Master Fintech Apps: Best Practices for Hedge Fund Managers

Introduction

Understanding the evolving landscape of fintech is crucial for hedge fund managers who seek to enhance their operational efficiency and investment strategies. The rapid integration of technologies such as AI and blockchain has made these financial tools essential for maintaining a competitive edge. However, hedge fund managers face the challenge of navigating the complexities associated with compliance, security, and the effective integration of these applications.

To successfully leverage fintech solutions while mitigating risks and maximizing performance, what best practices can they adopt?

Understand Fintech Fundamentals and Their Relevance to Hedge Funds

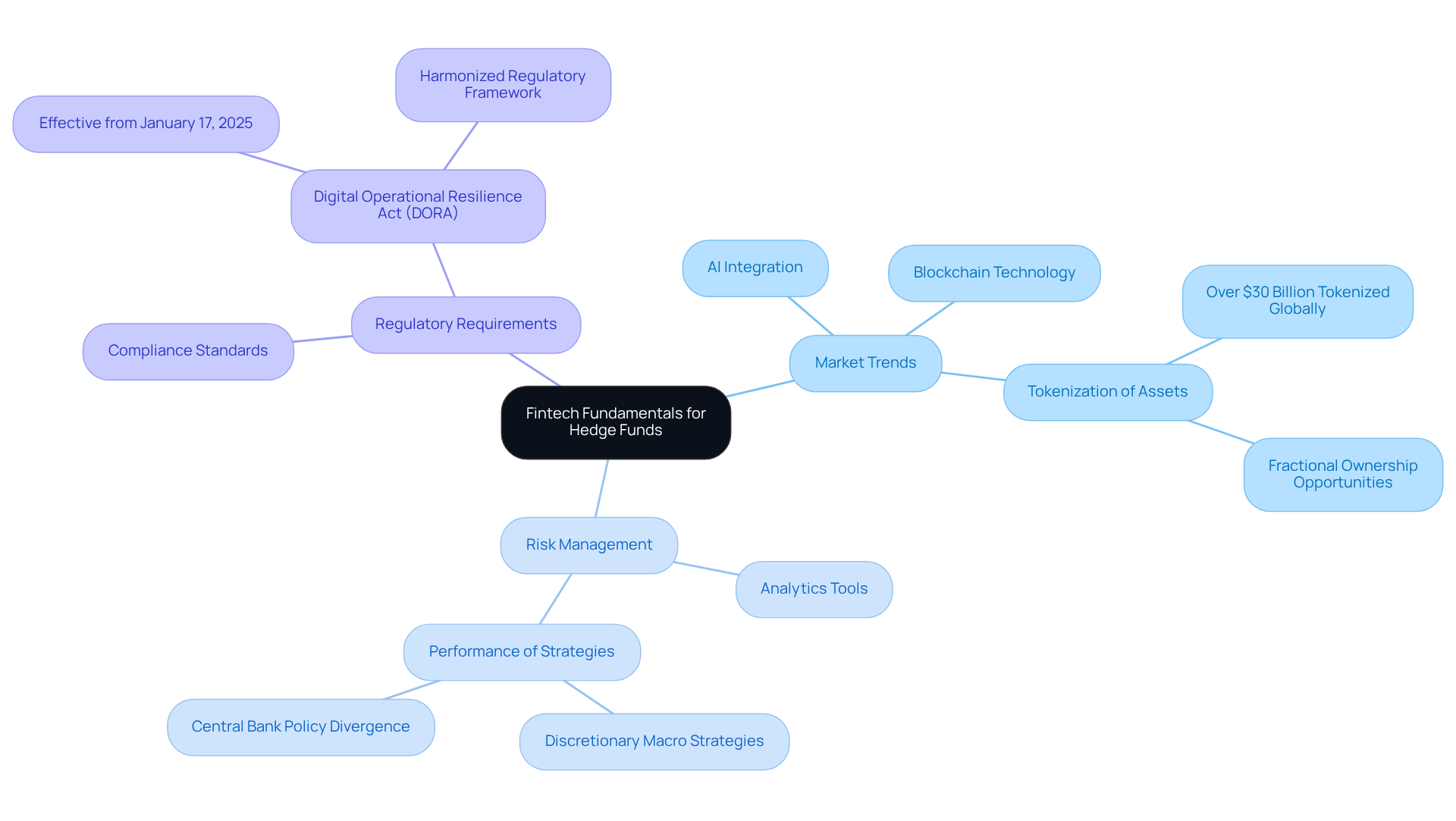

Fintech apps, which represent financial technology, encompass a wide range of applications and services that enhance financial operations through technology. For investment managers, understanding these fundamentals is essential for navigating the complexities of modern finance. Key areas include:

-

Market Trends: Awareness of current fintech trends, such as AI integration and blockchain technology, enables hedge fund managers to anticipate market changes and adapt their strategies accordingly. Notably, over $30 billion in assets are tokenized globally, reshaping investment landscapes and facilitating fractional ownership of high-value assets.

-

Risk Management: Fintech tools provide sophisticated analytics and modeling features that enhance risk evaluation and oversight, allowing hedge groups to make informed investment decisions. The performance of discretionary macro strategies in 2025 illustrates how effective risk management can capitalize on Central Bank policy divergence and market volatility, as these strategies have shown strong performance and are likely to continue benefiting from such conditions.

-

Regulatory Requirements: Familiarity with regulatory frameworks and adherence to standards is critical, as fintech apps must ensure compliance with stringent regulations in the financial sector. The Digital Operational Resilience Act (DORA), effective from January 17, 2025, introduces a harmonized regulatory framework impacting both fintech apps and investment funds, underscoring the necessity for robust compliance strategies.

By grasping these fundamentals, investment managers can better align their technology strategies with their financial objectives, ultimately enhancing operational efficiency and performance. As Christopher Bernard, a Senior Knowledge Lawyer, states, “We believe investment vehicles will play a valuable role in investor portfolios during 2026, regardless of the market’s ultimate direction.

Identify Key Features for Hedge Fund Management Applications

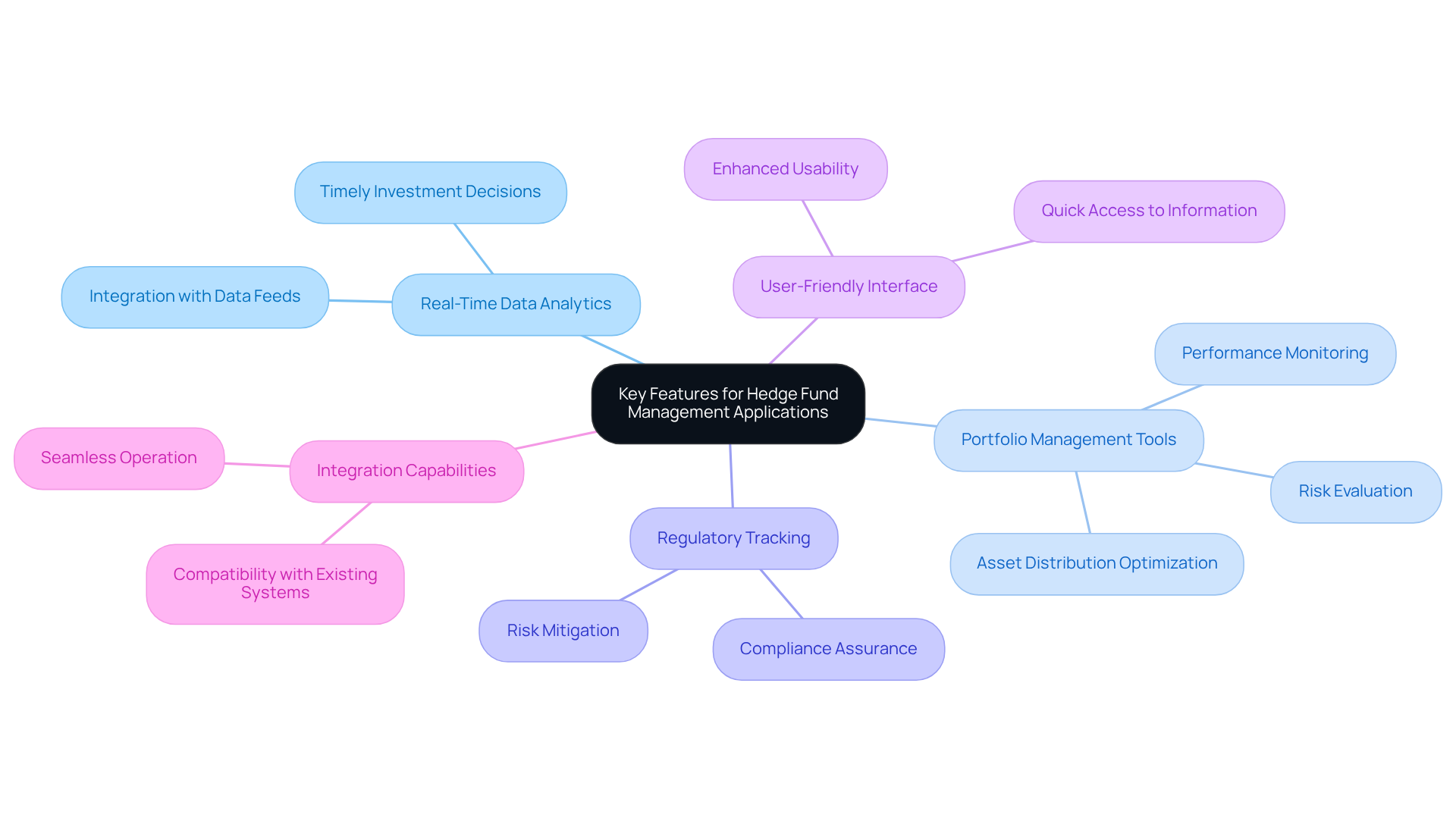

When developing fintech apps for hedge fund management, it is essential to prioritize several key features that enhance operational efficiency and decision-making capabilities.

-

Real-Time Data Analytics is crucial for making timely investment decisions. The ability to analyze market data in real-time allows applications to integrate with data feeds, providing up-to-date information that investment managers rely on.

-

Portfolio Management Tools are vital for efficient oversight of investment performance. These functionalities enable managers to monitor performance metrics, evaluate risk, and optimize asset distribution effectively.

-

Regulatory Tracking features are necessary to ensure compliance with industry standards. By integrating these capabilities, applications can help mitigate the risk of legal issues associated with transactions and operations.

-

A User-Friendly Interface significantly enhances usability. A well-designed interface allows managers to navigate the application efficiently, ensuring quick access to critical information.

-

Finally, Integration Capabilities are essential for seamless operation. The application should integrate effortlessly with existing systems and third-party tools, streamlining processes and enhancing overall functionality.

Incorporating these features into fintech apps for investment management can significantly enhance operational efficiency and decision-making abilities.

Ensure Compliance and Security in Fintech App Implementation

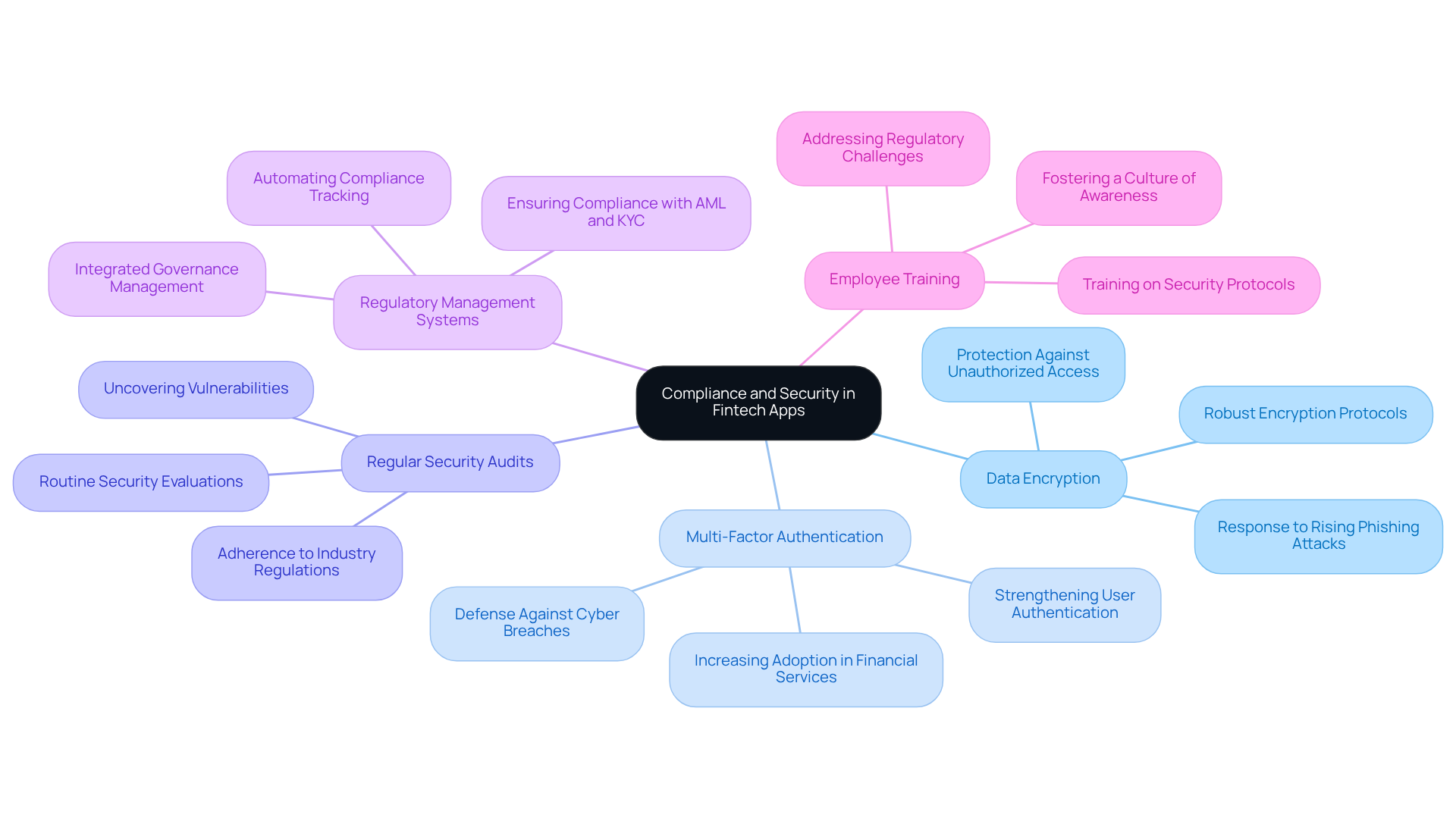

Guaranteeing adherence and safety is crucial in fintech apps for investment portfolios. To effectively address these concerns, several best practices should be considered:

-

Data Encryption: Employ robust encryption protocols for both data at rest and in transit. This is essential for safeguarding sensitive financial information against unauthorized access, particularly as the financial services industry faces increasing scrutiny over data protection. Recent reports indicate that the rise in phishing attacks underscores the necessity for strong data protection measures.

-

Multi-Factor Authentication (MFA): Implement MFA to strengthen user authentication processes. This additional layer of security is vital in defending against potential breaches, especially as the adoption of MFA continues to rise in financial services through 2026. Experts emphasize that MFA serves as a critical defense against the growing threat of cyberattacks.

-

Regular Security Audits: Conduct routine security evaluations and audits to uncover vulnerabilities and ensure adherence to industry regulations. This proactive approach enables hedge funds to stay ahead of emerging threats and regulatory changes, which are becoming increasingly complex.

-

Regulatory Management Systems: Integrate regulatory management tools that automate the tracking and reporting of legal requirements. This ensures compliance with laws such as Anti-Money Laundering (AML) and Know Your Customer (KYC), which are increasingly critical in today’s regulatory landscape. As regulatory challenges evolve, organizations must adopt a more integrated strategy for governance management.

-

Employee Training: Regularly train employees on security protocols and regulatory standards. Fostering a culture of awareness and vigilance is essential for maintaining security and adherence in the rapidly evolving environment of fintech apps. Training programs should address common challenges in regulatory approaches to assist investment managers in avoiding errors.

By prioritizing these compliance and security measures, investment firms can effectively mitigate risks and enhance trust with their clients.

Develop a Structured Integration Plan for Fintech Solutions

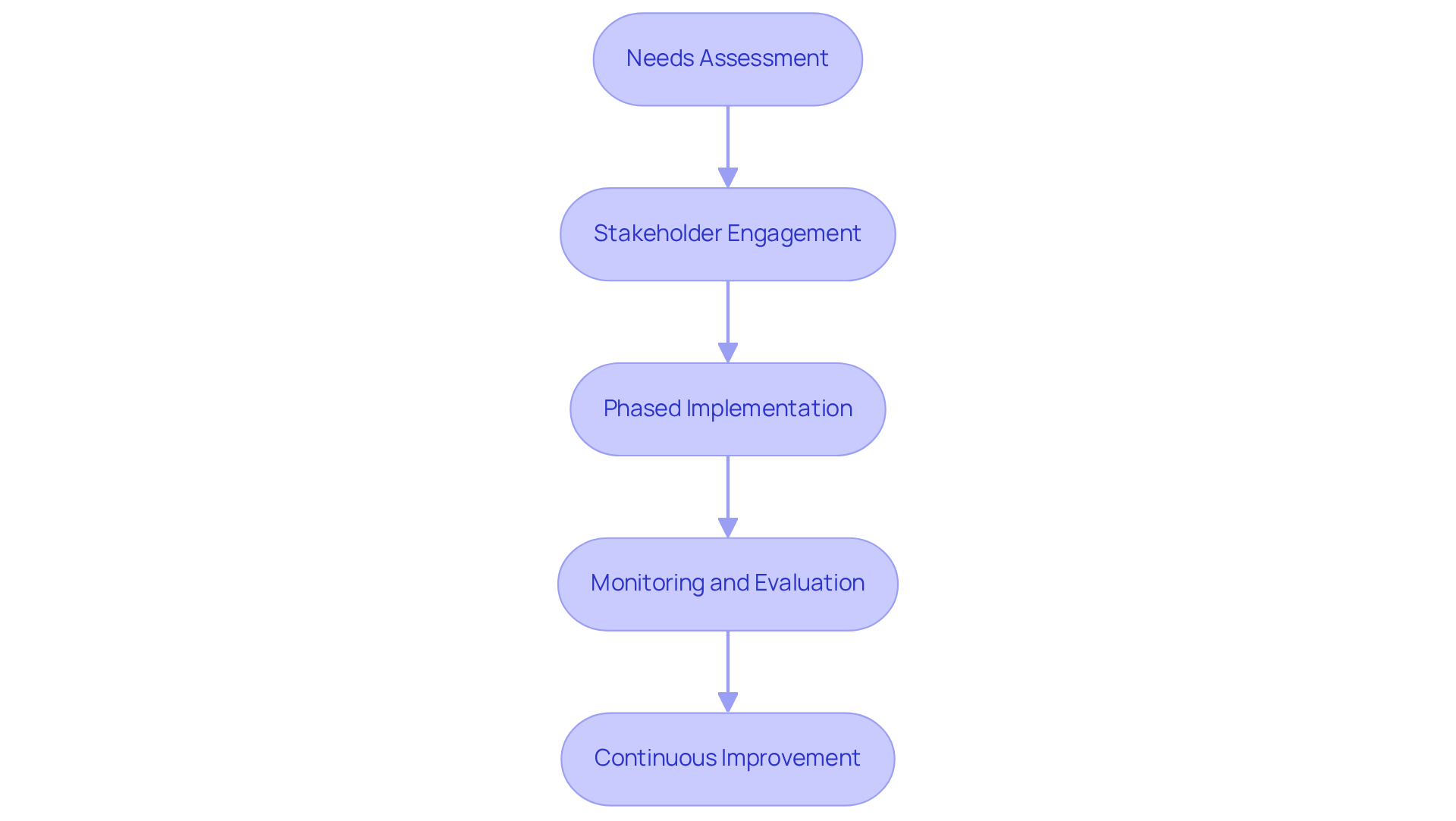

A well-organized integration strategy is essential for the effective execution of financial technology solutions in hedge funds. Key steps include:

- Needs Assessment: Conduct a thorough assessment of existing systems to identify gaps that the new fintech solution will address. This assessment should focus on operational inefficiencies and user requirements to ensure alignment with business objectives. Understanding user needs is crucial for effective integration, as highlighted in the whitepaper ‘Human + AI: Drivers of Customer Experience AI Agents in 2026’.

- Stakeholder Engagement: Actively involve key stakeholders from various departments, including compliance, operations, and IT, to gather diverse input. This collaborative approach ensures that the integration plan addresses the needs of all users and fosters a sense of ownership among team members. Interacting with consumer protection agencies and clients averts legal measures and enhances trust, a principle equally relevant in financial technology integration.

- Phased Implementation: Adopt a phased approach to integration, allowing for incremental testing and adjustments before full deployment. This strategy minimizes disruption and provides opportunities for feedback, ensuring that any issues are addressed early in the process. The case study of Paytm Payments Bank Ltd v. Reserve Bank of India illustrates the importance of careful planning and regulatory engagement in successful financial technology operations.

- Monitoring and Evaluation: Establish clear metrics to assess the success of the integration, focusing on performance indicators such as system efficiency, user satisfaction, and compliance adherence. Regular evaluations will help identify areas for improvement. Continuous monitoring is essential to adapt to evolving challenges in the financial technology landscape, as mentioned in the ‘Beyond Chargebacks’ whitepaper.

- Continuous Improvement: Post-implementation, maintain an ongoing feedback loop to gather insights from users and make necessary adjustments. This commitment to continuous improvement will optimize the integration and enhance the overall user experience. Engaging stakeholders continuously, as discussed in the case of Revolut Ltd v. FCA, is critical to avoid operational hindrances.

By following these steps, hedge funds can effectively integrate fintech apps, which will lead to enhanced operational efficiency and informed decision-making. The expected impact of implementing these practices includes improved compliance, increased user satisfaction, and a stronger competitive position in the market.

Conclusion

Understanding and mastering fintech applications is essential for hedge fund managers who wish to excel in a rapidly evolving financial landscape. By harnessing technology, investment managers can significantly enhance operational efficiency, improve risk management, and ensure compliance with stringent regulations. This proactive approach aligns technology strategies with financial objectives and positions hedge funds to capitalize on emerging market trends.

The article identifies several key areas that hedge fund managers should prioritize:

- Recognizing the importance of real-time data analytics and user-friendly interfaces.

- Implementing robust compliance measures and security protocols.

- Developing a structured integration plan for ensuring that fintech solutions are seamlessly incorporated into existing systems.

These best practices are vital for optimizing hedge fund management, which paves the way for improved decision-making and enhanced performance.

Ultimately, embracing fintech transcends merely keeping pace with industry changes; it involves leading the charge in innovation and efficiency. Hedge fund managers are urged to adopt these best practices and integrate advanced fintech solutions into their operations. By doing so, they can mitigate risks and cultivate a more resilient and competitive edge in the market, ensuring they are well-prepared for the challenges and opportunities that lie ahead.

Frequently Asked Questions

What is fintech and why is it important for hedge funds?

Fintech, or financial technology, encompasses a variety of applications and services that improve financial operations through technology. It is important for hedge funds as it helps investment managers navigate the complexities of modern finance.

What are some key areas of fintech that hedge fund managers should be aware of?

Key areas include market trends, risk management, and regulatory requirements. Understanding these areas allows hedge fund managers to adapt strategies, enhance risk evaluation, and ensure compliance with regulations.

How do market trends in fintech affect hedge funds?

Awareness of current fintech trends, such as AI integration and blockchain technology, helps hedge fund managers anticipate market changes and adapt their strategies. For example, over $30 billion in assets are tokenized globally, which reshapes investment landscapes and facilitates fractional ownership.

How do fintech tools improve risk management for hedge funds?

Fintech tools provide advanced analytics and modeling features that enhance risk evaluation and oversight, enabling hedge funds to make informed investment decisions. Effective risk management can capitalize on market volatility and policy divergence.

What regulatory requirements should hedge funds consider in relation to fintech?

Hedge funds must be familiar with regulatory frameworks and ensure compliance with standards. The Digital Operational Resilience Act (DORA), effective from January 17, 2025, introduces a unified regulatory framework that affects both fintech applications and investment funds.

How can understanding fintech fundamentals benefit investment managers?

By grasping fintech fundamentals, investment managers can align their technology strategies with financial objectives, improving operational efficiency and performance in their investment activities.