4 Best Practices for Effective Lending Software Solutions in Hedge Funds

Introduction

The landscape of hedge fund operations is increasingly intertwined with technology, particularly in lending software solutions. As hedge funds navigate complex regulatory environments and strive for operational efficiency, understanding best practices for implementing effective lending software is crucial. This article explores essential strategies that enhance compliance and integration, ensuring that these technological solutions meet the evolving needs of the industry.

With numerous options available, hedge funds must determine which practices will genuinely elevate their lending operations and protect against potential pitfalls.

Identify Key Requirements for Lending Software in Hedge Funds

To effectively develop lending applications for hedge funds, identifying key requirements that align with the operational and regulatory landscape of the financial services industry is crucial. The following considerations are critical:

-

User Needs Assessment: Engaging with end-users, including portfolio managers and compliance officers, is essential to gather insights on their specific needs and pain points. This approach ensures that the system addresses real-world challenges, thereby enhancing user satisfaction and operational effectiveness.

-

Regulatory Compliance: The software must adhere to relevant regulations, such as SEC guidelines and anti-money laundering (AML) requirements. Incorporating features for comprehensive reporting and audit trails is essential to maintain compliance and mitigate risks.

-

Integration Capabilities: Seamless integration with existing systems, such as trading platforms and risk management tools, is vital for facilitating data flow and operational efficiency. This capability enables hedge organizations to utilize their existing infrastructure while improving functionality.

-

Scalability: As hedge investments grow, their application requirements may change. The solution should be scalable to accommodate increased transaction volumes and additional features without compromising performance, ensuring long-term viability.

-

Security Features: Given the sensitive nature of financial data, robust security measures, including encryption and access controls, are paramount to protect against data breaches and fraud. Implementing these features builds trust and safeguards the integrity of financial operations.

By concentrating on these criteria, hedge investments can ensure that their lending applications, utilizing a lending software solution, are not only functional but also enhance overall operational efficiency and regulatory compliance.

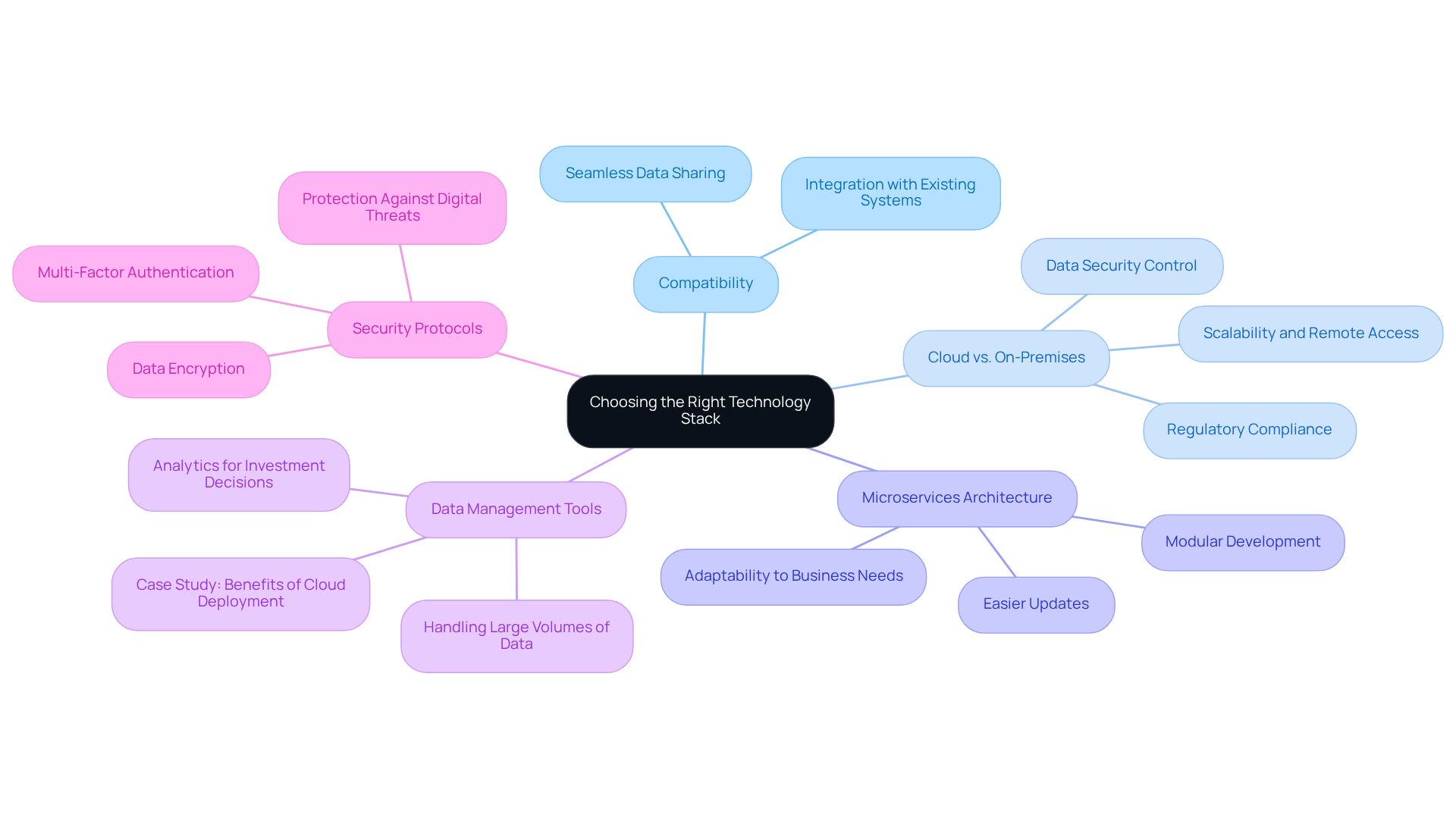

Choose the Right Technology Stack for Seamless Integration

Selecting the appropriate technology stack is crucial for the effective implementation of a lending software solution in lending applications within hedge funds. Key considerations include:

-

Compatibility: It is vital to ensure that the selected technologies are compatible with existing systems, such as CRM and portfolio management tools. This compatibility facilitates seamless data sharing and operational workflows.

-

Cloud vs. On-Premises: A thorough evaluation of cloud-based solutions, which provide scalability and remote access, versus on-premises systems, which may offer enhanced control over data security, is necessary. As Jed Gardner, SVP at Linedata Technology Services, notes, “They needed a partner with global legal and compliance expertise to ensure all regulations were followed during migration and that appropriate control frameworks were in place moving forward.”

-

Microservices Architecture: Adopting a microservices architecture can be beneficial, as it allows for modular development and easier updates. This flexibility enables applications to adapt to evolving business needs, helping hedge organizations avoid common pitfalls associated with rigid systems.

-

Data Management Tools: Implementing robust data management and analytics tools is essential for efficiently handling large volumes of data. These tools provide insights that drive investment decisions. The “Benefits of Cloud Deployment” case study exemplifies how cloud solutions can lead to quicker ROI and reduced operational burdens.

-

Security Protocols: It is imperative to select technologies that incorporate advanced security protocols, such as multi-factor authentication and encryption, to protect sensitive financial information. This is crucial in safeguarding against potential threats in an increasingly digital landscape.

By carefully selecting the right technology stack, hedge investments can ensure that their lending software solution is not only efficient but also prepared for future challenges and capable of adapting to shifting market demands.

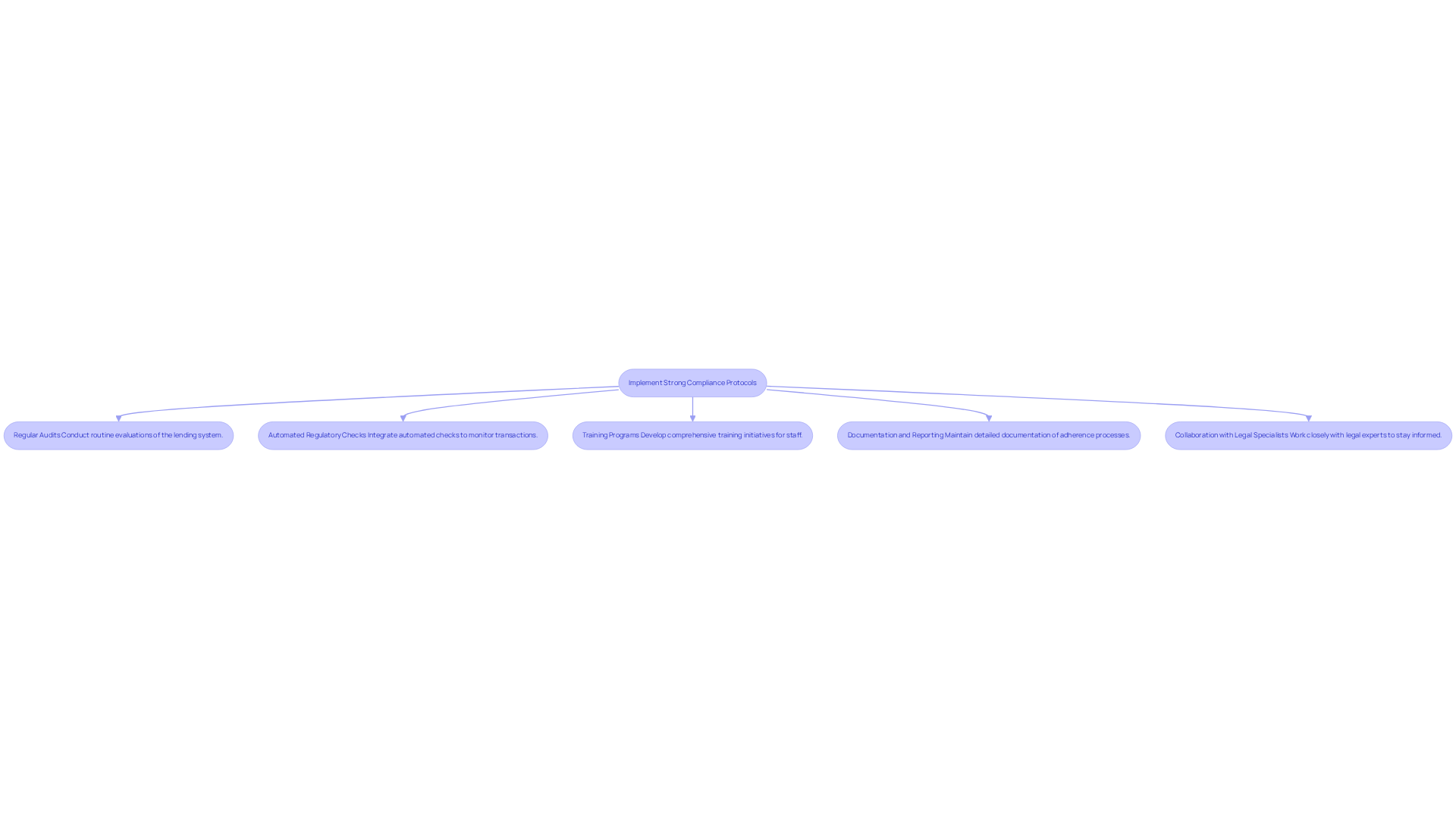

Implement Strong Compliance Protocols in Lending Software

To ensure that lending applications meet regulatory standards, hedge funds must implement robust adherence protocols. Key strategies include:

-

Regular Audits: Conduct routine evaluations of the lending system to ensure compliance with evolving regulations and internal policies. This practice helps identify potential gaps and areas for improvement. As noted by the Financial Industry Regulatory Authority, “Firms must maintain robust programs aligned with applicable SEC rules, including safeguards for customer information and identity theft prevention.”

-

Automated Regulatory Checks: Integrate automated regulatory checks within the software to monitor transactions in real-time, flagging any that may violate regulations or internal guidelines. This proactive approach not only enhances adherence but also streamlines operations, reducing the burden on staff.

-

Training Programs: Develop comprehensive training initiatives for staff to ensure they understand regulatory requirements and the importance of compliance in their daily operations. Regular training sessions can lead to a 25% increase in adherence among employees.

-

Documentation and Reporting: Maintain detailed documentation of adherence processes and decisions, which is crucial for audits and regulatory reviews. Implement reporting features that facilitate easy access to regulatory data. The SEC’s focus on adherence to Regulation S-P will be emphasized during examinations in 2026, highlighting the importance of thorough documentation.

-

Collaboration with Legal Specialists: Collaborate closely with legal and regulatory experts to remain informed about regulatory changes and ensure that the system is adjusted accordingly. This partnership guarantees that the software is continuously updated to meet new requirements, thereby minimizing risks associated with non-compliance.

By prioritizing these regulatory measures, hedge organizations can mitigate legal risks and enhance their operational credibility, ultimately fostering trust with investors and regulators alike. A case study on improper valuation practices in asset management illustrates the repercussions of neglecting compliance, resulting in significant penalties and a loss of investor trust.

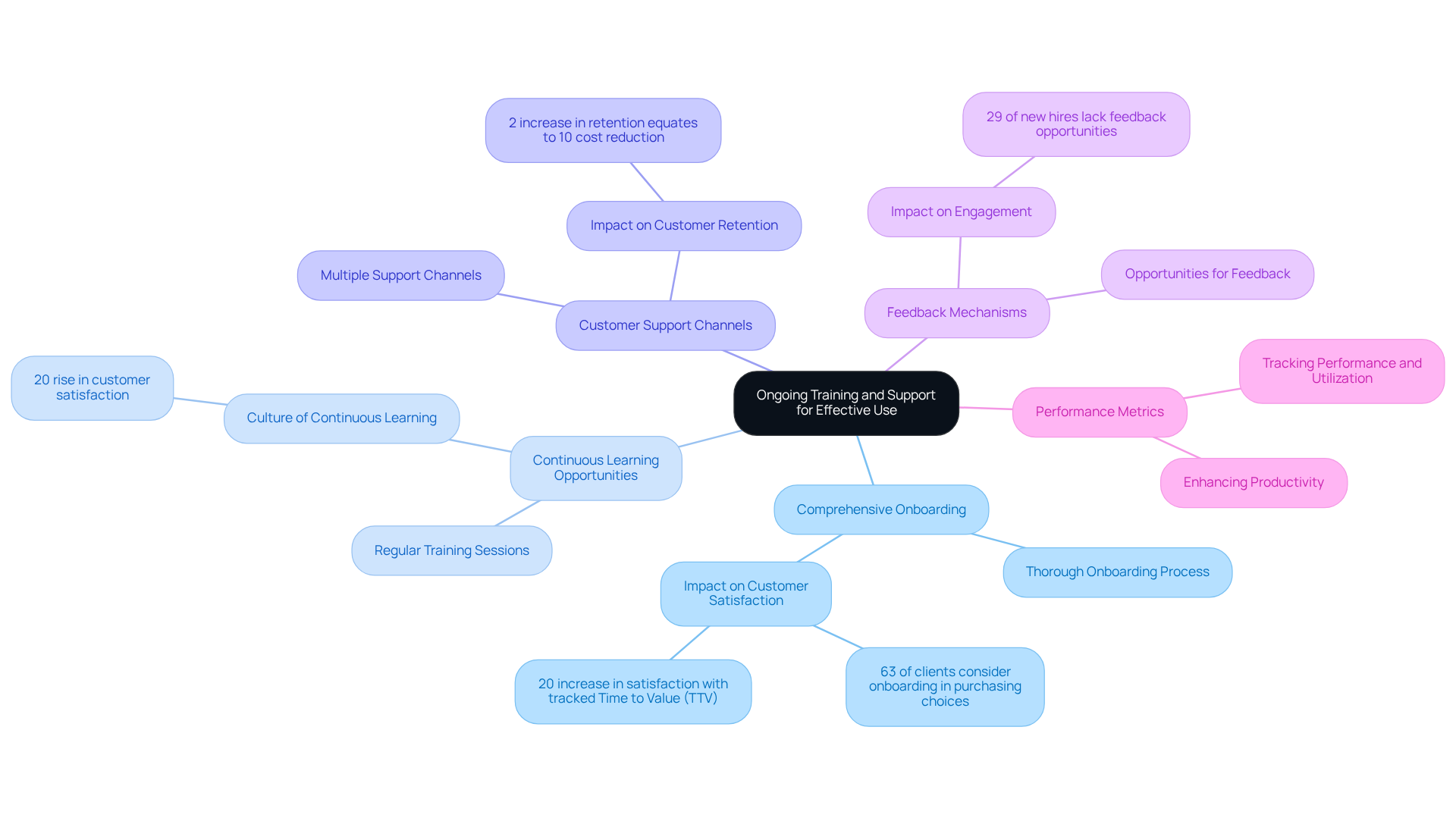

Provide Ongoing Training and Support for Effective Use

To enhance the efficiency of lending applications, hedge funds must prioritize continuous training and assistance for their participants. Here are essential strategies:

-

Comprehensive Onboarding: A thorough onboarding process is crucial for new participants. This should encompass practical training sessions, access to comprehensive manuals, and resources customized to the specific software being implemented. Studies show that effective onboarding can greatly improve customer satisfaction and retention, with 63% of clients factoring onboarding into their purchasing choices. Additionally, companies that track Time to Value (TTV) report a 20% increase in customer satisfaction, underscoring the importance of effective onboarding processes.

-

Continuous Learning Opportunities: Regular training sessions and workshops are essential to keep individuals informed about new features and best practices. This fosters a culture of continuous learning, which is vital in the fast-evolving financial software landscape. Businesses that invest in continuous education report a 20% rise in customer satisfaction, demonstrating the importance of keeping clients engaged.

-

Customer Support Channels: Establishing multiple support channels – such as help desks, chat support, and online forums – ensures individuals have access to assistance whenever they encounter issues. This multi-faceted approach to support can lead to a 2% increase in customer retention, equating to the financial impact of reducing costs by 10%.

-

Feedback Mechanisms: Implementing feedback mechanisms enables individuals to share their experiences and suggestions for enhancement. This not only informs future updates and training programs but also boosts participant engagement. Organizations that encourage feedback can see improved satisfaction and retention levels, as 29% of new hires report not having the opportunity to provide feedback during onboarding. This highlights the critical role of feedback in optimizing the onboarding process.

-

Performance Metrics: Tracking participant performance and application utilization metrics is crucial to pinpoint areas where further training might be necessary. By ensuring that all individuals can utilize the application effectively, hedge investments can enhance overall productivity and participant engagement.

As LinkedIn Talent states, “Onboarding has the 2nd highest impact, after recruiting, of all HR practices.” By prioritizing these strategies, hedge funds can significantly enhance user engagement and ensure that their lending software solution is utilized to its fullest potential.

Conclusion

In conclusion, implementing effective lending software solutions in hedge funds necessitates a strategic approach that incorporates several critical best practices. By concentrating on identifying key requirements, selecting the appropriate technology stack, enforcing compliance protocols, and providing ongoing training and support, hedge funds can optimize their lending applications to enhance operational efficiency and ensure regulatory adherence.

This article underscores the significance of understanding user needs, ensuring regulatory compliance, and integrating advanced technology to establish a robust lending framework. Essential insights include the necessity for scalable solutions that can adapt to growth, the value of automated compliance checks, and the impact of comprehensive training programs on user engagement and satisfaction. Each of these elements is crucial in ensuring that lending software not only meets current demands but is also prepared to navigate future challenges.

As the financial landscape continues to evolve, hedge funds must prioritize these best practices to maintain a competitive edge. Investing in effective lending software solutions transcends merely meeting operational needs; it is about fostering trust with both investors and regulators. By adopting these strategies, hedge funds can secure their position in an increasingly complex financial environment, ensuring sustainable growth and compliance in the years ahead.

Frequently Asked Questions

What are the key requirements for lending software in hedge funds?

Key requirements include user needs assessment, regulatory compliance, integration capabilities, scalability, and security features.

Why is user needs assessment important in developing lending software?

Engaging with end-users like portfolio managers and compliance officers helps gather insights on their specific needs and pain points, ensuring the system addresses real-world challenges and enhances user satisfaction.

What regulatory compliance considerations are necessary for lending software?

The software must adhere to relevant regulations, such as SEC guidelines and anti-money laundering (AML) requirements, and should incorporate features for comprehensive reporting and audit trails to maintain compliance and mitigate risks.

How important are integration capabilities in lending software for hedge funds?

Seamless integration with existing systems, like trading platforms and risk management tools, is vital for facilitating data flow and operational efficiency, allowing hedge organizations to utilize their existing infrastructure effectively.

What does scalability mean in the context of lending software for hedge funds?

Scalability refers to the software’s ability to accommodate increased transaction volumes and additional features as hedge investments grow, ensuring long-term viability without compromising performance.

What security features are essential for lending software?

Robust security measures, including encryption and access controls, are crucial to protect sensitive financial data against breaches and fraud, thereby building trust and safeguarding the integrity of financial operations.