Compare Business Software Solutions for Hedge Funds’ Unique Needs

Introduction

Hedge funds navigate a landscape characterized by complexity and rapid change, where the right software can significantly influence success or failure. These investment vehicles encounter unique challenges, ranging from real-time data analytics to stringent compliance requirements. Consequently, selecting appropriate business software solutions is crucial. However, with a plethora of options available, firms must determine how to choose tools that not only address their current needs but also adapt to the evolving demands of the market.

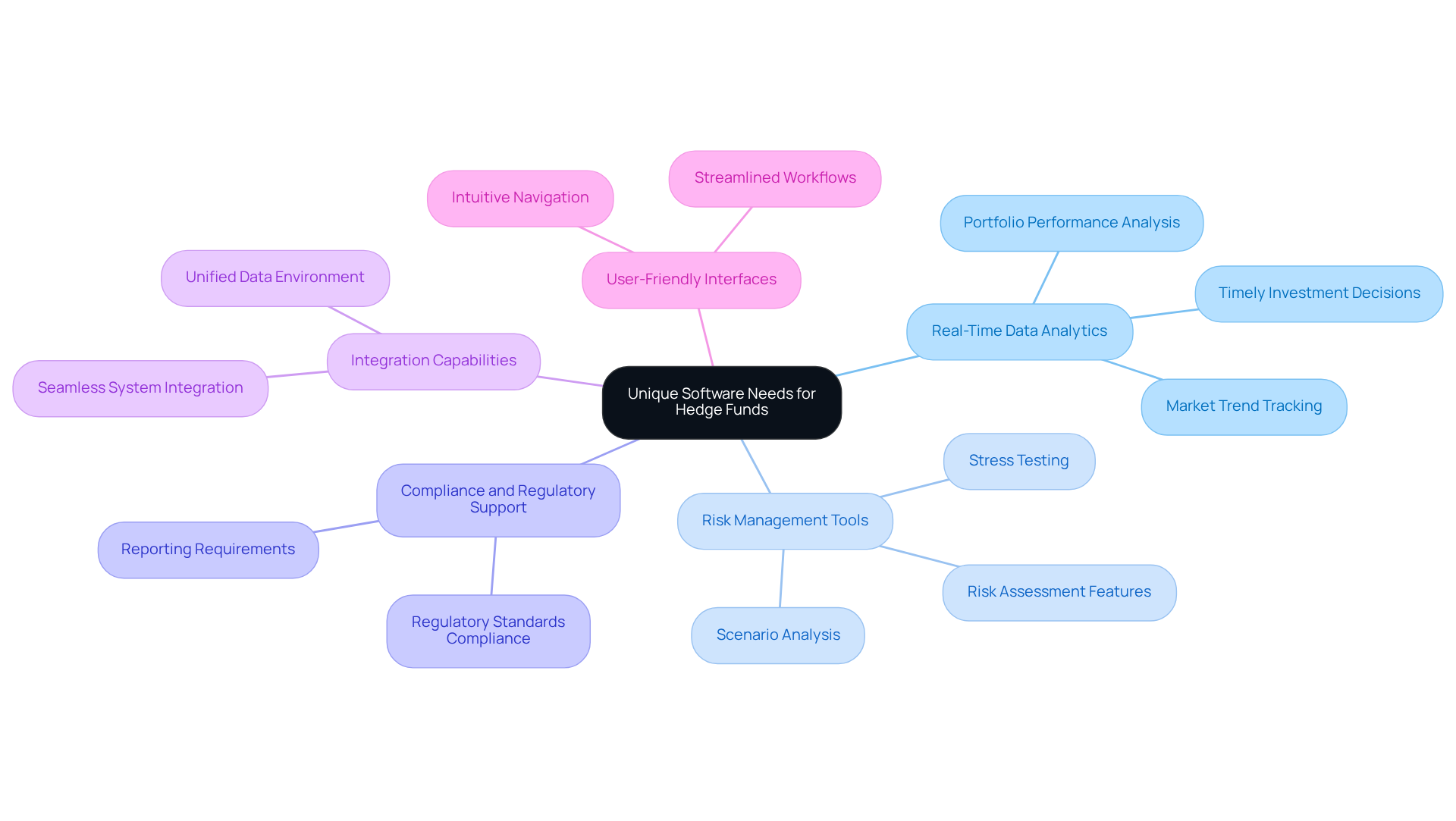

Identify Unique Software Needs for Hedge Funds

Hedge investment vehicles necessitate specialized software solutions tailored to their distinct operational requirements. Key needs include:

-

Real-Time Data Analytics: Hedge funds must swiftly analyze vast amounts of data to make timely investment decisions. Software that offers real-time analytics is crucial for tracking market trends and portfolio performance. The market for real-time large-scale analytics is projected to expand significantly, underscoring the necessity for investment groups to adopt advanced analytical solutions that can yield consistent returns and enhance risk oversight capabilities.

-

Risk Management Tools: Effective risk management is vital in investment operations. Software solutions should encompass features for stress testing, scenario analysis, and risk assessment to mitigate potential losses. Leading investment groups employ microstructure-aware simulation environments to accurately replay historical data, thereby boosting strategy execution confidence and minimizing surprises during live deployment.

-

Compliance and Regulatory Support: In light of the stringent regulations governing hedge funds, software must facilitate compliance with reporting requirements and regulatory standards, ensuring that investments operate within legal frameworks. This aspect is increasingly critical as firms adapt to the evolving regulatory landscape.

-

Integration Capabilities: Hedge funds frequently utilize multiple systems for trading, reporting, and compliance. Software that integrates seamlessly with existing tools enhances operational efficiency and information accuracy. High-performing quantitative teams consolidate fragmented datasets into a unified, time-aligned environment, enabling precise synchronization of tick data, order books, and reference data.

-

User-Friendly Interfaces: Given the complexity of investment group operations, software must be intuitive, allowing managers and analysts to navigate easily and utilize its features effectively. Solutions should be designed to streamline workflows and enhance productivity.

As investment groups face competitive pressures and the need for rapid decision-making, investing in high-performance data-driven applications becomes imperative. Nick Nolan from Alternative Management asserts that a robust operational infrastructure is crucial for sustaining growth and maintaining allocator trust in 2026 and beyond. Firms that successfully integrate open-source technologies with commercial solutions, such as Eze Eclipse, are poised to lead in the market for real-time big data analytics.

Evaluate Key Features of Business Software Solutions

When assessing business software solutions for hedge funds, several essential features warrant careful consideration.

-

Portfolio Management: Effective management of diverse asset classes and performance tracking is paramount. Look for software that offers robust portfolio oversight tools, including performance attribution and benchmarking capabilities. For instance, platforms such as Addepar, recognized for its strong portfolio oversight for high-net-worth and intricate assets, and FinFolio, which automates portfolio oversight and reporting, excel in providing customizable reporting and real-time performance monitoring. These features are essential for informed decision-making.

-

Risk Analytics: Advanced risk analytics functionalities, such as Value-at-Risk (VaR) calculations and stress testing, are vital for identifying potential vulnerabilities in investment strategies. Tools like Orion Advisor Tech leverage behavioral finance technology to enhance client outcomes, showcasing the importance of integrating sophisticated risk assessment features. The platform’s recognition in the HFM US Services Awards 2024 for service excellence in risk oversight further underscores its capabilities.

-

Compliance Automation: Automating compliance processes can significantly reduce the risk of human error and save valuable time. Seek software that includes automated reporting and alerts for regulatory changes, ensuring adherence to industry standards. Wealthscape, for example, provides tools that streamline compliance management, enhancing operational efficiency. Its accolades in the industry highlight its effectiveness in this area.

-

Information Integration: The ability to seamlessly connect with third-party information providers and existing systems is essential for maintaining a comprehensive view of investments and market conditions. Platforms like AdvisorEngine and Finartis Prospero facilitate data aggregation from multiple sources, allowing for enhanced analytics and reporting. This integration capability is crucial for investment groups seeking to optimize their operations.

-

User Experience: A user-friendly interface is essential for maximizing productivity, enabling users to quickly access critical information. Consider the availability of training and support resources, as these can significantly impact the overall user experience. Software solutions that prioritize intuitive design, such as Black Diamond, often lead to higher user satisfaction and efficiency. Industry leaders note that a strong user experience is key to successful software adoption.

In summary, choosing the appropriate business software solutions for portfolio oversight entails assessing these essential characteristics to ensure that the selected solution aligns with the distinct requirements of investment groups, ultimately improving operational efficiency and client service.

Compare Leading Business Software Solutions for Hedge Funds

Several leading business software solutions specifically cater to hedge funds, each providing unique features that enhance operational efficiency and investment management.

-

Addepar stands out for its robust data aggregation and analytics capabilities, enabling hedge funds to manage multi-asset portfolios effectively. Its user-friendly interface, combined with strong reporting tools, makes it a popular choice among investment professionals.

-

BlackRock Aladdin is a comprehensive platform that integrates risk oversight, portfolio management, and compliance features. Favored for its extensive data capabilities, it is widely utilized by institutional investors seeking a holistic view of their investments.

-

Eze Investment Suite provides a suite of tools designed for trading, portfolio management, and compliance. Its robust integration features with other financial systems render it a versatile choice for investment firms looking to streamline operations.

-

FactSet delivers comprehensive financial information and analytics tools, empowering hedge funds to conduct thorough research and analysis. The platform’s customizable dashboards significantly enhance user experience and data accessibility.

-

Pinnakl focuses on investment oversight, offering features such as live order supervision and portfolio analytics. This platform is tailored for firms seeking business software solutions that provide a comprehensive investment management solution to support informed decision-making.

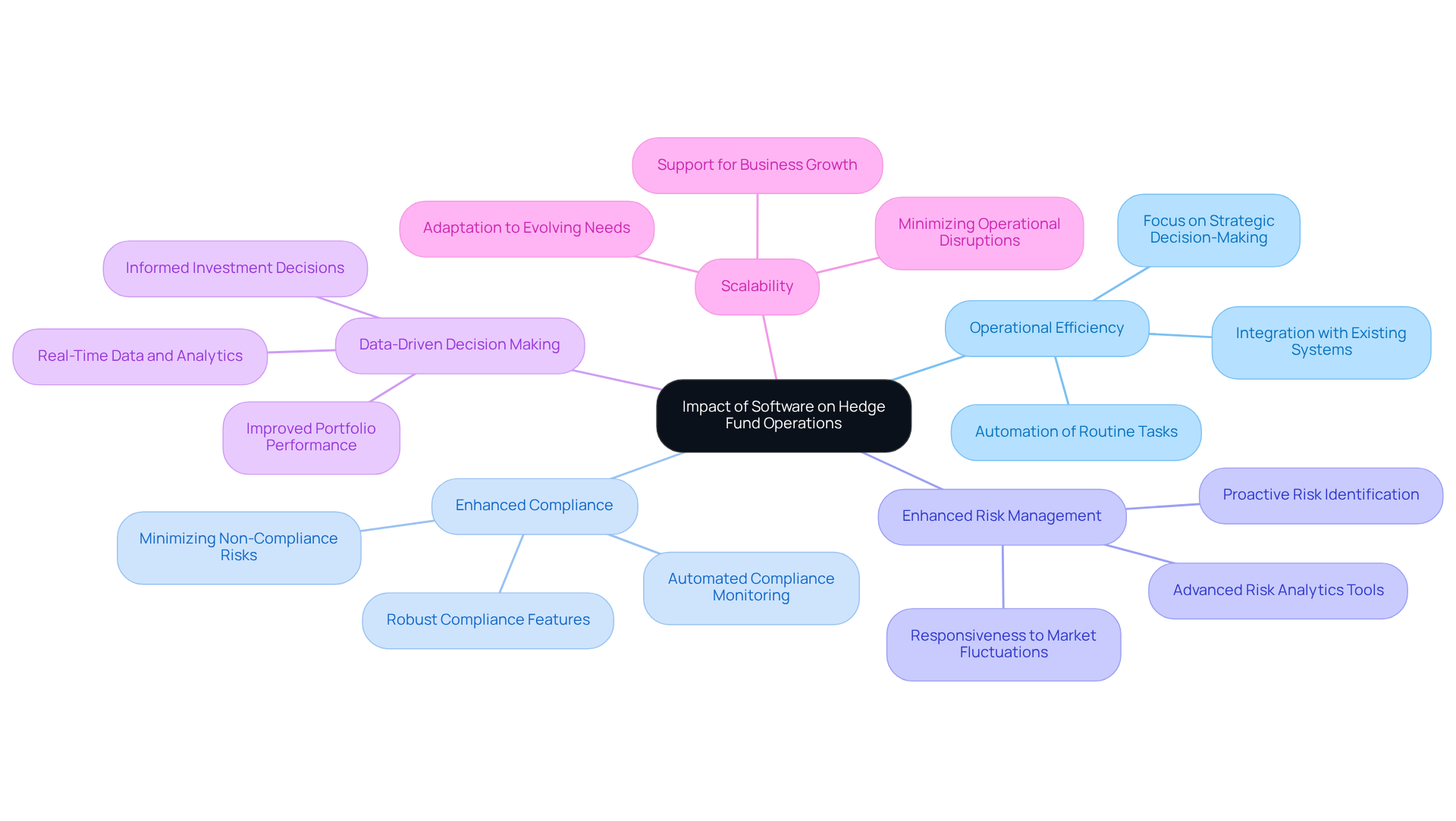

Assess Impact of Software Choice on Hedge Fund Operations

The selection of software plays a crucial role in shaping hedge fund operations in several key areas:

-

Operational Efficiency: Implementing software that automates routine tasks and integrates smoothly with existing systems can significantly streamline operations. This reduces the time allocated to manual processes, enabling teams to concentrate on strategic decision-making.

-

Enhanced Compliance: Choosing software equipped with robust compliance features aids investment groups in effectively navigating regulatory requirements. This proactive approach minimizes the risk of non-compliance and the associated penalties.

-

Enhanced Risk Management: Advanced risk analytics tools empower investment firms to identify and address risks proactively. This capability enhances their responsiveness to market fluctuations and helps protect investor capital.

-

Data-Driven Decision Making: Software that provides real-time data and analytics is essential for investment managers. It facilitates informed decision-making, thereby improving overall portfolio performance.

-

Scalability: As hedge funds expand, their software requirements may change. Solutions that offer scalability enable firms to adapt to evolving needs without causing significant disruptions to their operations.

Conclusion

Selecting the right business software solutions for hedge funds is crucial to meet their distinct operational needs. By identifying specific requirements – such as real-time data analytics, comprehensive risk management tools, compliance support, and seamless integration capabilities – hedge funds can significantly improve their operational efficiency and investment strategies. The appropriate software serves as a foundational element, empowering firms to navigate the complexities of the financial landscape while ensuring compliance and optimizing performance.

The article emphasizes key insights regarding essential features like portfolio management, risk analytics, and user-friendly interfaces. Platforms such as Addepar, BlackRock Aladdin, and Eze Investment Suite illustrate how customized solutions can streamline operations and enhance decision-making processes. The focus on automation and integration capabilities further highlights the necessity for software that not only addresses current demands but also adapts to future growth and regulatory changes.

Ultimately, the choice of software has implications that extend beyond basic functionality; it fundamentally influences the effectiveness and agility of hedge fund operations. As the industry evolves, investment groups must prioritize software solutions that bolster data-driven decision-making, ensure compliance, and facilitate scalable growth. By doing so, they position themselves for sustained success and a competitive edge in an increasingly complex market.

Frequently Asked Questions

What are the unique software needs for hedge funds?

Hedge funds require specialized software solutions that include real-time data analytics, risk management tools, compliance and regulatory support, integration capabilities, and user-friendly interfaces.

Why is real-time data analytics important for hedge funds?

Real-time data analytics is crucial for hedge funds as it enables them to swiftly analyze large amounts of data to make timely investment decisions, track market trends, and monitor portfolio performance.

What features should risk management tools for hedge funds include?

Risk management tools should include features for stress testing, scenario analysis, and risk assessment to help mitigate potential losses. They often utilize microstructure-aware simulation environments to replay historical data for better strategy execution.

How does software support compliance and regulatory needs for hedge funds?

Software must facilitate compliance with reporting requirements and regulatory standards, ensuring that hedge fund investments operate within legal frameworks, which is increasingly critical due to evolving regulations.

Why are integration capabilities important for hedge fund software?

Integration capabilities are important because hedge funds often use multiple systems for trading, reporting, and compliance. Software that integrates seamlessly with existing tools enhances operational efficiency and ensures data accuracy.

What role do user-friendly interfaces play in hedge fund software?

User-friendly interfaces are essential as they allow managers and analysts to easily navigate the software and utilize its features effectively, streamlining workflows and enhancing productivity.

What is the significance of investing in high-performance data-driven applications for hedge funds?

Investing in high-performance data-driven applications is imperative for hedge funds to sustain growth and maintain allocator trust, especially in a competitive environment that demands rapid decision-making.

What does Nick Nolan from Alternative Management say about operational infrastructure for hedge funds?

Nick Nolan asserts that a robust operational infrastructure is crucial for sustaining growth and maintaining allocator trust in 2026 and beyond, emphasizing the importance of integrating open-source technologies with commercial solutions.