In-House Developed Software vs. External Solutions for Hedge Funds

Introduction

In the competitive realm of hedge funds, the decision between in-house developed software and external solutions is crucial, often determining both operational efficiency and compliance success. Investment groups can derive significant advantages from in-house development, as it allows for tailored solutions that align closely with their unique strategies and stringent regulatory requirements.

However, this choice is not without its challenges; factors such as cost, talent acquisition, and ongoing maintenance can complicate the decision-making process. As firms navigate these complexities, a critical question arises: do the benefits of customized internal solutions outweigh the potential drawbacks, or do external partnerships present a more viable path to success in an ever-evolving financial landscape?

Evaluate the Advantages of In-House Software Development for Hedge Funds

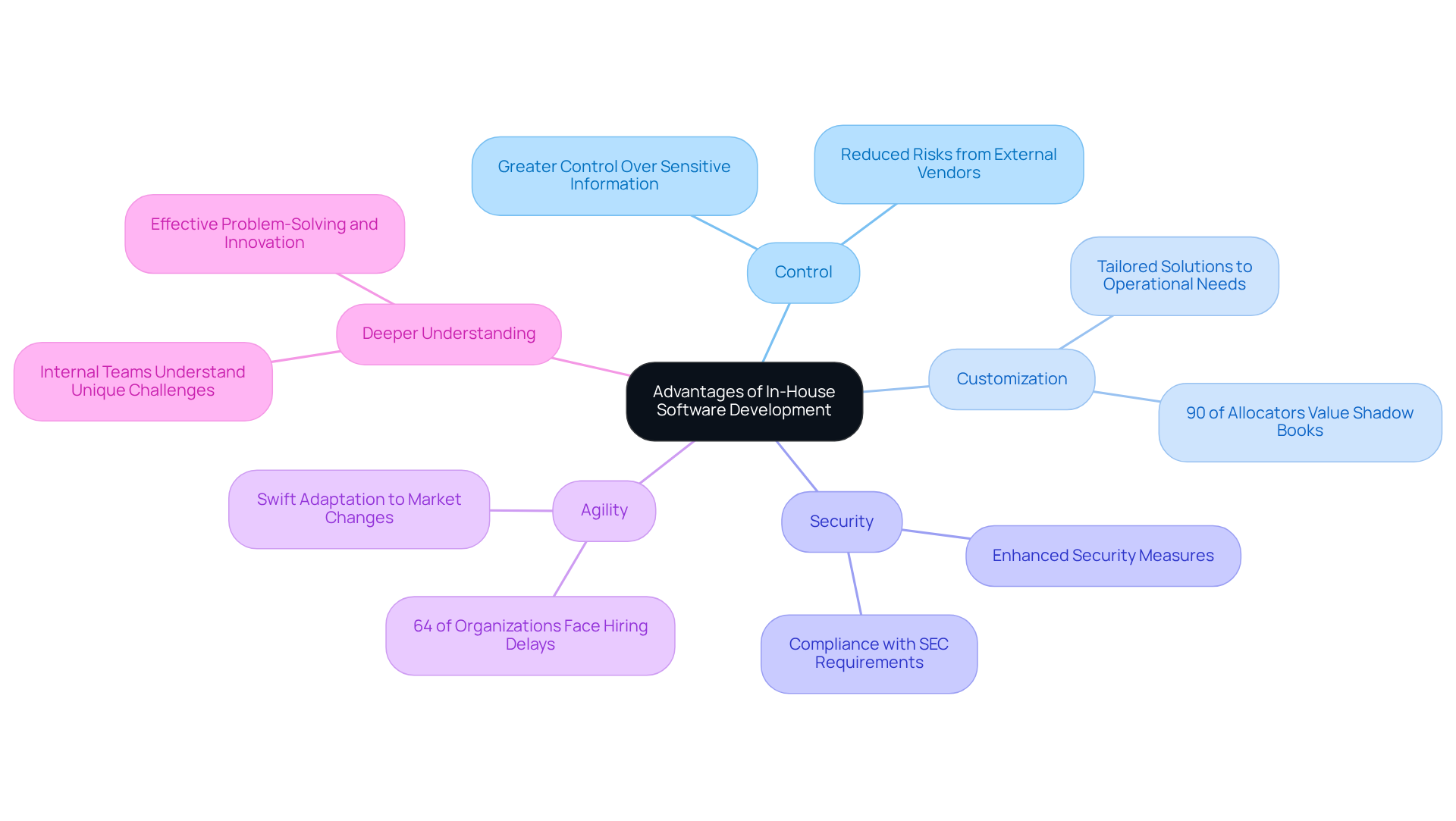

In-house application development presents significant advantages for investment groups, particularly in terms of control, customization, and security. By tailoring technological solutions to their specific operational needs, investment firms can ensure that technology aligns seamlessly with their investment strategies and compliance requirements – something that is often unattainable with off-the-shelf solutions. This level of customization is essential, as nearly 90% of allocators deem shadow books of records critical for validating trades and ensuring accurate reporting, highlighting the necessity for bespoke solutions.

Moreover, internal teams can swiftly adapt to changes in market conditions or regulatory demands, facilitating flexible modifications to functionalities. This agility is crucial in a competitive landscape where 64% of organizations indicate that it takes over four months to fill technology positions, potentially impeding timely adaptations.

Security represents another vital advantage; developing software in-house allows investment firms to exert greater control over sensitive information and intellectual property, significantly reducing the risks associated with external vendors. The complexities of regulatory compliance further underscore the importance of this control, as investment vehicles must navigate stringent SEC requirements that impose rigorous reporting standards.

Additionally, in-house teams cultivate a deeper understanding of the project’s unique challenges, which fosters more effective problem-solving and innovation. For example, successful in-house initiatives have shown that customized applications can automate routine tasks, streamline data processing, and enable real-time analytics, thereby enhancing operational efficiency.

In summary, the ability to create tailored solutions that are secure, compliant, and aligned with specific needs makes internal development a compelling choice for investment groups striving to excel in a dynamic financial environment.

Assess the Disadvantages of In-House Software Development for Hedge Funds

Internal application development offers numerous benefits; however, it also presents significant challenges that investment groups must carefully evaluate. A primary concern is the substantial cost associated with hiring and retaining skilled developers, which can strain budgets, particularly for smaller financial resources. The average hiring time for tech roles is approximately 5.4 months, with 64% of organizations indicating that it takes over four months to fill these positions. This extended timeline complicates the ability to respond swiftly to market changes. Moreover, the time and resources required to develop and maintain applications can divert attention from core investment activities, potentially hindering overall performance.

Additionally, many hedge funds encounter skill shortages, lacking access to the specialized talent necessary for developing complex financial applications. This limitation can result in suboptimal solutions that do not meet the stringent demands of the industry. The ongoing maintenance and updates required for in-house systems introduce another layer of operational burden, often leading to increased costs and resource depletion. Indeed, technical debt can accumulate over time, with 72% of software development teams reporting such debt, which slows project cycles and stifles innovation.

These factors collectively render in-house development less attractive, especially when juxtaposed with the flexibility and cost-effectiveness of outsourcing options. By partnering with Neutech, investment groups can leverage a tailored engineering talent supply process. Neutech assesses client needs and provides specialized developers and designers, enabling investment firms to tap into external expertise, optimize operations, and ensure compliance with stringent regulations. This strategic collaboration ultimately positions them for sustainable growth in a competitive market.

Explore the Benefits of External Software Development for Hedge Funds

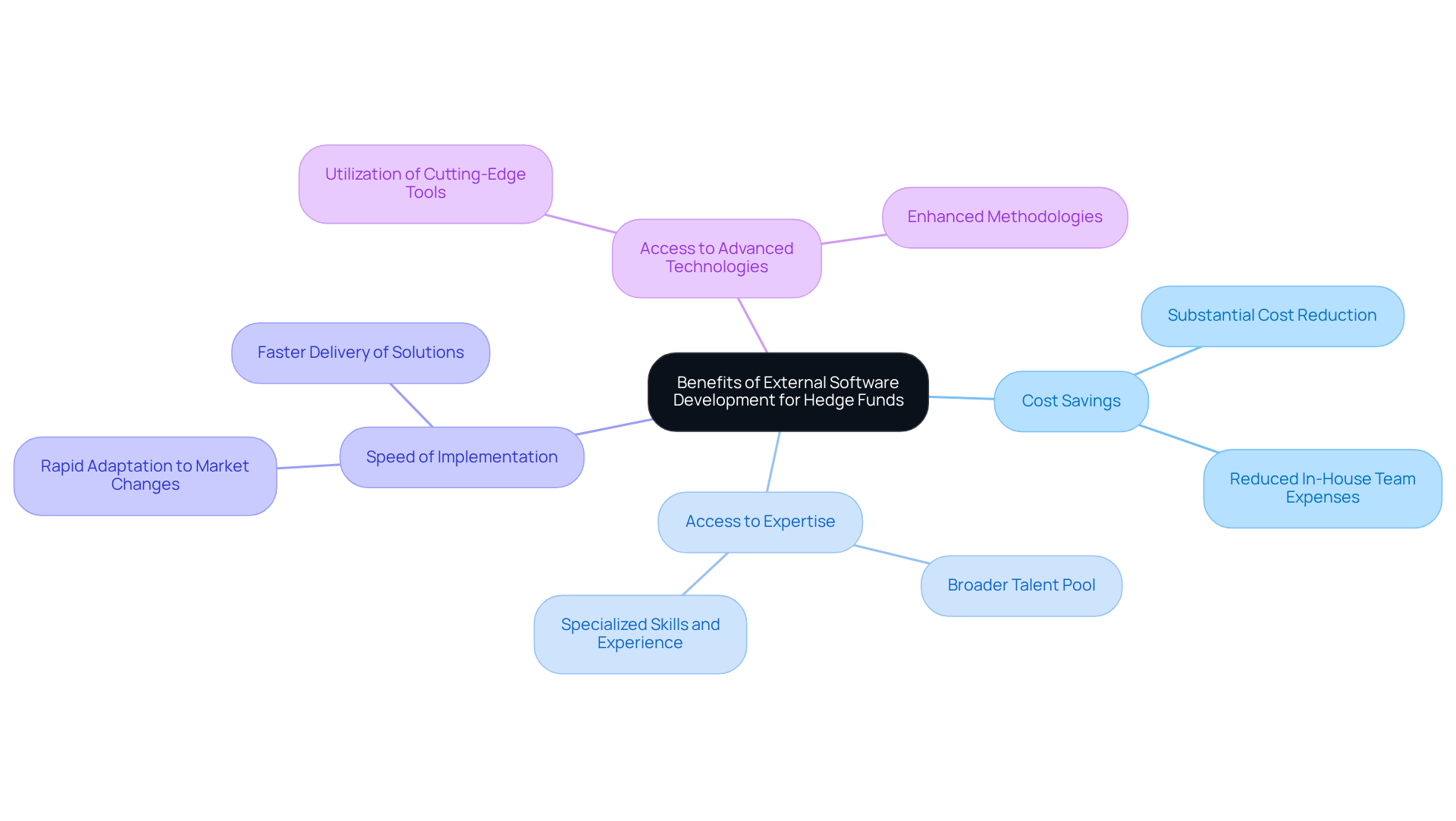

Outsourcing software development presents investment firms with numerous advantages that can significantly enhance operational efficiency and technological capability. A primary benefit is the substantial cost savings; by leveraging external talent, firms can tap into a broader pool of expertise without incurring the expenses associated with maintaining an in-house team. This is especially advantageous for smaller investment groups that may not have the resources for extensive technology investments. Moreover, external developers often possess specialized skills and experience, fostering innovative and effective solutions tailored to the unique challenges of the investment sector.

Another critical advantage is the speed of implementation; external teams frequently deliver technological solutions more rapidly than internal teams, enabling investment firms to swiftly adapt to market changes. This agility is crucial in an environment where timely decision-making can greatly influence performance. Additionally, outsourcing grants access to advanced technologies and methodologies, ensuring that investment firms remain competitive in a continually evolving industry.

In summary, the flexibility and expertise offered by external software development make it a compelling option for hedge funds seeking to optimize their operations and strengthen their market positioning.

Conclusion

Investment firms encounter a pivotal decision when evaluating the advantages of in-house software development versus external solutions. The capacity to develop customized, secure, and compliant software tailored to specific operational requirements positions in-house development as a compelling option. Nevertheless, this approach presents challenges, including elevated costs, skill shortages, and the potential diversion of resources from core investment activities.

Key insights indicate that while in-house development affords greater control and adaptability in a swiftly evolving financial landscape, it also imposes substantial financial and operational burdens. In contrast, outsourcing emerges as a viable alternative, granting access to specialized skills and innovative solutions without the overhead associated with maintaining an internal team. This flexibility can significantly enhance operational efficiency and ensure hedge funds remain competitive.

Ultimately, the decision between in-house and external software solutions should be informed by a firm’s distinct needs, resources, and strategic objectives. Whether choosing the tailored approach of in-house development or the agility of outsourcing, investment groups must prioritize solutions that empower them to thrive in an increasingly complex market. Adopting the appropriate software strategy is crucial for achieving sustainable growth and preserving a competitive advantage in the hedge fund industry.

Frequently Asked Questions

What are the main advantages of in-house software development for hedge funds?

The main advantages include enhanced control, customization, and security, allowing investment firms to tailor technological solutions to their operational needs and compliance requirements.

Why is customization important for investment firms?

Customization is essential because nearly 90% of allocators consider shadow books of records critical for validating trades and ensuring accurate reporting, which is often unattainable with off-the-shelf solutions.

How does in-house development help firms adapt to market changes?

Internal teams can quickly modify functionalities in response to changes in market conditions or regulatory demands, which is crucial in a competitive landscape where filling technology positions can take over four months.

What security benefits does in-house software development provide?

Developing software in-house allows investment firms to have greater control over sensitive information and intellectual property, significantly reducing risks associated with external vendors.

How does regulatory compliance influence the need for in-house development?

The complexities of regulatory compliance, particularly with stringent SEC requirements, underscore the importance of having control over software development to meet rigorous reporting standards.

What additional benefits do in-house teams offer?

In-house teams develop a deeper understanding of unique project challenges, leading to more effective problem-solving and innovation, such as automating routine tasks and enabling real-time analytics.

Why is operational efficiency important for investment groups?

Enhanced operational efficiency, achieved through customized applications, helps investment groups streamline data processing and improve overall performance in a dynamic financial environment.