Why Hedge Funds Need a SaaS Based Product Development Company

Introduction

The financial landscape is evolving rapidly, compelling hedge funds to seek innovative solutions to maintain their competitive edge. Software as a Service (SaaS) stands out as a transformative approach, providing investment groups with a pathway to improved efficiency, scalability, and compliance.

Nevertheless, a critical question persists: how can hedge funds effectively utilize SaaS to address their distinct challenges and capitalize on emerging opportunities in a swiftly changing market?

Explore the Unique Advantages of SaaS for Hedge Funds

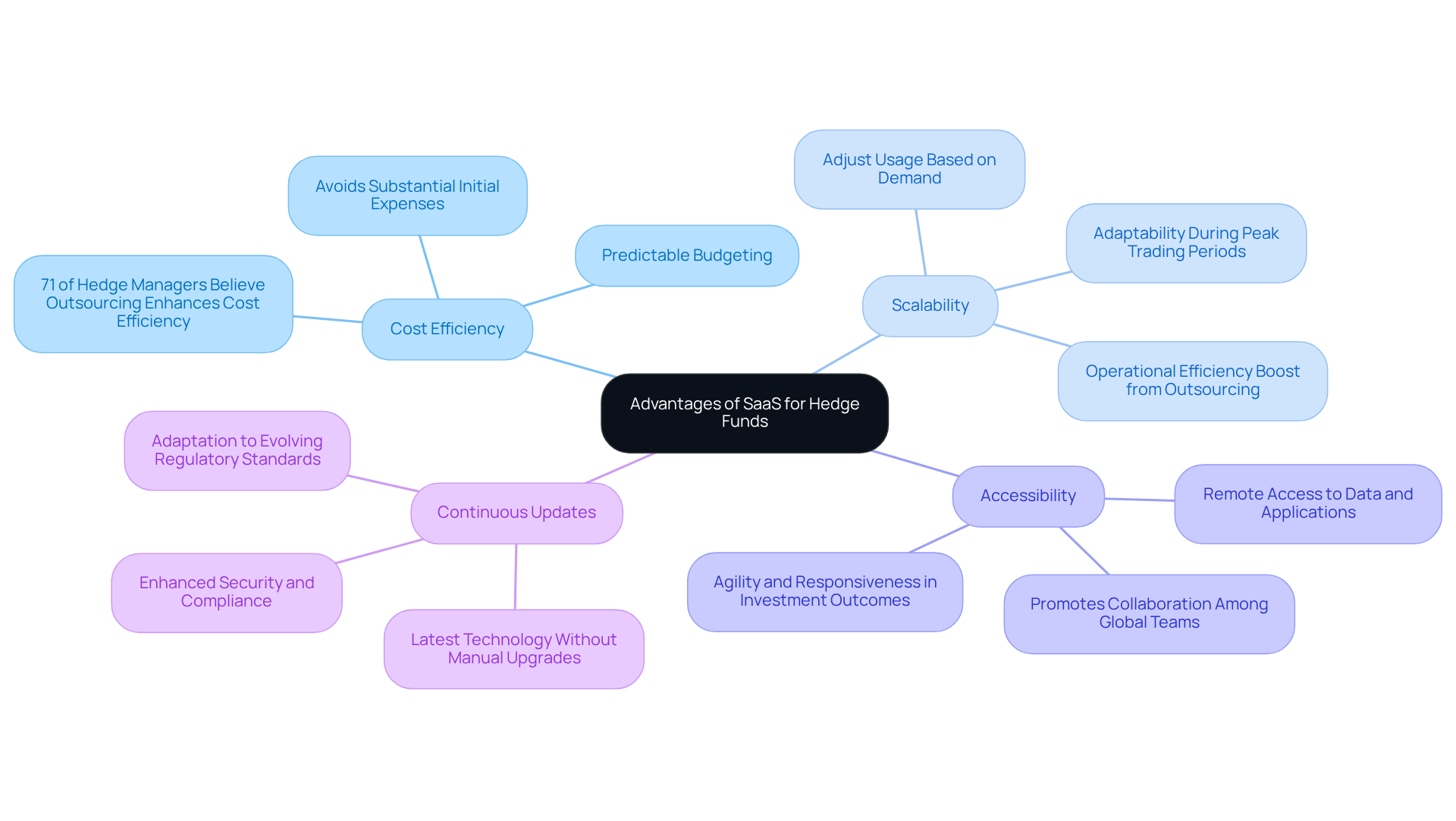

Software as a Service (SaaS) offers investment groups numerous benefits that are particularly advantageous in the dynamic and highly regulated financial landscape. A primary advantage is cost efficiency; investment pools can avoid the substantial initial expenses associated with traditional software setups and infrastructure. By subscribing to SaaS solutions, they can achieve predictable budgeting and mitigate financial risk. Notably, 71% of hedge managers believe that outsourcing certain operations can enhance cost efficiency, as indicated by recent industry trends.

Furthermore, SaaS platforms provide exceptional scalability. Hedge vehicles can easily adjust their usage in response to fluctuating demands, whether they need to ramp up during peak trading periods or scale back during quieter times. This adaptability is crucial in a market where conditions can change rapidly, as evidenced by the increasing trend of investment groups outsourcing services to boost operational efficiency.

In addition, SaaS solutions improve accessibility. Fund managers and analysts can access vital data and applications from any location with an internet connection, promoting remote work and collaboration among global teams. This capability is especially significant in today’s environment, where agility and responsiveness can greatly influence investment outcomes.

Lastly, service providers often offer continuous updates and enhancements, ensuring that investment groups consistently utilize the latest technology without the burden of manual upgrades. This not only bolsters security but also guarantees compliance with evolving regulatory standards, a critical consideration for hedge funds operating in a closely monitored industry. As Thomas McHugh, CEO and co-founder of Finbourne Technology, noted, the perception of SaaS and cloud solutions has shifted from a risk to a vital component for security. As the industry increasingly embraces a ‘start with custody, scale into full ops’ approach, the role of SaaS in facilitating rapid deployment and operational efficiency becomes even more pronounced.

Identify Key Challenges Hedge Funds Face and How SaaS Addresses Them

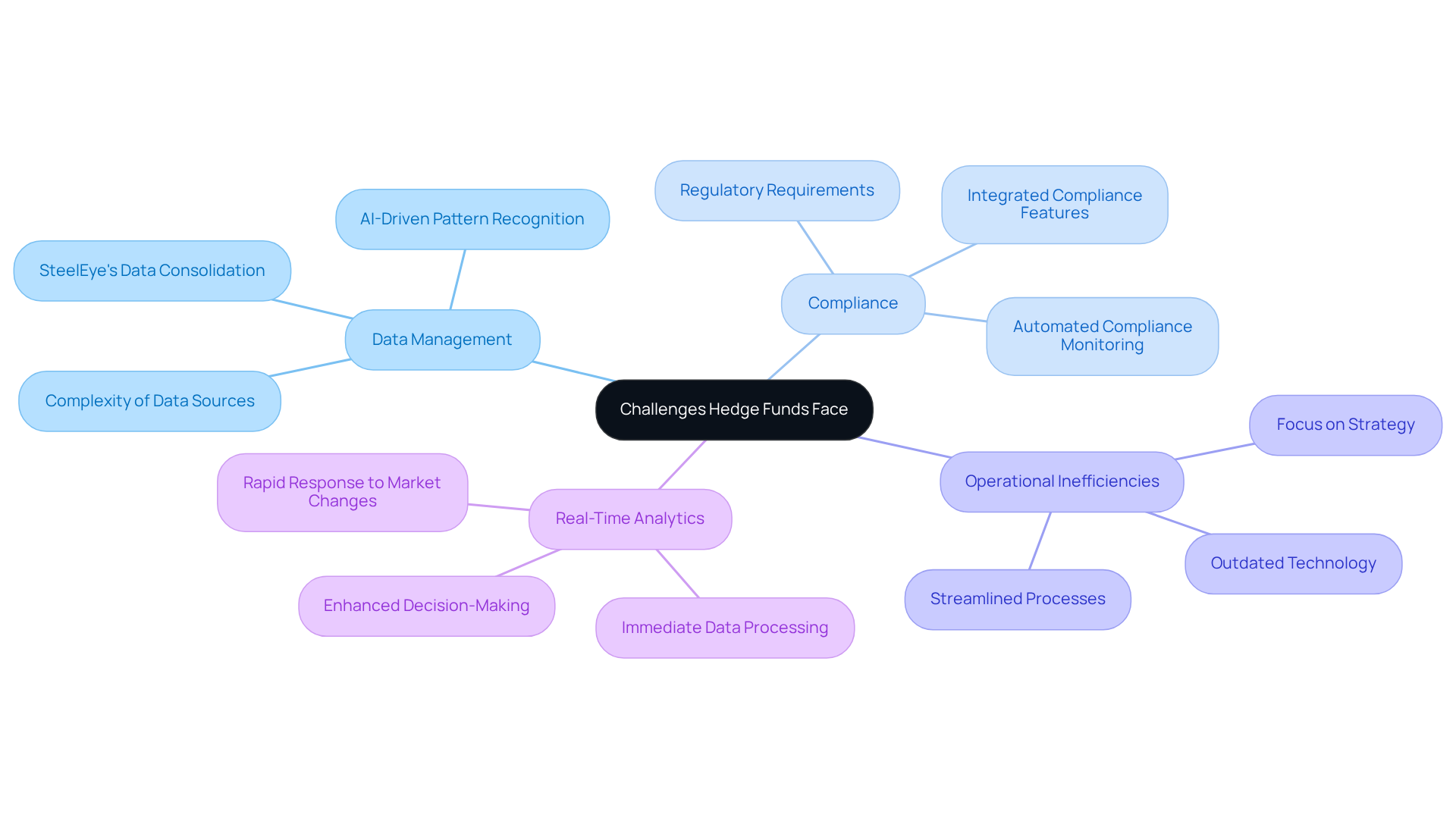

Hedge pools operate within a complex environment characterized by numerous challenges that can hinder their performance and growth. A significant challenge is data management; investment entities must handle vast amounts of information from various sources, complicating the analysis and extraction of actionable insights. Cloud-based solutions facilitate data integration and analytics, enabling investment groups to make informed decisions swiftly. For example, SteelEye’s platform consolidates data from multiple sources, significantly reducing workload and providing cost efficiencies, thereby enhancing operational efficiency and compliance capabilities.

Compliance represents another critical issue. The financial services industry is subject to stringent regulations, and non-compliance can lead to severe penalties. A SaaS based product development company often incorporates integrated compliance features in its SaaS platforms that assist investment groups in adhering to regulatory standards, thereby reducing the risk of non-compliance. SteelEye’s compliance solutions are recognized for their effectiveness and innovation, further aiding investment firms in managing these requirements adeptly.

Operational inefficiencies also impact many investment pools, particularly those reliant on outdated technology. A SaaS based product development company offers solutions that streamline numerous repetitive tasks, allowing asset managers to focus their valuable time on strategy and investment decisions. By leveraging a SaaS based product development company, investment groups can enhance their operational effectiveness, ultimately leading to improved performance and client satisfaction.

Moreover, the demand for real-time analytics has never been more urgent. SaaS platforms developed by a SaaS based product development company provide immediate data processing capabilities, enabling investment groups to respond swiftly to market fluctuations and refine their trading strategies accordingly. This capability is crucial, as investment groups face reputational and financial risks if they fail to implement necessary measures in their compliance efforts.

Evaluate Essential Criteria for Choosing a SaaS Development Partner

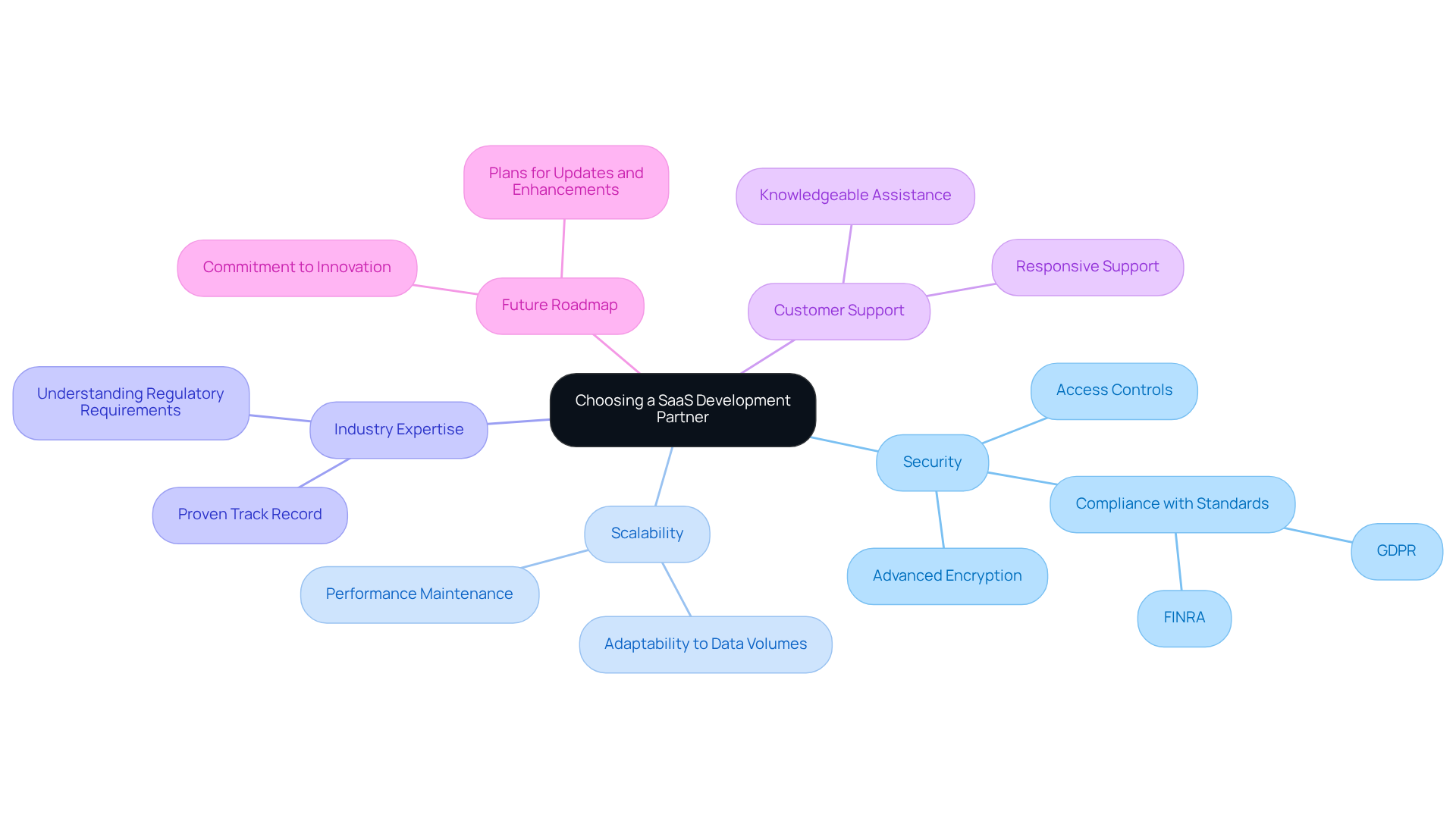

When selecting a software development partner, hedge investments must prioritize several critical criteria to ensure a successful collaboration. Security stands out as the foremost concern; due to the sensitive nature of financial data, it is essential that the chosen provider implements robust security measures. This includes:

- Advanced encryption

- Stringent access controls

- Compliance with industry standards such as GDPR and FINRA

The increasing demand for advanced encryption methods, particularly within financial institutions, underscores the necessity for partners to offer reliable hold-your-own-key options alongside standard certifications.

Scalability is another vital consideration. Hedge pools should evaluate whether the software-as-a-service offering can adapt to their evolving requirements, accommodating larger data volumes and user expectations without compromising performance. This flexibility is crucial for navigating market fluctuations and effectively adjusting business strategies.

Industry expertise is equally important. A SaaS-based product development company with a proven track record in the financial services sector will have a deeper understanding of the unique challenges and regulatory requirements faced by hedge funds. This specialized knowledge can lead to more tailored solutions that address specific operational needs.

Furthermore, the quality of customer support provided by the software partner is essential. Hedge investment groups should seek out providers that offer responsive and knowledgeable support, ensuring that any issues can be resolved promptly to minimize disruptions. Lastly, evaluating the provider’s roadmap for future updates and enhancements can provide insights into their commitment to innovation and long-term partnership, which is crucial for maintaining a competitive edge in a rapidly evolving landscape.

Understand the Long-Term Impact of Your SaaS Development Choice

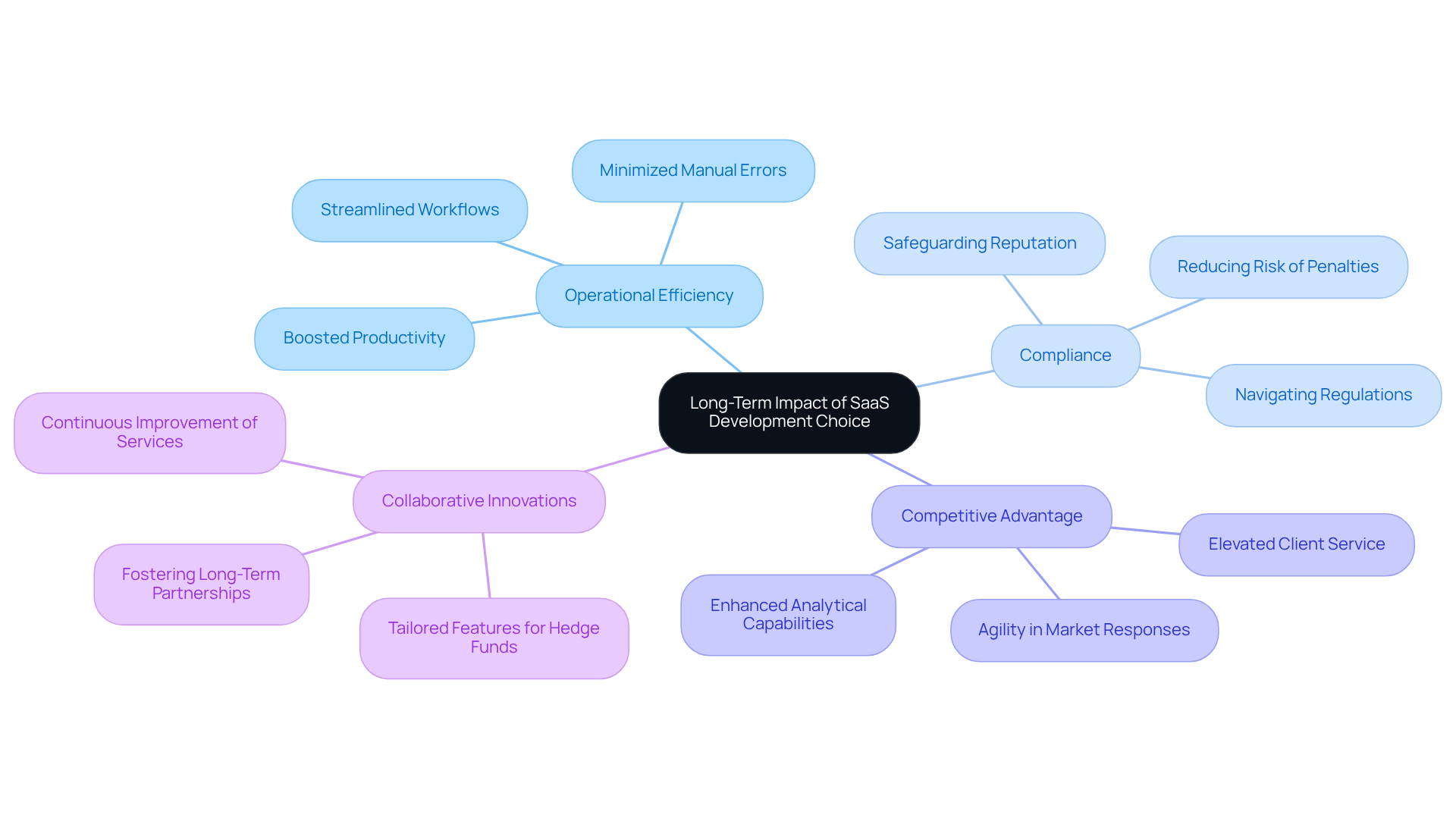

Selecting the right software development partner is essential for investment groups, significantly impacting long-term operational efficiency. An effective software service can streamline workflows, minimize manual errors, and boost productivity, resulting in ongoing performance enhancements over time.

Compliance is a critical issue within the financial sector. By collaborating with a software service provider that emphasizes compliance, investment groups can navigate the complexities of evolving regulations, thereby reducing the risk of costly penalties and safeguarding their reputations.

In a rapidly changing competitive landscape, investment groups that adopt innovative software solutions can secure a distinct advantage. These tools enhance analytical capabilities, elevate client service, and facilitate swift responses to market changes – qualities that are vital for success in an environment where agility is paramount.

Furthermore, the partnership with a SaaS based product development company can develop over time, fostering collaborative innovations. A robust relationship enables the creation of new features and functionalities tailored to the specific needs of hedge funds, significantly improving operational capabilities and market positioning.

Conclusion

The integration of Software as a Service (SaaS) solutions into hedge fund operations represents a strategic opportunity for investment groups aiming to enhance efficiency, scalability, and compliance. By utilizing these cloud-based platforms, hedge funds can navigate the complexities of the financial landscape with increased agility, all while minimizing costs and operational risks.

Key advantages of SaaS for hedge funds include:

- Cost efficiency

- Improved accessibility

- Robust compliance features

The capacity to scale operations in response to market demands, combined with real-time data processing capabilities, empowers investment groups to make informed decisions swiftly. Moreover, selecting the right SaaS development partner is essential for ensuring long-term operational success, influencing aspects from security measures to customer support and innovation.

Ultimately, adopting SaaS solutions is not just a trend; it is a strategic necessity for hedge funds that aspire to thrive in a competitive and rapidly evolving market. By prioritizing the right partnerships and technologies, investment groups can position themselves for sustained growth and success, making informed choices that will enhance their operational efficiency and market responsiveness for years to come.

Frequently Asked Questions

What is Software as a Service (SaaS) and how does it benefit hedge funds?

SaaS is a cloud-based software delivery model that offers hedge funds various benefits, including cost efficiency, scalability, improved accessibility, and continuous updates, all of which are crucial in the regulated financial landscape.

How does SaaS improve cost efficiency for hedge funds?

SaaS allows hedge funds to avoid substantial initial expenses associated with traditional software setups and infrastructure. By subscribing to SaaS solutions, they can achieve predictable budgeting and reduce financial risk.

What percentage of hedge managers believe outsourcing operations enhances cost efficiency?

According to recent industry trends, 71% of hedge managers believe that outsourcing certain operations can enhance cost efficiency.

In what way does SaaS offer scalability for hedge funds?

SaaS platforms enable hedge funds to easily adjust their usage according to fluctuating demands, allowing them to ramp up during peak trading periods or scale back during quieter times.

How does SaaS enhance accessibility for fund managers and analysts?

SaaS solutions allow fund managers and analysts to access vital data and applications from any location with an internet connection, promoting remote work and collaboration among global teams.

What role do continuous updates play in SaaS solutions for hedge funds?

Service providers offer continuous updates and enhancements, ensuring that hedge funds utilize the latest technology without the need for manual upgrades, which bolsters security and ensures compliance with evolving regulatory standards.

How has the perception of SaaS and cloud solutions changed in the hedge fund industry?

The perception has shifted from viewing SaaS and cloud solutions as a risk to recognizing them as a vital component for security, especially as the industry embraces a ‘start with custody, scale into full ops’ approach.