Why Hedge Funds Need Customised Software Solutions for Success

Introduction

In the complex realm of hedge funds, precision and adaptability are essential. The demand for customized software solutions has reached unprecedented levels. These tailored applications not only tackle the unique operational and regulatory challenges that investment firms encounter but also significantly enhance decision-making and operational efficiency.

As the financial landscape continues to evolve, a critical question emerges: what risks do hedge funds face if they persist in relying on generic software solutions? Analyzing this tension underscores the substantial impact that bespoke technology can have on a hedge fund’s success and competitiveness in an ever-changing market.

Define Customized Software Solutions for Hedge Funds

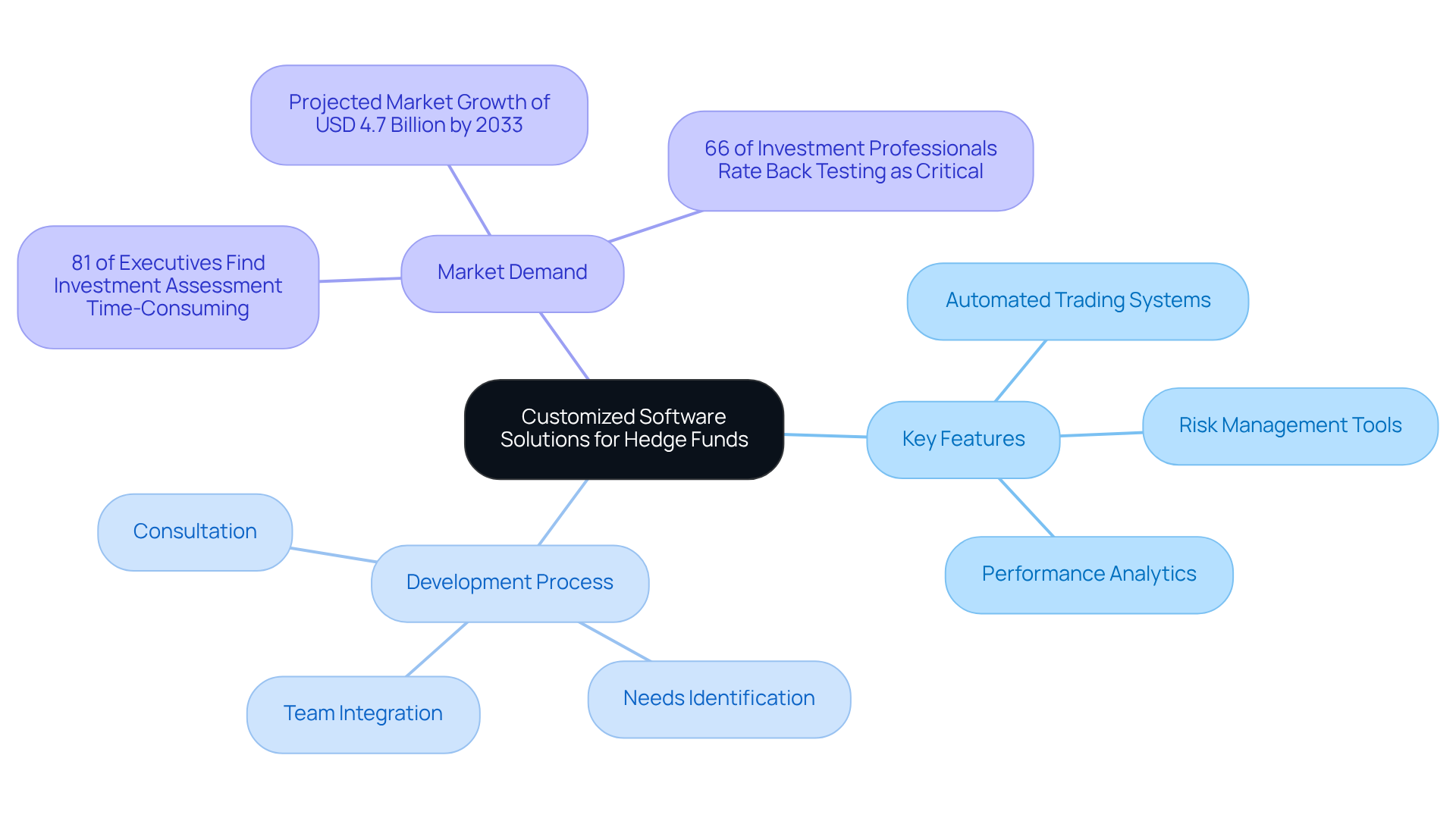

Tailored application offerings for investment pools are customised software solutions specifically designed to meet the unique operational, regulatory, and strategic needs of financial organizations. Unlike off-the-shelf applications, which provide general features, customised software solutions focus on addressing the specific challenges faced by investment firms, such as complex data analysis, compliance with stringent financial regulations, and the necessity for real-time reporting. Key features typically include automated trading systems, advanced risk management tools, and performance analytics dashboards, all customized to improve operational efficiency and enhance decision-making processes.

At Neutech, we initiate the process by scheduling a complimentary consultation to understand your company’s structure and specific requirements. After collaboratively identifying your needs, we provide a selection of specialized designers and developers to integrate into your team. This tailored provision of engineering talent ensures that the technology closely aligns with your investment strategies and operational workflows. By leveraging customised software solutions, investment groups can streamline processes, significantly boost efficiency, and gain a competitive edge in a rapidly evolving market.

Industry experts have noted that ‘81% of executives find investment assessment and due diligence to be time-consuming,’ underscoring the demand for solutions that enhance efficiency. Furthermore, with ‘66% of investment professionals rating back testing as a critical feature of trading infrastructure,’ the necessity for customised software solutions that facilitate these processes becomes evident. The investment vehicle market is projected to reach USD 4.7 billion by 2033, growing at a CAGR of 12.87%, which highlights the increasing demand for tailored offerings. Ultimately, customised software solutions empower hedge portfolios to navigate complexities effectively, ensuring they remain agile and responsive to market dynamics.

Address Hedge Fund Challenges with Tailored Software

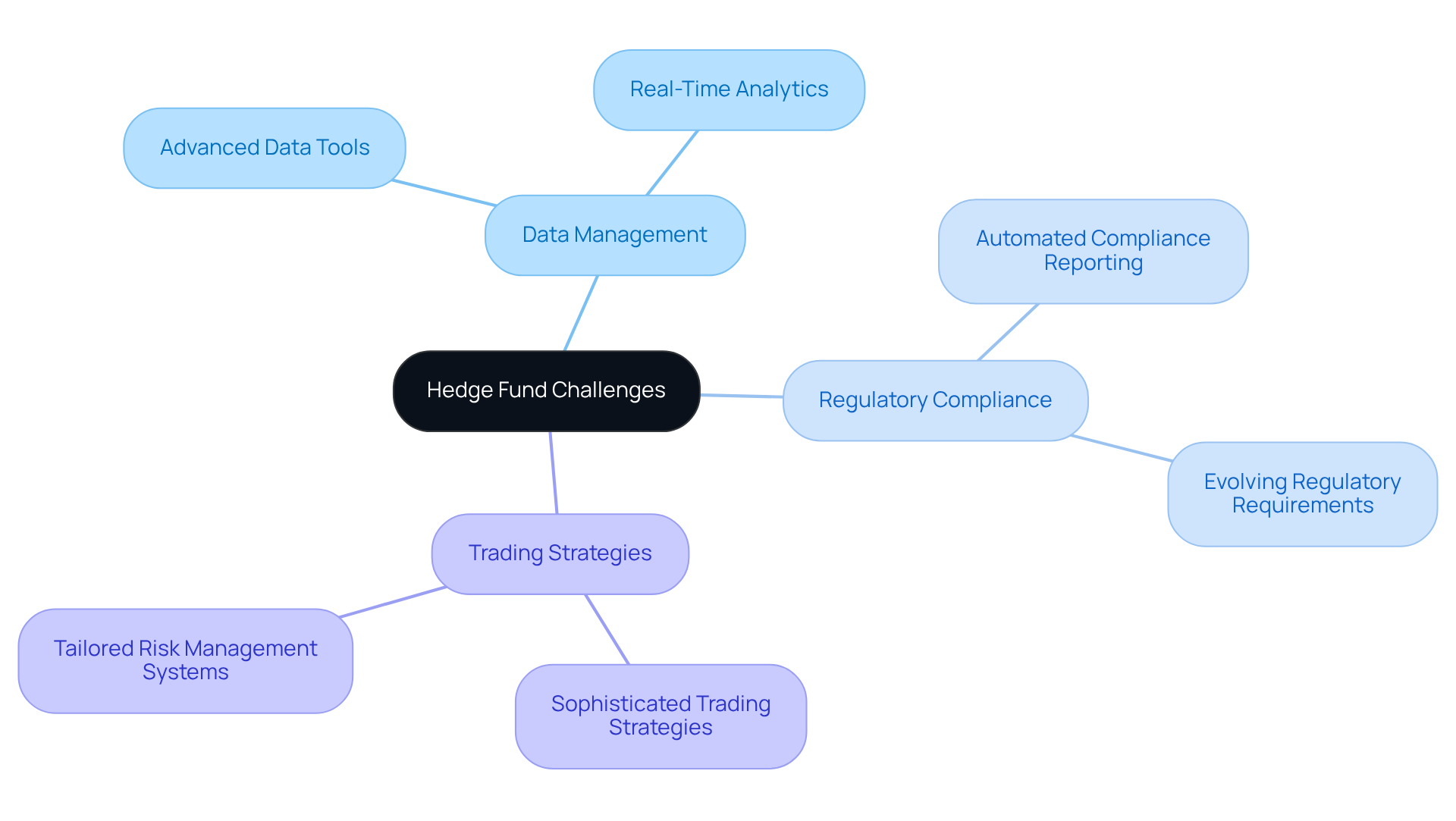

Hedge pools navigate a complex environment marked by stringent regulations and fierce competition, which can impede their performance. The primary challenges they face include:

- Managing large volumes of data

- Complying with evolving regulatory requirements

- Executing sophisticated trading strategies

Customized software solutions from Neutech are crucial for overcoming these obstacles, offering advanced tools that enhance data management, automate compliance reporting, and enable real-time analytics.

For example, a tailored risk management system allows hedge funds to pinpoint potential risks within their portfolios, facilitating timely adjustments to their strategies. Furthermore, bespoke applications can streamline operations by automating repetitive tasks, enabling asset managers to concentrate on strategic decision-making rather than administrative duties. Neutech’s expertise encompasses a variety of development platforms, including:

- React

- Python

- .NET

- Android

- GoLang

- Node.js

- and more

This ensures comprehensive solutions that cater to diverse needs.

By leveraging customised software solutions, investment firms can more effectively address their specific challenges, leading to improved operational efficiency and enhanced investment outcomes. Schedule a free consultation with Neutech to discover how we can add value to your operations.

Leverage Customized Software for Competitive Advantage

In the competitive landscape of investment pools, the effective utilization of technology significantly enhances performance. Neutech’s customised software solutions enable investment firms to swiftly adapt to market fluctuations and client demands, providing a distinct advantage over competitors. For instance, investment vehicles that utilize customised software solutions can rapidly gain insights into market trends and investment opportunities, facilitating quicker and more informed decision-making compared to those relying on standard software. This agility not only improves investment outcomes but also contributes to enhanced returns.

Moreover, customised software solutions, including those utilizing React, Python, or AWS DevOps, can seamlessly integrate with existing systems, fostering a cohesive operational framework that bolsters strategic initiatives. By investing in customised software solutions from Neutech, investment groups can enhance their operational capabilities and establish themselves as innovative leaders within the financial sector, thereby attracting more investors and strengthening their market reputation.

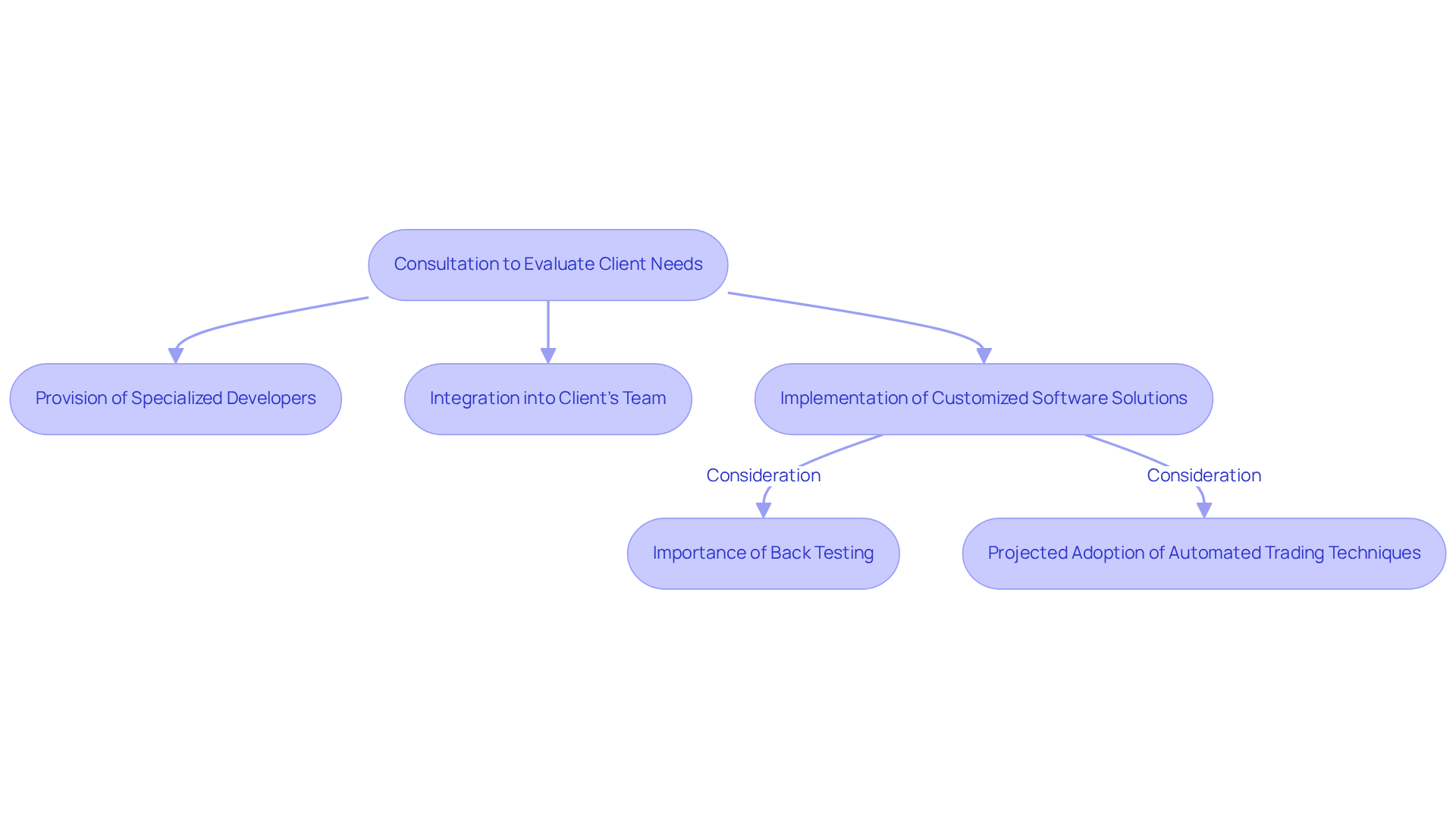

Neutech’s process commences with a complimentary consultation to evaluate client needs, followed by the provision of specialized developers and designers who integrate into the client’s team. By 2026, it is projected that approximately 90% of investment groups will adopt automated trading techniques, underscoring the imperative for investment firms to invest in these methodologies. As Nicole Bennett aptly states, “Automation isn’t just a competitive edge anymore – it’s the baseline for staying relevant.”

Furthermore, the importance of back testing cannot be overlooked, particularly for larger investment pools. A significant 89% of those managing between $25 billion and $50 billion regard it as very important, further emphasizing the operational capabilities that tailored applications can enhance.

Understand Risks of Not Implementing Customized Solutions

Neglecting to apply tailored technological solutions exposes investment firms to significant risks, including operational inefficiencies, compliance breaches, and missed investment opportunities. Generic software often lacks the flexibility and specificity required to meet the unique needs of investment firms, which can lead to functional gaps. For instance, without a customized risk management system, a hedge fund may struggle to identify and mitigate risks effectively, potentially resulting in financial losses.

Furthermore, reliance on off-the-shelf products can hinder an organization’s ability to comply with regulatory standards, increasing the risk of legal repercussions and reputational damage. Notably, 85% of operational failures stem from misrepresentation, fraud, or unauthorized trading, underscoring the importance of customized solutions in preventing such issues. Additionally, an alarming 17% of investment vehicles rely on spreadsheets for over half of their operations, highlighting a significant operational risk tied to the use of standard applications. In a fast-paced market, the inability to adapt swiftly can also lead to a loss of competitive advantage.

Thus, investing in customised software solutions is not merely a strategic choice; it is a critical measure to safeguard a hedge fund’s operational integrity and long-term success. Neutech understands these challenges and, once we collaboratively identify your needs, will provide you with a selection of candidate designers and developers to integrate into your team, ensuring that the solutions developed are specifically tailored to your operational requirements.

The collapse of the Lipper convertible arbitrage vehicles serves as a cautionary tale, illustrating how inadequate scrutiny and standard approaches can lead to substantial losses. As compliance expert Kirat Singh points out, there is a compelling case for leveraging available technologies to enhance analysis and decision-making, reinforcing the necessity of customized solutions within the hedge fund sector.

Conclusion

Customized software solutions are vital for hedge funds seeking to excel in a complex and competitive financial landscape. By addressing specific operational, regulatory, and strategic needs, these tailored applications equip firms with the necessary tools to enhance efficiency, streamline processes, and improve decision-making. Investment firms that adopt bespoke solutions are better positioned to navigate market dynamics with agility and precision, ultimately securing a competitive advantage.

Key points throughout the article emphasize the significance of customized software in overcoming the challenges faced by hedge funds. From managing extensive data to ensuring compliance with constantly evolving regulations, tailored solutions empower firms to execute sophisticated trading strategies effectively. The substantial demand for these technologies is highlighted by industry statistics, demonstrating how investment groups can markedly enhance their operational capabilities and investment outcomes through the adoption of bespoke software.

Given the potential risks associated with generic software – such as operational inefficiencies and compliance breaches – it is evident that investing in customized solutions is not merely advantageous but essential for long-term success. As the financial landscape continues to evolve, hedge funds must prioritize the development and implementation of tailored software to protect their operational integrity and strengthen their market position. Embracing this technology represents a proactive step toward ensuring resilience and fostering innovation in an ever-changing environment.

Frequently Asked Questions

What are customized software solutions for hedge funds?

Customized software solutions for hedge funds are tailored applications specifically designed to meet the unique operational, regulatory, and strategic needs of financial organizations, addressing challenges like complex data analysis and compliance with financial regulations.

How do customized solutions differ from off-the-shelf applications?

Unlike off-the-shelf applications that provide general features, customized solutions focus on the specific challenges faced by investment firms, offering specialized tools such as automated trading systems and advanced risk management.

What key features are included in customized software solutions?

Key features typically include automated trading systems, advanced risk management tools, and performance analytics dashboards, all designed to improve operational efficiency and enhance decision-making processes.

How does Neutech approach the development of customized software solutions?

Neutech begins by scheduling a complimentary consultation to understand a company’s structure and specific requirements, then provides specialized designers and developers to integrate into the client’s team, ensuring alignment with investment strategies and workflows.

What benefits do investment groups gain from using customized software solutions?

Investment groups can streamline processes, significantly boost efficiency, and gain a competitive edge in a rapidly evolving market by leveraging customized software solutions.

What statistics highlight the demand for customized software solutions in the investment sector?

Industry experts note that 81% of executives find investment assessment and due diligence time-consuming, and 66% of investment professionals consider back testing a critical feature of trading infrastructure.

What is the projected growth of the investment vehicle market?

The investment vehicle market is projected to reach USD 4.7 billion by 2033, growing at a CAGR of 12.87%, indicating an increasing demand for tailored software solutions.

How do customized software solutions empower hedge portfolios?

Customized software solutions empower hedge portfolios to navigate complexities effectively, ensuring they remain agile and responsive to changing market dynamics.