Why Hedge Fund Managers Need Automated Software for Success

Introduction

Market volatility presents a significant challenge for hedge fund managers, often resulting in unpredictable asset price fluctuations that can disrupt even the most meticulously designed investment strategies. As the financial landscape continues to evolve, the integration of automated software has emerged as a vital solution. This technology enables managers to enhance trading efficiency, ensure regulatory compliance, and improve decision-making processes. However, a critical question persists: can automation genuinely provide the competitive edge required to navigate the complexities of modern finance, or does it introduce new risks that could potentially undermine its advantages?

Address Market Volatility with Automation

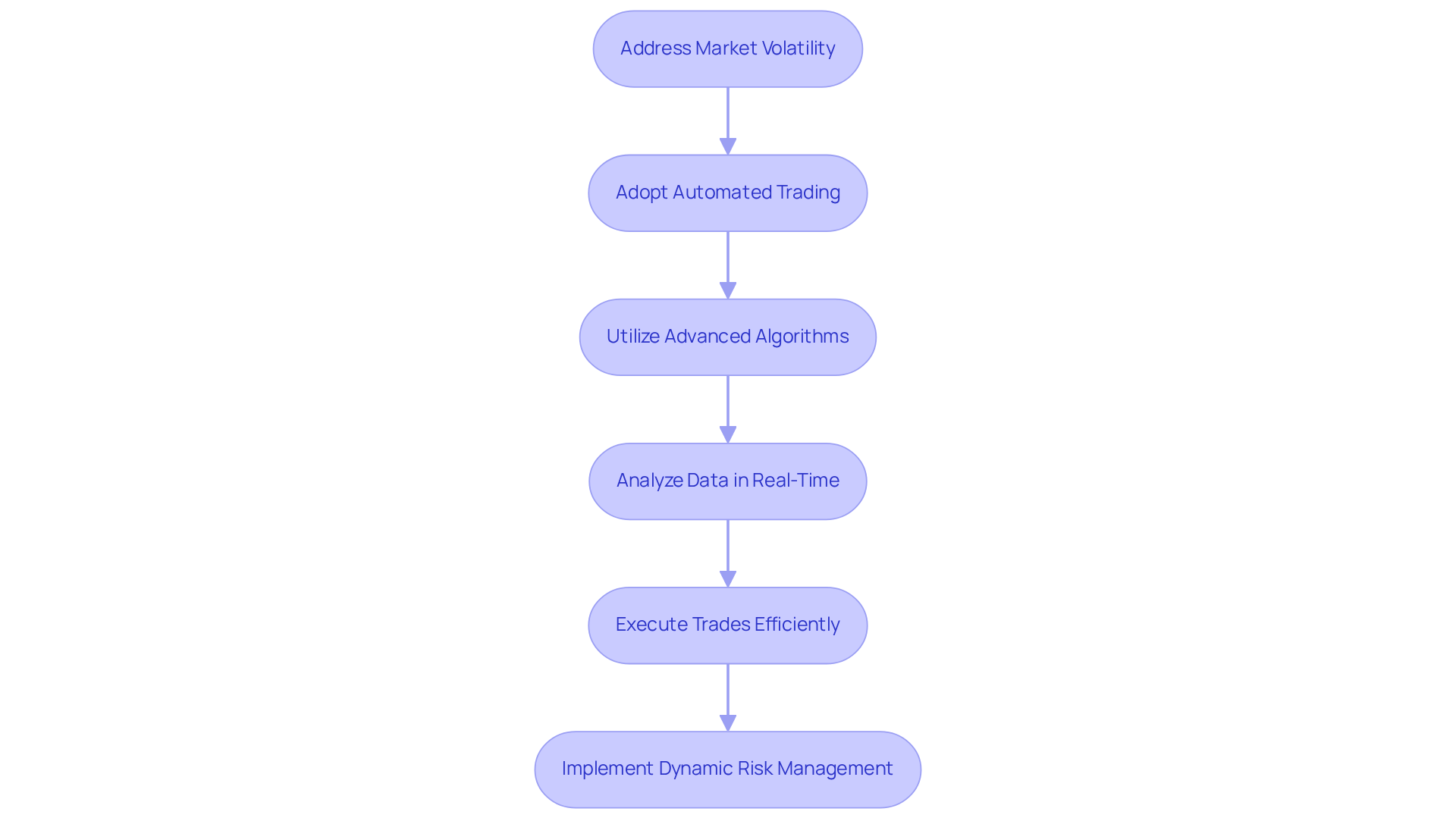

Market volatility presents a significant challenge for investment managers, often resulting in rapid fluctuations in asset prices that can disrupt investment strategies. By 2026, it is projected that approximately 90% of investment pools will adopt automated trading methods to effectively tackle these challenges. These systems utilize advanced algorithms to analyze extensive data sets in real-time, enabling hedge funds to execute trades with remarkable efficiency and respond swiftly to environmental changes.

For instance, automated trading systems can identify patterns and execute trades based on predefined criteria, allowing managers to capitalize on fleeting opportunities while minimizing emotional decision-making. This capability not only enhances trading efficiency but also mitigates the risk of human error, which can be particularly detrimental during periods of volatility. Furthermore, automation empowers investment firms to implement dynamic risk management strategies that automatically adjust positions in response to price movements, thereby protecting investments from sudden downturns.

As financial experts emphasize, integrating automated trading mechanisms is essential for investment firms aiming to maintain a competitive edge in an increasingly unstable economic landscape. However, it is vital to address the challenges associated with AI implementation, particularly regarding data quality and integrity, to optimize the effectiveness of these systems. By incorporating operational alpha into their strategies, investment firms can further bolster their efficiency and competitiveness in the market.

Ensure Regulatory Compliance through Automation

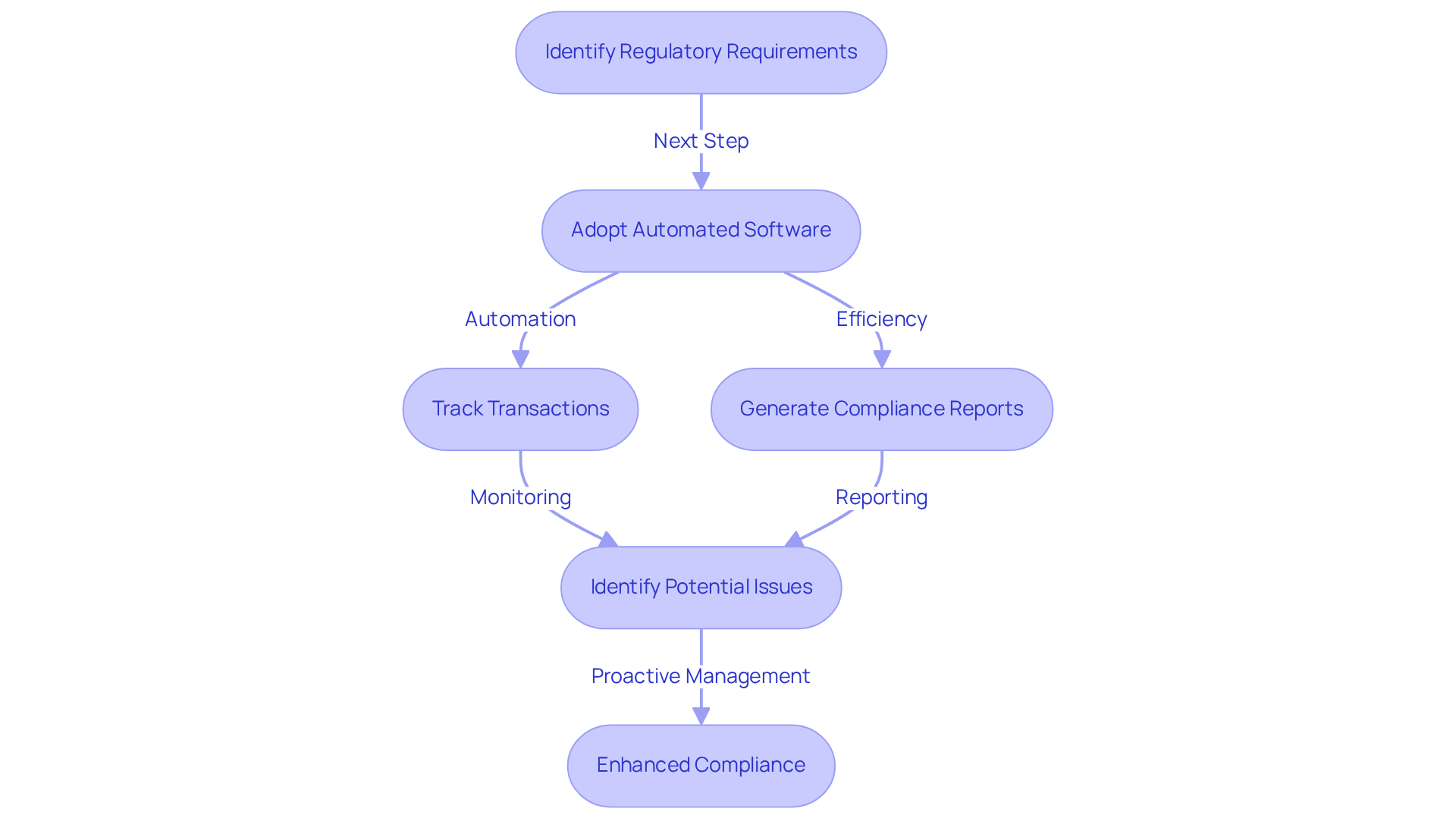

In the highly regulated environment of investment firms, adherence to financial regulations is not just a legal obligation; it is essential for maintaining operational integrity. Increasingly, automated software solutions are being adopted to streamline the monitoring and reporting processes required by regulatory bodies. These systems can automatically track transactions, generate compliance reports, and identify potential issues before they develop into significant problems.

For instance, automated software tools can ensure that all trades comply with anti-money laundering (AML) regulations and other legal requirements, thereby significantly alleviating the administrative burden on compliance teams. By using automated software to automate these processes, investment firms can enhance their compliance posture while freeing up valuable resources to concentrate on strategic initiatives, ultimately leading to improved operational efficiency.

Given that the average global cost of a data breach reached USD$4.88 million in 2024, the necessity for robust compliance mechanisms is more urgent than ever. Moreover, firms that implement automated software as AI-driven compliance tools through subscription services can reduce compliance costs by up to 50%, highlighting the financial advantages of automation in this sector.

Enhance Decision-Making Efficiency with Automated Solutions

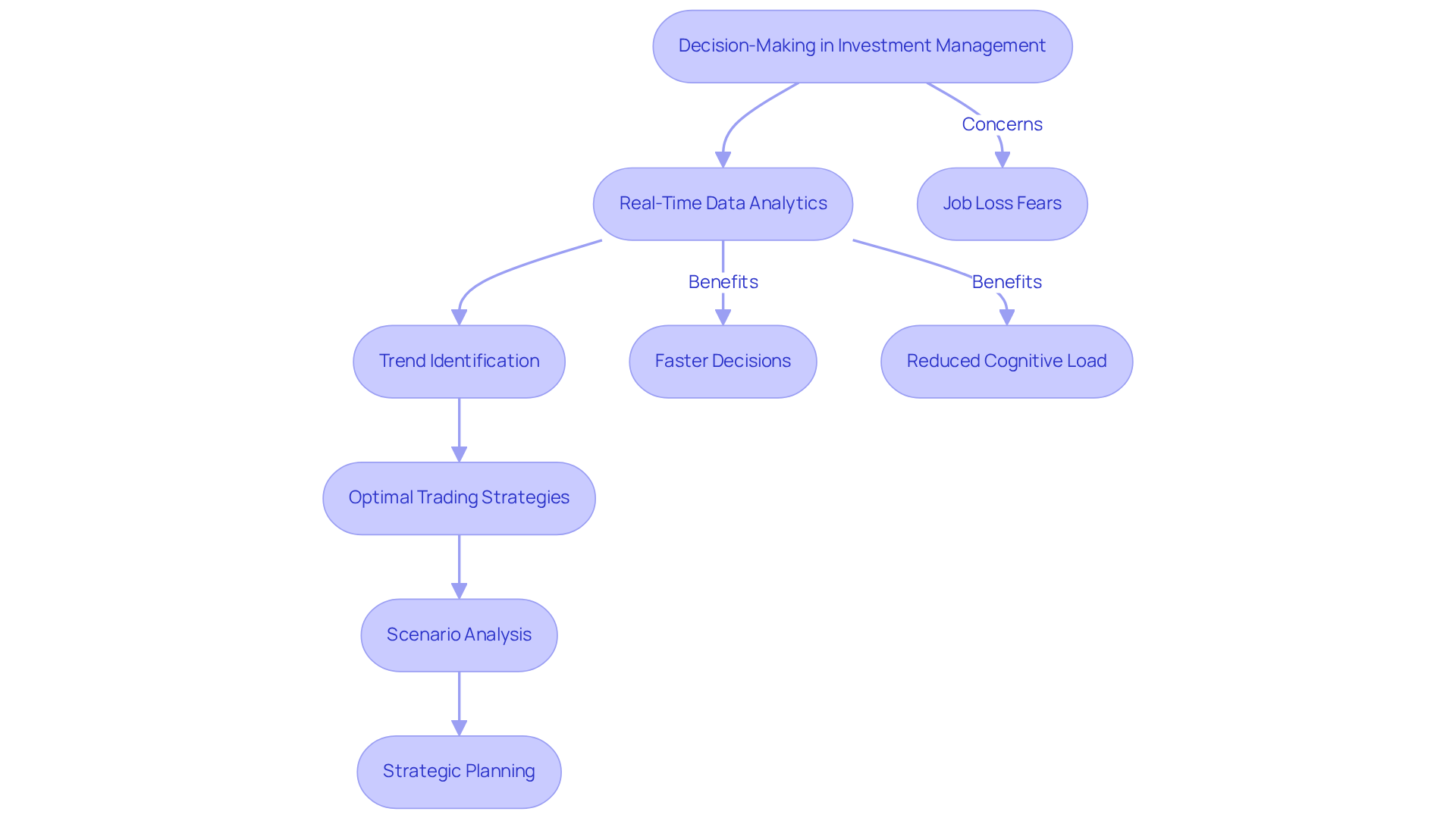

In the fast-paced realm of investment management, the ability to make swift and knowledgeable decisions is crucial. Automated software significantly enhances decision-making efficiency by delivering real-time data analytics and insights to hedge fund managers. These systems aggregate and analyze vast datasets, enabling managers to identify trends and make data-driven decisions swiftly.

For instance, automated software tools evaluate the performance of various assets and suggest optimal trading strategies based on historical data and predictive analytics. This not only accelerates the decision-making process but also reduces the cognitive load on managers, allowing them to focus on higher-level strategic planning. Moreover, automation facilitates scenario analysis, enabling managers to simulate different market conditions and assess potential outcomes, thereby enhancing their preparedness for various market scenarios.

As Nicole Bennett states, “Automation isn’t just a competitive edge anymore – it’s the baseline for staying relevant.” Furthermore, statistics indicate that “Eighty-four percent of finance staff say they’re able to make decisions faster thanks to automation tools.” Real-world instances, such as Citadel’s use of automated software like an AI chatbot to optimize operations, demonstrate the practical application of these automated solutions in asset management.

However, it is essential to acknowledge concerns regarding automation, as 37% of professionals fear job loss due to these advancements. As investment groups increasingly adopt these technologies, the integration of automated software for decision-making becomes a cornerstone for achieving competitive advantage.

Gain Competitive Advantage through Automation

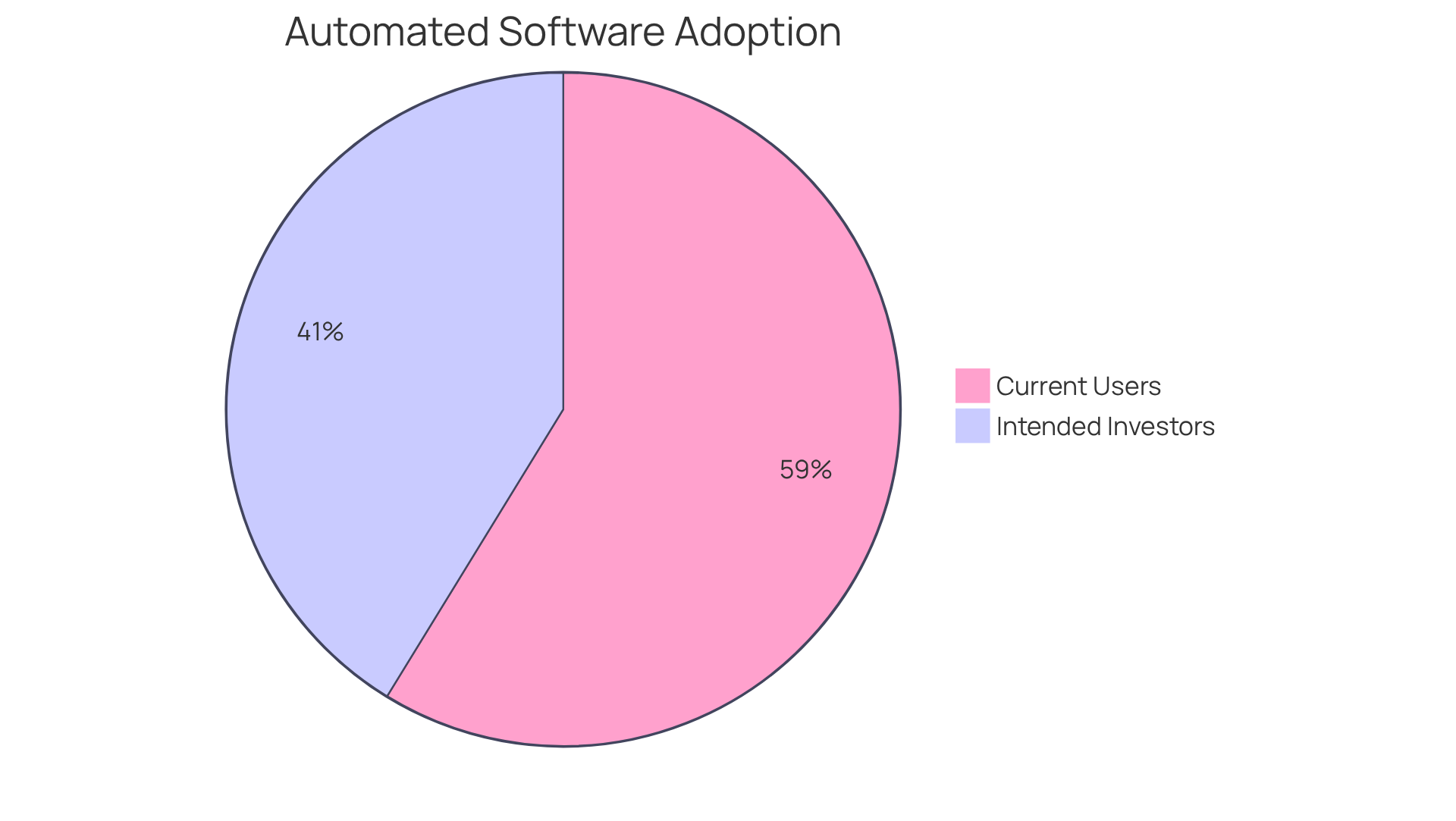

In the highly competitive investment landscape, leveraging technology for operational efficiency and strategic advantage is essential. Automated software provides hedge organizations a significant edge by facilitating rapid trade execution, enhancing risk management, and improving client service. Automated software for trading platforms can execute orders in milliseconds, allowing capital to seize fleeting market opportunities. As Jeff Sekinger observes, “Execution speed plays a critical role in the performance of automated trading systems.” A recent survey revealed that:

- 40% of investment managers intend to invest in automated software to automate manual processes.

- 57% are already using automated software to boost operational efficiency, highlighting the industry’s transition towards greater efficiency.

Moreover, automation improves client interactions by providing real-time updates and insights, which fosters transparency and trust. However, hedge funds must also weigh the potential risks associated with automation, including the necessity for reliable data and the challenges posed by AI adoption. Organizations that adopt automated software solutions are better positioned to respond to changing market conditions and client demands, ultimately enhancing investor confidence and loyalty. As the financial industry continues to evolve, those prioritizing automated software are likely to lead, establishing new standards for efficiency and performance.

Conclusion

The integration of automated software in hedge fund management has transitioned from a luxury to a necessity for success in the current volatile financial landscape. By adopting these advanced technological solutions, investment firms can effectively navigate market fluctuations, ensure compliance with regulatory standards, and enhance decision-making efficiency. This shift towards automation is a direct response to the challenges posed by rapid market changes, highlighting its critical role in maintaining a competitive edge.

Key insights reveal that automation significantly addresses market volatility by executing trades with both speed and accuracy, thereby minimizing human error and emotional bias. Furthermore, automated systems streamline compliance processes, substantially reducing the burden on teams and allowing firms to concentrate on strategic initiatives. The capability to leverage real-time data analytics empowers managers to make informed decisions swiftly, thereby enhancing overall operational efficiency.

As the financial industry continues to evolve, embracing automation will be pivotal for hedge funds striving to thrive. The imperative is clear: investment managers must prioritize the adoption of automated solutions not only to keep pace with industry standards but also to establish new benchmarks for performance and efficiency. By doing so, they can cultivate greater investor confidence and loyalty, ultimately positioning themselves for sustained success in an increasingly competitive environment.

Frequently Asked Questions

What is market volatility and why is it a challenge for investment managers?

Market volatility refers to rapid fluctuations in asset prices that can disrupt investment strategies, posing significant challenges for investment managers.

What percentage of investment pools is expected to adopt automated trading methods by 2026?

By 2026, it is projected that approximately 90% of investment pools will adopt automated trading methods to address market volatility.

How do automated trading systems work?

Automated trading systems utilize advanced algorithms to analyze extensive data sets in real-time, enabling hedge funds to execute trades efficiently and respond quickly to changes in the market.

What are the benefits of using automated trading systems?

Automated trading systems can identify patterns and execute trades based on predefined criteria, allowing managers to capitalize on fleeting opportunities, minimize emotional decision-making, enhance trading efficiency, and reduce the risk of human error.

How does automation help with risk management in investment firms?

Automation allows investment firms to implement dynamic risk management strategies that automatically adjust positions in response to price movements, helping to protect investments from sudden downturns.

Why is integrating automated trading mechanisms important for investment firms?

Integrating automated trading mechanisms is essential for investment firms to maintain a competitive edge in an increasingly unstable economic landscape.

What challenges are associated with implementing AI in trading systems?

Challenges associated with AI implementation include ensuring data quality and integrity, which are crucial for optimizing the effectiveness of automated trading systems.

What is operational alpha and how does it relate to automated trading?

Operational alpha refers to the additional efficiency and competitiveness that investment firms can achieve by incorporating advanced strategies, including automated trading, into their operations.