Develop AI Software for Hedge Funds: Best Practices for Compliance

Introduction

AI is transforming the software development landscape, especially in regulated sectors such as finance. Hedge funds are increasingly adopting advanced technologies to enhance compliance and operational efficiency. By leveraging AI, these firms can automate regulatory checks, improve data analysis, and streamline decision-making processes. This positions them to navigate the complexities of the financial regulatory environment more effectively.

However, the integration of AI introduces distinct challenges. It raises an important question: how can hedge funds ensure that their AI solutions not only adhere to stringent regulations but also promote sustained operational excellence?

Understand AI’s Impact on Software Development in Regulated Industries

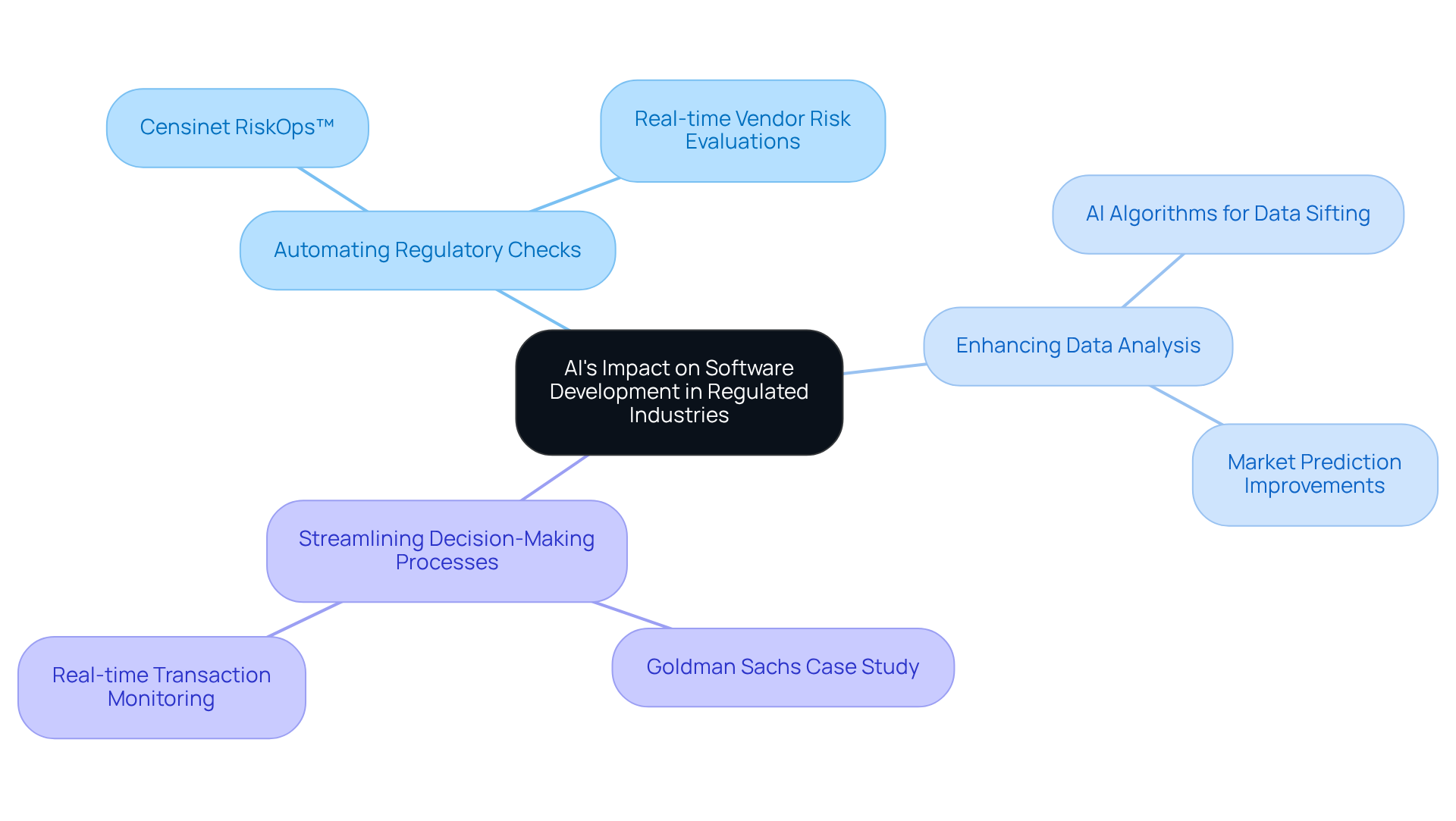

AI is fundamentally transforming the ways we develop AI software in regulated sectors, particularly in finance and healthcare. In hedge funds, AI plays a crucial role in:

- Automating regulatory checks

- Enhancing data analysis

- Streamlining decision-making processes

For example, AI algorithms can sift through extensive datasets to identify regulatory risks and detect anomalies in trading patterns, ensuring adherence to stringent regulations.

Moreover, AI tools such as Censinet RiskOps™ provide real-time vendor risk evaluations and notifications, which are essential for maintaining regulatory standards. Additionally, AI facilitates real-time transaction monitoring, enabling hedge funds to swiftly adapt to regulatory changes. This proactive strategy not only enhances regulatory frameworks but also improves operational efficiency, positioning firms to navigate the complexities of the financial landscape more effectively.

However, it is important to note that while developers anticipate a 24% productivity gain from AI, they are currently experiencing a 19% slowdown in controlled conditions. This discrepancy underscores the necessity for careful implementation. A pertinent case study is Goldman Sachs, which has utilized its capability to develop AI software to automate accounting and regulatory processes, illustrating both the practical benefits and challenges associated with AI adoption in regulatory automation.

Leverage Key AI Capabilities for Enhanced Compliance and Efficiency

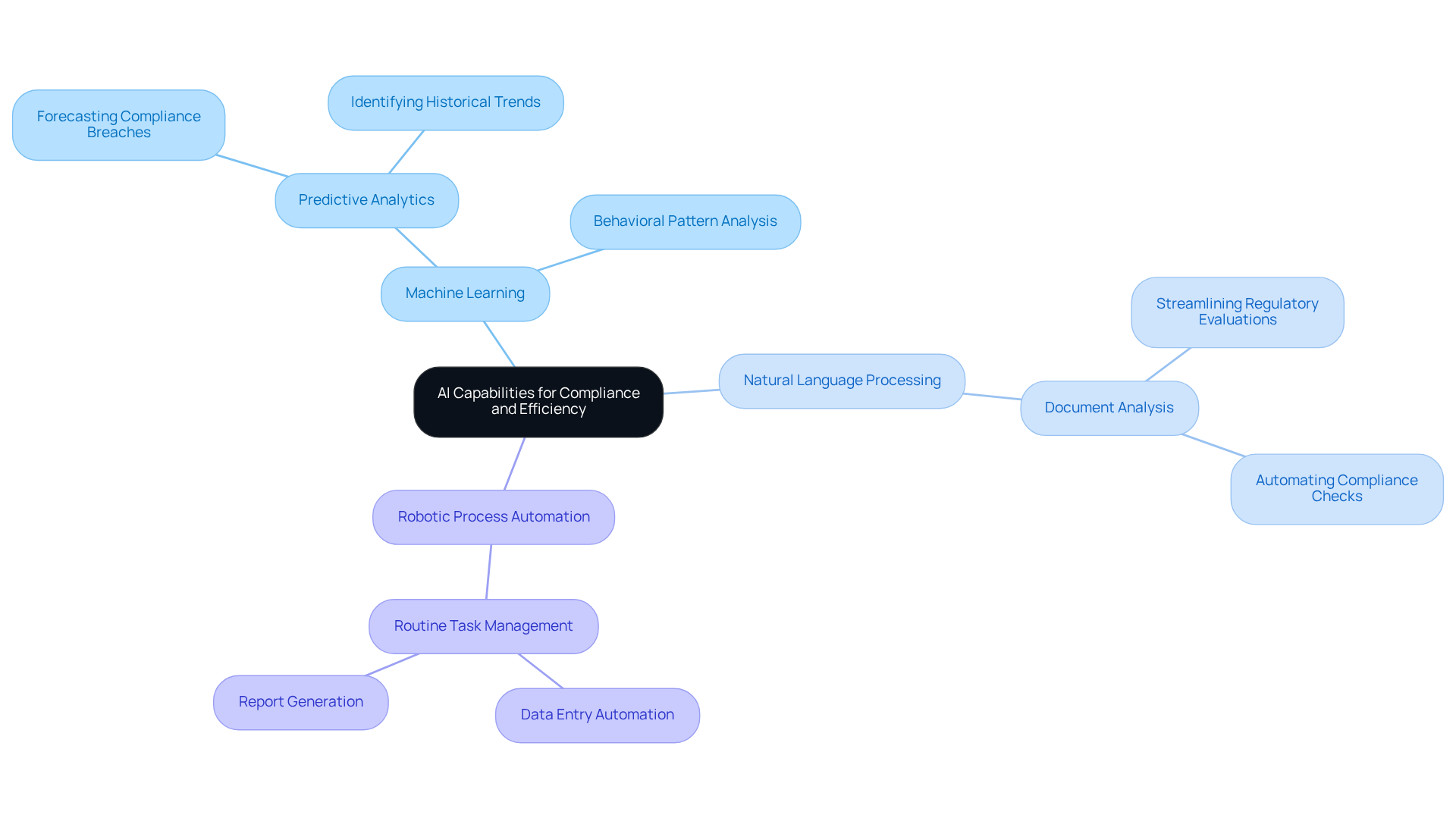

To enhance adherence and efficiency, hedge funds must develop AI software that leverages capabilities such as:

- Machine learning for predictive analytics

- Natural language processing for document analysis

- Robotic process automation for routine tasks

Machine learning models can predict potential violations by analyzing historical data trends, a necessity given the heightened oversight and enforcement actions within the financial sector. For example, in 2025, financial institutions reported $766 million in suspicious activity linked to adult and senior day care centers in New York, highlighting the urgent need for proactive compliance strategies.

Furthermore, natural language processing can streamline the evaluation of regulatory documents, ensuring that all necessary adherence measures are met efficiently. By automating the analysis of complex regulations, NLP reduces the time and effort required for regulatory teams to stay updated on evolving requirements. Additionally, robotic process automation can manage repetitive tasks such as data entry and report generation, allowing regulatory teams to focus on more strategic initiatives.

However, it is crucial to acknowledge the potential compliance risks associated with the deployment of systems that develop AI software. Institutions must ensure that AI models do not yield discriminatory outcomes and that decisions can be justified to regulators. This integration of AI technologies not only improves accuracy and speed but also empowers investment firms to navigate the complexities of regulatory landscapes with enhanced agility.

Implement AI Across the Software Development Lifecycle: A Step-by-Step Guide

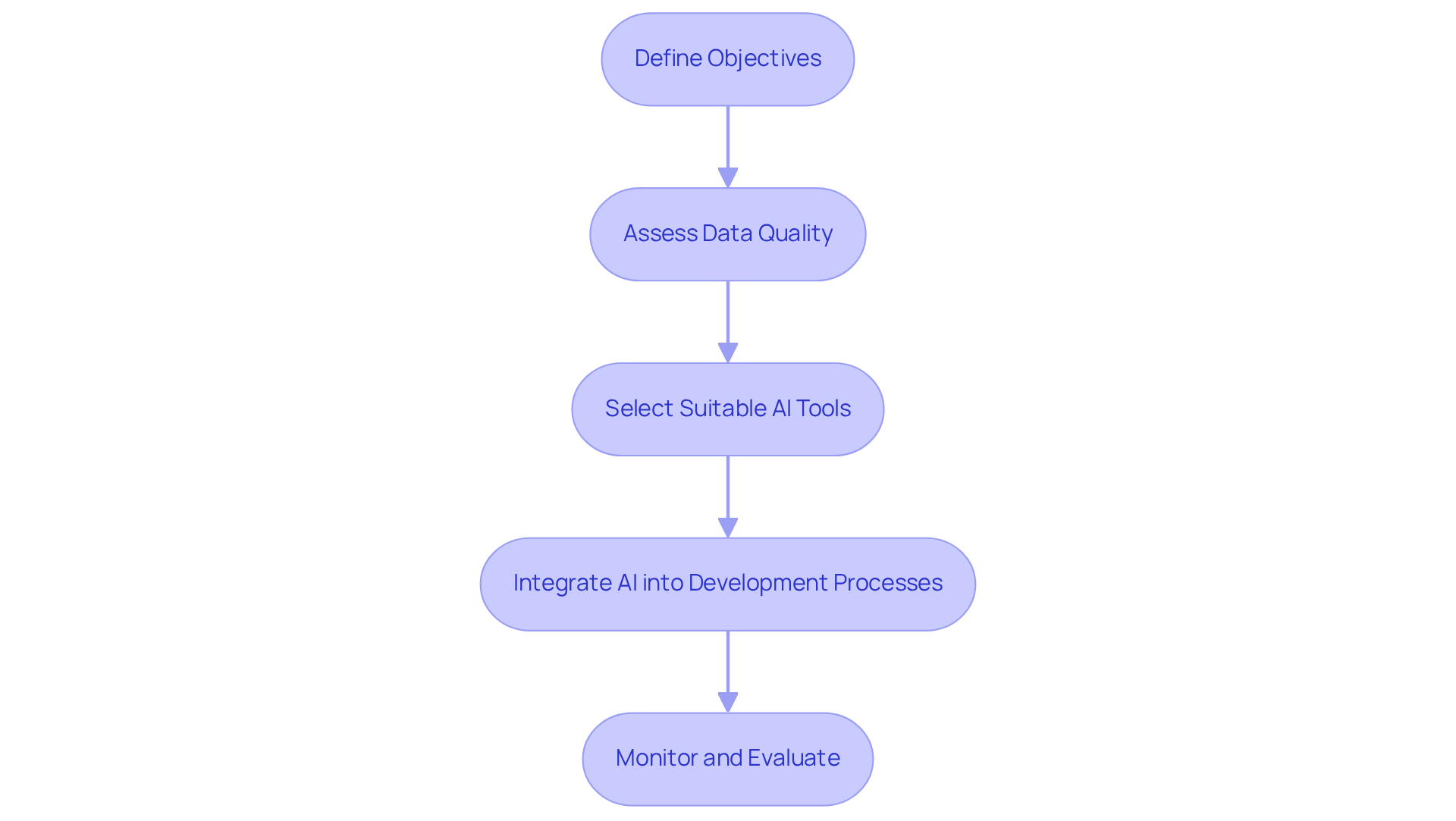

To implement AI effectively across the software development lifecycle, hedge funds should adhere to the following steps:

-

Define Objectives: Clearly articulate regulatory goals and identify how AI can facilitate their achievement. Projections indicate that global AI spending is expected to reach $337 billion by 2025, underscoring the importance of strategic AI integration.

-

Assess Data Quality: Ensure that the data utilized for AI training is accurate, complete, and adheres to regulatory standards. This is crucial, as organizations face governance challenges, with less than half expected to deploy generative AI widely by 2025.

-

Select Suitable AI Tools: Choose AI technologies that comply with regulatory requirements, such as machine learning for risk evaluation and anomaly identification. Insights from the SEC’s Division of Examinations highlight the necessity of addressing AI-driven threats to data integrity.

-

Integrate AI into Development Processes: Seamlessly embed AI tools into existing workflows, automating regulatory checks wherever feasible to enhance efficiency. However, hedge funds should be aware that approximately 75% of large-scale attempts to replace workforce roles with autonomous AI are predicted to fail by 2025, emphasizing the need for careful implementation.

-

Monitor and Evaluate: Continuously assess the performance of AI systems to ensure they meet regulatory standards, making adjustments as necessary to address any discrepancies or evolving regulations. Anecdotal evidence suggests that organizations that proactively manage their AI integration are better equipped to navigate the complexities of regulation.

Ensure Continuous Optimization of AI Solutions for Sustained Compliance

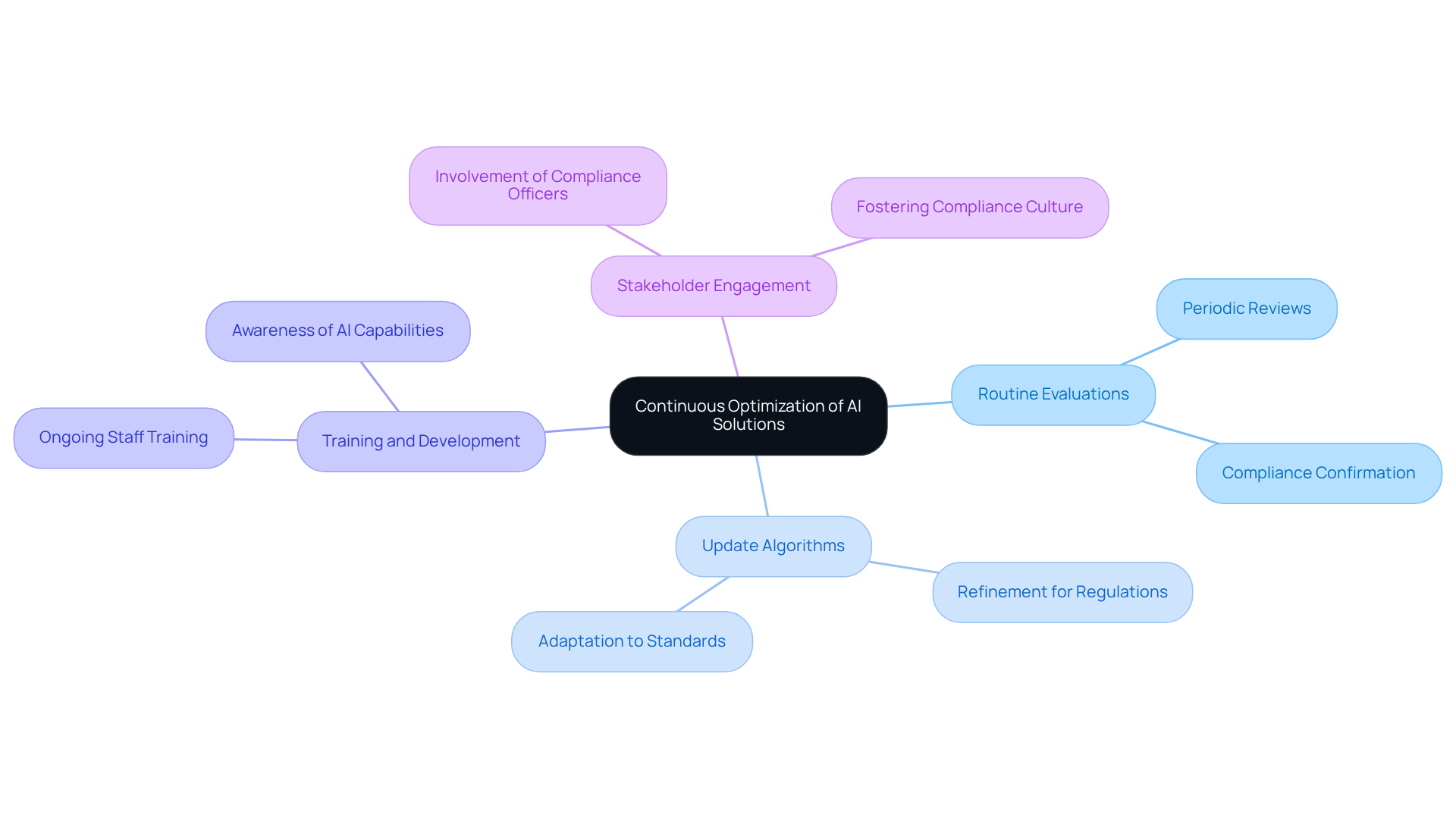

To ensure the continuous optimization of AI solutions, hedge funds must implement a feedback loop that incorporates regular audits and updates in response to regulatory changes. This approach encompasses several key components:

-

Routine Evaluations: Periodic reviews of AI systems are essential to confirm they function as intended and comply with regulatory standards.

-

Update Algorithms: It is crucial to regularly refine AI algorithms to adapt to evolving regulations and standards.

-

Training and Development: Investing in ongoing training for staff is vital to keep them informed about AI capabilities and regulatory requirements.

-

Stakeholder Engagement: Involving compliance officers in the AI development process ensures that their insights and concerns are addressed, fostering a culture of compliance within the organization.

Conclusion

AI is transforming software development in regulated sectors, especially for hedge funds facing compliance challenges. By automating regulatory checks, enhancing data analysis, and streamlining decision-making processes, AI acts as a crucial ally in maintaining adherence to strict regulations. The adoption of advanced AI tools enables hedge funds to proactively manage compliance risks and improve operational efficiency, positioning them to succeed in a rapidly changing financial environment.

The article outlines several key strategies for effectively leveraging AI. Essential capabilities such as machine learning, natural language processing, and robotic process automation play a vital role in enhancing compliance and operational efficiency. It is critical to:

- Define clear objectives

- Assess data quality

- Select suitable AI tools

- Continuously monitor and evaluate AI systems

These practices not only support regulatory compliance but also ensure that hedge funds remain agile in response to evolving regulations.

Given the substantial impact of AI on compliance within hedge funds, organizations must adopt a proactive stance. Implementing a continuous feedback loop that includes regular audits, updates, and stakeholder engagement allows hedge funds to optimize their AI solutions for sustained compliance. By embracing these best practices, firms can mitigate compliance risks and fully leverage the potential of AI, ultimately fostering innovation and success in the financial services sector.

Frequently Asked Questions

How is AI impacting software development in regulated industries?

AI is transforming software development in regulated sectors like finance and healthcare by automating regulatory checks, enhancing data analysis, and streamlining decision-making processes.

What role does AI play in hedge funds?

In hedge funds, AI automates regulatory checks, enhances data analysis, and streamlines decision-making processes, helping firms adhere to stringent regulations.

Can you provide an example of how AI is used in hedge funds?

AI algorithms can analyze extensive datasets to identify regulatory risks and detect anomalies in trading patterns, ensuring compliance with regulations.

What tools are mentioned for maintaining regulatory standards?

Tools like Censinet RiskOps™ provide real-time vendor risk evaluations and notifications, which are essential for maintaining regulatory standards.

How does AI improve transaction monitoring in hedge funds?

AI facilitates real-time transaction monitoring, allowing hedge funds to quickly adapt to regulatory changes and enhance operational efficiency.

What productivity gains do developers anticipate from AI?

Developers anticipate a 24% productivity gain from AI; however, they are currently experiencing a 19% slowdown in controlled conditions.

What case study is mentioned regarding AI adoption in regulatory automation?

Goldman Sachs is highlighted as a case study for utilizing AI to automate accounting and regulatory processes, showcasing the benefits and challenges of AI adoption.