Understanding Offshore Software Outsourcing Companies for Hedge Funds

Introduction

The investment management landscape is undergoing rapid evolution, as firms actively seek innovative solutions to enhance their operations while navigating stringent regulatory environments. Offshore software outsourcing companies have become a crucial resource for hedge funds, providing access to specialized talent and substantial cost savings. However, as these firms adopt this strategic approach, they must confront potential challenges, including communication barriers and compliance risks. Therefore, how can hedge funds effectively leverage offshore outsourcing to streamline their operations while upholding high standards of quality and compliance?

Define Offshore Software Outsourcing Companies

An offshore software outsourcing company is a specialized organization that delivers software creation services from locations outside the client’s home nation. This strategic model allows businesses, particularly in regulated sectors like finance, to access a diverse talent pool while significantly reducing operational costs. By 2026, the software development industry is projected to sustain robust growth, with approximately 54% of companies worldwide leveraging external teams to enhance customer interactions and operational efficiency.

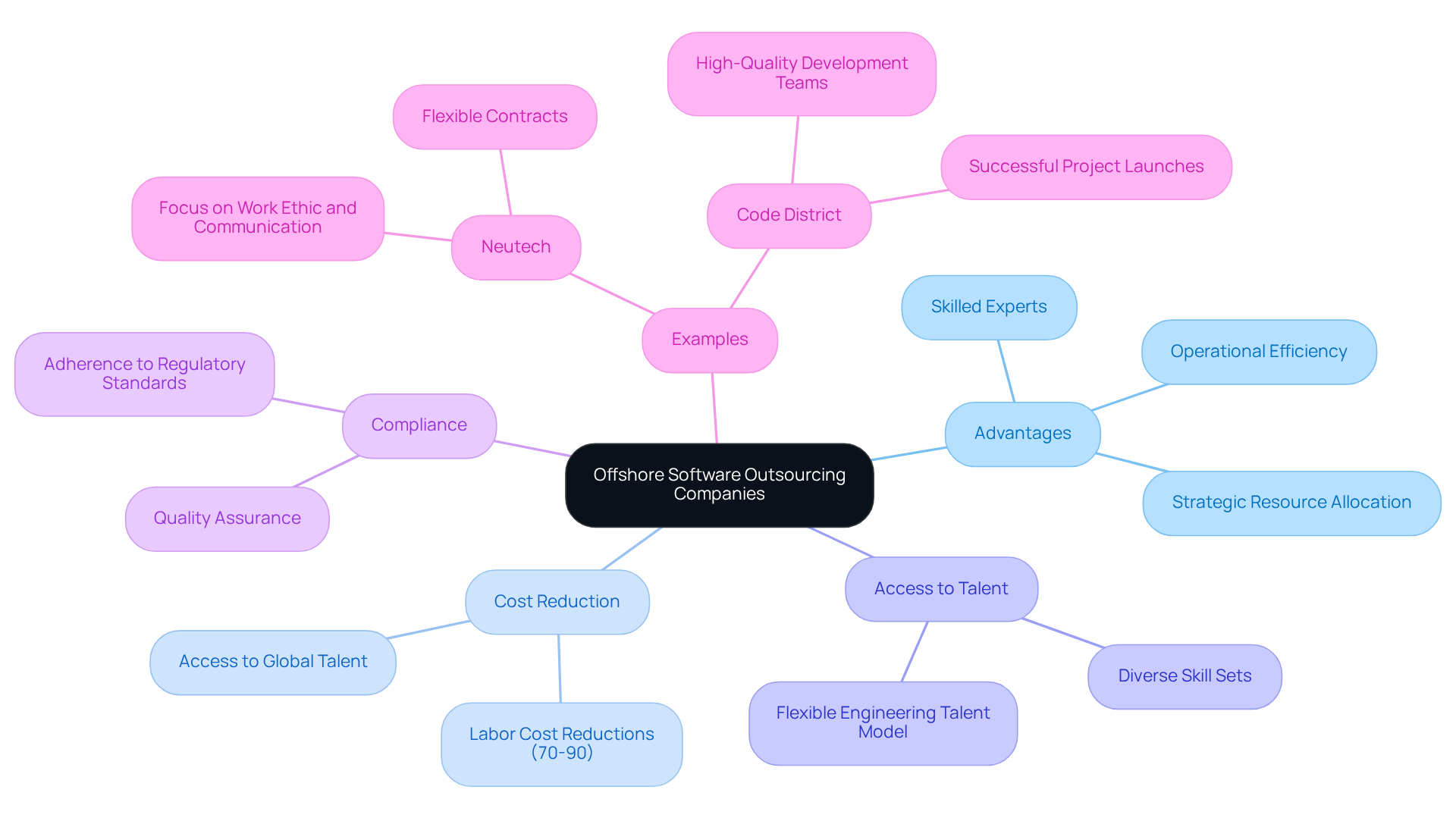

The primary advantage of working with an offshore software outsourcing company lies in its capacity to provide access to skilled experts proficient in various programming languages and technologies. This flexibility enables firms to scale operations effectively, ensuring they meet the demands of a dynamic market while adhering to stringent compliance standards. For example, companies can realize labor cost reductions of up to 70-90%, allowing for more strategic resource allocation.

Expert insights underscore the importance of engaging an offshore software outsourcing company in regulated sectors, where the need for specialized talent is paramount. Numerous successful examples exist, particularly within financial services, where firms have engaged an offshore software outsourcing company to enhance their technological capabilities and streamline operations. By integrating external resources, these organizations not only enhance service delivery but also maintain high standards of quality and compliance, which are essential for navigating the complexities of the financial landscape.

Neutech exemplifies this model by prioritizing intangible qualities in their hiring process, emphasizing work ethic, communication, and leadership skills among their developers. This commitment to reliability ensures high employee retention and seamless integration of engineering talent, which is vital for investment managers seeking trustworthy and skilled resources. Neutech’s flexible engineering talent model, featuring month-to-month contracts, enables firms to scale operations efficiently while upholding quality and compliance with industry standards. Clients can readily adjust their development resources according to project needs, ensuring optimal project management and responsiveness to evolving demands. The primary appeal of an offshore software outsourcing company is its ability to grant access to a global talent pool, empowering firms to achieve their operational objectives while benefiting from Neutech’s distinctive approach.

Contextualize Offshore Outsourcing for Hedge Funds

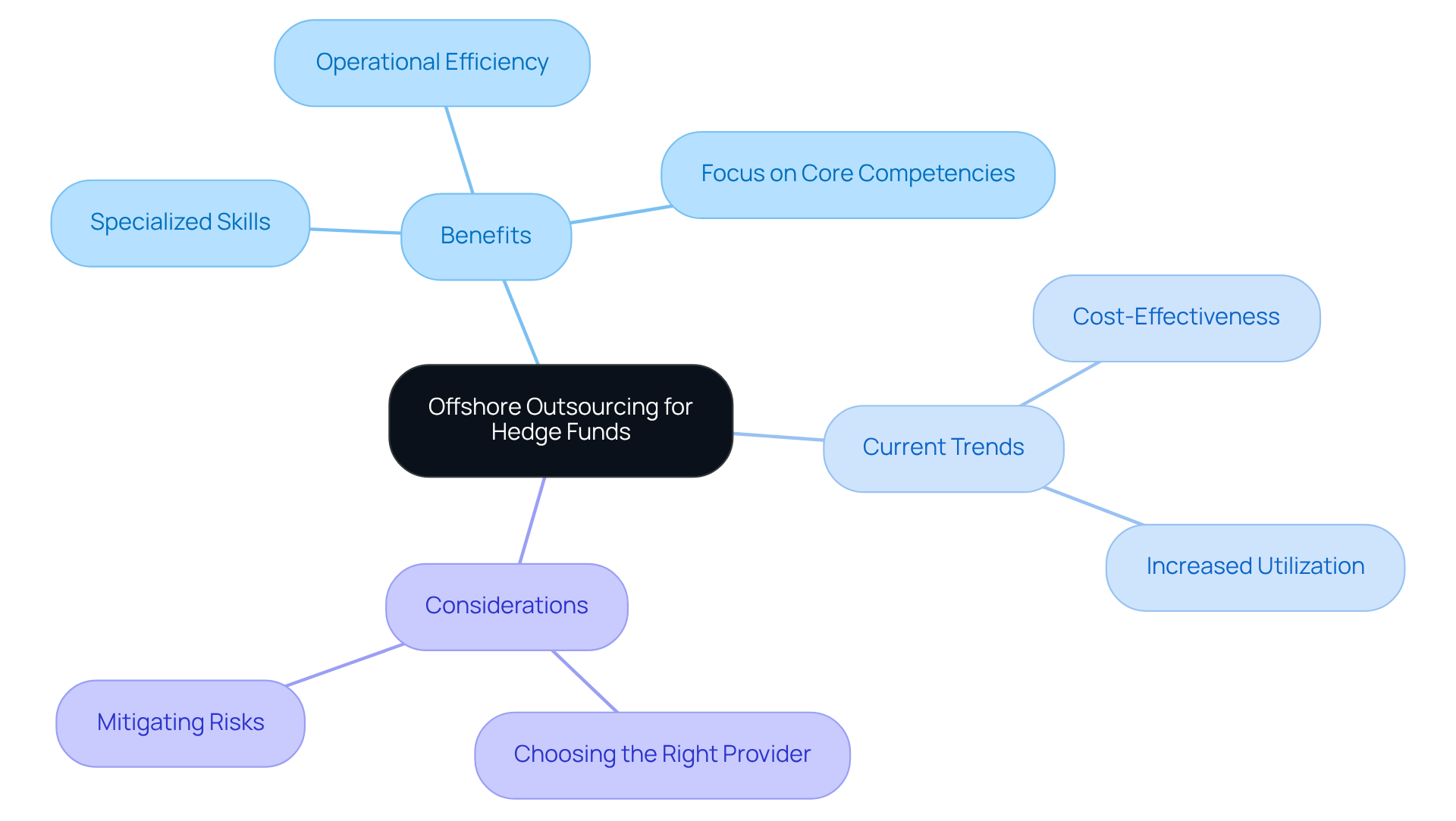

In the competitive and highly regulated landscape of investment vehicles, swift innovation and rigorous adherence to standards are paramount. An offshore software outsourcing company emerges as a strategic solution, enabling investment firms to tap into specialized skills that may be scarce in local markets, particularly in areas like advanced data analytics and algorithm development. By outsourcing software development, these firms can concentrate on their core competencies – investment strategies and risk management – while delegating technical tasks to external partners. This approach not only enhances operational efficiency but also allows investment firms to adapt swiftly to evolving market conditions and regulatory demands.

Current trends indicate that a significant portion of investment pools is increasingly utilizing an offshore software outsourcing company for their software development services, with many recognizing the cost-effectiveness and expertise these providers offer. As investment groups navigate the complexities of compliance and operational requirements, utilizing an offshore software outsourcing company becomes an essential element of their strategic framework. However, it is crucial for investment firms to choose external service providers, such as Neutech, that possess relevant experience and a deep understanding of investment operations. This careful selection helps mitigate potential challenges, such as the risk of producing flawed final products due to a lack of contextual awareness.

Highlight Benefits of Offshore Outsourcing for Hedge Funds

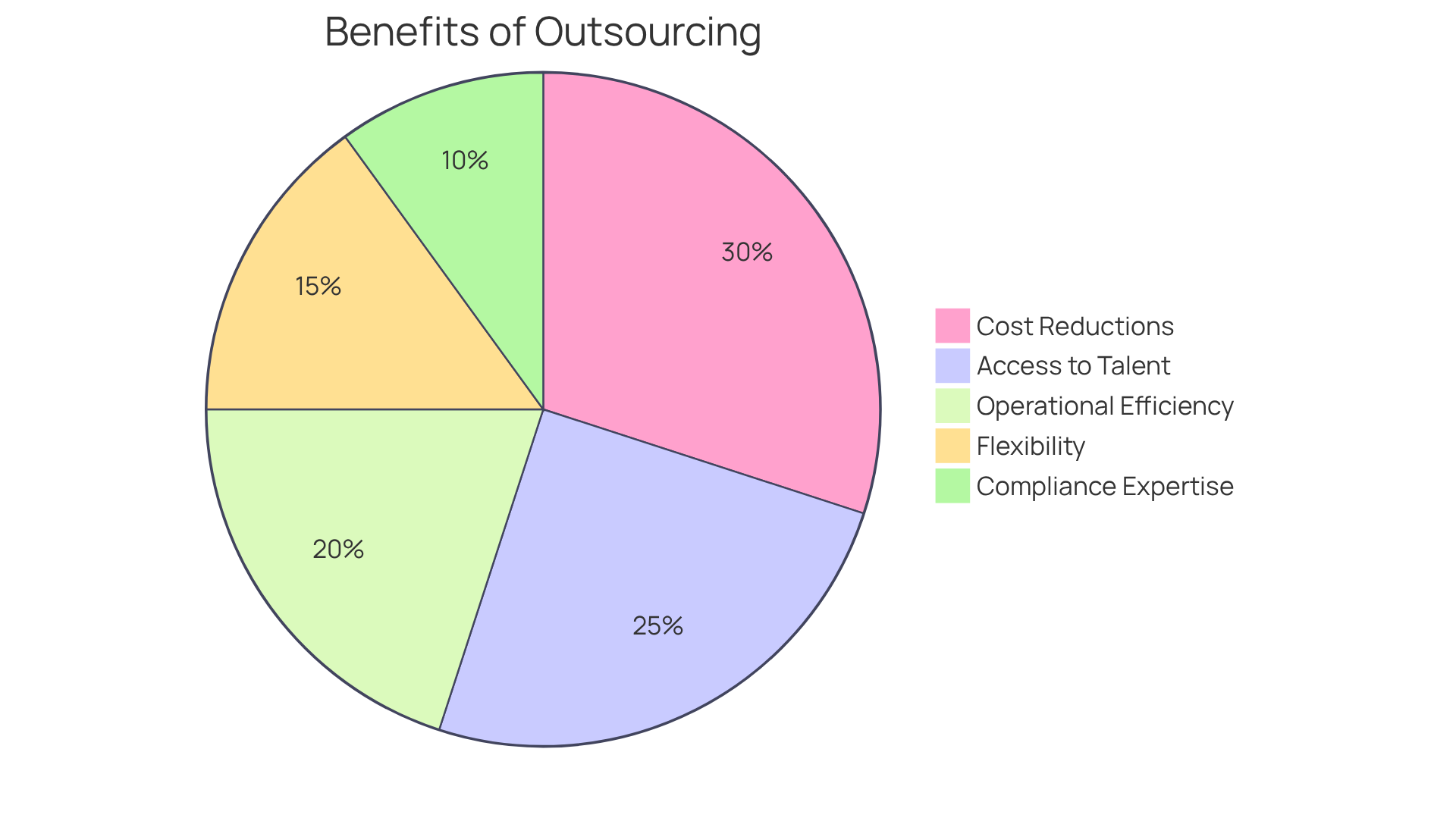

An offshore software outsourcing company provides investment groups significant advantages, such as substantial cost reductions, access to a diverse talent pool, and enhanced operational efficiency. By leveraging an offshore software outsourcing company, investment firms can achieve labor cost savings of up to 50%, facilitating a more effective allocation of resources. Neutech plays a pivotal role in this process by evaluating client needs and meticulously selecting specialized developers and designers tailored to those specifications. An offshore software outsourcing company often possesses expertise in critical areas such as compliance, data security, and financial modeling, which are essential for investment operations. This global access to talent promotes rapid innovation and the adoption of advanced technologies, ultimately refining investment strategies and improving client outcomes.

Moreover, subcontracting provides investment groups with the flexibility to adjust operations in response to market conditions and evolving business needs, ensuring they remain competitive in a dynamic environment. Notably, 71% of investment pools believe they could achieve enhanced cost efficiency by outsourcing specific operations, underscoring the strategic advantage of this approach.

As Thomas McHugh, CEO of Finbourne Technology, remarks, “Outsourcing provides a solution that allows organizations to adapt to these changing requirements without incurring additional expenses or facing time-consuming hiring procedures.

Examine Challenges of Offshore Outsourcing for Hedge Funds

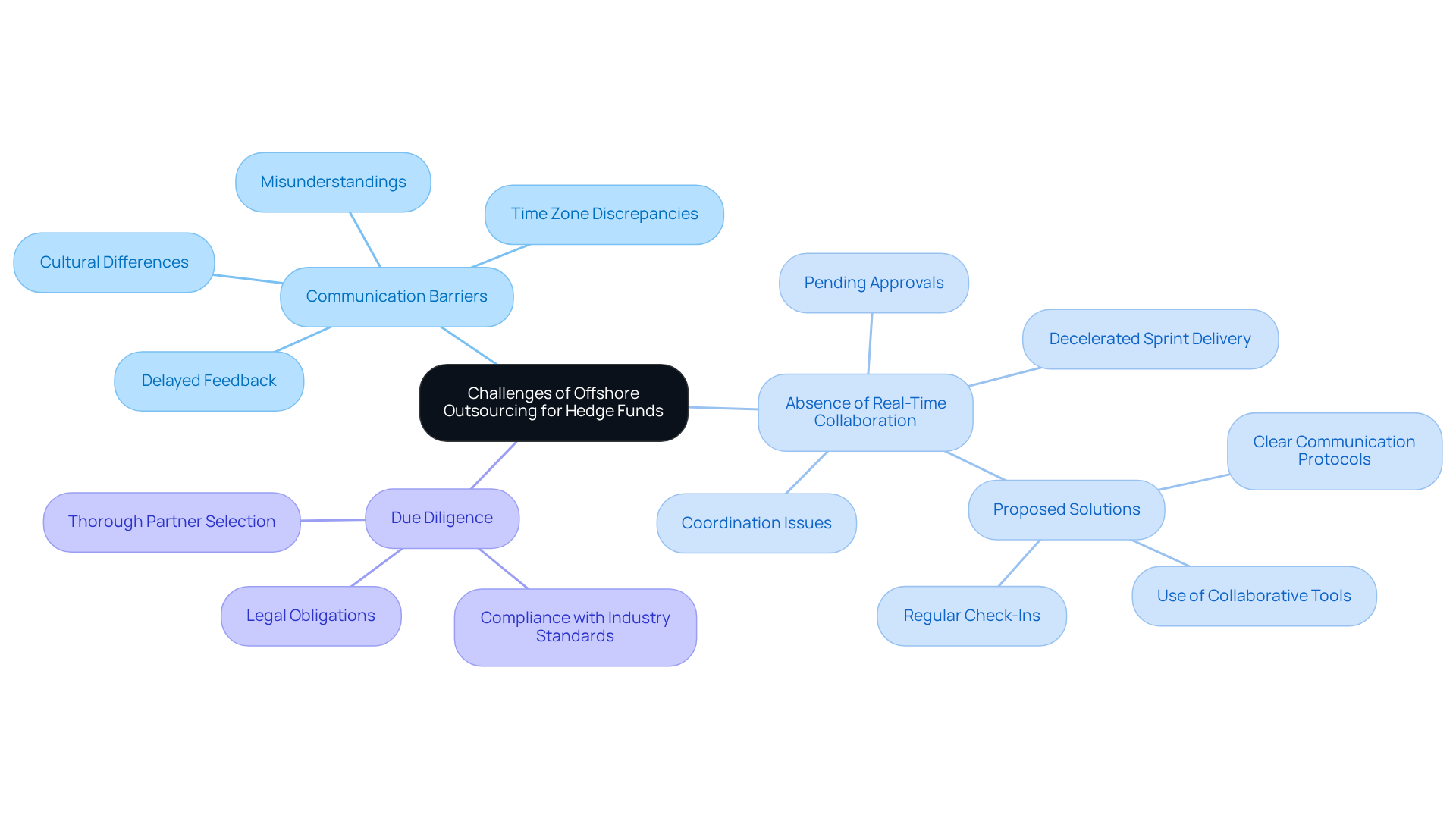

Offshore delegation presents significant advantages for investment groups, yet it also introduces various challenges that require careful management. A primary concern is the emergence of communication barriers, which often arise from cultural differences and time zone discrepancies. These barriers can result in misunderstandings, delayed feedback, and misaligned expectations, ultimately leading to project delays and suboptimal outcomes. Research indicates that communication issues can increase project costs by 20-30%, underscoring the financial ramifications of these challenges.

Additionally, the absence of real-time collaboration can impede decision-making, as teams may struggle to coordinate meetings across different time zones. This situation can decelerate sprint delivery, with code reviews and approvals potentially remaining pending until the next available shift. To address these challenges, investment groups should establish clear communication protocols from the outset, ensuring that all team members understand their roles and responsibilities.

Regular check-ins and the use of collaborative tools can help sustain momentum and cultivate a blame-free environment where mistakes are perceived as opportunities for learning. Furthermore, conducting thorough due diligence when selecting external partners is crucial to ensure compliance with industry standards and legal obligations. By proactively tackling these communication barriers, hedge funds can improve project outcomes and fully capitalize on the advantages of offshore outsourcing.

Conclusion

Offshore software outsourcing companies represent a strategic approach for hedge funds, allowing these investment firms to access a global talent pool while significantly reducing costs. By leveraging specialized expertise from external providers, firms can enhance operational efficiency and concentrate on their core competencies, ultimately leading to improved investment outcomes. This model not only fosters innovation but also ensures adherence to the stringent regulations governing the financial sector.

Key advantages of offshore outsourcing include:

- Substantial cost savings

- Access to advanced technological skills

- Flexibility to adapt to evolving market conditions

Companies like Neutech illustrate how strategic partnerships can enhance service delivery and operational agility, enabling hedge funds to navigate the complexities of their industry more effectively. However, challenges such as communication barriers and time zone discrepancies must be addressed to fully realize these benefits.

In summary, the importance of offshore software outsourcing for hedge funds is significant. As the financial landscape continues to evolve, adopting this approach is not merely an option but a necessity for firms seeking to maintain a competitive edge. By selecting appropriate partners and implementing effective communication strategies, hedge funds can overcome the inherent challenges of outsourcing, positioning themselves for sustained success in an increasingly dynamic market.

Frequently Asked Questions

What is an offshore software outsourcing company?

An offshore software outsourcing company is a specialized organization that provides software creation services from locations outside the client’s home country, allowing access to a diverse talent pool and reduced operational costs.

What are the benefits of working with an offshore software outsourcing company?

The primary benefits include access to skilled experts in various programming languages and technologies, significant labor cost reductions (up to 70-90%), and the ability to scale operations effectively to meet market demands and compliance standards.

How does offshore software outsourcing impact companies in regulated sectors?

In regulated sectors, offshore software outsourcing is crucial for accessing specialized talent, enhancing technological capabilities, and maintaining high standards of quality and compliance, which are essential for navigating complex regulatory environments.

Can you provide an example of a successful offshore software outsourcing company?

Neutech is an example that prioritizes intangible qualities like work ethic, communication, and leadership skills in their hiring process, ensuring high employee retention and seamless integration of engineering talent.

How does Neutech’s engineering talent model work?

Neutech offers a flexible engineering talent model with month-to-month contracts, allowing firms to scale their operations efficiently while maintaining quality and compliance with industry standards.

What is the projected growth for the software development industry by 2026?

By 2026, the software development industry is expected to sustain robust growth, with approximately 54% of companies worldwide leveraging external teams to enhance customer interactions and operational efficiency.