact of the talent shortage on hedge fund software development?

The scarcity of skilled engineers with expertise in financial services can hinder an investment group’s ability to develop and maintain high-quality applications internally, making outsourced software development an attractive option.

How can outsourced software product development companies assist hedge funds?

Outsourced software product development companies can provide specialized skills and knowledge, tailoring engineering expertise to meet client needs, which helps investment groups navigate the complexities of application development effectively.