Best Practices for a Successful Digital Back Office in Hedge Funds

Introduction

In the rapidly changing landscape of hedge funds, the significance of a robust digital back office is paramount. Investment firms are increasingly dependent on technology to streamline operations and ensure compliance. Therefore, understanding best practices is essential for maintaining a competitive edge. However, the swift pace of regulatory changes and the growing complexity of financial markets present challenges.

How can hedge funds effectively navigate these obstacles while optimizing their back office operations?

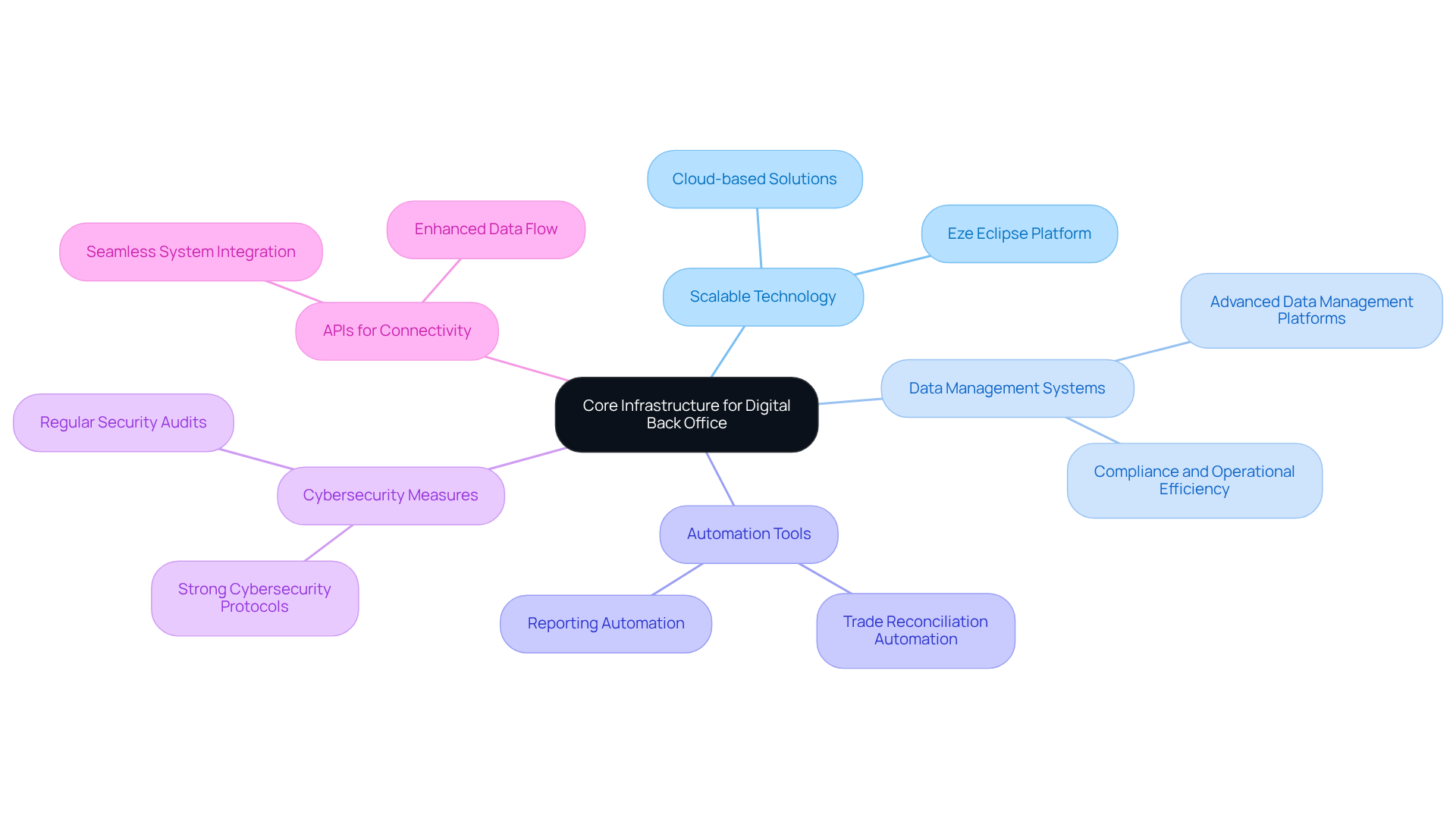

Establish Core Infrastructure for Digital Back Office

To establish a core infrastructure for a digital back office in hedge funds, it is essential to consider the following best practices:

-

Invest in Scalable Technology: Selecting cloud-based solutions that can scale with business needs is crucial. This approach allows for flexibility in resource allocation and accommodates fluctuating workloads. Platforms such as Eze Eclipse, which supports the complete investment lifecycle, are vital for enhancing operational resilience.

-

Implement Robust Data Management Systems: Advanced data management platforms should be utilized to ensure data integrity and accessibility. Statistics indicate that investment pools are increasingly reliant on such technologies, with a significant portion implementing data management systems to maintain compliance and operational efficiency.

-

Adopt Automation Tools: Automating repetitive tasks, including trade reconciliation and reporting, can significantly reduce errors and free up staff for more strategic activities. This transition not only boosts productivity but also aligns with the industry’s ongoing shift towards greater efficiency.

-

Ensure Cybersecurity Measures: Strong cybersecurity protocols must be implemented to safeguard sensitive financial data. Regular audits and updates to security systems are necessary to mitigate risks, particularly in an environment where data breaches can have severe consequences.

-

Integrate APIs for Seamless Connectivity: Application Programming Interfaces (APIs) should be employed to connect various systems and platforms, ensuring smooth data flow and operational efficiency. This integration is essential for maintaining a cohesive digital ecosystem that supports agile decision-making.

By focusing on these areas, investment groups can create a strong digital back office that effectively supports their operational and strategic objectives. Furthermore, with the investment sector projected to expand at a compound annual growth rate (CAGR) of 12.87%, the adoption of these best practices is more critical than ever.

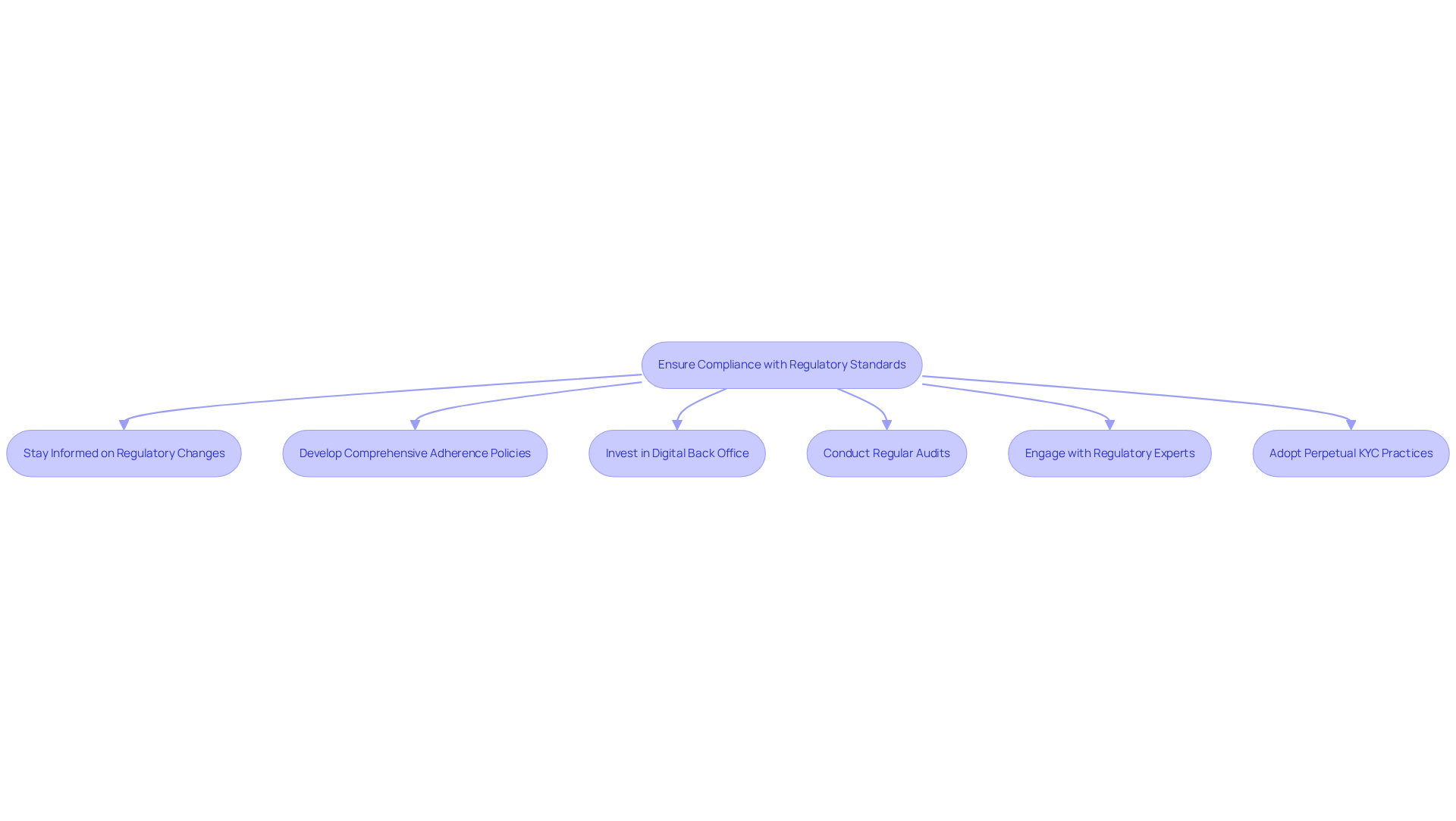

Ensure Compliance with Regulatory Standards

To ensure compliance with regulatory standards in hedge funds, it is essential to implement the following best practices:

-

Stay Informed on Regulatory Changes: Regularly review updates from regulatory bodies such as the SEC and CFTC. The SEC imposed over $5 billion in penalties in 2024 alone, highlighting the financial risks associated with non-compliance. Therefore, aligning practices with evolving requirements is crucial.

-

Develop Comprehensive Adherence Policies: Create detailed manuals that outline procedures for trading, reporting, and risk management. It is vital to educate all staff on these policies, as regulators increasingly hold senior executives accountable for adherence failures.

-

Invest in a digital back office by utilizing management software that automates monitoring and reporting processes. This technology reduces the risk of human error and enhances operational efficiency, allowing hedge funds to concentrate on core investment strategies.

-

Conduct Regular Audits: Schedule internal audits to evaluate adherence to established policies and identify areas for enhancement. This proactive approach can prevent potential violations and is increasingly favored by regulators who are shifting towards proactive supervision.

-

Engage with Regulatory Experts: Collaborate with legal and regulatory professionals to navigate complex regulations. As 86% of investment managers anticipate an increase in third-party assistance for risk management over the next five years, utilizing expert insights can ensure your portfolio remains compliant and competitive.

-

Adopt Perpetual KYC Practices: Implement ongoing client and counterparty screening to meet regulatory expectations. This practice is crucial for maintaining adherence in a rapidly evolving regulatory landscape.

By prioritizing compliance, investment firms can safeguard their operations and build trust with investors, ultimately enhancing their long-term viability.

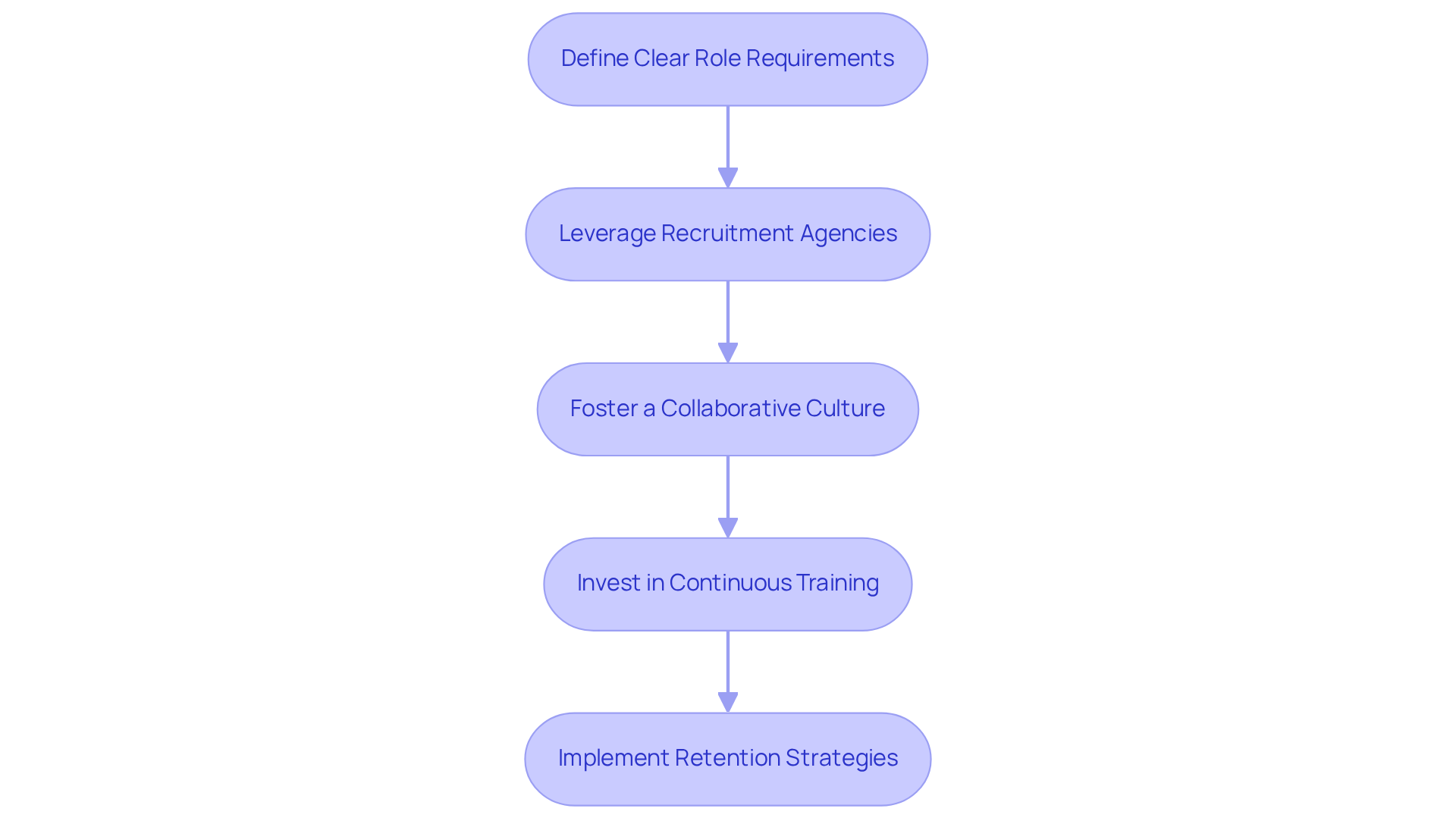

Integrate Specialized Engineering Talent

To effectively integrate specialized engineering talent into your hedge fund’s operations, it is essential to adopt several best practices:

-

Define Clear Role Requirements: Clearly articulate the specific skills and experience necessary for engineering roles. Emphasizing expertise in financial software development and data analysis is crucial. This clarity attracts candidates who are not only technically proficient but also possess an understanding of the financial sector’s nuances.

-

Leverage Recruitment Agencies: Collaborate with recruitment firms that specialize in financial services engineering. These agencies provide access to a broader talent pool and streamline the hiring process, ensuring that you identify candidates who meet your precise needs.

-

Foster a Collaborative Culture: Cultivate an environment that promotes collaboration between engineers and financial analysts. This synergy ensures that technology solutions are innovative and aligned with the business’s strategic goals, thereby enhancing overall efficiency.

-

Invest in Continuous Training: Commit to ongoing training and development for your engineering team. Keeping staff updated on the latest technologies and industry trends is vital for maintaining a competitive edge in a rapidly evolving market.

-

Implement Retention Strategies: Establish programs that enhance employee engagement and satisfaction. Flexible work arrangements and clear career advancement opportunities significantly improve retention rates, ensuring that your investment group retains top engineering talent.

By concentrating on these tactics, investment groups can cultivate a robust engineering team that drives innovation and excellence in operations.

Adopt Flexible Operational Models

To adopt flexible operational models in hedge funds, it is essential to implement the following best practices:

-

Utilize Cloud Solutions: Leverage cloud-based platforms that facilitate easy scaling of resources and support remote work, thereby enhancing operational flexibility.

-

Implement Agile Methodologies: Adopt agile project management techniques to improve responsiveness to changes in market conditions and client needs.

-

Outsource Non-Core Functions: Consider outsourcing functions such as compliance and IT support to specialized firms. This allows your team to concentrate on core investment strategies.

-

Establish a Contingency Plan: Create contingency plans that outline procedures for various scenarios, ensuring that your investment group can swiftly adapt to unforeseen challenges.

-

Encourage Cross-Functional Teams: Promote collaboration across different departments to enhance communication and streamline decision-making processes.

By embracing these flexible operational strategies, hedge funds can significantly enhance their agility and resilience in a dynamic market environment.

Conclusion

The establishment of a successful digital back office in hedge funds is essential for navigating the complexities of today’s financial landscape. By concentrating on effective practices such as:

- Investing in scalable technology

- Implementing robust data management systems

- Ensuring compliance with regulatory standards

Investment firms can significantly enhance their operational efficiency and maintain a competitive edge.

Key insights from this article highlight the necessity of:

- Integrating specialized engineering talent

- Adopting automation tools

- Fostering a culture of collaboration

Moreover, embracing flexible operational models, including cloud solutions and agile methodologies, enables hedge funds to swiftly adapt to market changes and client needs, ultimately driving innovation and resilience.

In a rapidly evolving industry, prioritizing these effective practices not only safeguards compliance and operational integrity but also positions hedge funds for sustainable growth. By taking proactive steps to optimize their digital back office, investment firms can better prepare for future challenges and capitalize on emerging opportunities, ensuring long-term success in the competitive hedge fund arena.

Frequently Asked Questions

What is the importance of establishing a core infrastructure for a digital back office in hedge funds?

Establishing a core infrastructure for a digital back office is crucial for supporting operational and strategic objectives, enhancing operational resilience, and accommodating the projected growth in the investment sector.

What technology should hedge funds invest in for their digital back office?

Hedge funds should invest in scalable, cloud-based technology solutions that can adapt to business needs and support the complete investment lifecycle, such as Eze Eclipse.

Why is robust data management important for hedge funds?

Robust data management systems are essential to ensure data integrity and accessibility, helping investment pools maintain compliance and operational efficiency.

How can automation tools benefit hedge funds?

Automation tools can significantly reduce errors by automating repetitive tasks like trade reconciliation and reporting, allowing staff to focus on more strategic activities and enhancing overall productivity.

What cybersecurity measures should hedge funds implement?

Hedge funds must implement strong cybersecurity protocols, including regular audits and updates to security systems, to protect sensitive financial data and mitigate risks associated with data breaches.

How do APIs contribute to a digital back office?

APIs (Application Programming Interfaces) facilitate seamless connectivity between various systems and platforms, ensuring smooth data flow and operational efficiency, which is vital for agile decision-making.

What is the projected growth rate of the investment sector, and why is it relevant?

The investment sector is projected to expand at a compound annual growth rate (CAGR) of 12.87%, making the adoption of best practices for digital back offices more critical than ever for investment groups.