5 Key Insights on Custom Tailored IT Services for Hedge Funds

Introduction

The financial landscape is evolving rapidly, presenting hedge funds with increasing pressure to adapt to stringent regulatory requirements and dynamic market conditions. Custom-tailored IT services emerge as a pivotal solution, providing the flexibility and precision necessary to enhance operational efficiency and ensure compliance.

However, the choice between bespoke solutions and off-the-shelf software raises critical questions:

- Can standard solutions genuinely meet the unique demands of investment firms, or

- Do they ultimately hinder innovation and growth?

Exploring this dilemma reveals the essential considerations that hedge funds must navigate in their pursuit of an ideal IT strategy.

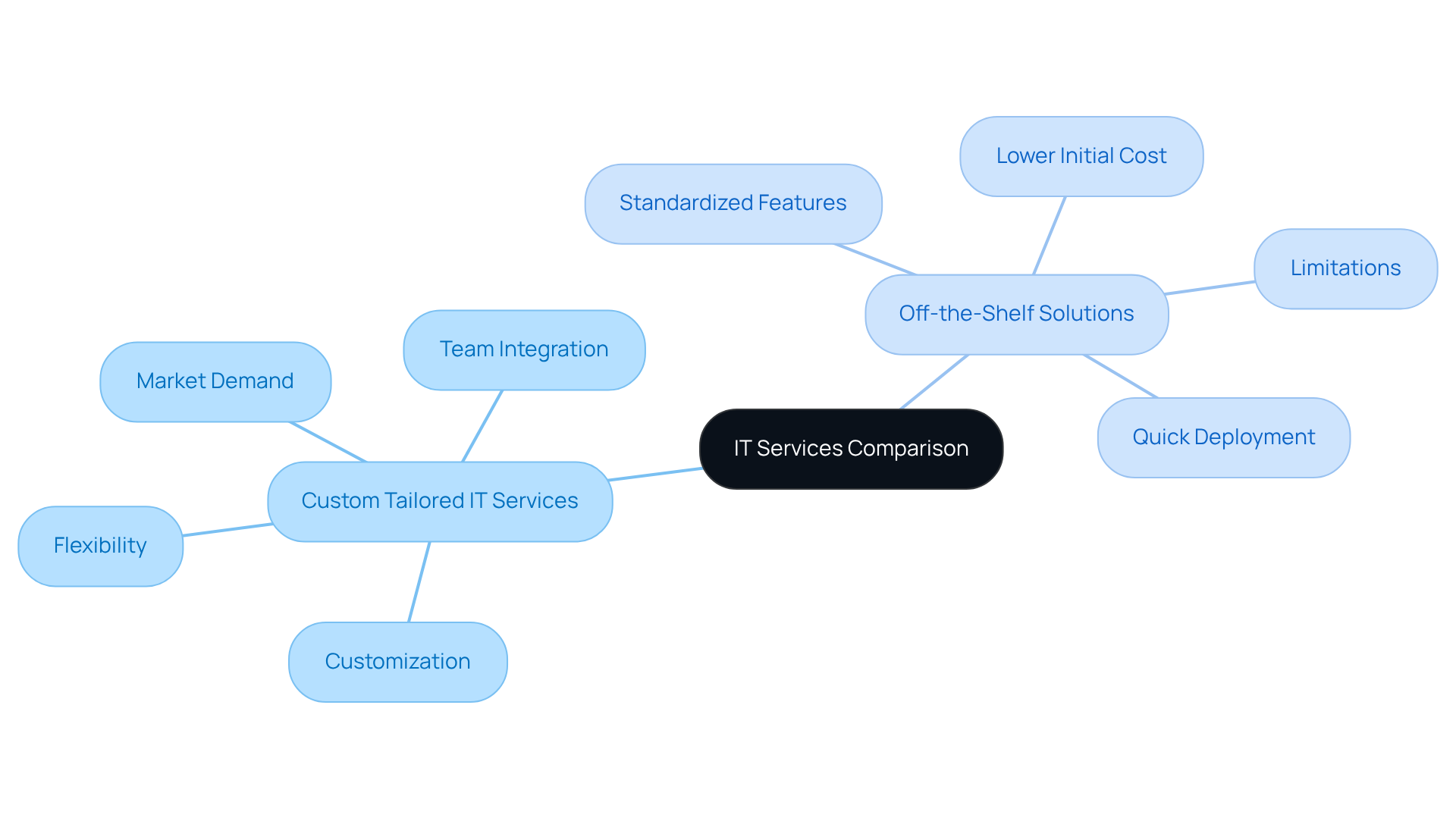

Defining Custom Tailored IT Services and Off-the-Shelf Solutions

At Neutech, we provide custom tailored IT services that are meticulously designed to address the specific needs of investment firms. This approach offers unparalleled flexibility and adaptability, allowing us to respond effectively to evolving market conditions and regulatory requirements. Once we collaboratively identify your needs, Neutech will present several potential designers and developers to integrate into your team. This direct involvement enhances the customization of every feature, ensuring alignment with your organization’s operational strategies and compliance mandates.

In contrast, ready-made software products are pre-packaged applications aimed at a broad audience. These solutions typically offer standardized features that may not adequately meet the unique requirements of investment firms. While ready-made options can be deployed quickly and often come with a lower initial cost, they frequently fall short in terms of customization, which is crucial for optimal performance in a highly regulated environment.

As the investment sector continues to grow, with an estimated market size of $5 trillion and significant reallocations expected annually, the demand for custom tailored IT services that enhance operational efficiency and compliance is increasingly vital. By 2026, the market for ready-made IT offerings in investment firms is projected to remain competitive, with North America accounting for approximately 40% of global revenue in 2024. Companies seeking a unique advantage may find that tailored approaches, supported by Neutech’s specialized talent provision, deliver the necessary adaptability and integration capabilities to thrive in this dynamic landscape.

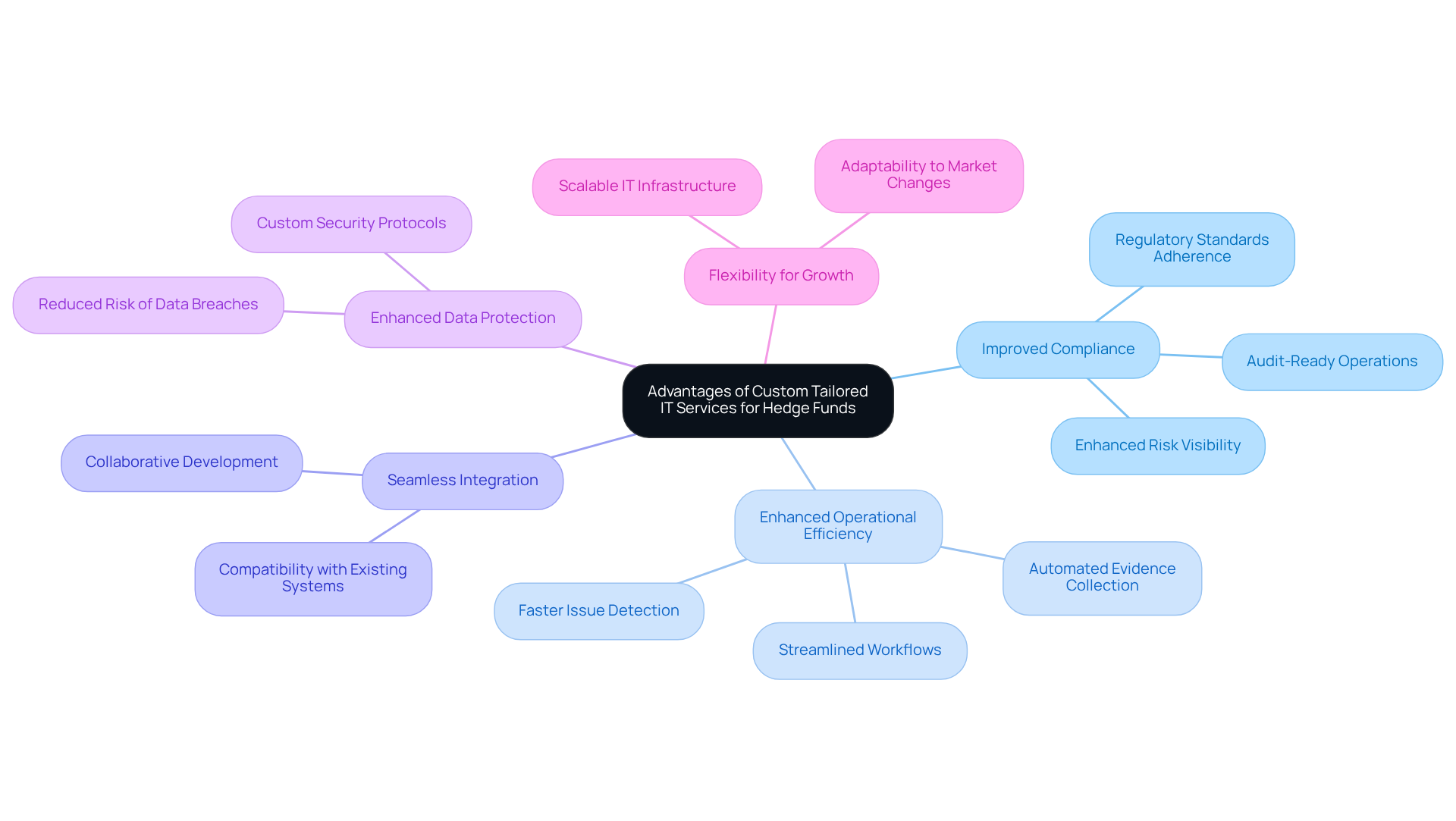

Advantages of Custom Tailored IT Services for Hedge Funds

Investment firms can benefit from custom tailored IT services that provide significant advantages, including:

- Improved compliance with regulatory standards

- Enhanced operational efficiency

- Seamless integration with existing systems

At Neutech, we initiate the process by collaboratively identifying your specific needs. This allows us to provide specialized designers and developers who can integrate directly into your team.

These tailored approaches can be customized to align with specific investment strategies and reporting requirements, enabling investment groups to respond swiftly to market fluctuations. Additionally, custom tailored IT services often enhance data protection, as they can be designed with specific security protocols in mind, thereby reducing the risk of data breaches.

Moreover, the flexibility of custom tailored IT services allows investment groups to scale their IT infrastructure in accordance with their growth and evolving business needs.

Benefits and Limitations of Off-the-Shelf IT Solutions

Ready-made IT options offer significant advantages for hedge funds, including lower initial costs, quicker implementation times, and a comprehensive array of features that cater to common operational needs. These solutions benefit from extensive testing and a broad user base, which enhances their reliability and minimizes maintenance expenses. For instance, the implementation of ready-made options is typically around 60% faster than that of customized alternatives.

However, there are notable limitations. Off-the-shelf software often lacks the necessary customization to fulfill specific regulatory compliance requirements or unique operational workflows. As hedge funds expand and adapt, these solutions may struggle to scale effectively, resulting in inefficiencies and heightened operational risks. Financial analysts have noted that while ready-made options can be appealing for smaller investments, they may not provide the competitive edge required in a rapidly evolving market.

Anish Devasia highlights that ‘over 90% of midsize and large firms report downtime expenses surpassing $300,000 per hour,’ emphasizing the financial repercussions of downtime linked to ready-made products. Furthermore, many investment groups have indicated that reliance on standard solutions can hinder their ability to implement distinctive trading strategies, which are essential for maintaining a competitive advantage. Ultimately, investment pools must weigh the immediate benefits of ready-made options against the long-term implications for scalability and operational integrity.

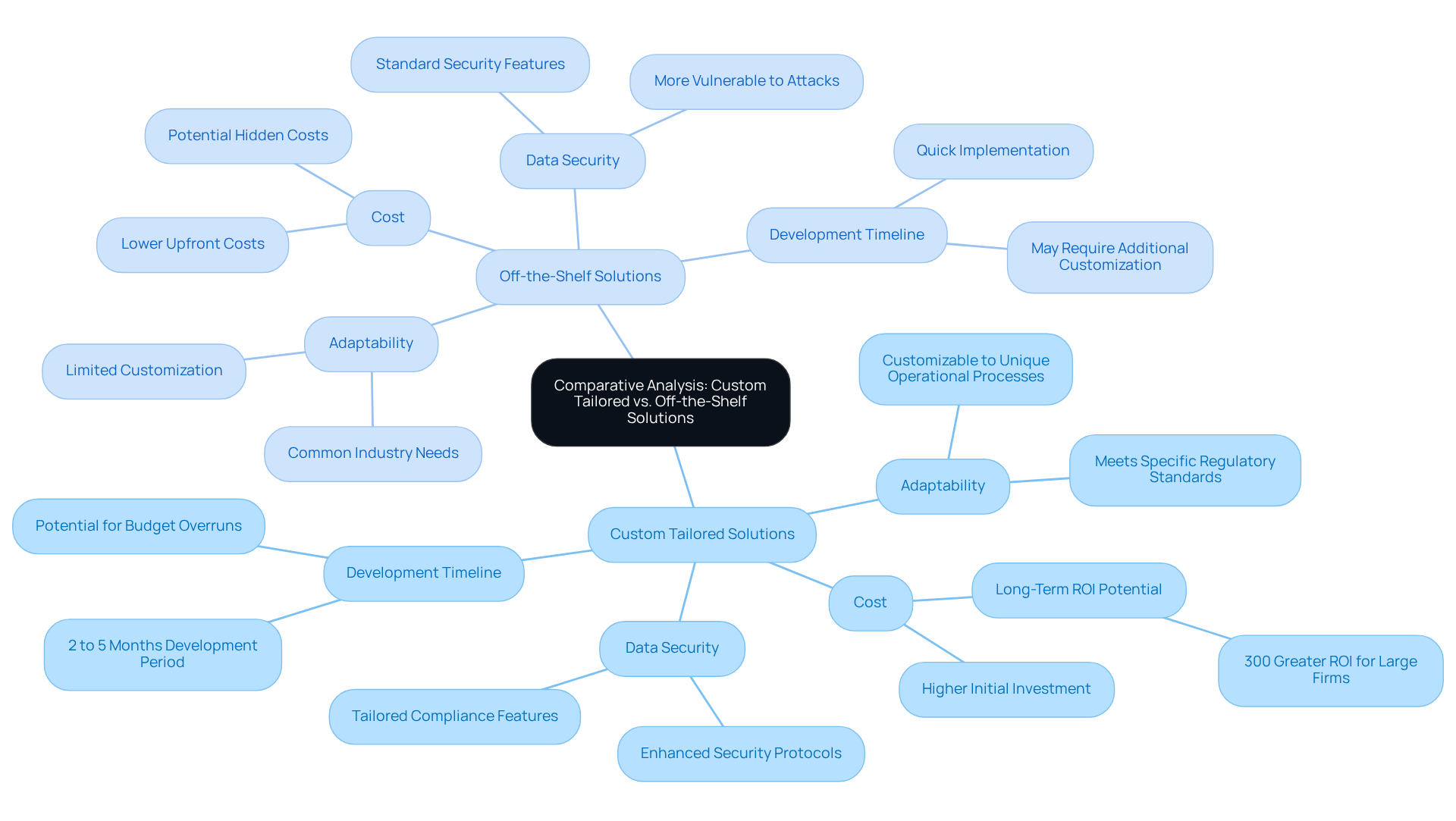

Comparative Analysis: Custom Tailored vs. Off-the-Shelf Solutions

When assessing bespoke IT services against ready-made offerings, several critical factors come into play. Bespoke options are particularly notable for their adaptability, enabling hedge portfolios to customize software to meet specific regulatory standards and unique operational processes. This adaptability is vital in an environment where compliance and operational efficiency are of utmost importance. Neutech recognizes this necessity and provides a tailored engineering talent provision process, assessing client needs and supplying specialized developers and designers skilled in technologies such as React, Python, and GoLang, ensuring seamless integration into your team.

Conversely, ready-made options may offer quicker implementation and lower upfront costs, appealing to funds with constrained budgets or urgent requirements. However, the long-term financial implications of these ready-made solutions can be substantial. Such approaches often lead to inefficiencies and may require additional customization, ultimately escalating costs over time. For instance, companies with over 500 users have reported approximately 300% greater ROI from custom software, underscoring the potential long-term benefits of investing in tailored solutions.

Moreover, bespoke approaches inherently provide enhanced data security and compliance features, which are crucial for safeguarding sensitive financial information in a highly regulated landscape. Hedge pools utilizing ready-made software have faced data security incidents, revealing the vulnerabilities associated with standard solutions. In contrast, custom software facilitates the implementation of tailored security protocols, bolstering protection against potential breaches.

The development timeline for bespoke software typically ranges from 2 to 5 months, influenced by the technologies used, such as .NET or Node.js. This timeframe is a significant consideration for investment firms as they evaluate their options. However, it is essential to recognize the potential risks associated with custom software development, including budget overruns and extended development periods, which can affect project timelines and costs.

Ultimately, the decision between custom tailored IT services and ready-made options depends on the specific operational needs, budget constraints, and long-term strategic objectives of the investment firm. As companies navigate the complexities of the financial landscape, the choice of a technology partner and software will significantly influence their ability to innovate and maintain a competitive edge.

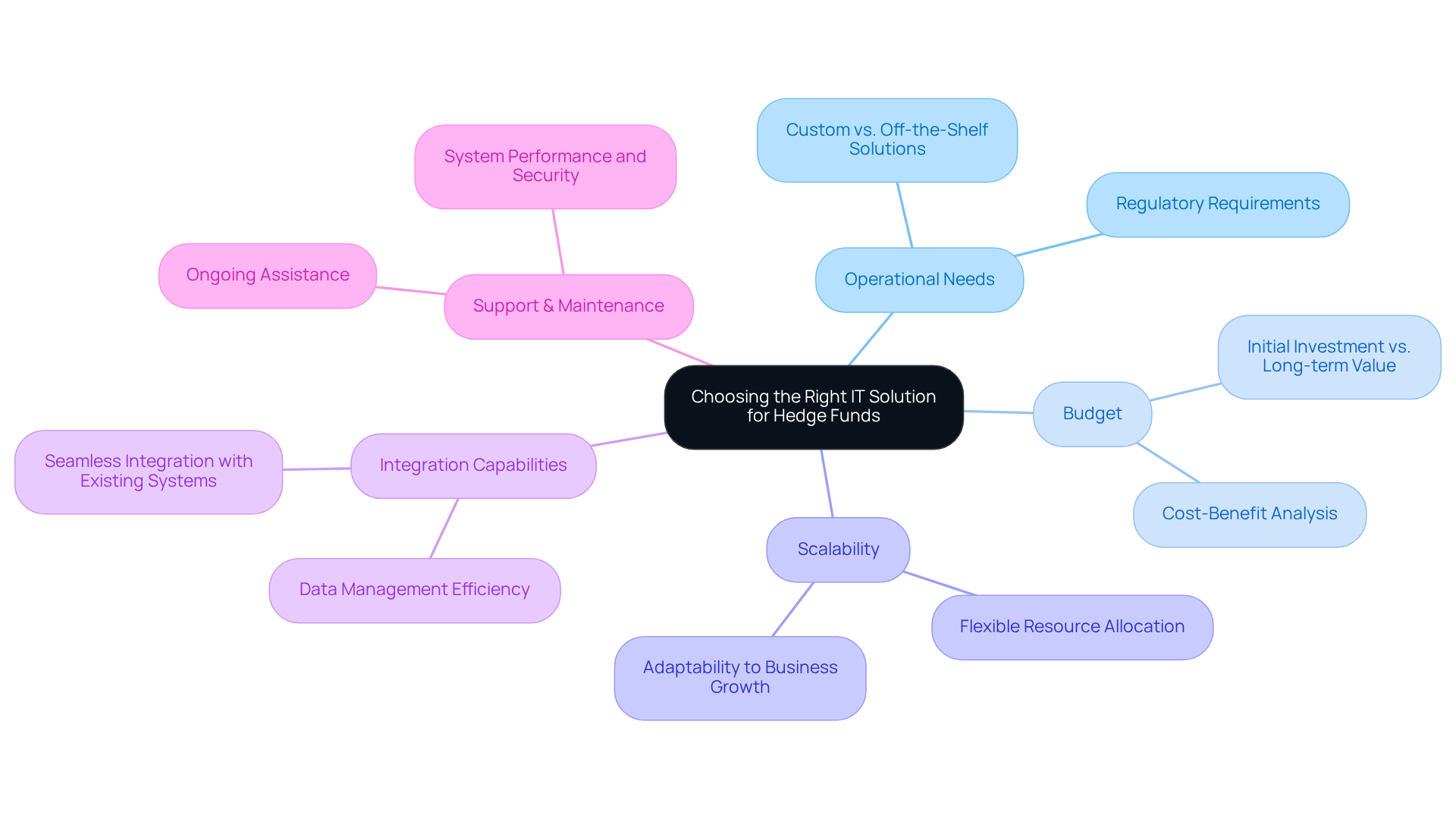

Choosing the Right IT Solution for Hedge Funds: Key Considerations

Choosing the appropriate IT option is crucial for hedge funds. This decision necessitates a comprehensive assessment of several key factors. First, firms must evaluate their unique operational needs and regulatory requirements to determine whether a custom or off-the-shelf solution is more suitable. Budget limitations significantly influence this choice; while custom tailored IT services may require a higher initial investment, they often deliver superior long-term value through enhanced efficiency and compliance.

Scalability is another vital consideration, as the selected option must be capable of evolving alongside the business. Neutech’s flexible engineering talent model, featuring month-to-month contracts, enables hedge funds to easily adjust their development resources as needed. This flexibility ensures that firms can adapt to changing demands without being tied to long-term commitments.

Additionally, integration capabilities with existing systems are essential. Seamless integration can greatly enhance operational efficiency, allowing for smoother workflows and improved data management. Lastly, the level of support and maintenance provided by the solution provider is critical. Ongoing assistance is necessary to sustain system performance and security, ensuring that hedge funds can operate effectively in a regulated environment.

Conclusion

The evaluation of IT solutions for hedge funds presents a pivotal decision between custom tailored services and off-the-shelf options. Custom tailored IT services are distinguished by their capacity to address the unique demands of investment firms, offering the flexibility and adaptability essential for navigating the complexities of regulatory compliance and operational efficiency. Conversely, while off-the-shelf solutions may provide immediate cost savings and quicker implementation, they frequently lack the necessary customization to effectively support the distinctive strategies and needs of hedge funds.

Key insights from the article underscore the benefits of custom tailored IT services, which include:

- Improved compliance

- Enhanced operational efficiency

- Seamless integration with existing systems

These services empower hedge funds to respond dynamically to market fluctuations and regulatory requirements, ultimately safeguarding sensitive data and ensuring long-term operational integrity. In contrast, the limitations of ready-made solutions, such as scalability issues and potential security vulnerabilities, highlight the importance of carefully considering the long-term implications of these choices.

As hedge funds continue to evolve within a competitive landscape, the decision regarding IT solutions becomes increasingly critical. Firms must evaluate their specific operational needs, budget constraints, and strategic objectives to select the appropriate technology partner. Embracing custom tailored IT services can provide a significant advantage, enabling investment firms to innovate and thrive in an ever-changing financial environment. Taking proactive measures to assess and implement the best IT solutions will ultimately position hedge funds for sustained success and growth.

Frequently Asked Questions

What are custom tailored IT services?

Custom tailored IT services are specifically designed solutions that address the unique needs of investment firms, offering flexibility and adaptability to respond to changing market conditions and regulatory requirements.

How does Neutech approach the development of custom IT services?

Neutech collaborates with clients to identify their specific needs and then presents potential designers and developers to integrate into their team, enhancing the customization of features to align with operational strategies and compliance mandates.

What are off-the-shelf solutions?

Off-the-shelf solutions are pre-packaged software products aimed at a broad audience, offering standardized features that may not meet the specific requirements of investment firms.

What are the limitations of off-the-shelf IT solutions for investment firms?

Off-the-shelf solutions often lack the necessary customization for optimal performance in a regulated environment, even though they can be deployed quickly and may have a lower initial cost.

Why is there a growing demand for custom tailored IT services in the investment sector?

The investment sector is expanding, with a projected market size of $5 trillion and significant reallocations expected annually, leading to an increased need for IT services that enhance operational efficiency and compliance.

What advantages do custom tailored IT services offer to hedge funds?

Custom tailored IT services provide improved compliance with regulatory standards, enhanced operational efficiency, seamless integration with existing systems, and better data protection through specific security protocols.

How does Neutech ensure that their IT services align with investment strategies?

Neutech works collaboratively with investment firms to identify their specific needs, allowing for tailored approaches that align with investment strategies and reporting requirements.

How do custom tailored IT services support scalability for investment firms?

The flexibility of custom tailored IT services allows investment groups to scale their IT infrastructure according to their growth and evolving business needs.