Why Hedge Funds Need Custom Application Development Consultants

Introduction

In the fast-paced realm of hedge funds, where precision and compliance are paramount, the significance of custom application development consultants has reached unprecedented heights. These specialists deliver tailored software solutions that effectively tackle the unique challenges encountered by investment firms, ranging from regulatory pressures to inefficiencies in data management. As the demand for specialized technology escalates, a critical question emerges: how can hedge funds strategically leverage these custom solutions to not only enhance operational efficiency but also secure a competitive advantage in an increasingly intricate market?

Understand the Critical Role of Custom Application Development Consultants in Hedge Funds

In the highly regulated and competitive landscape of investment vehicles, accuracy, speed, and adherence to regulations are paramount. Custom application development consultants, particularly those at leading firms, play a crucial role in this environment by providing tailored solutions that effectively address the unique operational challenges faced by these companies.

Unlike generic off-the-shelf software, solutions provided by custom application development consultants are specifically designed to enhance efficiency, automate complex processes, and ensure compliance with regulatory standards. For instance, a hedge fund may require a bespoke trading platform that seamlessly integrates real-time data analytics and advanced risk management tools – capabilities that can only be achieved through specialized development.

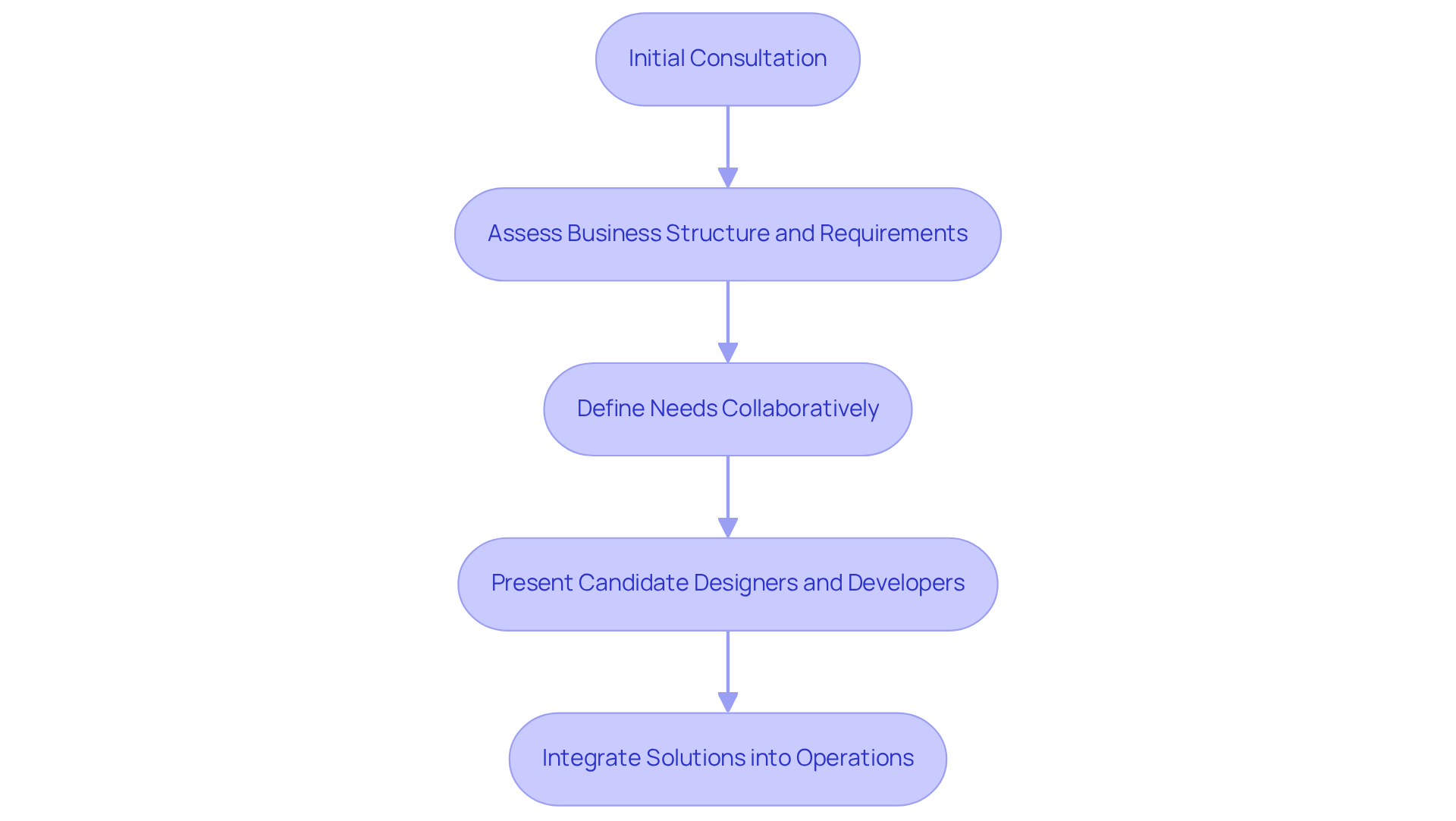

The process begins with a complimentary consultation to assess your business structure and requirements, ensuring that the appropriate engineering expertise is aligned with your team. Once we collaboratively define your needs, Neutech will present a selection of candidate designers and developers to integrate into your operations.

Moreover, with 92% of investment executives reporting excessive time spent on consolidating and integrating data from various sources, the demand for tailored approaches becomes increasingly evident. The ability to automate KYC/AML workflows represents a significant regulatory advantage that can be delivered by custom application development consultants. This level of customization, facilitated by custom application development consultants, not only enhances operational efficiency but also provides a competitive edge in a market where every second counts.

Additionally, incorporating back-testing features into trading infrastructure is essential for ensuring consistency and reliability in trading strategies, which further emphasizes the role of custom application development consultants in providing tailored software solutions. As artificial intelligence continues to evolve, its role in optimizing portfolios and interpreting volatile markets will be a critical consideration for hedge groups striving to maintain their competitive advantage.

Address Hedge Fund Challenges with Tailored Solutions from Consultants

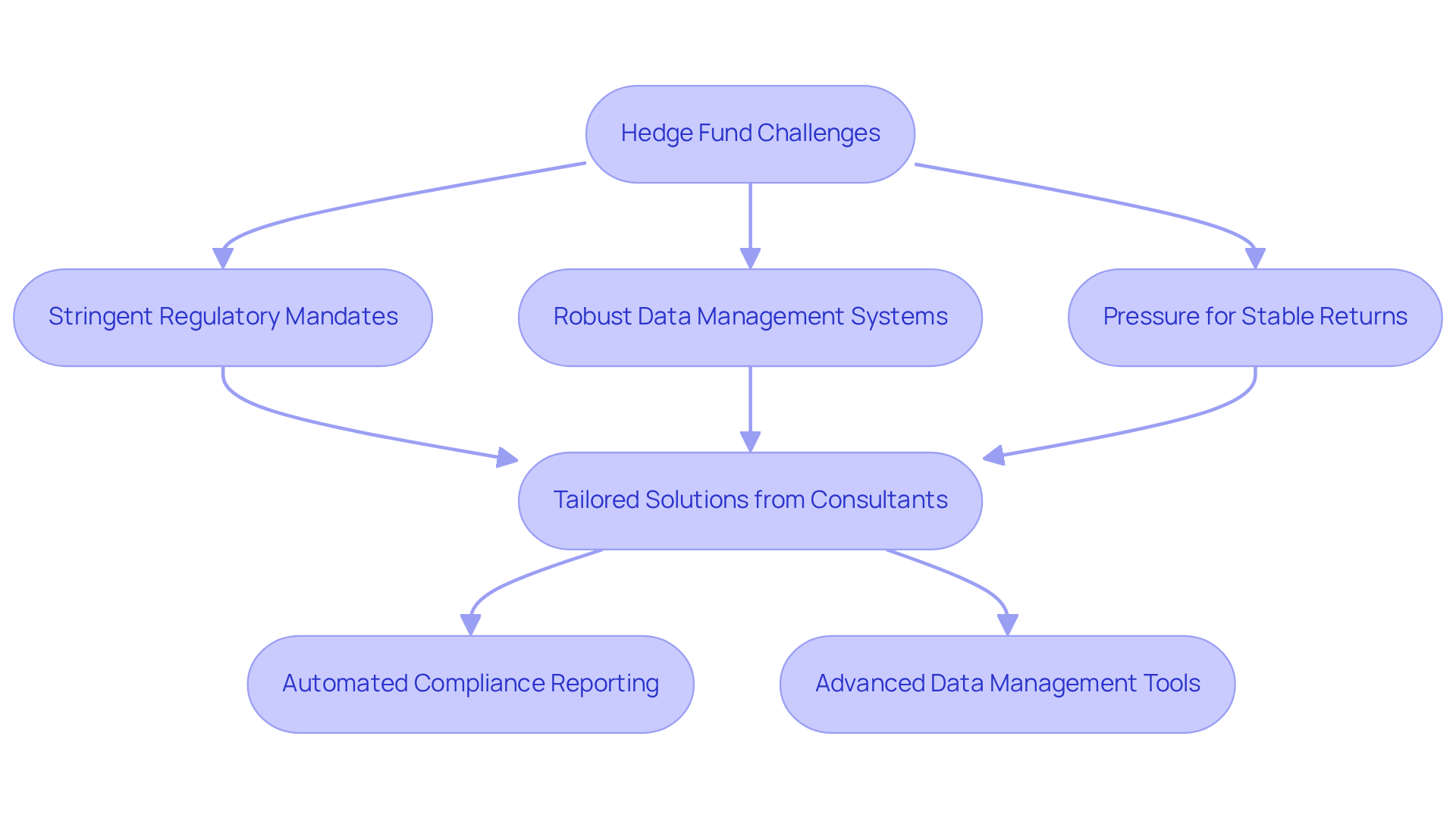

Hedge vehicles face numerous obstacles that can impede their operational effectiveness. These include:

- Stringent regulatory mandates

- The necessity for robust data management systems

- The pressure to deliver stable returns to investors

Notably, 49% of asset managers have identified the provision of high-quality data to clients as their most significant challenge, underscoring the urgent need for effective data management strategies.

Custom application development consultants, such as those at a specific company, are instrumental in addressing these challenges. They develop tailored approaches that meet the unique needs of investment firms. After Neutech conducts a thorough assessment to identify a financial management entity’s requirements, they assign specialized designers and developers to integrate into the team. This ensures that the solutions are meticulously aligned with operational demands.

For instance, when an investment group encounters difficulties with compliance reporting, custom application development consultants can create a customized application that automates this process, guaranteeing both accuracy and timeliness. As Colleen Judge noted, “By integrating seamlessly with the organization’s existing trading systems, it provides strong reporting and reconciliation tools, minimizing manual intervention and alleviating operational risks.”

Moreover, as investment firms increasingly embrace data-driven strategies, the ability to manage and analyze large volumes of data becomes crucial. Tailored solutions not only streamline data processes but also mitigate human error and enhance decision-making capabilities. By implementing automated compliance reporting and advanced data management tools, investment firms can navigate regulatory complexities more effectively, ultimately preserving their competitive edge in a rapidly evolving market.

Leverage Strategic Advantages through Custom Development Partnerships

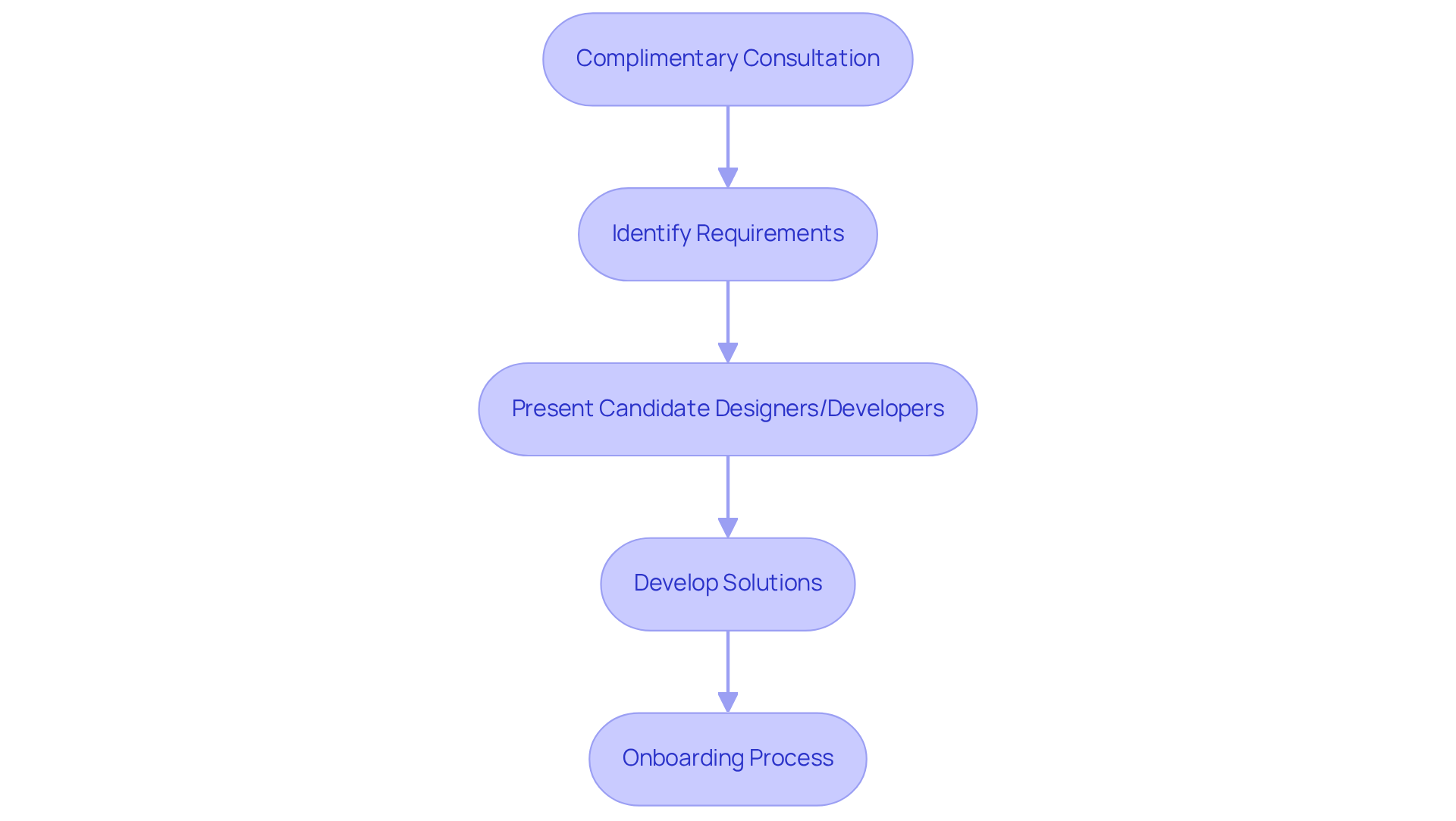

In the competitive landscape of investment portfolios, securing strategic advantages is vital for success. By collaborating with custom application development consultants, investment firms can harness specialized knowledge and advanced technology to bolster their operational capabilities. Our client engagement process begins with a complimentary consultation, allowing us to understand your business structure and specific needs. After we mutually identify your requirements, we present a selection of candidate designers and developers tailored to your team. This approach ensures that the solutions we provide are not only innovative but also aligned with the unique demands of the investment environment.

For example, an investment group may partner with Neutech to create a proprietary algorithm that enhances trading strategies by analyzing real-time market data. This not only improves trading efficiency but also positions the investment group as an industry leader. Additionally, our onboarding process includes regular management discussions to refine your roadmap and align on our ongoing performance, fostering scalability and enabling investment groups to swiftly adapt to evolving market conditions and changing investor expectations.

Statistics reveal that nearly 70% of C-level executives believe technological advancements are essential for initiating new investments, underscoring the significance of these development partnerships in maintaining a competitive edge. Furthermore, with the investment management sector operating within a market potential exceeding $80 billion, the demand for technology-driven solutions is more pressing than ever. The importance of back testing in trading systems, regarded as very important by 66% of investment firm executives, further highlights the critical role of technology in enhancing operational efficiency. As investment groups face competitive pressures, the necessity to innovate and retain talent through development partnerships with custom application development consultants like Neutech becomes increasingly evident.

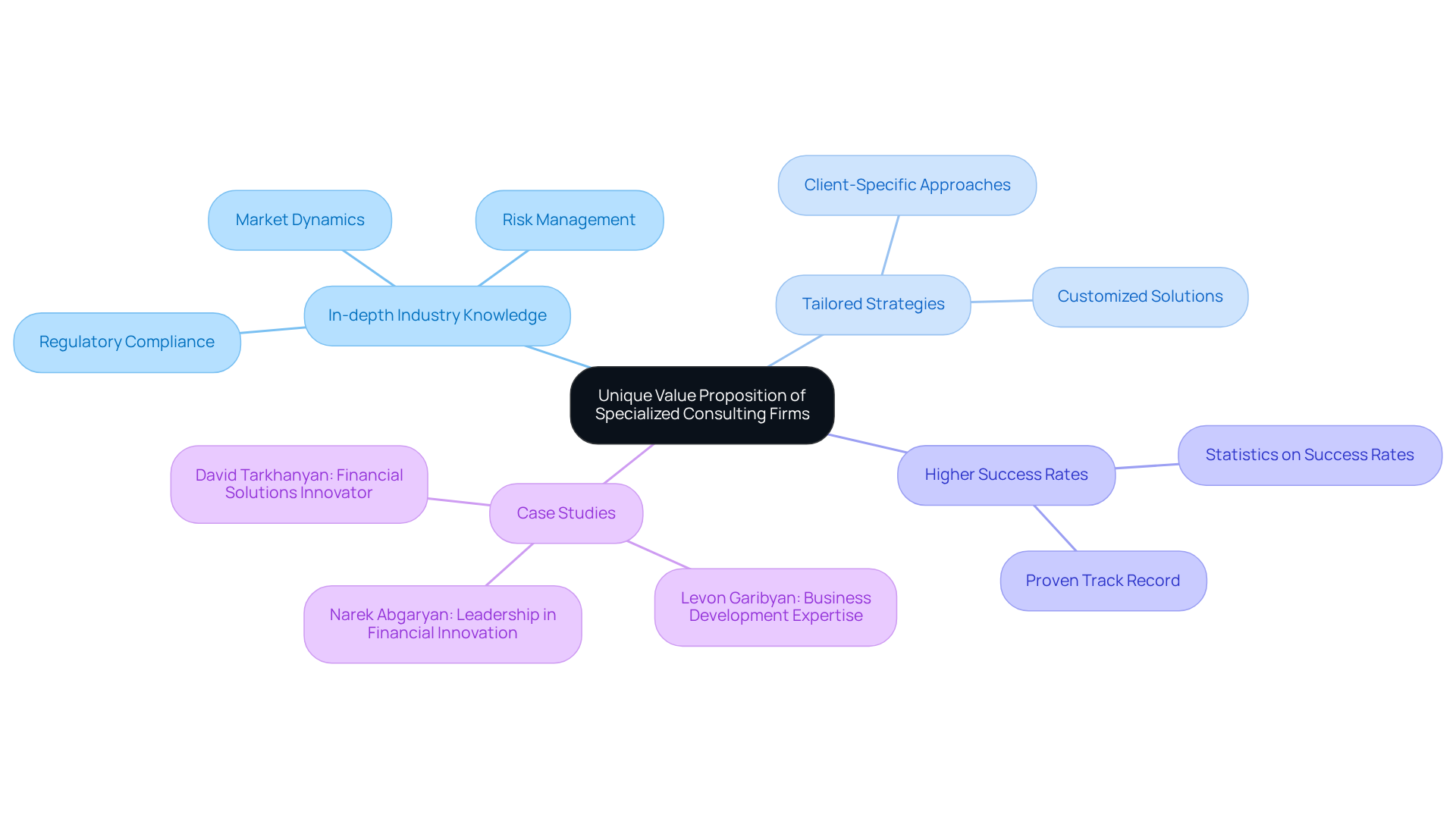

Recognize the Unique Value Proposition of Specialized Consulting Firms

Specialized consulting companies deliver a unique value proposition that significantly benefits investment partnerships. These firms possess in-depth industry knowledge and technical expertise that generalist firms often lack. For instance, a consulting agency specializing in financial services understands the complexities of regulatory compliance, risk management, and market dynamics that are crucial for investment pools. This specialized knowledge allows them to provide solutions that are not only technically robust but also strategically aligned with the investment firm’s objectives.

At Neutech, we understand the necessity of customizing our approach to meet the distinct needs of each client. After collaboratively identifying your requirements, we present a selection of candidate designers and developers who can seamlessly integrate into your team. This tailored provision of engineering talent ensures that investment firms receive specialized support that enhances their operational efficiency.

Statistics indicate that investment pools utilizing specialized consulting services achieve a success rate significantly higher than those relying on generalist firms. This is primarily due to the tailored strategies these firms implement, ensuring that solutions are personalized to meet the specific demands of the investment sector. Moreover, specialized companies often demonstrate a proven track record of successful projects, instilling confidence in investment groups that their investments in custom application development consultants will yield substantial returns.

By leveraging the distinct advantages offered by specialized consulting firms like Neutech, investment groups can enhance their operational efficiency and strengthen their competitive position in a rapidly evolving market. For example, case studies reveal that firms concentrating on tailored financial solutions have markedly improved their compliance and risk management processes, resulting in superior overall performance. This underscores the importance of selecting a consulting partner that comprehends the unique challenges and opportunities within the hedge fund industry.

Conclusion

Custom application development consultants play a crucial role for hedge funds as they navigate the complexities of the contemporary financial landscape. By delivering tailored software solutions, these specialists effectively address the unique operational challenges that investment firms encounter. This not only enhances efficiency but also ensures compliance, ultimately driving performance. The necessity for bespoke applications becomes increasingly evident as hedge funds seek to optimize their operations and maintain a competitive edge in a rapidly evolving market.

The article underscores the significant impact of custom application development, illustrating how these consultants streamline data management, automate compliance processes, and leverage advanced technology to meet stringent regulatory standards. Insights reveal that specialized consulting firms possess not only the technical expertise required for effective solution implementation but also a deep understanding of the intricate nuances of the hedge fund industry. This combination leads to improved operational efficiency and enhanced decision-making capabilities.

In conclusion, the collaboration between hedge funds and custom application development consultants is not merely advantageous; it is essential for success in a highly competitive environment. As the demand for innovative and efficient solutions continues to grow, investment firms must acknowledge the importance of these specialized consultants in addressing their unique challenges. By embracing tailored software development, hedge funds can significantly enhance their performance, ensuring agility and responsiveness to market changes while maximizing their potential for growth and profitability.

Frequently Asked Questions

What is the role of custom application development consultants in hedge funds?

Custom application development consultants play a crucial role in hedge funds by providing tailored solutions that address unique operational challenges, enhance efficiency, automate complex processes, and ensure compliance with regulatory standards.

How do custom solutions differ from off-the-shelf software?

Unlike generic off-the-shelf software, custom solutions are specifically designed to meet the unique needs of hedge funds, such as integrating real-time data analytics and advanced risk management tools.

What is the process for engaging custom application development consultants?

The process begins with a complimentary consultation to assess the business structure and requirements. After defining needs, the consultants present a selection of candidate designers and developers to integrate into the operations.

Why is there a demand for tailored approaches in hedge funds?

There is a high demand for tailored approaches due to 92% of investment executives reporting excessive time spent on consolidating and integrating data from various sources, highlighting the need for customized solutions.

How do custom application development consultants help with regulatory compliance?

They can automate KYC/AML workflows, providing a significant regulatory advantage and enhancing operational efficiency for hedge funds.

What additional features can custom application development consultants provide?

They can incorporate back-testing features into trading infrastructure to ensure consistency and reliability in trading strategies.

How is artificial intelligence relevant to custom application development in hedge funds?

As artificial intelligence evolves, it plays a critical role in optimizing portfolios and interpreting volatile markets, which is essential for hedge funds to maintain their competitive advantage.