Top 10 Software Development Companies for Hedge Fund Success

Introduction

In the dynamic realm of finance, hedge funds increasingly depend on advanced technology to sustain their competitive advantage. Selecting the right software development partner can significantly influence a hedge fund’s trajectory, distinguishing between success and stagnation. Such partners provide customized solutions that not only enhance operational efficiency but also ensure adherence to rigorous regulatory standards. Given the multitude of options available, hedge funds face the challenge of identifying software development firms that genuinely comprehend their distinct challenges and requirements.

This article examines the top ten software development companies equipped to propel hedge fund success, emphasizing their specialized services and innovative strategies that can revolutionize financial operations.

Neutech: Specialized Engineering Talent for Regulated Industries

Neutech stands as a premier software and design development agency, specializing in delivering advanced engineering expertise tailored for regulated sectors, particularly within service industries and healthcare. Through a rigorous residency program in collaboration with the University of São Paulo, Neutech guarantees that its engineers achieve senior-level proficiency alongside industry-specific knowledge. This focus on specialized training empowers Neutech to offer high-quality, compliant software solutions that meet the stringent requirements of investment firms and other financial institutions.

The agency’s zero-bench philosophy ensures that every engineer is actively involved in projects, providing clients with the flexibility to scale resources as necessary. Neutech’s dedication to reliability is reflected in its high employee retention rate and proactive strategies, such as maintaining a pool of replacement developers to ensure continuity in client projects. By emphasizing intangibles like work ethic, communication, and leadership, Neutech not only elevates the caliber of its engineering talent but also cultivates a collaborative environment that aligns with client objectives.

Furthermore, Neutech offers flexible month-to-month contracts and an agile resource allocation model, allowing clients to efficiently adapt their engineering resources to meet changing project demands. The client engagement process initiates with a complimentary consultation to assess client needs, followed by the careful selection of suitable candidates and regular management calls to reinforce project alignment.

Euristiq: Comprehensive Software Development Services

Euristiq is a distinguished digital transformation agency that specializes in developing customized software applications utilizing emerging technologies. The agency emphasizes its expertise in:

- Internet of Things (IoT)

- Artificial intelligence (AI)

- Cloud adoption

This positions itself as a vital partner for hedge funds seeking to innovate and modernize their operations.

Euristiq’s commitment to security and reliability ensures that institutions can confidently implement its solutions to manage sensitive data, all while complying with stringent regulatory standards. This focus on security is crucial in today’s financial landscape, where data integrity and compliance are paramount.

Additionally, Euristiq employs an agile approach that promotes rapid iteration and adaptation. This flexibility is a significant advantage in the ever-evolving financial sector, where timely responses to market changes are essential for maintaining a competitive edge.

MindSea: Mobile App Development and UX Design Expertise

MindSea stands out as a leading mobile app development company, collaborating with key players in Health Tech and Wellness to design user-centered applications. Their commitment to UX design guarantees that these applications are not only functional but also engaging for users. For investment groups, this presents a significant opportunity to develop mobile solutions that enhance client interactions and streamline operations.

MindSea’s expertise in crafting intuitive interfaces can significantly boost user satisfaction and retention, positioning them as a valuable partner within the services industry. Furthermore, Neutech’s specialized engineering talent provision process can supply dedicated developers and designers, further augmenting MindSea’s capabilities.

Research indicates that even a modest 5% increase in retention can lead to profit growth of 25-95%, highlighting the critical role of effective UX design in minimizing churn rates and fostering customer loyalty. Success stories from investment groups illustrate how MindSea’s design principles not only enhance user experiences but also contribute to overall operational efficiency, underscoring the vital importance of UX in the competitive landscape of financial applications.

As industry experts assert, “Investment in money, time, and resources is necessary to reap worthwhile benefits,” which emphasizes the strategic value of prioritizing UX in financial services.

Spiria: Custom Software Solutions with Agile Methodologies

Spiria stands as a prominent software engineering firm, specializing in custom software solutions that utilize agile methodologies to enhance operational efficiency. By streamlining processes and optimizing workflows, Spiria empowers hedge funds to achieve quicker delivery of software solutions that can rapidly adapt to changing market conditions. Their commitment to collaboration and transparency fosters active client engagement throughout the development process, resulting in tailored solutions that effectively address specific requirements. This approach not only accelerates project timelines but also ensures that the final products are closely aligned with the strategic objectives of financial organizations, ultimately promoting success in a competitive landscape.

Iversoft: Innovative Mobile and Web Application Development

Iversoft distinguishes itself as a mobile-first software creation company, specializing in the development of custom applications that significantly enhance user experience. This focus on mobile solutions is particularly advantageous for investment groups seeking to provide clients with seamless access to services. Leveraging their expertise in UX design and multi-platform application development, Iversoft empowers investment groups to deliver high-quality, engaging applications that align with the expectations of today’s discerning users.

Success stories from Iversoft exemplify their ability to transform financial applications, ensuring that user experience is not merely an afterthought but a fundamental aspect of their development process.

Whitecap Canada: Expertise in Software Engineering and Project Management

Whitecap Canada is recognized as a leading software development firm, with over 25 years of experience in delivering custom digital solutions specifically designed for hedge funds. Their deep expertise in software engineering and project management establishes them as a reliable partner for financial institutions seeking to develop secure and scalable applications.

The firm’s unwavering commitment to quality and compliance ensures that their solutions meet the rigorous standards of the financial services sector. This dedication not only provides clients with essential peace of mind but also reinforces the importance of compliance as a cornerstone of trust in digital financial solutions.

Industry leaders emphasize that compliance transcends mere regulatory requirements; it is fundamental to fostering trust in digital operations within finance. This perspective underscores Whitecap’s pivotal role in facilitating secure monetary transactions.

247 Labs Inc.: Agile Development Practices and Client Commitment

247 Labs Inc. stands out as a leading Canadian firm specializing in custom software development and AI integration, particularly within the financial sector. Their agile development methodologies enable the prompt delivery of high-quality applications, meticulously tailored to meet the specific needs of clients. This adaptability is crucial for investment groups, allowing them to swiftly respond to evolving market conditions and demands.

The company’s steadfast dedication to client satisfaction is evident in their remarkable track record, with 93% of Agile companies reporting improved customer satisfaction. This ongoing commitment to enhancement has solidified 247 Labs’ reputation as a trustworthy partner in the investment sector, positioning them as an excellent choice for investment groups in search of reliable and innovative software solutions.

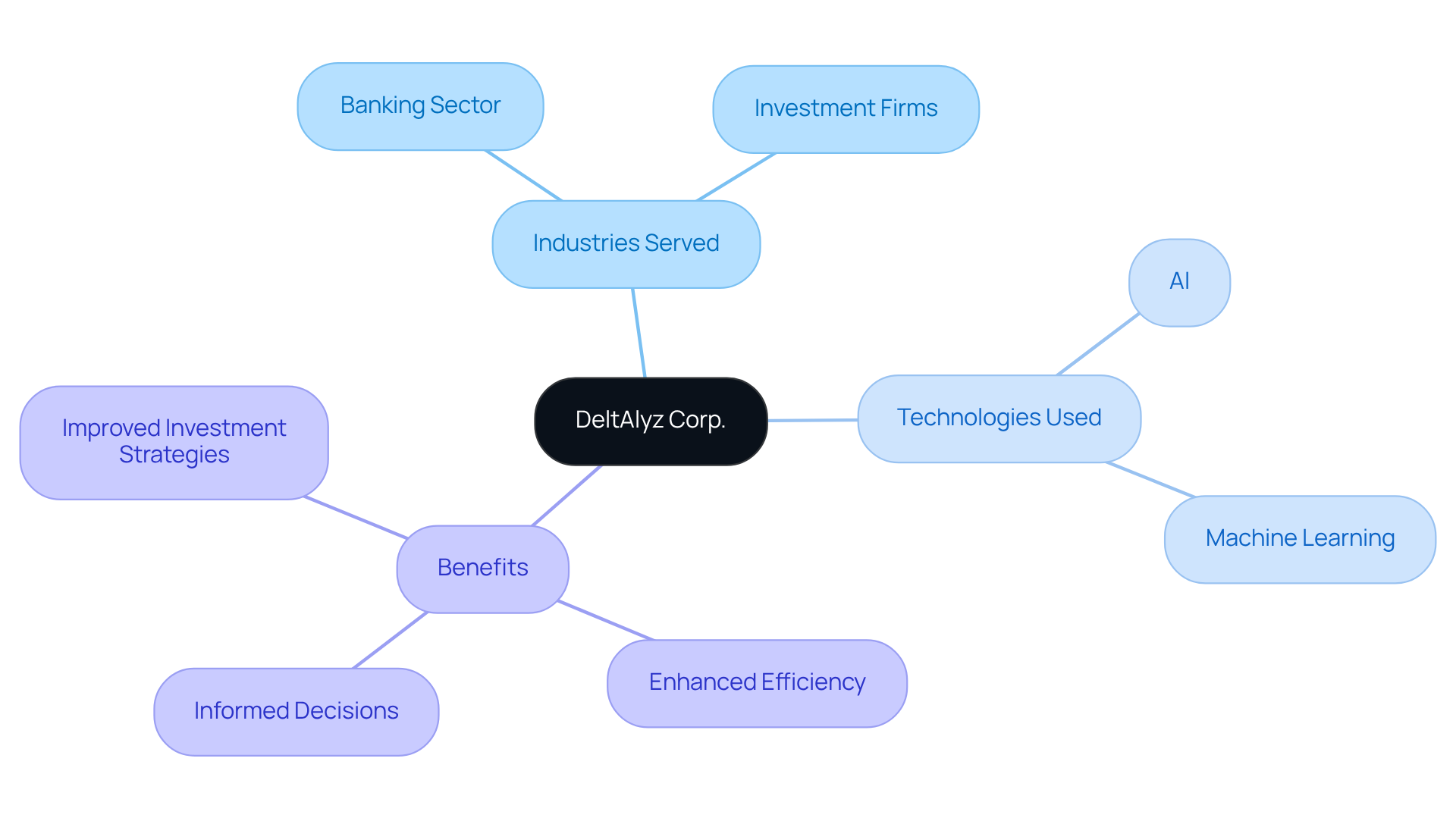

DeltAlyz Corp.: Custom Software Solutions Across Industries

DeltAlyz Corp. stands out as a leader in providing custom AI-powered software solutions that significantly enhance efficiency and drive innovation within the banking sector. Their deep expertise in systems integration and data analytics positions them as a vital partner for investment firms aiming to improve operational capabilities. By leveraging AI and machine learning, DeltAlyz enables institutions to make informed, data-driven decisions, which ultimately leads to enhanced investment strategies and robust risk management practices.

Industry leaders recognize the critical role of data analytics in investment operations. Firms that employ advanced analytics can experience a notable increase in predictive accuracy and alpha generation. Success stories from DeltAlyz illustrate how their tailored solutions have empowered investment groups to navigate complex market dynamics effectively, underscoring the importance of integrating advanced technology into financial decision-making.

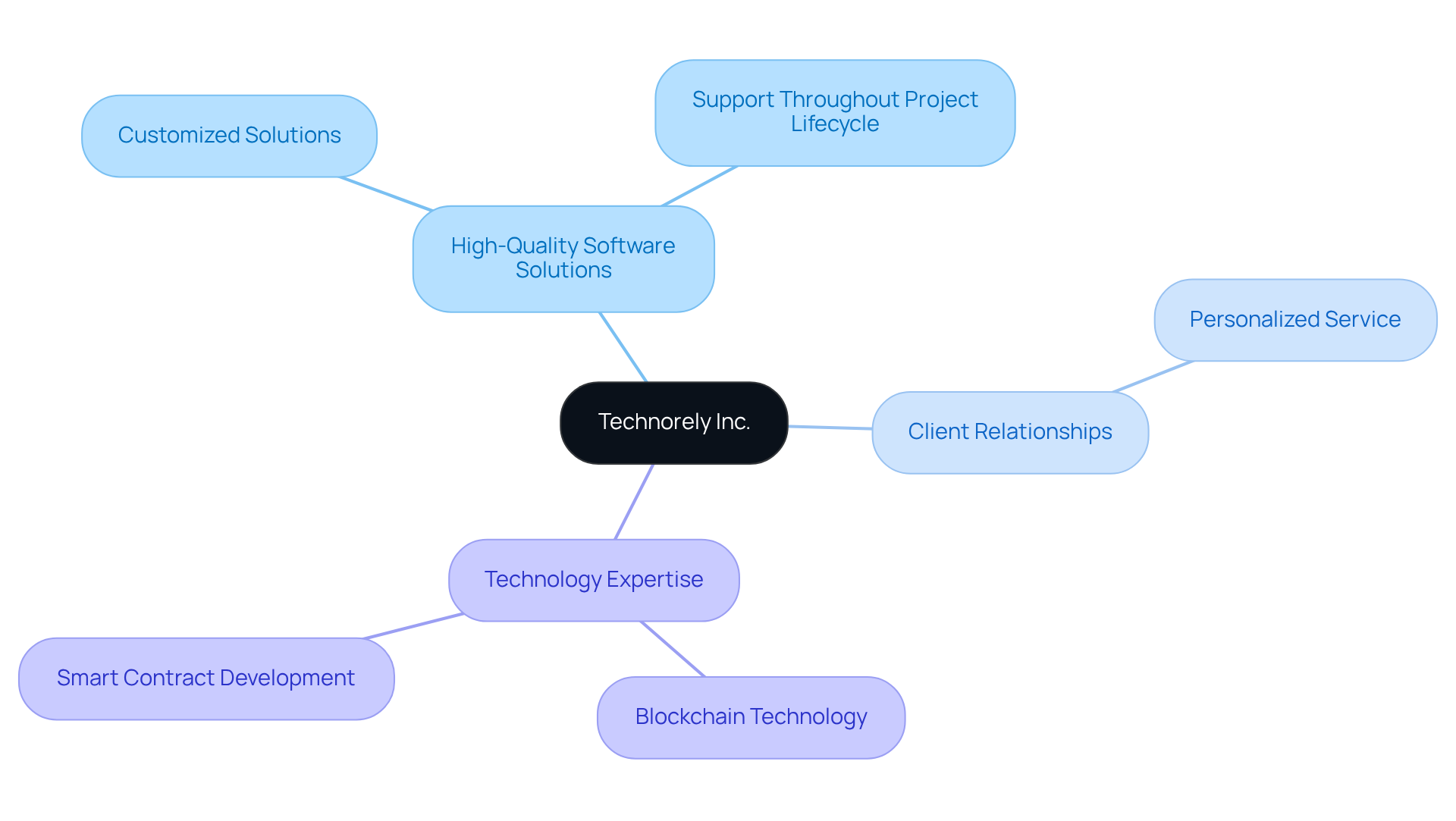

Technorely Inc.: High-Quality Software Solutions and Client Relationships

Technorely Inc. is a distinguished Canadian software creation and IT outsourcing firm that is dedicated to delivering high-quality, customized solutions tailored to the specific needs of investment groups. Their focus on fostering strong client relationships ensures that institutions receive personalized service and ongoing support throughout the project lifecycle.

With a robust expertise in blockchain technology and smart contract development, Technorely positions itself as an innovative partner for hedge funds. This partnership enables them to leverage advanced technology, thereby maintaining a competitive edge in the rapidly evolving economic landscape.

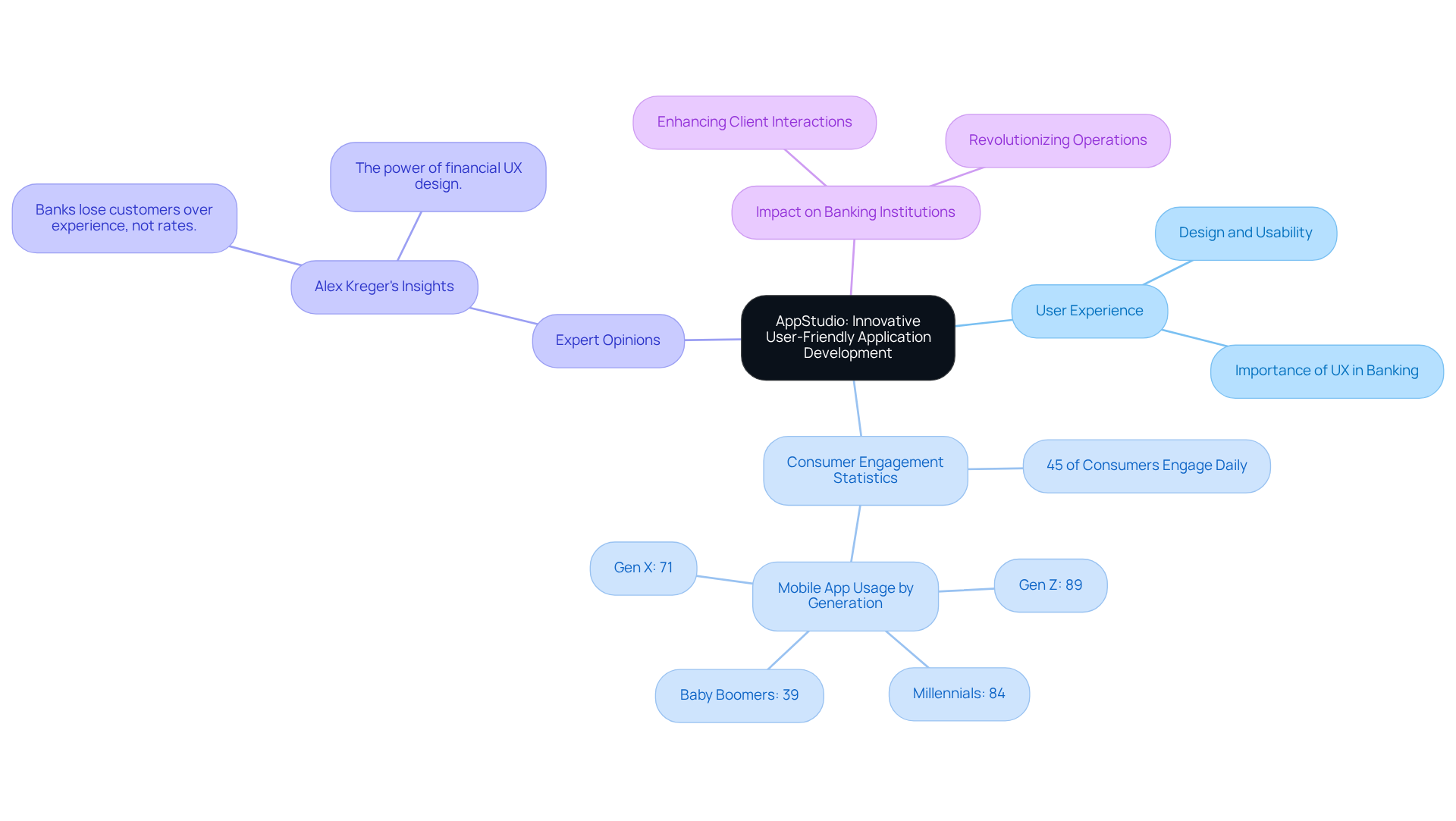

AppStudio: Innovative User-Friendly Application Development

AppStudio stands out as a premier mobile app development firm, dedicated to creating user-friendly applications tailored to the specific needs of banking institutions. Their innovative approach to app development not only meets functional requirements but also emphasizes exceptional user experience, a critical factor in today’s competitive landscape. Statistics indicate that 45% of consumers engage in finance-related tasks on a mobile app at least once daily, underscoring the necessity for institutions to effectively engage their clients.

By focusing on design and usability, AppStudio empowers investment firms to enhance operations and improve client interactions. Industry leaders highlight that banks frequently lose customers not due to interest rates but because of inadequate user experiences, which reinforces the essential role of thoughtful design in financial applications. As Alex Kreger, CEO of UXDA, noted, “Banks don’t lose customers over rates – they lose them over experience.” AppStudio’s dedication to innovative app development positions them as a pivotal player in reshaping how hedge funds connect with clients and manage their operations.

Conclusion

The landscape of software development for hedge funds is evolving rapidly, with specialized firms emerging to meet the unique demands of the financial sector. Each of the highlighted companies brings a distinct set of skills and innovations that cater to the specific needs of investment firms, ensuring they remain competitive in a challenging environment. By leveraging advanced technologies, agile methodologies, and a commitment to user experience, these companies provide the essential tools that hedge funds need for success.

From Neutech’s expertise in regulated industries to Euristiq’s focus on digital transformation, this article showcases a variety of firms that are paving the way for innovation in financial technology. MindSea emphasizes the importance of user-centric design, while Spiria and 247 Labs Inc. highlight the benefits of agile development practices. Additionally, companies like DeltAlyz Corp. and Technorely Inc. illustrate how AI and blockchain can enhance operational efficiency and security. Each firm’s unique offerings contribute significantly to the overall success of hedge funds, demonstrating the critical role of tailored software solutions in the financial sector.

As hedge funds navigate an increasingly complex market, the choice of a software development partner becomes paramount. Investing in the right technology and expertise not only streamlines operations but also enhances client interactions and compliance with regulatory standards. By prioritizing partnerships with these leading software development firms, hedge funds can position themselves for sustained success and innovation in the ever-evolving financial landscape.

Frequently Asked Questions

What is Neutech and what industries does it specialize in?

Neutech is a premier software and design development agency that specializes in providing advanced engineering expertise tailored for regulated sectors, particularly within service industries and healthcare.

How does Neutech ensure the proficiency of its engineers?

Neutech ensures the proficiency of its engineers through a rigorous residency program in collaboration with the University of São Paulo, which helps them achieve senior-level proficiency alongside industry-specific knowledge.

What is Neutech’s zero-bench philosophy?

Neutech’s zero-bench philosophy means that every engineer is actively involved in projects, allowing clients the flexibility to scale resources as necessary.

How does Neutech maintain reliability in its services?

Neutech maintains reliability through a high employee retention rate and proactive strategies, such as keeping a pool of replacement developers to ensure continuity in client projects.

What type of contracts does Neutech offer to its clients?

Neutech offers flexible month-to-month contracts and an agile resource allocation model, enabling clients to adapt their engineering resources efficiently to changing project demands.

What is the client engagement process at Neutech?

The client engagement process at Neutech begins with a complimentary consultation to assess client needs, followed by the careful selection of suitable candidates and regular management calls to reinforce project alignment.

What services does Euristiq provide?

Euristiq specializes in developing customized software applications using emerging technologies, particularly in Internet of Things (IoT), artificial intelligence (AI), and cloud adoption.

How does Euristiq ensure security and reliability in its solutions?

Euristiq emphasizes security and reliability in its solutions, ensuring that institutions can manage sensitive data while complying with stringent regulatory standards.

What approach does Euristiq use for software development?

Euristiq employs an agile approach that promotes rapid iteration and adaptation, which is essential for responding to market changes in the financial sector.

What is MindSea known for?

MindSea is a leading mobile app development company that collaborates with key players in Health Tech and Wellness to design user-centered applications.

How does MindSea enhance user satisfaction?

MindSea enhances user satisfaction through its commitment to UX design, crafting intuitive interfaces that engage users and boost retention.

What impact does effective UX design have on investment groups?

Effective UX design can significantly minimize churn rates and foster customer loyalty, with research indicating that even a modest 5% increase in retention can lead to profit growth of 25-95%.

How does Neutech support MindSea’s capabilities?

Neutech can supply dedicated developers and designers to augment MindSea’s capabilities in mobile app development and UX design.