Essential Software Outsourcing Solutions for Hedge Fund Managers

Introduction

Navigating the intricate landscape of hedge fund management demands not only sharp financial acumen but also the appropriate technological tools. As hedge fund managers increasingly adopt software outsourcing solutions, it becomes essential to effectively define their software needs. This article explores the critical strategies for:

- Selecting specialized partners

- Implementing robust communication practices

- Continuously adapting outsourcing strategies to meet evolving demands

How can hedge fund leaders ensure that their software development processes are efficient and aligned with regulatory requirements and industry trends?

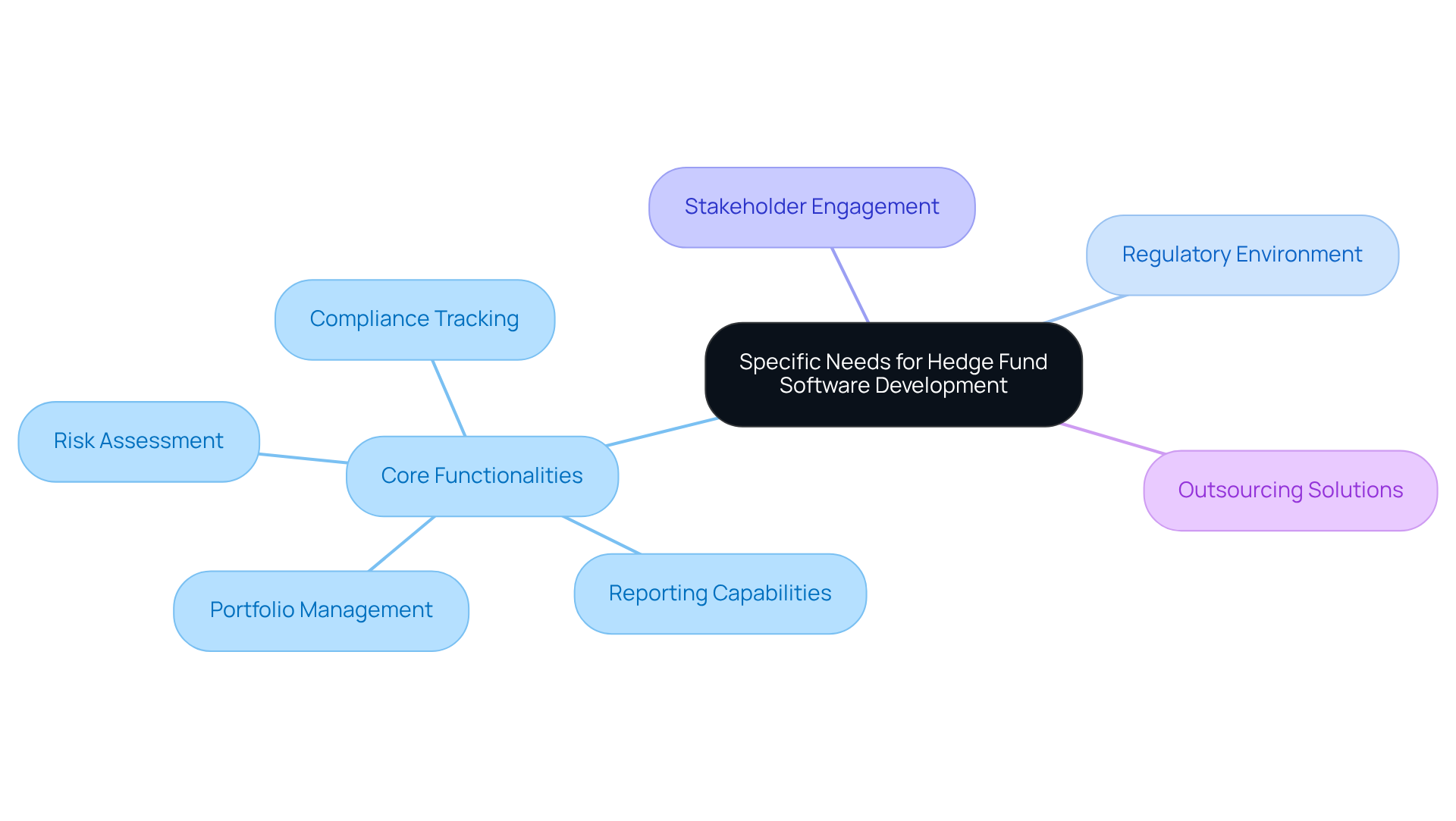

Define Specific Needs for Hedge Fund Software Development

To effectively implement software outsourcing solutions for software development, hedge managers must first articulate their specific needs. This process begins with identifying core functionalities, which include essential features such as:

- Portfolio management

- Risk assessment

- Compliance tracking

- Reporting capabilities

Next, it is crucial to consider the regulatory environment. Understanding how compliance requirements can influence software design is vital, particularly in relation to the investment’s focus, whether it be algorithmic trading or private equity.

Engaging stakeholders is another key aspect. Involving relevant parties ensures that diverse perspectives are integrated, leading to a comprehensive requirements document.

Once these needs are clearly defined, Neutech will provide a selection of candidate designers and developers as part of its software outsourcing solutions. This approach facilitates a seamless integration into your team, ensuring that the specialized talent aligns with your specific project requirements.

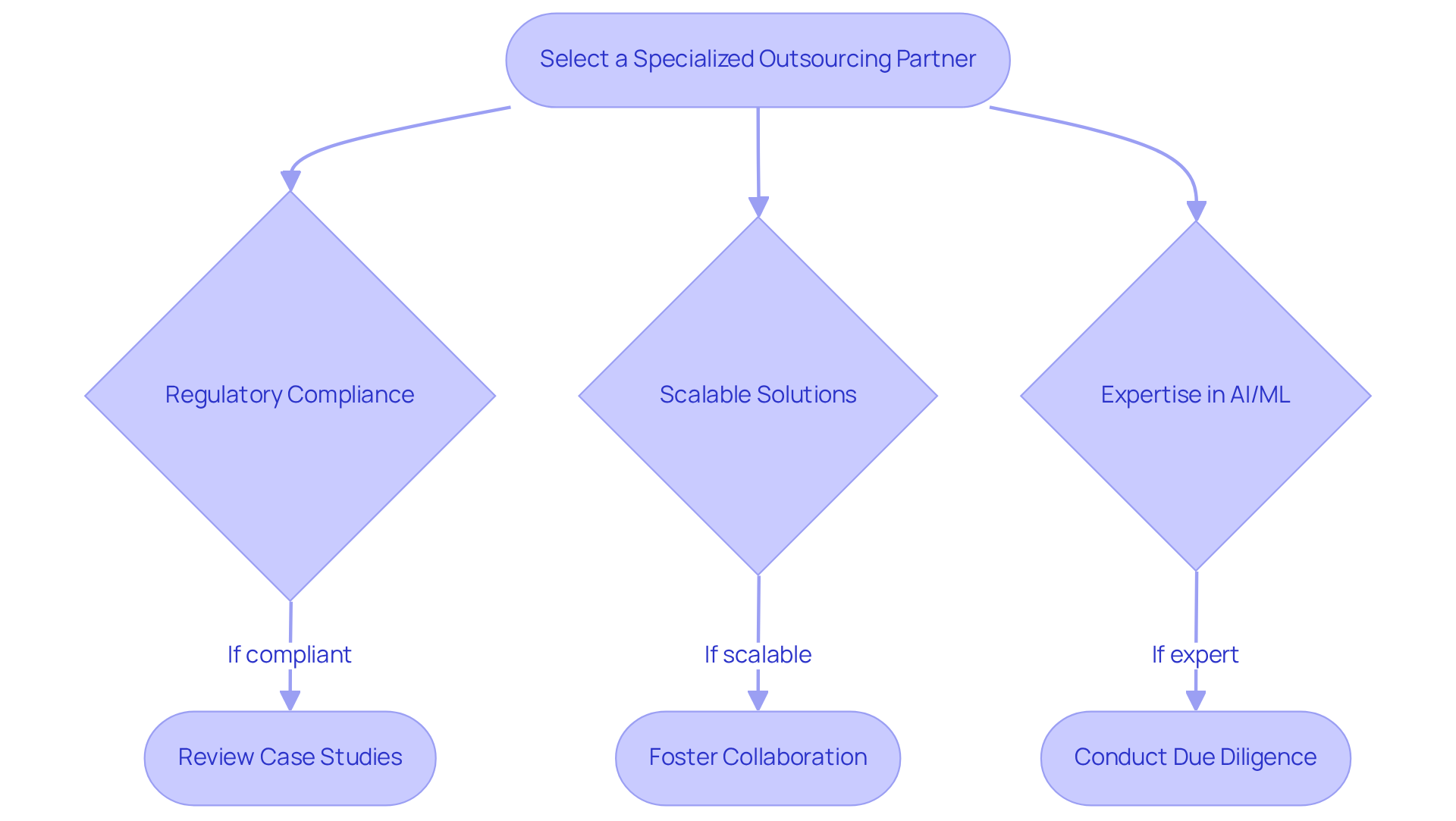

Select a Specialized Outsourcing Partner with Financial Expertise

Choosing the right software outsourcing solutions partner is essential for investment professionals in the software development process. It is vital to select partners with a proven track record in financial software development, particularly those who provide software outsourcing solutions to navigate the unique challenges of the hedge fund sector. Key considerations include:

- The partner’s experience with regulatory compliance

- Their ability to deliver scalable software outsourcing solutions

- Their expertise in cutting-edge technologies such as artificial intelligence and machine learning

At Neutech, we prioritize understanding your specific needs. Once we mutually identify those needs, we provide you with a selection of candidate designers and developers who can seamlessly integrate into your team. Conducting thorough due diligence-reviewing case studies and client testimonials-enables supervisors to effectively assess the capabilities of potential partners.

Moreover, fostering a collaborative relationship from the outset enhances communication and streamlines task execution, ultimately contributing to the success of the development process.

Implement Effective Communication and Project Management Strategies

To ensure successful software development, hedge fund managers must implement effective communication and management strategies. This involves:

- Establishing regular check-ins

- Utilizing management tools such as Jira or Trello

- Fostering an open dialogue between internal teams and the outsourcing partner to effectively implement software outsourcing solutions

Clear documentation of objectives, timelines, and deliverables is essential for maintaining alignment among all parties involved.

For instance, an investment management company that adopted software outsourcing solutions from Empaxis experienced significant enhancements in back-office functions, including improved portfolio accounting and automated bank reconciliation. This example underscores the critical role of organized communication and management in achieving operational efficiency.

Moreover, adopting Agile methodologies can enhance flexibility and responsiveness to changes in scope or requirements. By prioritizing communication and structured oversight practices, hedge fund leaders can mitigate risks and increase the likelihood of successful outcomes. However, it is crucial to avoid common pitfalls such as inadequate documentation or a lack of regular updates, as these can lead to misalignment and delays.

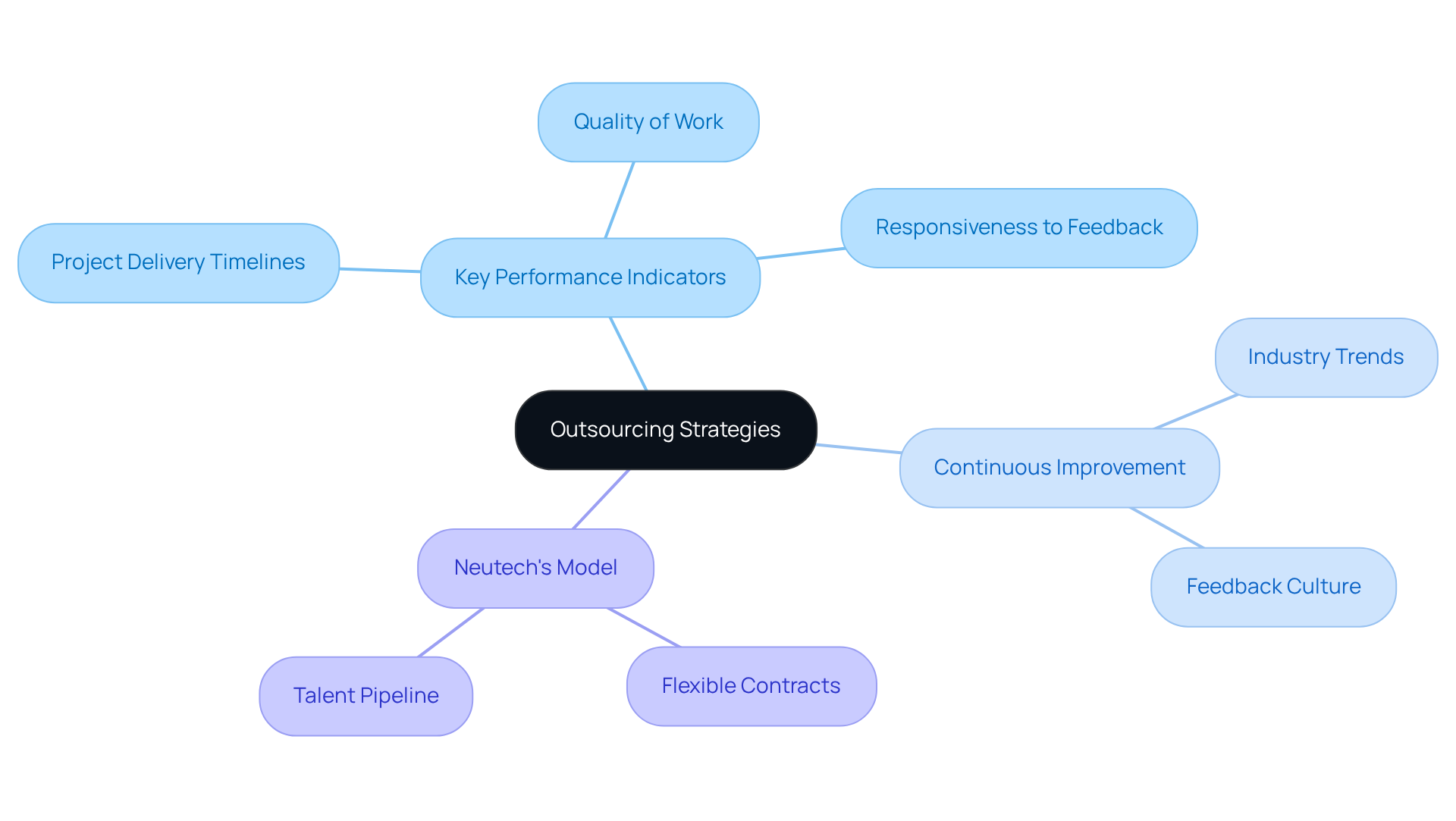

Continuously Evaluate and Adapt Outsourcing Strategies

Hedge fund leaders must adopt a proactive approach in evaluating and adapting their outsourcing strategies. Regular assessments of outsourcing partners against key performance indicators (KPIs) are essential. These KPIs should encompass:

- Project delivery timelines

- Quality of work

- Responsiveness to feedback

Staying informed about industry trends and technological advancements enables leaders to pinpoint areas for improvement. For example, the emergence of new regulatory requirements may necessitate adjustments in software capabilities.

By fostering a culture of continuous improvement and encouraging open feedback, investment leaders can ensure their outsourcing strategies remain effective and aligned with evolving business needs. Neutech’s customized engineering talent supply process facilitates the seamless integration of specialized developers and designers, allowing hedge fund managers to swiftly adapt to changing demands. Their flexible month-to-month contracts empower firms to scale resources up or down as necessary, optimizing project management.

This plug-and-play model is particularly advantageous in regulated industries, where rapid scaling may be required to meet compliance demands. Furthermore, Neutech has established a streamlined ongoing pipeline for identifying talented software engineers and training them to senior-level proficiency, providing full-time access to expert-level engineering and product management support. This approach not only enhances operational efficiency but also positions firms to respond swiftly to market changes, ultimately driving better outcomes.

According to industry analysts, “63% of organizations are considering or willing to change their outsourcing provider,” underscoring the necessity for regular evaluations. Additionally, the business process outsourcing market is projected to grow by over 9% per year between now and 2030, highlighting the importance of adapting strategies to leverage this growth effectively.

Conclusion

In conclusion, defining and implementing effective software outsourcing solutions is essential for hedge fund managers who seek to enhance operational efficiency and ensure compliance. By articulating specific needs, selecting appropriate partners, and establishing strong communication and management strategies, hedge funds can navigate the complexities of software development more successfully.

Key insights emphasize the necessity of understanding regulatory environments, engaging stakeholders, and fostering collaborative relationships with outsourcing partners. Furthermore, adopting agile methodologies and continuously evaluating performance against established KPIs allows strategies to remain aligned with evolving business demands and technological advancements.

In a rapidly changing financial landscape, embracing these best practices not only improves software development outcomes but also positions hedge fund managers to respond effectively to market shifts. By prioritizing robust outsourcing strategies, firms can drive innovation, optimize resource allocation, and ultimately achieve superior results in their investment endeavors.

Frequently Asked Questions

What is the first step in implementing software outsourcing solutions for hedge fund software development?

The first step is to articulate specific needs by identifying core functionalities such as portfolio management, risk assessment, compliance tracking, and reporting capabilities.

Why is it important to consider the regulatory environment in software development for hedge funds?

Understanding the regulatory environment is crucial because compliance requirements can significantly influence software design, especially depending on the investment focus, such as algorithmic trading or private equity.

How can engaging stakeholders benefit the software development process?

Engaging stakeholders ensures that diverse perspectives are integrated, leading to the creation of a comprehensive requirements document that accurately reflects the needs of all relevant parties.

What does Neutech provide once the specific needs for hedge fund software development are defined?

Neutech provides a selection of candidate designers and developers as part of its software outsourcing solutions, facilitating a seamless integration into your team.

How does Neutech ensure that the talent aligns with specific project requirements?

By offering a tailored selection of designers and developers based on the clearly defined needs, Neutech ensures that the specialized talent aligns with the specific project requirements of the hedge fund.