Why Hedge Funds Choose a Java Web Application Development Company

Introduction

Hedge funds operate in an environment where precision and speed are paramount. Consequently, the choice of technology becomes a critical factor in their success. Java, recognized for its robust capabilities and extensive community support, emerges as a favored programming language for developing web applications tailored to the unique demands of these financial powerhouses. This raises an important question: how can hedge funds ensure they are leveraging Java to its fullest potential? By focusing on enhancing performance, security, and compliance, they can navigate the challenges of a rapidly evolving market.

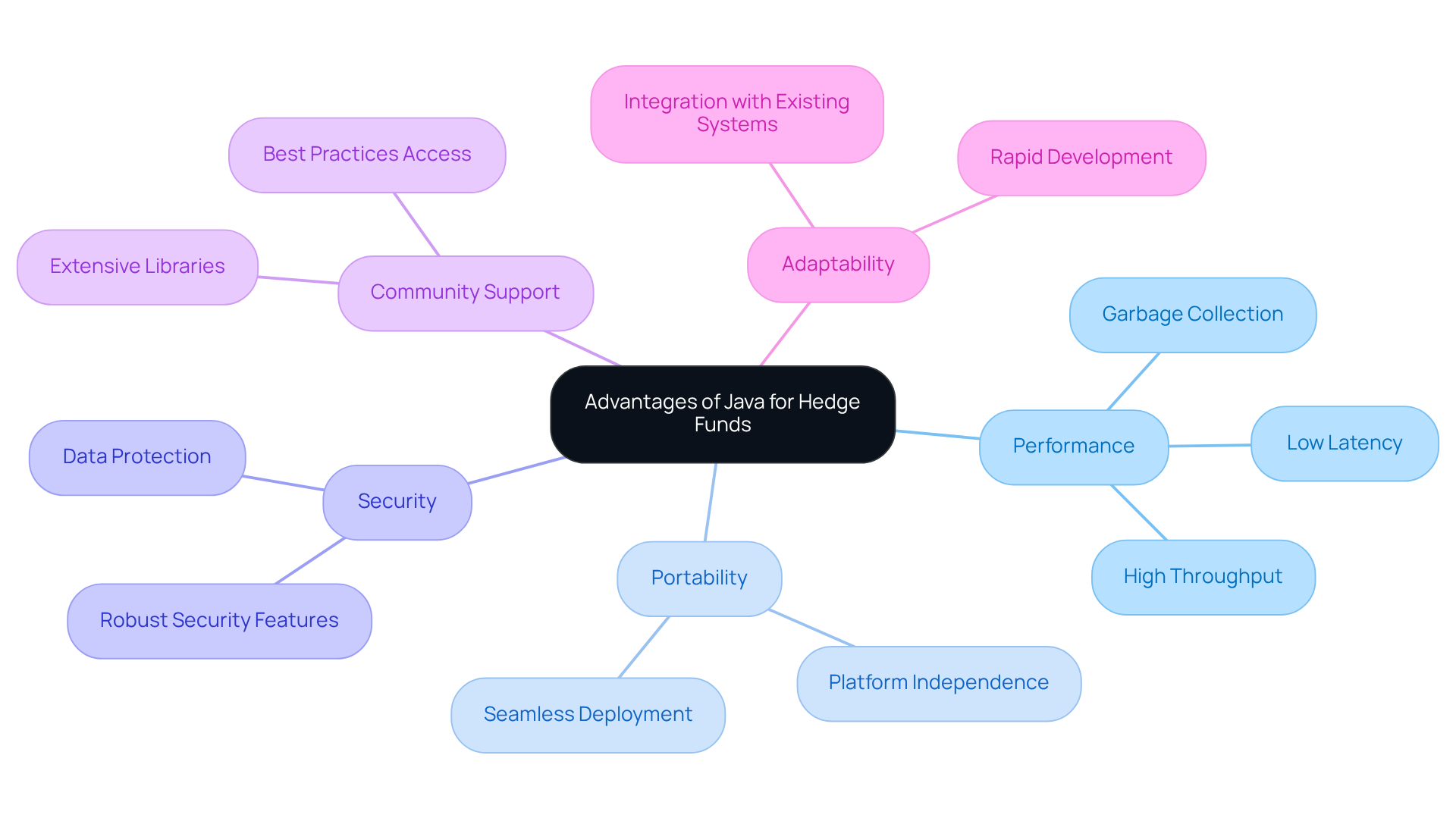

Understand the Advantages of Java for Hedge Funds

This programming language is widely recognized for its strength, portability, and safety, making it an ideal choice for investment groups that require reliable and scalable software solutions. Its platform independence facilitates seamless deployment across diverse environments, effectively eliminating compatibility issues that can impede operational efficiency. The language’s advanced memory management and garbage collection capabilities significantly enhance application performance, which is essential for processing large volumes of financial data swiftly and accurately.

In the context of hedge funds, Java’s extensive libraries and frameworks, such as Spring and Hibernate, streamline rapid development and enable integration with existing systems. This adaptability allows hedge funds to respond quickly to market fluctuations and evolving regulatory requirements. Furthermore, the robust community support surrounding the programming language provides developers with access to a wealth of resources and best practices, reinforcing its status as a preferred technology in the banking services sector.

Case studies illustrate the programming language’s effectiveness in high-frequency trading applications, where even a millisecond delay can result in substantial monetary losses. A study from Cornell University indicates that a mere 1-millisecond enhancement in trading application performance can translate to a potential gain of $100 million annually for brokerage firms. Organizations utilizing Java have reported improved transaction speeds and reduced latency through effective garbage collection strategies, which are critical for maintaining a competitive edge in fast-paced trading environments. Additionally, hedge fund managers have emphasized that Java’s security features are crucial for protecting sensitive financial data, further solidifying its role in the development of secure financial applications.

Moreover, implementing robust JVM monitoring strategies is vital for optimizing the performance of the programming language. Continuous monitoring of garbage collection and memory usage ensures that applications operate efficiently, minimizing latency and maximizing throughput. Overall, Java’s combination of performance metrics, security, and community support makes it an indispensable tool for hedge enterprises that require a java web application development company to optimize their software solutions and enhance operational efficiency.

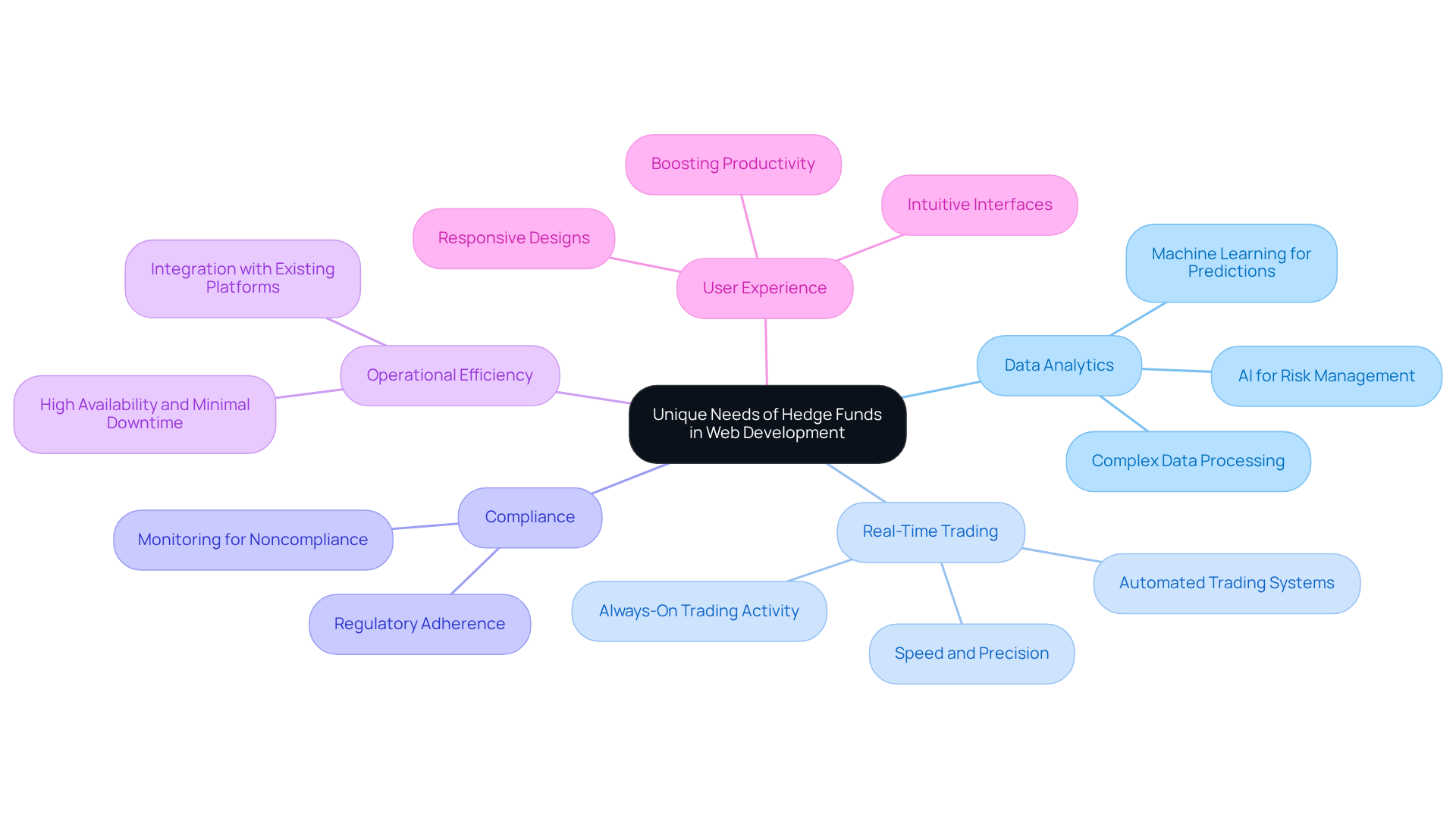

Identify the Unique Needs of Hedge Funds in Web Development

Hedge funds operate within a highly competitive and regulated environment, which necessitates the development of web applications capable of managing complex data analytics, facilitating real-time trading, and ensuring compliance with stringent regulations. These firms require systems that can process large datasets swiftly and accurately, enabling timely decision-making that can significantly impact economic outcomes.

Custom solutions that integrate seamlessly with existing trading platforms and data feeds are essential, as they enhance operational efficiency and responsiveness. The demand for high availability and minimal downtime is critical; even minor delays can lead to substantial financial repercussions. Moreover, hedge fund investments place a premium on user experience for traders and analysts, necessitating intuitive interfaces and responsive designs that boost productivity.

These specific requirements underscore the importance of collaborating with a web application development firm that possesses a deep understanding of the complexities inherent in the banking industry.

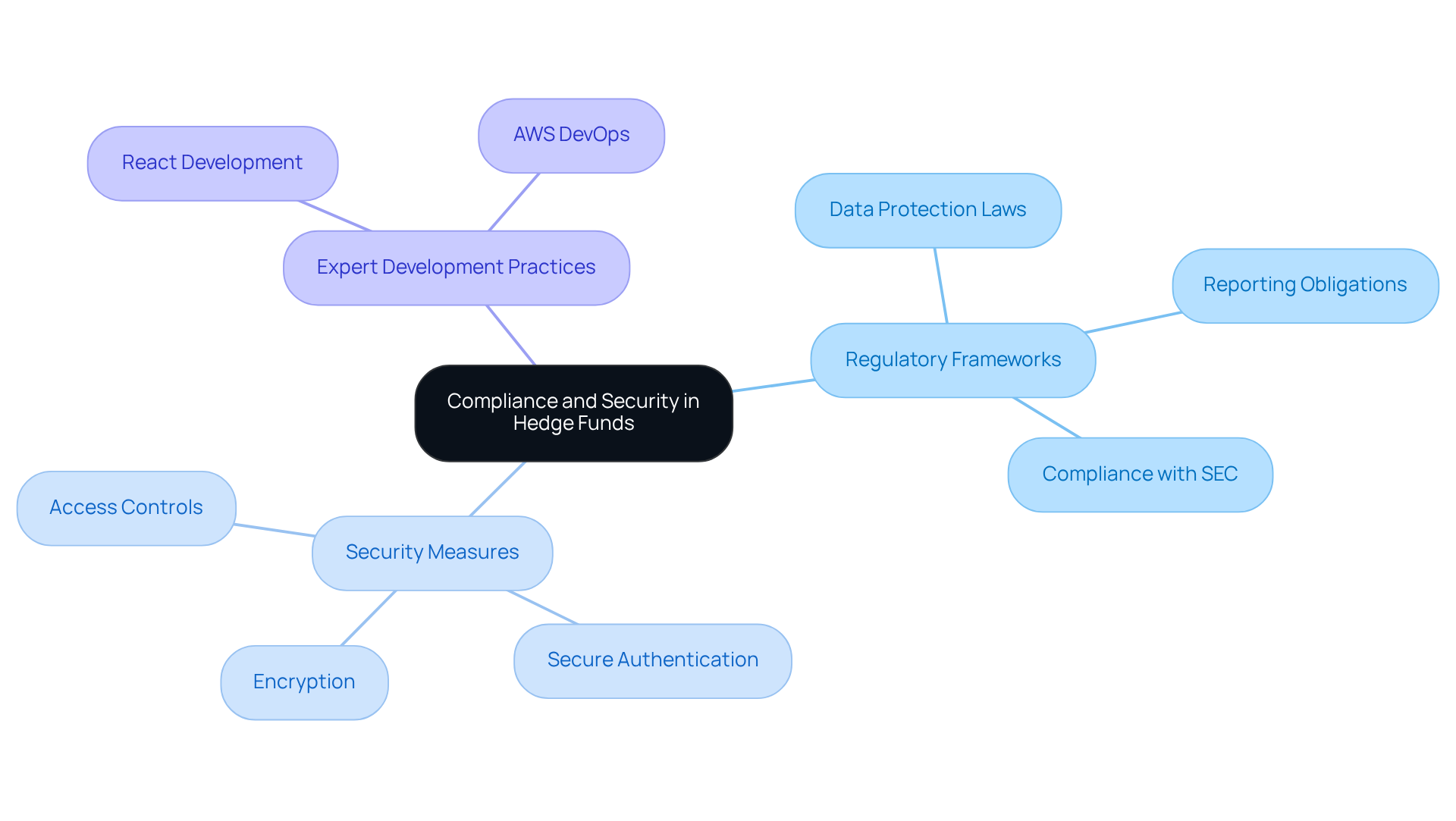

Ensure Compliance and Security through Expert Development

Hedge funds operate within stringent regulatory frameworks that encompass data protection laws and reporting obligations. By partnering with Neutech, a Java web application development company, hedge funds can implement robust security measures, including encryption, secure authentication, and strict access controls, which are essential for protecting sensitive financial data. The inherent security features of Java, such as the Java Security Manager, are pivotal in mitigating risks associated with unauthorized access and data breaches.

Furthermore, by adopting expert development practices, including proficiency in React Development and AWS DevOps, hedge funds can ensure their applications not only comply with current regulatory requirements but also possess the flexibility to adapt to future regulatory changes. This proactive approach to compliance and security is crucial for maintaining investor trust and avoiding significant financial penalties. Notably, 44% of data breaches expose personal information, highlighting the urgent need for effective security measures in financial applications.

As the landscape of data privacy continues to evolve, investment firms must prioritize these security features to sustain a competitive advantage and uphold their reputations.

Leverage Scalability and Flexibility for Long-Term Success

In the fast-paced realm of investment strategies, the ability to expand operations swiftly is essential. The architecture of this programming language facilitates the development of scalable applications capable of handling increased demands without compromising performance. This capability is particularly critical during periods of market volatility, when trading volumes may surge.

Moreover, Java’s flexibility enables hedge funds to introduce new features and functionalities as their business needs evolve, ensuring that their technology remains aligned with strategic goals. By choosing Neutech as their Java web application development company, investment firms benefit from a development process that adapts to fluctuations in market conditions, regulatory requirements, and technological advancements.

Neutech’s month-to-month agreements provide the flexibility to adjust resources as needed, allowing investment groups to respond swiftly to changing demands. Additionally, Neutech’s tailored approach guarantees that specialized developers and designers, skilled in areas such as React and Python, are provided based on the specific requirements of the hedge fund. This is further supported by a streamlined ongoing pipeline for identifying and training talented software engineers, ultimately positioning them for long-term success.

Conclusion

Choosing a Java web application development company is crucial for hedge funds that seek to improve operational efficiency and secure their technology infrastructure. Java’s reliability, portability, and security make it an ideal programming language for the intricate demands of hedge funds, enabling them to navigate the competitive landscape with confidence and agility.

This article delves into the advantages of Java, examining its performance metrics, extensive libraries, and robust community support. The specific requirements of hedge funds – such as the need for rapid data processing, seamless integration with existing systems, and strict compliance with regulatory standards – highlight the necessity of selecting a development partner who comprehends these complexities. Furthermore, Java’s capacity to support scalable and flexible applications empowers hedge funds to effectively adapt to market fluctuations and technological advancements.

In summary, investing in a Java web application development company transcends a mere technical choice; it represents a strategic decision that can profoundly impact the long-term success of hedge funds. By emphasizing security, compliance, and scalability, hedge funds position themselves to excel in an ever-evolving financial environment. Embracing these technological advancements is vital for maintaining a competitive edge and ensuring sustained growth in the dynamic finance sector.

Frequently Asked Questions

What makes Java a suitable programming language for hedge funds?

Java is recognized for its strength, portability, and safety, making it ideal for investment groups that need reliable and scalable software solutions.

How does Java’s platform independence benefit hedge funds?

Java’s platform independence allows for seamless deployment across diverse environments, eliminating compatibility issues that can hinder operational efficiency.

What performance advantages does Java offer for processing financial data?

Java’s advanced memory management and garbage collection capabilities significantly enhance application performance, which is crucial for processing large volumes of financial data swiftly and accurately.

How do Java’s libraries and frameworks assist hedge funds?

Java’s extensive libraries and frameworks, such as Spring and Hibernate, streamline rapid development and enable integration with existing systems, allowing hedge funds to quickly respond to market changes and regulatory requirements.

What role does community support play in Java’s use in banking services?

The robust community support surrounding Java provides developers with access to a wealth of resources and best practices, reinforcing its status as a preferred technology in the banking services sector.

Why is performance critical in high-frequency trading applications using Java?

In high-frequency trading, even a millisecond delay can lead to significant monetary losses. Enhancements in trading application performance can result in substantial financial gains for brokerage firms.

How does Java improve transaction speeds and reduce latency in trading environments?

Organizations using Java have reported improved transaction speeds and reduced latency through effective garbage collection strategies, which are essential for maintaining a competitive edge.

What security features does Java provide for hedge funds?

Java’s security features are crucial for protecting sensitive financial data, solidifying its role in developing secure financial applications.

What is the importance of JVM monitoring strategies in Java applications?

Implementing robust JVM monitoring strategies is vital for optimizing Java performance by continuously monitoring garbage collection and memory usage, which minimizes latency and maximizes throughput.

Why is Java considered indispensable for hedge enterprises?

Java’s combination of performance metrics, security, and community support makes it an essential tool for hedge enterprises looking to optimize their software solutions and enhance operational efficiency.