Best Practices for Cloud Data Warehouse Services in Hedge Funds

Introduction

The rapid evolution of technology has fundamentally transformed the financial landscape, positioning cloud data warehousing as a cornerstone for hedge fund management. This innovative approach streamlines data storage and analysis, significantly enhancing decision-making capabilities. As a result, firms can respond swiftly to market changes, gaining a competitive edge.

However, the transition to cloud data warehousing is not without its challenges. Hedge funds encounter a myriad of complexities, ranging from data migration issues to the necessity of ensuring compliance with stringent regulatory standards. To navigate this transition effectively, investment groups must employ strategic approaches that harness the full potential of cloud data warehousing.

Define Cloud Data Warehouse and Its Relevance to Hedge Fund Management

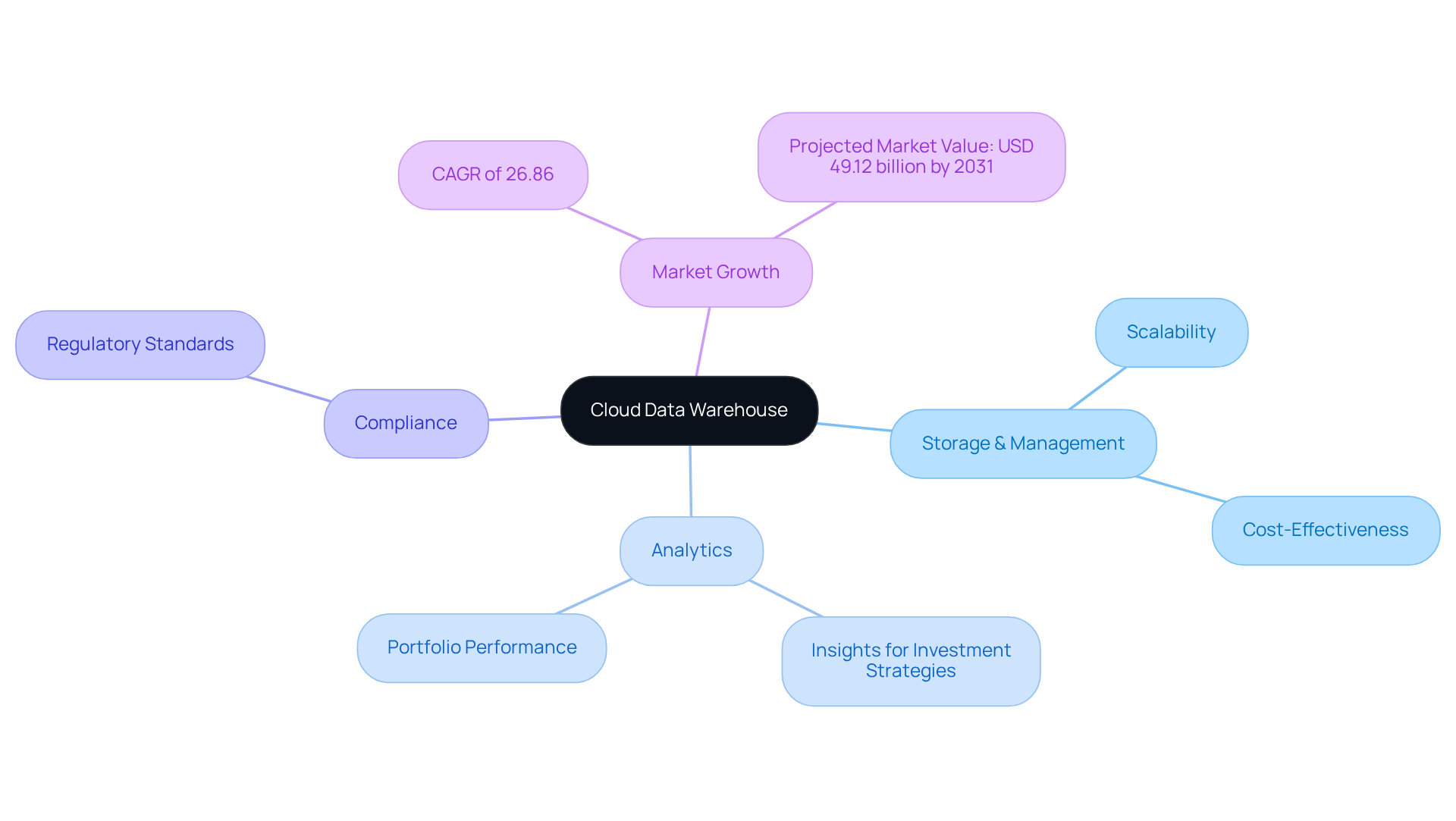

A centralized repository in a virtual environment enables organizations to utilize cloud data warehouse services for the storage, management, and analysis of extensive volumes of structured and semi-structured information. This technology is particularly essential for investment pools, as it facilitates immediate access to information, which in turn allows for prompt decision-making and enhanced operational effectiveness. The scalability of online storage systems ensures that investment firms can adapt to changing information requirements without incurring excessive costs, making these systems an economical solution for managing investment data.

Moreover, these systems support advanced analytics, empowering investment firms to extract insights that inform investment strategies and improve portfolio performance. Compliance with regulatory requirements is another critical aspect, as storage warehouses can optimize information management processes, ensuring that investment groups effectively meet essential standards. As the financial landscape evolves, the importance of online storage facilities in investment management continues to grow, positioning them as vital tools for navigating the complexities of asset management in 2026 and beyond.

Industry forecasts indicate that the online storage warehouse sector is expected to expand at a CAGR of 26.86%, reaching USD 49.12 billion by 2031. This growth underscores the increasing reliance on online solutions among investment groups, as they seek to leverage advanced analytics and enhance operational efficiency. Financial analysts emphasize that adopting cloud data warehouse services not only enhances accessibility but also helps in meeting evolving regulatory standards, making them indispensable in today’s investment environment.

Identify Key Benefits of Cloud Data Warehousing for Hedge Funds

Cloud data warehousing offers several significant advantages for hedge funds:

-

Scalability: Hedge fund managers can easily adjust their data storage and processing capabilities to match fluctuating volumes. This flexibility allows for operational expansion without incurring substantial upfront costs. Such adaptability is crucial in the fast-paced financial environment, where information needs can change rapidly. Regular health checks are performed to ensure operational readiness and improve efficiency, further supporting this scalability.

-

Cost Efficiency: Utilizing a pay-as-you-go model enables hedge funds to reduce expenses associated with on-premises infrastructure. This strategy not only lowers capital expenditures but also facilitates better resource allocation, aligning spending with actual usage and operational requirements. The cloud data warehouse services market is projected to grow at a 26.86% CAGR, reaching USD 49.12 billion by 2031, underscoring the increasing importance of these solutions in the financial sector.

-

Improved Information Accessibility: Cloud storage systems allow for real-time data retrieval from any location, accelerating decision-making processes and fostering enhanced collaboration among teams. This accessibility is vital for investment groups that require timely insights to capitalize on market opportunities.

-

Enhanced Analytics: The integration of advanced analytical tools within cloud storage systems empowers investment firms to extract actionable insights from their data. This capability not only refines investment strategies but also bolsters risk management practices, enabling firms to navigate complex market conditions more effectively.

-

Compliance and Security: Leading cloud service providers implement robust security measures and maintain compliance certifications, ensuring that sensitive financial data is protected and adheres to regulatory standards. This focus on security and compliance is essential for investment groups operating in a highly regulated environment, where adherence to regulations like AIFMD is critical for operational success.

A case study on KYC simplification through cloud solutions demonstrates how investment groups can enhance client verification processes and improve onboarding efficiency via secure, scalable internet-based systems. Additionally, client feedback underscores the advantages of enhanced scalability and operational flexibility, reinforcing the benefits of adopting cloud data warehouse services.

Implement Best Practices for Effective Cloud Data Warehouse Solutions

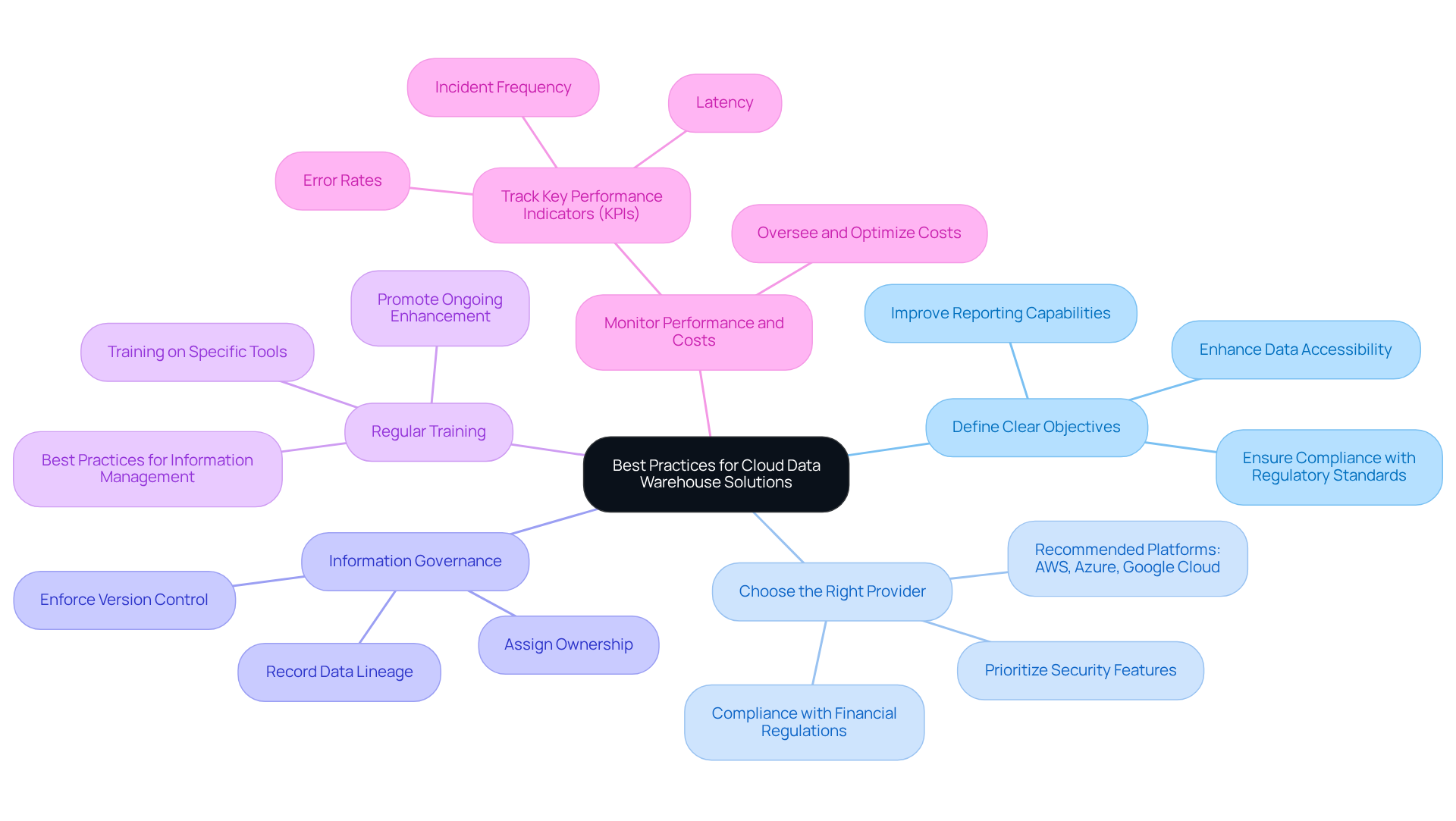

To effectively implement cloud data warehouse solutions, hedge funds should adhere to several best practices:

-

Define Clear Objectives: Establish specific goals for the data warehouse, such as enhancing data accessibility, improving reporting capabilities, or ensuring compliance with regulatory standards. Clear objectives guide the design and implementation process, aligning technology with business needs.

-

Choose the Right Provider: Selecting a service provider is critical. Hedge funds should prioritize providers that offer robust security features and compliance with financial regulations. Major platforms such as AWS, Microsoft Azure, and Google Cloud are recommended for their capabilities tailored to the financial sector. Industry insights indicate that over 90% of organizations are now utilizing cloud services, making it essential to choose a provider that can meet the unique demands of the financial sector.

-

Information Governance: Establishing robust information governance policies is essential for upholding quality and integrity. This encompasses recording lineage, assigning ownership, and enforcing version control to ensure compliance with industry standards. Effective governance frameworks can significantly reduce operational risks and improve information reliability.

-

Regular Training: Continuous instruction for personnel is essential to guarantee expertise in utilizing the storage warehouse. This training should address best practices for information management and the specific tools used within the online environment, promoting a culture of ongoing enhancement and flexibility.

-

Monitor Performance and Costs: Continuous performance monitoring is essential to identify and address issues promptly. Hedge funds should monitor key performance indicators (KPIs) such as latency, error rates, and incident frequency to ensure optimal operation and information availability. Furthermore, overseeing and enhancing costs is crucial, as many organizations underestimate the continuous expenses linked with online environments. Regular assessments can help in fine-tuning the system and enhancing overall efficiency.

By adhering to these optimal methods, investment pools can effectively utilize online storage solutions to enhance operational efficiency, guarantee compliance, and strengthen decision-making abilities.

Address Challenges in Transitioning to Cloud Data Warehousing

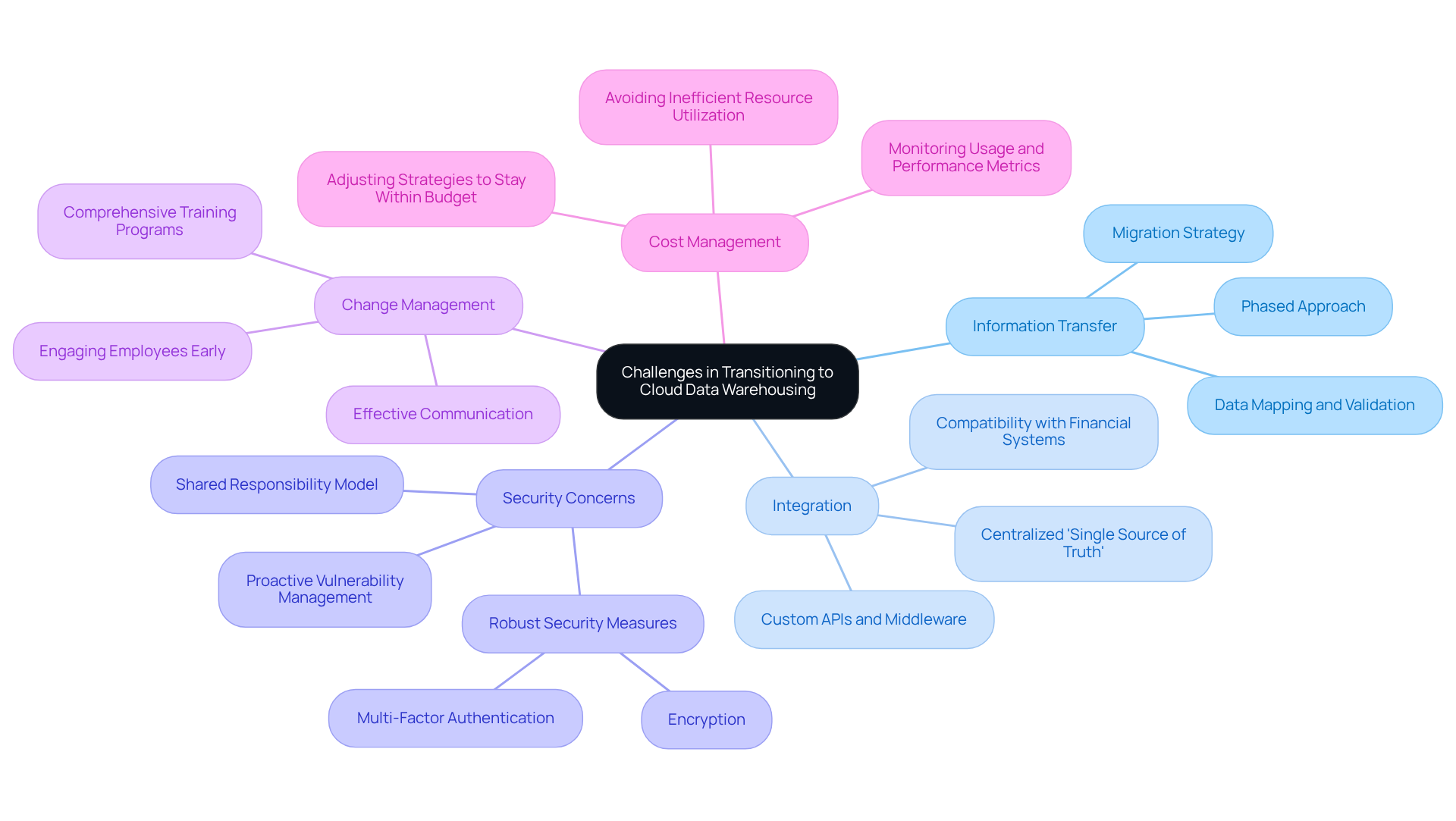

Transitioning to a cloud data warehouse poses several challenges for hedge funds, which can be categorized as follows:

-

Information Transfer: The process of migrating large volumes of data from local systems to the cloud can be intricate and time-consuming. Hedge funds must develop a comprehensive migration strategy that encompasses data mapping, validation procedures, and a phased approach. This strategy is essential to mitigate risks associated with data loss or operational downtime. The growing demand for cloud data warehouse services, propelled by the proliferation of cloud applications and business intelligence tools, underscores the necessity of a well-structured migration plan.

-

Ensuring seamless integration of cloud data warehouse services with current financial systems is critical. This may require the creation of custom APIs or middleware solutions to guarantee compatibility and functionality across platforms. Addressing potential integration challenges is vital to prevent disruptions in operations. Maintaining a centralized ‘single source of truth’ is essential for consistent key performance indicators (KPIs) and accurate reporting, which are crucial for investment firms.

-

Security Concerns: During the transition, hedge funds must proactively tackle security vulnerabilities. Implementing robust security measures, such as encryption and multi-factor authentication, is crucial to protect sensitive data and ensure compliance with regulatory standards. Understanding the shared responsibility model in cloud data warehouse services is key to mitigating risks associated with security vulnerabilities during the transition.

-

Change Management: Resistance to change among staff can hinder the transition process. To promote acceptance and adoption of the new system, effective communication and comprehensive training programs are essential. Engaging employees early in the process can help alleviate concerns and cultivate a culture of adaptability.

-

Cost Management: While cloud solutions can yield long-term savings, unforeseen costs may arise during the transition. Hedge funds should meticulously monitor usage and performance metrics, adjusting their strategies as necessary to remain within budget and avoid inefficient resource utilization that could lead to unexpected expenses. As industry experts note, “Poorly optimized cloud usage can lead to unexpected costs, while rapid data ingestion can result in poorly governed data environments if not properly managed.

Conclusion

The integration of cloud data warehouse services is reshaping hedge fund management by providing essential tools for data storage, analysis, and compliance. Leveraging these advanced solutions allows hedge funds to enhance operational efficiency, improve decision-making processes, and adapt to the evolving demands of the financial sector. The ability to scale resources, combined with cost-effective models, positions cloud data warehousing as a vital asset for investment firms navigating the complexities of asset management.

Key benefits such as improved accessibility, enhanced analytics, and rigorous compliance measures have been highlighted throughout the article. These advantages streamline operations and empower hedge funds to extract valuable insights from their data, refining investment strategies and bolstering risk management. Additionally, the discussion on best practices emphasizes the importance of:

- Clear objectives

- Provider selection

- Information governance

- Continuous training

to ensure the successful implementation of cloud data warehouse solutions.

As hedge funds increasingly embrace cloud data warehousing, it is crucial to recognize the challenges that may arise during the transition. By proactively addressing issues such as:

- Data migration

- Integration

- Security

- Change management

- Cost control

investment firms can effectively harness the full potential of cloud technologies. Embracing these innovative solutions will not only enhance competitive advantage but also ensure that hedge funds remain agile and responsive in an increasingly dynamic financial landscape.

Frequently Asked Questions

What is a cloud data warehouse?

A cloud data warehouse is a centralized repository in a virtual environment that enables organizations to store, manage, and analyze extensive volumes of structured and semi-structured information.

Why is a cloud data warehouse relevant to hedge fund management?

It facilitates immediate access to information, allowing for prompt decision-making and enhanced operational effectiveness, which is essential for investment pools.

How does a cloud data warehouse benefit investment firms?

It provides scalability to adapt to changing information requirements without incurring excessive costs, supports advanced analytics for extracting insights, and helps ensure compliance with regulatory requirements.

What role does advanced analytics play in investment management through cloud data warehouses?

Advanced analytics empower investment firms to extract insights that inform investment strategies and improve portfolio performance.

How does a cloud data warehouse assist with regulatory compliance?

It optimizes information management processes, ensuring that investment groups effectively meet essential regulatory standards.

What is the expected growth of the cloud data warehouse sector?

The online storage warehouse sector is expected to expand at a CAGR of 26.86%, reaching USD 49.12 billion by 2031.

Why are cloud data warehouse services becoming indispensable in today’s investment environment?

They enhance accessibility, help meet evolving regulatory standards, and support the increasing reliance on advanced analytics among investment groups.