Evaluate IoT Application Development Services for Hedge Funds

Introduction

The rapid evolution of technology has significantly transformed the landscape of financial services, with the Internet of Things (IoT) leading this revolution. For hedge funds, integrating IoT application development services offers a unique opportunity to leverage real-time data, enhancing decision-making and operational efficiency.

However, as investment firms navigate the complexities of IoT implementation, they face critical questions regarding:

- Security

- Compliance

- The selection of appropriate service providers

What essential criteria should be considered when evaluating IoT development services? Furthermore, how can hedge funds effectively leverage these solutions to secure a competitive edge in an increasingly data-driven market?

Define IoT Application Development and Its Relevance to Hedge Funds

IoT application development involves creating software solutions that facilitate communication and interaction among devices over the internet. This technology is particularly relevant for investment firms, as it allows for real-time data gathering and analysis, which are crucial for making informed financial decisions. By integrating IoT solutions, these firms can effectively monitor market conditions, track asset performance, and optimize trading strategies through automated systems.

The ability to leverage vast amounts of data from connected devices provides investment firms with insights that were previously unattainable, thereby enhancing their competitive edge in the financial market. However, it is essential for these firms to consider the complexities and costs associated with AI integration when planning their IoT application development services. Increased connectivity through IoT also raises potential privacy and security concerns that must be addressed to ensure compliance and safeguard sensitive data.

Moreover, IoT’s capability to improve market surveillance by identifying unusual trading patterns can aid in detecting potential fraud, thus enhancing risk management practices. As investment firms increasingly harness IoT data, they can refine their decision-making processes, ultimately leading to better returns and improved risk management.

Evaluate Key IoT Application Development Services Offered by Leading Companies

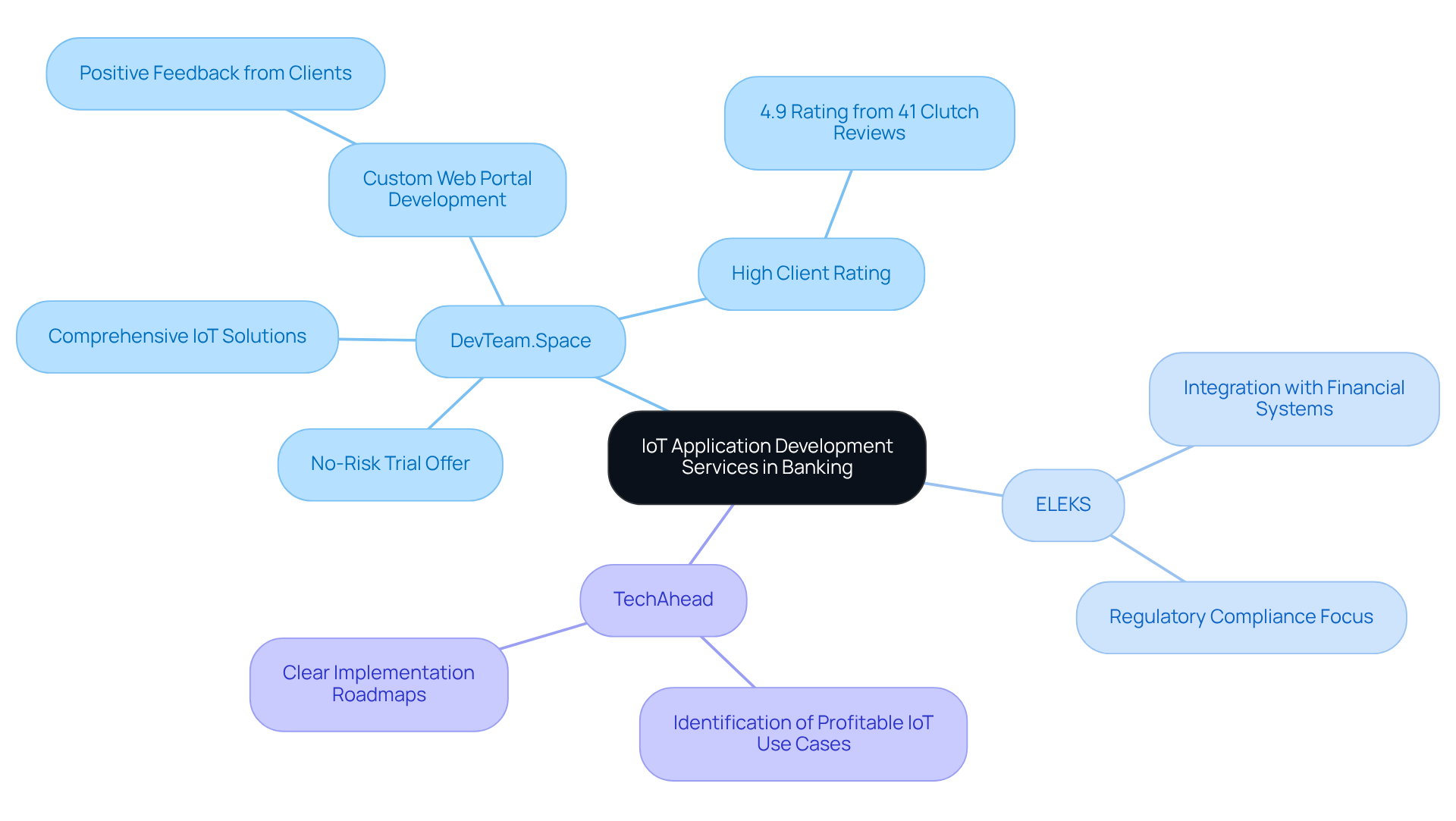

Several prominent companies provide IoT application development services specifically tailored for the banking sector. DevTeam.Space distinguishes itself with comprehensive IoT solutions that address both consumer and industrial applications, emphasizing scalability and security. Their expertise is evidenced by successful projects, such as a custom web portal developed for an investment firm, which received commendations from Bryan Cutter, CIO of an investment company, for its organization and professionalism.

In 2022, global funding activity in fintech reached $203.6 billion across 8,178 deals, underscoring the increasing significance of IoT solutions in this sector. In contrast, ELEKS excels in integrating IoT with existing financial systems, ensuring seamless operations across various business locations while prioritizing regulatory compliance – an essential aspect for investment firms navigating complex legal landscapes.

Meanwhile, TechAhead aids investment groups in identifying profitable IoT use cases, offering clear implementation roadmaps that align with strategic objectives. Each of these companies brings unique strengths, including advanced data analytics capabilities and a deep understanding of compliance requirements, which are crucial for investment firms operating in a highly regulated environment.

As the demand for IoT application development services in finance continues to rise, these firms are well-positioned to assist investment groups in leveraging technology for improved operational efficiency and competitive advantage. Notably, DevTeam.Space boasts a 4.9 rating based on 41 Clutch reviews and offers a no-risk trial, allowing clients to engage their services with confidence.

Identify Critical Selection Criteria for IoT Development Services in Financial Services

When selecting IoT development services, hedge funds must prioritize several critical criteria:

-

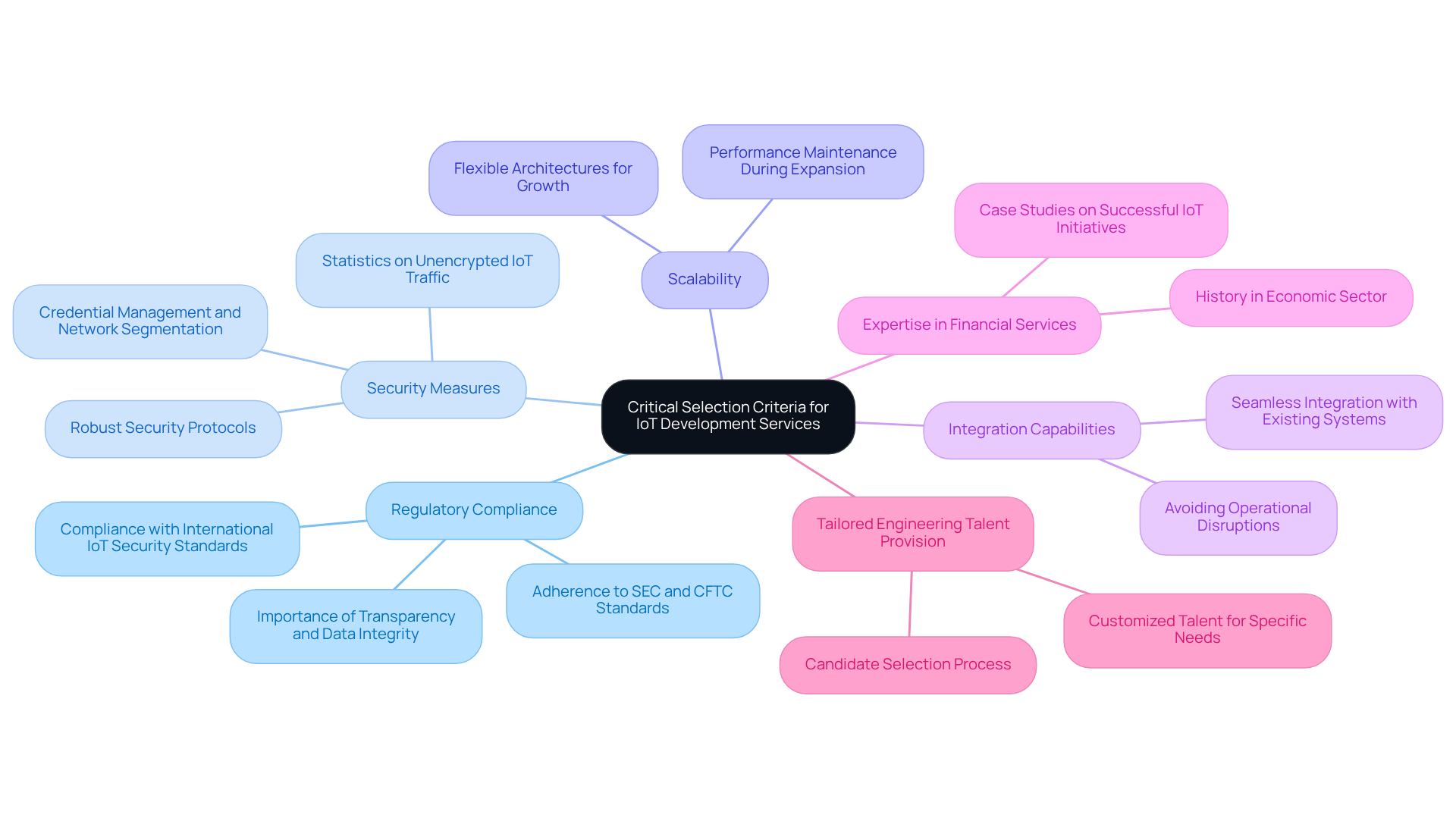

Regulatory Compliance: Adherence to monetary regulations is essential, as investment pools face increasing scrutiny from regulators. The SEC and CFTC emphasize transparency and data integrity, making it crucial for providers to align with these standards. Neutech’s tailored engineering talent in IoT application development services can help ensure compliance by providing developers who understand these regulations.

-

Security Measures: Given the sensitive nature of monetary data, robust security protocols are non-negotiable. Statistics reveal that 98% of IoT traffic remains unencrypted, exposing critical information to potential breaches. Effective IoT implementations must incorporate strong credential management and rigorous network segmentation to mitigate risks. Neutech can supply developers through its IoT application development services to enhance security-focused measures.

-

Scalability: The capacity to expand solutions as the investment group grows is crucial for long-term success. Providers should offer flexible architectures that can adapt to evolving operational needs without compromising performance. Neutech’s engineers can design scalable solutions tailored to specific growth trajectories using their IoT application development services.

-

Integration Capabilities: Seamless integration with existing systems is paramount to avoid operational disruptions. Successful banks have demonstrated that IoT signals must inform core banking platforms rather than operate in isolation, ensuring that data flows smoothly across systems. Neutech’s developers are skilled in providing IoT application development services that create integrations to enhance operational efficiency.

-

Expertise in Financial Services: Providers with a demonstrated history in the economic sector are better equipped to navigate the unique challenges encountered by investment groups. Case studies show that banks that anchor IoT initiatives to clearly defined operational problems achieve better outcomes, highlighting the importance of specialized knowledge in this domain. Neutech’s team has extensive experience in financial services, which enhances their IoT application development services and ensures relevant expertise.

-

Tailored Engineering Talent Provision: At Neutech, we recognize that each investment group has distinct requirements. Once we mutually determine your requirements, we will supply you with a few candidate designers and developers for your IoT application development services, ensuring that you have the specialized talent necessary to achieve your objectives.

Compare Pros and Cons of Top IoT Application Development Services for Hedge Funds

When evaluating IoT application development services, hedge funds should carefully consider the following advantages and disadvantages:

-

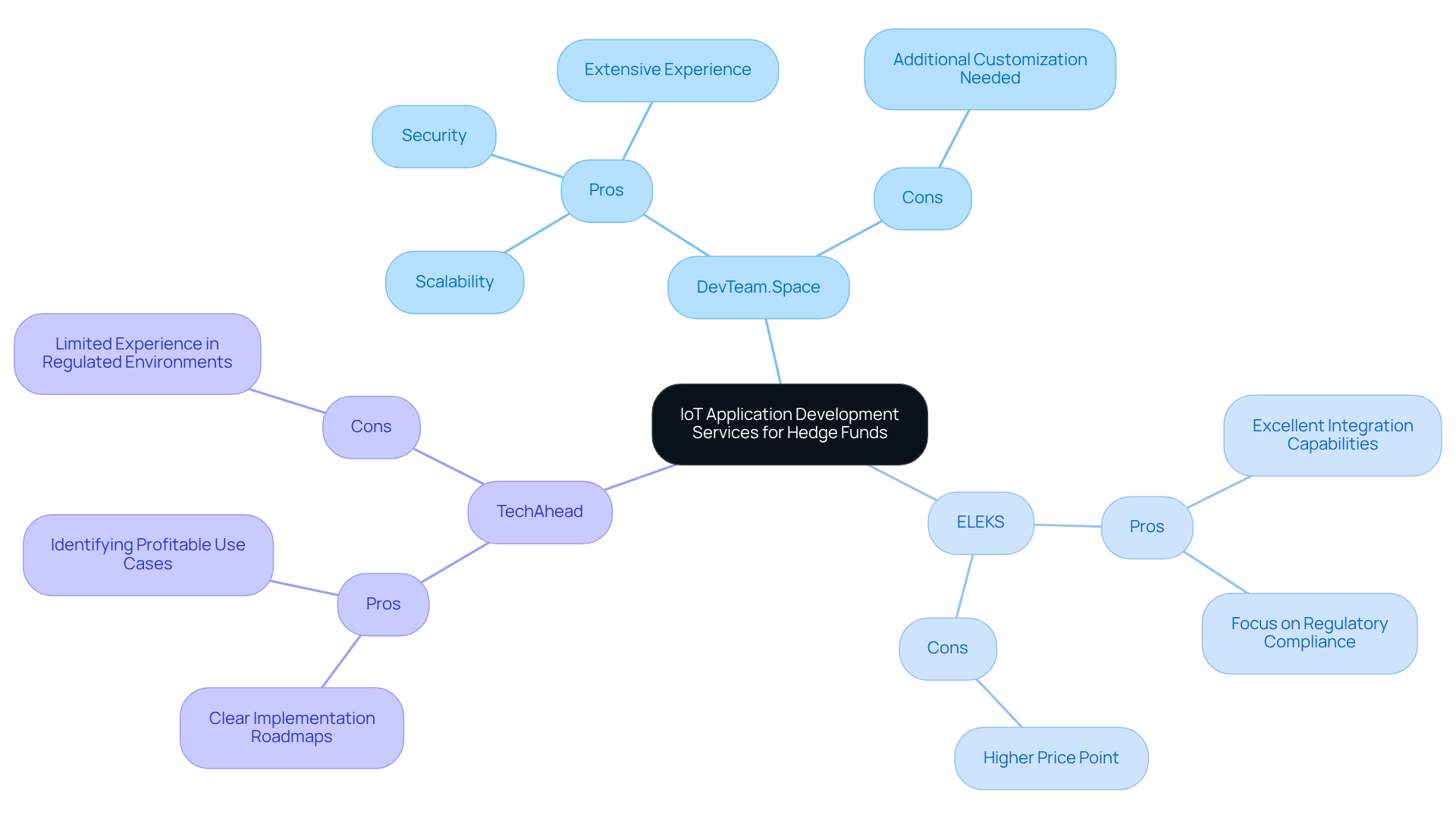

DevTeam.Space:

Pros: This service emphasizes scalability and security, supported by extensive experience in both consumer and industrial IoT applications.

Cons: It may necessitate additional customization to meet the unique requirements of specific monetary applications. -

ELEKS:

Pros: Known for its excellent integration capabilities with existing financial systems, ELEKS also maintains a strong focus on regulatory compliance, ensuring adherence to industry standards.

Cons: This service generally commands a higher price point compared to some competitors, which may impact budget considerations. -

TechAhead:

Pros: TechAhead offers clear implementation roadmaps and assists in identifying profitable use cases, facilitating strategic planning.

Cons: However, it has limited experience in navigating the complexities of highly regulated financial environments, which may pose challenges for investment firms.

By weighing these factors, hedge funds can make informed decisions when selecting the IoT development service that best aligns with their operational needs and strategic objectives.

Conclusion

The integration of IoT application development services into hedge funds presents a significant opportunity to enhance operational efficiency and decision-making. By leveraging real-time data and advanced analytics, investment firms can gain insights that markedly improve their competitive positioning within the financial market. However, it is crucial to carefully consider the complexities, costs, and potential security implications to ensure successful implementation.

This article evaluates leading IoT development service providers, showcasing the diverse capabilities available to hedge funds. Companies such as DevTeam.Space, ELEKS, and TechAhead each bring unique strengths, ranging from scalability and regulatory compliance to strategic planning and implementation roadmaps. Key selection criteria, including regulatory adherence, security measures, and integration capabilities, are essential for firms aiming to navigate the intricate landscape of financial services effectively.

Ultimately, embracing IoT technology can empower hedge funds to optimize operations and enhance risk management practices. As the industry evolves, investment firms must adopt a proactive approach to IoT application development, ensuring they select the right partners and solutions to fully realize the potential of this innovative technology. Collaborating with experienced service providers can lead to improved returns and a more resilient operational framework, making it imperative for hedge funds to prioritize IoT integration as a strategic advantage in the highly competitive financial sector.

Frequently Asked Questions

What is IoT application development?

IoT application development involves creating software solutions that enable communication and interaction among devices over the internet.

Why is IoT application development relevant to hedge funds?

It allows investment firms to gather and analyze real-time data, which is crucial for making informed financial decisions, monitoring market conditions, tracking asset performance, and optimizing trading strategies.

How does IoT enhance the competitive edge of investment firms?

By leveraging vast amounts of data from connected devices, investment firms gain insights that were previously unattainable, enhancing their ability to compete in the financial market.

What complexities should investment firms consider when developing IoT applications?

Firms need to consider the complexities and costs associated with AI integration as part of their IoT application development services.

What privacy and security concerns are associated with IoT in hedge funds?

Increased connectivity through IoT raises potential privacy and security concerns that must be addressed to ensure compliance and protect sensitive data.

How can IoT improve risk management in investment firms?

IoT can enhance market surveillance by identifying unusual trading patterns, aiding in the detection of potential fraud and improving overall risk management practices.

What benefits do investment firms gain from harnessing IoT data?

By utilizing IoT data, investment firms can refine their decision-making processes, leading to better returns and improved risk management.