What Is Orchestration in Software? Key Insights for Hedge Fund Managers

Introduction

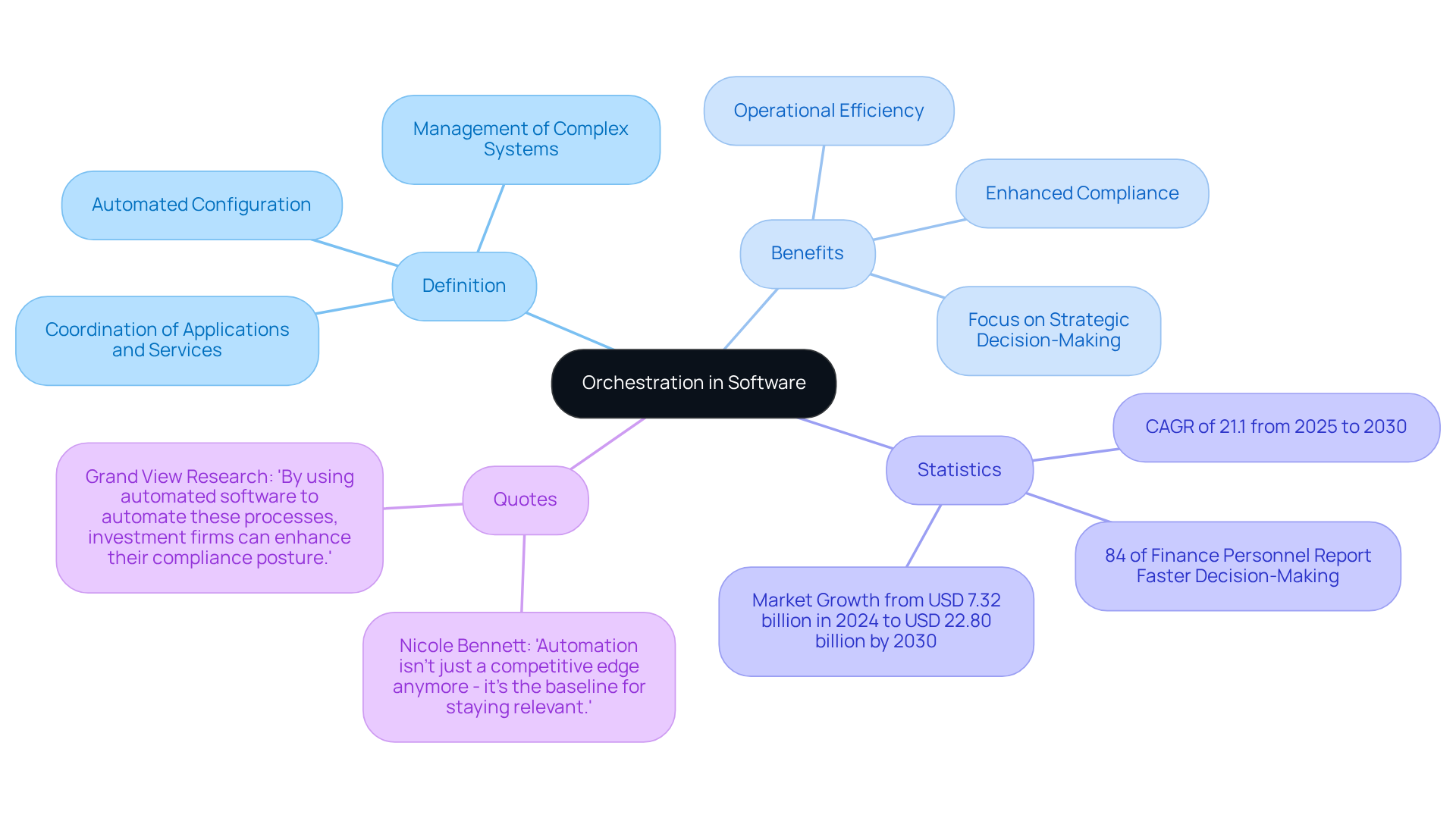

In finance, where precision and speed are crucial for success, the concept of orchestration in software stands out as a vital element. This advanced process automates the management and coordination of complex systems, streamlining operations. As a result, hedge fund managers can concentrate on strategic decision-making rather than routine tasks. With the financial landscape continually evolving, a key question emerges: how can hedge funds leverage orchestration to improve efficiency, ensure compliance, and ultimately achieve superior investment outcomes?

Define Orchestration in Software: Key Concepts and Significance

What is orchestration in software? It involves the automated configuration, management, and coordination of complex systems, applications, and services. This process integrates various components to ensure seamless collaboration, facilitating efficient workflows and operations. In the context of investment vehicles, coordination is essential as it automates repetitive tasks, significantly enhancing operational efficiency and ensuring compliance with stringent regulatory standards. By streamlining these processes, investment managers can concentrate on strategic decision-making rather than being encumbered by manual operations.

In today’s fast-paced financial landscape, where timely and accurate data processing is vital, the ability to automate workflows can greatly impact investment outcomes. Notably, eighty-four percent of finance personnel report that automation tools enable quicker decision-making, underscoring the transformative role of coordination within the financial services sector. Furthermore, the global process coordination market is projected to grow from USD 7.32 billion in 2024 to USD 22.80 billion by 2030, reflecting a compound annual growth rate of 21.1%. This growth highlights the critical importance of automated solutions for investment managers.

As Nicole Bennett articulates, “Automation isn’t just a competitive edge anymore – it’s the baseline for staying relevant.” This statement emphasizes the necessity for hedge funds to adopt management solutions that effectively navigate the complexities of compliance and operational efficiency.

Explore the Evolution and Context of Software Orchestration

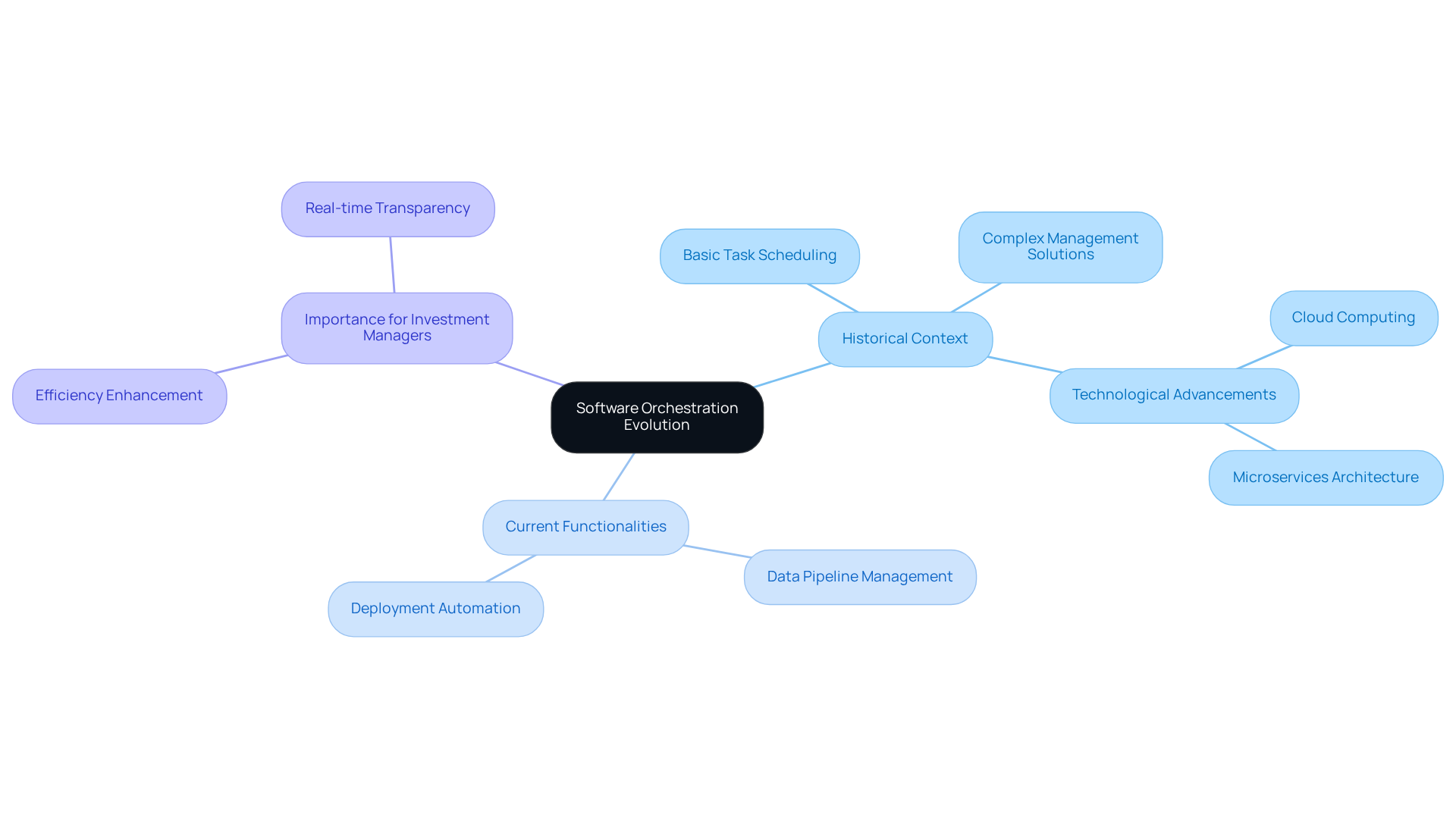

The evolution of coordination in financial technology has undergone significant transformation over the past few decades, primarily driven by the increasing complexity of software systems and the demand for automation. Initially, coordination focused on basic task scheduling; however, as software architectures grew more intricate, the necessity for advanced coordination tools became evident. The advent of cloud computing and microservices architecture has further propelled this evolution, facilitating the development of dynamic and scalable management solutions.

Currently, what is orchestration in software involves a wide range of functionalities, including the management of data pipelines and the automation of deployment processes. This evolution is crucial for investment managers who leverage technology to enhance efficiency and maintain a competitive edge in a rapidly changing market. As the global hedge fund sector reached a total capital of $4.98 trillion in Q3 2025, the integration of advanced management tools has become essential for improving performance and meeting the heightened demands of investors for real-time transparency and operational agility.

Analyze the Components and Characteristics of Orchestration

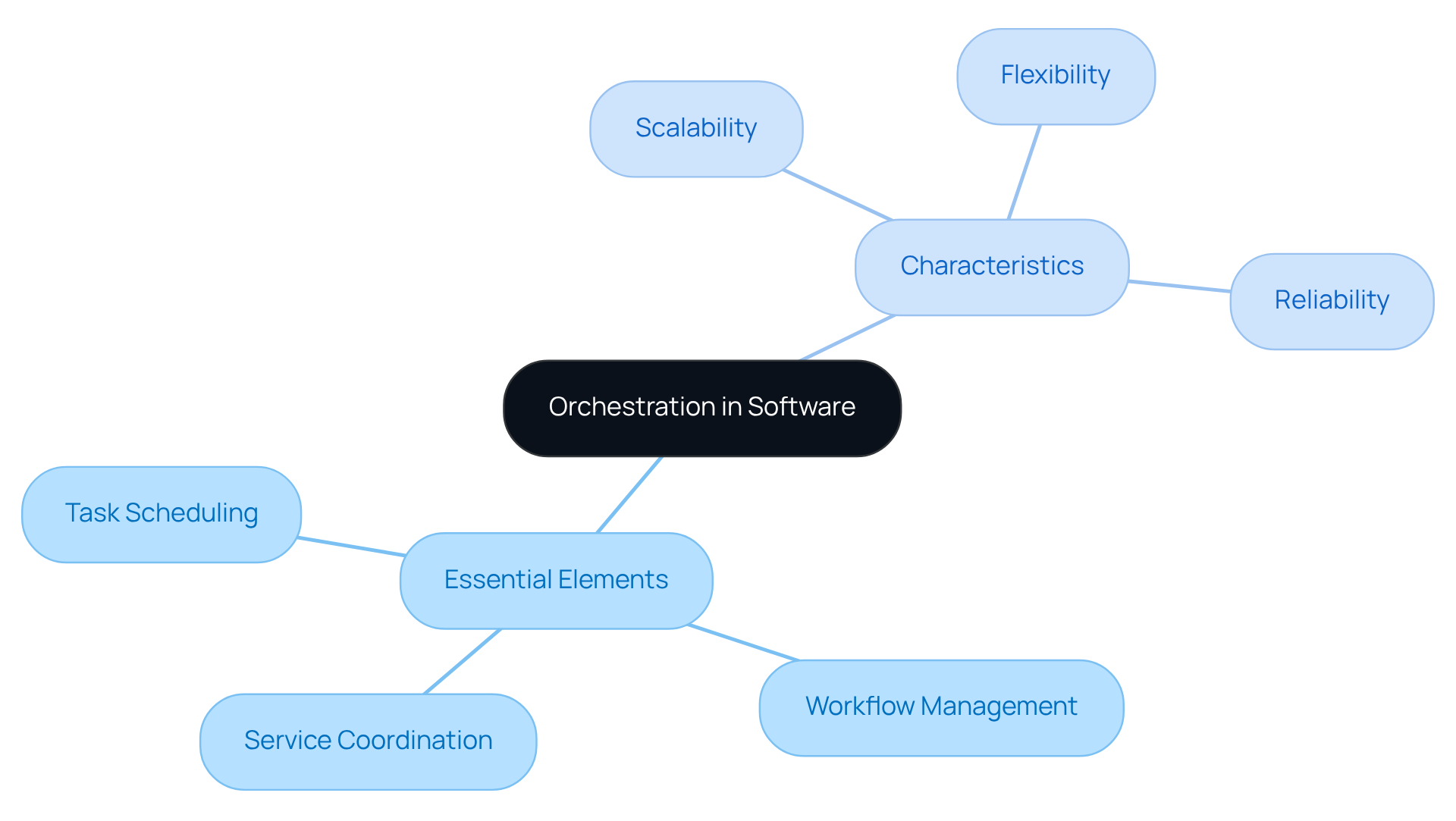

Essential elements of arrangement involve understanding what is orchestration in software, which includes:

- Task scheduling

- Workflow management

- Service coordination

Task scheduling is crucial as it determines when and how tasks should be executed. In parallel, workflow management ensures that tasks are completed in the correct order, respecting dependencies. Service coordination integrates various services and applications, facilitating effective communication and functionality among them.

Characteristics of effective coordination include:

- Scalability

- Flexibility

- Reliability

For hedge fund managers, understanding what is orchestration in software is vital, as it has a direct impact on the efficiency and effectiveness of software solutions. This understanding ultimately influences investment strategies and overall success.

Statistics indicate that organizations employing effective coordination can achieve significant improvements in task efficiency and operational resilience. Thus, understanding what is orchestration in software emerges as a critical focus area for financial software solutions.

Illustrate Practical Applications of Orchestration in Software

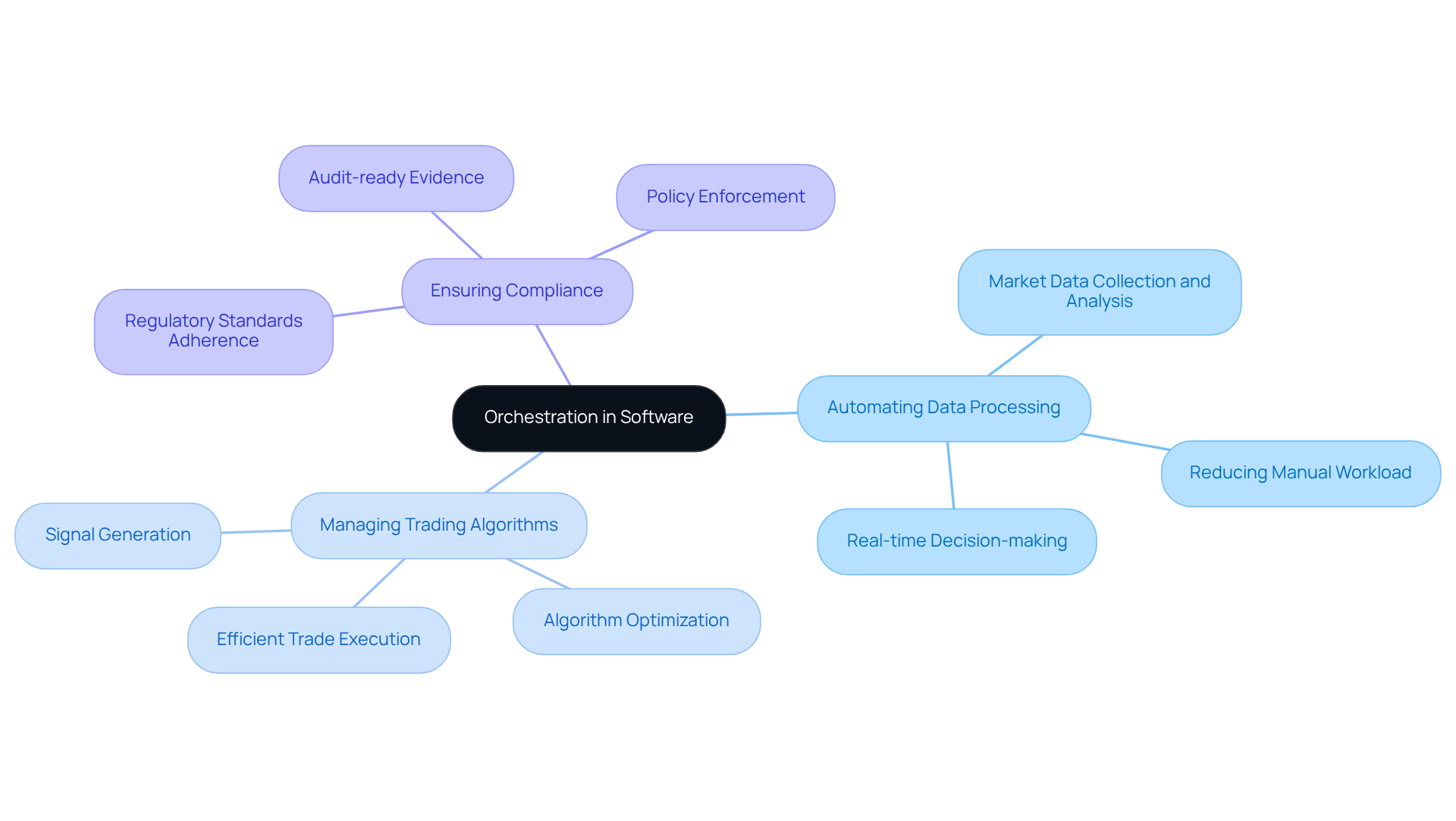

Coordination is essential in the financial services sector, particularly for automating data processing, managing trading algorithms, and ensuring compliance with regulatory standards. For instance, investment pools can utilize coordination tools to automate the collection and analysis of market data, which facilitates real-time decision-making based on accurate information.

Moreover, coordination simplifies the implementation of trading strategies by aligning various systems and services, ensuring that trades are executed efficiently and without delay. By understanding what is orchestration in software, hedge fund managers can significantly enhance their operational efficiency, minimize the risk of errors, and ultimately improve their investment performance.

Conclusion

Orchestration in software is crucial for automating and managing complex systems, especially in the financial sector. This process streamlines workflows and enhances operational efficiency, enabling hedge fund managers to concentrate on strategic decision-making instead of being overwhelmed by manual tasks. The integration of orchestration tools has transitioned from a mere advantage to an essential requirement for maintaining competitiveness and compliance in a rapidly changing investment landscape.

The evolution of orchestration is marked by its shift from basic task scheduling to advanced management solutions that address the complexities of modern software architectures. Key components, including task scheduling, workflow management, and service coordination, are vital for optimizing performance. Moreover, the advantages of orchestration – such as improved efficiency and reduced error rates – are supported by compelling statistics that highlight its influence on decision-making and operational resilience.

Given these insights, hedge fund managers should adopt orchestration as a core element of their operational strategy. As the financial services industry evolves, leveraging automated solutions will not only boost performance but also ensure adherence to regulatory standards. The future of investment management hinges on the capacity to adapt and implement effective orchestration practices, making it essential to prioritize this critical area of software management.

Frequently Asked Questions

What is orchestration in software?

Orchestration in software refers to the automated configuration, management, and coordination of complex systems, applications, and services to ensure seamless collaboration and efficient workflows.

Why is orchestration important in the context of investment vehicles?

Orchestration automates repetitive tasks, enhancing operational efficiency and ensuring compliance with regulatory standards, allowing investment managers to focus on strategic decision-making instead of manual operations.

How does automation impact decision-making in finance?

Automation tools enable quicker decision-making, with eighty-four percent of finance personnel reporting that these tools significantly enhance the speed and accuracy of their decisions.

What is the projected growth of the global process coordination market?

The global process coordination market is projected to grow from USD 7.32 billion in 2024 to USD 22.80 billion by 2030, reflecting a compound annual growth rate of 21.1%.

What does Nicole Bennett suggest about automation in the financial sector?

Nicole Bennett suggests that automation has become a baseline necessity for hedge funds to remain relevant, emphasizing the importance of adopting management solutions that address compliance and operational efficiency challenges.