Why Hedge Funds Need a Bespoke Web Application Development Company

Introduction

Hedge funds operate within a complex landscape defined by stringent regulations and high-stakes investment strategies. In this environment, the demand for tailored technological solutions is not merely advantageous; it is essential. A bespoke web application development company plays a critical role in enabling these firms to efficiently manage extensive data, ensure compliance, and enhance security amid increasing scrutiny.

However, reliance on generic software solutions introduces significant risks that can jeopardize compliance and operational efficiency. Therefore, it is imperative for hedge funds to consider how custom development can address their unique challenges. By leveraging tailored solutions, these firms can not only meet regulatory demands but also secure a competitive edge in this dynamic sector.

Understand the Unique Needs of Hedge Funds in Web Development

Hedge pools operate within a complex environment defined by stringent regulatory standards, high-stakes investment strategies, and the need for rapid decision-making. These factors create specific demands for a bespoke web application development company, which standard solutions often fail to meet. Hedge vehicles require software that can manage vast amounts of data while ensuring compliance with financial regulations and implementing robust security measures to safeguard sensitive information.

Moreover, the ability to quickly adapt to market fluctuations is essential, necessitating a bespoke web application development company that can create custom solutions evolving with business needs. This specificity underscores the critical importance of partnering with a bespoke web application development company like Neutech, which specializes in technologies such as React, Python, and AWS DevOps. Neutech prioritizes reliability through high employee retention and seamless client integration, enabling investment firms to scale their development resources as required.

By emphasizing intangibles such as work ethic, communication, and leadership, Neutech ensures that the engineering talent provided is not only technically skilled but also aligned with the unique demands of regulated industries. By choosing Neutech, investment groups can leverage the offerings of a bespoke web application development company that addresses their distinct requirements.

Explore the Advantages of Bespoke Solutions for Regulatory Compliance and Security

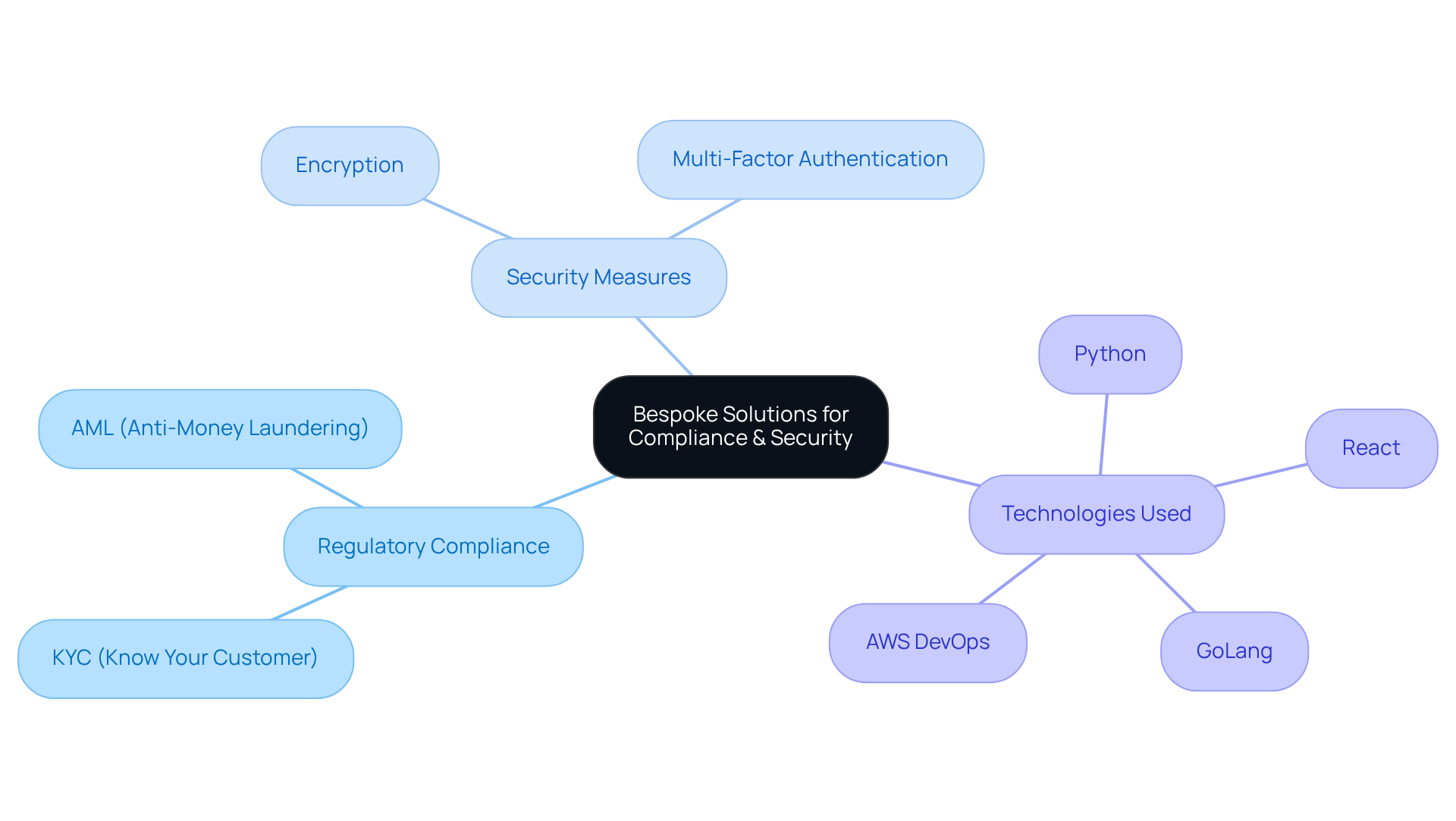

A bespoke web application development company offers investment groups substantial advantages in regulatory compliance and security. These tailored solutions are designed to meet specific regulatory requirements, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines. This ensures that investment groups operate within the necessary legal frameworks, thereby avoiding penalties and protecting their reputations. Additionally, these programs can integrate advanced security measures, including encryption and multi-factor authentication, to protect sensitive financial data from cyber threats.

By investing in a bespoke web application development company, investment groups can mitigate risks associated with regulatory non-compliance while also enhancing their overall security posture. This fosters greater trust among investors and stakeholders. As a bespoke web application development company, Neutech offers comprehensive engineering services, including expertise in:

- React

- Python

- GoLang

- AWS DevOps

This empowers investment firms to develop customized solutions that address their unique challenges.

This proactive approach to compliance and security is essential in an environment where regulatory scrutiny is intensifying and the stakes are high, particularly given that the private investment sector is valued at over $11 trillion.

Assess the Risks of Generic Solutions in the Hedge Fund Industry

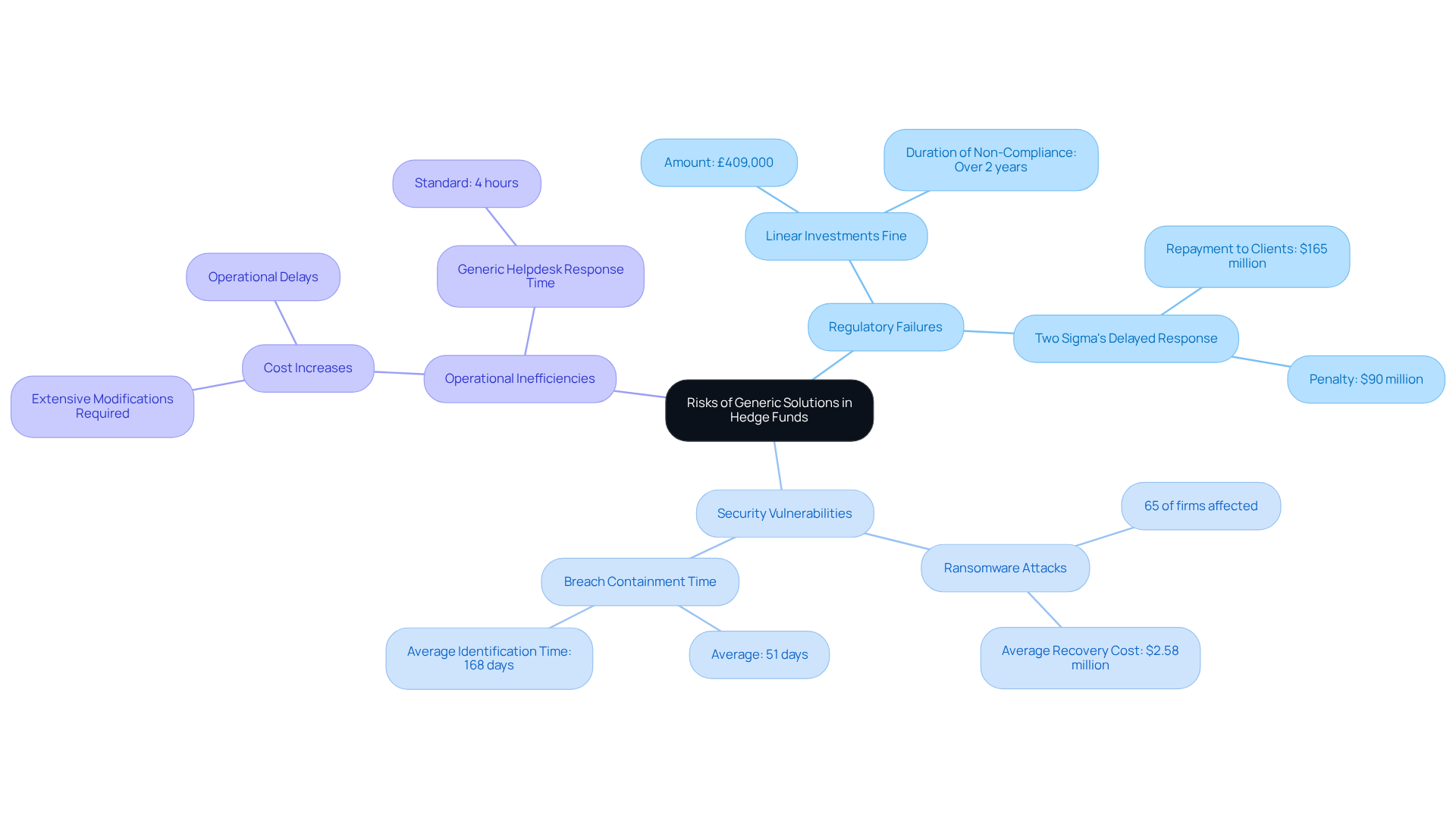

Generic web applications present significant risks for investment groups due to their one-size-fits-all nature. These solutions often lack the necessary customization to meet the unique regulatory and operational requirements of investment firms, leading to regulatory failures and security vulnerabilities. For instance, off-the-shelf software frequently omits critical features essential for managing complex investment strategies and may not comply with the latest regulatory standards, thereby exposing firms to potential legal liabilities. Notably, 65% of financial services organizations reported experiencing ransomware attacks in the past year, with the average recovery cost reaching $2.58 million. This statistic underscores the necessity for tailored security measures.

Moreover, generic solutions can lead to inefficiencies, necessitating extensive modifications to align with a specific investment firm’s workflows. This not only increases costs but also introduces operational delays that can adversely affect performance. A pertinent example is Linear Investments, which incurred a £409,000 fine for failing to manage market abuse risks due to reliance on inadequate post-trade surveillance systems. Such compliance failures highlight the critical need for a bespoke web application development company that can provide tailored development to address the complex demands of investment firms.

By acknowledging these risks, investment groups can make informed decisions regarding the importance of a bespoke web application development company, which ultimately safeguards their operations and enhances compliance with regulatory standards.

Evaluate Long-Term Benefits of Custom Development for Competitive Advantage

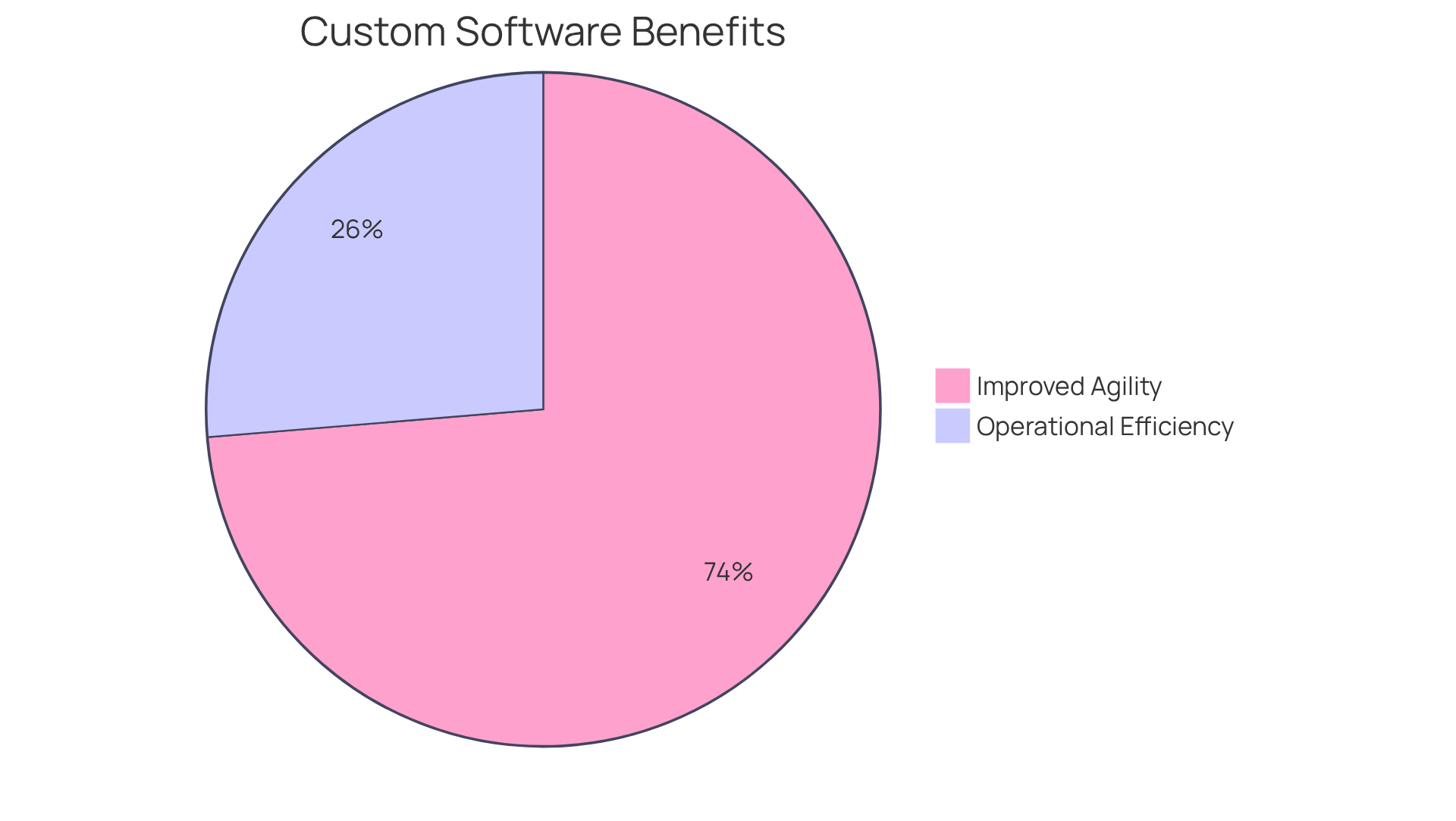

Investing in a bespoke web application development company provides hedge funds with significant long-term advantages that contribute to achieving a competitive edge. Custom solutions streamline operations, automate routine tasks, and enhance data analytics capabilities, which enable more informed investment decisions. For instance, companies utilizing customized programs have reported a 20% to 30% increase in operational efficiency compared to those relying on standard software. This efficiency is crucial in the fast-paced financial landscape, where timely and accurate data can profoundly influence investment outcomes.

Custom solutions are designed to scale with the company, adapting to growth and evolving market needs without the constraints often associated with off-the-shelf options. This adaptability not only enhances operational efficiency but also empowers investment firms to respond swiftly to market fluctuations, thereby strengthening their competitive advantage. In fact, 70% of businesses that adopt custom software report improved agility and innovation, enabling them to launch products more rapidly and adjust to changing market conditions.

Ultimately, strategic investment in custom development can lead to enhanced performance, higher returns, and a more robust market position. As the financial services sector faces increasing regulatory pressures and the demand for sophisticated compliance solutions, a bespoke web application development company enables firms to integrate compliance into their core workflows. This integration ensures adherence to regulations while simultaneously improving operational efficiency. Such a proactive approach to technology investment is essential for hedge funds seeking to maintain a competitive advantage in a rapidly evolving industry.

Conclusion

The necessity for hedge funds to engage with a bespoke web application development company is paramount. Tailored solutions are essential for navigating the complex landscape of financial regulations, security demands, and the rapid pace of market changes. By opting for customized development, hedge funds can ensure that their software not only meets regulatory requirements but also enhances operational efficiency and security.

Several critical points underscore the advantages of bespoke solutions. These include:

- The ability to manage compliance with specific regulations such as KYC and AML

- The mitigation of risks associated with generic software

- The long-term benefits of custom development that foster agility and innovation

The emphasis on security and the unique operational needs of hedge funds further highlights the importance of partnering with a specialized development company like Neutech.

In a highly competitive financial sector, the integration of bespoke web applications is not merely a choice but a strategic imperative. Hedge funds that invest in custom solutions position themselves to respond effectively to market demands, enhance their operational capabilities, and maintain compliance with evolving regulations. Embracing this approach not only safeguards their operations but also fortifies their competitive edge, ensuring they thrive in an increasingly complex environment.

Frequently Asked Questions

What are the unique needs of hedge funds in web development?

Hedge funds operate in a complex environment with stringent regulatory standards, high-stakes investment strategies, and a need for rapid decision-making, which creates specific demands for bespoke web application development.

Why do hedge funds require bespoke web applications?

Standard solutions often fail to meet the specific needs of hedge funds, which include managing large amounts of data, ensuring compliance with financial regulations, and implementing robust security measures for sensitive information.

What technological expertise does Neutech offer for hedge fund web development?

Neutech specializes in technologies such as React, Python, and AWS DevOps, which are essential for creating custom solutions that evolve with the business needs of hedge funds.

How does Neutech ensure reliability in its web development services?

Neutech prioritizes high employee retention and seamless client integration, allowing investment firms to scale their development resources as needed.

What intangibles does Neutech emphasize in its engineering talent?

Neutech emphasizes work ethic, communication, and leadership, ensuring that the engineering talent is not only technically skilled but also aligned with the unique demands of regulated industries.

How can investment groups benefit from partnering with Neutech?

By choosing Neutech, investment groups can leverage a bespoke web application development company that addresses their distinct requirements and supports their operational needs effectively.