Why Hedge Fund Managers Need a Database Development Company Now

Introduction

As the financial landscape evolves into a data-driven environment, hedge fund managers face a critical juncture where effective database management is essential rather than optional. Partnering with a specialized database development company enables these investment professionals to access valuable insights, streamline operations, and ensure compliance with regulatory standards. Conversely, neglecting this crucial aspect of their business can lead to significant risks. Inadequate data systems may result in poor investment decisions and substantial financial losses. Thus, examining the necessity of robust database solutions not only highlights opportunities for competitive advantage but also underscores the severe consequences of inaction in a rapidly changing market.

Understand the Essential Role of Database Development in Business Operations

A database development company plays a vital role in the operational framework of investment firms, particularly in 2026, as the financial landscape becomes increasingly data-driven. Effective information management systems empower hedge fund managers to efficiently store, retrieve, and analyze extensive datasets, which is essential for making informed investment decisions. These systems not only organize and streamline information access but also enable managers to swiftly adapt to market fluctuations and client demands.

Moreover, robust information management solutions are critical in ensuring compliance with regulatory standards, ensuring that all information management practices align with industry requirements. As the financial sector evolves, the importance of information management systems becomes even more pronounced; they are not merely technical necessities but strategic assets that enhance operational efficiency and decision-making capabilities.

For instance, a case study demonstrates how firms utilizing advanced analytical techniques have significantly bolstered their competitive edge by leveraging insights derived from their information sources. This underscores the necessity for investment managers to invest in sophisticated services offered by a database development company, as the potential revenue loss from underutilized information can reach $5.2 million annually. Expert opinions further corroborate this viewpoint, emphasizing that the integration of effective information systems is crucial for navigating the complexities of modern financial markets and achieving sustained success.

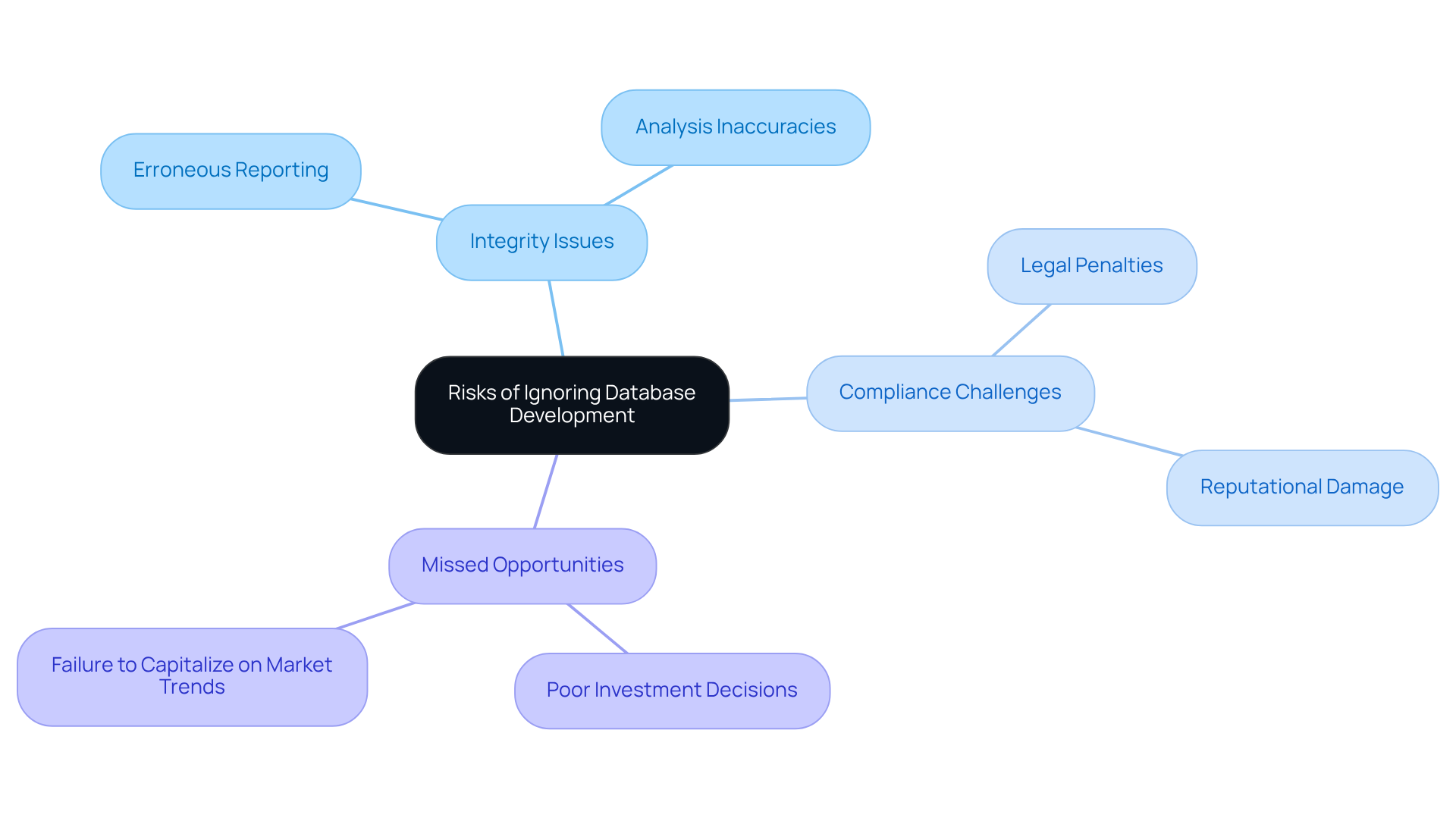

Examine the Risks of Ignoring Database Development

Neglecting the development of data systems can expose hedge fund managers to numerous risks that jeopardize their operations. A disorganized information system may lead to integrity issues, resulting in erroneous reporting and analysis. Such inaccuracies can culminate in poor investment decisions and substantial financial losses.

Moreover, inadequate information systems can hinder compliance with regulatory standards, putting firms at risk of legal penalties and damaging their reputation. The inability to manage and analyze data effectively can also result in missed opportunities in the fast-paced financial market.

Thus, the dangers associated with neglecting data management development extend beyond technical challenges; they carry significant implications for the overall success and sustainability of investment operations.

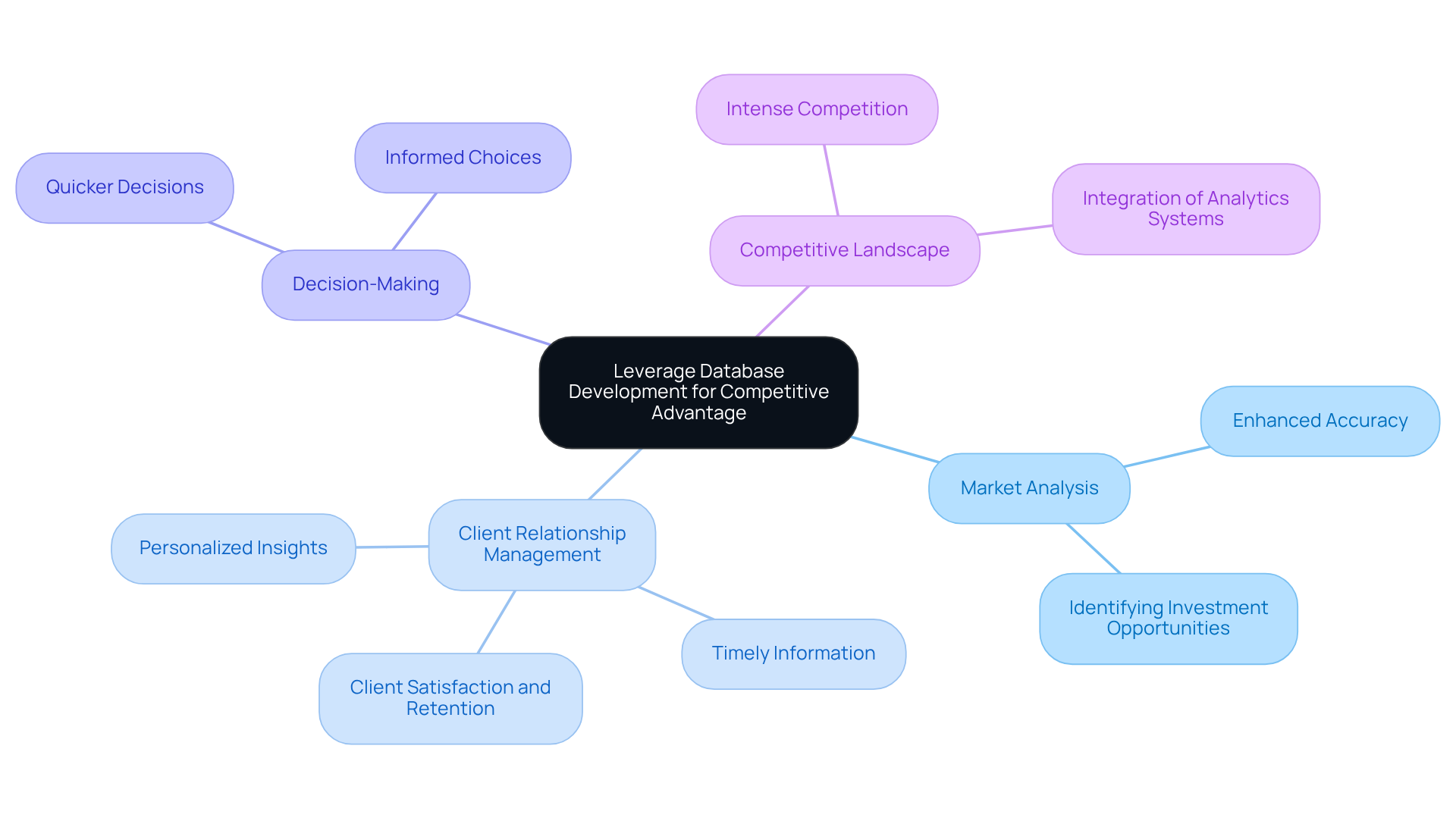

Leverage Database Development for Competitive Advantage

In the highly competitive realm of investment management, the development of efficient information systems is essential for gaining a strategic advantage. A well-organized information system enables firms to analyze market trends and investment opportunities with enhanced accuracy, leading to quicker and more informed decision-making. Advanced analytics and reporting tools empower investment groups to uncover insights that competitors with less sophisticated systems may overlook.

Furthermore, a robust information system improves client relationship management by providing personalized insights and timely information, which significantly enhances client satisfaction and retention rates. As investment groups increasingly adopt analytics for market insights, case studies indicate that those utilizing advanced information systems have successfully navigated market fluctuations and identified profitable investment opportunities.

The investment management sector faces intense competition, with approximately 15,000 entities operating in the market. Consequently, the integration of analytics systems is a critical factor in transforming information into a strategic resource that cultivates a competitive edge within the financial industry.

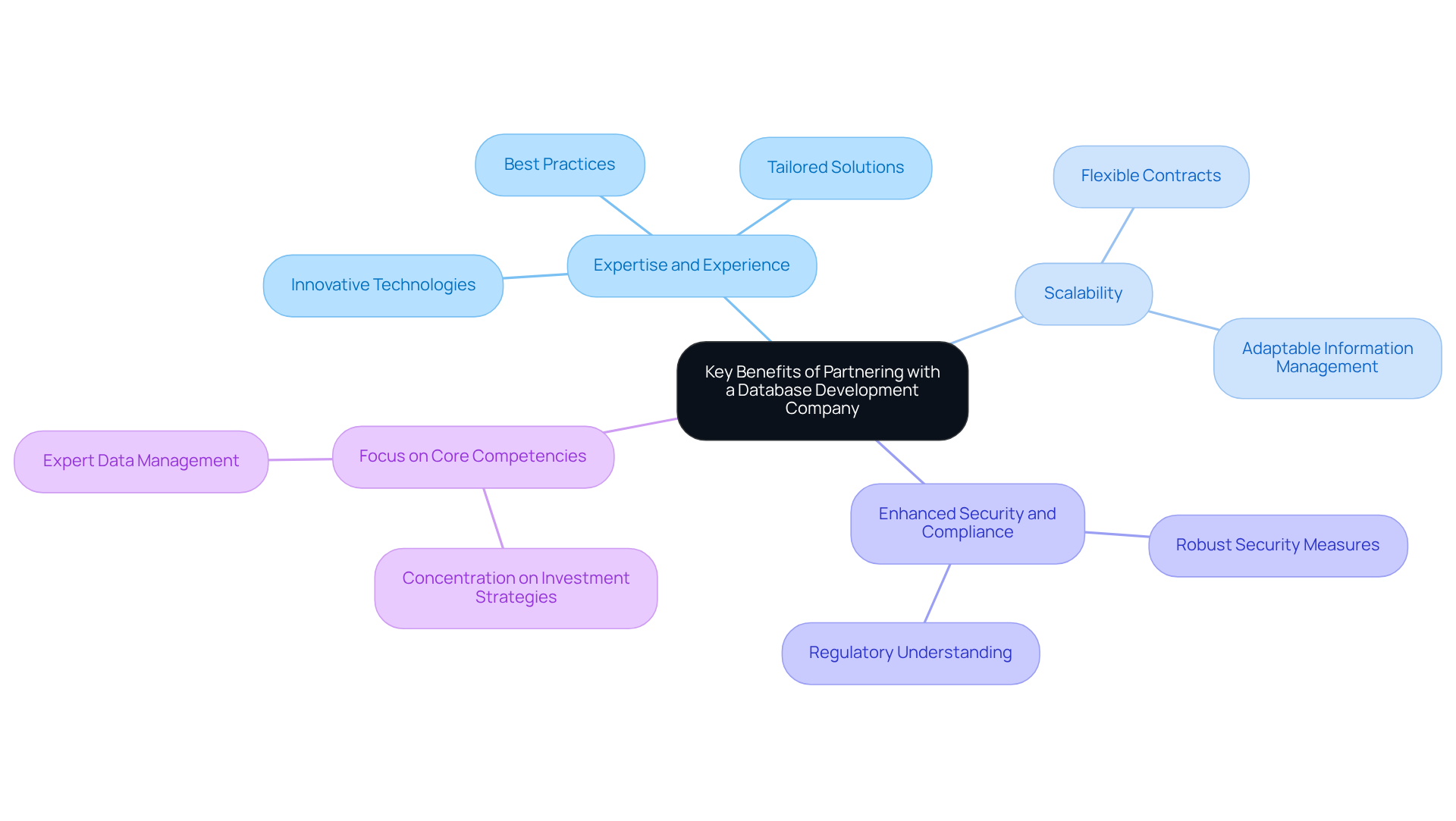

Identify Key Benefits of Partnering with a Database Development Company

Collaborating with a specialized database development company like Neutech offers investment managers significant advantages that can enhance their operational capabilities. Neutech, a leading database development company, brings extensive expertise and experience in designing and implementing database solutions tailored specifically to the financial sector‘s unique needs. This ensures that investment groups can leverage best practices and innovative technologies without the challenges associated with internal development.

Additionally, Neutech’s flexible engineering talent model allows for improved scalability, enabling investment firms to adapt their information management strategies as their business evolves. With month-to-month contracts, clients can easily adjust their teams based on project requirements, ensuring optimal resource allocation.

Furthermore, such collaborations can lead to enhanced information security and compliance. Neutech’s deep understanding of the regulatory landscape enables them to implement robust security measures effectively. By prioritizing intangibles such as work ethic, communication, and leadership, Neutech ensures that investment managers receive reliable and dedicated developers who can seamlessly integrate into their teams.

Ultimately, engaging with Neutech empowers hedge fund managers to concentrate on their core competencies while ensuring that their data management needs are expertly addressed.

Conclusion

The integration of a dedicated database development company has become increasingly critical for hedge fund managers navigating the complexities of the financial landscape. As data-driven decision-making surges, the importance of robust information management systems cannot be overstated. These systems not only enhance operational efficiency but also serve as strategic assets, empowering investment firms to respond swiftly to market changes and client needs.

Key insights have emerged regarding the necessity of effective database management. Ensuring compliance with regulatory standards and mitigating risks associated with inaccurate data are paramount. The implications of neglecting database development are profound. Furthermore, a well-structured information system is essential for gaining a competitive edge, enabling firms to make informed investment decisions and improve client relationships through personalized insights.

In light of these considerations, investing in database development is not merely an option but a necessity for hedge fund managers aiming for sustained success. As the financial industry continues to evolve, leveraging advanced database solutions will be crucial for maintaining competitiveness and capitalizing on market opportunities. Embracing this strategic partnership will ultimately empower investment firms to focus on their core competencies while ensuring their data management needs are met with expertise and precision.

Frequently Asked Questions

What role does database development play in business operations for investment firms?

Database development is essential for investment firms as it helps them efficiently store, retrieve, and analyze extensive datasets, which is crucial for making informed investment decisions.

How do information management systems benefit hedge fund managers?

Information management systems organize and streamline information access, allowing hedge fund managers to quickly adapt to market fluctuations and client demands.

Why is compliance important in information management for financial firms?

Compliance is critical to ensure that all information management practices align with regulatory standards, which is increasingly important as the financial sector evolves.

What is the strategic value of information management systems in the financial sector?

Information management systems are strategic assets that enhance operational efficiency and decision-making capabilities, rather than just being technical necessities.

Can you provide an example of how firms benefit from advanced analytical techniques?

Firms that utilize advanced analytical techniques have significantly improved their competitive edge by leveraging insights from their information sources.

What are the potential financial implications of underutilized information for investment managers?

The potential revenue loss from underutilized information can reach $5.2 million annually for investment managers.

What do experts say about the integration of effective information systems in financial markets?

Experts emphasize that integrating effective information systems is crucial for navigating the complexities of modern financial markets and achieving sustained success.