Why Hedge Funds Need Customized Software Solutions for Success

Introduction

Hedge funds navigate a complex and dynamic financial landscape characterized by high stakes and intense competition. To succeed, these investment firms must address distinct challenges, including stringent compliance requirements and the management of substantial data volumes. This article explores how tailored software solutions can streamline operations, improve decision-making, and enhance risk management, thereby positioning hedge funds for success. As regulatory scrutiny increases, a critical question arises: how can hedge funds effectively utilize customized technology to sustain their competitive advantage while addressing these challenges?

Understand the Unique Challenges Hedge Funds Face

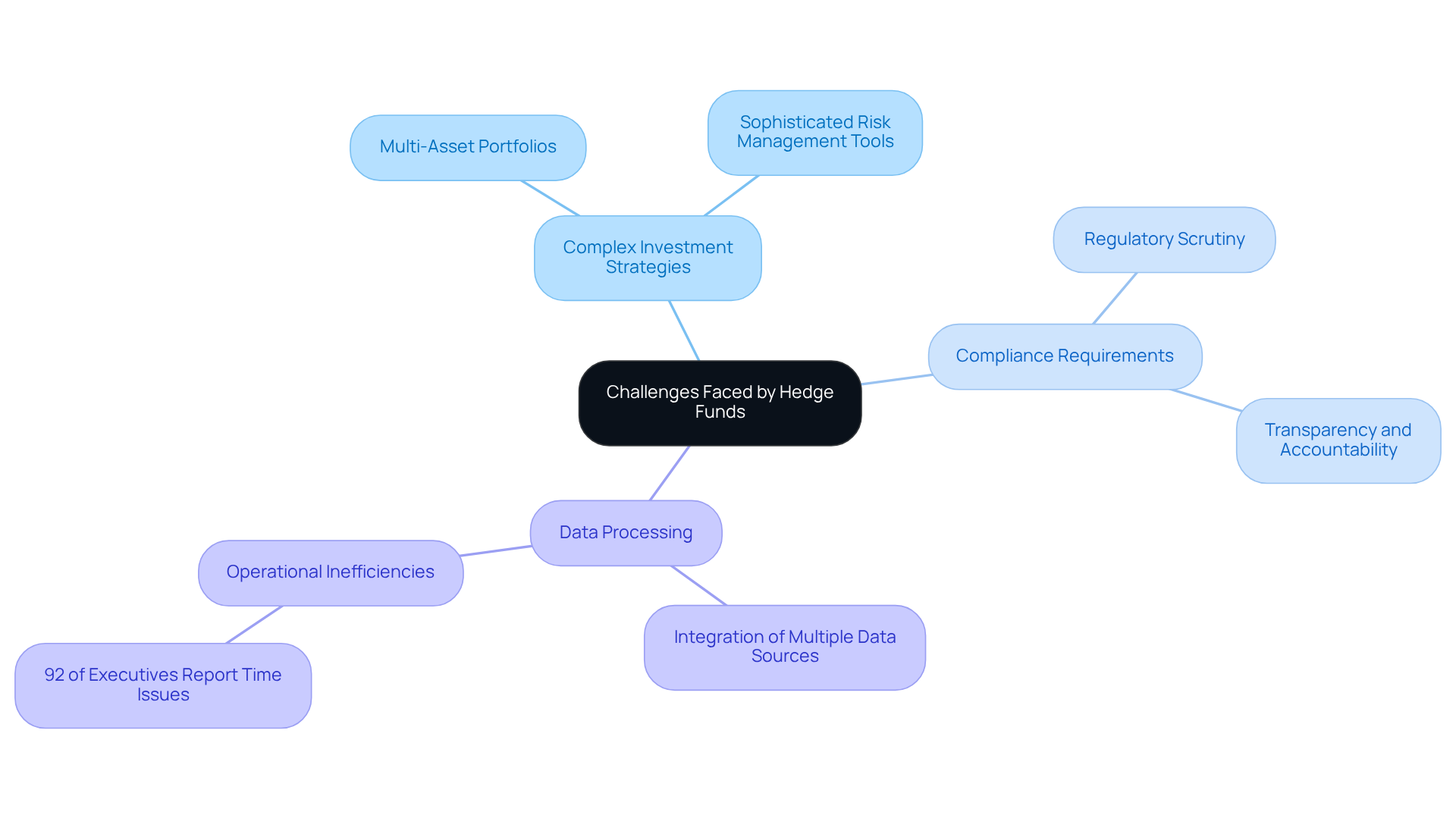

Hedge portfolios operate within a highly competitive and regulated environment, encountering specific challenges that necessitate a customized software solution. These challenges include:

- Managing complex investment strategies

- Adhering to stringent compliance requirements

- Processing vast volumes of data

For example, investment groups often oversee multi-asset portfolios that demand sophisticated risk management tools capable of assessing market variations and enhancing returns.

The increasing scrutiny from regulators has amplified the need for transparency and accountability, compelling investment firms to implement systems that ensure thorough reporting and audit trails. Notably, 92% of investment executives report spending excessive time consolidating and integrating data from multiple sources, highlighting the operational inefficiencies that can arise without tailored technological solutions.

Furthermore, investment groups that utilize customized applications – such as those developed with React, Python, or .NET – have demonstrated improved performance in their investment strategies, enabling them to navigate market complexities more effectively. In this context, the lack of a customized software solution can lead to significant operational inefficiencies and compliance failures, ultimately jeopardizing an investment firm’s competitive edge.

At Neutech, we understand these challenges and offer comprehensive engineering services specifically tailored for regulated sectors like investment groups. Our process begins with a detailed assessment of your needs, allowing us to provide specialized developers and designers who can seamlessly integrate into your team. This customized approach ensures that our offerings not only meet regulatory requirements but also enhance operational efficiency and support your strategic objectives.

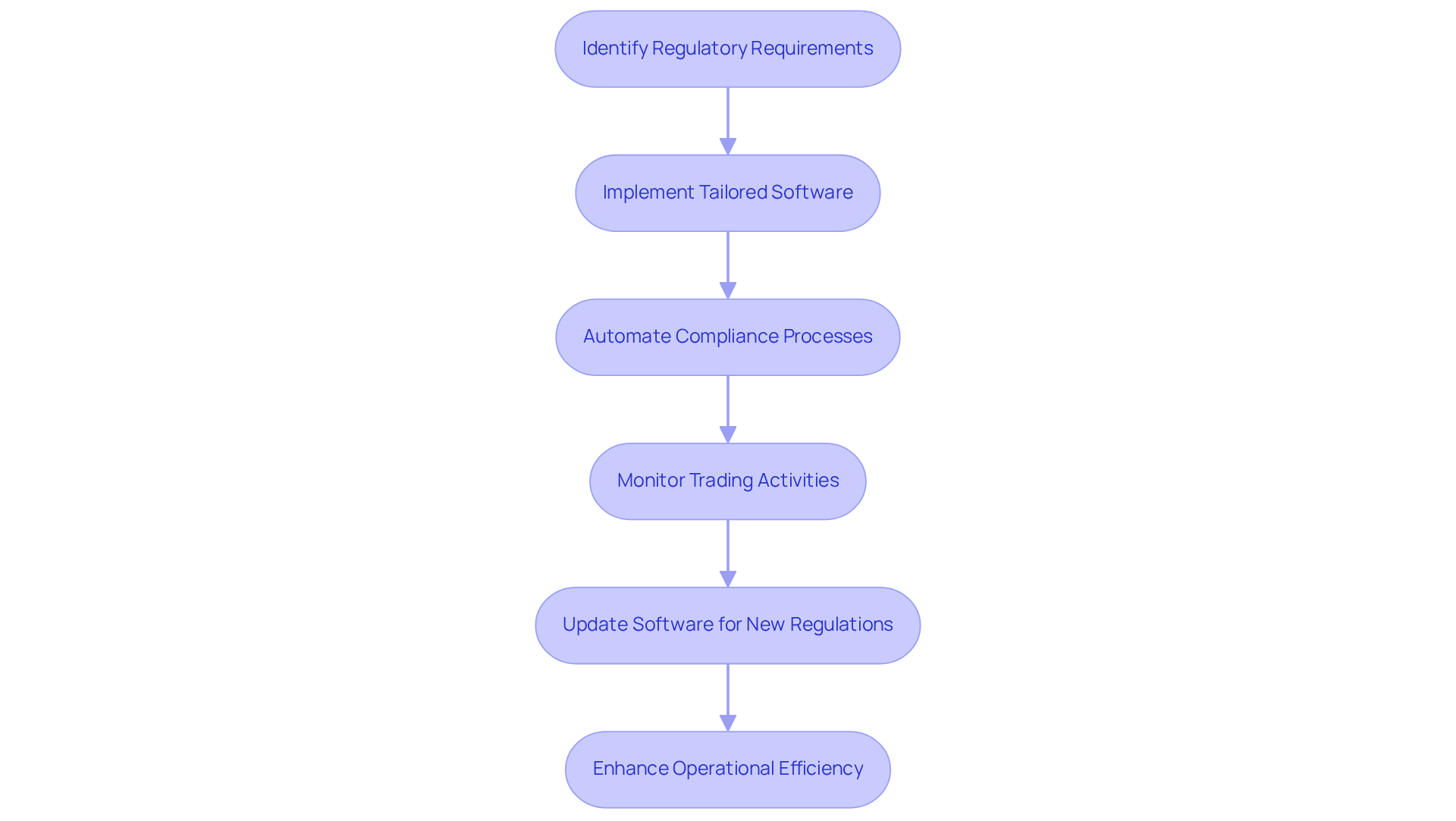

Address Regulatory Compliance with Tailored Software

Regulatory compliance represents a critical concern for investment firms, necessitating adherence to a multitude of laws and regulations governing their operations. Neutech provides a customized software solution that includes tailored technology services such as React Development and Python Development, aimed at automating compliance processes. This ensures that hedge investments can effectively manage reporting requirements and maintain accurate records.

For example, customized applications can monitor trading activities in real-time, identifying potential compliance issues before they escalate. This proactive strategy not only mitigates risks but also bolsters the organization’s reputation with regulators and investors alike. Furthermore, as regulations evolve, Neutech’s customized software solution can be updated to align with new compliance criteria, providing investment groups with the necessary flexibility to adapt to a changing environment.

Compliance officers have observed that such automation significantly alleviates manual workloads, enabling teams to concentrate on strategic initiatives rather than being encumbered by time-consuming processes. By integrating automated compliance systems, investment firms can enhance operational efficiency and ensure robust governance, ultimately fostering trust and transparency in their operations.

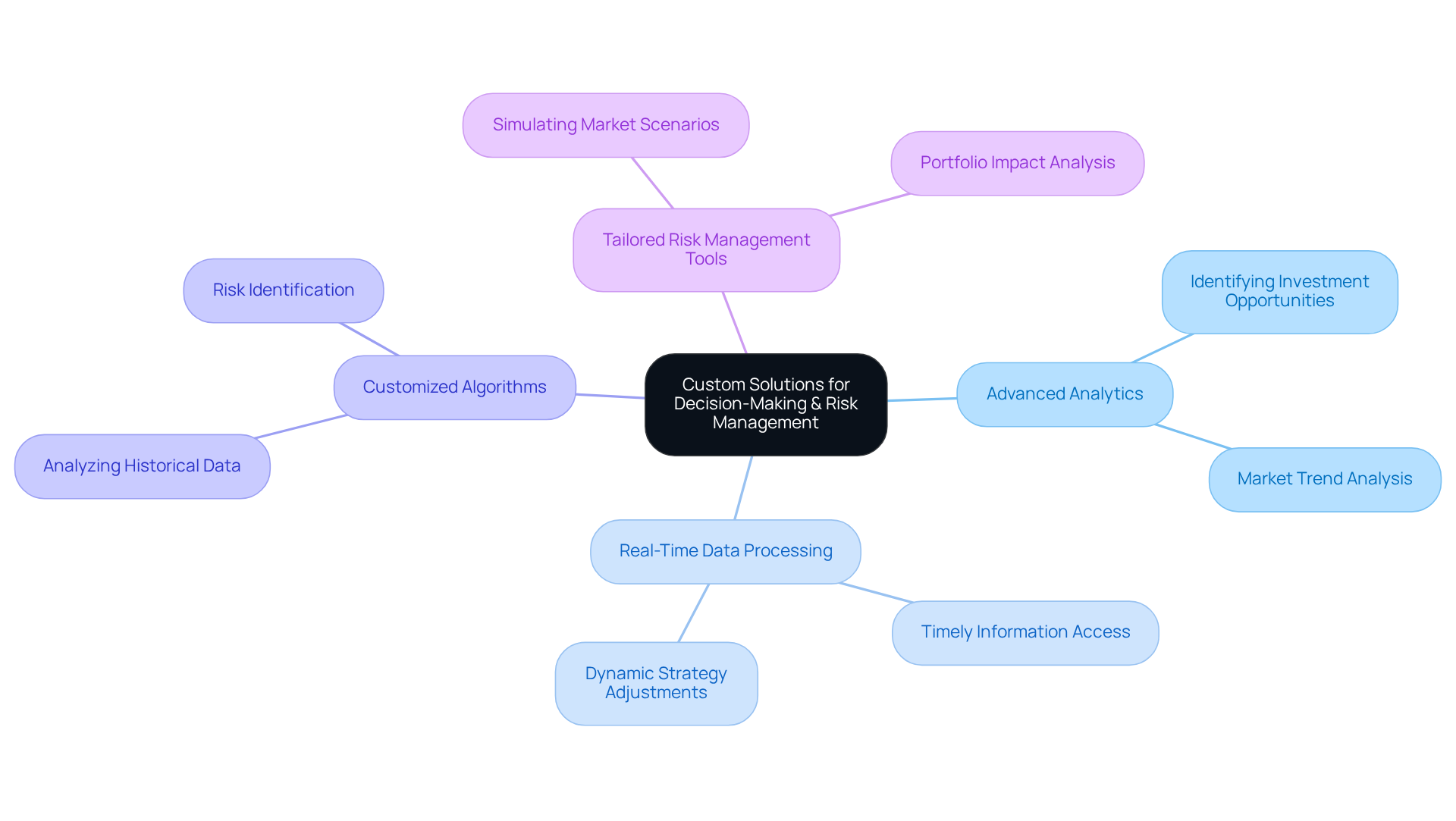

Enhance Decision-Making and Risk Management through Custom Solutions

Investment firms aiming to enhance their decision-making and risk management capabilities find that a customized software solution is essential. By leveraging advanced analytics and real-time data processing, these solutions empower asset managers to make informed investment decisions based on accurate and timely information. Customized algorithms, for example, can analyze market trends and historical data, identifying potential investment opportunities or risks. This enables investment firms to proactively adjust their strategies.

Moreover, customized software solutions can provide tailored risk management tools that simulate various market scenarios, allowing managers to understand potential impacts on their portfolios and make necessary adjustments. Such depth of insight is crucial for maintaining a competitive edge in the rapidly evolving financial landscape. A recent survey revealed that 58% of companies anticipate generative AI will play a larger role in investment decision-making within the next year, highlighting the growing reliance on advanced analytics in investment operations.

As Chris Elliott stated, “The firms that will stand out are those pairing credible investment in capabilities with clear governance and human oversight.” This underscores the importance of not only adopting advanced technologies but also ensuring their responsible implementation.

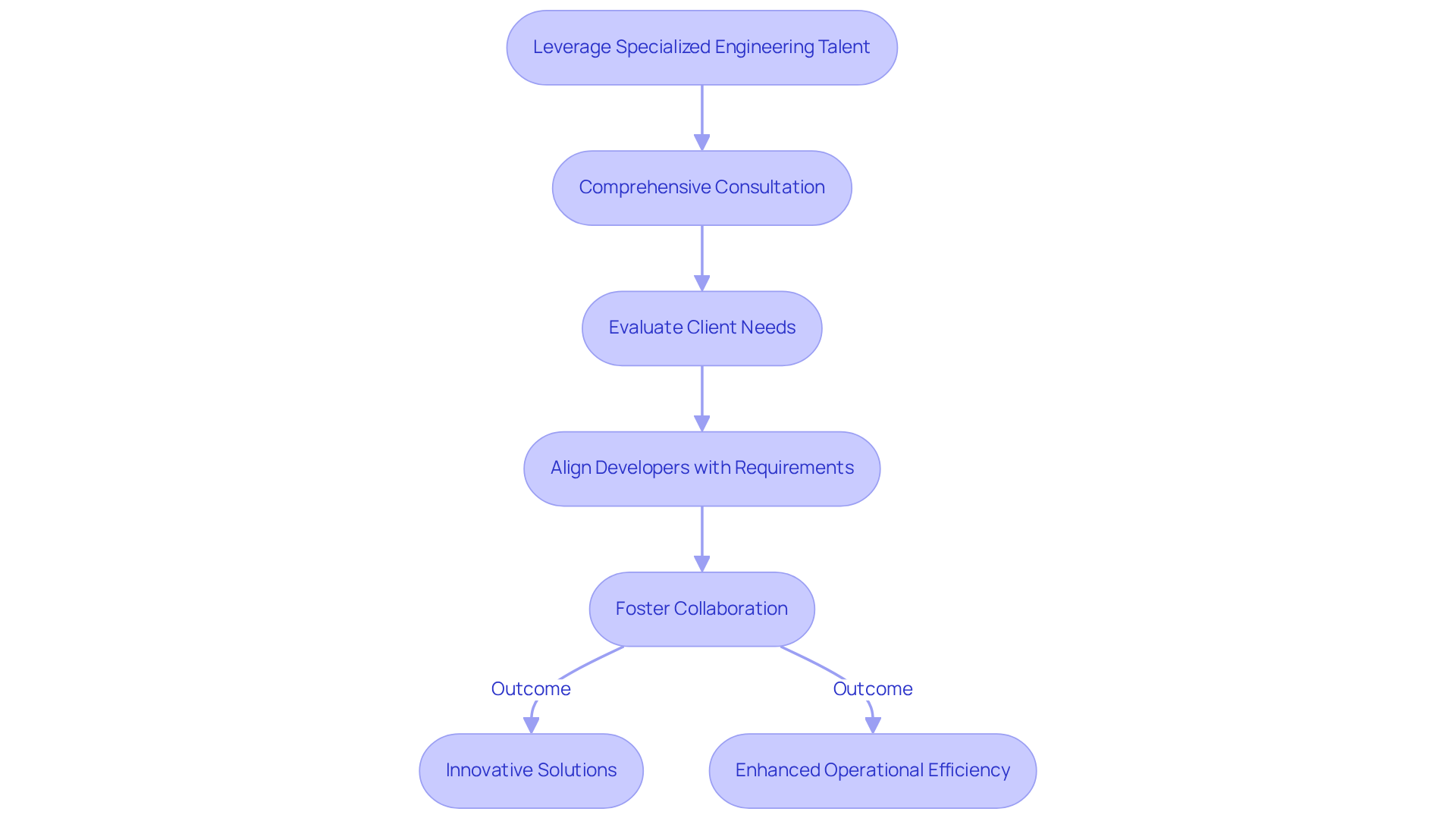

Leverage Specialized Engineering Talent for Effective Software Development

To create efficient, tailored technological applications, investment firms must leverage specialized engineering skills to develop a customized software solution that combines technical expertise with industry knowledge. Neutech excels in this domain by thoroughly evaluating client needs through a comprehensive consultation process. This ensures that developers and designers are not only proficient but also aligned with the specific requirements of hedge investment companies, including compliance, risk management, and data analysis. Such talent is crucial for developing robust, scalable, and secure software systems.

Moreover, Neutech places significant emphasis on intangibles such as work ethic, communication, and leadership. These qualities are vital for fostering a collaborative approach between engineers and financial managers. This partnership can lead to innovative solutions that address specific challenges faced by the sector. For instance, engineers can collaborate closely with portfolio managers to create tools that streamline trading operations or enhance data visualization, ultimately driving improved investment outcomes.

Statistics reveal that 92% of investment managers report spending excessive time consolidating and integrating data from multiple sources. This underscores the pressing need for a customized software solution that can enhance operational efficiency. Furthermore, as investment firms increasingly integrate AI into their operations, the demand for engineers capable of bridging traditional and AI-oriented roles is growing. This highlights the importance of a skilled workforce in navigating this evolving landscape.

With Neutech’s flexible month-to-month contracts, hedge funds can easily adjust their engineering resources based on project needs, ensuring optimal project management and responsiveness to changing demands.

Conclusion

The hedge fund industry faces unique challenges, such as complex investment strategies, stringent compliance demands, and the necessity for efficient data processing. Customized software solutions are essential in addressing these issues, enhancing operational efficiency, and ensuring that hedge funds remain competitive in a rapidly evolving financial landscape.

Key insights throughout this article demonstrate how tailored applications can significantly improve decision-making and risk management. They automate compliance processes and leverage specialized engineering talent for effective software development. By implementing bespoke solutions, hedge funds can streamline operations, manage risks more effectively, and ultimately drive superior investment performance.

As the hedge fund industry navigates increasing regulatory scrutiny and market complexities, the importance of adopting customized software solutions is paramount. Investment firms are urged to explore tailored technologies that not only fulfill compliance requirements but also empower them to make informed decisions and optimize their strategies. Embracing this approach will be crucial for achieving long-term success and maintaining a competitive edge in the financial sector.

Frequently Asked Questions

What unique challenges do hedge funds face?

Hedge funds face challenges such as managing complex investment strategies, adhering to stringent compliance requirements, and processing vast volumes of data.

Why is risk management important for hedge funds?

Risk management is crucial for hedge funds as they often oversee multi-asset portfolios that require sophisticated tools to assess market variations and enhance returns.

How has regulatory scrutiny affected hedge funds?

Increasing regulatory scrutiny has heightened the need for transparency and accountability, prompting investment firms to implement systems for thorough reporting and audit trails.

What operational inefficiencies do investment executives report?

92% of investment executives report spending excessive time consolidating and integrating data from multiple sources, indicating significant operational inefficiencies.

How can customized software solutions benefit hedge funds?

Customized software solutions, developed with technologies like React, Python, or .NET, can improve performance in investment strategies and help hedge funds navigate market complexities more effectively.

What services does Neutech offer to hedge funds?

Neutech offers comprehensive engineering services tailored for regulated sectors like investment groups, starting with a detailed assessment of needs and providing specialized developers and designers for integration into teams.

How does Neutech ensure compliance for hedge funds?

Neutech’s customized approach ensures that their offerings meet regulatory requirements while enhancing operational efficiency and supporting strategic objectives.