Master Automation for Financial Services: Best Practices for Hedge Funds

Introduction

In the fast-paced realm of hedge funds, where every second is critical and precision is essential, the integration of automation into financial services has become a necessity rather than a luxury. This article explores the significant impact of finance automation, highlighting effective practices that empower hedge funds to streamline operations, enhance accuracy, and bolster compliance.

However, alongside the potential for increased efficiency and cost savings, hedge funds encounter various challenges in adopting these advanced technologies. Understanding how to navigate this intricate landscape is crucial for ensuring successful implementation.

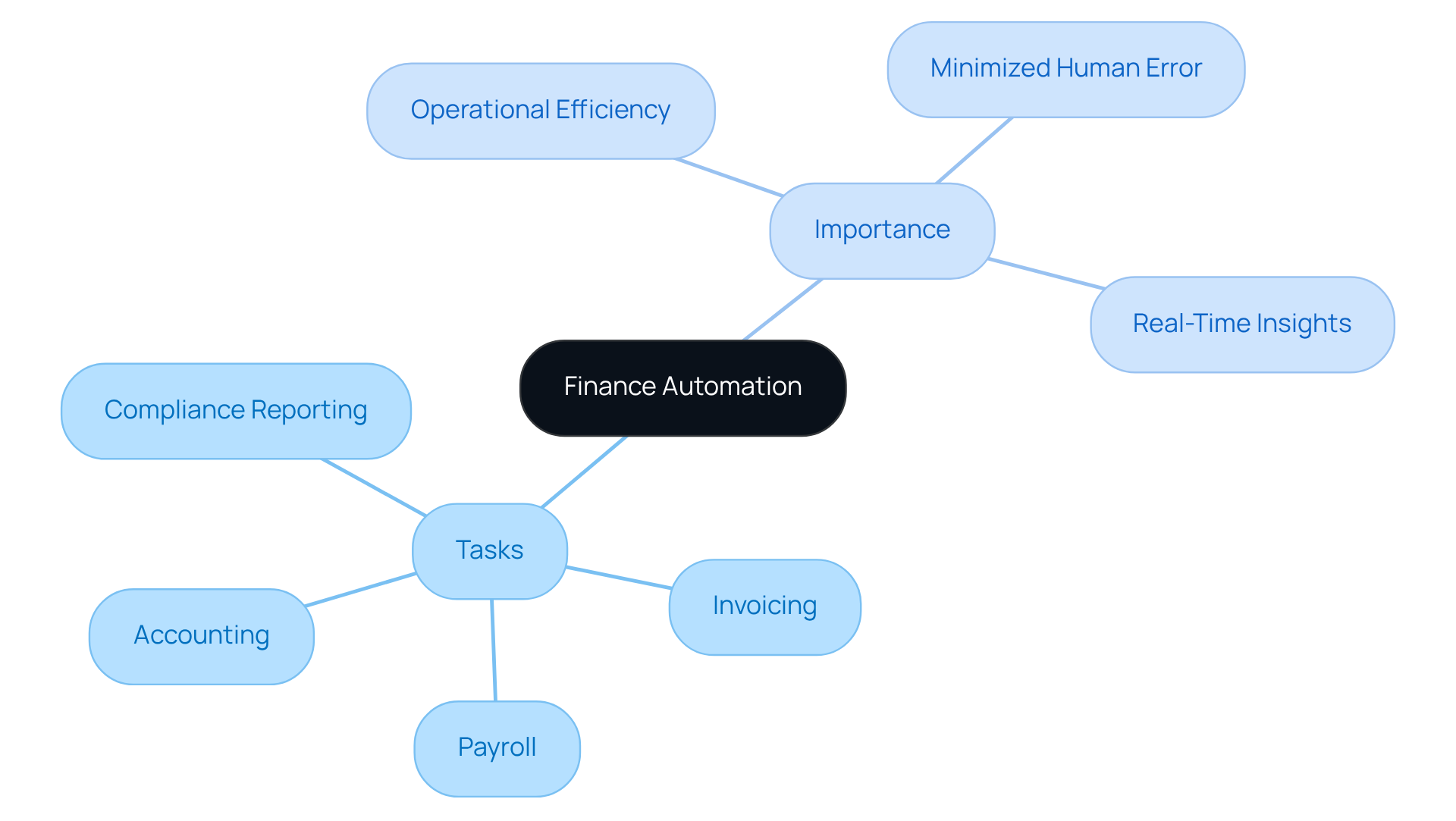

Understand Finance Automation: Definition and Importance

Finance technology involves the application of tools designed to streamline and optimize financial processes, thereby reducing manual effort and enhancing accuracy. This field encompasses a range of tasks, including:

- Invoicing

- Payroll

- Accounting

- Compliance reporting

The importance of financial technology lies in its ability to improve operational efficiency, minimize human error, and provide real-time insights into financial performance. For investment groups, where precision and speed are paramount, automation can yield significant competitive advantages by enabling faster decision-making and improved risk management.

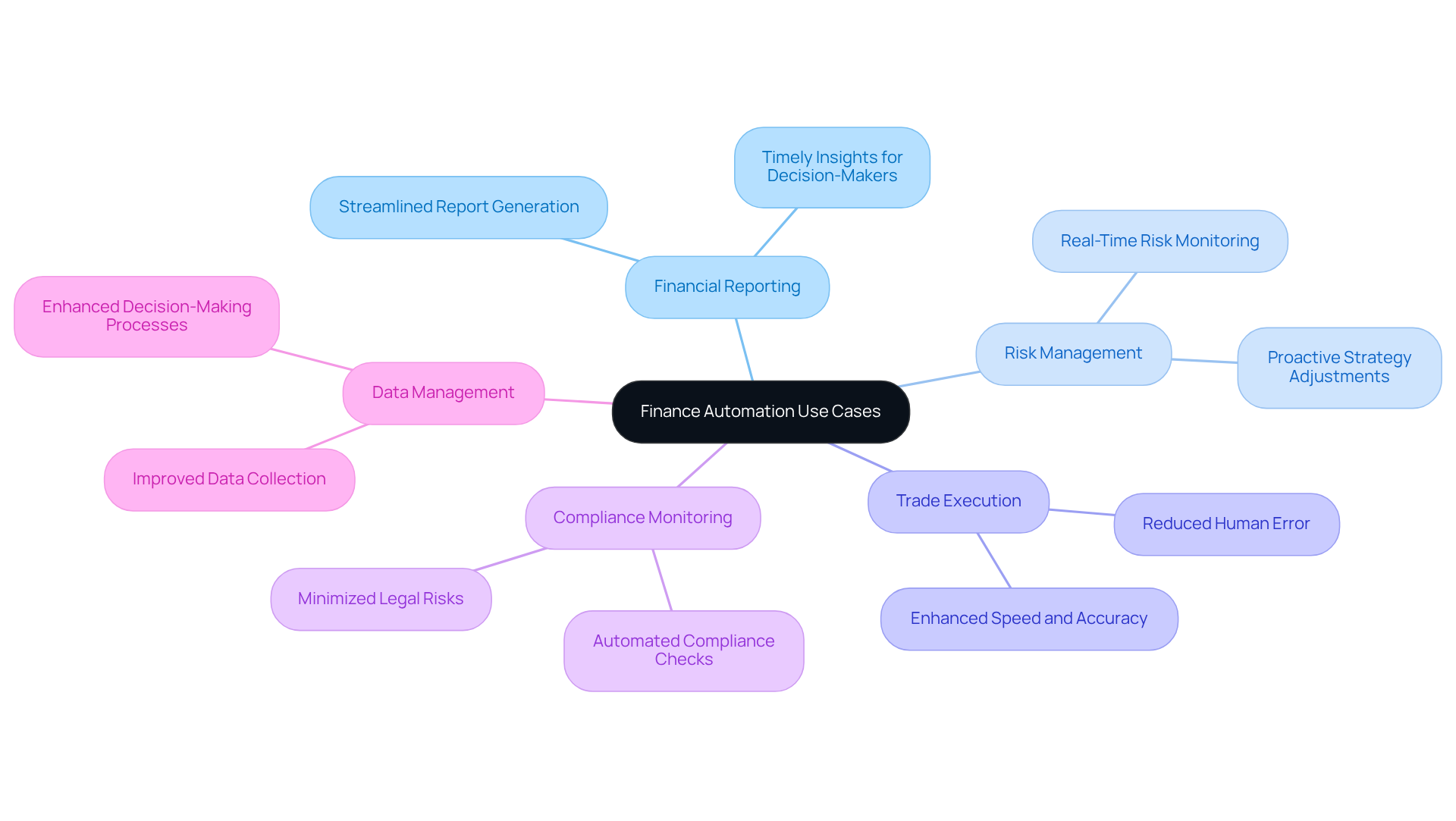

Explore Key Use Cases for Finance Automation

Key use cases for finance automation in hedge funds encompass several critical areas:

- The automation for financial services involves streamlining the generation of financial reports, ensuring timely and accurate insights for decision-makers.

- Risk Management: The automation for financial services plays a vital role in monitoring and analyzing risk factors in real-time. This capability allows for proactive adjustments to investment strategies, enhancing overall risk mitigation.

- Trade Execution: By utilizing automation for financial services in trade processes, hedge funds can significantly enhance speed and accuracy, thereby reducing the likelihood of human error in executing trades.

- Compliance Monitoring: The implementation of automation for financial services through automated compliance checks is essential for ensuring adherence to regulatory requirements. This approach minimizes legal risks and enhances operational integrity.

- Data Management: The implementation of automation for financial services in data collection and analysis improves decision-making processes and operational efficiency, allowing hedge funds to leverage data more effectively.

These use cases illustrate how mechanization can transform various elements of investment operations, leading to enhanced performance and reduced operational expenses.

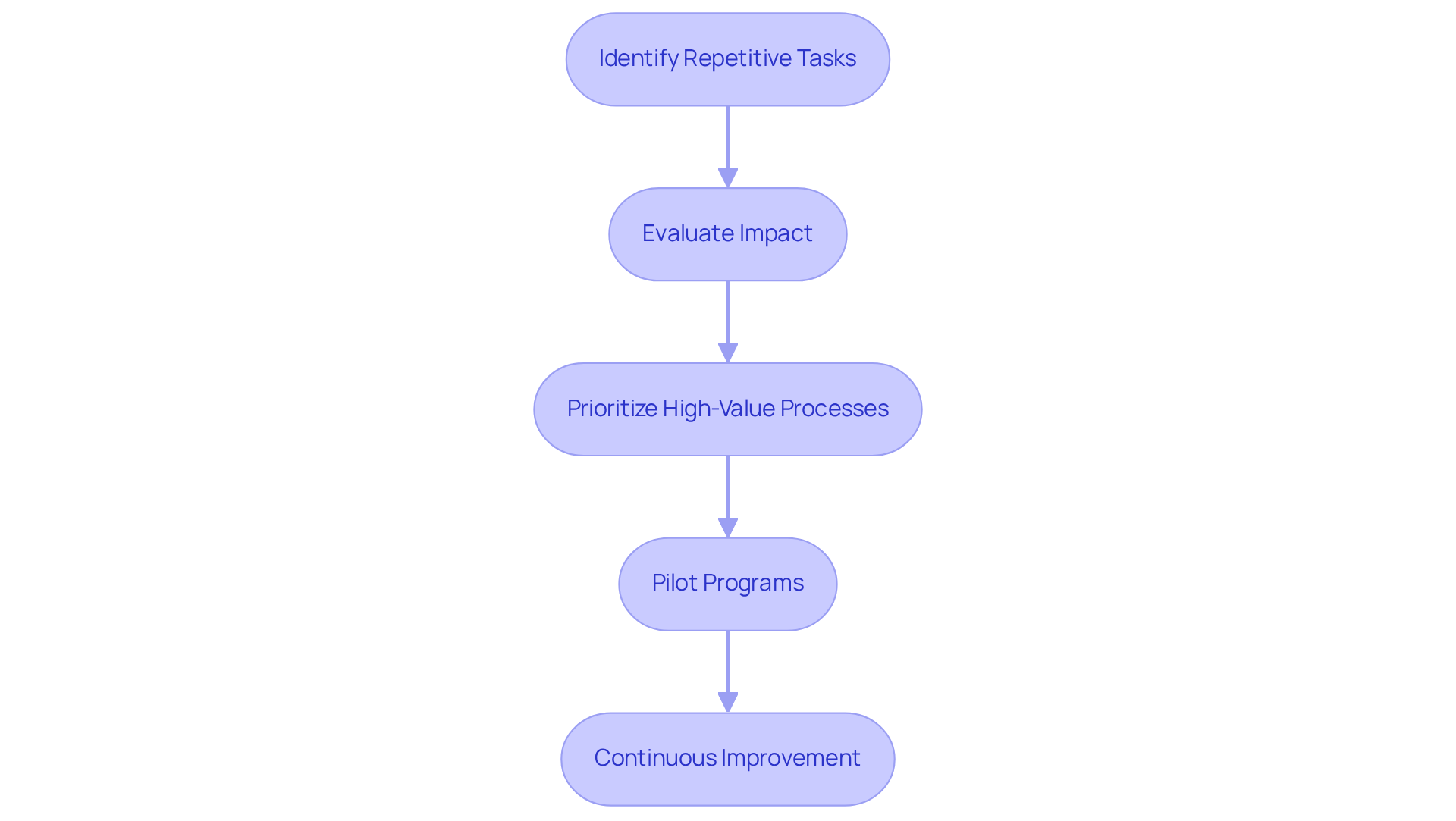

Implement Automation: Strategies for Prioritization and Evaluation

To implement automation effectively, hedge funds should adopt the following strategies:

- Identify Repetitive Tasks: Begin by analyzing current workflows to identify repetitive, time-consuming tasks that are ideal candidates for automation.

- Evaluate Impact: Assess the potential impact of automating each task, taking into account factors such as time savings, error reduction, and improvements in adherence to regulations.

- Prioritize High-Value Processes: Concentrate on automating processes that yield the highest return on investment, particularly those that directly influence trading efficiency or compliance.

- Pilot Programs: Execute pilot projects to evaluate the effectiveness of automation solutions prior to a full-scale rollout, allowing for necessary adjustments based on real-world feedback.

- Continuous Improvement: Create a feedback loop to consistently assess and refine automated processes, ensuring they remain aligned with the evolving needs of the business.

By implementing these strategies, investment groups can optimize the benefits of automation while minimizing disruptions to their operations.

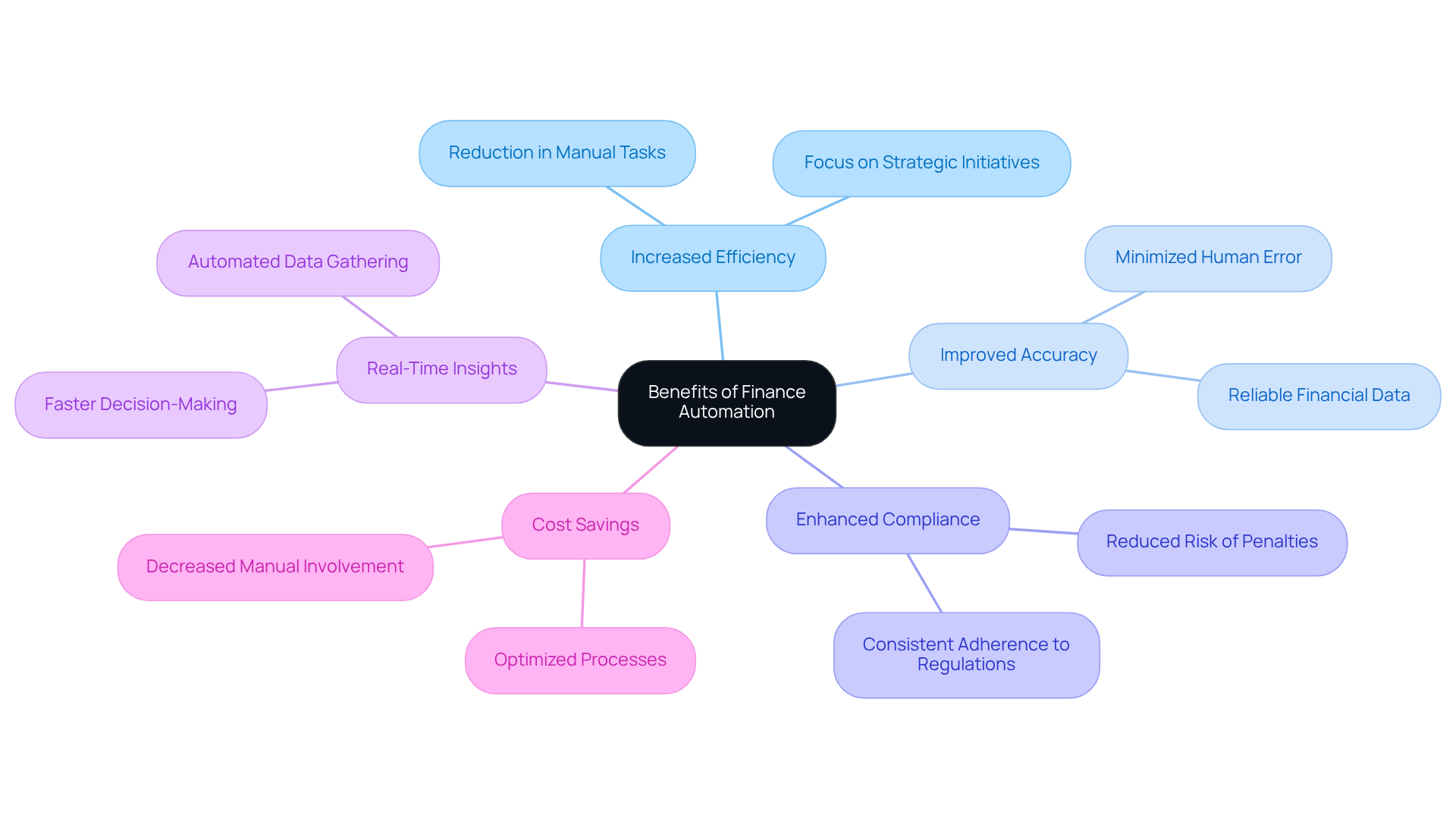

Leverage Benefits: Enhancing Efficiency and Compliance through Automation

The benefits of finance automation for hedge funds are significant and multifaceted:

- Increased Efficiency: Automation significantly reduces the time spent on manual tasks. This allows teams to concentrate on strategic initiatives that drive growth.

- Improved Accuracy: Automated systems effectively minimize human error, resulting in more reliable financial data and reporting.

- Enhanced Compliance: Automation ensures that compliance processes are consistently adhered to, thereby reducing the risk of regulatory penalties.

- Real-Time Insights: Automated data gathering and analysis provide investment groups with real-time insights, facilitating faster and more informed decision-making.

- Cost Savings: By optimizing processes and decreasing the need for manual involvement, automation can lead to substantial cost reductions over time.

These benefits illustrate that automation for financial services not only enhances operational performance but also strengthens the overall compliance framework of hedge funds, positioning them for long-term success.

Conclusion

Mastering automation in financial services is not merely a trend; it is a critical strategy for hedge funds seeking to enhance operational efficiency and maintain a competitive edge. By embracing finance automation, investment groups can streamline processes, reduce human error, and gain valuable insights. This ultimately leads to more informed decision-making and improved risk management.

Key use cases for automation have been identified, including:

- Financial reporting

- Risk management

- Trade execution

- Compliance monitoring

- Data management

Each of these areas illustrates how automation can transform hedge fund operations, enabling quicker responses to market changes while ensuring adherence to regulatory standards. The outlined implementation strategies emphasize the importance of prioritizing high-impact tasks and continuously refining automated processes to align with evolving business needs.

The significance of embracing automation in financial services cannot be overstated. As the industry evolves, hedge funds that effectively leverage these technologies will enhance their operational performance and position themselves for sustainable growth and compliance in an increasingly complex regulatory landscape. Taking proactive steps towards automation today will pave the way for a more efficient and resilient future in finance.

Frequently Asked Questions

What is finance automation?

Finance automation refers to the application of tools designed to streamline and optimize financial processes, reducing manual effort and enhancing accuracy.

What tasks are included in finance automation?

Finance automation encompasses tasks such as invoicing, payroll, accounting, and compliance reporting.

Why is finance technology important?

Finance technology is important because it improves operational efficiency, minimizes human error, and provides real-time insights into financial performance.

How does finance automation benefit investment groups?

For investment groups, finance automation yields significant competitive advantages by enabling faster decision-making and improved risk management.