10 Benefits of In-House Software Development for Hedge Funds

Introduction

In-house software development is reshaping the operational landscape for hedge funds, providing them with unparalleled control over their technological processes. By creating tailored solutions that align with specific trading strategies and regulatory requirements, investment firms can significantly improve their agility and responsiveness to market fluctuations. However, a critical question arises: how can hedge funds effectively utilize this approach to streamline development while also gaining a competitive advantage in a constantly evolving financial environment?

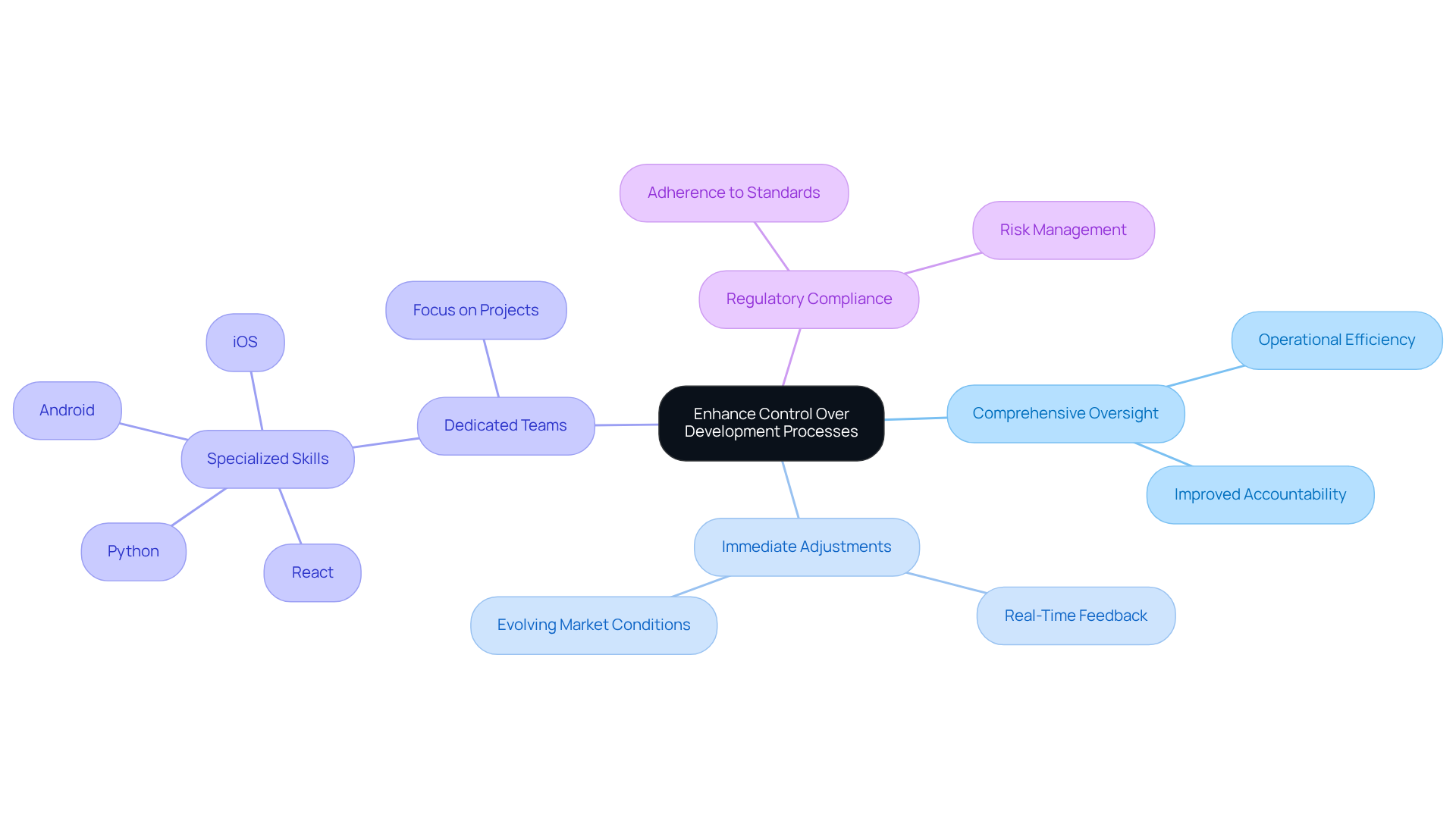

Enhance Control Over Development Processes

In-house software development provides investment firms with comprehensive oversight of the entire development lifecycle. This direct control allows for immediate adjustments in response to real-time feedback and evolving market conditions. By maintaining dedicated teams focused exclusively on their projects, hedge funds can ensure that their in-house software development aligns meticulously with operational needs and stringent compliance requirements. Such control is particularly vital in regulated industries, where adherence to standards is imperative.

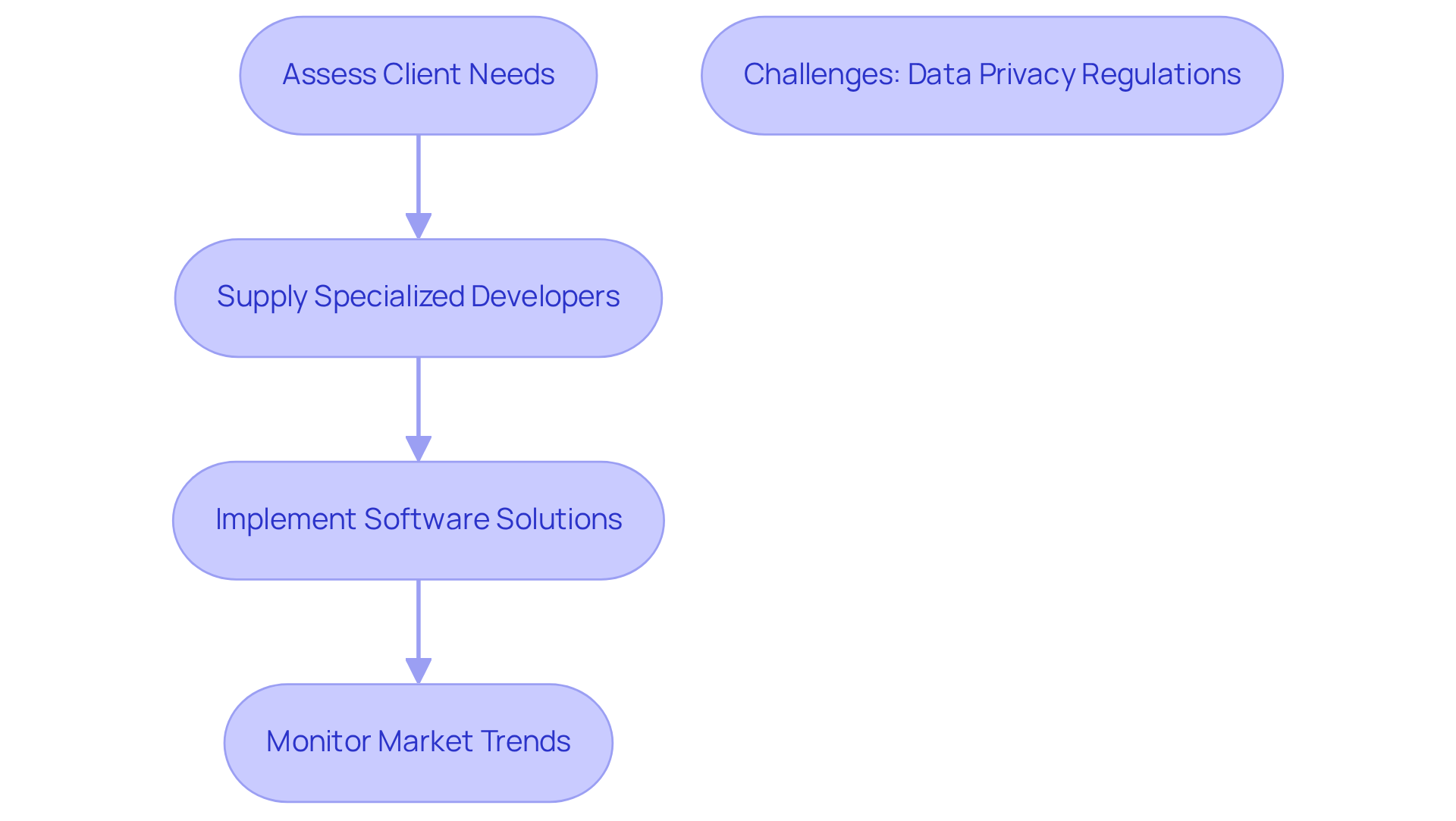

At Neutech, we enhance this process by assessing client needs and supplying specialized developers and designers tailored to specific requirements, including proficiencies in:

- React

- Python

- Android

- iOS

- More

This level of oversight not only improves operational efficiency but also fosters a culture of accountability and responsiveness. Ultimately, this leads to more effective risk management and decision-making.

Achieve Tailored Software Solutions

Hedge funds necessitate specialized tools tailored to their distinct trading strategies and operational workflows. The creation of customized solutions that can model specific financial scenarios, automate complex calculations, and integrate seamlessly with existing systems is enabled by in-house software development. This tailored approach not only enhances operational efficiency but also provides a significant competitive edge, allowing hedge funds to swiftly adapt to market fluctuations.

At Neutech, we specialize in a range of programming technologies, including:

- React

- Python

- AWS DevOps

This ensures our solutions align with your strategic objectives. Our process commences with a comprehensive assessment of your requirements, followed by the provision of a selection of skilled designers and developers tailored to your project. This guarantees that the software solutions we develop are not only customized but also equipped with the latest technologies to bolster your operational capabilities.

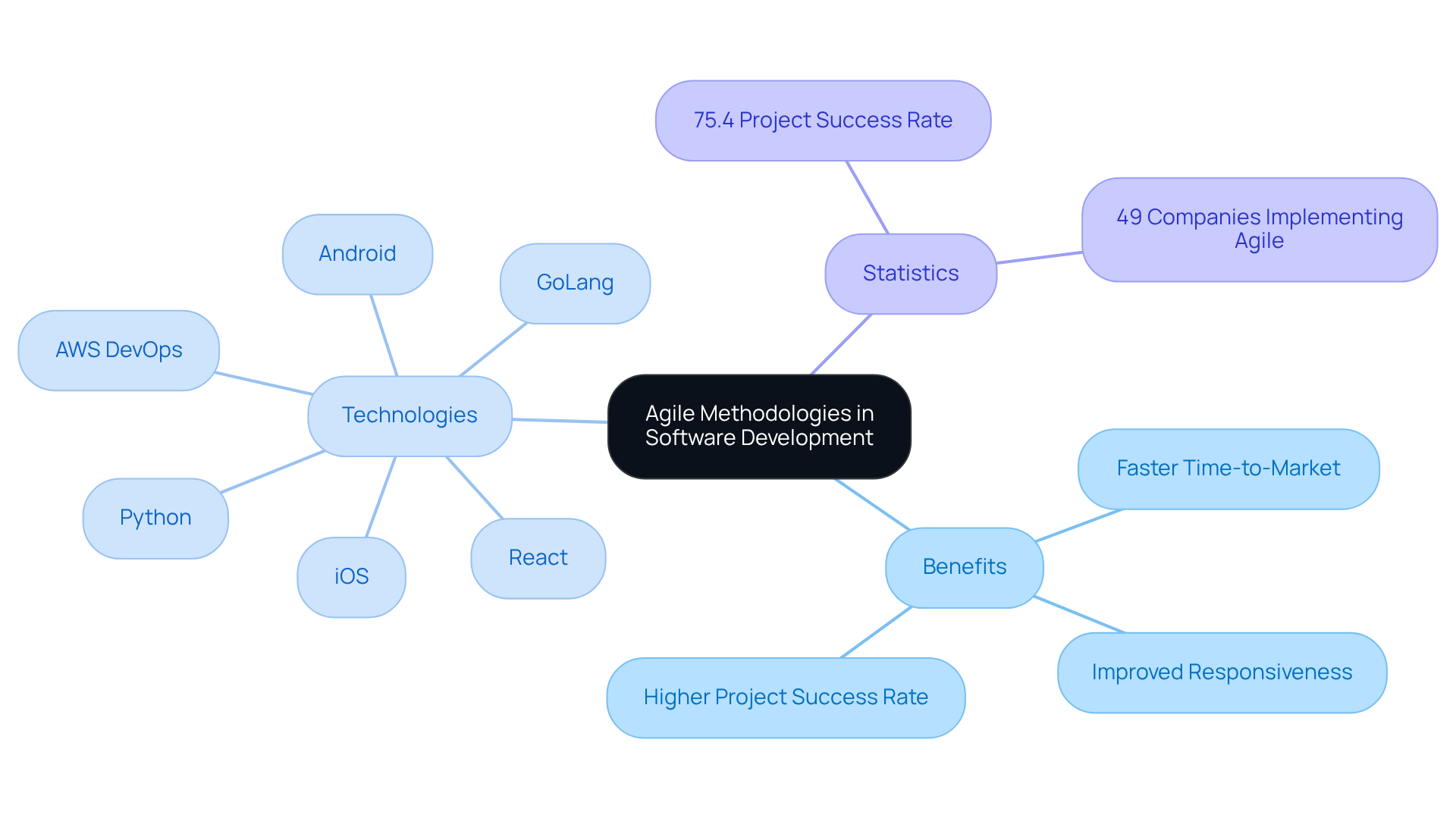

Accelerate Time-to-Market for New Features

In-house software development teams are strategically positioned to leverage agile methodologies, facilitating rapid iteration and deployment of new features. This agility empowers investment firms to respond swiftly to market demands, regulatory changes, and technological advancements. By significantly reducing the time needed to introduce new functionalities, hedge funds can refine their trading strategies and enhance overall performance.

Neutech’s extensive engineering offerings, which include specialized software development in areas such as React, Python, GoLang, Android, iOS, and AWS DevOps, enable investment firms to harness advanced technologies and maintain a competitive edge in a rapidly evolving financial landscape. Firms that adopt agile practices report a project success rate of 75.4%, underscoring the effectiveness of this approach in delivering timely and relevant solutions.

As Jacob Bennett, CEO of Crux Analytics, emphasizes, the capacity to provide real-time insights and proactive recommendations is essential for capturing market share in a competitive environment. Furthermore, with 49% of companies implementing agile throughout their application delivery lifecycle, this trend highlights the increasing recognition of agile’s role in enhancing responsiveness and adaptability in in-house software development for financial services.

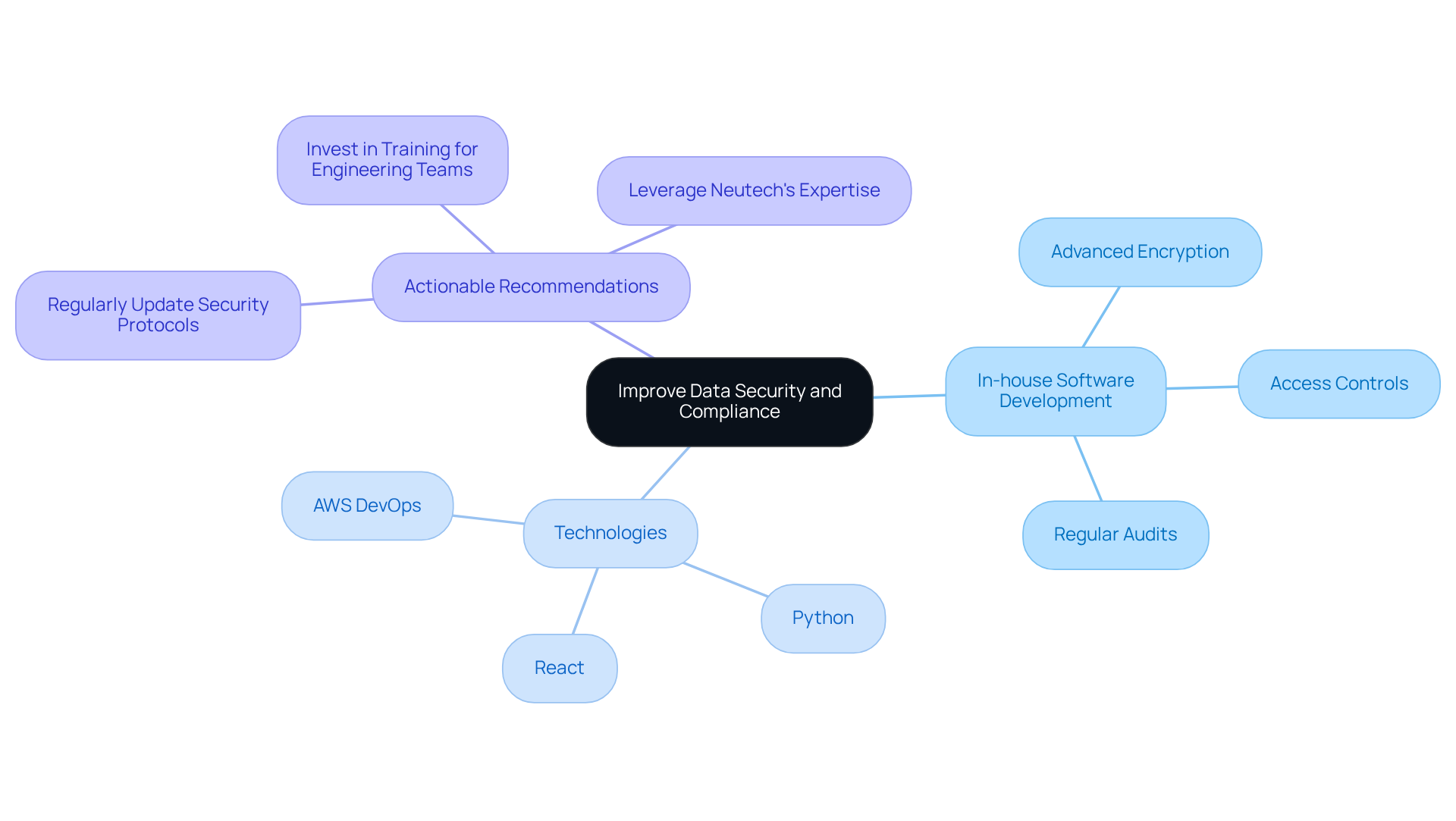

Improve Data Security and Compliance

In-house software development empowers investment firms to embed data security and compliance into their core operations from the very beginning. This strategy facilitates the adoption of advanced encryption techniques, stringent access controls, and regular audits, ensuring adherence to regulatory standards. By establishing dedicated teams focused on security, investment groups can significantly mitigate risks associated with data breaches, thereby preserving investor trust and confidence.

Neutech offers comprehensive engineering services, including specialized software development in technologies such as React, Python, and AWS DevOps. These are crucial for constructing secure applications tailored to the specific needs of regulated industries. For instance, hedge funds that have integrated robust security measures into their in-house software development processes report enhanced resilience against cyber threats, underscoring the vital role of compliance in maintaining operational integrity.

Cybersecurity experts assert that a proactive approach to compliance not only protects assets but also fortifies the overall governance framework within financial services. To refine your strategy, consider these actionable recommendations:

- Regularly update your security protocols to comply with the latest regulations.

- Invest in training for your engineering teams on best practices for data security.

- Leverage Neutech’s expertise in React, Python, and AWS DevOps to develop secure applications that fulfill your specific requirements.

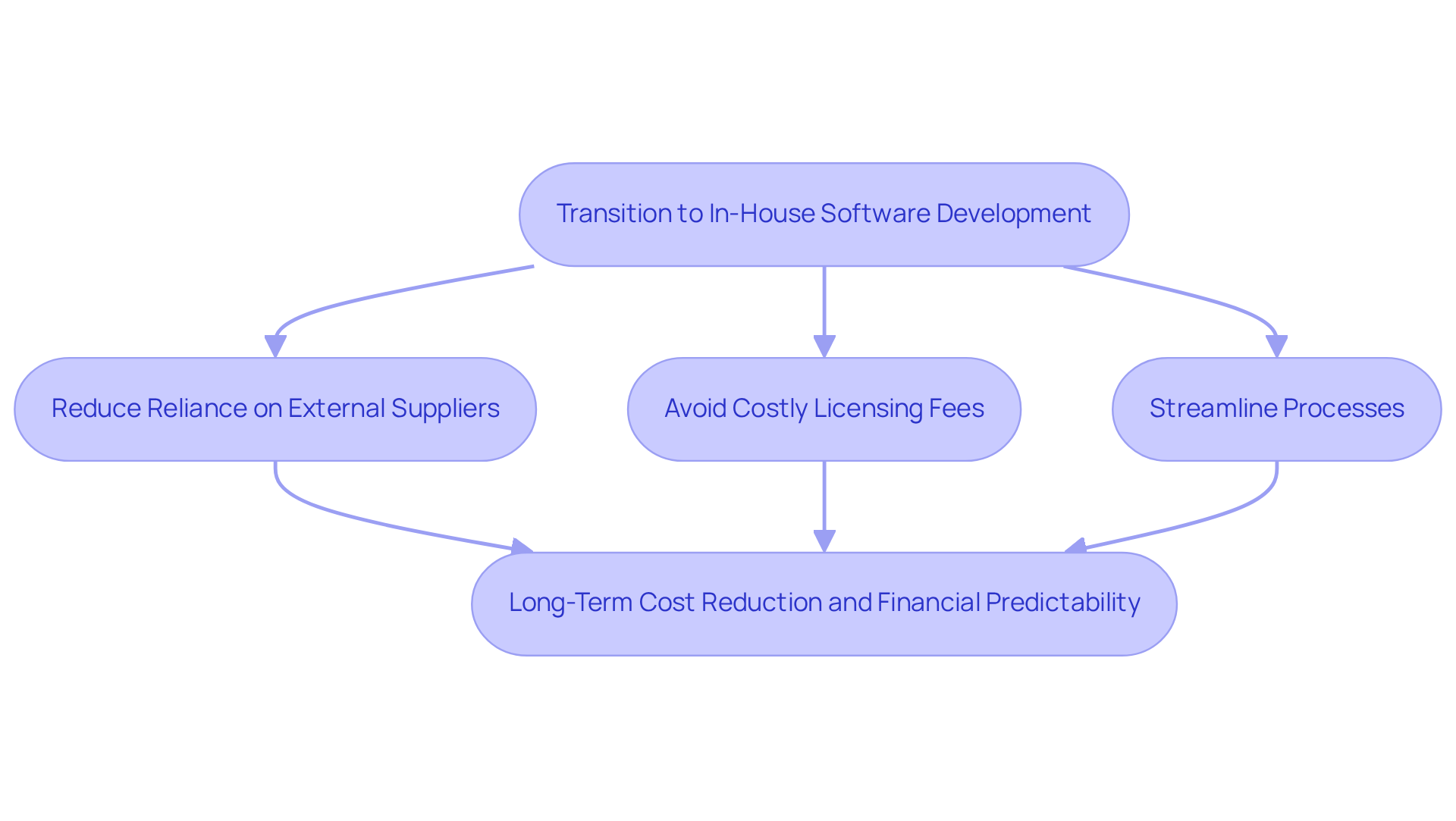

Reduce Long-Term Development Costs

Investing in in-house software development may entail a higher upfront cost; however, the long-term financial benefits are substantial. By reducing reliance on external suppliers and avoiding costly licensing fees through in-house software development, investment firms can enhance their financial predictability. Internal teams are strategically positioned to streamline processes, minimize waste, and ultimately reduce operational costs by leveraging in-house software development. For instance, investment groups that have transitioned to in-house software development units have reported notable decreases in creation costs, facilitating a more strategic allocation of resources.

Financial analysts emphasize that this shift not only fosters a more agile response to market demands but also contributes to establishing a more sustainable financial framework through in-house software development. This ensures that resources can adapt without incurring high expenses associated with outsourcing. A recent study indicates that hedge funds utilizing in-house software development teams have achieved a 30% reduction in production costs compared to those relying on external suppliers. Moreover, companies like Two Sigma have effectively implemented in-house software development as part of their internal growth strategies, resulting in improved operational efficiency and cost management.

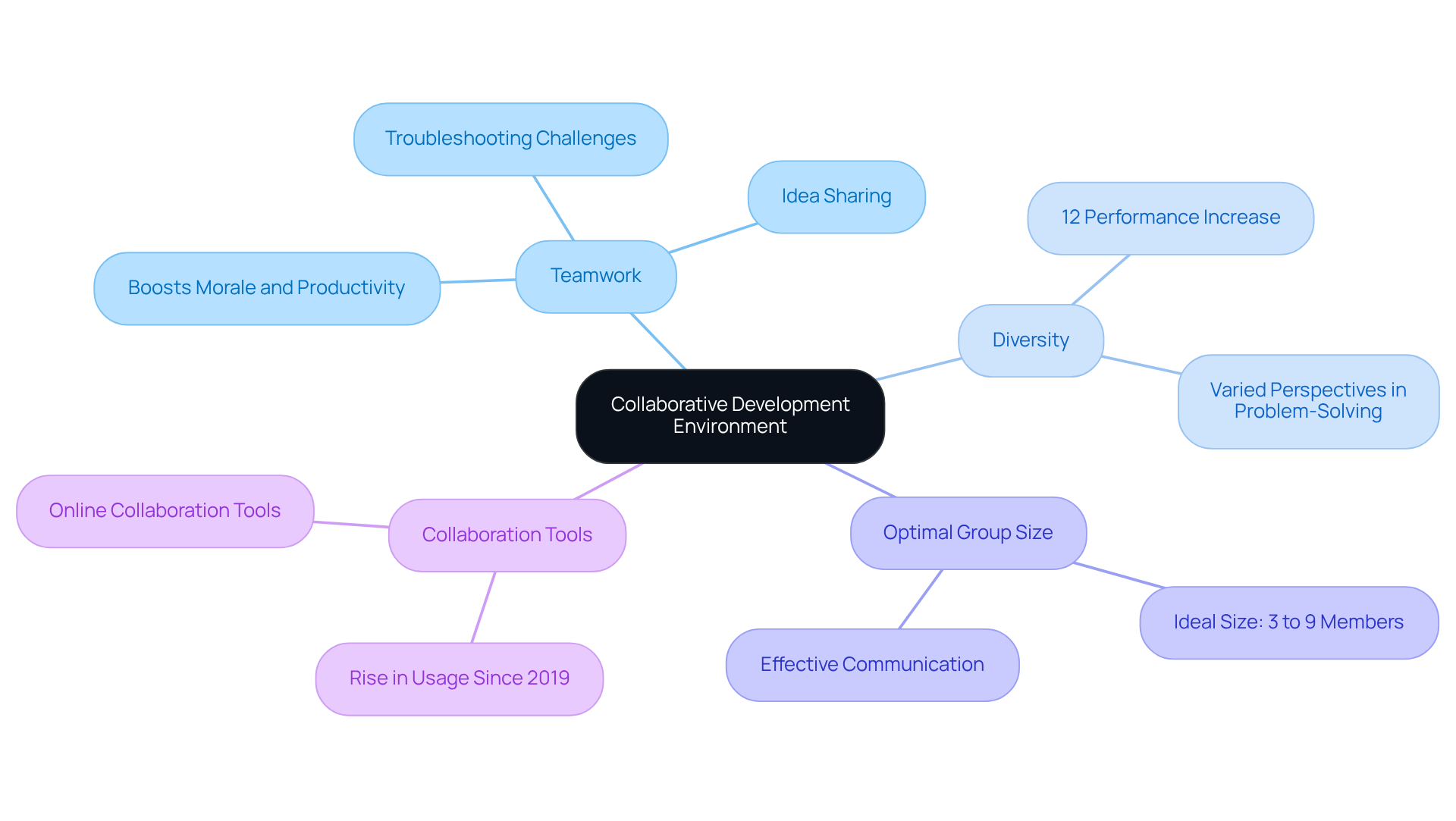

Foster a Collaborative Development Environment

In-house software development fosters a collaborative culture where team members actively share ideas, troubleshoot challenges, and innovate together. This synergy not only enhances the quality of the software produced through in-house software development but also boosts group morale and productivity. By promoting open communication and teamwork, hedge funds can leverage the diverse expertise of their developers in-house software development, resulting in superior software solutions. Neutech plays a crucial role in this process by assessing client needs and providing specialized developers and designers, ensuring the integration of the right talent into the team.

Research indicates that diverse groups outperform non-diverse groups by 12%, underscoring the importance of varied perspectives in problem-solving. Additionally, the optimal group size for fostering collaboration is between three and nine members, which facilitates effective communication and cooperation. As Brian Eno aptly states, ‘Every collaboration helps you grow,’ highlighting the transformative power of teamwork in achieving exceptional results. Furthermore, the significant rise in the use of online collaboration tools since 2019 reflects the increasing importance of collaboration in in-house software development.

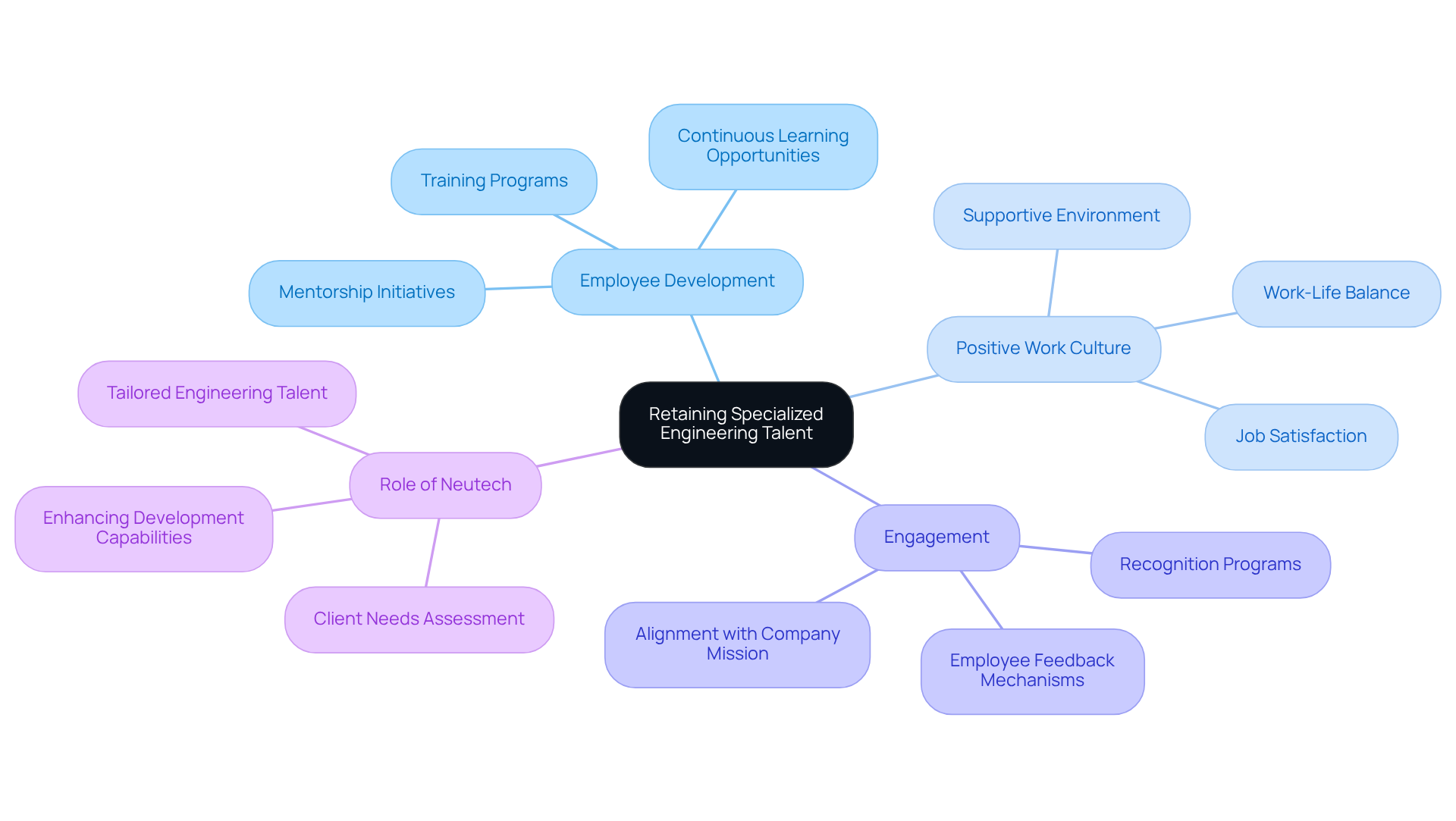

Retain Specialized Engineering Talent

In-house software development allows hedge funds to create a dedicated team of specialized engineers who possess a deep understanding of the financial sector’s complexities. By prioritizing employee development and cultivating a positive work culture, hedge funds can significantly improve retention rates. Engaged employees, who feel a strong connection to their organization’s mission, are more likely to stay with the company, thereby reducing turnover and its associated costs. This stability not only minimizes recruitment expenses but also ensures that the team has the critical expertise required to navigate complex challenges effectively.

Moreover, a supportive work environment enhances employee satisfaction, which is crucial for attracting and retaining top talent in a competitive landscape. As hedge funds increasingly acknowledge the significance of specialized talent, investing in their development emerges as a strategic advantage that drives both performance and innovation. Neutech plays a pivotal role in this process by assessing client needs and providing tailored engineering talent, including specialized developers and designers, to enhance in-house software development capabilities. Given the current talent shortage in the industry, developing talent internally is not merely beneficial; it is essential for sustaining a competitive edge.

Adapt Quickly to Changing Market Needs

Teams engaged in in-house software development have the agility to swiftly adapt to market fluctuations by recalibrating their priorities and workflows. This flexibility is crucial in the financial sector, where conditions can change rapidly. By fostering a responsive in-house software development process, hedge funds can ensure their software solutions remain relevant and effective, enabling them to seize emerging opportunities as they arise.

Neutech enhances this adaptability by thoroughly assessing client needs through consultations and project evaluations. This process allows Neutech to supply specialized developers and designers tailored to those specific needs, ensuring that teams are equipped with the right talent to meet market demands.

Firms leveraging alternative data have reported a 10% increase in alpha generation over five years, primarily due to their ability to identify market trends ahead of competitors. This proactive approach not only enhances performance but also positions firms to navigate the complexities of the financial landscape with confidence. However, investment pools must also be aware of the challenges linked to utilizing alternative data, such as ensuring adherence to data privacy regulations.

Seamlessly Integrate with Existing Systems

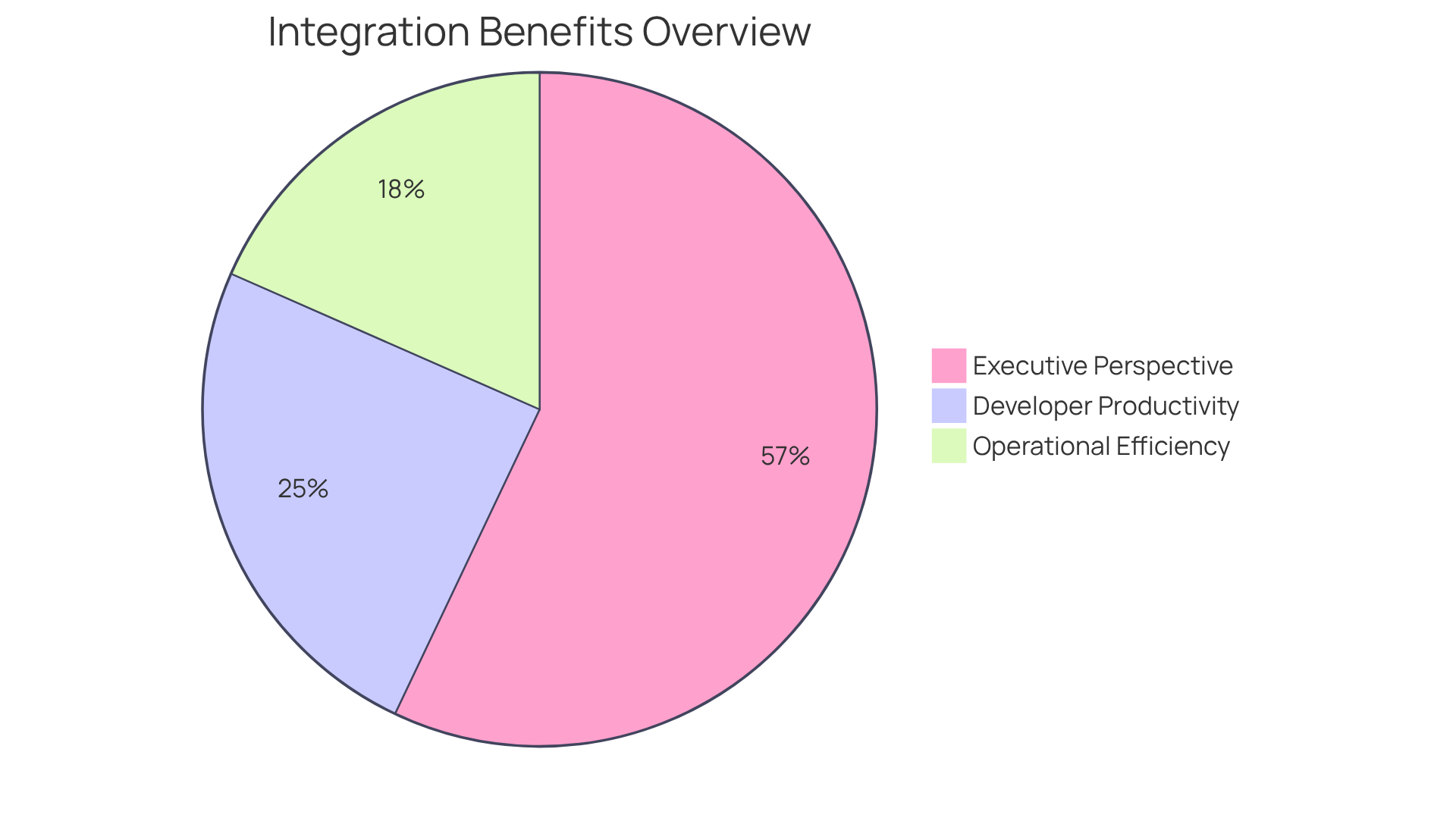

In-house software development enables hedge funds to design solutions that integrate seamlessly with their existing systems. This capability is essential for maintaining data integrity and maximizing operational efficiency. By collaboratively identifying client needs, Neutech provides specialized developers and designers for in-house software development tailored to those requirements, ensuring that new software aligns effectively with legacy systems. Such alignment significantly minimizes disruptions and enhances overall productivity.

Research shows that companies can boost operational efficiency by as much as 30% through effective IT systems integration. Moreover, 93% of hedge fund executives regard seamless integration with existing systems as a critical source of competitive advantage. This compatibility not only streamlines workflows but also fosters a more agile response to changing market conditions, ultimately supporting improved risk management and decision-making.

Additionally, developer productivity can increase by 35-45% with modern integration platforms, highlighting the operational efficiency gains that can be achieved through effective integration.

Leverage Neutech’s Expertise for Enhanced Development

Partnering with Neutech allows hedge funds to access specialized in-house software development expertise specifically tailored to the financial sector. Neutech’s engineers possess the skills necessary for in-house software development to navigate the unique challenges faced by hedge funds, ensuring the delivery of high-quality, compliant software solutions.

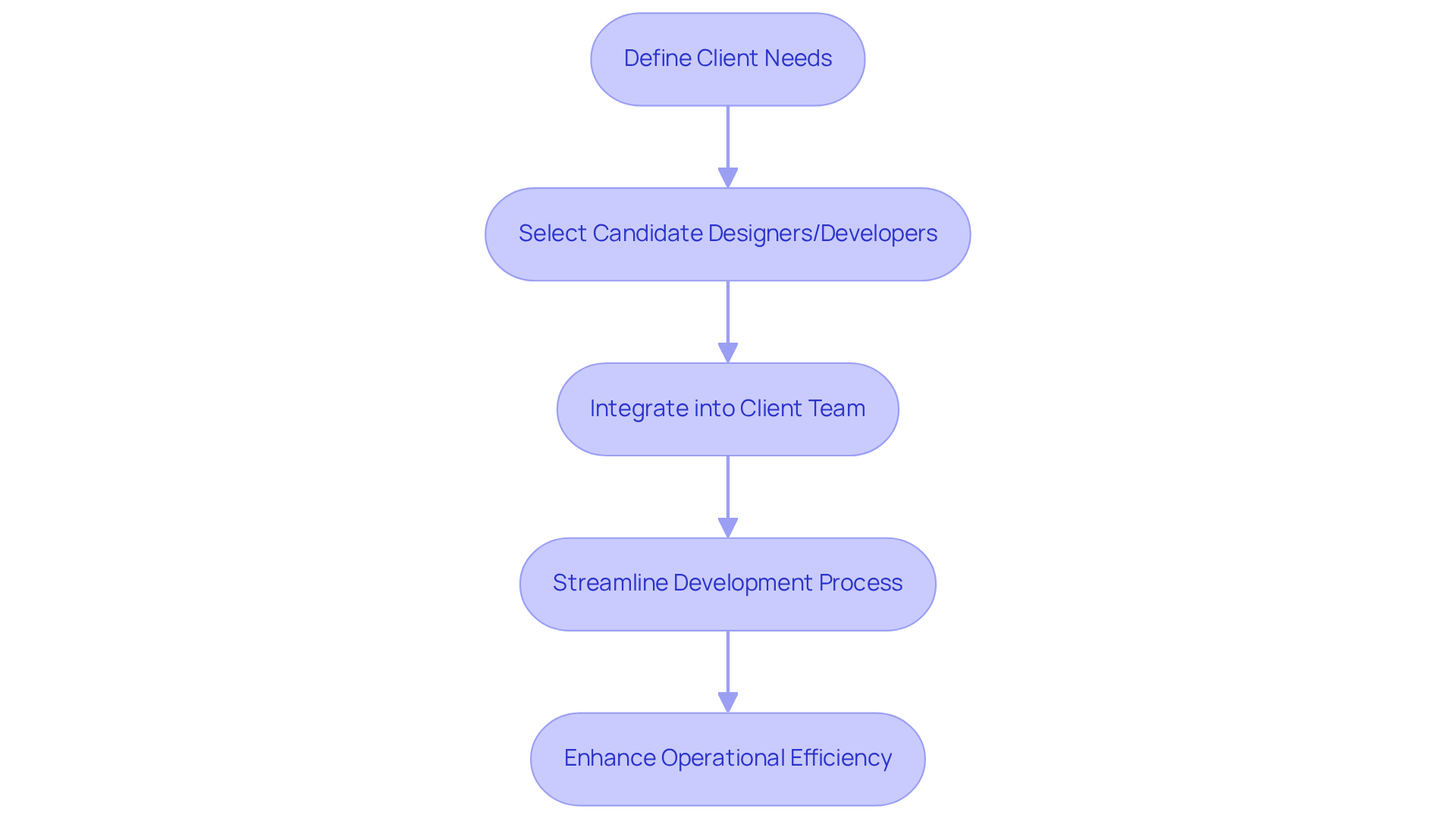

Once client needs are clearly defined, Neutech provides a selection of candidate designers and developers who can seamlessly integrate into the client’s team. This customized approach streamlines the development process, positioning hedge funds to thrive in a rapidly changing market landscape.

By leveraging Neutech’s capabilities, investment groups can enhance their operational efficiency and maintain a competitive advantage. As Ginni Rometty aptly stated, “Growth and comfort do not coexist,” underscoring the necessity for hedge funds to embrace specialized engineering talent to effectively navigate the complexities of the financial landscape.

Conclusion

In-house software development offers hedge funds a distinct advantage by providing enhanced control over their technology solutions. This alignment of development processes with operational needs and compliance requirements not only improves oversight but also cultivates a culture of accountability and responsiveness, which is essential in the fast-paced financial sector.

The primary benefits of this model include:

- The creation of customized software solutions tailored to specific trading strategies

- A faster time-to-market for new features

- Improved data security and compliance

By investing in specialized engineering talent and promoting a collaborative environment, hedge funds can significantly boost their operational efficiency while simultaneously lowering long-term development costs. Additionally, the agility afforded by in-house teams enables funds to swiftly adapt to evolving market demands, ensuring their software remains relevant and effective.

Ultimately, adopting in-house software development transcends a mere tactical choice; it embodies a strategic necessity for hedge funds striving to maintain a competitive edge in a dynamic financial landscape. By leveraging the expertise of specialized partners like Neutech, firms can optimize their development processes and foster innovation, positioning themselves for sustained success in an ever-evolving market.

Frequently Asked Questions

What are the key benefits of in-house software development for investment firms?

In-house software development provides investment firms with comprehensive oversight of the development lifecycle, allowing for immediate adjustments based on real-time feedback and evolving market conditions. It ensures alignment with operational needs and compliance requirements, particularly in regulated industries.

How does Neutech support in-house software development?

Neutech enhances in-house software development by assessing client needs and supplying specialized developers and designers tailored to specific requirements, including expertise in React, Python, Android, iOS, and more.

Why is tailored software important for hedge funds?

Tailored software solutions are crucial for hedge funds as they need specialized tools that align with their distinct trading strategies and operational workflows. Customized solutions can model specific financial scenarios, automate complex calculations, and integrate seamlessly with existing systems, providing a competitive edge.

What programming technologies does Neutech specialize in?

Neutech specializes in a range of programming technologies, including React, Python, and AWS DevOps, ensuring that the software solutions developed align with the strategic objectives of hedge funds.

How does in-house software development accelerate time-to-market for new features?

In-house software development teams utilize agile methodologies, allowing for rapid iteration and deployment of new features. This agility enables investment firms to respond quickly to market demands, regulatory changes, and technological advancements, significantly reducing the time to introduce new functionalities.

What is the reported success rate of projects that adopt agile practices in software development?

Firms that adopt agile practices report a project success rate of 75.4%, highlighting the effectiveness of this approach in delivering timely and relevant solutions.

What does Jacob Bennett, CEO of Crux Analytics, emphasize about in-house software development?

Jacob Bennett emphasizes the importance of providing real-time insights and proactive recommendations to capture market share in a competitive environment, underscoring the critical nature of responsiveness and adaptability in in-house software development for financial services.

What percentage of companies are implementing agile practices throughout their application delivery lifecycle?

49% of companies are implementing agile throughout their application delivery lifecycle, indicating a growing recognition of agile’s role in enhancing responsiveness and adaptability in software development.