5 Best Business Intelligence Software Practices for Hedge Funds

Introduction

In an increasingly data-driven environment, the importance of Business Intelligence (BI) is paramount, particularly in regulated sectors such as finance. For hedge funds operating within intricate regulatory frameworks, effective BI practices can convert raw data into actionable insights that inform strategic decisions and ensure compliance. However, the path to successful BI implementation is not without its challenges. These include:

- The integration of diverse data sources

- The necessity of securing user adoption

Therefore, how can hedge funds navigate these hurdles and fully leverage BI tools to maintain competitiveness and compliance in 2025 and beyond?

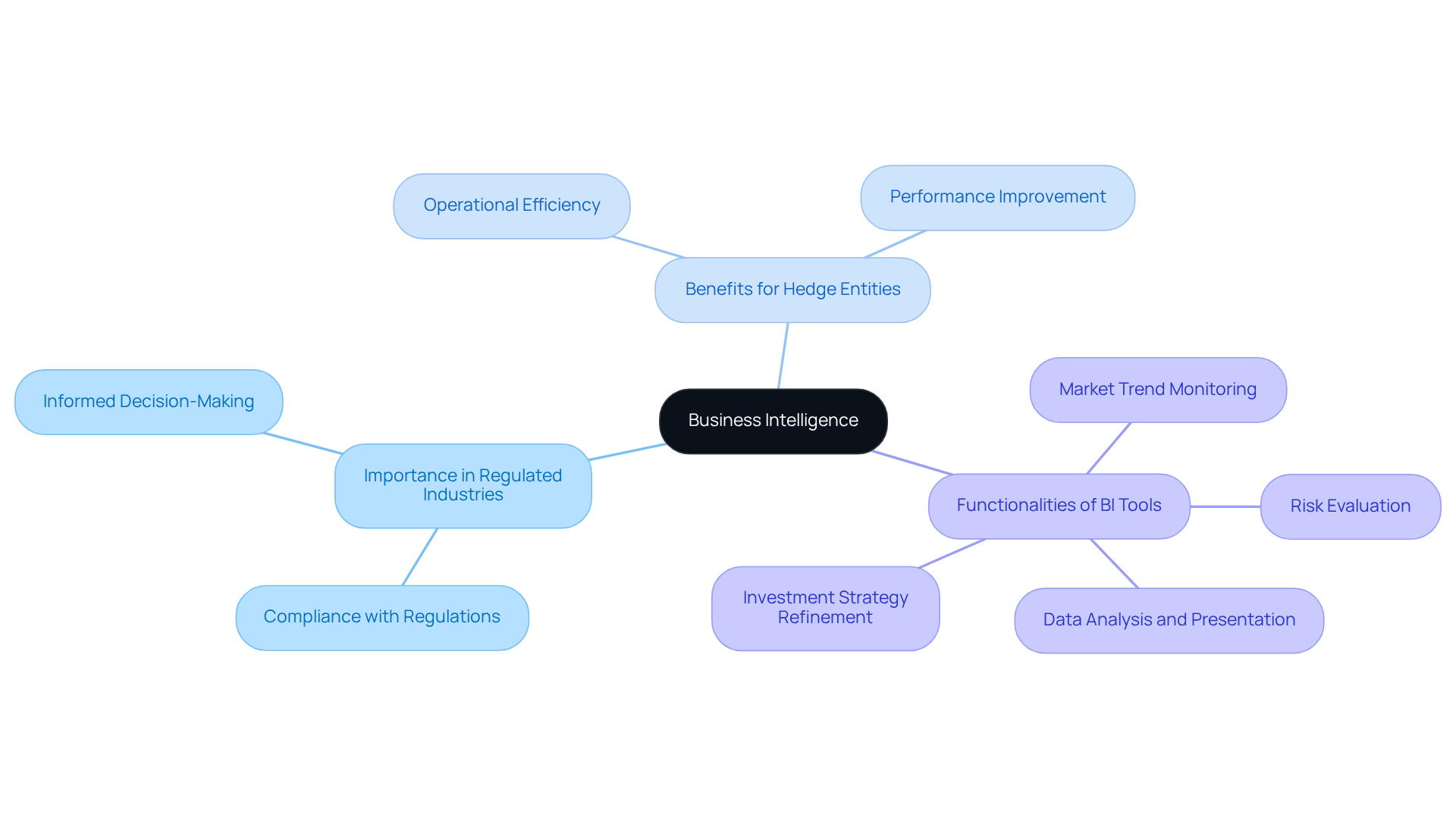

Define Business Intelligence and Its Importance in Regulated Industries

Business Intelligence (BI) encompasses the best business intelligence software, technologies, resources, and practices involved in gathering, analyzing, and presenting business information. In regulated sectors such as finance, BI plays a crucial role in converting raw data into actionable insights that inform strategic decision-making.

Particularly for hedge entities, which face stringent regulatory requirements, the implementation of BI tools is vital. These tools are considered the best business intelligence software because they not only enhance operational efficiency but also ensure compliance with applicable laws and regulations.

The best business intelligence software empowers investment firms to monitor market trends, evaluate risks, and refine investment strategies. This ultimately contributes to improved performance and adherence to regulatory standards.

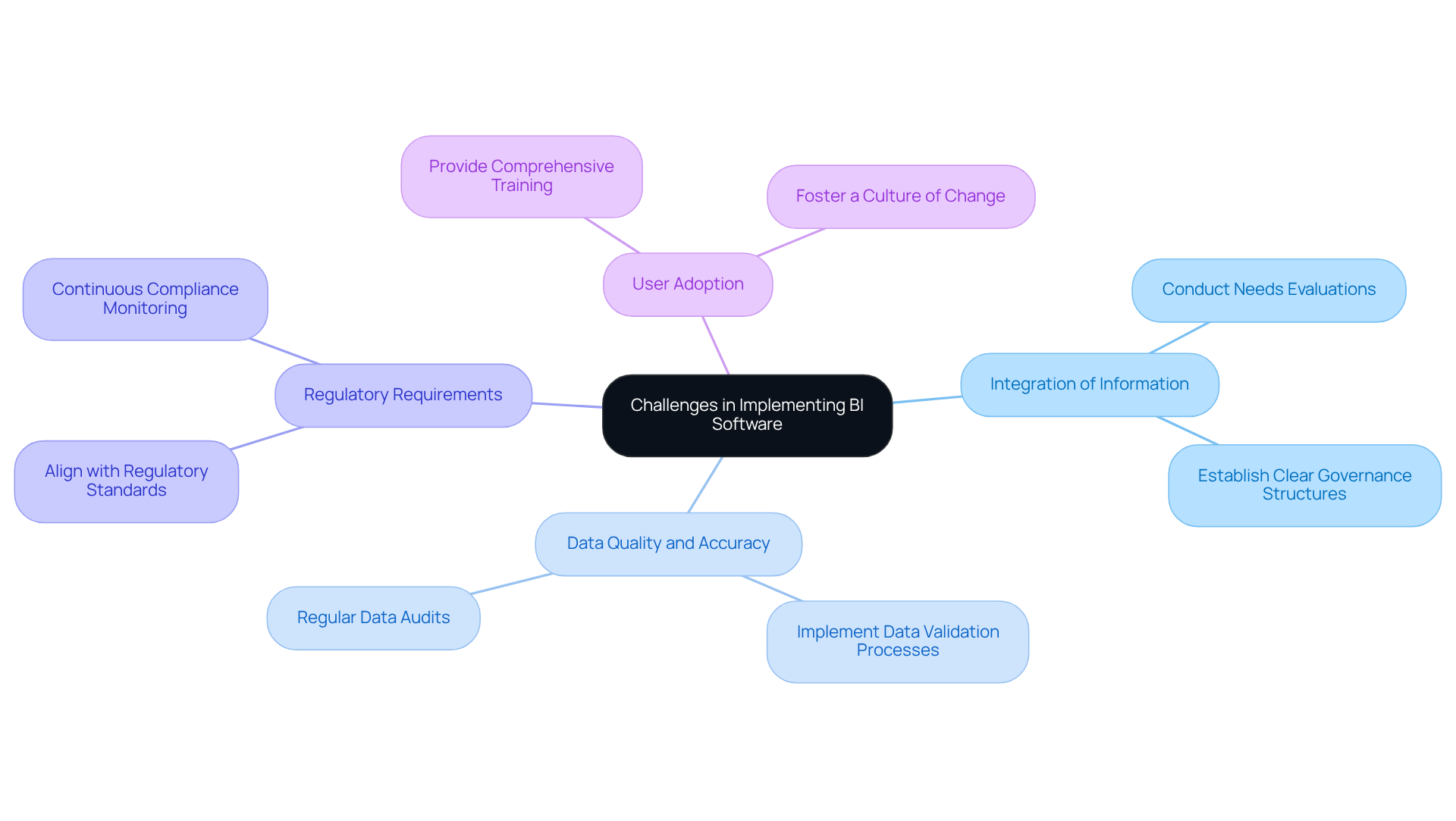

Identify Challenges in Implementing Business Intelligence Software in Regulated Industries

Implementing BI software in regulated sectors, such as investment firms, poses several significant challenges. The primary issues include:

- The integration of information from disparate sources

- Ensuring data quality and accuracy

- Navigating complex regulatory requirements

Moreover, user adoption can present a considerable hurdle. Employees may resist new technologies or lack the necessary training to utilize them effectively. This resistance can hinder the successful implementation of BI solutions.

To address these challenges, investment groups should conduct comprehensive needs evaluations. Involving stakeholders early in the process is crucial, as it fosters buy-in and ensures that the solutions developed meet the actual needs of the organization. Additionally, establishing clear governance structures will guide the BI implementation process, ensuring that it aligns with regulatory standards and organizational objectives.

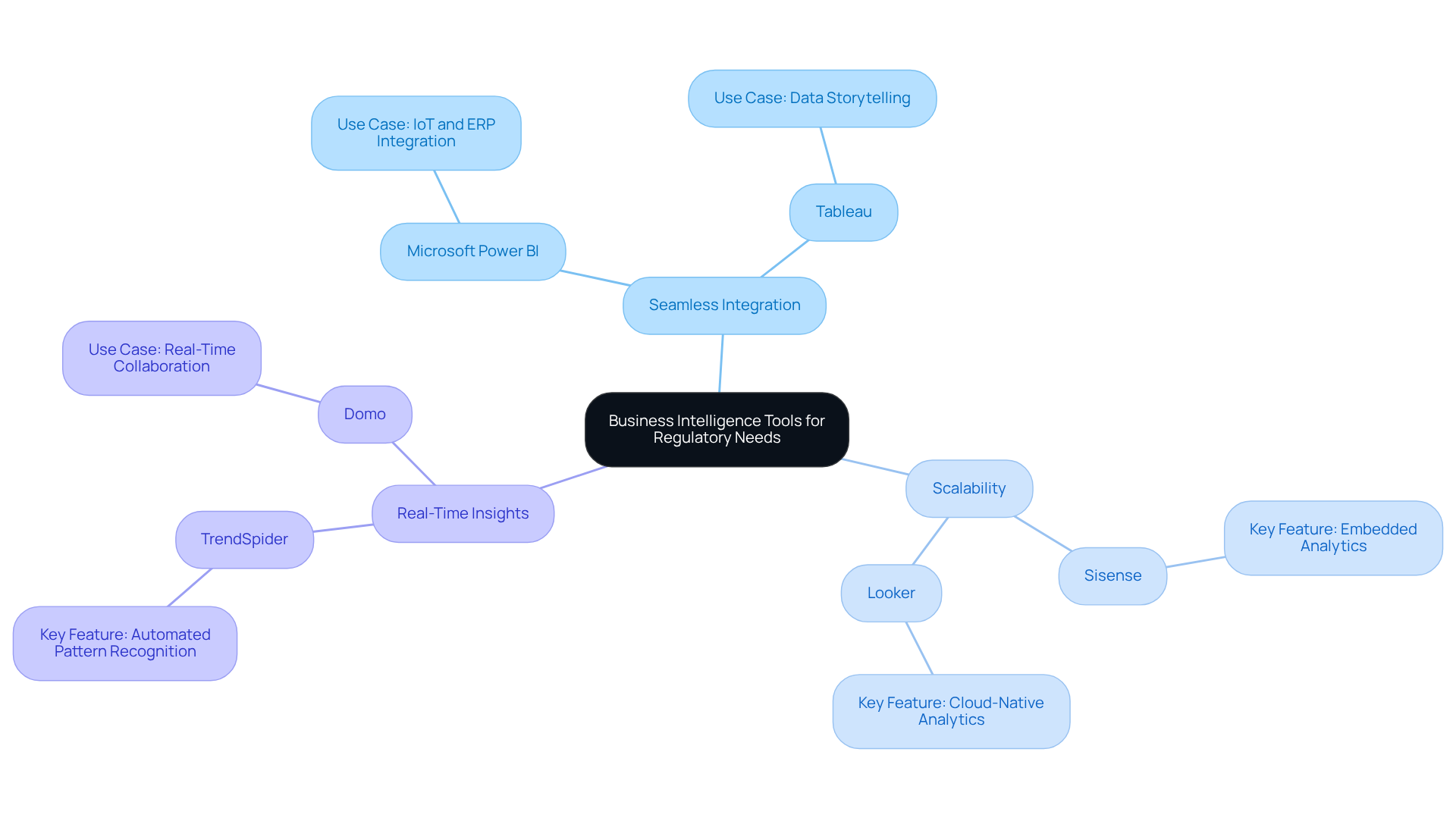

Select the Right Business Intelligence Tools for Your Regulatory Needs

Selecting the best business intelligence software is crucial for hedge funds aiming to manage information effectively while adhering to regulatory standards. The primary considerations include:

- Seamless integration with existing systems

- Scalability to support growth

- The ability to provide real-time insights

Prominent tools such as Microsoft Power BI, Tableau, Sisense, and Looker are recognized for their robust analytics capabilities and user-friendly interfaces. For example, Microsoft Power BI has been successfully utilized in financial services, allowing organizations to connect IoT sensor data and ERP information, which led to a 20% reduction in downtime and improved operational efficiency.

Moreover, investment pools should focus on the best business intelligence software that emphasizes strong data governance capabilities, ensuring compliance with industry regulations and facilitating accurate reporting. By focusing on these criteria, investment groups can enhance their decision-making processes and maintain a competitive edge in a rapidly evolving market.

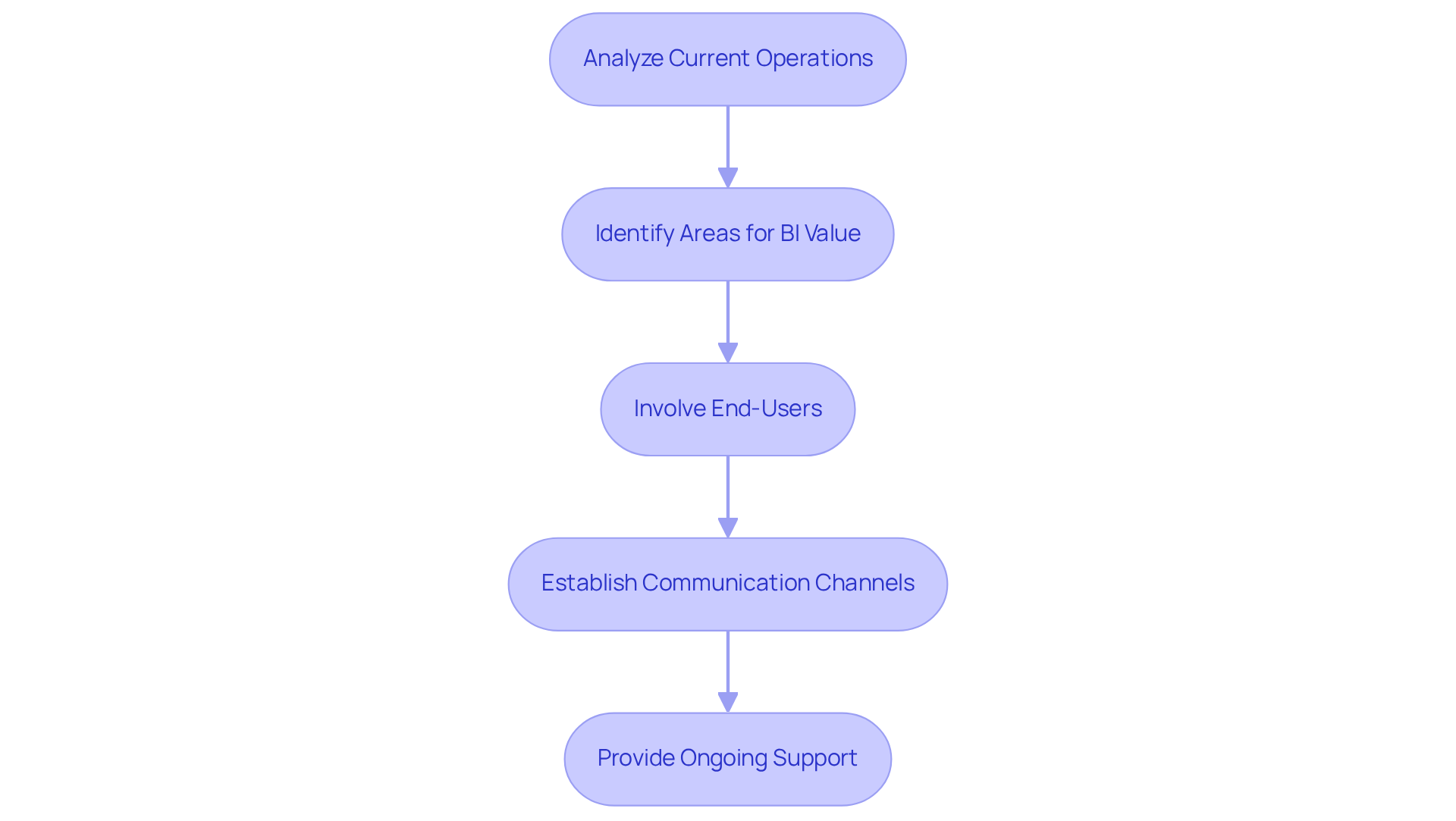

Integrate Business Intelligence Software Seamlessly into Existing Workflows

To fully harness the advantages of business intelligence (BI) software, investment firms must prioritize seamless integration into their existing workflows. This process begins with a thorough analysis of current operations to identify areas where BI can provide substantial value. Involving end-users during the integration phase is essential; their insights can help tailor BI resources to meet specific operational needs. Establishing clear communication channels and providing ongoing support not only eases the transition but also encourages user adoption.

Organizations that actively engage users in the integration process report a 35% improvement in overall productivity, as highlighted by a recent study from Deloitte. Furthermore, industry trends indicate that 78% of business executives recognize the necessity of incorporating AI-driven features to enhance their BI capabilities, a factor that is particularly crucial for investment firms aiming to stay competitive in a rapidly evolving market. Additionally, 95% of finance teams continue to encounter workflow inefficiencies that AI could potentially resolve, emphasizing the urgent need for effective BI integration.

By focusing on these optimal strategies, investment groups can ensure that their BI tools not only integrate smoothly into their workflows but also yield significant insights and operational efficiencies. For instance, the application of AI in fraud detection has proven effective for investment firms, allowing them to identify potential fraudulent activities more efficiently while enhancing compliance and risk management.

Provide Comprehensive Training and Support for Effective Use of Business Intelligence Software

Thorough training and assistance are crucial for the successful implementation of BI software in investment firms. Organizations must develop tailored training programs that address the specific needs of their employees, focusing on how to effectively utilize BI resources for data analysis and decision-making. A report indicates that businesses with comprehensive training initiatives experience 218% greater revenue per employee compared to those without structured training, underscoring the importance of effective training in investment management.

Ongoing support, which includes access to resources and expert guidance, is essential for helping users navigate challenges and improve their proficiency with the software. Additionally, cultivating a culture of data-driven decision-making within the organization can further promote the effective use of BI tools. According to the PwC Future of Learning Survey, 92% of L&D professionals believe that AI-powered, collaborative learning platforms will be vital by 2026, emphasizing the need for innovative training approaches.

Moreover, with the self-service BI market projected to reach $27.32 billion by 2032, the demand for effective training programs in hedge funds is more critical than ever.

Conclusion

Business intelligence (BI) is essential for hedge funds as they navigate the complexities of regulated industries. By converting extensive data into actionable insights, BI enhances operational efficiency and ensures compliance with stringent regulatory requirements. The effective use of top-tier business intelligence software allows investment firms to monitor market trends, assess risks, and refine their strategies, ultimately leading to improved performance.

This article outlines key practices for implementing BI in hedge funds. These practices include:

- Identifying challenges such as data integration and user adoption

- Selecting appropriate tools tailored to regulatory needs

- Ensuring seamless integration into existing workflows

- Providing comprehensive training and support for users

Each of these practices is crucial for overcoming obstacles and maximizing the benefits of BI software, fostering a culture of data-driven decision-making.

The importance of adopting robust BI practices cannot be overstated. As the finance landscape continues to evolve, hedge funds must prioritize effective BI implementation to maintain compliance and secure a competitive edge. By embracing these best practices, firms position themselves for success in 2025 and beyond, empowering them to fully leverage their data and drive informed decisions that lead to sustainable growth and innovation.

Frequently Asked Questions

What is Business Intelligence (BI)?

Business Intelligence (BI) refers to the software, technologies, resources, and practices involved in gathering, analyzing, and presenting business information to inform strategic decision-making.

Why is BI important in regulated industries?

In regulated sectors like finance, BI is crucial for converting raw data into actionable insights, enhancing operational efficiency, and ensuring compliance with laws and regulations.

How do BI tools benefit hedge entities?

BI tools help hedge entities monitor market trends, evaluate risks, and refine investment strategies, which improves performance and adherence to regulatory standards.

What are the main challenges of implementing BI software in regulated industries?

The primary challenges include integrating information from disparate sources, ensuring data quality and accuracy, navigating complex regulatory requirements, and overcoming user adoption resistance.

How can organizations address the challenges of BI implementation?

Organizations can address these challenges by conducting comprehensive needs evaluations, involving stakeholders early in the process, and establishing clear governance structures to align BI implementation with regulatory standards and organizational objectives.